Content

What is the Current Recycled Plastics Market Size and Share?

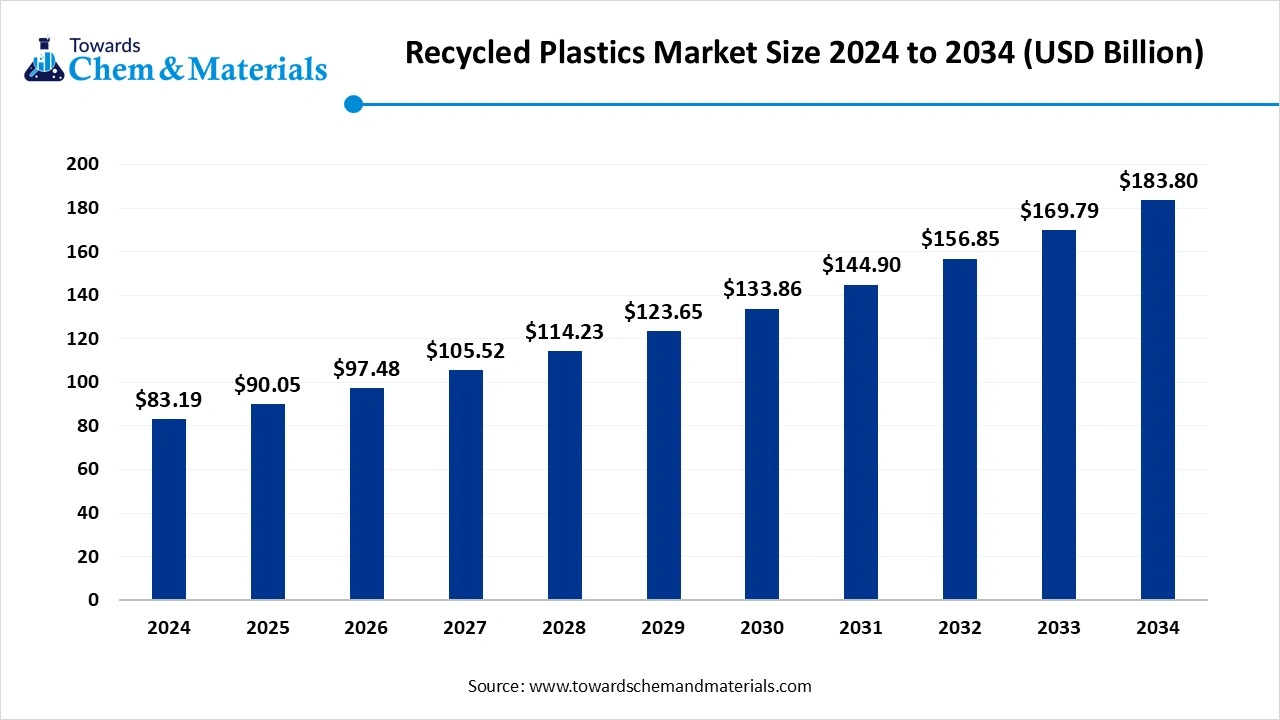

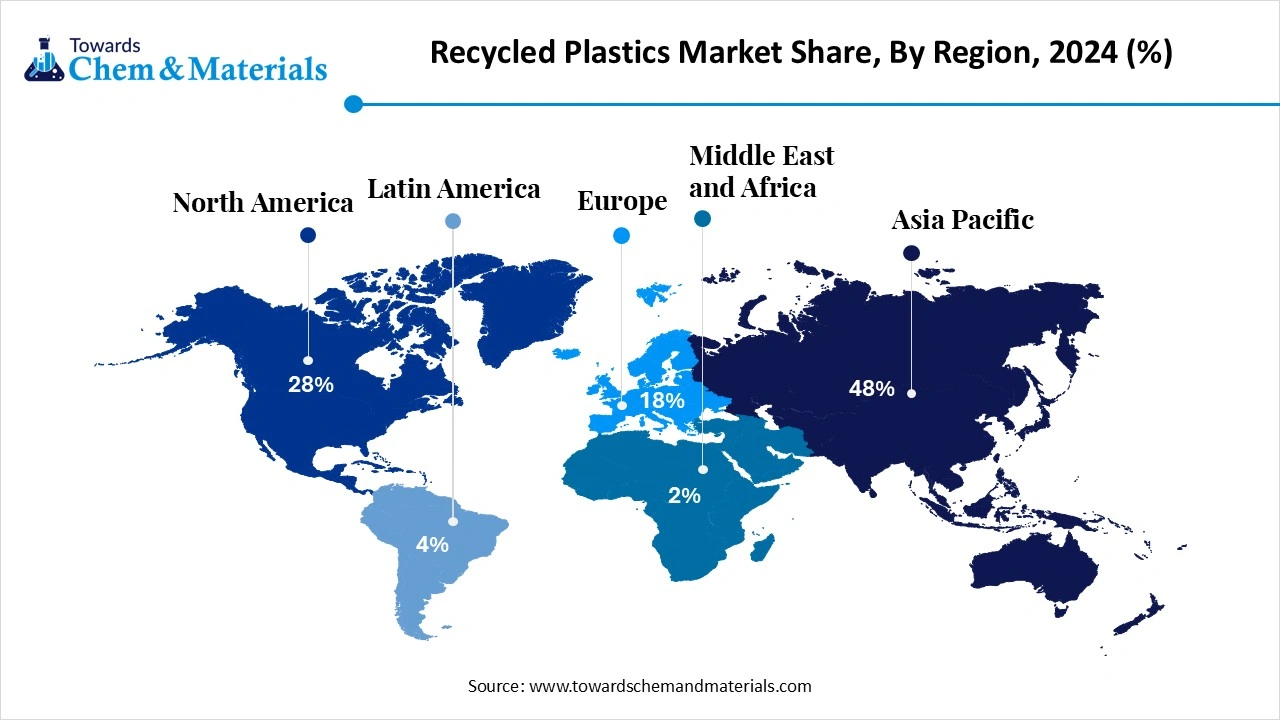

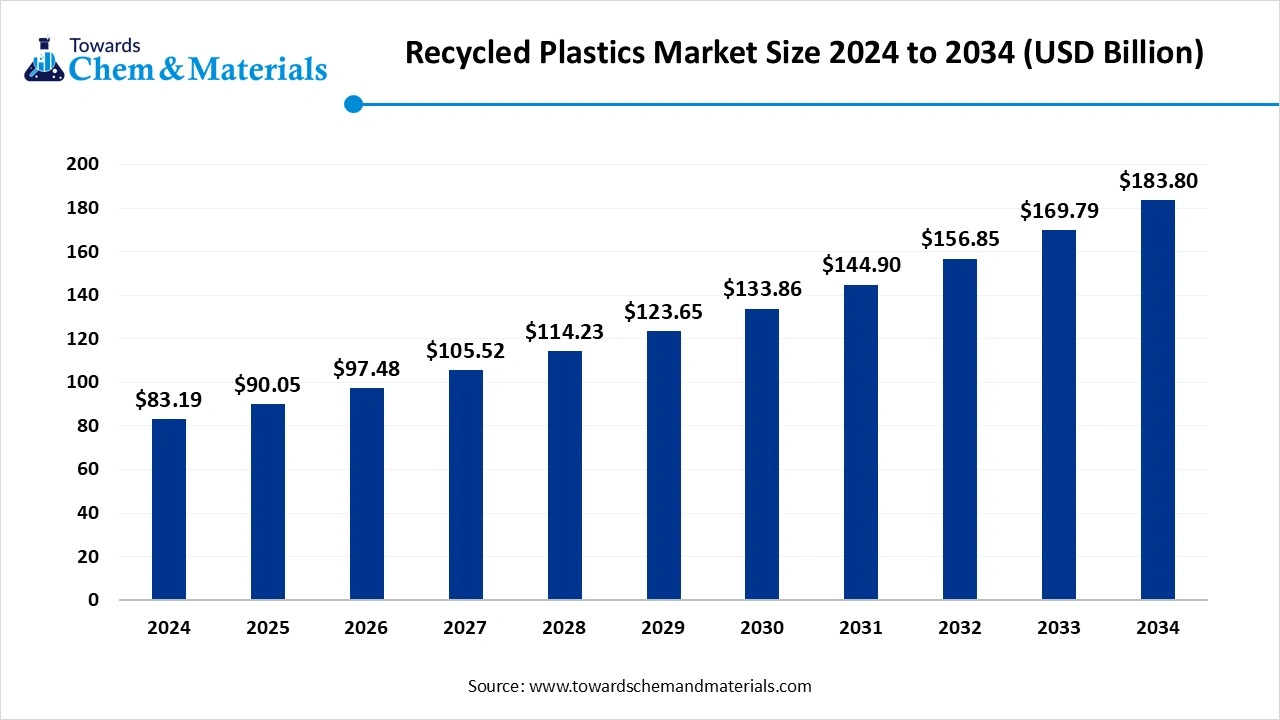

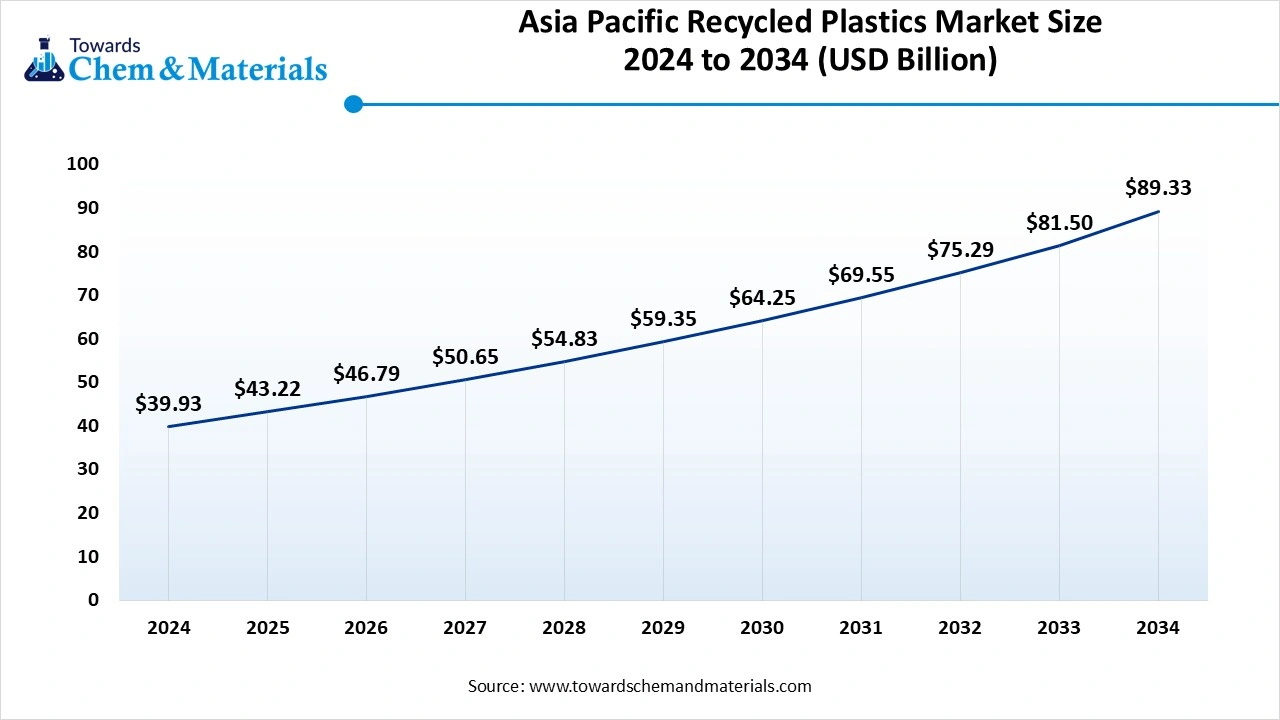

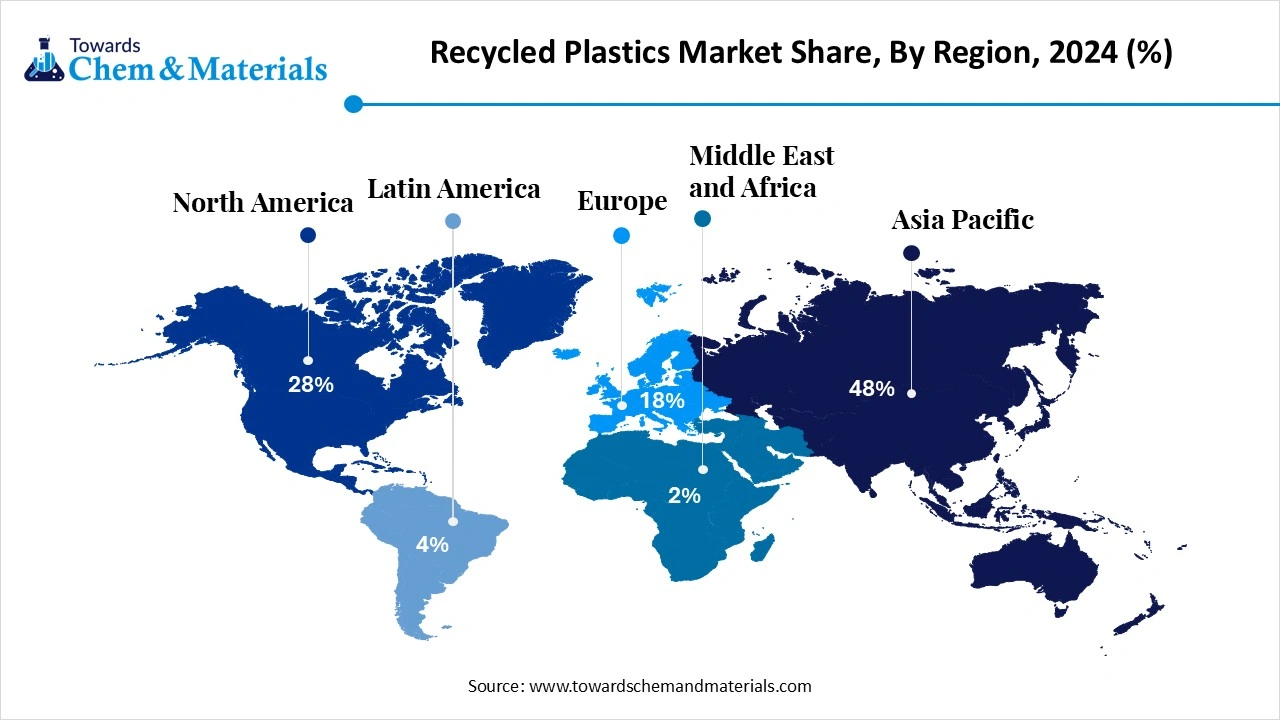

The global recycled plastics market size is calculated at USD 86.11 billion in 2025 and is predicted to increase from USD 93.21 billion in 2026 and is projected to reach around USD 190.25 billion by 2035, The market is expanding at a CAGR of 8.25% between 2026 and 2035. Asia Pacific dominated the recycled plastics market with a market share of 49.14% the global market in 2025. The growing environmental concerns, increasing adoption of sustainable products, and technological advancements in recycling drive the market growth.

Key Takeaways

- Asia Pacific dominated the global recycled plastics market with the largest revenue share of 49.14% in 2025.

- The China recycled plastics market is projected to grow during the forecast period.

- By source, the bottles segment accounted for the largest revenue share of 75.16% in 2025.

- By polymer type, the PET segment dominated with the largest revenue share of 38.47% in 2025.

- By process, the mechanical recycling segment dominated with the largest revenue share of 70.74% in 2025.

- By product form, the flakes segment led the market and accounted for 75.34% of the global revenue share in 2025.

- By application, the packaging segment accounted for the largest revenue share of 39.35% in 2025.

Recycled Plastics: Solution for a Cleaner Planet and Modern Manufacturing

Recycled plastics are recycled plastic material used in the production of new plastic products. Recycled plastics are produced from post-industrial waste and post-consumer waste. The recycled plastic involves processes like collection & sorting of plastic items, processing, sorting plastics, remelting & converting to new products. The recycling methods required are chemical recycling, advanced recycling, thermal recycling, and mechanical recycling.

Recycled plastics minimize reliance on fossil fuels, lower GHG emissions, reduce landfill plastic waste, and conserve natural resources. Recycled plastics are used in various products like furniture, clothing, and construction materials. The stricter government regulations, like the EU, and growing plastic pollution, increase demand for recycled plastics. The growing expansion of industries like textiles, construction, packaging, and automotive contributes to the growth of the recycled plastics market.

- According to Volza’s Export data, Vietnam exported 3181 shipments of recycled plastics.(Source: www.volza.com)

- According to Volza’s Export data, the United States exported 2202 shipments of recycled plastics.(Source: www.volza.com)

- According to Volza’s Export data, GDB International Inc. is the leading supplier of recycled plastics in the world. (Source: www.volza.com)

- According to Volza’s Export data, Vietnam exported 1019 shipments of recycled plastic scrap.(Source: www.volza.com)

Who are the Leading Exporters of Recycled Plastics Pellet?

| Country | Export |

| Vietnam | 3001 |

| Malaysia | 258 |

| United States | 226 |

Recycled Plastics Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement for recycled plastic includes post-industrial plastic waste, like manufacturing processes waste, and post-consumer plastic waste, like individual & household waste.

- Chemical Synthesis and Processing :The chemical synthesis involves steps like depolymerization, pyrolysis, gasification, and superficial fluid depolymerization for breaking down plastic waste into monomers to manufacture new plastic products.

- Key Players:- Shell, Agilyx, BASF SE, SABIC, Itero Technologies

- Waste Management and Recycling :The waste management includes the collection of plastics, sorting by types, shredding, cleaning, pelletizing, & manufacturing new products, and recycling involves chemical recycling & mechanical recycling processes.

- Key Players:- KW Plastics, Biffa, Veolia, TerraCycle, Banyan Nation

Growing Automotive Industry Drives Recycled Plastics Market

The growing automotive sector and increasing production of vehicles in developing nations increase demand for recycled plastics for various automotive applications. The focus on reducing vehicle weight and improving the fuel efficiency of vehicles increases the adoption of recycled plastics. The increasing production of interior components like center consoles, dashboards, and door trims increases demand for recycled plastics.

The manufacturing of exterior components like body panels, bumpers, and wheel arch liners increases the adoption of recycled plastics. The rise in electric vehicles fuels demand for recycled plastics for enhancing energy efficiency and battery casing. The need for the under-the-hood components like air filter housing & engine covers requires recycled plastics. The growing automotive industry is a key driver for the growth of the recycled plastics market.

Market Trends

- Growing Construction Activities:- The rapid urbanization and growing construction activities increase demand for recycled plastics for the development of construction materials like fences, structural lumber, and insulation.

- Growing Environmental Concerns:- The growing plastic pollution and increasing environmental concerns increase demand for recycled plastic. This helps to support sustainability and reduce pollution.

- Technological Advancements:- The ongoing technological advancements, like pyrolysis and thermal depolymerization, help to develop high-quality recycled plastics and enhance efficiency.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 93.21 Billion |

| Revenue Forecast in 2035 | USD 190.25 Billion |

| Growth Rate | CAGR 8.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Source, By Polymer Type, By Recycling Process, By Product Form, By End-Use Industry / Application, By Region |

| Key companies profiled | SABIC, Dow Chemical, Veolia, BASF, Indorama Ventures, LyondellBasell, Mitsui Chemicals, TotalEnergies, Envision Plastics, Green Dot Bioplastics, Braskem, PolyOne Corporation, Covestro AG, Eastman Chemical Company, ExxonMobil Chemical (Exxon Mobil Corporation), Loop Industries, Inc., MBA Polymers Inc., Plastipak Holdings, Inc., Alpek, Cabka |

Market Opportunity

Growing Electronic Industry Surges Demand for Recycled Plastics

The growing electronic industry and increasing adoption of various electronic products like computers, smartphones, laptops, printers, and monitors increase demand for recycled plastics for the production of various electronic components. The growing demand for housing and casing in electronics products increases the adoption of recycled plastics. The increasing production of components like connectors and circuit boards increases demand for recycled plastics.

The increasing utilization of speakers, keyboards, and mice increases demand for recycled plastics. The growing manufacturing of mobile cases, TV frames, and laptop enclosures increases demand for recycled plastics due to their high durability and impact strength. Key players like Samsung, Logitech, LG Electronics, Dell, Lenovo, and many more use recycled plastics in the production of electronic products. The growing electronic industry creates an opportunity for the growth of the recycled plastics market.

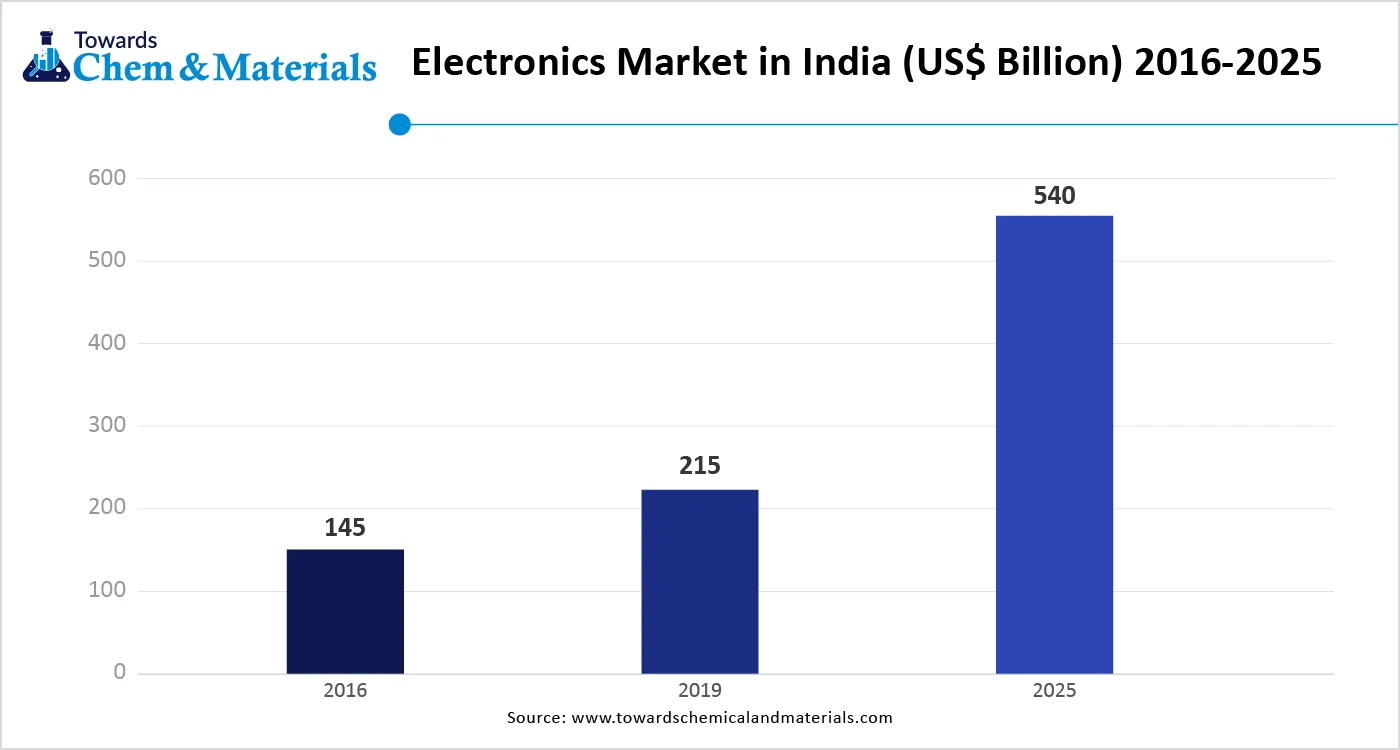

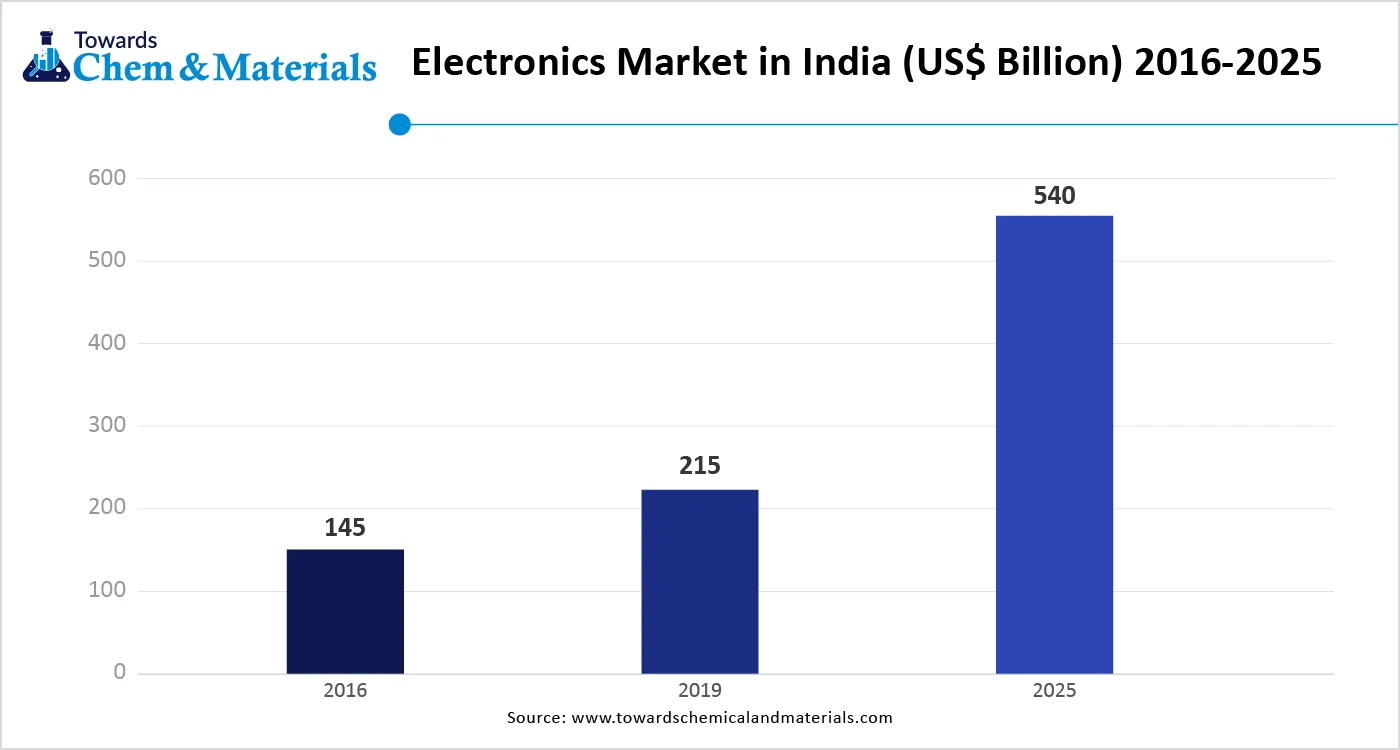

According to the India Brand Equity Foundation, electronics manufacturing is growing in India. The manufacturing of electronic hardware products, consumer electronics, nano electronics, medical electronics, and others is growing.

Market Challenge

High Recycling Cost Shuts Down Growth of the Recycled Plastics Market

Despite several benefits of recycled plastics in various industries, the high recycling cost restricts the growth of the market. Factors like contamination issues, complexity in the recycling process, development of advanced infrastructure, and energy-intensive processes for sorting & collecting plastic waste are responsible for high recycling costs.

The complex recycling process for cleaning, sorting, processing, degradation, and separation of plastics increases the cost. The need for specialized recycling equipment for processes like reprocessing, shredding, and cleaning requires a high initial cost. The high investments in the development of recycling infrastructure directly affect the market. The high recycling cost hampers the growth of the recycled plastics market.

Segmental Insights

By Source

Why did Bottles Segment Dominate the Recycled Plastics Market?

The bottles segment dominated the recycled plastics market in 2025. The growing availability of bottles in household products, beverages, and personal care items helps market growth. The growing use of plastic bottles in urban areas increases the production of recycled plastics. The growing development of HDPE and PET bottles increases the production of recycled plastics. The growing utilization of plastic bottles in various industries like pharmaceuticals, food & beverage, and personal care & cosmetics drives the overall growth of the market.

The films & sheets segment is the fastest-growing in the market during the forecast period. The growing demand for construction insulation and flexible food packaging increases the adoption of films & sheets. The ongoing technological advancements, like recycling technologies, polymer blending, and extrusion techniques, increase the production of films & sheets.

The increasing production of films for reducing water usage, crop protection, and improving crop yields in the agriculture sector, helping the market growth. The growing demand for construction materials like protective layers, insulation, and vapor barriers increases the adoption of films & sheets, supporting the overall growth of the market.

By Polymer Type

How the PET Segment Held the Largest Share in the Recycled Plastics Market?

The PET segment held the largest revenue share in the recycled plastics market in 2025. The increasing production of consumer goods and beverage bottles increases demand for PET. The growing advancements in recycling technologies increase the production of PET. The increasing manufacturing of fibers, furniture, and carpets increases demand for PET. It is highly recyclable, lightweight, and strong. The growing utilization of PET in industries like construction, personal care, and packaging drives the overall growth of the market.

The HDPE segment is experiencing the fastest growth in the market during the forecast period. The stricter regulations to reduce plastic waste and growing consumer awareness about sustainable products increase demand for HDPE. The increasing production of containers, pipes, bottles, and picnic tables increases demand for HDPE. It offers excellent stiffness, strength, and is easy to recycle. The growing use of HDPE in industries like consumer goods, packaging, and construction supports the overall growth of the market.

By Recycling Process

Why did the Mechanical Recycling Segment Dominate the Recycled Plastics Market?

The mechanical recycling segment dominated the recycled plastics market in 2025. The strong focus on energy efficiency and cost-effective plastic processing options increases the adoption of mechanical recycling. The focus on reducing operational expenditure and the availability of suitable feedstocks increase the adoption of mechanical recycling. The growing demand for re-extruding, shredding, and washing plastics increases demand for mechanical recycling. The focus on lowering greenhouse gas emissions and growing investment in mechanical recycling technology drives the overall growth of the market.

The chemical recycling segment is the fastest-growing in the market during the forecast period. The increasing demand for processing complex plastics like laminates & films increases the adoption of chemical recycling. The growing demand for high-quality feedstocks and increasing concerns about plastic pollution increase the demand for recycled plastic. The focus on lowering the carbon footprint and increasing investment in chemical recycling technologies supports the overall growth of the market.

By Product Form

How Flakes Segment Held the Largest Share in the Recycled Plastics Market?

The flakes segment held the largest revenue share in the recycled plastics market in 2025. The increasing production of packaging materials, fibers, plastic bottles, and textiles increases demand for flakes. The growing large-scale recycling operations and advancements in recycling technology increase demand for flakes. The growing consumer adoption of sustainable products and the increasing demand for high-quality flakes help the market growth. The growing bottle-to-bottle recycling increases the adoption of flakes, driving the overall growth of the market.

The pellets segment is experiencing the fastest growth in the market during the forecast period. The bans on single-use plastics and stringent government regulations increase the demand for recycled pellets. The growth in the 3D printing sector and technological advancements like pelletizing processes increase the production of pellets. The growing use of pellets in sectors like automotive, consumer goods, packaging, and construction supports the overall growth of the market.

By Application

Which Application Dominated the Recycled Plastics Market?

The packaging segment dominated the recycled plastics market in 2025. The increasing demand for personal care products and increased consumption of packaged foods increases demand for packaging. The strong focus on sustainable packaging and stricter government regulations for packaging increases the adoption of recycled plastics. The growth in e-commerce and the rise in online shopping increase demand for packaging. The growing packaging demand in sectors like consumer goods, the food & beverage industry, and e-commerce drives the overall growth of the market.

The automotive segment is the fastest-growing in the market during the forecast period. The need to minimize greenhouse gas emissions and focus on reducing vehicle weight increases demand for recycled plastics. The focus on improving fuel efficiency and growing production of automotive parts like under-the-hood components, interior parts, and bumpers increases demand for recycled plastics. The growing utilization of lightweight materials in vehicle production and the growing development of advanced automotive components increase the adoption of recycled plastics, supporting the overall growth of the market.

Regional Insights

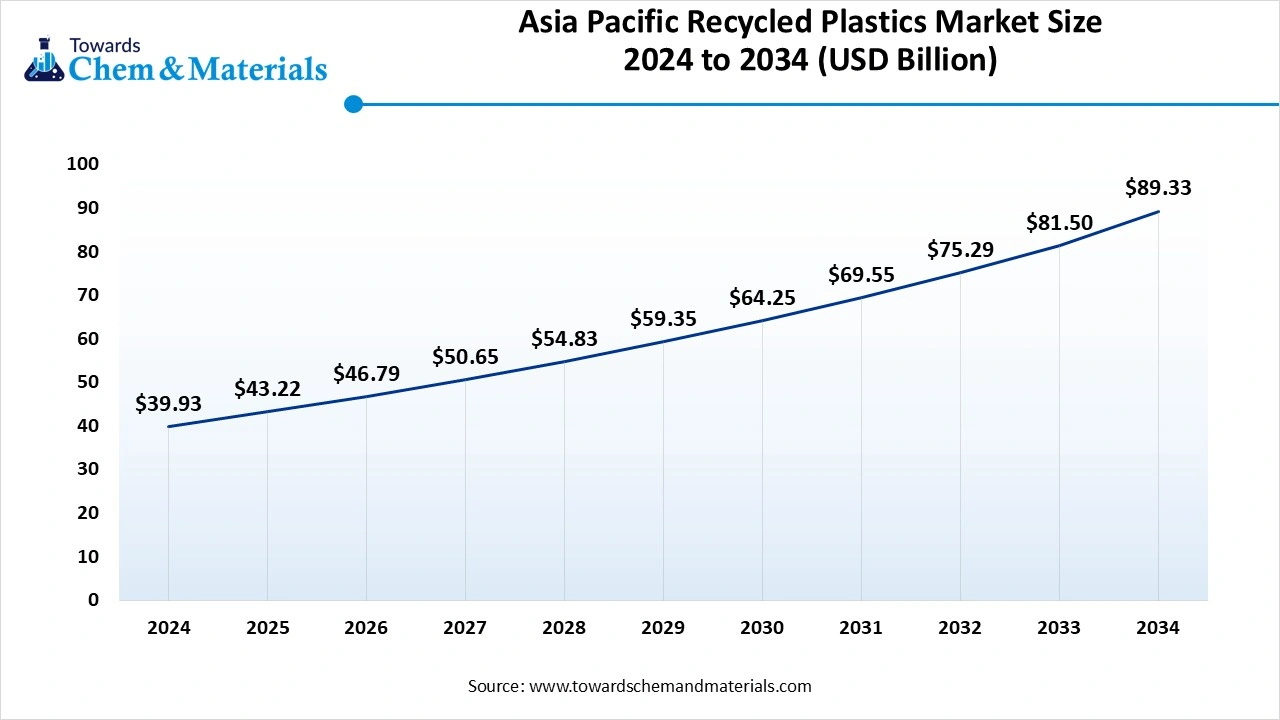

The Asia Pacific recycled plastics market size was valued at USD 42.31 billion in 2025 and is expected to reach USD 93.56 billion by 2035, growing at a CAGR of 8.26% from 2025 to 2035. Asia Pacific dominated the recycled plastics market in 2025. The high population and growing demand for plastic products increase the adoption of recycled plastics. The well-established manufacturing infrastructure and growing industrialization increase demand for recycled plastics.

The stricter government regulations for plastic waste management and focus on reducing plastic waste increase the adoption of recycled plastics. The increased consumption of packaged food & beverages and the expansion of the packaging sector increase demand for recycled plastics. The growing demand for recycled plastics across industries like electrical & electronics, automotive, and construction drives the overall growth of the market.

China Recycled Plastics Market Trends

China is a major contributor to the recycled plastics market. The presence of a large manufacturing base in sectors like electronics & packaging increases demand for recycled plastics. The growing utilization of food delivery services and the expansion of the e-commerce sector increase demand for recycled plastics. The government has a strong focus on sustainability, and low labor costs increase production of recycled plastics, supporting the overall growth of the market.

- According to Volza’s Export data, China exported 2186 shipments of recycled plastics.(Source: www.volza.com)

Europe Recycled Plastics Market Trends

Europe experiences the fastest growth in the market during the forecast period. The growing consumer awareness about plastic waste and stricter environmental regulations like EPR laws increases the adoption of recycled plastics. The well-developed recycling base and increasing investment in recycling technologies like chemical & mechanical recycling help the market growth. The growth in sectors like construction, automotive, and packaging increases the adoption of recycled plastics, driving the overall growth of the market.

Germany Recycled Plastics Market Trends

Germany is growing in the recycled plastics market. The stricter regulatory frameworks, like EU regulations and the presence of advanced recycling infrastructure, increase the production of recycled plastics. The ongoing innovations in recycling technologies and increasing investments in advanced sorting technologies increase demand for recycled plastics. The growing environmental issues and increasing industrial activities are increasing the adoption of recycled plastics, supporting the overall growth of the market.

Middle East & Africa (MEA) Recycled Plastics Market

The MEA region is witnessing a gradual increase in recycled plastics adoption, driven by rising environmental concerns, industrialization, and urbanization. Countries in the region are investing in modern waste management systems and recycling plants to handle increasing volumes of plastic waste. Industrial demand, particularly in packaging, construction, and consumer goods, is propelling the market, while regional initiatives to reduce landfill dependency and promote sustainability are encouraging recycling activities. Challenges such as limited sorting infrastructure and inconsistent waste collection are gradually being addressed through public-private partnerships.

UAE Recycled Plastics Market Trends:

The UAE has emerged as a key player in the Middle East’s recycled plastics market due to its strong focus on sustainability and circular economy initiatives. The government is actively promoting recycling programs, supporting private-sector investments in mechanical and chemical recycling facilities, and enforcing regulations to reduce single-use plastics. Industries such as packaging, construction, and automotive are increasingly incorporating recycled polymers, while awareness campaigns and corporate sustainability goals are driving consumer acceptance. The UAE is also positioning itself as a regional hub for recycling technology and innovation, attracting international partnerships and investments.

Recent Developments

- In January 2025, Cadbury launched 80% recycled plastic packaging. The company uses chemical recycling technology, and the material is safe for food contact.(Source: www.packagingdigest.com)

- In June 2025, Ineos Olefins & Polymers launched recycled plastic production in Europe. The facility uses pyrolysis oil, and the process used for the production is advanced recycling. The plastic is useful in high-performance applications and uses post-consumer plastic packaging waste.(Source: hemanager-online.com)

- In May 2025, Saint-Gobain collaborated with DOW and Prepack Thailand to launch grout recycled plastic packaging. The partnership focuses on lowering carbon emissions and minimizing plastic waste. The packaging is made up of 10% post-consumer recycled plastics and offers moisture protection & impact resistance.(Source: www.nationthailand.com)

Recycled Plastics Market Top Companies

- SABIC

- Dow Chemical

- Veolia

- BASF

- Indorama Ventures

- LyondellBasell

- Mitsui Chemicals

- TotalEnergies

- Envision Plastics

- Green Dot Bioplastics

- Braskem

- PolyOne Corporation

- Covestro AG

- Eastman Chemical Company

- ExxonMobil Chemical (Exxon Mobil Corporation)

- Loop Industries, Inc.

- MBA Polymers Inc.

- Plastipak Holdings, Inc.

- Alpek

- Cabka

Segments Covered

By Source

- Bottles

- Films & sheets

- Foams

- Fibres

- Non-bottle rigid

- Others (e.g., multi-layer packaging scraps, etc.)

By Polymer Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Others (e.g., Polycarbonate, PU, mixed polymers)

By Recycling Process

- Mechanical Recycling

- Chemical Recycling

- Thermal Recycling

- Novel/Advanced

By Product Form

- Flakes

- Pellets/granules

- Films/sheets (re-extruded)

- Resin powders/paste

- Specialty additive products (e.g., waxes, compatibilizers)

By End-Use Industry / Application

- Packaging

- Building & Construction

- Automotive & Transportation

- Textiles & Fibres

- Electrical & Electronics

- Consumer Goods

- Healthcare & Pharmaceuticals

- Agriculture & Gardening

- Other (e.g., stationery, miscellaneous)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa