Content

What is the Current Bioplastic Compounding Market Size and Volume?

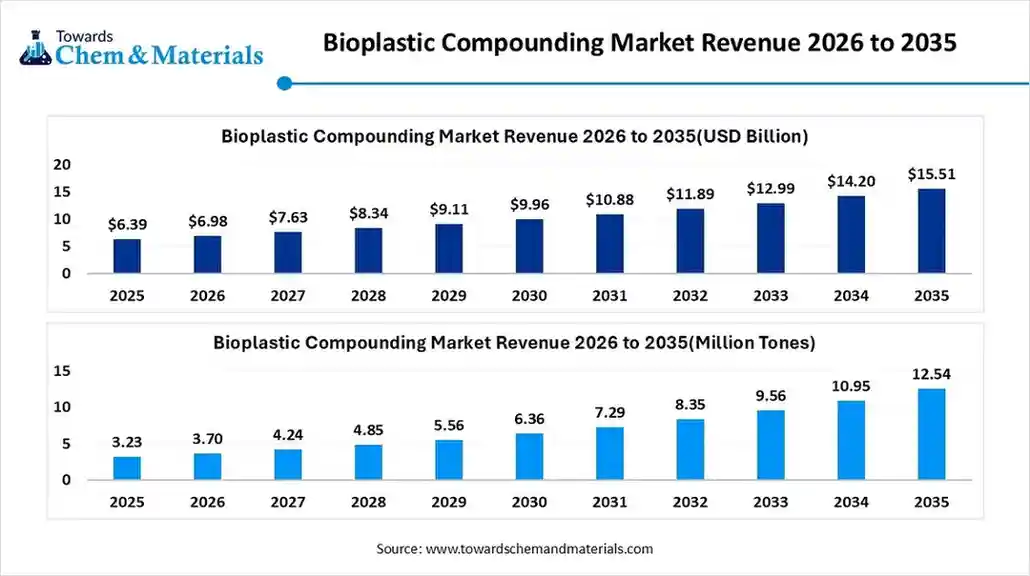

The global bioplastic compounding market volume was 3.23 million tons in 2025 and is predicted to increase from USD 3.70 million tons in 2026 and is expected to be worth around 12.54 million tons by 2035, exhibiting a compound annual growth rate (CAGR) of 14.52% over the forecast period from 2026 to 2035. Asia Pacific dominated the bioplastic compounding market with the largest revenue share of 17.53% in 2025.

The global bioplastic compounding market size was valued at USD 6.39 billion in 2025 and is expected to hit around USD 15.51 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.27% over the forecast period from 2026 to 2035.

Key Takeaways

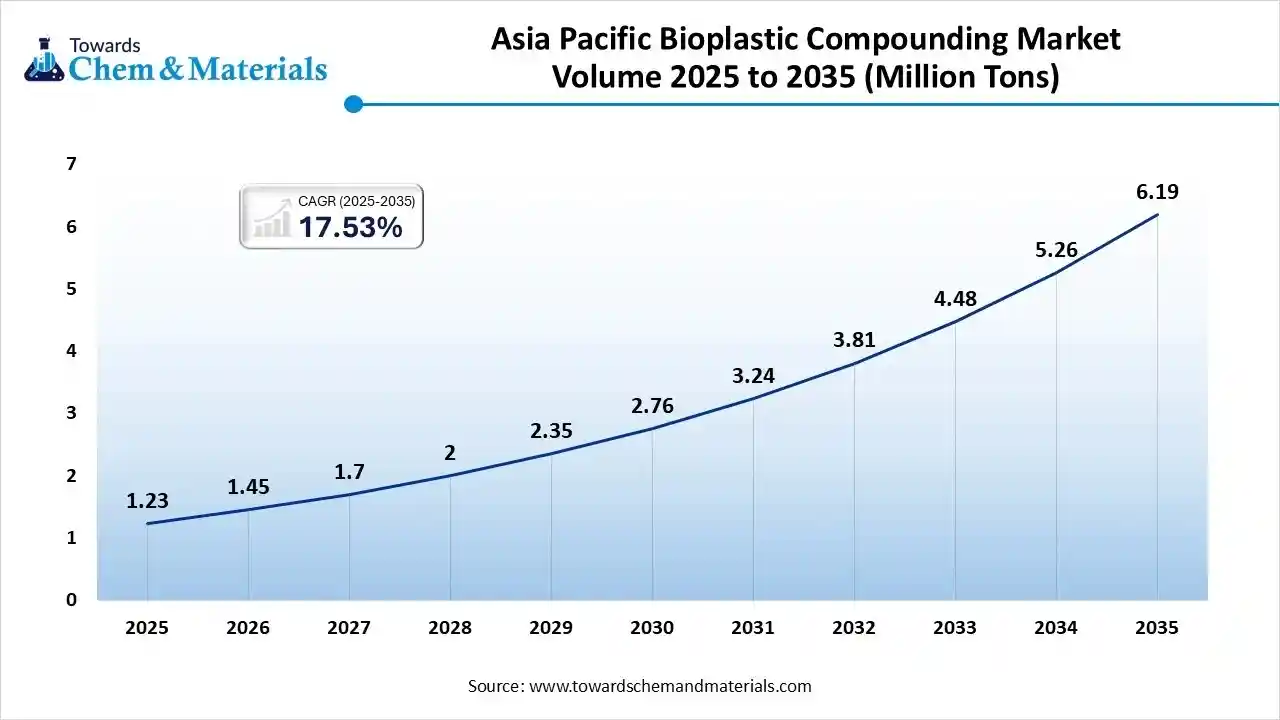

- By region, Asia Pacific led the green gas market with the largest revenue volume share of over 17.53% in 2025 and is expected to grow at the fastest CAGR over the forecast period. The dominance and growth of the region can be attributed to the proactive initiatives and technological advancement.

- By region, North America expects the fastest growth in the bioplastic compounding market. Due to increasing e-commerce in the packaging sector.

- By material type (Base Resin), the bio-based nonbiodegradable segment led the market with the largest volume share of 60% in 2025. The dominance of the segment can be attributed to rising infrastructure and its performance.

- By material type (Base Resin), the biodegradable polymers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to their widespread applications.

- By compounding ingredient, the reinforcing agents/fillers segment accounted for the largest revenue volume share of 45% in 2025.The dominance of the segment can be linked to the rising use in the various sectors.

- By compounding ingredient, the functional additives segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by enhancement in performance requirements.

- By processing technology, the twin-screw extrusion segment dominated with the largest revenue volume share of 70% in 2025. The dominance of the segment can be driven by its superior control.

- By processing technology, the reactive compounding segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the inherent material preference.

- By end-use industry, the packaging segment dominated the market and accounted for the largest revenue volume share of 65% in 2025. The dominance of the segment can be linked to the massive demand.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising number of consumers.

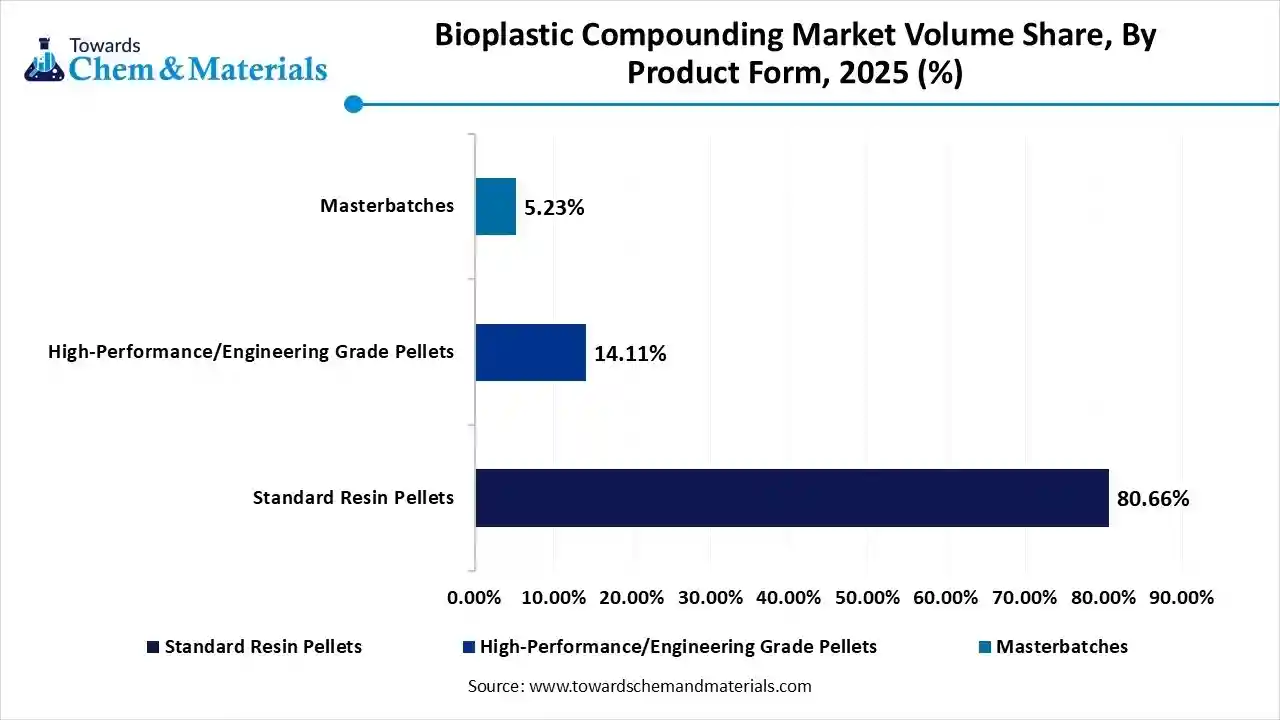

- By product form, the standard resin pellets segment accounted for the largest market revenue volume share of 80% in 2025, The widespread industrial demand.

- By product form, the masterbatches segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by enhanced functionality.

What are Bioplastic Compounding Market?

The bioplastic compounding market involves the process of melt-blending raw biopolymers (such as PLA, PHA, or Bio-PE) with various additives, fillers, and reinforcing agents to enhance their physical, thermal, and mechanical properties.

Bioplastic Compounding Market Trends

- Increasing demand in the packaging industry, particularly in the packaging sectors, is the largest application area for bioplastics, particularly in food and beverage packaging, due to the demand for sustainable, flexible, and rigid alternatives to the demand for sustainable, flexible, and rigid alternatives to traditional plastics.

- Innovation in production technology and feedstock, such as fermentation technologies and enzyme engineering, is enhancing the functionality and affordability of bioplastics.

- Rising adoption of applications beyond packaging, bioplastics are finding traction in various sectors, such as the automotive industry for lightweight components, agriculture for biodegradable mulch films, and the textile industry for sustainable fibers.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | 3.23 Million Tons |

| Revenue Forecast in 2035 | 12.54 Million Tons |

| Growth Rate | CAGR 14.52% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type (Base Resin), By Compounding Ingredient/Additive, By Processing Technology, By Product Form/Grade, By End-Use Industry, By Region |

| Key companies profiled | Novamont S.p.A., TotalEnergies Corbion, NatureWorks LLC, BASF SE, Danimer Scientific, Braskem S.A., Mitsubishi Chemical Group Corporation, Kaneka Corporation, Arkema S.A., FKuR Kunststoff GmbH, Biome Bioplastics Limited, Bio-on S.p.A., Kingfa Science & Technology (India) Limited, Kuraray Co., Ltd., Futerro SA, PTT MCC Biochem Co., Ltd., Avantium N.V., Zhejiang Hisun Biomaterials Co., Ltd., Green Dot Bioplastics, Inc., Sukano AG |

Corporate sustainability goals, consumer awareness, and government regulations and policy initiatives.

How Cutting Edge Technologies are revolutionizing the Bioplastic Compounding Market?

The integration of advanced technologies, such as artificial intelligence and machine learning, advanced compounding and extrusion equipment, nanotechnology, and specialty additives, as well as novel feedstock development, is significantly transforming the industry's focus on utilizing a wider variety of abundant, non-food biomass sources, including agricultural waste, microalgae, and wood pulp. Artificial Intelligence and machine learning are accelerating material discovery and optimization. These tools can screen millions of potential polymer designs, predict material properties based on molecular structure, and optimize blending strategies.

Trade Analysis of Bioplastic Compounding Market Import & Export Statistics:

- During April 2024 to March 2025, the world imported 39 shipments of bioplastic compounding. World imports most of its Bioplastics Compounding from China, South Korea, and Turkey.

- According to global data export, world exported 39 shipments of bioplastic compounding from 2024 to 2025.

- Majority of the Bioplastics Compounding exports from the world destined to Indonesia, India, and Colombia.

Bioplastic Compounding Market Value Chain Analysis

- Raw Material Sourcing/Feedstock Production: This foundational stage involves growing and harvesting renewable biomass sources such as corn, sugarcane, or potatoes.

- Major Players: Cargill Incorporated and Braskem.

- Biopolymer Production/Synthesis: In this stage, the raw biomass is processed (often through fermentation and polymerization) to create basic biopolymers or monomers like lactic acid (for PLA) or polyhydroxyalkanoates (PHAs).

- Major Players: NatureWorks LLC (PLA), TotalEnergies Corbion (PLA), Novamont S.p.A. (PHA, starch-based), and Danimer Scientific.

- Compounding & Modification: Compounding involves blending the raw biopolymers with additives (plasticizers, fillers, colorants) to enhance specific material properties such as flexibility, heat resistance, and strength to meet specific application requirements.

- Major Players: NatureWorks, BASF SE, FKuR Kunststoff GmbH, Biome Technologies PLC.

- Conversion/Manufacturing: The compounded bioplastic pellets are then used by manufacturers to create final or intermediate products using conventional plastic processing techniques like injection molding, extrusion, or blow molding.

- Major Players: Amcor Plc. and Coveris.

- Distribution & End-Use Applications: Finished bioplastic products are distributed through various channels to end-users in industries such as packaging, agriculture, and textiles.

Bioplastic Compounding Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (U.S.) | The U.S. government increasingly uses tax incentives and research grants to support the transition to bio-based feedstock. California have implimented strict compostable packaging mandates and bans on single-use plastics. |

| European Union (EU) | The packaging and packaging waste regulation establishes new legal obligations for bioplastics and promotes their use as replacements for recycled food-contract materials when supply is low. In 2025, they recycled 25% material from PET beverage bottles and shifted towards compostable and bio-based alternatives. |

| Japan | Japan’s plastic resource circulation statergy inludes subsidies for bioplastics research to reach a 25% |

Segmental Insights

Material Type (Base Resin) Insights

How Much Share Did the Bio-Based Non-Biodegradable Segment Held in 2025?

The bio-based non-biodegradable segment dominated the 60% share market with the largest share in 2025. The dominance of the segment can be attributed to its familiarity and infrastructure, its performance and versatility, and regulatory push and rising consumer demand. The increasing demand for lightweight, sustainable packaging in e-commerce and food packaging sectors fuelled the need for readily available bio-based options.

The biodegradable polymers segment is expected to grow at the fastest CAGR over the forecast period. The rising awareness of plastic pollution’s impact is driving the demand for eco-friendly alternatives. Its expanded application, such as packaging into textiles, automotive, and the medical field. The increasing consumer preference for green products is pushing major brands to adapt sustainable packaging, and rising corporate demand.

Compounding Ingredient Insights

Which Compounding Ingredient Segment Dominated the Bioplastic Compounding Market in 2025?

The reinforcing agents/fillers segment held the largest 45% market volume share in 2025. The dominance of the segment can be linked to the cost-effectiveness, property enhancement, and these enhanced properties expand the use of plastic into performance-demanding sectors, and their wide applications, such as building and construction, automotive, packaging, and electronics and electrical.

The functional additives segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its enhanced performance requirements, rising lightweight trends, and safety and regulatory compliance. The growing environmental concerns and push towards a circular economy have increased demand for additives that enhance the recyclability of plastics or make them biodegradable.

Processing Technology Insights

Which Processing Technology Segment Dominated the Bioplastic Compounding Market in 2025?

The twin-screw extrusion segment held the largest 70% market volume share in 2025. The dominance of the segment can be linked to the intermeshing screws, which provide intense shear and mixing, crucial for blending additives, filters, and different polymers uniformly. It's superior control, higher throughput, and efficiency, and process versatility.

The reactive compounding segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing demand for sustainable solutions due to stringent environmental regulations and consumer preferences. The inherent material preference, lightweighting in automotive and aerospace, and innovation in processing equipment, such as advanced twin-screw extruders and an AI-based monitoring system, improve the efficiency and consistency of reactive compounding.

End-Use Industry Insights

Which End-Use Industry Segment Dominated the Bioplastic Compounding Market in 2025?

The packaging segment held the largest 65% market volume share in 2025. The dominance of the segment can be boosted by online retail and general consumerism, which creates massive demand for durable, secure, and appealing packaging for shipping and product display. Materials' versatility and cost-effective, light-weighting, and sustainability push fuel the market growth.

The automotive & transportation segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing number of consumers who are environmentally conscious and prefer eco-friendly products. Stringent environmental regulation, materials and technological advancements, and circular economy initiatives.

Product Form Insights

Which Product Form Segment Dominated the Bioplastic Compounding Market in 2025?

The standard resin pellets segment held the largest 80% market volume share in 2025. The dominance of the segment can be driven by its versatility and desirable properties, cost-effectiveness, and ease of production, and standard plastic compounds are in high demand across several large end-user industries. Their widespread industrial demand, such as automotive, packaging, and construction drive the market growth.

The masterbatches segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the enhanced functionality and customization, the shift towards sustainable and green products and packaging. Manufacturing efficiency and technological advancements also fuel the market growth.

Bioplastic Compounding Market Volume and Share, By Product Form, 2025- 2035 (%)

| By Product Form | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Standard Resin Pellets | 80.66% | 2.61 | 8.94 | 13.13% | 71.32% |

| High-Performance/Engineering Grade Pellets | 14.11% | 0.46 | 3.03 | 20.84% | 24.13% |

| Masterbatches | 5.23% | 0.17 | 0.57 | 12.94% | 4.55% |

Regional Insights

The Asia Pacific bioplastic compounding market size was valued at 0.98 million tons in 2025 and is expected to surpass around 5.03 million tons by 2035, expanding at a compound annual growth rate (CAGR) of 40.13% over the forecast period from 2026 to 2035. Asia Pacific dominated the market with the largest share of 30.45% in 2025 and is expected to grow at the fastest CAGR over the forecast period.

The dominance and growth of the region can be attributed to the critical need to address its role as the world's largest plastic producer. Supported by proactive initiatives like the India Plastics Pact and abundant agricultural feedstocks, the region offers a highly cost-effective manufacturing ecosystem. Rapid urbanization and technological innovation from firms like Praj Industries are further accelerating the transition toward a circular economy.

China Bioplastic Compounding Market Trends

In Chinas bioplastic sector is rapidly scaling through high-growth materials like PLA and PHA, fueled by intensive R&D into biodegradable properties. While corn and starch remain primary feedstocks, the industry is strategically transitioning toward non-food biomass, such as wood waste, to enhance sustainability.

North America is expected to grow fastest in the bioplastic compounding market. The growth of the region can be driven by the high demand for food and beverages and the growing e-commerce industry in the packaging sector. Innovation in PLA, PHA, and starch blends improves durability and barrier properties, a circular economy focus, and expansion in packaging sectors in the region drive the market growth.

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 19.20% | 0.62 | 1.89 | 13.18% | 15.07% |

| Europe | 30.11% | 0.97 | 4.03 | 17.10% | 32.12% |

| Asia Pacific | 38.23% | 1.23 | 6.19 | 17.53% | 42.13% |

| South America | 7.23% | 0.23 | 0.77 | 14.15% | 6.13% |

| Middle East & Africa | 5.23% | 0.17 | 0.57 | 14.48% | 4.55% |

U.S. Bioplastic Compounding Market Trends

In North America, the U.S. led the market due to rigorous regulatory mandates from states like California and federal incentives, pushing major brands like Coca-Cola towards sustainable alternatives. The packaging sector maintains the largest share, leveraging cost-effective biodegradable materials like PLA and starch blends to meet escalating consumer and e-commerce demands. Concurrently, rapid innovation in non-biodegradable bioplastics (Bio-PE, Bio-PET) is facilitating significant growth in the automotive sector for lightweight components.

Europe held a significant market share in 2025. The growth of the region can be credited to the high demand across sectors, focus on the circular economy, and strong regulatory frameworks. The region's bioplastic innovation, with significant capacity expansion in materials, growing eco-consciousness, and corporate sustainability goals, led to higher adoption in the food, automotive, and retail sectors.

Germany Bioplastic Compounding Market Trends

The growth of the market in Germany can be driven by the transformation of the packaging and packaging waste regulation (PPWR) and a new national single-use plastics levy. Biodegradable materials like PLA and starch blends dominate the packaging sector, while the automotive industry is quickly adopting bioplastics to comply with EU End-of-Life Vehicles (ELV) mandates.

South America held a notable market share in 2025. The growth of the region can be fuelled by rising consumer awareness and preference for sustainable and eco-friendly products, pushing brands and manufacturers to adopt bioplastic solutions in packaging. Abundant row materials, rising industry expansion and investment, and their various applications.

Brazil Bioplastic Compounding Market Trends

The growth of the market in the country can be propelled by the cost-effective, starch-based biodegradable polymers used primarily in the packaging sector to meet consumer demand and align with government regulations. A significant competitive advantage lies in the country's abundant sugarcane resources, providing local, renewable feedstock for materials like bio-PE, reducing fossil fuel dependence.

The growth of the market in the Middle East & Africa can be boosted by a stringent government regulation in nations like the UAE and Saudi Arabia, which effectively ban single-use plastics and force a transition to sustainable alternatives. This regulatory pressure, combined with heightened consumer environmental awareness and rapid urbanization, is driving significant demand for bioplastics, especially within the dominant packaging sector.

Saudi Arabia Bioplastic Compounding Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be driven by escalating environmental concerns and the urgent need to mitigate plastic pollution in the packaging and agricultural sectors. Strong adoption is evident across flexible packaging, healthcare, and automotive industries, where bio-based alternatives facilitate critical weight reduction and regulatory compliance.

Recent Developments

- In July 2025, Floreon introduced a halogen-free, fire-resistant PLA-based compound ("Therma-Tech" grade), which is the world's first bioplastic to achieve the UL94V-0 flammability certification, targeting applications in electronics, automotive, and construction.(Source: www.specialchem.com)

- In September 2025, TripleW launched the world's first commercial PLA bioplastic made entirely from food waste, an important step in using second-generation feedstocks.(Source: www.triplew.co )

- In November 2025, BIO-FED (a branch of AKRO-PLASTIC) has developed the M·VERA® GP1065, a specialized, near 100% renewable biocompound for coffee capsules that is home compostable and has improved oxygen barrier properties.(Source: bio-fed.com)

- In October 2025, Geno and Sojitz formed a partnership to accelerate the commercialization of biobased nylon-6 using Geno's proprietary technology for various applications.(Source : www.genomatica.com)

Bioplastic Compounding Market Companies

- BASF SE: BASF SE leads the market by producing advanced biodegradable and certified compostable polymers, such as its ecoflex® and ecovio® brands, designed for high-performance flexible packaging and agricultural mulch films.

- NatureWorks LLC: NatureWorks LLC is a primary manufacturer of Ingeo™ PLA, a versatile biopolymer derived from renewable plant sugars that serves as a foundational resin for hundreds of compounded applications.

- TotalEnergies Corbion: TotalEnergies Corbion focuses on the large-scale production of high-heat Luminy® PLA, which enables the compounding of durable, heat-resistant products for the electronics and automotive sectors.

- Novamont S.p.A.: Novamont S.p.A. specializes in the development of Mater-Bi®, a leading family of biodegradable and compostable bioplastics made from proprietary blends of starches and vegetable oils.

Other Companies in the Market

- Novamont S.p.A.

- TotalEnergies Corbion

- NatureWorks LLC

- BASF SE

- Danimer Scientific

- Braskem S.A.

- Mitsubishi Chemical Group Corporation

- Kaneka Corporation

- Arkema S.A.

- FKuR Kunststoff GmbH

- Biome Bioplastics Limited

- Bio-on S.p.A.

- Kingfa Science & Technology (India) Limited

- Kuraray Co., Ltd.

- Futerro SA

- PTT MCC Biochem Co., Ltd.

- Avantium N.V.

- Zhejiang Hisun Biomaterials Co., Ltd.

- Green Dot Bioplastics, Inc.

- Sukano AG

Segments Covered in the Report

By Material Type (Base Resin)

- Biodegradable Polymers

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends (Thermoplastic Starch)

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Cellulose-based Compounds

- Bio-based Non-Biodegradable Polymers

- Bio-Polyethylene (Bio-PE)

- Bio-Polyethylene Terephthalate (Bio-PET)

- Bio-Polypropylene (Bio-PP)

- Bio-Polyamides (Bio-PA)

- Bio-Polytrimethylene Terephthalate (Bio-PTT)

By Compounding Ingredient/Additive

- Reinforcing Agents/Fillers

- Natural Fibers (Hemp, Jute, Flax, Wood Flour)

- Mineral Fillers (Calcium Carbonate, Talc, Clay)

- Carbon-based Fillers (Carbon Black, Bio-char)

- Functional Additives

- Plasticizers (Bio-based)

- Impact Modifiers and Compatibilizers

- UV Stabilizers and Antioxidants

- Flame Retardants

- Nucleating Agents (for crystallinity control)

- Colorants and Pigments

By Processing Technology

- Twin-Screw Extrusion

- Single-Screw Extrusion

- Continuous Kneading

- Reactive Compounding (In-situ polymerization/modification)

By Product Form/Grade

- Standard Resin Pellets

- High-Performance/Engineering Grade Pellets

- Masterbatches (Concentrated additive carriers)

By End-Use Industry

- Packaging

- Flexible Packaging (Films, Pouches, Bags)

- Rigid Packaging (Bottles, Containers, Trays)

- Consumer Goods & Electronics

- Household Appliances

- Mobile and IT Device Housings

- Toys and Sporting Goods

- Automotive & Transportation

- Interior Trim and Dashboards

- Under-the-hood Components

- Agriculture & Horticulture

- Mulch Films

- Seed Pots and Trays

- Textiles

- Bio-based Synthetic Fibers

- Non-woven Fabrics

- Medical & Pharmaceutical

- Biocompatible Devices

- Surgical Sutures and Implants

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa