Content

What is the Current Petrochemical Market Size and Share?

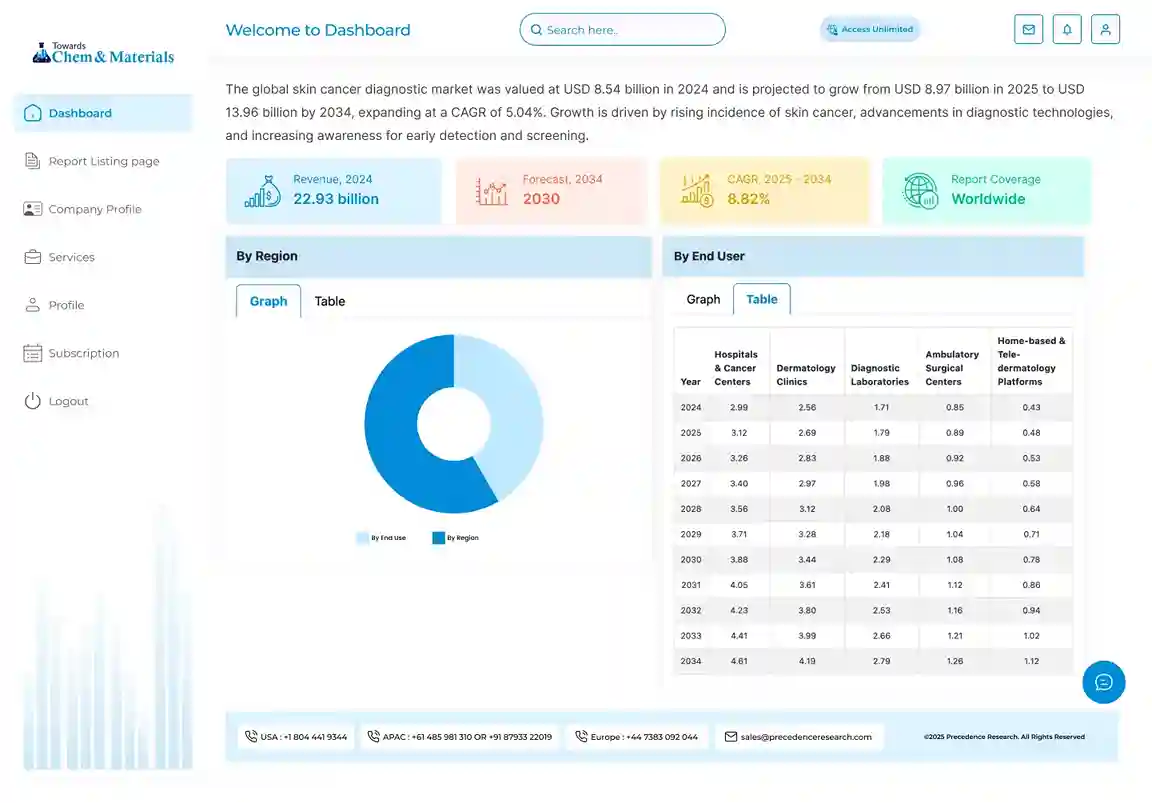

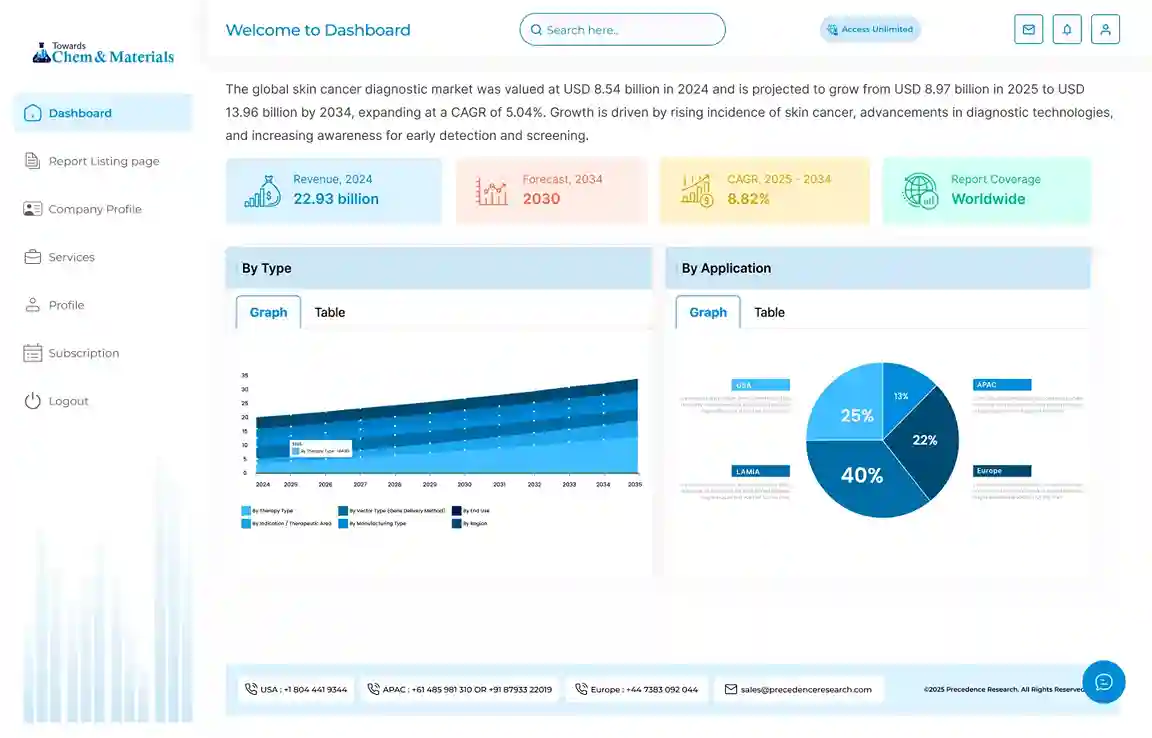

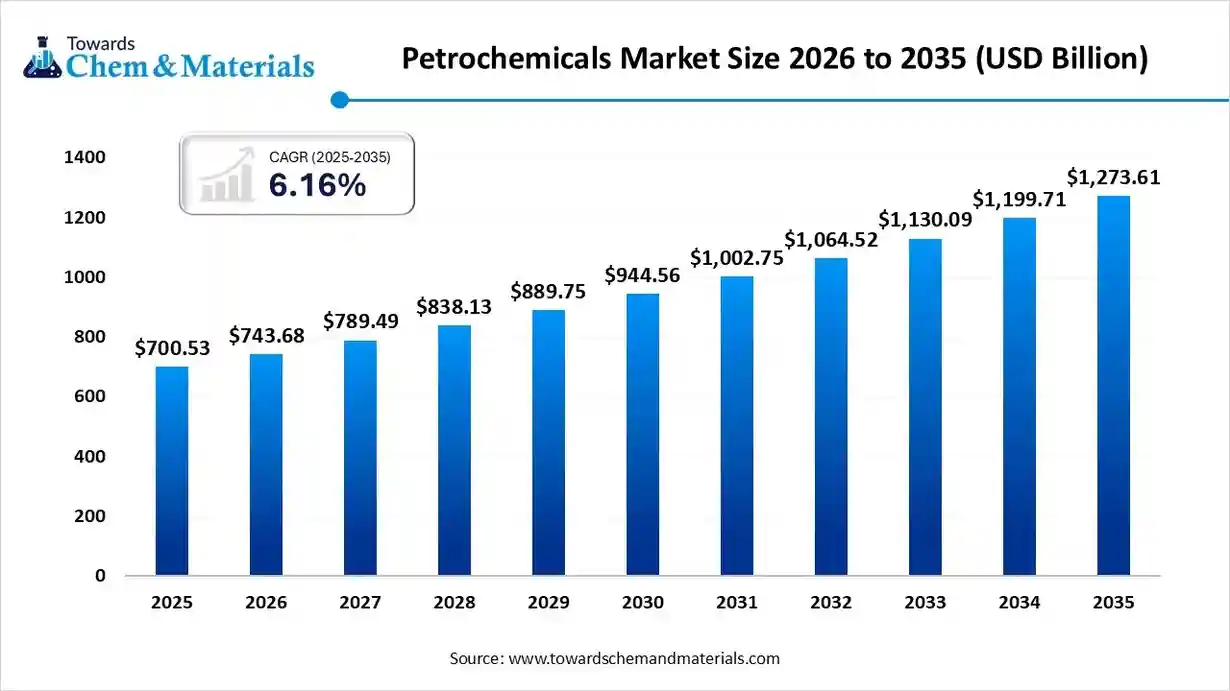

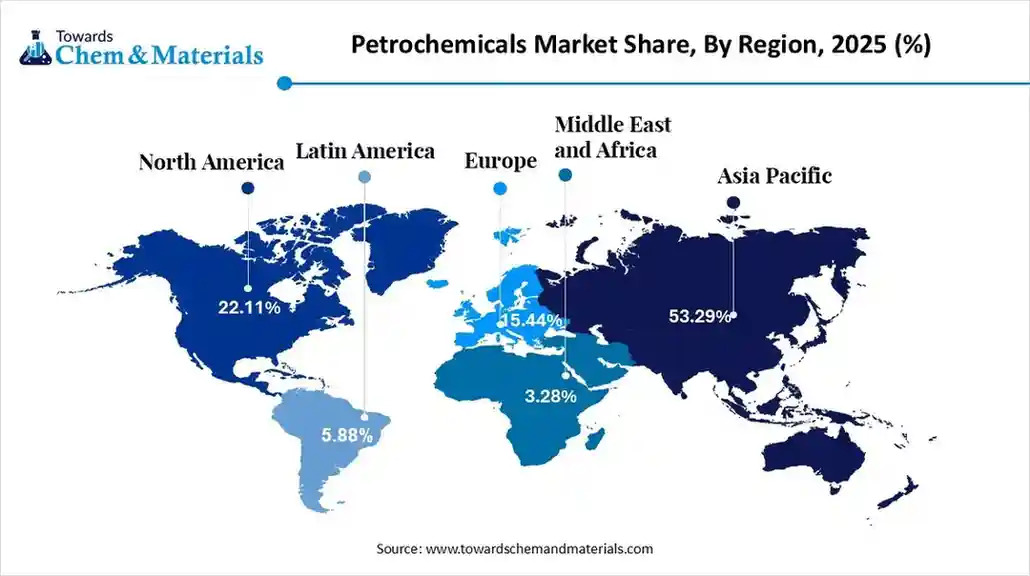

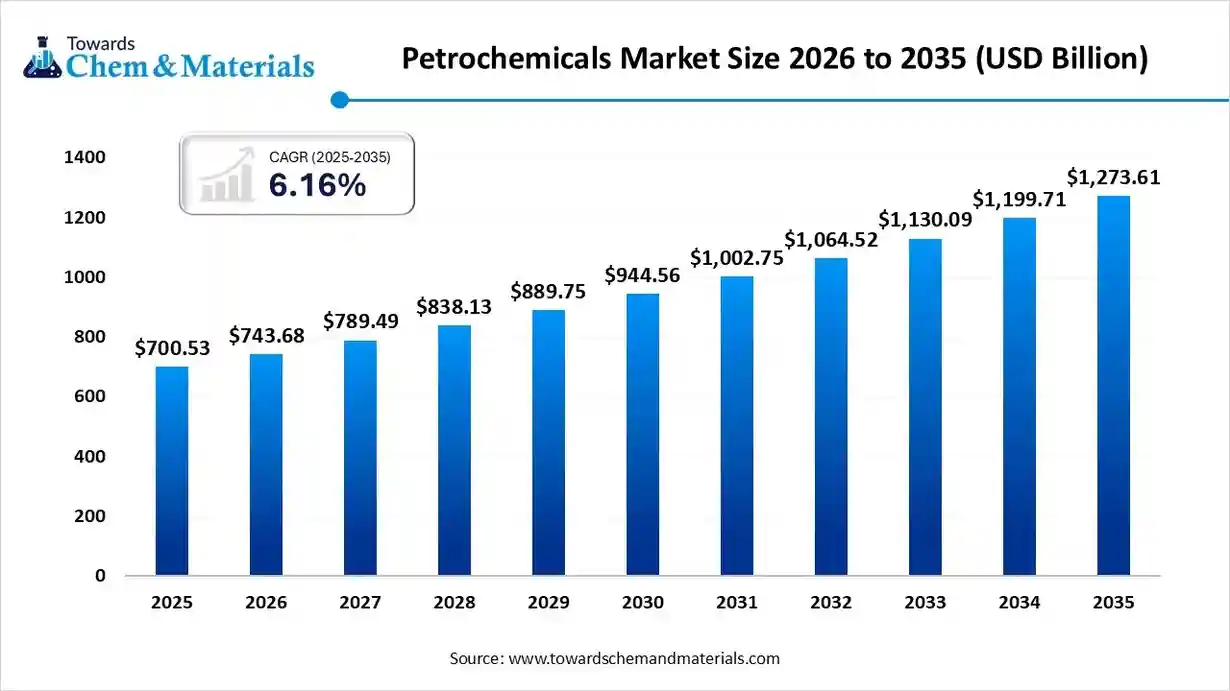

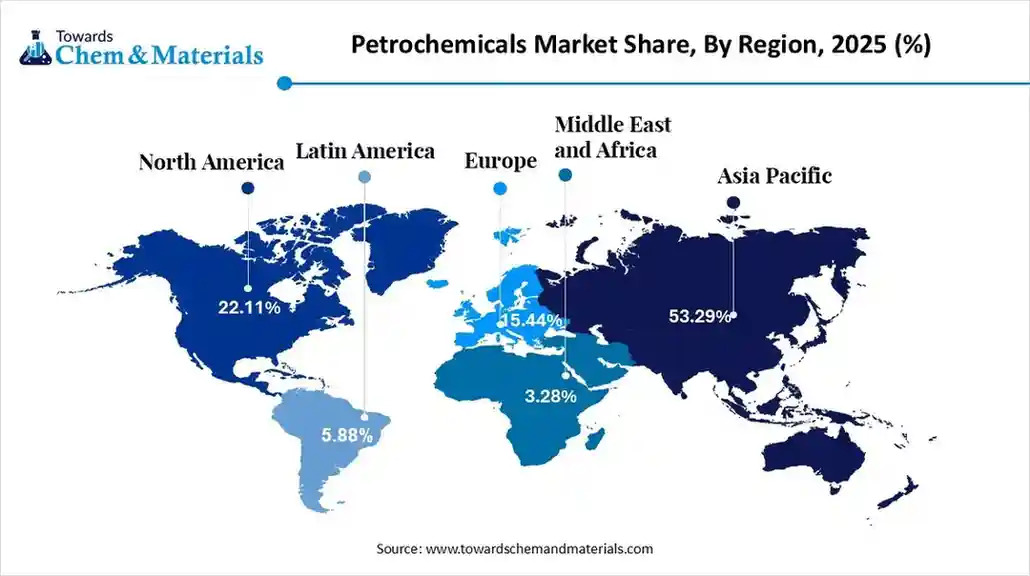

The global petrochemical market size was estimated at USD 700.53 billion in 2025 and is expected to increase from USD 743.68 billion in 2026 to USD 1,273.61 billion by 2035, growing at a CAGR of 6.16% from 2026 to 2035. Asia Pacific dominated the Petrochemical market with the largest revenue share of 53.29% in 2025.

Key Takeaways

- By region, Asia Pacific held approximately 53.29% share in the petrochemicals market in 2025.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period.

- By product type, the olefins segment held approximately a 45.12% share in the market in 2025.

- By product type, the polypropylene & bio-based olefins segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By raw material, the crude oil segment held approximately a 53.16% share in the market in 2025.

- By raw material, the natural gas & naphtha alternatives segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By manufacturing process, the steam cracking segment held approximately a 49.09% share in the market in 2025.

- By manufacturing process, the methanol-to-olefins segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use industry, the packaging segment held approximately a 30.65% share in the market in 2025.

- By end-use industry, the automotive & EV materials segment is expected to grow at the fastest CAGR in the market during the forecast period.

What are Petrochemicals?

Petrochemicals are obtained from natural gas and crude oil for the production of various materials like synthetic fibers, detergents, plastics, fuels, and solvents. Petrochemicals are derived into two types: aromatics like xylene, benzene, & toluene, and olefins like propylene & ethylene. They are widely used in various applications like manufacturing plastic products, production of synthetic fibers, manufacturing chemicals, food preservation, lightweight automotive components, and many more.

Factors driving the market growth are growing industrialization, rapid urbanization, growth in e-commerce, increasing consumption of consumer goods, high availability of feedstocks, increasing development of energy storage systems, rise in adoption of electric vehicles, and increasing utilization of electronic devices.

What is the Export of Petrochemicals and Petrochemical Products?

- Vietnam exported 5532 shipments of petrochemicals.(Source: www.volza.com)

- CONG TY TNHH TOYO INK COMPOUNDS VIET NAM is the leading supplier of petrochemicals in the world.(Source: www.volza.com )

- The United States exported 28468 shipments of olefins.(Source: www.volza.com)

- South Korea exported $2.71B of benzene in 2023.(Source: oec.world)

- South Korea exported $756M of toluene in 2023.(Source: oec.world)

Growing Construction Activities Surge Petrochemicals Demand

The rapid urbanization and growing construction activities in various regions increase demand for petrochemicals for various applications. The growing investment in the development of infrastructure projects and the increasing construction of new homes increase demand for petrochemicals. The increasing need for insulation, paints, adhesives, coatings, and piping requires petrochemicals to enhance energy efficiency and improve the aesthetics of buildings.

The strong focus on interior design and increasing development of window frames increases the adoption of petrochemicals. The growing utilization of energy-efficient construction materials and the rise in commercial & residential construction require petrochemicals. The growing construction activities are a key driver for the growth of the market.

Market Trends

- Growing Demand for Plastics: The growing demand for plastics across various industries like electronics, packaging, and construction increases the adoption of petrochemicals.

- Growth in Automotive Industry: The growing manufacturing of lightweight automotive components and focus on enhancing fuel efficiency of vehicles increases demand for petrochemicals.

- Rise in Development of Infrastructure Projects: The growing development of infrastructure projects like roads, bridges, and other infrastructure increases demand for adhesives, cements, and plastics that require petrochemicals.

Petrochemical Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 700.05 Billion |

| Expected size in 2034 | USD 1,196.85 Billion |

| Growth Rate | CAGR 6.14% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product Type, By Raw Material, By Manufacturing Process, By End-Use Industry, By Region |

| Key Companies Profiled | BASF SE, Dow Chemical Company, SABIC, LyondellBasell Industries, ExxonMobil Chemical, INEOS Group, Sinopec, Reliance Industries Limited (RIL), Shell Chemicals, TotalEnergies Chemicals, Formosa Plastics Group, Mitsubishi Chemical Group, LG Chem, Covestro AG, Braskem S.A., Arkema S.A., Chevron Phillips Chemical, PTT Global Chemical, Mitsui Chemicals, Hanwha Solutions |

Market Opportunity

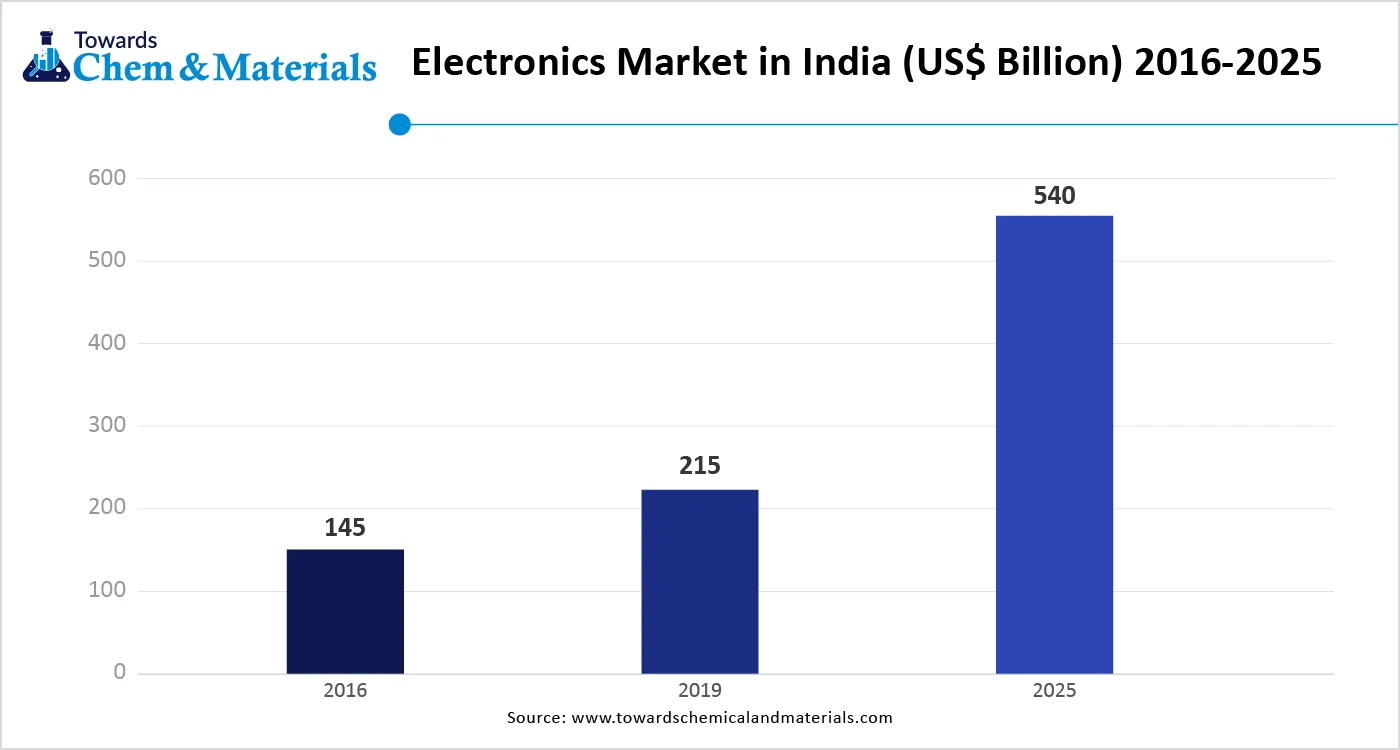

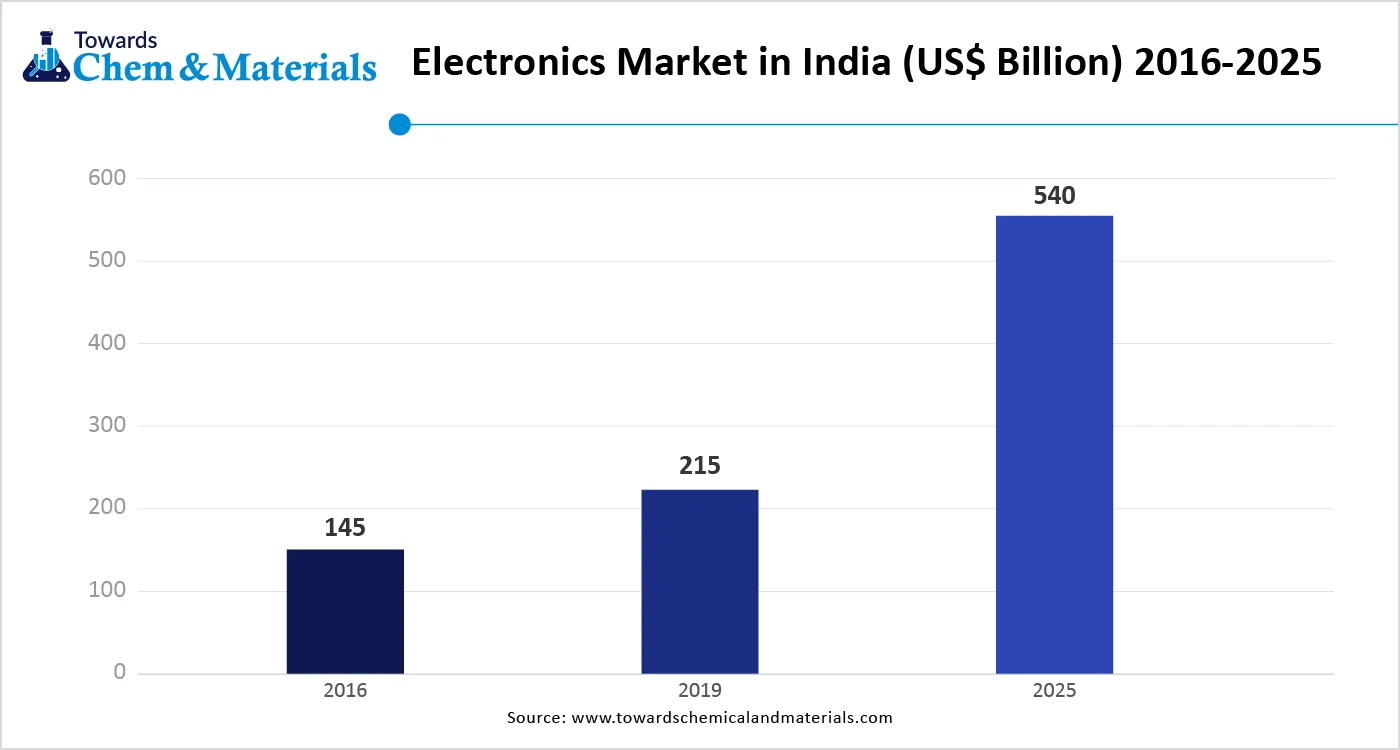

Growing Electronic Industry Unlocks Market Opportunity

The growing electronic sector and the rise in the adoption of electronic devices increase demand for petrochemicals. The increasing production of electronic components like cables, circuit boards, microchips, connectors, and advanced semiconductors increases the adoption of petrochemicals. The growing development of lightweight electronic devices and the increasing miniaturization of electronic devices require petrochemicals.

The increasing adoption of devices like tablets, smartphones, wearables, and laptops, and ongoing innovations in electronics, increase the adoption of petrochemicals. The growing need for electrical insulation in electronic devices and the development of flexible displays require petrochemicals. The growing electronic industry creates an opportunity for the growth of the petrochemicals market.

Market Challenge

Fluctuating Raw Material Prices Halts Market Expansion

Despite several benefits of the petrochemicals in various industries, the fluctuating cost of raw materials restricts the market growth. The volatility in prices of raw materials like natural gas and crude oil directly affects the market. Supply chain disruptions due to factors like natural disasters, logistical issues, wars, and trade restrictions increase the raw material cost. The geopolitical instability and increasing cost of energy increase the cost. The stringent changes in regulations and variations in feedstock availability require a high cost. The fluctuating raw material prices hamper the growth of the market.

Key Regulations Impacting the Petrochemicals

| Country | Primary Regulatory Focus | Key Regulatory Policy |

| U.S. | Environmental Emissions & Worker Safety | Clean Air Act, CERCLA, OSHA safety standards, and GHG reporting. |

| EU | Chemical Management & Industrial Emissions | REACH regulation, Industrial Emissions Directive (IED), and circular economy push. |

| China & India | Pollution Control & Sustainable Growth | National environmental acts, investment incentives, and an increasing focus on sustainable practices in response to rapid industrialization. |

Value Chain Analysis

- Research and Development (R&D): This involves new catalysts, recycling methods, bio-based feedstocks, and advanced high-performance materials.

- Key Players: ExxonMobil Chemical Company, Shell plc, BASF SE, SABIC.

- Raw Material Sourcing: This focuses on the extraction and refining of crude oil and natural gas into feedstocks like naphtha, ethane, and propane.

- Key Players: ExxonMobil, Shell, Sinopec, and Saudi Aramco.

- Production of Intermediates & Derivatives: This converts basic chemicals into polymers, synthetic rubber, and other derivatives.

- Key Players: Dow Chemical Company, Braskem S.A., Sumitomo Chemical Co., Ltd., Arkema Group.

- Logistics & Distribution: This involves the transport and storage of petrochemicals via pipelines, ships, rail, and trucks.

- Key Players: Univar Solutions Inc., Kinder Morgan, Inc., Enterprise Products Partners L.P., various shipping lines.

- Sustainability & Waste Management: This includes emission control, plastic recycling, and the development of bio-based alternatives.

- Key Players: Waste Management, Inc., Veolia Environnement S.A., and PureCycle Technologies.

Segmental Insights

Product Type Insights

Why did the Olefins Segment Dominate the Petrochemicals Market?

The olefins segment dominated the market with approximately a 45.12% share in 2025. The increasing production of various polymers and plastics increases demand for olefins. The presence of vast reserves of natural gas and the increasing development of lightweight vehicle materials increase demand for olefins. The growing expansion of the packaging industry and rise in construction activities increase the adoption of olefins, driving the overall market growth.

The polypropylene & bio-based olefins segment is the fastest-growing in the market during the forecast period. The growing expansion of the packaging industry and increasing construction activities increase demand for PP. The increasing production of automotive components, films, and containers increases demand for PP. The growing environmental concerns and stricter environmental regulations increase the adoption of bio-based olefins. The focus on lowering the carbon footprint and minimizing greenhouse gas emissions supports the market growth.

Raw Material Insights

How Crude Oil Segment Held the Largest Share in the Petrochemicals Market?

The crude oil segment held the largest revenue share of approximately 53.16% in the market in 2025. The presence of vast reserves of hydrocarbon and the increasing utilization of steam cracking increase demand for crude oil. The increasing production of synthetic fibers, detergents, and plastics requires crude oil. The high availability of feedstocks and growth in industries like consumer goods, packaging, and construction require crude oil, driving the overall market growth.

The natural gas & naphtha alternatives segment is experiencing the fastest growth in the market during the forecast period. The growing demand for products like clothing, plastics, and fertilizers increases the adoption of natural gas. The increasing environmental concerns and high availability of natural gas liquids help the market growth. The increasing shift towards cleaner processes and the increasing adoption of sustainable processes increase demand for natural gas & naphtha alternatives, supporting the overall market growth.

Manufacturing Process

Why Steam Cracking Segment is Dominating the Petrochemicals Market?

The steam cracking segment dominated the petrochemicals market with approximately a 49.09% share in 2025. The increasing production of light olefins and increasing processes of hydrocarbon feedstock increase demand for steam cracking. The growing manufacturing of ethane, naphtha, and LPG requires steam cracking. The increasing use of household items like shampoos and detergents increases demand for steam cracking. The growing production of downstream products and cost-effectiveness drive the market growth.

The methanol-to-olefins segment is the fastest-growing in the market during the forecast period. The increasing need for construction materials and the production of automotive components increases demand for MTO. The focus on energy security and the presence of diverse feedstocks increase the adoption of MTO. The strong focus on lowering oil dependency and the need to minimize carbon footprint increase the adoption of MTO. The growing utilization of plastics and the expansion of the packaging industry require MTO, supporting the market growth.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the Petrochemicals Market?

The packaging segment held the largest revenue share of approximately 30.65% in the petrochemicals market in 2025. The growing demand for packaged goods and the increasing consumption of packaged food increases demand for petrochemicals. The rise in the e-commerce sector and focus on extending the shelf life of packaged products increase the adoption of petrochemicals. The growing packaging of chemicals, fertilizers, non-food items, and lubricants drives the overall market growth.

The automotive & EV materials segment is experiencing the fastest growth in the market during the forecast period. The increasing manufacturing of lightweight vehicle components like interior trims, bumpers, and dashboards increases demand for petrochemicals. The focus on lowering vehicle weight and the rise in the adoption of electric vehicles increase demand for petrochemicals. The growing expansion of EV infrastructure and increasing manufacturing of battery components support the overall market growth.

Regional Insights

Asia Pacific Petrochemicals Market Size, Industry Report 2034

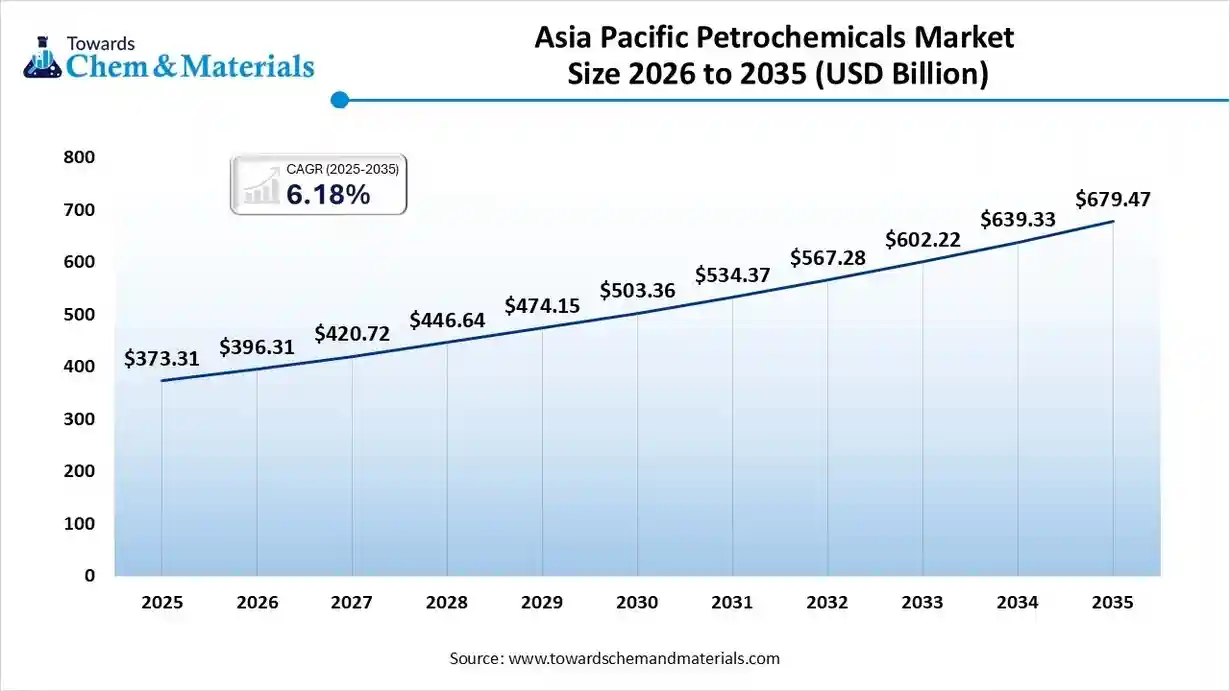

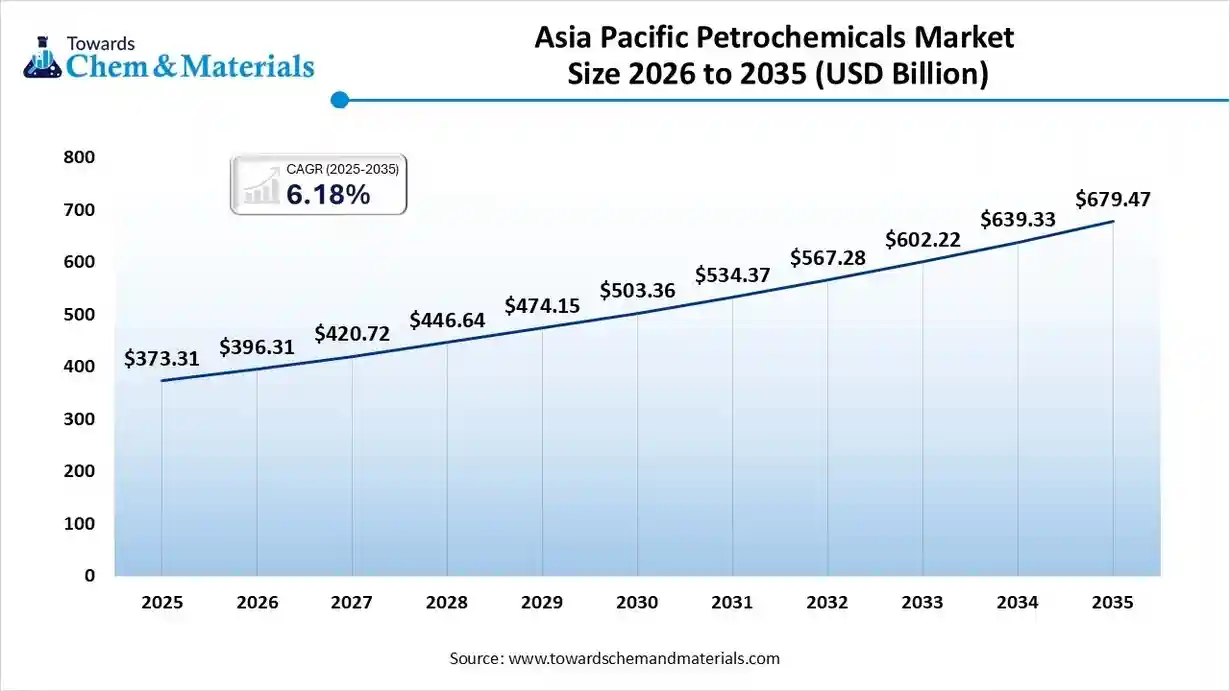

The Asia Pacific petrochemicals market size was estimated at USD 373.31 billion in 2025 and is projected to reach USD 679.46 billion by 2034, growing at a CAGR of 6.18% from 2025 to 2034. Asia Pacific dominated the petrochemicals market with approximately a 53.29% share in 2025.

The growing industrialization and presence of abundant raw materials in the region increase the production of petrochemicals. The high government investment in petrochemical infrastructure and increasing demand for petrochemical-based products help the market growth. The growing expansion of the packaging industry and growth in construction activities require petrochemicals. The increasing automotive manufacturing and growing development of infrastructure projects drive the overall market growth.

China Petrochemicals Market Trends

China is a major contributor to the market. The growing expansion of the petrochemical industry and high investment in petrochemical facilities help the market growth. The growing sectors like consumer durables, construction, and automobiles increase demand for petrochemicals. The increasing need for products like synthetic fibers & plastics, and the presence of vast reserves of coal, increase the production of petrochemicals, supporting the overall market growth.

- China exported 419 shipments of petrochemicals.

(Source: www.volza.com) - China exported $570K of benzene in 2024.

(Source:oec.world) - China exported $490M of toluene in 2023.

(Source: oec.world)

Middle East & Africa Petrochemicals Market Trends

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The presence of abundant hydrocarbons and the low cost of production increase the development of petrochemicals. The increasing investment in petrochemical projects and growing industrialization increase demand for petrochemicals. The growth in the development of infrastructure projects and the strong presence of a petrochemical plant in Qatar & Saudi Arabia drive the overall market growth.

South Africa Petrochemicals Market Trends

South Africa is a key contributor to the market. The vast reserves of coal and the presence of CTL technology increase the production of petrochemicals. The increasing construction activities and growth in automotive manufacturing increase demand for petrochemicals. The growing industrial activities and the growing expansion of the packaging industry increase the adoption of petrochemicals, supporting the overall market growth.

- South Africa exported ZAR 8.56M of toluene in 2024. (Source:oec.world)

How will North America influence the Petrochemicals Market?

North America plays a pivotal role in the global petrochemicals market, defined by its large market size, technological leadership, and unique feedstock advantage. Abundant, low-cost natural gas liquids derived from the shale revolution have positioned the region, particularly the U.S., as a highly competitive producer and a key global exporter of petrochemical building blocks such as ethylene and polyethylene. This position allows it to be a key global exporter and innovator in the field.

U.S. Petrochemicals Market Trends

The U.S. has a large, technologically advanced petrochemicals market. Leveraging its abundant and low-cost shale gas feedstock, the U.S. industry is highly competitive and export-oriented, focusing on innovation in specialized derivatives and sustainable practices. Key drivers include strong demand from end-use sectors like packaging and automotive, as well as government policies supporting energy independence.

How will Europe contribute to the Petrochemicals market?

Europe maintains a significant share of the global petrochemicals market, driven by mature infrastructure and a strong focus on high-value specialty chemicals. The market is largely stable, driven by consistent demand from the automotive, construction, and packaging sectors, with a focus on efficient, high-performance polymers and intermediates. Stringent environmental regulations are pushing major players like BASF SE, INEOS, and SABIC to focus heavily on sustainability, recycling technologies, and bio-based feedstocks to maintain profitability and comply with regulations in a competitive landscape.

Germany Petrochemicals Market Trends

Germany holds the largest share of the European petrochemicals market, anchored by its powerful chemical industry and integrated value chains. The market is heavily influenced by demand from the advanced manufacturing and automotive sectors, particularly the transition to electric vehicles and the adoption of lightweight materials. Global leaders such as BASF SE, Covestro AG, and Evonik Industries AG drive innovation in specialty polymers, performance materials, and advanced catalysts, ensuring Germany remains a hub for high-value petrochemical production.

What is the contribution of Latin America to the Petrochemicals Market?

Latin America is a key contributor to the global market, driven by increasing urbanization, rising disposable incomes, and growth in key end-use industries such as packaging, construction, and agriculture. The region is a net importer of many basic chemicals but has strengths in specific areas, such as bioethanol derivatives in Brazil. Key international players such as Braskem, SABIC, and Dow Inc. are active, seeking to optimize production capacity and leverage growing domestic demand.

Brazil Petrochemicals Market Trends

Brazil maintains the largest petrochemicals market in Latin America, driven by significant domestic demand across consumer goods, packaging, and the automotive industry. The market is closely tied to the country's robust agricultural sector, which demands plastics and fertilizers. Key national player Braskem, along with others such as Oxiteno, operates extensive production complexes focused on ethylene, propylene, and thermoplastic resins to meet substantial local demand.

Petrochemicals Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for petrochemicals is naphtha, butane, ethane, crude oil, propane, and many more. There are two types of feedstocks, heavy & light feedstocks, for petrochemicals.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like steam reforming, pyrolysis, oxidation, alkylation, and polymerization.

- Key Players:- Shell, Chevron Phillips Chemical Company, ExxonMobil, Sinopec, and SABIC

- Quality Testing and Certification: The quality testing involves testing of purity & composition testing, tracing impurities, and physical properties like distillation, flash point, viscosity, color, & density, and certifications like ISO, API, CPSA, and BIS.

Recent Developments

- In September 2025, Sinopec and Aramco launched $10 billion petrochemical venture in Fujian Provinance. The facility consists of over 30 chemical & refining units, including 2 MTA capacity of aromatics, 16 MTA crude oil processing capacity, and 1.5 MTA ethylene capacity.

(Source: www.indianchemicalnews.com) - In September 2025, Farabi Petrochemicals opened $950 million LAB plant in Saudi Arabia. The plant adds LAB capacity by 120000 MTPA, and the plant is present in Yanbu Industrial City.

(Source:www.indianchemicalnews.com) - In July 2025, Manali Petrochemicals expanded its propylene glycol plant. The capacity increases by 5000 KPTA and supports sustainable expansion. The expansion focuses on lowering import dependence and supports industrial & domestic consumers.

(Source:www.indianchemicalnews.com)

Petrochemicals Market Top Companies

- BASF SE

- Dow Chemical Company

- SABIC

- LyondellBasell Industries

- ExxonMobil Chemical

- INEOS Group

- Sinopec

- Reliance Industries Limited (RIL)

- Shell Chemicals

- TotalEnergies Chemicals

- Formosa Plastics Group

- Mitsubishi Chemical Group

- LG Chem

- Covestro AG

- Braskem S.A.

- Arkema S.A.

- Chevron Phillips Chemical

- PTT Global Chemical

- Mitsui Chemicals

- Hanwha Solutions

Segments Covered

By Product Type

- Olefins (Ethylene, Propylene, Butadiene)

- Aromatics (Benzene, Toluene, Xylene)

- Methanol & Derivatives

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Synthetic Rubber

- Bio-Based Olefins

- Others (Acetylene, Butanes, Styrene)

By Raw Material

- Crude Oil

- Natural Gas

- Naphtha

- Others (LPG, Coal-derived feedstocks)

By Manufacturing Process

- Steam Cracking

- Catalytic Reforming

- Methanol-to-Olefins (MTO)

- Others (Gas-to-Liquid, Bio-based Processes)

By End-Use Industry

- Packaging

- Automotive & Transportation

- Construction & Infrastructure

- Textiles & Apparel

- Consumer Goods

- Electrical & Electronics

- Industrial Manufacturing

- Agriculture & Fertilizers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait