Content

Biodegradable Plastics Market Size and Growth 2025 to 2034

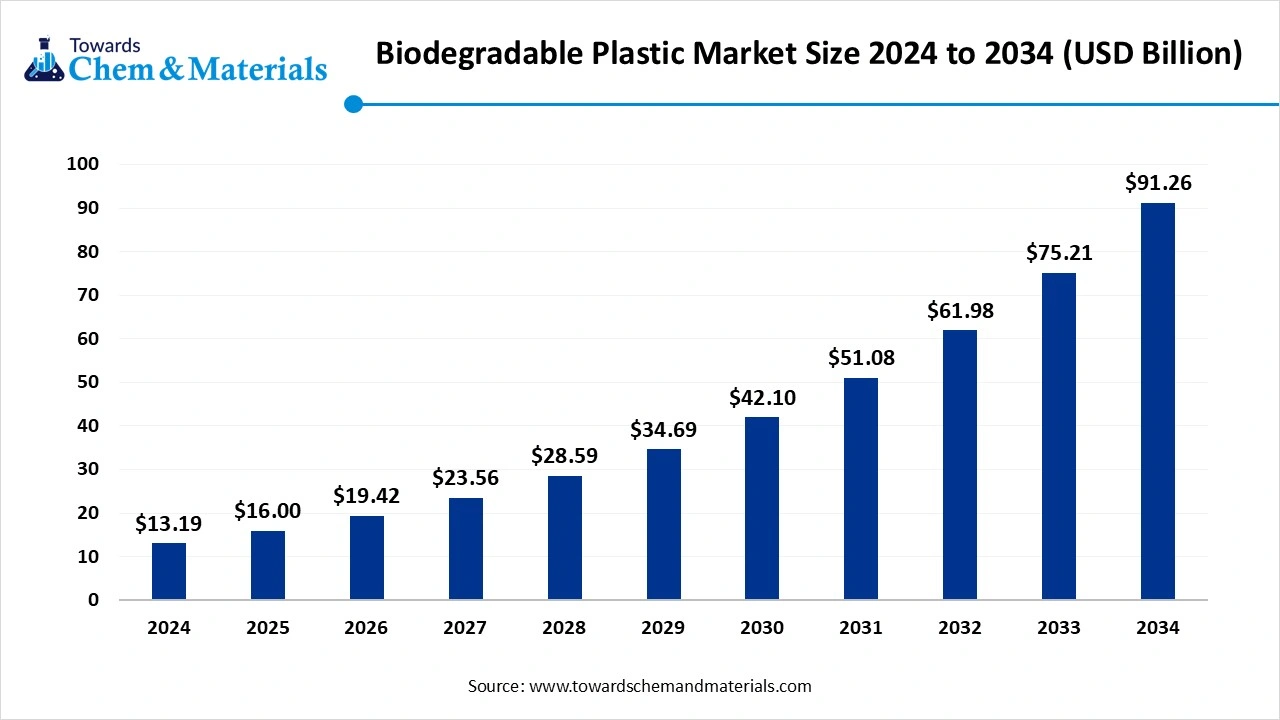

The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034. The global implementation of sustainable manufacturing practices is actively creating profitable pathways for sector participants.

Key Takeaways

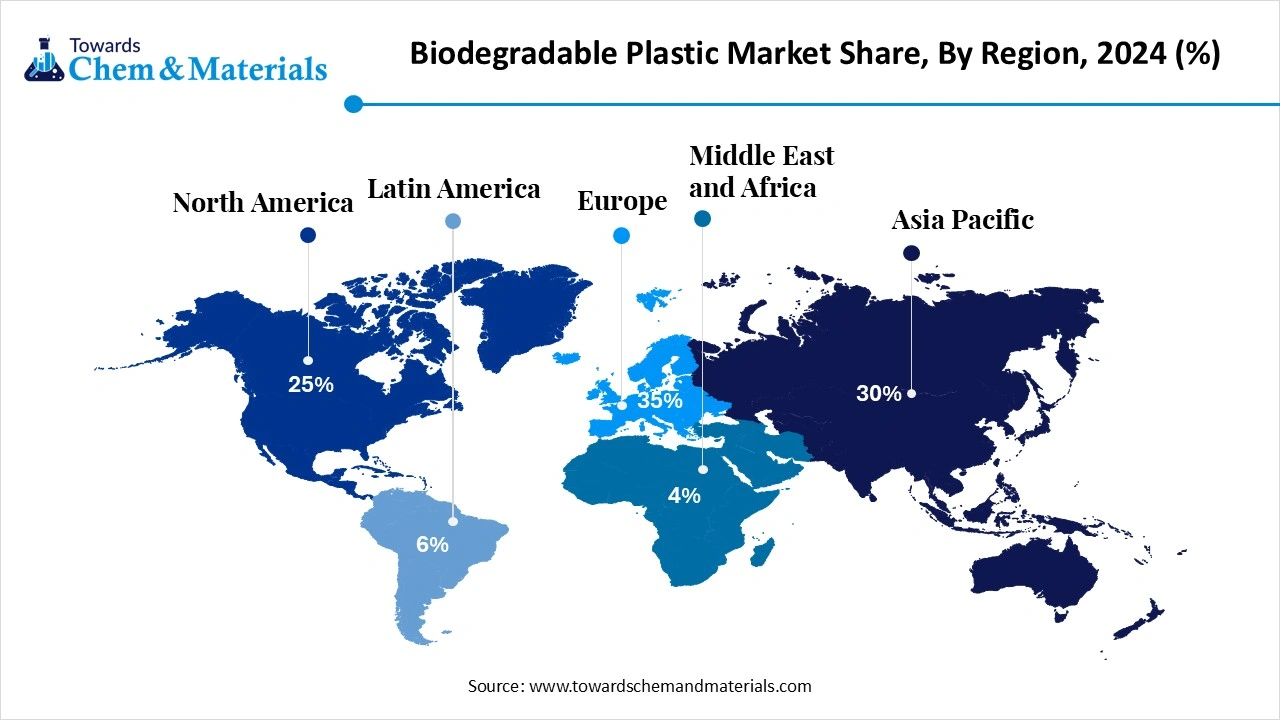

- By region, Europe dominated the market with approximately 35% industry share in 2024, owing to strong regional policies for eco-friendly manufacturing and the presence of advanced plastic waste management systems.

- By region, Asia Pacific expected to grow at a notable rate in the future, akin by the advanced recycling technology access and governmental push for eco-friendly manufacturing practices.

- By type, the PLA segment led the market with approximately 40% industry share in 2024, due to factors such as cost-effectiveness and wide availability.

- By type, the PHA segment is expected to grow at the fastest rate in the market during the forecast period, owing to its greater biodegradability than other materials.

- By application, the packaging segment emerged as the top-performing segment in the market with approximately 55% industry share in 2024, because it is the largest contributor to global plastic waste.

- By application, the agriculture segment is expected to lead the market in the coming years, as biodegradable plastics replace traditional films, mulch, and coatings.

- By end use, the food and beverages segment led the market with approximately 45% share in 2024, because it is the largest user of single-use plastics for packaging, bottles, and containers

- By end use, the healthcare and medical segment is expected to capture the biggest portion of the market in the coming years, because of the rising use of biodegradable plastics in implants, drug delivery systems, and disposable medical devices.

- By degradation environment, the industrial composting segment led the market with 60% industry share in 2024, because most biodegradable plastics, like PLA, require controlled conditions of high temperature and humidity to break down effectively.

- By degradation environment, the home composting segment is expected to grow at the fastest rate in the market during the forecast period, because most biodegradable plastics like PLA require controlled conditions of high temperature and humidity to break down effectively.

Market Overview

From Pollution to Solution: The Rise of Biodegradable Plastics

The biodegradable plastics market refers to polymer materials that can decompose into natural substances such as water, carbon dioxide, and biomass under specific environmental conditions, typically through microbial activity. These plastics are derived from renewable sources (corn starch, sugarcane, cassava) or petrochemical-based biodegradable polymers and are increasingly used as a sustainable alternative to conventional plastics.

Rising concerns over plastic pollution, regulatory bans on single-use plastics, corporate sustainability goals, and consumer demand for eco-friendly packaging are driving market growth. Key trends include the development of advanced compostable packaging, biodegradable plastics in agriculture films and textiles, integration of bioplastics in 3D printing, and ongoing R&D for cost reduction and performance improvement.

- According to the estimates by the Organization of Economic Cooperation and Development (OECD), the global production and use of plastic will cross 736 million tons by 2040.(Source: www.oecd.org)

How Single-Use Plastic Restrictions Are Powering Biodegradable Packaging Growth

The increasing restrictions on single-use plastic have allowed the key players to capitalize on growth opportunities in the current period. Furthermore, the growth of sectors like retail, food, and e-commerce has seen a surge in relevance within the sector in recent years. Furthermore, several major brands are actively investing in biodegradable packaging and have heavily promoted it on different social media platforms in the past few years.

- In May 2025, Futamura introduced its eco-friendly packaging solution. The company unveiled compostable liquid sachets, collaborating with GK Sondermaschinenbau.(Source: www.labelsandlabeling.com)

Market Trends

- The emergence of home compostable plastic has actively impacted the revenue potential and industry scalability in recent years. The plastic-like starch-based and PHA have seen greater demand.

- The heavy shift towards marine plastic has contributed to the growth of industry’s potential in the past few years. Moreover, marine material, like fishing gear, packaging, and single-use products, has been seen under a heavy integration of biodegradable plastic.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 16.00 Billion |

| Expected Size by 2034 | USD 91.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR 21.34% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Type, By Application, By End-Use Industry, By Degradation Environment, By Region |

| Key Companies Profiled | Cargill Incorporated, PTT MCC Biochem Co., Ltd., Biome Technologies plc, Plantic Technologies Limited, BASF SE, Total Corbion PLA, NatureWorks LLC, Eastman Chemical Company, Trineso, Danimer Scientific |

Market Opportunity

Investment Flows into Sustainable Packaging Amid E-commerce Booms

The business expansion in logistics and e-commerce packaging is likely to create competitive advantages in the production space in the upcoming period. With the technology upgradation, sectors like e-commerce and packaging are seeing under high growth potential, where packaging material like sustainable plastic is expected to attract increased capital and investment during the forecast period. Moreover, the greater push for sustainable manufacturing processes by several governments is likely to be flagged as a key area of market interest.

Market Challenge

The Hidden Cost of Bioplastics

The higher production cost of the biodegradable plastic as compared to traditional plastic is expected to disrupt planned expansion efforts within the sector in the coming years. Also, the feedstock, like sugarcane, corn, and other materials, is considered a seasonal material that can be available in specific months or years.

Regional Insights

Europe Biodegradable Plastics Market Trends

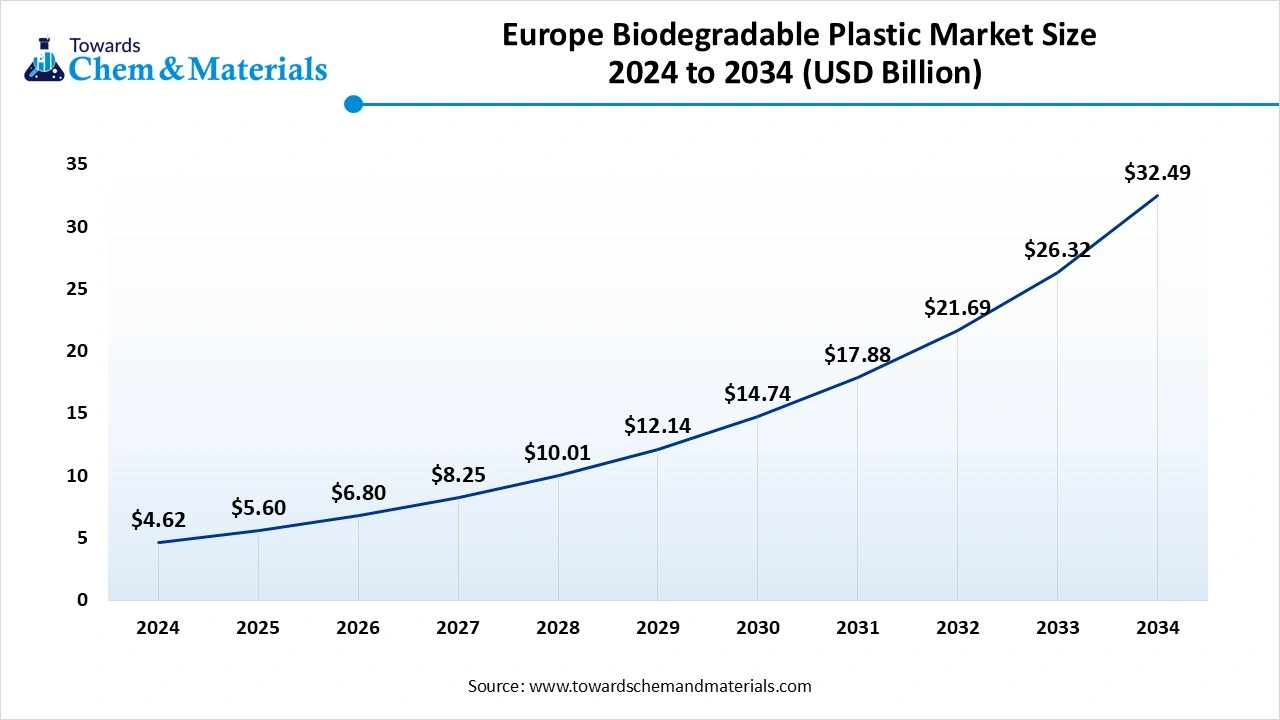

The Europe biodegradable plastics size was estimated at USD 4.62 billion in 2024 and is anticipated to reach USD 32.49 billion by 2034, growing at a CAGR of 21.54% from 2025 to 2034. Europe dominated the biodegradable plastics market in 2024,

owing to strong regional policies for eco-friendly manufacturing and the presence of advanced plastic waste management systems. Also, the region’s green deal and plastic tax have sparked great industry engagement in the past few years. Moreover, the sudden surge in the adoption of biodegradable plastic in sectors like retail, packaging, and agriculture has heavily driven investor confidence in the industry’s future in recent times.

- In June 2025, the technology of biodegradable plastic production by a UK-based company called Symphony Environmental Technologies received approval from the European Union to start operations in the region.(Source: www.azom.com)

Could PHA and PLA Be the Key to Germany's Scalable Green Industry?

Germany maintained its dominance in the biodegradable plastics market, owing to the presence of one of the leading chemical industries globally and a greater focus on R&D. Also, the enlarged demand for starch-based PHA and PLA plastics is positively impacting the revenue potential and industry scalability in the country nowadays. Moreover, the greater push from the government for sustainability has emerged as a key point of interest in the industry.

Asia Pacific Biodegradable Plastics Market Trends

Asia Pacific is expected to capture a major share of the biodegradable plastics market, akin by the advanced recycling technology access and governmental push for eco-friendly manufacturing practices. The factors such as the enlarged population and greater plastic consumption have contributed to the industry's potential in the region nowadays. Also, the regional countries such as Japan, China, and India have seen in establishing the biodegradable plastic research centers and manufacturing plants owing to their enlarged requirement of plastic in the future.

- In January 2025, the IIT-M launched its latest plant for the development of zero-waste bioplastics in India. Also, the motive behind the establishment is to find a cost-effective and scalable alternative to regular plastic, as per the report published by management.(Source: www.thehindu.com)

Segmental Insights

Type Insights

How did the PLA Segment Dominate the Biodegradable Plastics Market in 2024?

The PLA segment held the largest share of the market in 2024, due to factors such as cost-effectiveness and wide availability. Also, the production through renewable feedstocks, such as sugarcane and corn, the PLA segment has gained major industry share in the current period. Moreover, having greater strength and processability, the segment is likely to maintain its dominance in the market in the upcoming years, as per the recent industry expectations.

The PHA segment is expected to grow at a notable rate during the predicted timeframe, owing to its greater biodegradability than other materials. Moreover, the PHA has superior versatility, where multiple environments are likely to provide sophisticated consumers in the upcoming years. Also, the need for specialty packaging is expected to create lucrative opportunities for the manufacturer in the coming years.

Application Insights

Why does the Packaging Segment Dominate the Biodegradable Plastics Market by End Use?

The packaging segment held the largest share of the biodegradable plastics market in 2024, because it is the largest contributor to global plastic waste. With rising bans on single-use plastics, food and beverage companies shifted toward biodegradable alternatives for bottles, containers, and films. Consumers also demanding sustainable packaging solutions, especially in e-commerce and retail. Biodegradable plastics like PLA and starch blends are cost-effective solutions for packaging compared to other applications.

The agriculture segment is expected to grow at a notable rate during the forecast period, as biodegradable plastics replace traditional films, mulch, and coatings. Farmers increasingly use biodegradable films because they improve soil health, reduce waste disposal costs, and eliminate the need for plastic collection after harvest. Governments are promoting bio-based agricultural plastics to lower environmental impact in farming. With rising global food demand and sustainability initiatives, biodegradable plastics in agriculture will grow faster than in packaging.

End Use Insights

How did the Food and Beverages Segment Dominate the Biodegradable Plastics Market in 2024?

The food and beverages segment dominated the market with the largest share in 2024 because it is the largest user of single-use plastics for packaging, bottles, and containers. Growing demand for on-the-go food, bottled water, and ready-to-eat products fueled the need for sustainable alternatives like PLA-based packaging. Regulatory pressure banning plastic straws, cups, and wrappers also pushed the food sector to adopt biodegradable plastics faster than other industries.

The healthcare and medical segment is expected to grow at a significant rate during the forecast period, because of the rising use of biodegradable plastics in implants, drug delivery systems, and disposable medical devices. Materials like PHA and PLA are biocompatible, making them ideal for surgical sutures, stents, and packaging for pharmaceuticals.

Degradation Environment Insights

How did the Industrial Composting Segment Dominate the Biodegradable Plastics Market in 2024?

The industrial composting segment held the largest share of the market in 2024 because most biodegradable plastics, like PLA, require controlled conditions of high temperature and humidity to break down effectively. Many regions, such as Europe and North America, have built industrial composting facilities, making it easier to process these materials at scale. Food and retail industries also prefer industrial composting since it allows mixed waste processing with minimal sorting.

The home composting segment is expected to grow at a notable rate during the predicted timeframe because most biodegradable plastics like PLA require controlled conditions of high temperature and humidity to break down effectively. Many countries in Europe and North America have built industrial composting facilities, making it easier to process these materials at scale.

Biodegradable Plastics Market Value Chain Analysis

- Distribution to Industrial Users: Several biodegradable plastic manufacturing companies have sophisticated distribution networks, which include major industrial spaces.

- Key Players: Nature Works, Mitsubishi, and BASF

- Chemical Synthesis and Processing: The chemical synthesis of the biodegradable plastic includes major processes such as polycondensation, ring-opening polymerization, and direct condensation Polymerization.

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring of the biodegradable plastic mainly depend on the international and domestic standards like ASTM D6400 and EN13432, as per recent information.

Recent Developments

- In November 2024, Fortum unveiled its latest biodegradable plastic. The newly launched biodegradable product was made by CO2 using a lower rate of water oxygen transmission, as per the report published by the company recently.(Source: www.specialchem.com)

- In December 2024, The Symphony Environmental introduced its latest biodegradable resins. Also, the newly introduced resin can reduce the fossil content, which includes regular plastic in the coming years, as per the company's claim.(Source: www.recyclingtoday.com)

Biodegradable Plastics Market Top Companies

- Cargill Incorporated

- PTT MCC Biochem Co., Ltd.

- Biome Technologies plc

- Plantic Technologies Limited

- BASF SE

- Total Corbion PLA

- NatureWorks LLC

- Eastman Chemical Company

- Trineso

- Danimer Scientific

Segment Covered

By Type

- Polylactic Acid (PLA)

- Polybutylene Adipate Terephthalate (PBAT)

- Polyhydroxyalkanoates (PHA)

- Starch-Based Plastics

- Others (cellulose-based, blends, etc.)

By Application

- Packaging (rigid & flexible)

- Agriculture (mulch films, plant pots)

- Consumer Goods (bags, cutlery, disposable items)

- Textiles & Nonwovens

- Medical & Healthcare (implants, drug delivery, sutures)

- Others (3D printing, coatings)

By End-Use Industry

- Food & Beverage

- Retail & E-Commerce

- Agriculture

- Healthcare & Medical

- Textiles & Fashion

- Others (electronics, automotive)

By Degradation Environment

- Industrial Composting

- Home Composting

- Marine Degradation

- Anaerobic Digestion

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait