Content

What is the Current Plastic Waste Pyrolysis Oil Market Size and Volume?

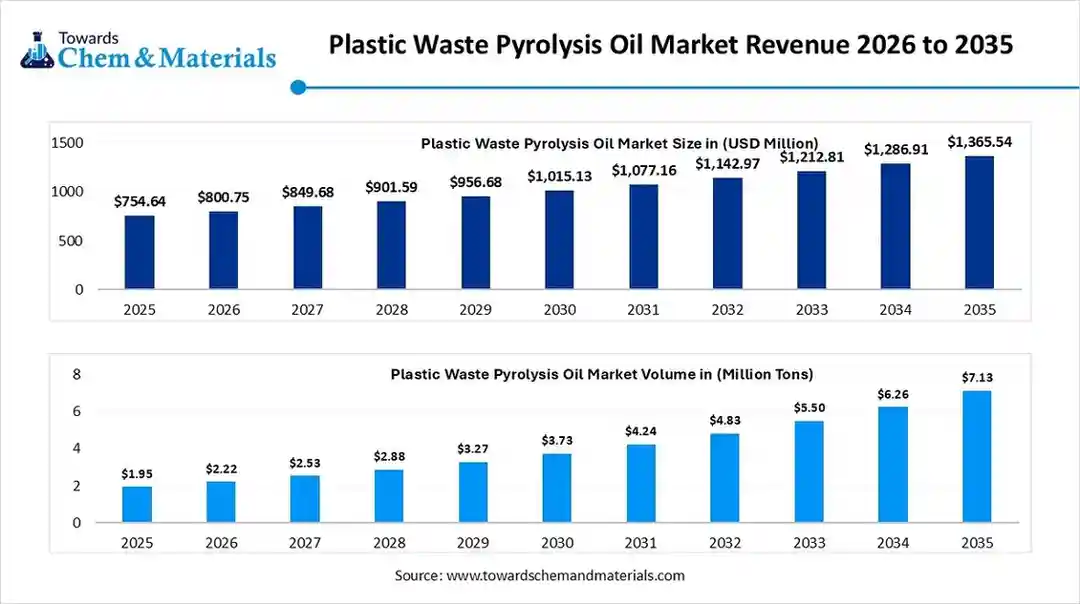

The global plastic waste pyrolysis oil market size was estimated at USD 754.64 million in 2025 and is expected to increase from USD 800.75 million in 2026 to USD 1,365.54 million by 2035, growing at a CAGR of 6.11% from 2026 to 2035.

The global plastic waste pyrolysis oil market volume was approximately USD 1.95 million tons in 2025 and is projected to reach approximately USD 7.13 million tons by 2035 growing at a CAGR of 13.84% from 2026 to 2035. Europe dominated the plastic waste pyrolysis oil market with the largest volume share of 40% in 2025.The shift towards sustainability and eco-friendly manufacturing approaches has accelerated market growth in the past few years.

Key Takeaways

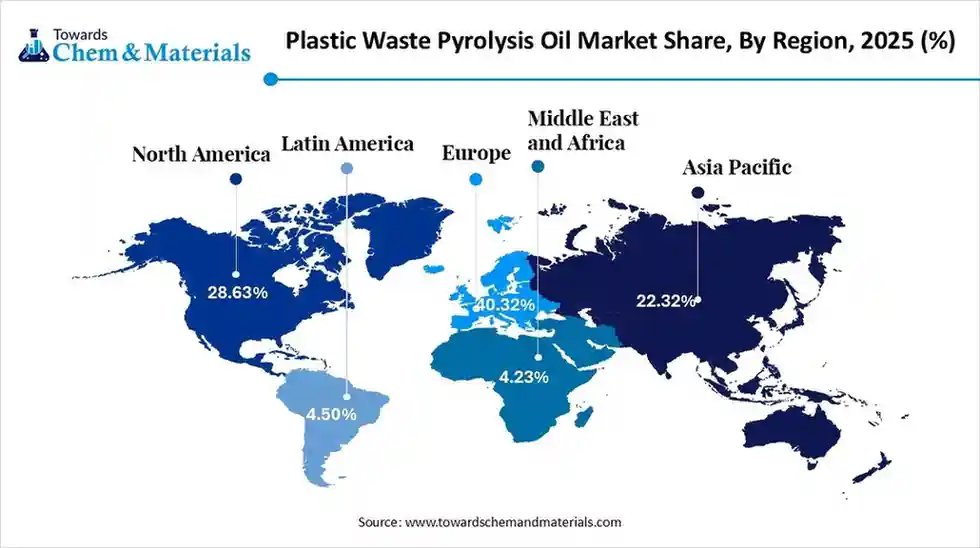

- By region, Europe dominated the plastic waste pyrolysis oil market with the largest volume share of 40% in 2025, akin to the increased shift toward eco-friendly manufacturing and fuel alternatives.

- By region, North America is anticipated to capture a greater portion of the market with a significant CAGR in the future, due to the greater technology investment for energy independence and carbon reduction in recent years.

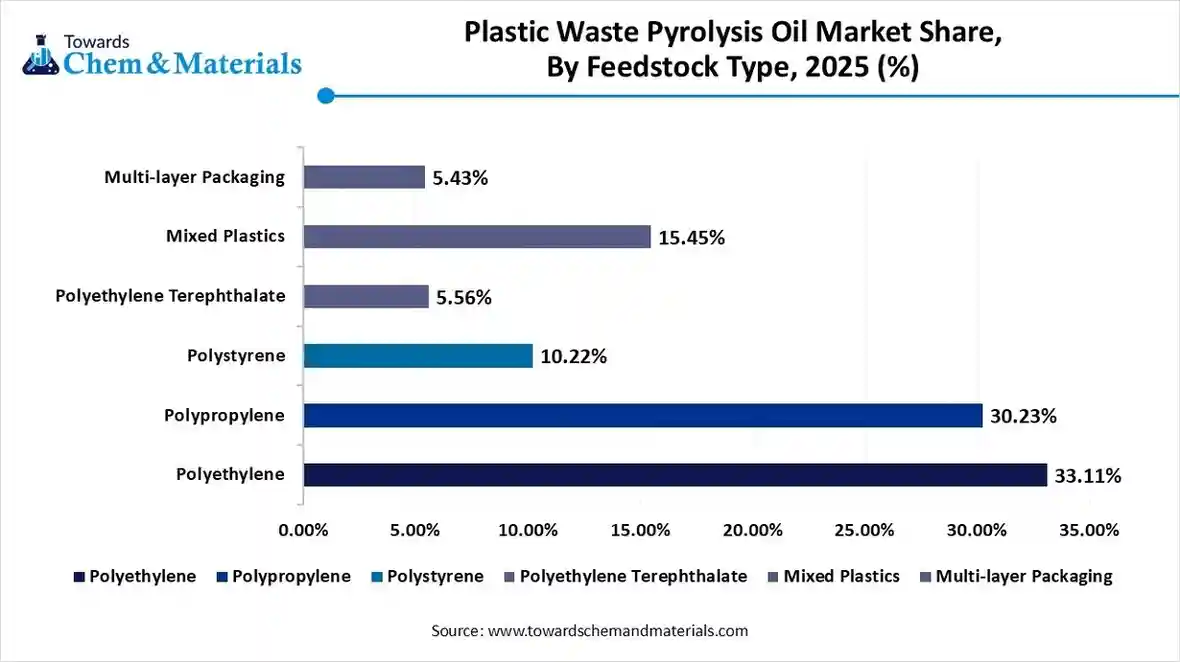

- By feedstock type, the polyethylene segment dominated the market with the largest volume share of 33% in 2025, akin to its easier conversion and affordability.

- By feedstock type, the mixed plastic segment is expected to grow during the forecast period, akin to wider availability and shift towards mixed polymer streams.

- By process tech, the fast pyrolysis segment dominated the market with the largest volume share of 50% in 2025, owing to its ability to deliver consistent pyrolysis oil output at relatively low operational complexity.

- By process tech, the catalytic pyrolysis segment is expected to grow at a rapid CAGR during the forecast period, as the market shifts from basic waste conversion to value- oriented optimization.

- By end-use, the fuel production segment dominated the market with the largest volume share of 45% in 2025 due to the pyrolysis oil's characteristics, which enabled its rapid integration into current fuel systems.

- By end-use, the petrochemical feedstock segment is expected to grow during the forecast period, due to industrial demand for renewable carbon sources that directly support materials production.

Driving Sustainability: Rising Demand for Pyrolysis Oil Replaces Traditional Fossil Fuels

The plastic waste pyrolysis oil refers to a type of fuel that is made by heating waste plastic without any oxygen. Moreover, by breaking down the longer plastic molecules into shorter ones, the process produces the dark liquid called pyrolysis oil without burning plastic. Moreover, the global demand for alternative fuel over fossil fuel has supported industry growth in recent years.

Plastic Waste Pyrolysis Oil Market Trends:

- The shift from waste disposal to value creation has translated into favourable financial prospects for producers in recent years. Earlier, the pyrolysis oil has seen under the usage to reduce landfill volume. Furthermore, several major bands are actively seen under the heavy investment towards the processing of chemical feedstocks.

- The plastic waste pyrolysis oil integration with the present renewable energy systems is projected to support stronger cash flows for manufacturing enterprises in the coming years. Moreover, several manufacturers are moving towards multifunctional waste plants where solar and biomass can be used, and waste treatments experience the lower energy cost with a minimum carbon footprint.

- The establishment of the local collection hubs emerged as the high margin opportunity for manufacturers in recent years. Moreover, the manufacturers are looking for an affordable solution to transport and process their waste instead of exporting or traveling long distances. Also, by creating local jobs, the local collection and process plants are anticipated to attract increased capital and investment in manufacturing as per future expectations.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 800.75 Million / 2.22 Million tons |

| Revenue Forecast in 2035 | USD 1,365.54 Million / 7.13 Million Tons |

| Growth Rate | CAGR 6.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Europe |

| Segment Covered | By Feedstock Type, By Process Technology, By End-Use, By Region |

| Key companies profiled | Nexus Circular, Mura Technology Limited , Alterra Energy , Pyrum Innovations AG , Neste Oyj , OMV Aktiengesellschaft (ReOil) , BlueAlp Innovations BV , Braven Environmental , RES S.p.A. , Plastic2Oil, Inc. (JBI) , Klean Industries Inc. , MK Aromatics Limited ,Niutech Environment Technology Corporation , Vadxx Energy LLC , New Hope Energy , Encina Development Group, LLC |

Next Generation Pyrolysis: Advanced Pyrolysis Systems Transform Plastic Waste Processing

The industry has seen greater technological integration in recent years. The market is moving from batch single-type processing to continuous, multi-feedstock pyrolysis systems. Early plants treated one type of plastic at a time, in small batches. New systems can handle mixed plastic waste continuously, adjusting heat and reaction conditions in real time to maximize oil quality. This reduces downtime and improves output consistency.

Trade Analysis of the Plastic Waste Pyrolysis Oil Market:

Import, Export, Consumption, and Production Statistics

- China has seen under the export of polyethylene waste or scrap, valued at around $968k in 2024, as per the published report.

- The United States has also been considered one of the leading plastic waste exporters, where the country has seen a heavy export of plastic waste to non-OECD countries, and the estimated value of the plastic waste was nearly 148 million kg per year in 2024, as per the report.

Value Chain Analysis of the Plastic Waste Pyrolysis Oil Market:

- Distribution to Industrial Users : The distribution of plastic waste pyrolysis oil to industrial users in 2025 is primarily conducted through direct industrial supply and integrated offtake agreements with large petrochemical refiners

- Key Players: Agilyx Corporation and Nexus Circular

- Chemical Synthesis and Processing: The chemical synthesis and processing of plastic waste pyrolysis oil (PWPO) focus on converting low-value mixed plastics into high-purity refinery feedstocks for a circular economy.

- Key Players: OMV Group and Neste

- Regulatory Compliance and Safety Monitoring: The regulatory compliance and safety monitoring for plastic waste pyrolysis oil (PWPO) are undergoing significant shifts globally, moving toward stricter traceability and specialized environmental standards while facing administrative policy changes in the United States.

- Key Agencies: Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA)

Plastic Waste Pyrolysis Oil Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) Section 8(a)(7) | Reducing the reporting burden on small-scale chemical recyclers |

| European Union | European Chemicals Agency (ECHA) | Waste Framework Directive (2008/98/EC) | Implementing the Digital Product Passport (DPP) to track plastic waste origins |

| China | Ministry of Ecology and Environment (MEE) | 14th Five-Year Plan for Plastic Pollution Control | Scaling up large-scale "industrial demonstration bases" for pyrolysis |

Segmental Insights

Feedstock Type Insights

How did the Polyethylene (PE) Segment Dominate the Plastic Waste Pyrolysis Oil Market in 2025?

The polyethylene (PE) segment dominated the market with 33% market share in 2025, due to its easier conversion and affordability. Moreover, having larger waste streams, polyethylene has emerged as the ideal and easier option to recycle in the manufacturing industry nowadays. Also, by offering high-yield oil over other plastics, polyethylene has gained major industry attention in recent years.

The mixed plastics segment is expected to grow with a rapid CAGR, owing to the wider availability and shift towards mixed polymer streams. Moreover, by reducing cost while increasing throughput with flexibility, the mixed plastic segment could result in high yield outcomes for industrial players, as per the recent survey and future industry expectations.

Plastic Waste Pyrolysis Oil Market Volume Share, By Feedstock Type, 2025 (%)

| By Feedstock Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Polyethylene | 33.11% | 0.65 | 2.06 | 12.30% | 28.88% |

| Polypropylene | 30.23% | 0.59 | 2.02 | 13.11% | 28.33% |

| Polystyrene | 10.22% | 0.2 | 0.86 | 7.10% | 12.11% |

| Polyethylene Terephthalate | 5.56% | 0.11 | 0.37 | 12.91% | 5.12% |

| Mixed Plastics | 15.45% | 0.3 | 1.3 | 15.74% | 18.22% |

| Multi-layer Packaging | 5.43% | 0.11 | 0.52 | 17.33% | 7.34% |

Process Tech Type Insights

Why does the Fast Pyrolysis Segment Dominate the Plastic Waste Pyrolysis Oil Market?

The fast pyrolysis segment dominated the market with 50% share in 2025, owing to its ability to deliver consistent pyrolysis oil output at relatively low operational complexity. Also, fast pyrolysis systems optimize heat transfer and residence time to maximize liquid oil yield from plastic waste.

The catalytic pyrolysis segment is expected to grow at a rapid CAGR as the market shifts from basic waste conversion to value- oriented optimization. Moreover, catalysts enable targeted cracking of polymer chains, resulting in higher yields of specific, market-relevant hydrocarbons. This enhanced control reduces downstream refining needs and improves product integration with existing fuel and chemical infrastructure.

End-Use Insights

How did the Fuel Production Segment Dominate the Plastic Waste Pyrolysis Oil Market in 2025?

The fuel production segment dominated the market with 45% share in 2025, due to the pyrolysis oil's characteristics, which enabled its rapid integration into current fuel systems. The capacity to supplement or replace fossil fuels in energy-intensive applications has generated immediate demand in the upcoming years.

The petrochemical feedstock segment is expected to grow with a rapid CAGR, due to industrial demand for renewable carbon sources that directly support materials production. Pyrolysis oil's conversion into key hydrocarbon intermediates, including ethylene and propylene, enables its use in polymers and advanced chemical syntheses during the forecast period.

Regional Insights

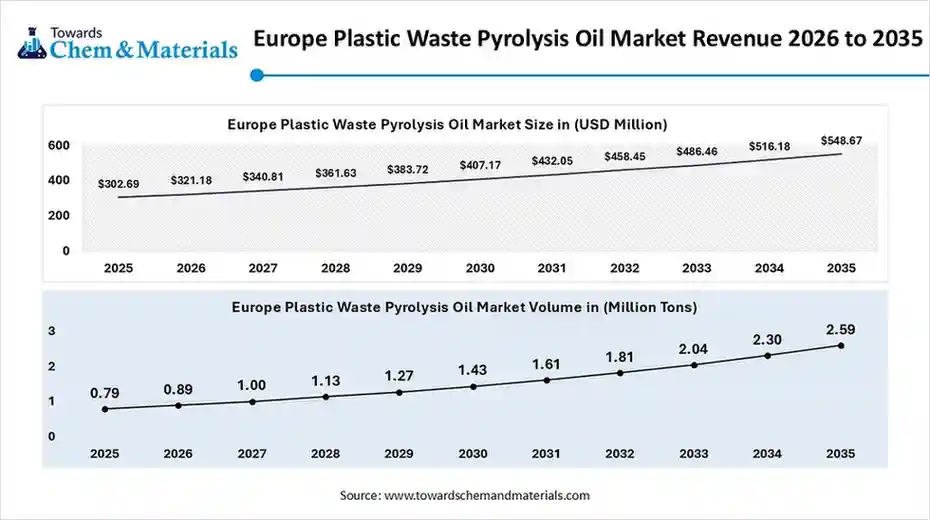

The Europe plastic waste pyrolysis oil market size was valued at USD 302.69 million in 2025 and is expected to be worth around USD 548.67 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.13% over the forecast period from 2026 to 2035.

The Europe plastic waste pyrolysis oil market volume was estimated at 0.79 million tons in 2025 and is projected to reach 2.59 million tons by 2035, growing at a CAGR of 12.61% from 2026 to 2035. Europe dominated the plastic waste pyrolysis oil market with 40% share in 2025, due to the increased shift toward eco-friendly manufacturing and fuel alternatives.

Moreover, the major countries in the region have seen under the heavy sustainability standard implementation of sustainability standards and have built renewable fuel networks in recent years. Also, the cross-court coordination has supported the industry with the exchange of better technology and equipment in the current period.

Germany’s Pyrolysis Oil Powers Chemical and Transport

Germany maintained its dominance in the plastic waste pyrolysis oil market, owing to the practical applications. The German manufacturers have integrated the pyrolysis directly into the chemical loops and industrial energy use in recent years. Moreover, the pyrolysis oil has been used in the chemical refiners, local manufacturing clusters, and even public transport fleets in the current period.

North America Plastic Waste Pyrolysis Oil Market Examination

North America is expected to capture a major share of the market with a rapid CAGR, owing to the greater technology investment for energy independence and carbon reduction in recent years. Moreover, the presence of the major global players of the recycling systems has supported industry potential in recent years in the region.

Plastic Waste Pyrolysis Oil Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 28.63% | 0.56 | 2.1 | 15.89% | 29.52% |

| Europe | 40.32% | 0.79 | 2.29 | 12.61% | 32.12% |

| Asia Pacific | 22.32% | 0.44 | 2.15 | 19.40% | 30.11% |

| South America | 4.50% | 0.09 | 0.37 | 17.19% | 5.13% |

| Middle East & Africa | 4.23% | 0.08 | 0.22 | 11.65% | 3.12% |

Digitalization and Sustainability Fuel United States Leadership in Plastic Waste Pyrolysis

The United States is expected to emerge as a prominent country for the plastic waste pyrolysis oil market in the coming years, akin to heavy digitalization and sustainability demand. Moreover, the major manufacturer in the United States has seen in focusing on co-products, not just oil, in the past few years. Furthermore, the greater demand from the sector, such as construction materials, chemicals, and industrial fuels, has resulted in high yield outcomes for industrial players.

Asia Pacific Plastic Waste Pyrolysis Oil Market Evaluation

Asia Pacific is a notably growing region, due to the heavy plastic manufacturing industry and waste. Moreover, the regional manufacturers are turning towards waste treatment instead of burning plastic these days. Also, the push for local manufacturing may lead to robust revenue growth across the sector in the upcoming period.

China’s Move from Oil Exports to Local Chemical Production

China is expected to gain a major industry share, akin to an increased shift towards the greater energy strategies at a national scale in recent years. Manufacturers in China has establishing the all-in-one plant where the processing, waste collection, and oil blending are present. Furthermore, China has focused on local chemical manufacturing instead of the traditional oil export nowadays.

Plastic Waste Pyrolysis Oil Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industry, due to structural needs for waste conversion and energy substitution in the region. Moreover, the regional governments and private investors are exploring pyrolysis as a scalable method to address plastic pollution while supplementing energy supply. Urban centers with high plastic waste generation are prioritizing conversion technologies that are attached to environmental goals.

Saudi Arabia Leads with Strategic Waste Conversion Driving Energy and Industrial Growth

Saudi Arabia is expected to emerge as a prominent country, akin to the high-level planning that connects waste management, industrial development, and energy innovation. Emerging projects emphasize the efficient conversion of municipal plastic waste into energy and chemical feedstocks that support local industrial ecosystems.

South America Plastic Waste Pyrolysis Oil Market Evaluation

South America is a notably growing region, as regional efforts to integrate waste-to-energy solutions within regional development goals. As plastic waste volumes rise, the regional stakeholders are turning to pyrolysis to produce oil that can serve local industry and energy demands in recent years. This approach not only mitigates environmental impact but also creates value from previously discarded materials in South America nowadays.

Brazil’s Pyrolysis Revolution Fuels Agriculture and Transport

Brazil is expected to gain a major industry share, akin to combining waste conversion with community-oriented energy solutions, in recent years. Also, pyrolysis plants in Brazil are being established in strategic locations where plastic waste can be transformed into fuel for local use, particularly in the agricultural and transport sectors.

Recent Developments

- In February 2025, Evonik extended its pyrolysis oil capability, unveiling the Purocel™ series. This newly launched technology can improve the quality of the pyrolysis oil, as per the company's claim. (Source: www.evonik.com)

Top Vendors in the Plastic Waste Pyrolysis Oil Market & Their Offerings:

- Agilyx AS: A pioneer in chemical recycling, Agilyx utilizes a proprietary pyrolysis technology to convert difficult-to-recycle post-use plastics into high-value circular feedstocks and fuels for global petrochemical partners.

- Plastic Energy Limited: A leading European operator that specializes in patented Thermal Anaerobic Conversion (TAC) technology to transform end-of-life plastic waste into TACOIL, a feedstock for creating food-grade recycled plastics.

- Quantafuel AS: This Norwegian technology-based energy company focuses on low-emission chemical recycling, operating a flagship plant in Skive, Denmark, that converts mixed plastic waste into high-quality synthetic fuels and chemical raw materials.

- Brightmark LLC: A global waste-solutions company that employs an innovative plastics-to-fuel process at its large-scale "Ashley" facility in Indiana to convert diverse plastic waste streams into ultra-low sulfur diesel, naphtha, and wax.

Other Key Players

- Nexus Circular

- Mura Technology Limited

- Alterra Energy

- Pyrum Innovations AG

- Neste Oyj

- OMV Aktiengesellschaft (ReOil)

- BlueAlp Innovations BV

- Braven Environmental

- RES S.p.A.

- Plastic2Oil, Inc. (JBI)

- Klean Industries Inc.

- MK Aromatics Limited

- Niutech Environment Technology Corporation

- Vadxx Energy LLC

- New Hope Energy

- Encina Development Group, LLC

Segments Covered in the Report

By Feedstock Type

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Mixed Plastics (Heterogeneous waste streams)

- Multi-layer Packaging (Laminates)

By Process Technology

- Fast Pyrolysis

- Slow Pyrolysis

- Flash Pyrolysis

- Catalytic Pyrolysis

- Microwave-assisted Pyrolysis

By End-Use

- Petrochemical Feedstock (Circular Plastics Production)

- Fuel Production

- Diesel Substitute

- Gasoline/Naphtha Blendstock

- Heavy Fuel Oil (HFO) for Marine/Industrial

- Power and Heat Generation

- Industrial Boilers

- Gas Turbines

- Diesel Engines

- Specialized Chemicals (Solvents, Lubricants)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa