Content

What is the Current Textile Colorant Market Size and Volume?

The global textile colorant market size was estimated at USD 10.86 billion in 2025 and is expected to increase from USD 11.45 billion in 2026 to USD 18.46 billion by 2035, growing at a CAGR of 5.45% from 2026 to 2035. In terms of volume, the market is projected to grow from 2.60 million tons in 2025 to 4.40 million tons by 2035. growing at a CAGR of 5.40% from 2026 to 2035. Asia Pacific dominated the textile colorant market with the largest volume share of 51.32% in 2025. The increased use of technical textiles and preference for natural dyes drive the market growth.

Key Takeaways

- By region, Asia Pacific led the textile colorant market with the largest volume share of over 51.32% in 2025, due to the huge production of textiles.

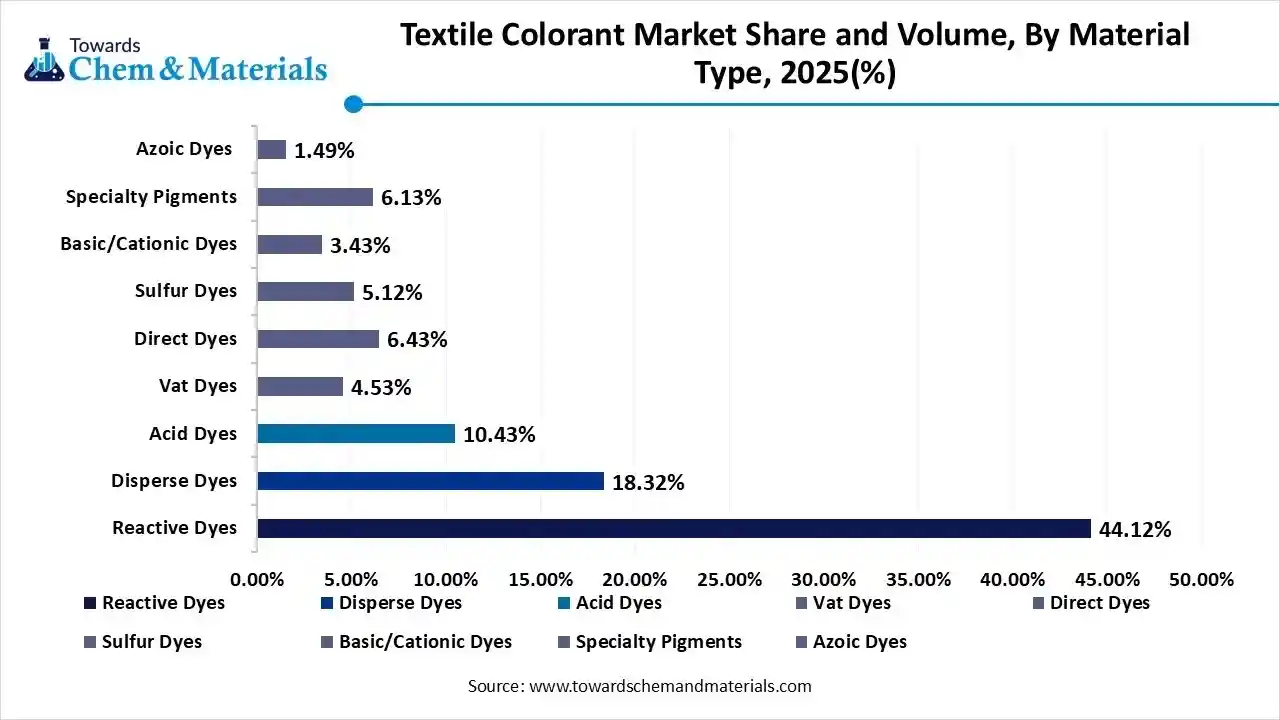

- By product type, the reactive dyes segment led the market with the largest volume share of 44.12% in 2025, due to the excellent wash fastness.

- By product type, the disperse dyes segment is growing at the fastest CAGR in the market during the forecast period due to the increasing use of synthetic fibers.

- By source of origin, the synthetic segment led the market with the largest volume share of 68.03% in 2025, due to the ease of mass production.

- By source of origin, the natural or bio-based dyes segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strict environmental regulations.

- By physical form, the powder segment accounted for the largest volume share of 42.05% in 2025, due to the ease of storage.

- By physical form, the liquid or fluid segment is expected to grow at the fastest CAGR in the market during the forecast period due to the ease of use.

- By fiber type, the polyester segment dominated with the largest volume share of 50.11% in 2025, due to its easy maintenance.

- By fiber type, the acrylic & others segment is expected to grow at the fastest CAGR in the market during the forecast period due to its long-lasting colors.

- By end-use application, the apparel & clothing segment dominated the market and accounted for the largest volume share of 55.02% in 2025, due to the growing online shopping.

- By end-use application, the technical textiles segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing construction activities.

Market Overview

- The textile colorant market growth is driven by huge polyester demand, the expanding apparel industry, high spending on colored textiles, the popularity of home décor, increased use of bio-based dyes, the development of customized textiles, increased need for high-performance dyes, and a surge in textile manufacturing.

- The textile colorant is a specialized coloring agent, dye, and pigment used to impart color and functional properties to fabrics & fibers. The colorants are made up of synthetic or natural materials. The colorants are applied to yarns, garments, fibers, and fabric. The textile colorants offer benefits like lasting color, unique designs, UV protection, softer feel, and excellent dispersion.

Textile Colorant Market Trends:

- Expanding Textile Manufacturing Activities:- The increased production of diverse textiles and the presence of large-scale textile production infrastructure increase demand for textile colorants to enhance durability and functional properties.

- Clothes Customization:- The strong focus on creating individual identity and the need for lowering textile overproduction increases demand for textile colorants. The development of unique apparel and focus on the production of custom colors creates huge demand for textile colorants.

- Sustainability Trends:- The increased awareness about environmental issues, growing recycling of fibers, and focus on lowering VOC emissions increase the development of natural dyes.

- Growth in Online Shopping:- The increased buying of clothes from online platforms and accelerated growth in fast-fashion increases demand for textile colorants. The high availability of branded clothes globally increases demand for textile colorants.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 11.45 Billion / 2.70 Million Tons |

| Revenue Forecast in 2035 | USD 18.46 Billion / 4.40 Million Tons |

| Growth Rate | CAGR 5.45% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Source of Origin, By Fiber Type, By End-Use Application, By Region |

| Key companies profiled | Colorant Limited, DyStar Group, Tanatex Chemicals, Zhejiang Longsheng Group Co., Ltd. (Lonsen), Archroma, Zhejiang Runtu Co., Ltd., Kiri Industries Ltd., Atul Ltd., BASF SE , Clariant , Everlight Chemical Industrial Corp., JAY Chemical Industries Private Limited, Bodal Chemicals Ltd., Kao Corporation, Sun Chemical (DIC Corporation), Dainichiseika Color & Chemicals Mfg. Co., Ltd., Kyung-In Synthetic Corporation (KISCO), Yorkshire Group, Sensient Technologies |

Key Technological Shifts in the Textile Colorant Market:

The textile colorant market is undergoing key technological changes driven by the demand for performance efficiency, cutting water use, sustainability, and enhancing color fastness. The technological innovations, like digital dyeing, nanotechnology, automation, machine learning, biotechnology, and electrochemistry, focus on minimizing waste and boosting performance. One of the key technological shifts is the integration of AI enhances operational efficiency and improves color matching.

AI lowers visual correction steps and develops relevant collections. AI detects color inconsistencies and creates new color palettes. Artificial Intelligence lowers the need for re-dyeing and predicts dye formulations. AI identifies sustainable dyeing processes and reduces water usage. AI inspects fibers in real-time and identifies irregularities in patterns. AI develops innovative textures and manages potential disruptions in supply chains. Overall, AI is a proactive color management way that meets the growing consumer textile demand.

Trade Analysis of Textile Colorant Market: Import & Export Statistics

- India exported 2,672 shipments of textile colorant.

- China exported 18,378 shipments of textile dyes.

- Vietnam imported 37,218 shipments of textile dyes.

- India exported 122,105 shipments of reactive dye.

- China exported 33,388 shipments of disperse dyes.

- Mexico imported 281 shipments of azoic dye.

- India exported 2,546 shipments of natural dyes.

Textile Colorant Market Value Chain Analysis

- Feedstock Procurement: Feedstock procurement is the process of acquiring raw materials like petrochemicals, minerals, leaves, fruits, lac, flowers, cochineal, and barks.

- Key Players:- Archroma, Huntsman Textile Effects, Zhejiang Longsheng Group, BASF, DyStar Group, Kiri Industries

- Chemical Synthesis and Processing: Chemical synthesis involves chemical reactions like intermediate synthesis, formation of chromophore, structural modification, and pigment manufacturing. The chemical processing involves three stages: preparatory process, dyeing & fixation, and post-treatment.

- Key Players:- DyStar Group, Kiri Industries, BASF, Colourtex Industries, Archroma, Clariant

- Quality Testing and Certifications: Quality testing is the process of checking attributes like pH, metamerism, perspiration fastness, light fastness, allergens, flammability, crocking fastness, and dimensional stability. Certifications like PASSPORT, GOTS, OEKO-TEX, ZDHC, and Bluesign.

- Key Players:- Intertek, TUV SUD, TESTEX, SGS, Bureau Veritas

From Fiber to Finish: A Wide Spectrum of Textile Colorants

| Type | Characteristics | Used on Fibers | Applications |

| Acid Dyes |

|

|

Textiles Furs Leather |

| Sulfur Dyes |

|

|

|

| Reactive Dyes |

|

|

|

| Vat Dyes |

|

|

|

Segmental Insights

By Materials Tytpe Insights

Why the Reactive Dyes Segment Dominates the Textile Colorant Market?

The reactive dyes segment dominated the textile colorant market with approximately 44.12% share in 2025. The increased production of silk clothes and a strong focus on durable fashion increase demand for reactive dyes. The superior color fastness, high compatibility with fibers, and deep shades of reactive dyes help market expansion. The growing demand for long-lasting apparel and increased cellulose fiber production requires reactive dyes, driving the overall market growth.

The disperse dyes segment is the fastest-growing in the market during the forecast period. The growing demand for athleisure and the rapid growth in polyester increase the demand for disperse dyes. The strong focus on long-lasting colors and the need for water-saving digital printing increase demand for disperse dyes. The increased use of general apparel and technical textiles development requires disperse dyes, supporting the overall market growth.

Textile Colorant Market Volume and Share, By Material Type, 2025-2035 (%)

| By Material Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Reactive Dyes | 44.12% | 1.1 | 2.0 | 6.31% | 45.24% |

| Disperse Dyes | 18.32% | 0.5 | 0.9 | 6.98% | 19.88% |

| Acid Dyes | 10.43% | 0.3 | 0.4 | 4.45% | 9.12% |

| Vat Dyes | 4.53% | 0.1 | 0.2 | 4.85% | 4.10% |

| Direct Dyes | 6.43% | 0.2 | 0.3 | 6.83% | 6.89% |

| Sulfur Dyes | 5.12% | 0.1 | 0.2 | 5.48% | 4.89% |

| Basic/Cationic Dyes | 3.43% | 0.1 | 0.1 | 4.91% | 3.12% |

| Specialty Pigments | 6.13% | 0.2 | 0.2 | 4.75% | 5.50% |

| Azoic Dyes | 1.49% | 0.0 | 0.1 | 4.06% | 1.26% |

Source of Origin Insights

How did Synthetic Segment hold the Largest Share in the Textile Colorant market?

The synthetic segment held the largest revenue share of approximately 68.03% in the textile colorant market in 2025. The cheaper production cost and availability of vast color palettes of synthetic dyes help market growth. The growing production of fibers like polyester, wool, and cotton requires synthetic dyes. The excellent fading resistance, ease of application, and high performance of synthetic dyes drive the overall growth of the market.

The natural or bio-based dyes segment is experiencing the fastest growth in the market during the forecast period. The growing environmental concerns and shift towards greener alternatives increase the adoption of natural dyes. The rapid growth in eco-conscious consumers and increased health awareness increases demand for natural dyes. The availability of plant-based raw material and the increasing demand for antimicrobial properties dyes increase production of bio-based dyes, supporting the overall market growth.

Physical Form Insights

Why is the Powder Segment Dominating the Textile Colorant Market?

The powder segment dominated the textile colorant market with approximately 42.05% share in 2025. The increased creation of denim and a strong focus on low moisture content increase the adoption of powder form. The cost-effectiveness and longer shelf life of powder help market growth. The ease of handling, high stability, and lower-weight-to-volume ratio of powder form drive the overall market growth.

The liquid or fluid segment is the fastest-growing in the market during the forecast period. The easy integration with automated feeding systems and enhanced color quality of liquid form help market growth. The stringent regulations of the environment and focus on less waste production require a liquid form. The longer shelf life and simple application of liquid form support the overall market growth.

Fiber Type Insights

How did the Polyester Segment hold the Largest Share in the Textile Colorant Market?

The polyester segment held the largest revenue share of approximately 50.11% in the textile colorant market in 2025. The trend of fast fashion and the increasing use of bright colors increases the adoption of polyester. The growing production of automotive fabrics and outerwear requires polyester, which increases demand for textile colorants. The mass production compatibility, superior durability, low maintenance, and dyeing compatibility of polyester drive the overall market growth.

The acrylic and others segment is experiencing the fastest growth in the market during the forecast period. The growing demand for soft fibers and the growing development of protective clothing increase the demand for acrylic. The aesthetic appeal, excellent colorfastness, high durability, and superior dyeability of acrylic help market expansion.

End-Use Application Insights

Which End-Use Application Segment Dominated the Textile Colorant Market?

The apparel & clothing segment dominated the textile colorant market with approximately 55.02% share in 2025. The growing evolution in styling and increased manufacturing of apparel requires textile colorants. The consumer focus on buying clothes and the booming athleisure sector increases demand for textile colorants. The expanding e-commerce and consumer shift towards eco-friendly clothing drive the overall market growth.

The technical textiles segment is the fastest-growing in the market during the forecast period. The rapid expansion of geotextiles and the focus on enhancing industrial safety increase demand for technical textiles. The expanding healthcare infrastructure and high utilization of medical textiles help market growth. The growth in development of infrastructure projects and increased vehicle production requires technical textiles, supporting the overall market growth.

Regional Insights

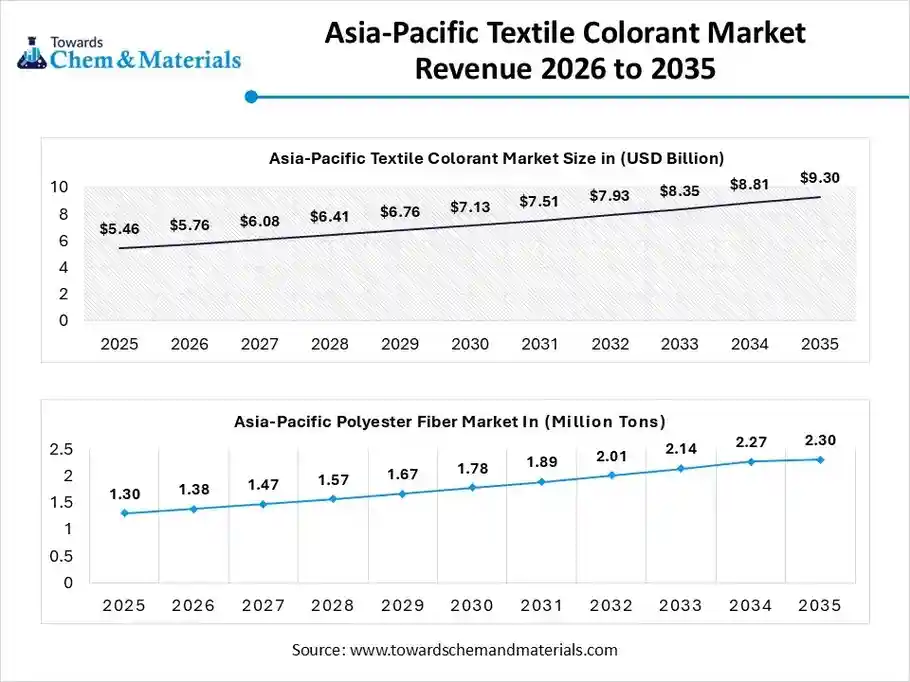

The Asia Pacific textile colorant market size was valued at USD 5.46 billion in 2025 and is expected to be worth around USD 9.30 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.47% over the forecast period from 2026 to 2035.

The Asia Pacific textile colorant market volume was estimated at 1.30 million tons in 2025 and is projected to reach 2.30 million tons by 2035, growing at a CAGR of 6.47% from 2026 to 2035. the Asia Pacific dominated the market with approximately 51.32% volume share in 2025.

The well-established textile manufacturing hub and the availability of raw materials increase the production of textile colorants. The increased spending on colored goods and the shift towards digital printing increase demand for textile colorants. The increasing investment in waterless dyes and the increased export of dyes help market expansion. The growing production of clothing and the rise in the utilization of technical textiles drive the market growth.

Color Behind Fabric: China's Power in the Production of Textile Colorant

China is a key contributor to the market in 2025. The increased domestic production of textiles and the presence of large-scale textile production facilities increase demand for textile colorants. The availability of cost-effective feedstocks increases the production of textile colorants. The development of finished garments and the presence of fast-fashion retailers increase demand for textile colorants. The presence of companies like Zhejiang Longsheng and DyStar supports the overall market growth.

- China exported 1,884 shipments of textile colorant.

Textile Colorant Market Volume and Share, By Region, 2025- 2035 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 14.18% | 0.4 | 0.7 | 7.06% | 15.49% |

| Europe | 20.31% | 0.5 | 0.8 | 5.10% | 18.78% |

| Asia Pacific | 51.32% | 1.3 | 2.3 | 6.47% | 53.32% |

| Latin America | 8.14% | 0.2 | 0.3 | 4.48% | 7.14% |

| Middle East & Africa | 6.05% | 0.2 | 0.2 | 4.40% | 5.27% |

North America Textile Colorant Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The stricter regulations for natural dyes and the strong presence of the apparel company help market growth. The growing manufacturing of medical textiles and the increased need for functional activewear increase demand for textile colorants. The expansion of home furnishing and the development of smart textiles require textile colorants. The surging digital printing technology drives the overall market growth.

Coloring Shades: The United States Leading Wave of Textile Colorant

The United States is a major contributor to the market. The growing consumer interest in activewear and increased consumer preference for durable clothing increase demand for textile colorants. The increasing use of high-performance textiles across various sectors and expanding online shopping increase demand for textile colorants. The development of eco-friendly fabrics and stringent regulations increases the development of sustainable dyes, supporting the overall growth of the market.

Europe Textile Colorant Market Trends

Europe is growing at a notable rate in the market. The stringent EU regulations and increased awareness about eco-friendly textiles increase demand for sustainable textile colorants. The rise of luxury fashion and increased spending on apparel increases the adoption of textile colorants. The growing use of technical textiles and increasing investment in sustainable dyeing drive the overall growth of the market.

Shade Precision: Germany’s Excellence in Textile Colorant Production

Germany is growing rapidly in the market. The strong focus on sustainability and supportive government policies for green transitions increases demand for textile colorants. The rise of Industry 4.0 and the growing development of automotive upholstery increase demand for textiles that require textile colorants. The rapid expansion of digital printing auxiliaries and the increased manufacturing of sportswear require textile colorants, supporting the overall market growth.

Middle East & Africa Textile Colorant Market Trends

The Middle East & Africa are growing substantially in the market. The growing demand for home furnishing and the rapid expansion of industries increase the demand for textile colorants. The expanding smart textiles and the rise in development of functional fabrics require textile colorants. The increased awareness about the utilization of non-toxic dyes and surging online retail drives the overall growth of the market.

Emerging Colors: UAE’s Rise in Textile Colorant

The United Arab Emirates is growing in the market. The surging fashion industry and increased spending on vibrant textiles increase demand for textile colorants. The development of functional textiles and the increased use of geotextiles in the construction sector require advanced colorants. The booming e-commerce and the shift towards eco-friendly dyes support the overall market growth.

South America Textile Colorant Market Trends

South America is significantly growing in the market. The changing trends of fashion and the increased production of cotton require textile colorants. The higher demand for technical textiles and the presence of strong textile traditions increase the demand for textile colorants. The increased use of durable colorants and heavy investment in water-saving indigo processes drive the overall market growth.

Vibrant Finish: Brazil’s Story of Textile Colorant

Brazil is growing at a substantial rate in the market. The increased spending on home textiles and the growing production of high-quality cotton increase demand for textile colorants. The abundance of natural raw materials increases the production of bio-based dyes. The robust domestic textile manufacturing and technological innovations like digital printing require textile colorants, supporting the overall market growth.

Recent Developments

- In June 2025, DYECOL launched the 4th generation reactive dyes DYECOL CARE ESN. The dyes require shorter processing time and are designed for cellulose fabrics. The dyes offer intense color strength and are available in medium to deep shades. (Source: www.textiletoday.com)

- In August 2025, Octarine Bio collaborated with Positive Materials, Impetus Group, and Acatel Acabamentos Texteis S.A. to launch sustainable bio-based dyes, PurePalette. The bio-based dye lowers carbon emissions and offers color diversity. (Source: www.synbiobeta.com)

- In January 2024, Archroma launched AVITERA® SE GENERATION NEXT for cost-effective sustainable dyeing. The solution offers exceptional environmental benefits and supports energy savings. The solution consists of a color range like AVITERA NIGHT STORM SE, AVITERA BLACK PEARL SE, and AVITERA BLUE HORIZON SE. (Source: www.indiantextilemagazine.in)

Top Companies List

- Archroma:- The company provides finishing chemicals, dyes, and printing to support the entire textile process, like dyeing, finishing, covering textiles, pretreatment, and printing.

- Colorant Limited:- The India-based company is the leading producer of reactive dyes to serve the textile industry applications like printing, apparel, cellulosic fibers, and home textiles.

- DyStar Group:- The company has products like pigments, chemicals, and dyes to offer textile industry services like testing, sustainability consulting, color communication, and auditing.

- Tanatex Chemicals:- The company offers specialty chemicals for textile processing and focuses on technologies such as digital printing & polyester dyeing.

- Zhejiang Longsheng Group Co., Ltd. (Lonsen):- The company is a leading manufacturer of dyes like reactive, cationic dyestuffs, disperse, and acid to serve textile industry customers.

Other Companies List

- Colorant Limited

- DyStar Group:

- Tanatex Chemicals

- Zhejiang Longsheng Group Co., Ltd. (Lonsen)

- Archroma

- Zhejiang Runtu Co., Ltd.

- Kiri Industries Ltd.

- Atul Ltd.

- BASF SE

- Clariant

- Everlight Chemical Industrial Corp.

- JAY Chemical Industries Private Limited

- Bodal Chemicals Ltd.

- Kao Corporation

- Sun Chemical (DIC Corporation)

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Kyung-In Synthetic Corporation (KISCO)

- Yorkshire Group

- Sensient Technologies

Segments Covered

By Product Type

- Reactive Dyes

- Disperse Dyes

- Acid Dyes

- Vat Dyes

- Direct Dyes

- Sulfur Dyes

- Basic/Cationic Dyes

- Specialty Pigments

- Azoic Dyes

By Source of Origin

- Synthetic Colorants

- Natural/Bio-based Dyes

- Recycled/Circular Dyes

By Physical Form

- Powder / Crystalline

- Liquid / Fluid

- Granular

- Paste / Slurry

By Fiber Type

- Cotton & Cellulosic

- Polyester & Blends

- Nylon/Polyamide

- Wool & Silk

- Acrylic & Others (Acetate, Polypropylene)

By End-Use Application

- Apparel & Clothing

- Fashion

- Sportswear

- Workwear

- Home Textiles

- Bedding

- Curtains

- Upholstery

- Carpets

- Technical Textiles

- Automotive interiors

- Medical

- Geotextiles

- Others (Industrial Textiles, etc.)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa