Content

Plastics Market Size | Top Companies Analysis

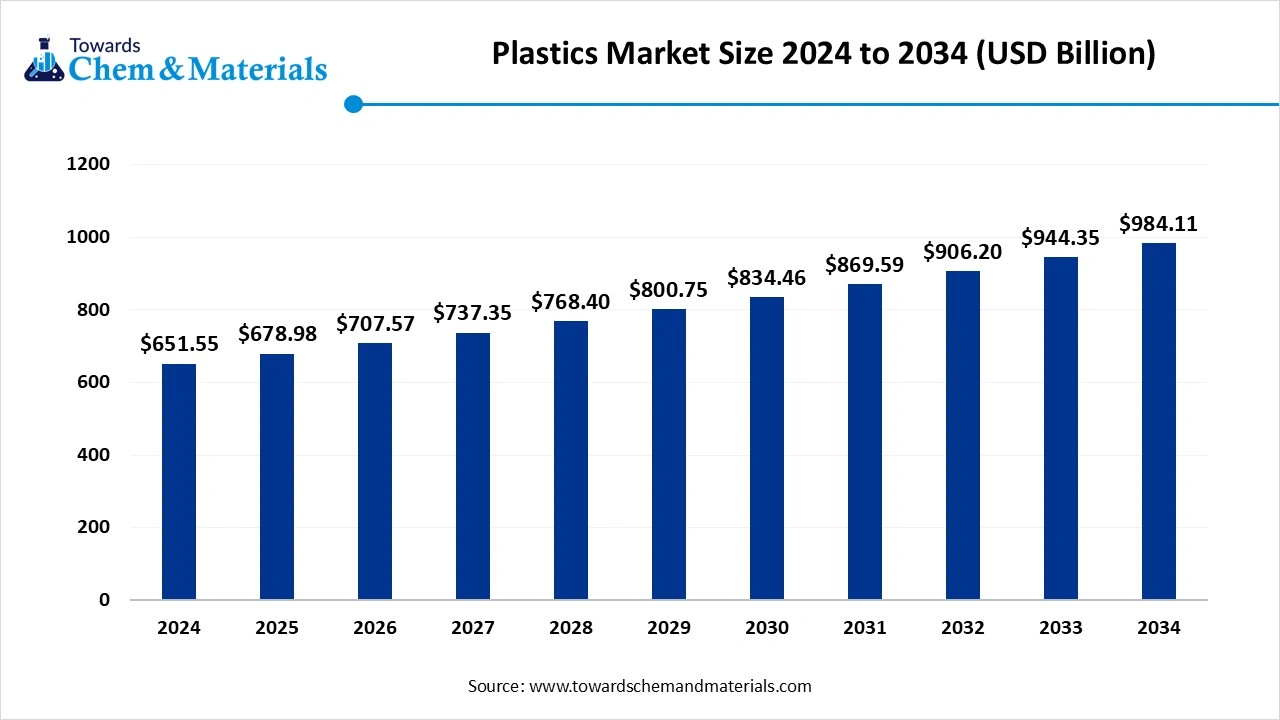

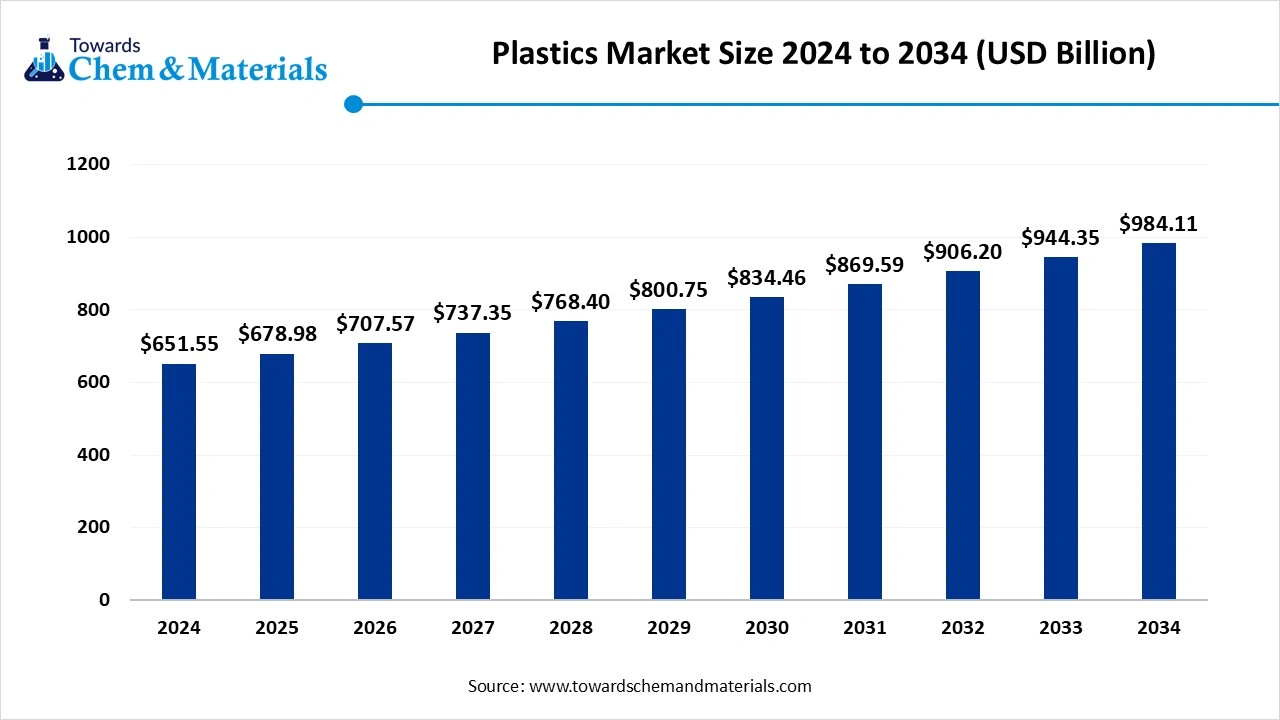

The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034. The growth of the market is driven by the growing demand from various sectors for packaging, automotive electronics, and construction due to their benefits and properties offered, which fuels the growth of the market.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 50% share in the market in 2024. The growth of the market is driven by rapid industrialization.

- By region, Europe is expected to have significant growth in the market in the forecast period. The growth is driven by the growing focus on sustainability and regulation.

- By polymer type, the polyethylene (PE – LDPE, LLDPE, HDPE) segment dominated the market in 2024. The polyethylene (PE – LDPE, LLDPE, HDPE) segment held approximately 30% share in the market in 2024. Its versatility, cost-effectiveness, and recyclability support its continued dominance.

- By polymer type, the polypropylene (PP) &bio-based plastics segment is expected to grow significantly in the market during the forecast period. It finds extensive use in automotive parts, packaging, textiles, and medical devices.

- By source, the petrochemical-based plastics segment dominated the market in 2024. The petrochemical-based plastics segment held approximately 85% share in the market in 2024. They are the backbone of the packaging, automotive, electronics, and construction industries.

- By source, the bio-based & biodegradable plastics segment is expected to grow in the forecast period. Biobased and biodegradable plastics are expanding rapidly as industries seek sustainable alternatives.

- By processing technology, the injection molding segment dominated the market in 2024. The injection molding segment held approximately 35% share in the market in 2024. It is widely applied in automotive parts, packaging containers, electronics housings, and healthcare devices

- By processing technology, the 3D printing/additive manufacturing segment is expected to grow in the forecast period. It enables on-demand, customized, and complex product designs with reduced material waste.

- By application, the packaging (rigid & flexible) segment dominated the market in 2024. The packaging (rigid & flexible) segment held approximately 40% share in the market in 2024. The cost-effective properties increase the adoption of the market.

- By application, the healthcare & medical devices segment is expected to grow in the forecast period. The biocompatibility and flexibility increase the demand for the market.

- By end-use industry, the packaging & consumer goods segment dominated the market in 2024. The packaging & consumer goods segment held approximately 45% share in the market in 2024. The versatility and durability increase the growth of the market.

- By end-use industry, the automotive & transportation (lightweighting trend) segment is expected to grow in the forecast period. The growing demand for lightweight vehicles to improve fuel efficiency fuels the growth.

Market Overview

Rising Demand For Durable Materials: Plastics Market To Expand

The global plastics market refers to the production, processing, and consumption of synthetic and bio-based polymers that can be molded into a wide range of products for packaging, construction, automotive, electrical & electronics, consumer goods, textiles, and industrial applications.

Plastics are derived primarily from petrochemicals (such as polyethylene, polypropylene, PVC, and polystyrene) as well as increasingly from renewable and bio-based feedstocks. The market is driven by lightweight, durable, and versatile properties of plastics, rapid industrialization, rising demand for sustainable and recyclable materials, and technological advancements in polymer chemistry and processing methods. Growing concerns about plastic waste and strict regulatory frameworks are accelerating the adoption of bioplastics and recycling technologies.

What Are The Key Growth Drivers That Support The Growth Of the Plastics Market?

The key growth drivers of the market are the growing demand from various industries like the packaging industry for convenience cot cost-effectiveness, and product protection, especially in e-commerce and food and beverages sectors, which fuel the growth of the market.

The other sectors are automotive, construction and infrastructure, and healthcare applications, which demand plastics components in medical devices and other materials like construction and for lightweight electric vehicles. Rapid urbanization and population growth lead to higher spending and demand for consumer goods. The technological advancements, use of sustainable materials, improvement of recycling infrastructure, and circular economy initiatives fuel the growth and expansion of the market.

Market Trends

- Sustainability: Strong growth in demand for recyclable and biodegradable plastics, along with increased focus on advanced recycling technologies to reduce environmental impact.

- Smart Manufacturing: Integration of AI-driven automation in plastics manufacturing to enhance efficiency and productivity.

- Additive Manufacturing (3D Printing): Continued advancements in 3D printing are creating new possibilities for producing customized and complex plastic components.

- Specialty & Engineering Plastics: Increased demand for engineering plastics due to their low weight, high durability, and cost-effectiveness in various end-use sectors, particularly the automotive industry

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 678.98 Billion |

| Expected Market Size by 2034 | USD 984.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.21% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Polymer Type, By Source, By Processing Technology, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | ExxonMobil Chemical, LyondellBasell Industries, SABIC: (Saudi Basic Industries Corporation), BASF SE, Dow Inc. (formerly Dow Chemical), INEOS, Reliance Industries , TotalEnergies, Chevron Phillips Chemical Co. LLC, Formosa Plastics Corporation, Covestro AG, DuPont, Evonik Industries AG, Celanese Corporation |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Plastics Market?

The key growth opportunities that support the growth of the market are the significant demand for recycled content, which creates an opportunity by focusing on recycled plastics, aligning with effective impact solutions to fuel the growth of the market. Other key growth opportunities are the use of biodegradable plastics and specialty plastics.

Due to their properties and benefits offered by these plastics, especially in e-commerce and food delivery services, which boost the need for plastic packaging, creating great opportunities for growth of the market.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Plastics Market?

The key growth challenges that hinder the growth of the market are the environmental and regulatory pressure, like plastic waste and pollution, stringent regulations, and a lack of waste management infrastructure for waste collection, treatment, and recycling exacerbates the problem of plastic waste. Other key growth drivers are the supply chain complexities, raw material shortage and volatility, and operational costs, which limit the growth and expansion of the market.

Regional Insights

How Did Asia Pacific Dominate The Plastics Market In 2024?

Asia Pacific dominates the plastics market in 2024, supported by rapid industrialization, strong manufacturing bases, and large consumer demand. China, India, Japan, and Southeast Asian economies drive consumption across packaging, automotive, electronics, and construction. The region is also investing heavily in recycling infrastructure and biobased alternatives to address environmental concerns.

High demand for low-cost, durable polymers ensures strong market growth. Expanding healthcare and e-commerce sectors further boost plastic applications, positioning Asia Pacific as the largest and fastest-growing hub in global plastics demand and innovation.

India Has Seen Growth Driven By Rapid Urbanization.

India is emerging as a major growth driver within the plastics market, fueled by rapid urbanization, a growing middle class, and expansion in packaging, automotive, and construction. The packaging sector, particularly food and beverages, accounts for a significant share of demand.

Government initiatives for “Make in India” and improvements in recycling systems are shaping market evolution. Increasing investment in bioplastics and circular economy practices positions India as both a high-demand and innovation-driven market in the plastics landscape.

Europe's Growth Is Driven By The Strong Focus On Sustainability And Regulation.

Europe expects the fastest growth in the market during the forecast period. Europe is a highly mature market for plastics, shaped strongly by sustainability-focused regulations and circular economy initiatives. The EU’s stringent recycling targets and bans on single-use plastics are pushing industries toward recycled and biobased polymers.

Automotive, packaging, and healthcare remain leading consumers of plastics, but with a greater emphasis on lightweight, recyclable, and eco-friendly solutions. Innovation in advanced polymers, 3D printing materials, and composites is prominent. Europe is positioning itself as a leader in high-performance and sustainable plastics through research, investments, and regulatory frameworks.

Segmental Insights

Polymer Type Insights

Which Polymer Type Segment Dominated The Plastics Market In 2024?

The polyethylene (PE – LDPE, LLDPE, HDPE) segment dominated the plastics market in 2024. Polyethylene remains the most widely used polymer in the market, with LDPE and LLDPE dominating flexible packaging applications, and HDPE used in rigid containers, pipes, and industrial components. Its versatility, cost-effectiveness, and recyclability support its continued dominance. Demand is strongly driven by packaging, construction, and agriculture.

Ongoing innovations in high-performance grades enhance durability, making polyethylene an indispensable material across diverse industries with expanding sustainability-focused applications.

The polypropylene (PP) & bio-based plastics segment expects significant growth in the market during the forecast period. Polypropylene is a key plastic due to its balance of strength, chemical resistance, and affordability. It finds extensive use in automotive parts, packaging, textiles, and medical devices.

Meanwhile, biobased plastics are gaining attention as sustainable alternatives, offering reduced carbon footprints while maintaining performance. Together, these materials reflect a dual trend: meeting large-scale industrial needs while supporting the transition toward more eco-friendly plastic solutions in packaging and consumer goods.

Source Insights

How Did the Petrochemical-Based Plastics Segment Dominate The Plastics Market In 2024?

The petrochemical-based plastics segment dominated the market in 2024. Petrochemical-based plastics dominate the market, providing the backbone for packaging, automotive, electronics, and construction industries.

Derived from fossil fuels, these plastics offer versatility, scalability, and cost-efficiency, making them irreplaceable in high-volume production. While facing scrutiny over environmental impact, they remain critical due to their strength and durability. Investments in recycling technologies and integration with biobased blends are supporting a gradual shift toward more sustainable uses of petrochemical-based plastics.

The bio-based & biodegradable plastics segment expects significant growth in the plastics market during the forecast period. Biobased and biodegradable plastics are expanding rapidly as industries seek sustainable alternatives. Derived from renewable sources such as corn, sugarcane, or cellulose, these materials address growing concerns over plastic waste and carbon emissions.

Their applications in packaging, agriculture, and disposable products are increasing due to supportive regulations and consumer preferences. Continuous R&D into performance-enhancing properties is improving adoption, positioning biobased plastics as a cornerstone in the future of circular economies.

Processing Technology Insights

Which Processing Technology Segment Dominated The Plastics Market In 2024?

The injection molding segment dominated the market in 2024. Injection molding remains the dominant processing technology in the market, enabling mass production of consistent, complex, and durable components. It is widely applied in automotive parts, packaging containers, electronics housings, and healthcare devices. The technology’s efficiency, scalability, and adaptability across multiple polymer types make it indispensable. Ongoing automation and digitalization enhance speed and precision, while integration with recycled and biobased plastics supports sustainability-focused manufacturing.

The 3D printing/additive manufacturing segment expects significant growth in the market during the forecast period. 3D printing, or additive manufacturing, is a rapidly growing processing technology in the market. It enables on-demand, customized, and complex product designs with reduced material waste. Applications span healthcare, aerospace, automotive, and prototyping. The use of specialized plastic filaments and resins is expanding as the technology matures. Its potential for decentralized production and integration of advanced biopolymers positions 3D printing as a disruptive force in future plastic manufacturing.

Application Insights

How Did the Packaging Segment Dominate the Plastics Market In 2024?

The packaging (rigid & flexible) segment dominated the market in 2024. Packaging dominates plastic applications, with rigid plastics used in bottles, containers, and caps, and flexible plastics applied in films, pouches, and wraps. Lightweight, durable, and cost-efficient properties drive adoption across food, beverages, healthcare, and e-commerce.

Sustainability initiatives, such as using recycled PET and biodegradable plastics, are reshaping the segment. Innovation in barrier films and lightweight packaging further enhances efficiency, making plastics central to modern packaging solutions worldwide.

The healthcare & medical devices segment expects significant growth in the market during the forecast period. Plastics play a crucial role in healthcare and medical devices, offering biocompatibility, sterilizability, and flexibility. They are used in syringes, catheters, implants, diagnostic kits, and packaging for pharmaceuticals.

Demand is driven by rising healthcare expenditure, aging populations, and the growth of single-use medical devices. Advanced polymers ensure safety and performance in critical applications. Ongoing innovation in biodegradable medical plastics is further enhancing their relevance in the healthcare sector.

End-Use Industry Insights

Which End Use Industry Segment Dominated The Plastics Market In 2024?

The packaging & consumer goods segment dominated the market in 2024. Packaging and consumer goods represent the largest end-use industry for plastics, with applications in household products, electronics, personal care items, and FMCG packaging.

Plastics’ affordability, versatility, and durability underpin their dominance in this sector. Consumer-focused brands are increasingly adopting recycled and biobased plastics to align with sustainability commitments. Continuous innovation in design and material efficiency ensures plastics remain essential for both protective and convenience-driven consumer applications.

The automotive & transportation (lightweighting trend) segment expects significant growth in the market during the forecast period. In automotive and transportation, plastics are integral for lightweighting, fuel efficiency, and cost reduction.

Applications span interiors, exteriors, under-the-hood components, and electric vehicle parts. High-performance polymers replace metals in several areas, improving design flexibility and safety. The shift toward EVs is accelerating demand for advanced plastics with thermal resistance and conductivity. Growing emphasis on sustainability is also driving the use of recycled and biobased plastics in vehicles.

Plastics Market Value Chain Analysis

- Chemical Synthesis and Processing: The plastics are synthesised and processed through extraction, injection molding, calendaring, casting, and chemical recycling.

- Key players: Emco Industrial Plastics, Inc., CS Hyde Company, Trident Plastics Inc: Industrial Plastic Supply, Inc

- Quality Testing and Certification: The plastics require plastic-free certification, which is offered by Control Union.

- Key players: ASTM International and UL Solutions

- Distribution to Industrial Users: The plastics are distributed to the packaging, automotive, electronics, and construction industries.

- Key players: Architectural Plastics Inc. and Arkay Plastics Inc.

Recent Developments

- In August 2025, the United Nations Development Programme in Jordan (UNDP), in partnership with the Municipality of Deir Alla, announced the launch of a new plastic recycling plant through European Union funding.(Source: www.undp.org)

Plastics Market Top Companies

- ExxonMobil Chemical

- LyondellBasell Industries

- SABIC: (Saudi Basic Industries Corporation)

- BASF SE

- Dow Inc. (formerly Dow Chemical)

- INEOS

- Reliance Industries

- TotalEnergies

- Chevron Phillips Chemical Co. LLC

- Formosa Plastics Corporation

- Covestro AG

- DuPont

- Evonik Industries AG

- Celanese Corporation

Segments Covered

By Polymer Type

- Polyethylene (PE – LDPE, LLDPE, HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS) & Expanded Polystyrene (EPS)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Others (Nylon, PMMA, etc.)

By Source

- Petrochemical-Based Plastics

- Bio-Based & Biodegradable Plastics

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Rotational Molding

- Compression Molding

- Thermoforming

- 3D Printing/Additive Manufacturing

By Application

- Packaging (rigid & flexible)

- Building & Construction (pipes, insulation, profiles)

- Automotive & Transportation (interiors, exteriors, components)

- Electrical & Electronics (cables, enclosures, devices)

- Consumer Goods (household, furniture, sports goods)

- Textiles & Apparel (fibers, nonwovens)

- Healthcare & Medical Devices

- Agriculture (films, greenhouse covers, irrigation)

- Industrial & Machinery

- Others

By End-Use Industry

- Packaging & Consumer Goods

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Healthcare & Medical

- Textiles & Fashion

- Agriculture

- Industrial & Machinery

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait