Content

What is the Current Plastic Processing Machinery Market Size and Share?

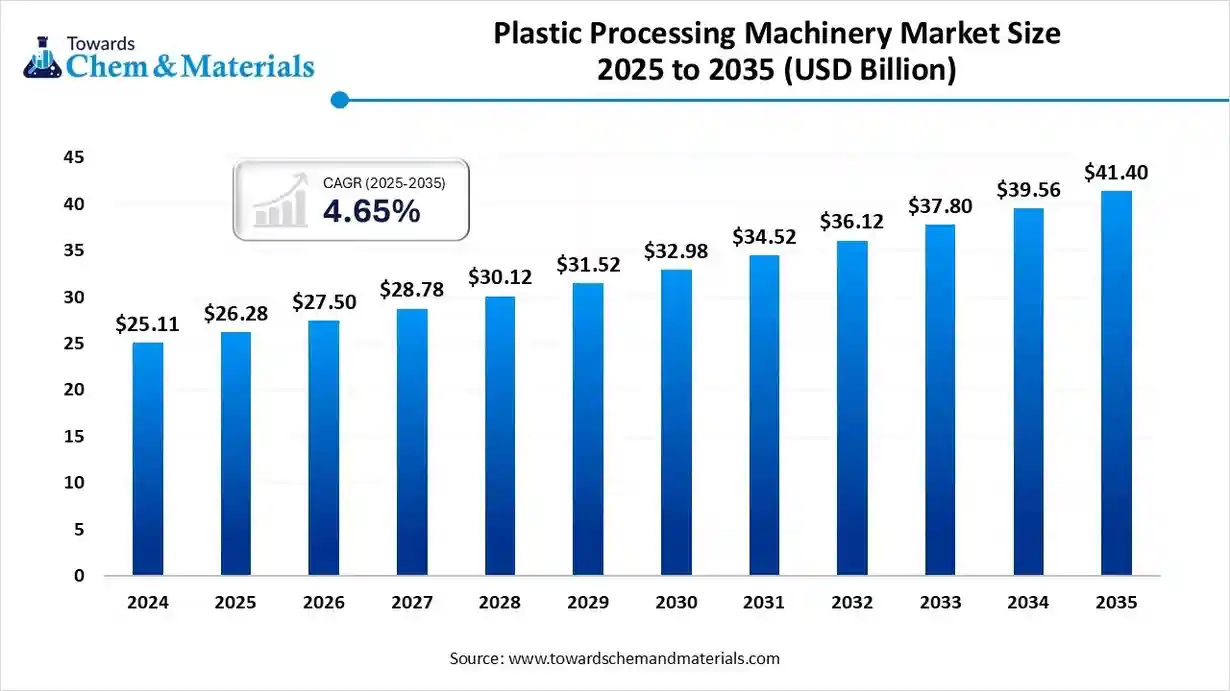

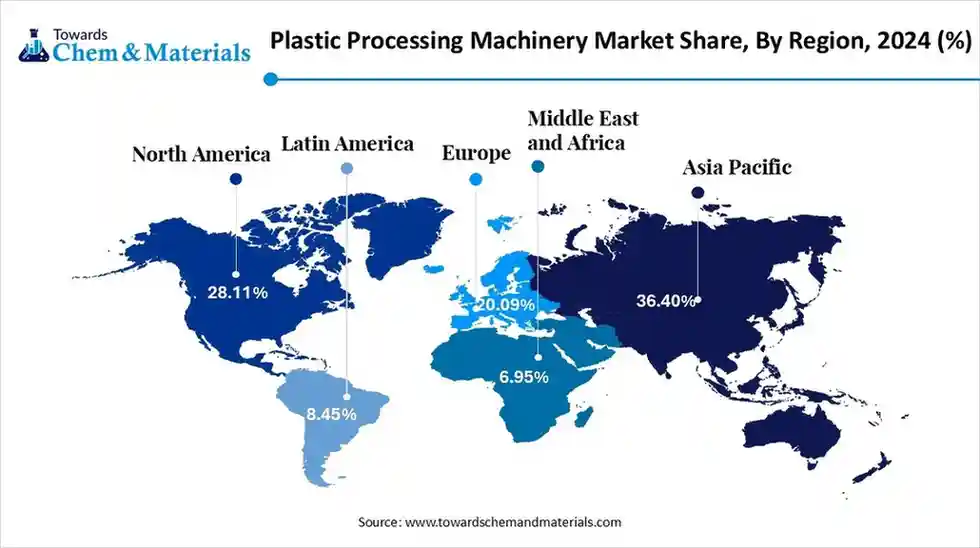

The global plastic processing machinery market size is estimated at USD 26.28 billion in 2025, it is predicted to increase from USD 27.50 billion in 2026 to approximately USD 41.40 billion by 2035, expanding at a CAGR of 4.65% from 2025 to 2035. Asia Pacific dominated the plastic processing machinery market with a market share of 36.40% the global market in 2024. The growing demand for plastic products across various sectors is the key factor driving market growth. Also, growing demand for sustainable recycling practices, coupled with the growing e-commerce sector across the globe, can fuel market growth further.

Key Takeaways

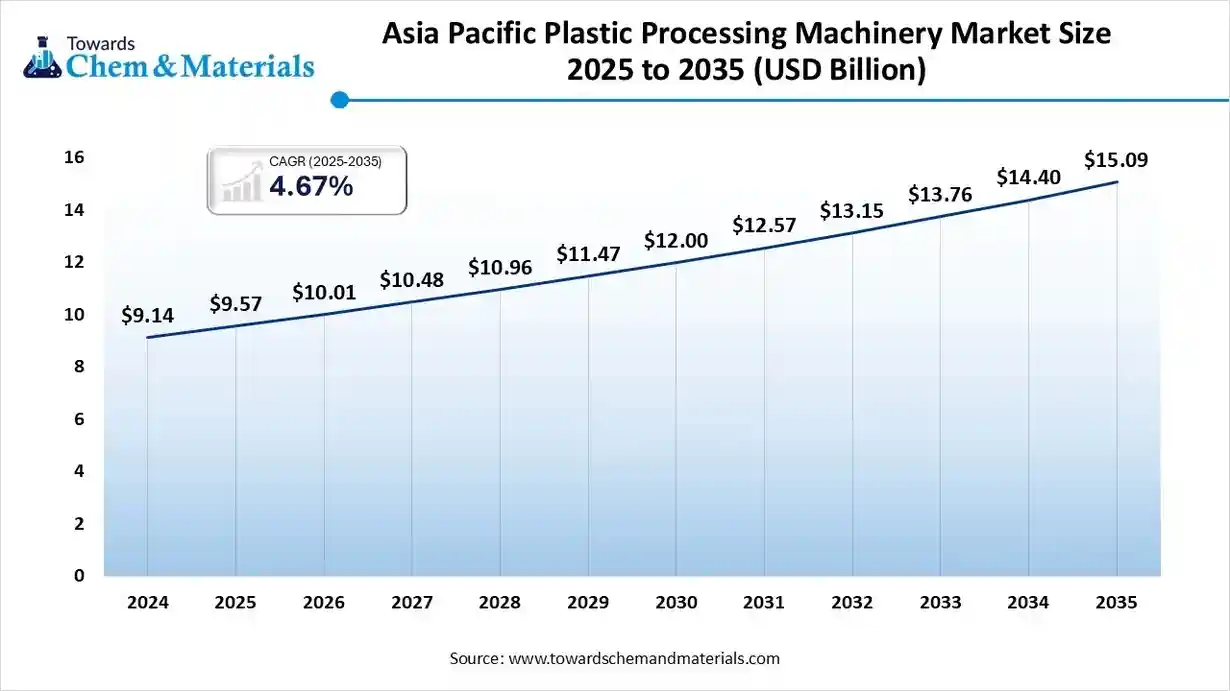

- By region, Asia Pacific dominated the market with a 36.4% share in 2024 and is expected to grow at the fastest CAGR of 6.0% over the forecast period.

- By region, North America is expected to grow at a notable CAGR over the forecast period.

- By type, the injection molding machines segment dominated the market with a 48.3% share in 2024.

- By type, the blow molding machines segment is expected to grow at the fastest CAGR of 5.0% over the forecast period.

- By operation mode, the hydraulic segment held 54.4% market share in 2024.

- By operation mode, the electric segment is expected to grow at the fastest CAGR of 5.1% over the forecast period.

- By material, the polypropylene segment dominated the market with a 40.4% share in 2024.

- By material, the polyethylene segment is expected to grow at the fastest CAGR of 5.2% during the projected period.

- By application, the film and sheet segment held 42.8% market share in 2024.

- By application, the pipes and profiles segment is expected to grow at the fastest CAGR of 5.3% during the study period.

- By end-use industry, the packaging segment dominated the market with 42.5% share in 2024.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR of 5.2% over the forecast period.

What is Plastic Processing Machinery?

The market is driven by increasing plastic consumption across industries. The plastic processing machinery market includes equipment used to convert raw plastic materials into finished products through processes such as molding, extrusion, forming, and recycling. These machines are essential for manufacturing packaging, automotive parts, consumer goods, and construction materials.

The market growth is also propelled by advancements in automation and energy-efficient machinery, and growing demand for sustainable processing technologies, particularly in lightweight materials and high-precision production applications.

Global Plastic Processing Machinery Market Outlook:

- Industry Growth Overview: The pharmaceutical, food and beverage, and consumer goods sectors are fuelling demand for efficient and more advanced packaging solutions, which in turn boosts the demand for plastic processing machinery.

- Sustainability Trends: Sustainability trends in the market include the development of machinery for recyclable and biodegradable plastics with a greater focus on energy efficiency, by combining smart manufacturing technologies.

- Major Investors: Major players in the market include large manufacturers such as Haitian International, Arburg GmbH + Co KG, and Milacron. Investment in this sector is largely driven by the demand for energy-efficient, advanced, and smart machinery, as well as rapid industrialization.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 27.50 Billion |

| Expected Size by 2035 | USD 41.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Type, By Operation Mode, By Material, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Engel Austria GmbH, KraussMaffei Group GmbH, Arburg GmbH + Co KG, Husky Injection Molding Systems Ltd. Sumitomo Heavy Industries Ltd., Milacron Holdings Corp., Toshiba Machine Co., Ltd., JSW Plastics Machinery Inc., Nissei Plastic Industrial Co., Ltd., Wittmann Battenfeld GmbH, Battenfeld-Cincinnati Group, Negri Bossi S.p.A., Chen Hsong Holdings Ltd., Fanuc Corporation |

How Cutting Edge Technologies are revolutionizing the Plastic Processing Machinery Market?

Advanced technologies are transforming the market by increasing precision, automation, and efficiency through the integration of robotics, Artificial Intelligence, and Industry 4.0 principles. Moreover, these advancements support more sustainable practices by facilitating resource use and the development of "smart" factories.

Trade Analysis of Plastic Processing Machinery Market: Import & Export Statistics:

- In 2024, the United States exported approximately 900 million pounds (about 410,000 metric tons) of recovered plastic materials, a slight decrease of about 2% from 2023, extending a long-term trend of declining export volumes.

- In the first ten months of FY25, India's plastic exports reached ₹89,296 crore (US$10.34 billion), with significant year-over-year growth in exports of plastic films & sheets (19.6%), FIBC woven sacks, woven fabrics & tarpaulin (17.2%), and packaging items (10.1%). The total cumulative exports for the period also saw a 9.6% increase compared to the same period last year.

Plastic Processing Machinery Market Value Chain Analysis

- Feedstock Procurement : It is the process of acquiring the raw or intermediate materials needed to produce plastic products.

- Chemical Synthesis and Processing : It refers to the stage that emphasises the machinery, equipment, and processes utilized for the actual creation of polymers.

- Packaging and Labelling : This stage focused on the regulatory requirements involved in creating and applying packaging and labels for plastic products.

- Regulatory Compliance and Safety Monitoring : It refers to the adherence to stringent industry standards and government regulations to ensure worker safety and product quality with environmental protection.

Plastic Processing Machinery Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| India | The Bureau of Indian Standards (BIS) certification is mandatory for many categories of imported and domestically produced plastic processing machinery to ensure compliance with Indian safety, quality, and performance standards. |

| European Union (EU) | Plastic processing machinery sold in the EU must have a CE mark, indicating compliance with essential health and safety requirements outlined in the EU Machinery Directive (2006/42/EC). |

| United States (US) | The Occupational Safety and Health Administration (OSHA) enforces workplace safety regulations. Compliance with American National Standards Institute (ANSI) safety standards (e.g., ANSI/PLASTICS B151.1 for Injection Molding Machines) is crucial. |

Segment Insights

Type Insights

How Much Share Did the Injection Molding Machines Segment Held in 2024?

- The injection molding machines segment dominated the market with a 48.3% share in 2024. The dominance of the segment can be attributed to the growing demand for fuel-efficient and lightweight vehicles, along with the expansion of the e-commerce and consumer goods sectors across the globe, which impacts positive segment growth.

- The blow molding machines segment is expected to grow at the fastest CAGR of 5.0% over the forecast period. The growth of the region can be credited to the rising demand for cost-effective and lightweight packaging from the food, beverage, and pharmaceutical industries. The integration of robotic systems improves precision and efficiency in the manufacturing process.

- The extrusion machines are one of the major segments in the market. The growing emphasis on sustainability fuels the demand for machinery that can process recycled and bio-based plastics. The integration of sophisticated control systems increases the productivity of the operations.

- The thermoforming machines segment held the major market share in 2024. The thermoformed plastics are used for protective enclosures for electronics, like accessories, device housing, and promotional displays. The growing demand for consumer durables further fuels market expansion.

Operation Mode Insights

Which Operation Mode Type Segment Dominated the Plastic Processing Machinery Market in 2024?

- The hydraulic segment held 54.4% market share in 2024. The dominance of the segment can be linked to the growing demand for durable plastic products and its crucial role in the production process, such as injection molding. Hydraulic systems are crucial for managing large loads, which makes them necessary for various applications.

- The electric segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. The growth of the segment can be driven by the ongoing push towards energy efficiency and sustainability, particularly in the automotive sector. Electric machines are more precise and energy-efficient than hydraulic machines.

- The hybrid segment held a significant market share in 2024. Hybrid machines offer substantial energy savings as compared to conventional hydraulic machines by utilizing servo-electric motors for specific movements. Their versatility enables processing an extensive range of materials and producing various products.

Material Insights

Which Material Type Segment Dominated the Plastic Processing Machinery Market in 2024?

- The polypropylene segment dominated the market with a 40.4% share in 2024. The dominance of the segment is owed to the growing material demand from the automotive, packaging, and consumer goods industries.

- Polypropylene is extensively used for components such as door trims, bumpers, and instrument panels due to its low density and durability.

- The polyethylene segment is expected to grow at the fastest CAGR of 5.2% during the projected period. The growth of the segment is due to the expanding e-commerce sector and rising demand for durable, lightweight, and cost-effective packaging solutions. The construction sector extensively uses polyethylene for various applications.

- The growth of the PVC segment is driven by its heavy use in the construction sector for energy-efficient buildings, coupled with the ongoing trend toward eco-friendly building materials. PVC's corrosion resistance, cost-effectiveness, and durability make it a preferred material for sewage and water supply.

- The ABS is one of the major segments in the market. The growing demand from major end-use industries such as electronics, automotive, and construction. ABS is a preferred material for computer housings, keyboards, and electronic enclosures because of its electrical insulation properties.

Application Insights

Which Application Type Segment Dominated the Plastic Processing Machinery Market in 2024?

- The film and sheet segment held 42.8% market share in 2024. The dominance of the segment can be attributed to the ongoing technological innovations in machinery, rising demand for packaging and construction materials, and a robust push for recyclable and sustainable plastic solutions.

- The pipes and profiles segment is expected to grow at the fastest CAGR of 5.3% during the study period. The growth of the segment can be credited to the superiority of plastic over traditional materials, ongoing urbanization, extensive infrastructure development, and significant technological innovations in extrusion machinery.

- The growth of the wires and cables segment is driven by extensive global infrastructure development, rising adoption of cutting-edge technologies such as automation and 5G networks, coupled with the expansion of renewable energy sources.

- The bottles and containers are one of the major segments in the market. The growth of the segment is mainly fuelled by changing consumer preferences for convenience, portability, and longer product shelf-life materials. Plastic materials like Polyethylene Terephthalate (PET) are mostly preferred for manufacturing.

End-Use Industry Insights

How Much Share Did the Packaging Segment Held in 2024?

- The packaging segment held 42.5% market share in 2024. The dominance of the segment can be linked to the growing demand for e-commerce and packaged consumer goods, along with the substantial technological innovations in automation and machinery efficiency.

- The automotive segment is expected to grow at the fastest CAGR of 5.2% over the forecast period. The growth of the segment can be driven by the growing need for lightweight vehicles to enhance fuel efficiency and minimize emissions. Also, the rapid shift towards high-performance plastics is increasing the manufacturing of electric vehicles (EVs).

- The construction segment held a significant market share in 2024. The growth of the segment is boosted by rising demand for durable and lightweight plastic products such as pipes, insulation, and window profiles, coupled with the advancements in fire-retardant and UV-stabilized plastics.

- Consumer goods are one of the major segments in the market. The consumer goods industry is heavily dependent on packaging, and the expansion of e-commerce further propels the demand for convenient, lightweight, and often plastic packaging solutions.

Regional Insight

The Asia Pacific plastic processing machinery market size was valued at USD 9.57 billion in 2025 and is expected to reach USD 15.09 billion by 2035, growing at a CAGR of 4.67% from 2025 to 2035.Asia Pacific dominated the market with a 36.4% share in 2024,The dominance and growth of the region can be attributed to the rapid industrialization and urbanization, along with the increasing population and disposable income in emerging economies such as China and India. In addition, favourable government policies are encouraging local manufacturing, further boosting market expansion.

China Plastic Processing Machinery Market Trends

In the Asia Pacific, China dominated the market owing to the increasing demand for lightweight materials in the packaging and automotive sectors, with the rising need for sustainable solutions like recycling machinery. China's robust export-oriented economy contributed to both domestic and international demand for processing machinery.

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be credited to the ongoing shift towards the circular economy and the rapid expansion of the healthcare sector. Also, government regulations and consumer preferences are fuelling the need for equipment that can handle biodegradable and recyclable plastic materials.

U.S. Plastic Processing Machinery Market Trends

In North America, the U.S. led the market due to growing demand for plastic packaging, particularly for e-commerce. The need to manufacture more complex plastic components with consistent quality is propelling the demand for high-precision machinery in the country.

Europe held a significant market share in 2024. The growth of the region is driven by a rapid push for sustainability and innovations in technology. The EU's emphasis on the circular economy and recycling targets requires machinery that can efficiently process recycled materials, leading to regional growth soon.

Germany Plastic Processing Machinery Market Trends

The growth of the market in Germany is fuelled by the development of advanced and new plastic materials with improved properties that necessitate more convenient and precise processing equipment. The automotive sector in the region drives demand for lightweight plastics to enhance overall fuel efficiency.

South America held a significant market share in 2024. The growth of the region is due to increasing consumer demand for lightweight automotive components and packaged goods, supported by rising investment in advanced technologies. Surge in environmental awareness and regulations is impelling the adoption of machinery capable of processing biodegradable plastics, contributing to regional growth soon.

Brazil Plastic Processing Machinery Market Trends

The market growth in Brazil is fuelled by growing demand for plastic products, especially in the automotive and packaging sectors, along with substantial innovations in technology like Industry 4.0 and automation. Also, Brazil's ongoing industrialization in emerging markets is creating substantial opportunities for market growth in the country.

The plastic processing machinery market in the Middle East and Africa is experiencing steady growth, driven by rising demand in packaging, construction, and consumer goods sectors. Expansion in infrastructure projects, increasing local manufacturing, and abundant petrochemical resources in Gulf countries support market growth. Injection molding and extrusion machines dominate, while demand for energy-efficient and automated machinery is increasing.

- However, factors such as regulatory pressures on plastics and uneven industrial development across Africa may moderate overall expansion.

South Africa Plastic Processing Machinery Market Trends

In South Africa, the plastic processing machinery market is growing steadily, supported by the country’s expanding packaging, construction, and automotive industries. Rising demand for plastic components, driven by infrastructure development and consumer goods production, is boosting machinery investments. Injection molding and extrusion machines dominate due to their wide industrial applications.

Recent Developments

- In June 2025, Sumitomo Chemical introduces a mass manufacturing technology for liquid crystal polymer (LCP) utilising a monomer obtained from biomass materials. LCP is a kind of plastic that excels in fire resistance and heat resistance.(Source: www.sumitomo-chem.co.jp)

- In June 2025, Sanathan Textiles introduces Plastic-to-Plant' drive on World Environment Day to boost circularity. Sanathan Textiles Limited is a major player in India's textile sector, living with a commitment to environmental sustainability.(Source: www.indiantextilemagazine.in)

Top Plastic Processing Machinery Market Companies

Haitian International Holdings Ltd.

Corporate Information

- Name: Haitian International Holdings Ltd. (Stock code: HKEX 1882)

- Headquarters: Ningbo, Zhejiang Province, China.

- Founded: 1966 (predecessor company)

- Industry: Manufacturing plastic injection moulding machines and related components & services.

- 2024 Revenue: RMB 16,128.3 million (approx) up 23.4 % year-on-year.

History and Background

The origins trace back to the predecessor company “Haitian Machinery Manufacturing” in Ningbo in 1966.

The company expanded rapidly in China and internationally; in 2006 it was listed on the Hong Kong Stock Exchange.

Key Developments and Strategic Initiatives

- In 2023, Haitian inaugurated a manufacturing facility in Jalisco, Mexico (approx. USD 50 million investment) to serve North & South America.

- In 2024, the company announced strong growth: revenue +23.4 %, injection-moulding machine business +23.8 % and growth in volume >35.5% (delivered units) for 2024.

Mergers & Acquisitions

- 2007: Acquisition of Zhafir Plastics Machinery (Germany) as noted above.

- While specific further large-M&A deals are less publicly detailed, the company has undertaken internal investments (for example, acquisition of manufacturing equipment from Haitian Precision for RMB 206.48 million in Dec 2024) to enhance capacity.

Partnerships & Collaborations

- Strategic Cooperation Agreement with Haier Smart Home Co., Ltd. (May 2025) leveraging smart home ecosystem, big data, AI, custom manufacturing.

- Strategic Alliance with Shengguang Medical Products Co., Ltd. (March 2025) to build intelligent medical manufacturing ecosystem.

Product Launches / Innovations

- The “5th-generation” injection-moulding machine technology was launched and showcased at exhibitions like NPE 2024 and CHINAPLAS 2024.

- Launch of large-clamping-force machine: e.g., the JU33000M multi-component rotary table machine (33,000 kN clamping force) in 2024.

Key Technology Focus Areas

- Electric & Servo-Hydraulic Machines: Through brands “Haitian” (standard/mass-production) and “Zhafir” (high-precision electric) the company covers a wide spectrum.

- Two-Platen Technology: The Jupiter series addresses large parts / high throughput applications.

Automation & Turnkey Solutions: Emphasis on full lines, robotics, plant solutions, not just single machines.

R&D Organisation & Investment

- According to one source, about 3.8% of revenue in 2022 was allocated to R&D; over 1,000 patents globally claimed.

- The company has national-level technology centres and a post-doctoral workstation (as per ESG report).

SWOT Analysis

Strengths:

- Large scale: industry-leading volumes (~53,000 machines in 2024) and strong brand recognition.

- Broad product portfolio covering standard, precision, electric, large-clamp force machines.

- Global footprint and localization: manufacturing bases abroad, service network in 130+ countries.

- Strong vertical integration, cost- efficient production base in China.

- Recent financial performance: robust growth rates (23%+ revenue growth in 2024).

Weaknesses:

- Heavy reliance on injection-moulding machine market, which is cyclical and sensitive to downstream industries (auto, consumer goods).

- Global expansion and localization cost may increase fixed-cost burden and complexity of operations.

- Electric/high-precision machines face intense competition from established Western players and may require higher margins to be profitable.

Opportunities:

- Growing demand for automation, turnkey solutions, Industry 4.0 in plastics processing.

- Expansion into emerging markets (Southeast Asia, Latin America) where localisation helps.

- Growth in electric vehicle, packaging and medical device sectors offering increased demand for high-precision machines.

- Sustainability trends: demand for energy-efficient machines and circular-economy solutions.

Threats:

- Global economic slowdown, trade tensions, supply-chain disruptions could impact machine orders.

- Raw-material cost inflation or shortage of components could squeeze margins.

- Technological disruption: if competitors innovate faster, the company must keep investing heavily in R&D.

- Localisation abroad introduces regulatory, labour and currency risks.

Recent News & Strategic Updates

- In the first half of 2025, Haitian reported revenue of RMB 9,018.3 million (+12.5 % YoY) and delivered ~29,438 machines (+8.8 %). Overseas business grew ~34.7 %.

- The company delivered turnkey pallet-line projects (HA27000/peg) to Honsen Beverage Group (Sep 2025) showcasing its turnkey line capability.

Other Top Companies in the Market

- Engel Austria GmbH: Engel Austria GmbH is a leading global manufacturer of plastic processing machines, offering integrated and automated production cells for various materials like thermoplastics, thermosets, and elastomers.

- KraussMaffei Group GmbH: KraussMaffei Group GmbH is one of the world's leading manufacturers of machinery and systems for producing and processing plastics and rubber. The company holds a significant position in the global plastic processing machinery market.

- Arburg GmbH + Co KG

- Husky Injection Molding Systems Ltd.

- Sumitomo Heavy Industries Ltd.

- Milacron Holdings Corp.

- Toshiba Machine Co., Ltd.

- JSW Plastics Machinery Inc.

- Nissei Plastic Industrial Co., Ltd.

- Wittmann Battenfeld GmbH

- Battenfeld-Cincinnati Group

- Negri Bossi S.p.A.

- Chen Hsong Holdings Ltd.

- Fanuc Corporation

Segments Covered in the Report

By Type

- Injection Molding Machines

- Blow Molding Machines

- Extrusion Machines

- Thermoforming Machines

- Compression Molding Machines

By Operation Mode

- Hydraulic

- Electric

- Hybrid

By Material

- Polypropylene

- Polyethylene

- PVC

- ABS

- Polystyrene

By Application

- Film and Sheet

- Pipes and Profiles

- Wires and Cables

- Bottles and Containers

By End-Use Industry

- Packaging

- Automotive

- Construction

- Consumer Goods

- Electronics

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA