Content

What is the Current Chemical Recycling Of Plastics Market Size and Volume?

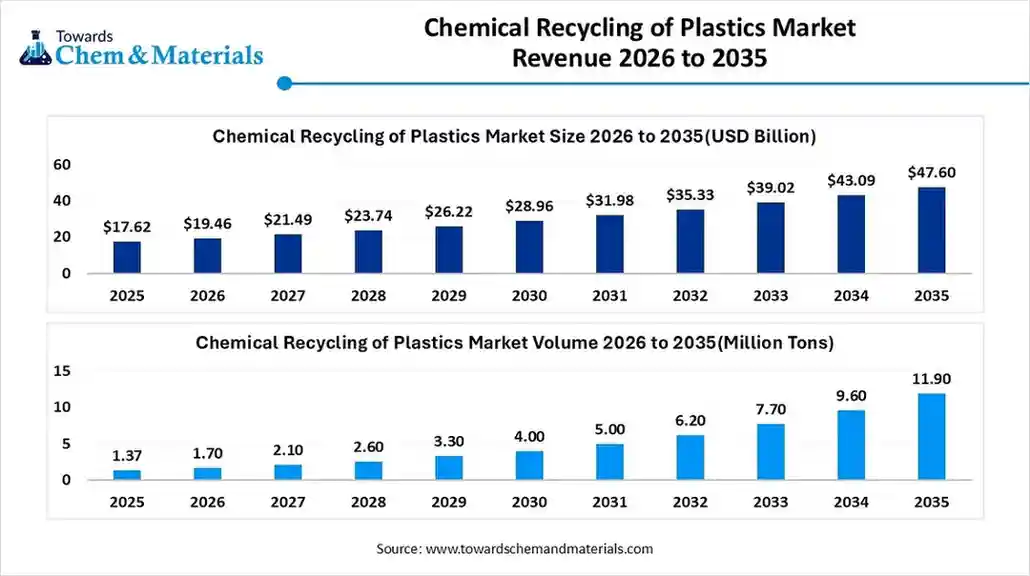

The global chemical recycling of plastics market size was estimated at USD 17.62 billion in 2025 and is predicted to increase from USD 19.46 billion in 2026 and is projected to reach around USD 47.60 billion by 2035, The market is expanding at a CAGR of 10.45% between 2026 and 2035.

The global chemical recycling of plastics market volume has expanded to reach approximately 1.37 million tones in 2025 and is predicted to increase from 1.70 million tons in 2026 and is projected to reach 11.90 million tons by 2035, growing at a CAGR of 24.13% from 2026 to 2035. Europe dominated the chemical recycling of plastics market with a market share of 34% the global market in 2025. The growing consumer demand for sustainable goods is the key factor driving market growth. Also, advancements in chemical recycling technologies, coupled with the increasing awareness of plastic pollution in oceans, can fuel market growth further.

Key Takeaways

- By region, Europe led the chemical recycling of plastics market with the largest volume share of over 34% in 2025. The dominance of the region can be attributed to the growing consumer demand for sustainability.

- By region, Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the extensive plastic waste generation.

- By region, North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by the increasing implementation of stringent regulations.

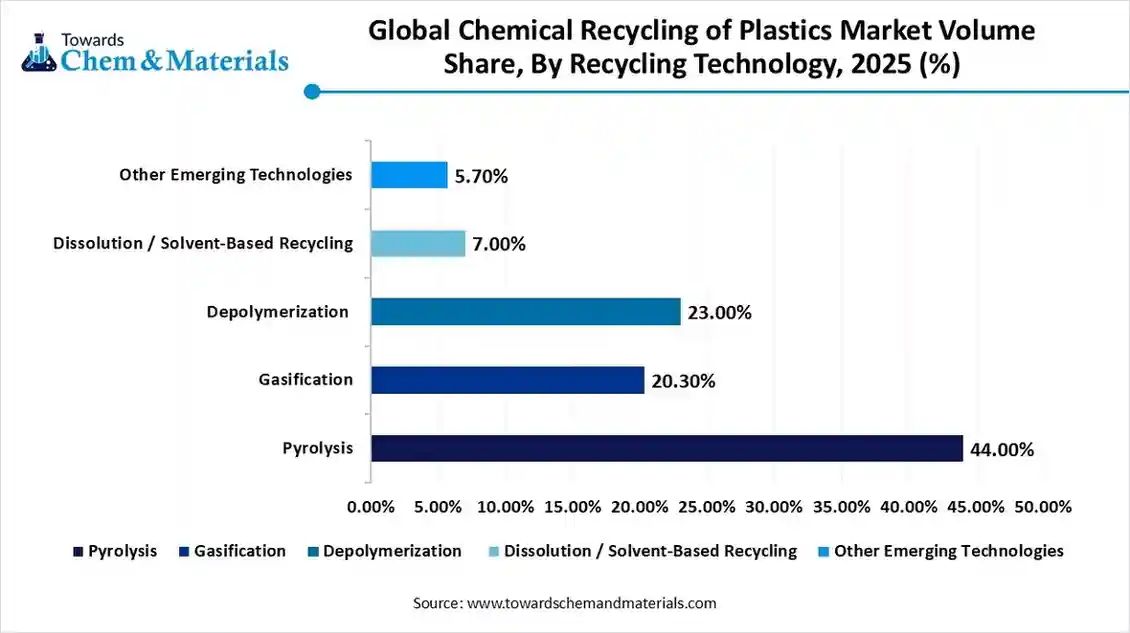

- By recycling technology, the pyrolysis segment dominated the market with nearly 44% volume share in 2025. The dominance of the segment can be attributed to the growing adoption of chemically recycled materials.

- By recycling technology, the depolymerization segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid technological advancements, which are enhancing efficiency.

- By plastic type, the polyolefins (PE & PP) segment held approximately 58% market volume share in 2025. The dominance of the segment can be linked to the ongoing private and government investments in new recycling facilities.

- By plastic type, the mixed & multilayer plastics segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing public concern over plastic waste.

- By end product, the pyrolysis oil segment dominated the market with approximately 46% volume share in 2025. The dominance of the segment is owed to the growing demand for chemical feedstocks.

- By end product, the monomers & chemical feedstocks segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to rapid R&D emphasizing the development of selective catalysts.

- By end-use industry, the packaging segment held nearly 41% market volume share in 2025. The dominance of the segment can be attributed to the government's incentives and investments for advanced recycling technologies.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the surge in virgin plastic costs and growing consumer demand for green cars.

What is Chemical Recycling Of Plastics?

The global chemical recycling of plastics market involves advanced recycling technologies that convert plastic waste into basic chemical building blocks (monomers, fuels, oils, syngas, or feedstock intermediates), enabling the production of virgin-equivalent plastics, fuels, and chemicals. Unlike mechanical recycling, chemical recycling processes can handle mixed, contaminated, and multi-layer plastics, supporting circular economy objectives across packaging, automotive, construction, and consumer goods industries.

Chemical Recycling Of Plastics Market Trends

- The growing demand for recycled plastics in different industries is the latest trend in the market. Recycled plastics give a sustainable and cost-effective solution, fuelling their adoption in various sectors, including construction, automotive, and packaging.

- The ongoing collaborations across several industries are emerging as a key driver for the market growth. These collaborations facilitate the sharing of resources, knowledge, and technologies, which can lead to smoother recycling processes with better end-product quality.

- The rapid research and development in chemical recycling is another major trend in the market, shaping positive market growth. This emphasis on R&D is necessary for overcoming current hurdles in the overall manufacturing process.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 19.46 Billion / 1.70 Million tons |

| Revenue Forecast in 2035 | USD 47.60 Billion / 11.90 Million Tons |

| Growth Rate | CAGR 10.45% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Europe |

| Segment Covered | By Recycling Technology, By Plastic Type, By End Product, By End-Use Industry, By Region |

| Key companies profiled | Plastic Energy Ltd, Agilyx ASA, Brightmark, Loop Industries, Eastman Chemical Company, BASF SE, SABIC, Dow Inc., ExxonMobil (Advanced Recycling), LyondellBasell, Honeywell (UpCycle Process), Licella Holdings, Alterra Energy, Recycling Technologies Ltd., Carbios, Encina Development Group, Nexus Circular, PureCycle Technologies, Quantafuel, Mitsubishi Chemical Group |

How Cutting Edge Technologies are revolutionizing the Chemical Recycling Of Plastics Market?

The integration of advanced technologies is revolutionizing the market by enhancing efficiency and growing the range of treatable plastics. Artificial intelligence (AI) and robotics are improving waste management facilities by deploying near-infrared sensors, high-resolution cameras, and machine learning algorithms to detect and separate various types of plastics with exceptional speed and precision.

Trade Analysis of Chemical Recycling Of Plastics Market: Import & Export Statistics

- In 2024, the United States plastic scrap export reached $264.30 million, a 6% increase from the prior year, with data for the first half of 2025 indicating exports of $109.12 million, according to official figures.

- India's plastics exports reached US$10.34 billion (₹89,296 Cr) by January 2025 (FY25), with significant jumps in Plastic Films & Sheets (19.6%), FIBC woven sacks/fabrics (17.2%), and Flexible/Rigid Packaging (10.1%) year-over-year.

Chemical Recycling Of Plastics Market Value Chain Analysis

- Feedstock Procurement : It is the crucial stage in the market, including the quality-controlled sourcing of different plastic wastes, which can be converted into high-grade chemical feedstocks.

- Major Players: Veolia Environnement SA, Waste Management, Inc.

- Chemical Synthesis and Processing : It involves a range of unit operations such as refining, purification, and synthesis to transform raw intermediate materials into high-grade market products.

- Major Players: BASF SE, Eastman Chemical Company.

- Packaging and Labelling : It involves details of the important role of material design and essential identification systems in accomplishing circular economy goals.

- Major Players: LyondellBasell, SABIC.

- Regulatory Compliance and Safety Monitoring: It refers to the detailed framework of industry standards, laws, and digital oversight mechanisms that ensure recycled materials are safe for the environment and human health.

- Major Players: Intertek, ISCC.

Chemical Recycling Of Plastics Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union | In July 2025, the European Commission launched a landmark consultation to set rules for calculating, verifying, and reporting chemically recycled content. |

| United States | The Recycling Technology Innovation Act: Introduced in late 2025, this bipartisan federal bill aims to classify chemical recycling as a manufacturing process rather than waste incineration. |

| India | The Plastic Waste Management Amendment of 2023 has reached full implementation in 2025, requiring major FMCG companies to obtain at least 25% of their packaging from recycled materials. |

Segmental Insights

Recycling Technology Insights

How Much Share Did the Pyrolysis Segment Held in 2025?

The pyrolysis segment dominated the market with nearly 44% share in 2025. The dominance of the segment can be attributed to the growing adoption of chemically recycled materials to fulfil ESG goals and reduce carbon footprints. Pyrolysis is mainly suited for processing "hard-to-recycle" plastics such as mixed polyolefins.

The depolymerization segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid technological advancements enhancing efficiency, along with the government's push towards a circular economy. Depolymerization has a smaller carbon footprint than manufacturing virgin plastic from crude oil.

Plastic Type Insights

Which Plastic Type Segment Dominated Chemical Recycling Of Plastics Market in 2025?

The polyolefins (PE & PP) segment held approximately 58% market share in 2025. The dominance of the segment can be linked to the ongoing private and government investments in new recycling facilities, along with the rapid adoption of innovative technology. Automakers are increasingly using conventional materials with recycled PP and PE to fulfil sustainability demands.

The mixed & multilayer plastics segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing public concern over plastic waste and rapid R&D in advanced recycling technologies. Advanced solvent-based techniques are used to delaminate multilayer packaging without destroying the forming polymers.

End Product Insights

How Much Share Did the Pyrolysis Oil Segment Held in 2025?

The pyrolysis oil segment dominated the market with approximately 46% share in 2025. The dominance of the segment is owed to growing demand for chemical feedstocks, which makes plastic a valuable resource. Furthermore, pyrolysis promotes circularity by turning waste into virgin-equivalent materials, which aligns with sustainability initiatives.

The monomers & chemical feedstocks segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to rapid R&D emphasized on developing selective catalysts, which increase the yield of specific monomers. The segment emphasises breaking down plastic polymers into molecular building blocks or monomers.

End-Use Industry Insights

Which End-Use Industry Type Segment Dominated Chemical Recycling Of Plastics Market in 2025?

The packaging segment held nearly 41% market share in 2025. The dominance of the segment can be attributed to the governments' incentives and investments for advanced recycling technologies and rapid advances in pyrolysis and gasification processes. In addition, Companies are heavily investing in chemical recycling to fulfil ambitious targets for recycled content.

The automotive segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the surge in virgin plastic costs and growing consumer demand for green cars. Furthermore, recycled plastics are used for door panels, dashboards, bumpers, and EV battery casings, contributing to segment expansion shortly.

Regional Insights

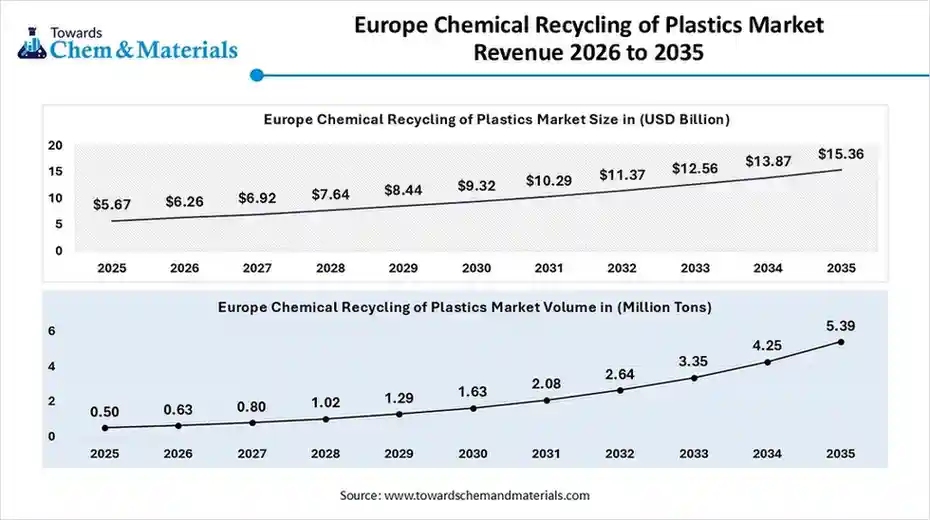

The Europe chemical recycling of plastics market size was valued at USD 5.67 billion in 2025 and is expected to reach USD 15.36 billion by 2035, growing at a CAGR of 10.48% from 2026 to 2035. Europe dominated the market with nearly 34% share in 2025.

The Europe chemical recycling of plastics market volume was estimated at 0.50 million tons in 2025 and is projected to reach 5.39 million tons by 2035, growing at a CAGR of 26.68% from 2026 to 2035.

The dominance of the region can be attributed to the growing consumer demand for sustainability and ongoing investments in cutting-edge technologies like pyrolysis/gasification. In addition, a surge in public concern and awareness over plastic pollution pushes governments and businesses to find sustainable solutions.

Germany Chemical Recycling Of Plastics Market Trends

In Europe, Germany dominated the market owing to increasing environmental concerns with the growing demand for chemically recycled materials across sectors. Major players in the country are developing and using advanced chemical recycling processes to manufacture virgin-quality plastics.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the extensive plastic waste generation and heavy investment in cutting-edge tech like depolymerization, especially in emerging economies. Also, proactive regulations and policies are pushing countries from exporting waste to creating domestic circularity.

China Chemical Recycling Of Plastics Market Trends

In the Asia Pacific, China led the market due to expanding sectors such as construction, automotive, and packaging increasingly using recycled content to reduce carbon footprints. China is a leading manufacturer and consumer of plastic, generating a vast feedstock for recycling.

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by increasing implementation of stringent regulations coupled with the growing consumer demand for eco-friendly goods. Advancements in chemical recycling processes allow the processing of an extensive range of plastics.

U.S. Chemical Recycling Of Plastics Market Trends

The growth of the market in the country can be driven by rapid advancements in chemical recycling technologies and surging global plastic waste concerns. Also, major companies in the country are heavily investing in different recycling facilities. Also, the U.S. government is heavily investing in recycling infrastructure to create favourable conditions for market expansion.

South America held a major market share in 2025. The growth of the region can be boosted by increasing plastic pollution and the ongoing government push towards adopting circular economy principles. Moreover, the countries' recycling sector heavily depends on waste picker cooperatives in major countries like Colombia and Argentina.

Chemical Recycling Of Plastics Market Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 25.32% | 0.3 | 2.9 | 26.45% | 24.10% |

| Europe | 34.00% | 0.5 | 3.9 | 26.68% | 32.89% |

| Asia Pacific | 27.95% | 0.4 | 3.6 | 28.14% | 29.97% |

| Latin America | 7.41% | 0.1 | 0.9 | 27.45% | 7.57% |

| Middle East & Africa | 5.32% | 0.1 | 0.7 | 27.54% | 5.47% |

Brazil Chemical Recycling Of Plastics Market Trends

The growth of the market in the country can be propelled by the rapid adoption of advanced chemical recycling technologies and rising public concerns over plastic pollution. Brazil is a leading plastic producer in South America, creating a vast amount of post-consumer waste for the market.

The growth of the market in the Middle East & Africa can be fueled by the rapid shift from conventional linear economic models towards collective circular economy standards. Many countries in the region are increasingly adopting EPR schemes. Recycled plastics give energy savings and cost reductions for industries, which makes them key alternatives to virgin plastics.

Saudi Arabia Chemical Recycling Of Plastics Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be linked to the rapid urbanization in major cities such as Riyadh, Jeddah, and Dammam, which generates a substantial amount of plastic waste, creating a huge feedstock for recycling plants and impacting positive market growth in the country further.

Recent Developments

- In July 2025, China unveils an advanced plastics cracking plant. This plant can process over 200,000 tonnes per year using one-step deep catalytic cracking technology created by Guangdong Dongyue Chemical Technology.(Source: recyclinginternational.com)

- In February 2025, PolyCycl introduces 'Generation VI' chemical recycling technology. This fully advanced system addresses India's growing plastic waste problem by allowing the conversion of hard-to-recycle plastics.(Source: www.indianchemicalnews.com)

Chemical Recycling Of Plastics Market Companies

- Agilyx ASA: Agilyx ASA has emerged as a cornerstone player within the chemical recycling of plastics market. Headquartered in Oslo, Norway, and with significant operations in the United States, the company serves as a critical bridge between unrecyclable plastic waste and high-value virgin-equivalent products.

- Plastic Energy Ltd.: Plastic Energy Ltd. is a leading chemical recycler transforming unrecyclable plastic waste into TACOIL™, a valuable feedstock replacing fossil fuels for new plastics, driving circularity with its patented TAC™ technology in operational Spanish plants and global projects.

Other Companies in the Market

- Plastic Energy Ltd

- Agilyx ASA

- Brightmark

- Loop Industries

- Eastman Chemical Company

- BASF SE

- SABIC

- Dow Inc.

- ExxonMobil (Advanced Recycling)

- LyondellBasell

- Honeywell (UpCycle Process)

- Licella Holdings

- Alterra Energy

- Recycling Technologies Ltd.

- Carbios

- Encina Development Group

- Nexus Circular

- PureCycle Technologies

- Quantafuel

- Mitsubishi Chemical Group

Segments Covered in the Report

By Recycling Technology

- Pyrolysis

- Thermal Pyrolysis

- Catalytic Pyrolysis

- Microwave-Assisted Pyrolysis

- Gasification

- Partial Oxidation Gasification

- Plasma Gasification

- Syngas-to-Chemicals/Fuels

- Depolymerization (Solvolysis-Based)

- Glycolysis

- Methanolysis

- Hydrolysis

- Aminolysis

- Dissolution / Solvent-Based Recycling

- Selective Polymer Dissolution

- Precipitation & Purification

- Other Emerging Technologies

- Enzymatic Recycling

- Catalytic Cracking

By Plastic Type

- Polyolefins

- Polyethylene (HDPE, LDPE, LLDPE)

- Polypropylene (PP)

- Polyesters

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Styrenics

- Polystyrene (PS)

- ABS

- Engineering & Specialty Plastics

- Polyamides (Nylon)

- Polycarbonates (PC)

- Polyurethanes (PU)

- Mixed & Multilayer Plastics

By End Product

- Monomers & Chemical Feedstocks

- Virgin-Equivalent Polymer Feedstock

- Basic Chemicals (Ethylene, Propylene, Styrene)

- Liquid Fuels & Oils

- Pyrolysis Oil

- Synthetic Diesel/Naphtha

- Gaseous Outputs

- Syngas

- Hydrogen

- Waxes & Specialty Intermediates

By End-Use Industry

- Packaging

- Food & Beverage Packaging

- Consumer & Industrial Packaging

- Automotive

- Interior & Exterior Components

- Building & Construction

- Pipes, Insulation, Profiles

- Electrical & Electronics

- Housings, Components, Wires

- Consumer Goods & Textiles

- Chemical & Refining Industry

- Feedstock Substitution for Virgin Petrochemicals

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa