Content

What is the Current Polyester Fiber Market Size and Volume?

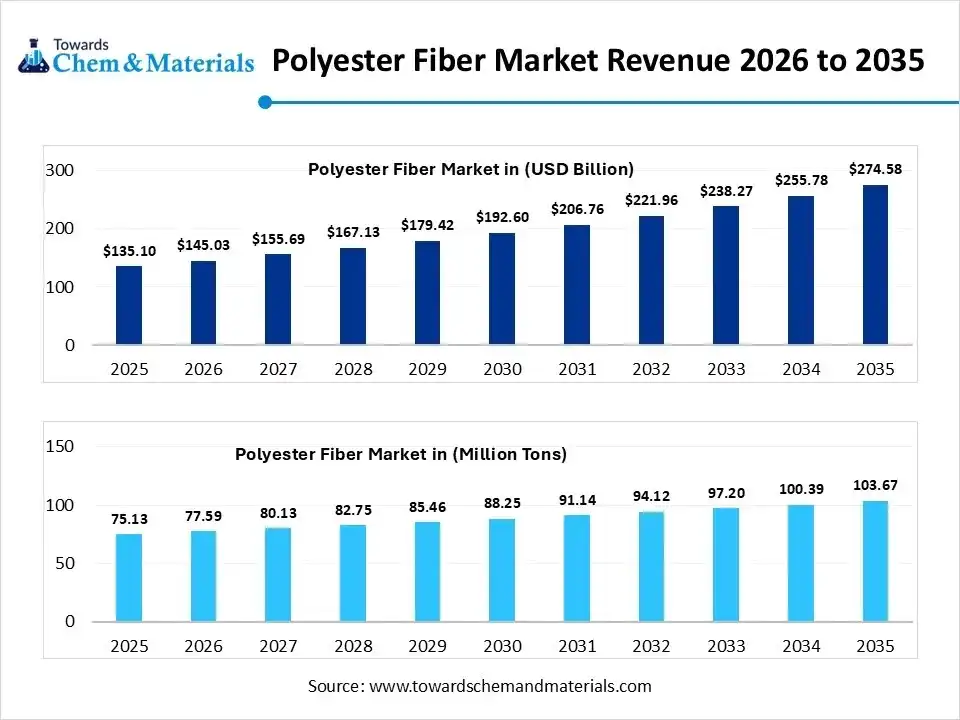

The global polyester fiber market size was estimated at USD 135.10 billion in 2025 and is expected to increase from USD 145.03 billion in 2026 to USD 274.58 billion by 2035, growing at a CAGR of 7.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 75.13 million tons in 2025 to 103.67 million tons by 2035. growing at a CAGR of 3.27% from 2026 to 2035. Asia Pacific dominated the polyester fiber market with the largest volume share of 72% in 2025. The growing consumer demand for low-cost fabrics is the key factor driving market growth. Also, a surge in disposable incomes, coupled with the increasing emphasis on the circular economy, can fuel market growth further.

Key Takeaways

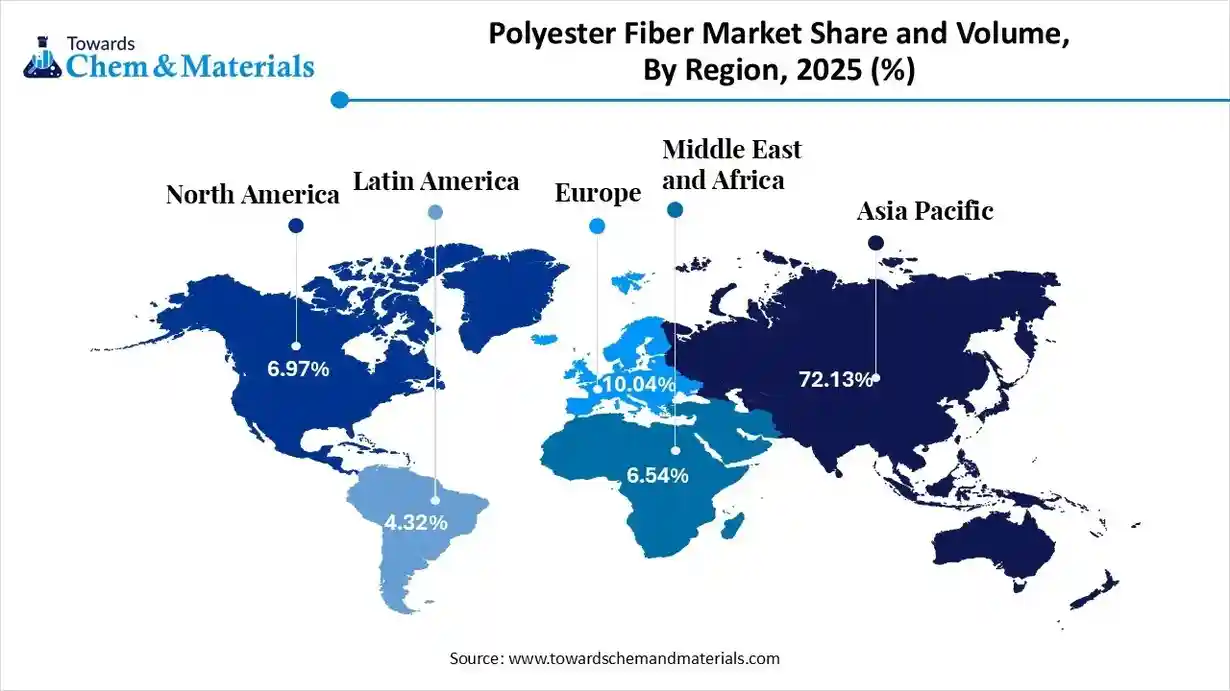

- By region, Asia Pacific led the polyester fiber market with the largest volume share of over 72% in 2025. The dominance and growth of the region can be attributed to rapid urbanisation.

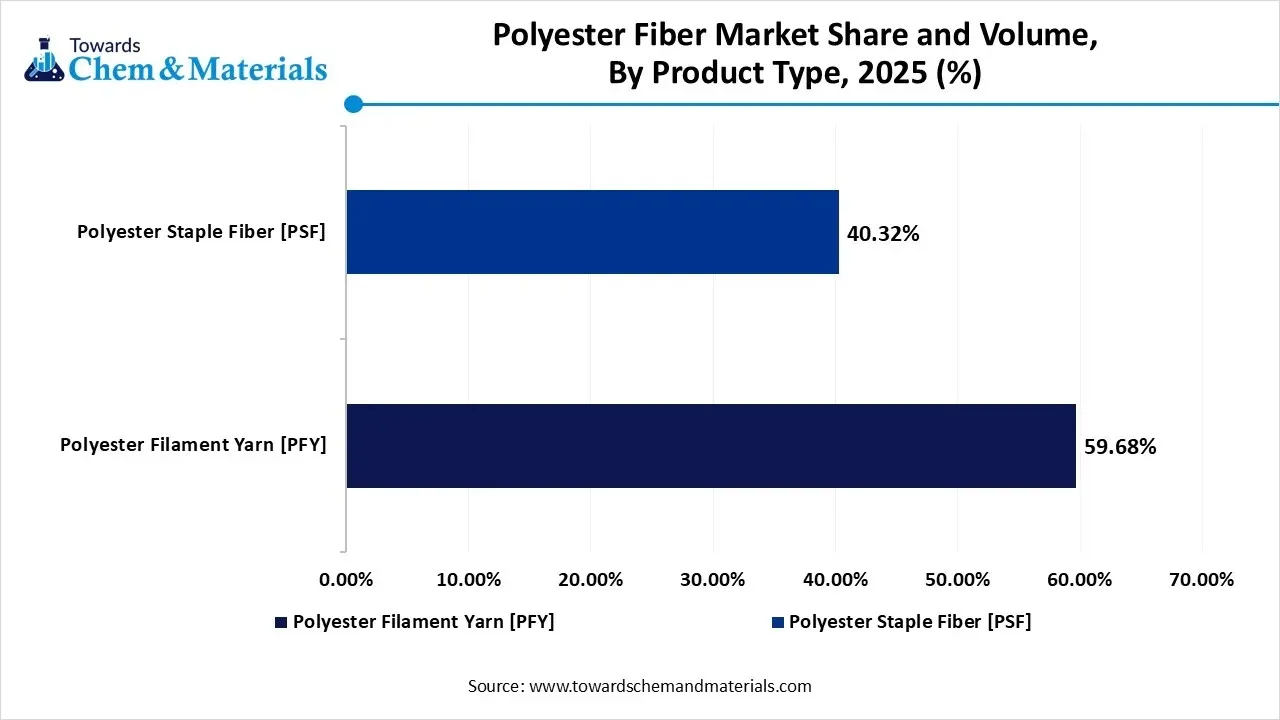

- By product type, the polyester filament yarn (PFY) segment led the market with the largest volume share of 60% in 2025. The dominance of the segment can be attributed to the increasing consumer spending on home enhancements.

- By product type, the polyester staple fiber (PSF) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its use in non-woven and car interiors.

- By grade, the PET polyester segment led the market with the largest volume share of 95% in 2025. The growth of the segment can be linked to its exceptional properties like strength, versatility, and cost-effectiveness.

- By grade, the Poly-1, 4-cyclohexylene dimethylene terephthalate (PCDT) polyester segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its superior durability.

- By origin, the virgin polyester fiber segment accounted for the largest volume share of 78% in 2025. The dominance of the segment is owed to its increasing use in geotextiles.

- By origin, the recycled polyester fiber (rPET) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to increasing sustainability awareness.

- By form, the solid fiber segment dominated with the largest volume share of 85% in 2025.The dominance of the segment can be attributed to its strength, durability, and affordability.

- By form, the hollow fiber segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to its better thermal insulation.

- By application, the textiles and apparel segment dominated the market and accounted for the largest volume share of 52% in 2025. The dominance of the segment can be linked to the ongoing transition towards sustainable options.

- By application, the industrial and technical textiles segment is expected to grow at the fastest rate during the study period. The growth of the segment can be driven by rapid advancements in functional fibers.

What is Polyester Fiber?

Polyester fiber is a synthetic fiber composed of long-chain polymers of the ester functional group, most commonly Polyethylene Terephthalate (PET). It is produced through the polymerization of ethylene glycol and terephthalic acid or its derivatives.

Polyester Fiber Market Trends

- The growing consumer awareness regarding sustainability is the latest trend in the market. Consumers are increasingly becoming conscious of their purchasing decisions, which leads to a transition towards eco-friendly products.

- The fashion and apparel industry is witnessing strong growth due to its versatility and affordability. Also, the increase in fast fashion brands, which focus on quick manufacturing cycles, is impacting positive market growth shortly.

- Technological advancements in fiber manufacturing are another major trend in the market. Advancements such as cutting-edge spinning techniques are improving the overall product functionality and quality.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 145.03 Billion / 77.59 Million Tons |

| Revenue Forecast in 2035 | USD 274.58 Billion / 103.67 Million Tons |

| Growth Rate | CAGR 7.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | Product Type Insights, Grade Insights, Origin Insights, Form Insights, Application Insights, Regional Insights |

| Key companies profiled | Indorama Ventures Public Company Limited, Reliance Industries Limited, Sinopec (China Petroleum & Chemical Corporation), Tongkun Group Co., Ltd., Hengli Group Co., Ltd., Alpek S.A.B. de C.V., Toray Industries, Inc., Teijin Limited, Far Eastern New Century Corporation, Nan Ya Plastics Corporation, Jiangsu Sanfangxiang Group Co., Ltd., Zhejiang Hengyi Group Co., Ltd., Shenghong Group Co., Ltd., Xinfengming Group Co., Ltd., Mitsui Chemicals, Inc., Mitsubishi Chemical Group Corporation, Toyobo Co., Ltd., Huvis Corporation, Eastman Chemical Company, Mossi Ghisolfi Group (M&G Chemicals) |

How Cutting Edge Technologies are revolutionizing the Polyester Fiber Market?

The market is witnessing a major transformation, fuelled by advanced technologies that tackle the long-standing challenges associated with quality control, environmental impact, and overall production efficiency. Furthermore, AI algorithms can monitor and control manufacturing parameters on a regular basis to reduce energy waste and consumption and optimize fiber extrusion.

Trade Analysis of Polyester Fiber Market: Import & Export Statistics

- The United States imports 55,230 shipments of Polyester Fibers from June 2024 to May 2025, involving 1,114 international suppliers and 29,257 U.S. buyers, with the growth rate of 888% compared to previous year which signaling strong demand for this key synthetic fiber.

- China exported 2,088 shipments of polyester from Apr 2024 to Mar 2025 (TTM). These exports were handled by 176 China Exporters to 243 Buyers, marking a growth rate of 70% compared to the previous twelve months.

Polyester Fiber Market Value Chain Analysis

- Feedstock Procurement : It refers to the process of sourcing the raw materials necessary to manufacture polyester polymers and subsequent fibers.

- Major Players: Indorama Ventures, Reliance Industries.

- Chemical Synthesis and Processing: It refers to the stage where petrochemical-derived raw materials are converted into synthetic polymers, which are then transformed into fibers for textiles.

- Major Players: Toray Industries, Inc, Alpek Polyester.

- Packaging and Labelling :It is the critical phase in the supply chain that ensures product protection and efficient handling, along with efficient communication to the end consumer.

- Major Players: Oji Holdings Corporation, Huhtamäki Oyj.

- Regulatory Compliance and Safety Monitoring: It involves the framework of necessary standards that ensure synthetic fibers are manufactured safely, contain no harmful substances, and meet environmental mandates.

- Major Players: Sinopec Yizheng, Toray Industries.

Polyester Fiber Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The U.S. International Trade Commission has initiated safeguard investigations and considered quotas on PSF imports to shield domestic producers from low-priced shipments. |

| India | The government implemented the mandatory Bureau of Indian Standards (BIS) certification for all domestic and imported polyester staple fibers (PSF) and yarns to ensure compliance with specific Indian Standards (e.g., IS 17263:2022). |

| China | As the largest producer and consumer, China influences global dynamics. Its waste import ban has also impacted rPET usage dynamics globally. |

Segmental Insights

Product Type Insights

How Much Share Did the Polyester Filament Yarn (PFY) Segment Held in 2025?

The polyester filament yarn (PFY) segment dominated the market with approximately 60% share in 2025. The dominance of the segment can be attributed to the increasing consumer spending on home enhancement projects, which fuels demand for polyester in rugs and carpets. In addition, PFY is rapidly being used in specialized technical textiles for various sectors.

The polyester staple fiber (PSF) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its use in non-woolens and car interiors, like seats and insulation. Rapid advancements in manufacturing technologies have facilitated the development of specialty fibers with improved properties, leading to segment growth soon.

Polyester Fiber Market Volume and Share, By Product Type, 2025 (%)

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Polyester Filament Yarn [PFY] | 59.68% | 44.84 | 65.07 | 4.23% | 62.77% |

| Polyester Staple Fiber [PSF] | 40.32% | 30.29 | 38.60 | 2.73% | 37.23% |

Grade Insights

Which Grade Type Segment Dominated Polyester Fiber Market in 2025?

The PET polyester segment held a nearly 95% market share in 2025. The growth of the segment can be linked to its exceptional properties like strength, versatility, and cost-effectiveness in automotive and home furnishings. PET is the common polyester in the packaging sector, and its recyclability directly supplies the fiber industry.

The Poly-1, 4-cyclohexylene dimethylene terephthalate (PCDT) polyester segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its superior durability and elasticity, suitable for heavy-duty applications such as upholstery and curtains. Additionally, PCDT's dimensional stability is one of the major factors driving segment growth during the forecast period.

Origin Insights

How Much Share Did the Virgin Polyester Fiber Segment Held in 2025?

The virgin polyester fiber segment dominated the market with nearly 78% share in 2025. The dominance of the segment is owed to its increasing use in geotextiles, filtration, and other industrial applications. Virgin fibers maintain uniform quality and physical properties, which makes them a favoured choice for large-scale textile production.

The recycled polyester fiber (rPET) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to increasing sustainability awareness, particularly among the young generation. Furthermore, innovations in spinning and polymerization make rPET fibers comparable in quality and performance to virgin polyester.

Form Insights

How Much Share Did the Solid Fiber Segment Held in 2025?

The solid fiber segment held approximately 85% market share in 2025. The dominance of the segment can be attributed to its strength, durability, affordability, and wrinkle resistance, which make it ideal for various industrial applications. Additionally, these fibers are more cost-effective than natural fibers such as cotton or wool, fuelling their adoption further.

The hollow fiber segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to its better thermal insulation, air-trapping ability, and lightweight nature, boosting demand in bedding and outerwear. These fibers are increasingly being utilized in technical textiles and other construction materials for insulation.

Application Insights

Which Applications Type Segment Dominated Polyester Fiber Market in 2025?

The textiles and apparel segment dominated the market with nearly 52% share in 2025. The dominance of the segment can be linked to the ongoing transition towards sustainable options such as recycled polyester, coupled with the growing need for durable and affordable fashion. Moreover, polyester is a more convenient option than natural fibers such as wool and cotton.

The industrial and technical textiles segment is expected to grow at the fastest rate during the study period. The growth of the segment can be driven by rapid advancements in functional fibers and polymerization technology. Polyester is utilized in construction materials for road stabilization and insulation, creating lucrative opportunities in the market.

Regional Insights

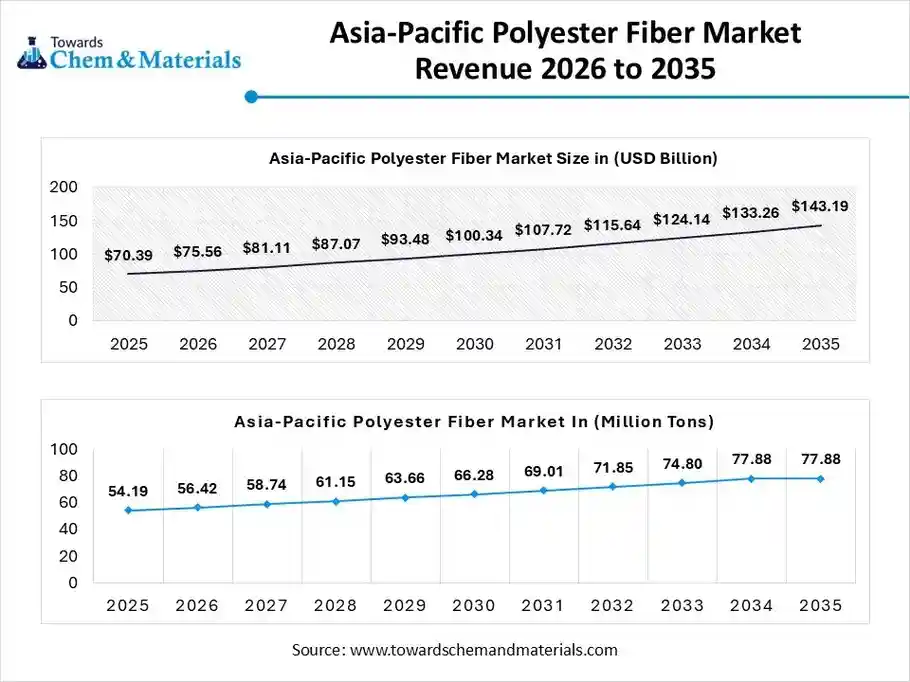

The polyester fiber market size was valued at USD 70.39 billion in 2025 and is expected to be worth around USD 143.19 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.37% over the forecast period from 2026 to 2035.

The polyester fiber market volume was estimated at 54.19 million tons in 2025 and is projected to reach 77.88 million tons by 2035, growing at a CAGR of 4.11% from 2026 to 2035.Asia Pacific dominated the market with nearly 72% share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The dominance and growth of the region can be attributed to the rapid urbanisation, increasing disposable incomes, and extensive textile demand. In addition, growing spending on home development fuels demand for polyester in upholstery, curtains, carpets, and bedding due to its durability.

China Polyester Fiber Market Trends

In China, the market is driven by polyester's affordability as compared to natural fibers, which makes it a favoured choice for market products. Also, rapid investment in smart production and automation propels production quality and efficiency.

North America Polyester Fiber Market Trends

North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the robust product demand from the home furnishing, textiles, and automotive sectors. The commercial and residential sectors fuel demand for polyester fibers in products like carpets, upholstery, and bedding because of their material resilience and durability.

U.S. Polyester Fiber Market Trends

In North America, the U.S. led the market due to the growing need for cost-effective, durable, and sustainable textiles in major applications such as automotive, apparel, and home furnishing. Government regulations are supporting sustainable practices, further optimising investment in recycled materials.

Europe Polyester Fiber Market Trends

Europe held a substantial market share in 2025. The growth of the region can be driven by increasing product use in lightweight, durable interior components such as carpets, supported by advancements in sustainable materials. Moreover, a surge in online retail drives the need for durable packaging alternatives such as shipping envelopes.

Germany Polyester Fiber Market Trends

The growth of the market in the country can be driven by its strong production base, which fulfils consumer demand and fosters innovation. Also, German fiber manufacturers are heavily investing in green production processes, using renewable energy sources to differentiate their products from other fiber products.

Polyester Fiber Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 6.97% | 5.23 | 6.21 | 1.92% | 5.99% |

| Europe | 10.04% | 7.55 | 9.44 | 2.53% | 9.11% |

| Asia Pacific | 72.13% | 54.19 | 77.88 | 4.11% | 75.12% |

| South America | 4.32% | 3.25 | 3.68 | 1.41% | 3.55% |

| Middle East & Africa | 6.54% | 4.91 | 6.46 | 3.08% | 6.23% |

South America Polyester Fiber Market Trends

South America held a notable market share in 2025. The growth of the region can be boosted by a surge in the middle-class population with a growing disposable income. The region's well -structured textile sector, especially in Brazil and Mexico, is a leading consumer of polyester fibers, contributing to regional expansion soon.

Brazil Polyester Fiber Market Trends

The growth of the market in the country can be boosted by growing urbanisation, propelling consumption, and a robust push for sustainable and recycling options. Brazil has a strong culture of outdoor activities and fitness, which has created demand for "performance fibers."

Middle east and Africa Polyester Fiber Market Trends

Middle east and Africa expects the significant growth in the market by increasing demand for smart" textiles featuring antimicrobial properties and moisture-wicking. The region's automotive industry utilizes polyester in airbags, seat belts, and other interior parts, which can boost the vehicle sales in the emerging regional economies, contributing to market expansion shortly.

Saudi Arabia Polyester Fiber Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be attributed to the rapid investments in cutting-edge nonwoven and spinning facilities, coupled with the robust demand for sustainable fashion. Surging urban populations need durable and affordable textiles for apparel and home décor.

Recent Developments

- In October 2025, Clariant will introduce a titanium catalyst for polyester manufacturing at K 2025. Its advanced AddWorks titanium-based catalyst solutions are set to revolutionize polyester polymerization with improved performance and sustainability.(Source: www.indianchemicalnews.com )

- In August 2025, Loop Industries, Inc,a clean tech company, and Shinkong launched a strategic partnership to promote a shift by global brands to circular polyester. This advanced polyester also provides virgin-quality performance.(Source: www.accessnewswire.com)

Polyester Fiber Market Companies

- Reliance Industries Limited: Reliance Industries Limited (RIL) is the world's largest fully integrated producer of polyester fiber and yarn. RIL dominates the sector through a unique "crude-to-customer" model that ensures total control over the supply chain.

- Indorama Ventures Public Company Limited: Indorama Ventures Public Company Limited (IVL) is a critical global leader in the polyester value chain, functioning as a primary bridge between upstream petrochemical feedstocks and downstream consumer applications like textiles and packaging.

Other Companies in the Market

- Indorama Ventures Public Company Limited

- Reliance Industries Limited

- Sinopec (China Petroleum & Chemical Corporation)

- Tongkun Group Co., Ltd.

- Hengli Group Co., Ltd.

- Alpek S.A.B. de C.V.

- Toray Industries, Inc.

- Teijin Limited

- Far Eastern New Century Corporation

- Nan Ya Plastics Corporation

- Jiangsu Sanfangxiang Group Co., Ltd.

- Zhejiang Hengyi Group Co., Ltd.

- Shenghong Group Co., Ltd.

- Xinfengming Group Co., Ltd.

- Mitsui Chemicals, Inc.

- Mitsubishi Chemical Group Corporation

- Toyobo Co., Ltd.

- Huvis Corporation

- Eastman Chemical Company

- Mossi Ghisolfi Group (M&G Chemicals)

Segments Covered in the Report

By Product Type

- Polyester Filament Yarn (PFY)

- Fully Drawn Yarn (FDY)

- Partially Oriented Yarn (POY)

- Draw Textured Yarn (DTY)

- Polyester Staple Fiber (PSF)

By Grade

- Polyethylene Terephthalate (PET) Polyester

- Poly-1, 4-cyclohexylene Dimethylene Terephthalate (PCDT) Polyester

- Other Specialty Co-polymers

By Origin

- Virgin Polyester Fiber

- Recycled Polyester Fiber (rPET)

- Post-Consumer Recycled (e.g., Plastic Bottles)

- Post-Industrial Recycled (e.g., Fabric Scraps)

By Form

- Solid Fiber

- Hollow Fiber

By Application

- Textiles and Apparel

- Sportswear and Activewear

- Innerwear and Intimates

- Outerwear and Casualwear

- Home Furnishing

- Bedding and Linens

- Carpets and Rugs

- Curtains and Upholstery

- Automotive and Transportation

- Tire Cords

- Seat Covers and Carpeting

- Safety Belts and Airbags

- Industrial and Technical Textiles

- Filtration Media

- Geotextiles

- Non-Woven Fabrics

- Ropes and Nets

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa