Content

What is the Current Polyethylene Market Size and Volume?

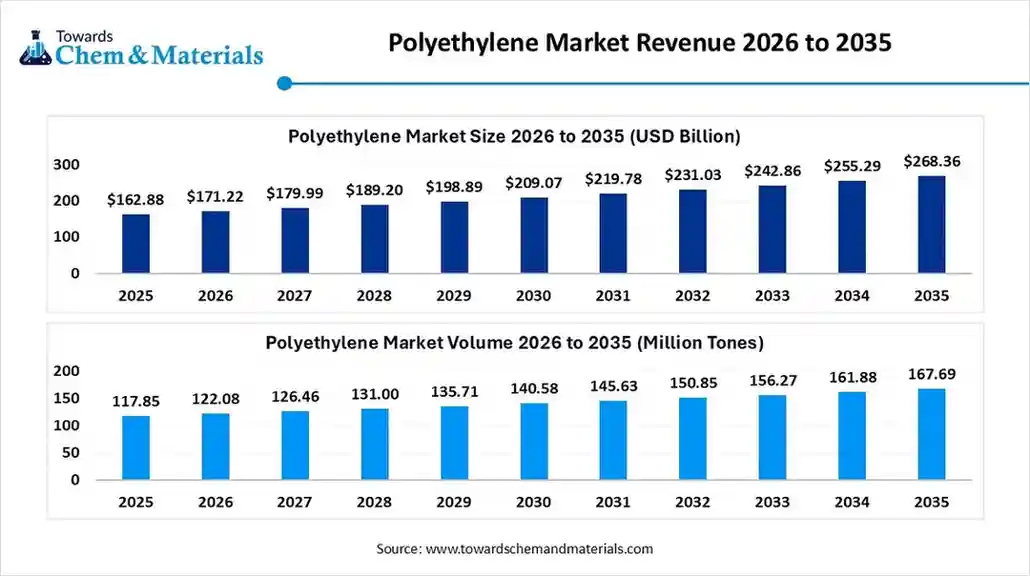

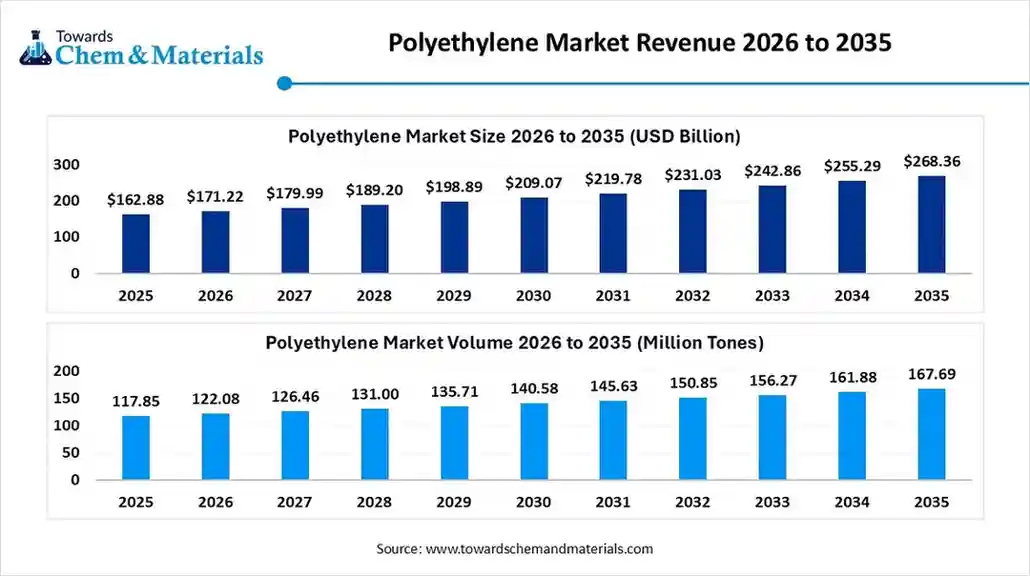

The global polyethylene market size was estimated at USD 162.88 billion in 2025 and is expected to increase from USD 171.22 billion in 2026 to USD 268.36 billion by 2035, growing at a CAGR of 5.12% from 2026 to 2035. In terms of volume, the market is projected to grow from 122.08 million tones in 2026 to 167.69 million tons by 2035. growing at a CAGR of 7.10% from 2026 to 2035. Asia Pacific dominated the polyethylene market with the largest volume share of 51.52% in 2025.

Report Highlights

- The Asia Pacific dominated the global polyethylene market with the largest volume share of 43% in 2025.

- The polyethylene market in North America is expected to grow at a substantial CAGR of 3.84% from 2026 to 2035.

- The Europe polyethylene market segment accounted for the major volume share of 17.66% in 2025.

- By product type, the High-density Polyethylene (HDPE) segment dominated the market and accounted for the largest volume share of 52.2% in 2025.

- By product type, the Low-density Polyethylene (LDPE)segment is expected to grow at the fastest CAGR of 3.56% from 2026 to 2035 in terms of volume.

- By Application, the Bottles & Containers segment led the market with the largest revenue volume share of 42.11% in 2025.

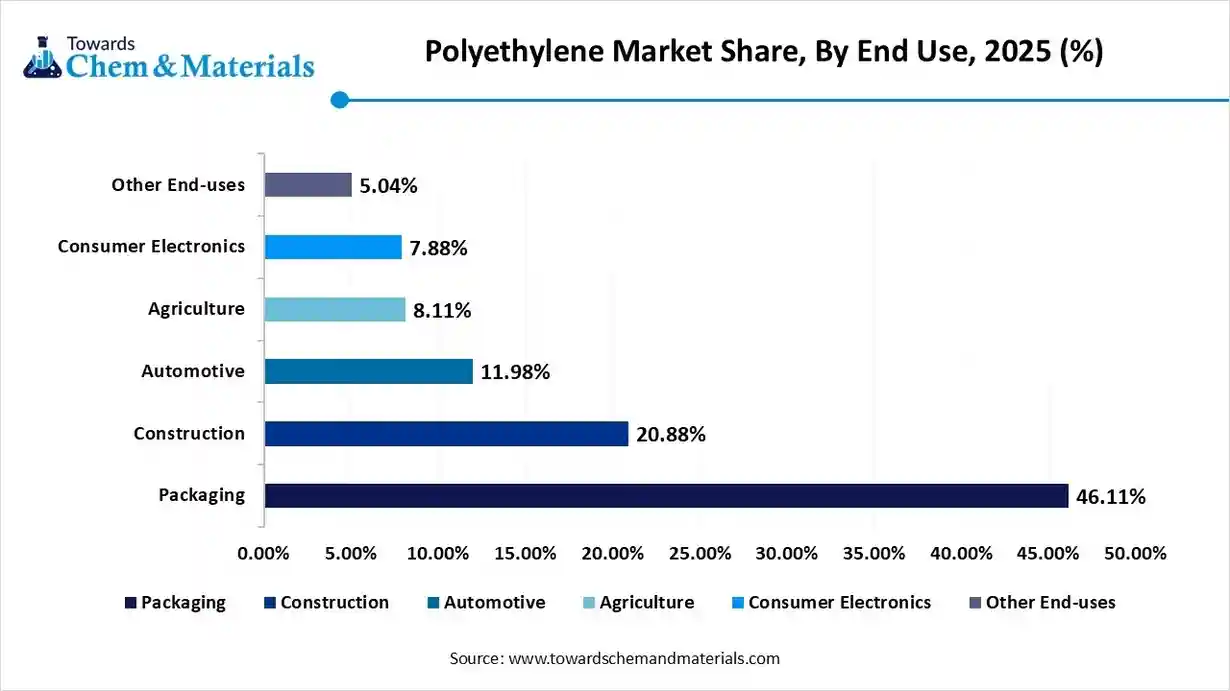

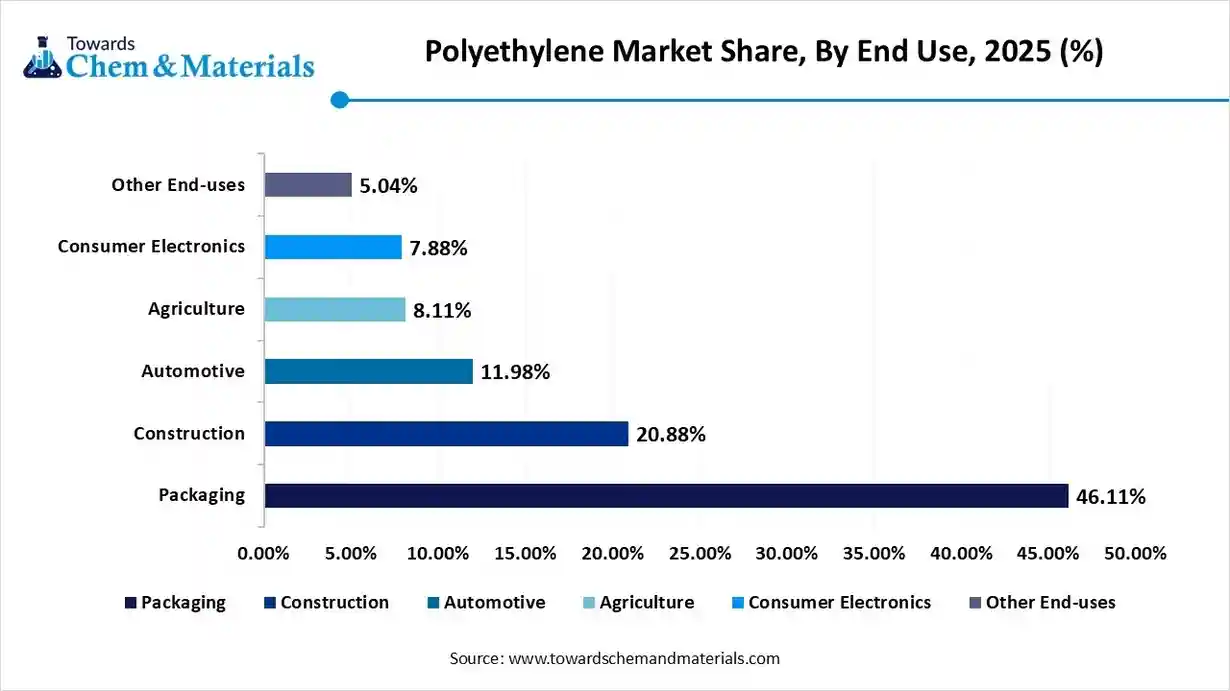

- By end use, the packaging segment dominated the market and accounted for the largest volume share of 47.64% in 2025.

Smart, Sustainable, Strong: The Polyethylene Revolution

The polyethylene market is witnessing a fast-paced growth, akin to being driven by its versatile applications across industries such as packaging, automotive, construction, and agriculture. The material’s lightweight nature, chemical resistance, and cost-effectiveness continue to make it an ideal choice for manufacturers as it delivers durable and high-performance solutions.

As heavy sectors demand more flexible and efficient materials, polyethylene's adaptability is contributing to the market enhancement in the current period. The sudden rise in demand for eco-friendly and recyclable polyethylene variants has gained major market share recently. This is associated with growing environmental awareness and regulatory pressures, pushing manufacturers to innovate around sustainability

The ongoing enhancement of the flexible packaging sector is spearheading the industry's growth in recent years. As consumer preferences shift toward convenience and product longevity, manufacturers are increasingly adopting polyethylene due to its lightweight, durable, and cost-effective nature. This material’s adaptability in producing films, bags, and wraps for food, pharmaceuticals, and personal care items significantly contributes to the market momentum.

Furthermore, its strong barrier properties and ease of processing make it a preferred choice for innovative packaging formats. As e-commerce continues to grow, the need for secure and efficient packaging further accelerates the demand. Also, the integration of advanced technologies enables high-quality output and better design flexibility, while evolving customer expectations. This growing dependency on polyethylene for packaging applications not only boosts production volumes but also encourages continuous material innovation in the future, as per observation

Polyethylene Market Trends

- The enlarged expansion of urban development and infrastructure projects is contributing to the use of polyethylene in piping, insulation, and geomembranes in recent years. Lightweight, corrosion-resistant, and cost-effective properties are driving material preference across these industries nowadays.

- With increasing focus on environmental impact, the market is seeing heavy growth in bio-based and recycled polyethylene. Companies are investing in R&D activities with circular economic goals to meet ongoing regulatory and consumer expectations.

- Polyethylene is rapidly gaining popularity in the healthcare sector for its safety, flexibility, and sterilization compatibility. From tubing to packaging, its role is expanding as demand for hygienic and durable materials continues

Polyethylene Market Report Scope

| Report Attributes | Details |

| Market Size / Volume in 2026 | USD 171.22 Billion/ 122.08 ,Million Tones |

| Expected Size/ Volume in 2035 | USD 268.36 Billion/ 167.69 Million Tons |

| Growth Rate | CAGR of 5.12% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026-2035 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product Type, By End Use, By Application, By region |

| Key Companies Profiled | BASF SE,Borealis AG, Braskem, Dow, Exxon Mobil Corporation,Formosa Plastics,INEOS Group,LG Chem LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, MOL Group,SABIC,China Petrochemical Corporation, (Sinopec) |

Polyethylene Market Opportunity

Fueling the Future: Lightweight Polyethylene Gains Traction in Automotive Design

Original automotive equipment manufacturers (OEMs) are seen under pressure to reduce vehicle weight for better fuel efficiency and lower emissions. Polyethylene components provide a cost-effective, lightweight alternative to metals and other plastics, which is expected to create significant opportunities for the polyethylene market during the forecast period. This shift supports manufacturers investing in high-performance, moldable grades of polyethylene. Also, the increasing adoption of electric vehicles will further contribute to the industry's growth potential.

Polyethylene Market Challenge

Polyethylene Faces Green Competition Amid Sustainability Shift

The polyethylene market is experiencing growing competition from bio-based and biodegradable alternatives. These eco-friendly materials are anticipated to hamper market growth in the coming years, as many industries are now adopting greener substitute solutions to meet corporate social responsibility goals and regulatory regulations. This shift can create significant challenges for manufacturers to reevaluate their product lines and invest in R&D for recyclable polyethylene variants.

Key Government Initiatives for the Polyethylene Market

| Country | Initiative | Goal |

| India | Mandates on plastic waste management (2016); banned specific single-use plastics (2022); Extended Producer Responsibility (EPR). | Boosts recycling and effectively manages plastic waste. |

| U.S. | Federal: Funding for recycling research (Save Our Seas 2.0 Act). State-level: Recycled content mandates and EPR laws in some states. | Improves recycling infrastructure and stimulates demand for recycled content. |

| EU | Single-Use Plastics (SUP) Directive; tax on virgin plastics. | Reduces plastic usage and promotes a circular economy. |

| Brazil | Initiatives to encourage recycling and investment in infrastructure. | Boosts domestic capacity and improves recycling rates. |

Value Chain Analysis

- Raw Material Extraction: The primary raw materials (crude oil and natural gas) are extracted.

- Key Players: ExxonMobil, Saudi Aramco, and Shell.

- Upstream Petrochemical Production: Raw materials are processed via cracking to produce ethylene, the monomer for polyethylene.

- Key Players: ExxonMobil, SABIC, Dow Inc., BASF SE, and Shell.

- Manufacturing and Polymerization: Ethylene is polymerized into various types of polyethylene (HDPE, LDPE, etc.).

- Key Players: Dow Inc., LyondellBasell Industries N.V., SABIC, and Ineos Group.

- Distribution and Supply Chain Management: Polyethylene pellets are delivered to converters and manufacturers globally.

- Key Players: Amcor plc, Berry Global Group, Inc., Sealed Air Corporation, and AptarGroup, Inc.

- Recycling and Waste Management: Focuses on the mechanical and chemical recycling of used plastics.

- Key Players: Agilyx Corporation, PureCycle Technologies, Inc., and Waste Management, Inc.

Polyethylene Market Segmental Insights

By Product Type

The high-density polyethylene segment held the dominating share 52.2% of the polyethylene market in 2025. Having a superior strength-to-density ratio, offering robustness across applications, high-density polyethylene has gained popularity in recent years. Also, its adaptability in pipe systems, containers, and heavy-duty packaging makes it an ideal industrial choice.

The material's resistance to moisture, impact, and chemicals enhances its performance in various environments. HDPE's compatibility with molding technologies supports efficient, high-volume production. Construction and automotive sectors are majorly contributing to the segment growth in the current industry environment. Cost-efficiency and recyclability further confirm their stronghold in the market space. The low-density polyethylene segment is expected to experience significant polyethylene market growth in the future.

Low-density polyethylene is expected to gain momentum mainly due to its exceptional flexibility and puncture resistance properties. It supports thinner film applications, reducing material use while maintaining durability. It can play a major role in stretch wraps, agricultural films, and flexible packaging, while ensuring evolving industrial needs in the future. Growing demand for lightweight, high-performance materials across sectors

Application Insights

The bottles and containers segment held the dominating share of the polyethylene market volume share 42.11% in 2025, akin to its high demand in packaging solutions across food, beverages, and personal care products. Moreover, polyethylene’s versatility, cost-effectiveness, and ability to provide barrier properties for product protection contribute to its widespread use and market growth.

Additionally, the rising preference for lightweight and durable packaging further drives the segment enhancement. Consumer demand for safe, eco-friendly packaging options has also contributed to the growth of the segment in the current period. The recyclability of polyethylene bottles and containers enhances their appeal in sustainability-focused markets. As industries prioritize convenience, this segment continues to lead the polyethylene application market.

The films and sheets segment are expected to experience significant market growth in the future, owing to its extensive use in agricultural, industrial, and retail applications. As the polyethylene films offer high flexibility, moisture resistance, and durability, making them ideal for packaging, greenhouse covers, and construction films, they will gain market momentum during the forecast period.

The growing trend of e-commerce packaging is driving demand for flexible packaging solutions. With the sustainability trend, innovations in biodegradable films are expected to fuel future growth. Increased awareness of the environmental impact of plastic packaging will push the development of eco-friendly polyethylene alternatives in this segment. As consumer preferences shift towards convenience and efficiency, the dominance of films and sheets in the polyethylene market will continue to rise.

End Use Insights

The packaging segment dominated the market with the largest volume share 47.64% in 2025 due to the increasing need for lightweight, flexible, and durable properties. Polyethylene’s ability to provide effective protection, reduce shipping costs, and maintain product integrity has made it a preferred choice in packaging applications. As e-commerce continues to expand, demand for cost-efficient and sustainable packaging solutions grows, further driving polyethylene's use. Additionally, innovations in biodegradable polyethylene are increasing the segment's potential. The sector’s dependence on large volumes of plastic packaging contributes.

The construction segments are expected to grow at the fastest rate in the market during the forecast period owing to increasing urbanization and infrastructure development during the forecast period. The polyethylene's versatility in applications such as piping, insulation, and vapor barriers makes it indispensable for construction projects in the future, as per market observations. The rising demand for durable, cost-effective, and lightweight materials will continue to push up their growth in this sector. Additionally, polyethylene’s resistance to corrosion and environmental factors positions it as an ideal material for modern construction needs. As the push for more sustainable construction materials intensifies, polyethylene's potential in eco-friendly solutions further boosts its future dominance.

Polyethylene Market Volume Share, By End-Use, 2025- 2035

| By End-Use | Market Volume Shares (%)2025 | Volume (Million Tons)(2025) | CAGR (2026-2035) |

| Packaging | 46.11% | 53.15 | 3.23% |

| Construction | 20.88% | 25.12 | 3.64% |

| Automotive | 11.98% | 14.23 | 4.42% |

| Agriculture | 8.11% | 10.11 | 2.99% |

| Consumer Electronics | 7.88% | 9.13 | 4.44% |

| Other End-uses | 5.04% | 6.12 | 1.39% |

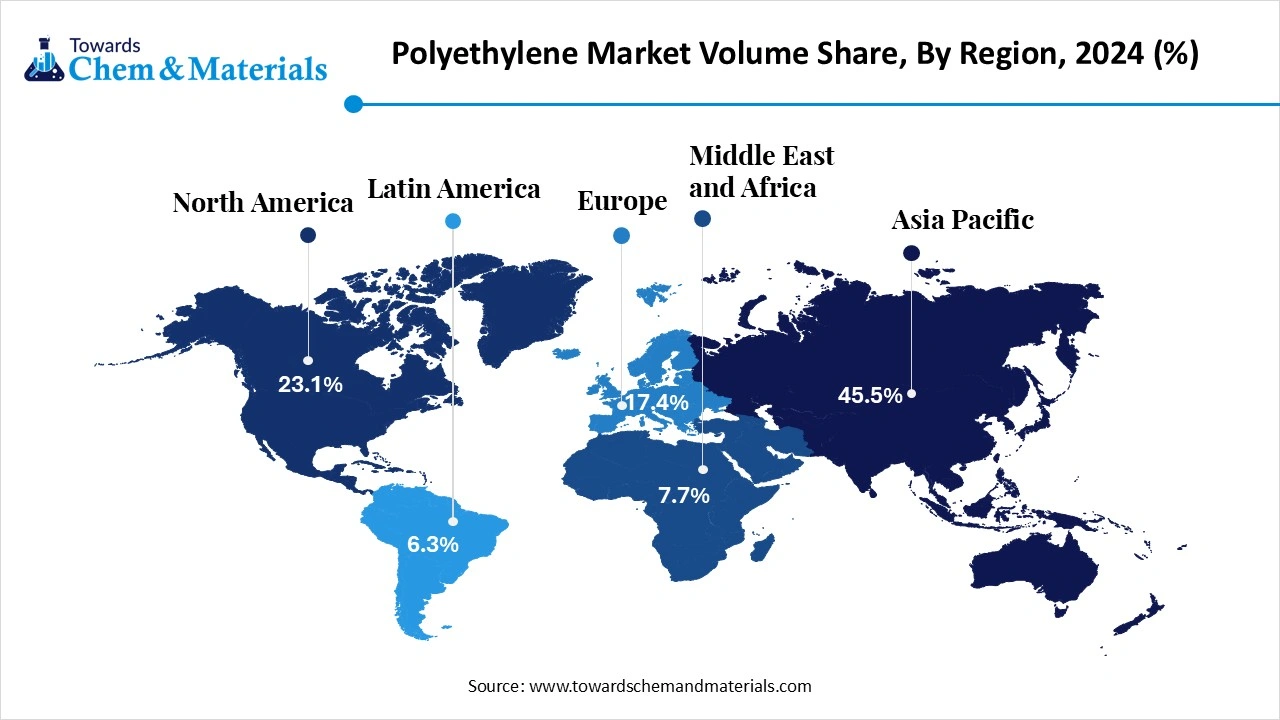

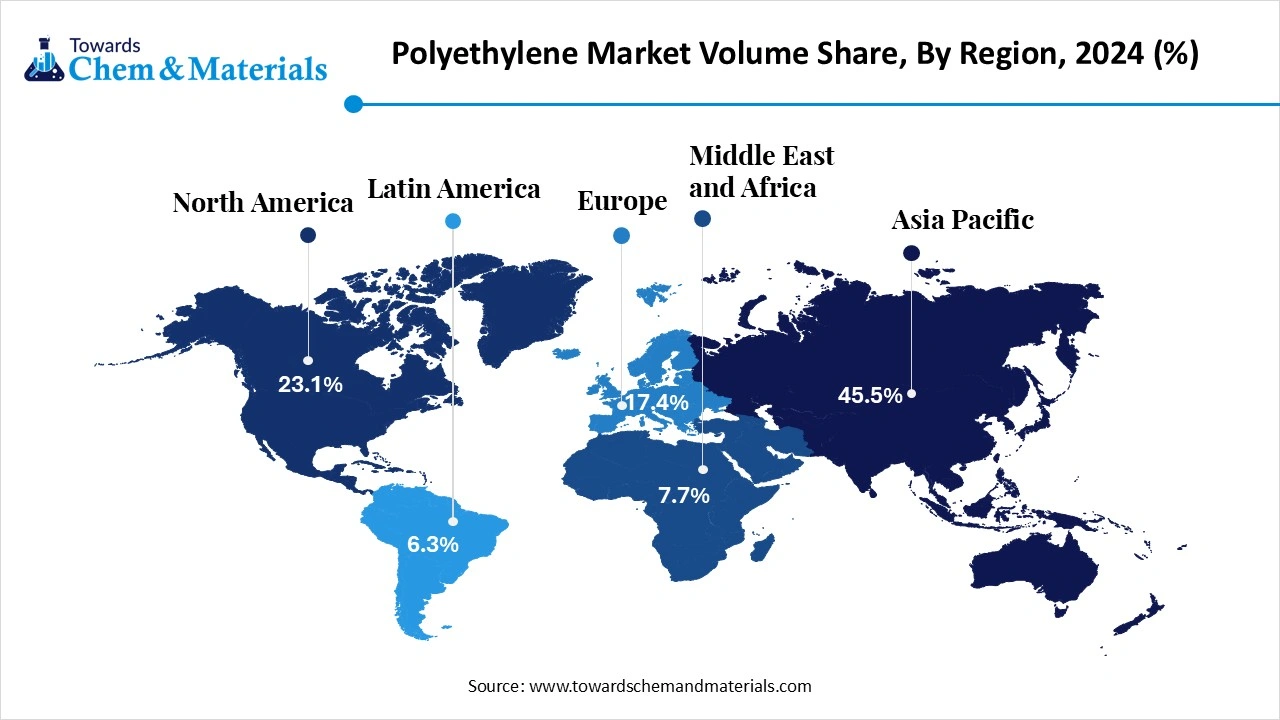

Regional Insights

The Asia Pacific polyethylene market volume was estimated at 53.11 million tons in 2025 and is projected to reach USD 78.99 million tons by 2035, growing at a CAGR of 3.71% from 2026 to 2035. Asia Pacific dominated the polyethylene market in 2025. Asia Pacific leads the market due to its massive manufacturing base and rapid industrialization. Also, high demand from the packaging, construction, and automotive sectors fuels consistent consumption.

Moreover, the rising urbanization and infrastructure development across emerging economies like India, China, and Japan are expected to support the market growth in the coming years. Furthermore, strong investments in petrochemical infrastructure enhance regional production capabilities. Also, the favorable government policies and trade dynamics make Asia Pacific a global

Packaging Powerhouse: China Fuels Polyethylene Surge in Asia Pacific

China has maintained its dominance in the Asia Pacific region for the past period. China’s polyethylene demand is mainly driven by its expansive packaging and consumer goods industries in recent times. Unlike the larger region, China focuses heavily on technological upgrades and domestic capacity building in the current industry environment. It continues to import high-grade polyethylene, despite local production expansion efforts. Strategic partnerships and international investments are majorly contributing to the market growth in China nowadays. Sustainability initiatives and circular economy goals are influencing material choices more

North America is expected to grow at the fastest pace in the coming period. North America leads the polyethylene market with its advanced manufacturing ecosystem and technological advancements. The region has an abundant raw material supply, especially shale gas, which gives benefits like steady and cost-effective production.

Strong infrastructure and logistics support smooth distribution across diverse end-user industries. Moreover, growth in the automotive, packaging, and construction sectors drives consistent demand for polyethylene materials. Regulatory initiatives and investment in sustainable plastic production further support regional dominance. Adoption of smart manufacturing practices helps the

Polyethylene Market Volume Share, By Region, 2025 (%)

| By Region | Market Shares (%)2025 | Volume (Million Tons)(2025) | CAGR (2026-2035) |

| North America | 22.59% | 27.10 | 3.89% |

| Europe | 17.66% | 20.17 | 2.66% |

| Asia Pacific | 46.55% | 52.45 | 3.75% |

| Latin America | 8.12% | 8.12 | 1.28% |

| Middle East & Africa | 5.08% | 9.23 | 3.57% |

From Manufacturing Might to Green Mandates: The United States Polyethylene Evolution

The United States is expected to play a crucial role in the development of the polyethylene market during the forecast period. The United States contributes a significant share due to its large-scale petrochemical base and export capacity. Major polyethylene producers, including multinational giants, are headquartered and operate heavily within the United States' advanced manufacturing environment.

Also, the United States is seen as pushing innovations in recyclable and performance-based polyethylene types. The domestic market is receiving the benefits from growing e-commerce and flexible packaging needs, increasing polyethylene demand.

How will Europe contribute to the Polyethylene Market?

Europe is a notable region in the polyethylene market focuses on balancing high demand, technological progress, and strict environmental policies. The region is characterized by high consumption and stringent regulations, which encourage manufacturers to adopt sustainable production methods and biodegradable alternatives. Germany leads in technology and recycling, while other countries prioritize circular economy strategies. The market is driven by sectors like packaging, automotive, and healthcare, with investments shifting toward bio-based polyethylene to meet environmental goals.

Germany Polyethylene Market Trends

Germany is a key player in the polyethylene market, marked by a strong emphasis on engineering excellence and a dedication to circular economy principles. The country combines a robust industrial base with innovation and environmental awareness. High consumption is mainly due to packaging, manufacturing, and automotive use, with a rising trend toward lightweight plastics for fuel efficiency. The German market is heavily influenced by EU regulations promoting sustainable practices and circular economy initiatives.

How will Latin America influence the Polyethylene Market?

Latin America is carving out a dynamic role in the global polyethylene industry, driven by demographic shifts and infrastructure development. The region is experiencing steady growth, supported by increasing demand in the packaging, construction, and automotive sectors. Urbanization and growing online shopping are boosting packaging demand. The automotive industry also plays a significant role, using polyethylene to replace heavier materials. Investments in recycling and sustainable solutions are rising, although growth may be affected by evolving regulations.

Brazil Polyethylene Market Trends

Brazil stands out as the main growth driver in Latin America’s polyethylene market, leveraging its large population and expanding industrial sector. The country’s demand is driven by packaging, automotive, and petrochemical manufacturing industries, as well as investments in petrochemical manufacturing. Brazil is increasingly adopting high-performance, bio-based polyethylene, with companies like Braskem leading ecological polymer initiatives. The booming e-commerce sector drives demand for flexible packaging, and government policies promote domestic production and green materials.

How will the Middle East and Africa surge in the Polyethylene Market?

Strategic resource advantages and major infrastructure projects support the Middle East and Africa's growth in the polyethylene market. The market is expanding rapidly, propelled by urbanization, development, and economic diversification. The region’s abundant petrochemical resources position it as a major producer. Key factors include demand for pipes and fittings in construction and the rising need for packaging and consumer goods. Industrial expansion and increased consumer spending also boost market growth.

UAE Polyethylene Market Trends

The UAE’s growth in the polyethylene market aligns with its ambitious national visions for economic diversification, smart city development, and technological progress. The country leverages its rich petrochemical resources and strategic infrastructure investments. The high demand for high-density polyethylene in the packaging, construction, and automotive sectors persists. The UAE's focus on smart city initiatives and its strong industrial base drive demand for polyethylene across various applications.

Polyethylene Market Recent Developments

Glenmark

- Product Launch: In 2025, Glenmark introduced its latest production of polyethylene, named Polyethylene Glycol 3350. Also, this is in powder form for the solutions. Also, the weight is 17 grams/capful according to the company information.

Pregis

- Product Launch: In 2024, Pregis introduced its latest polyethylene foam solution. This foam packaging includes certified circular polyethylene resins. Also, the company made a collaboration with ExxonMobil for the development of the product.

- Collaboration: In 2024, Evonik Industries created a partnership with the University of Mainz. This collaboration aims to research and develop

Polyethylene Market Top Companies list

- BASF SE

- Borealis AG

- Braskem

- Dow

- Exxon Mobil Corporation

- Formosa Plastics

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- MOL Group

- SABIC

- China Petrochemical Corporation (Sinopec)

Segment covered in the Report

By Product Type

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Linear Low-density Polyethylene (LLDPE)

By End Use

- Packaging

- Construction

- Automotive

- Agriculture

- Consumer Electronics

- Other End-uses

By Application

- Bottles & Containers

- Films & Sheets

- Bags & Sacks

- Pipes & Fittings

- Other applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait