Content

Polyethylene Terephthalate (PET) Market Size and Growth 2025 to 2034

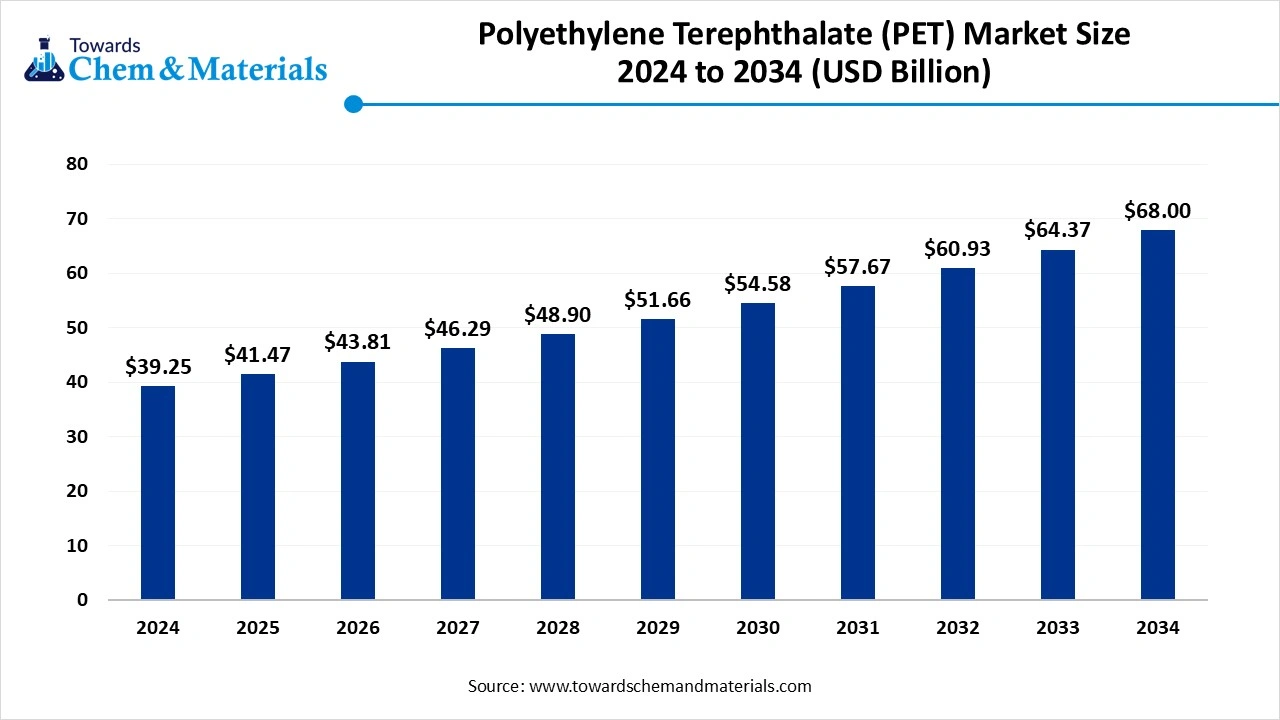

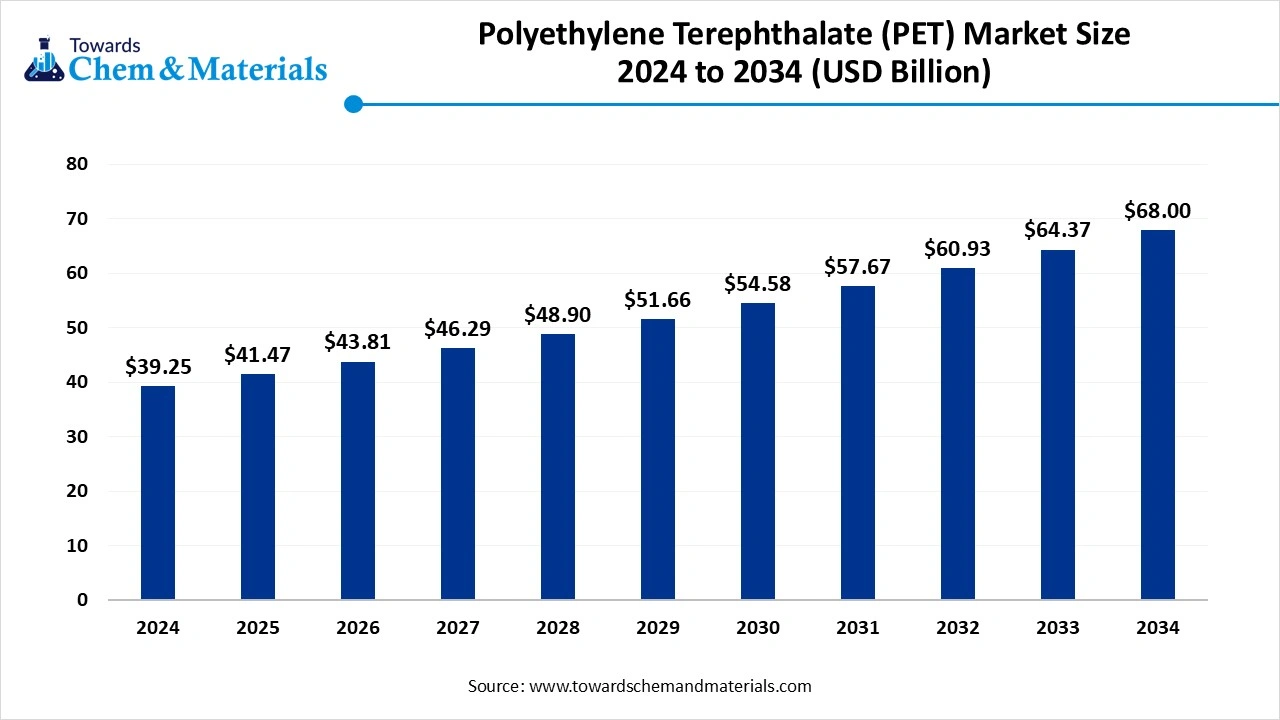

The global polyethylene terephthalate (PET) market size was reached at 39.25 USD Billion in 2024 and is expected to be worth around 68 USD Billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034. The growth of the market is driven by the growing demand for PET from industries like packaging and food and beverages industry due to its growing applications which fuels the growth of the market.

Key Takeaways

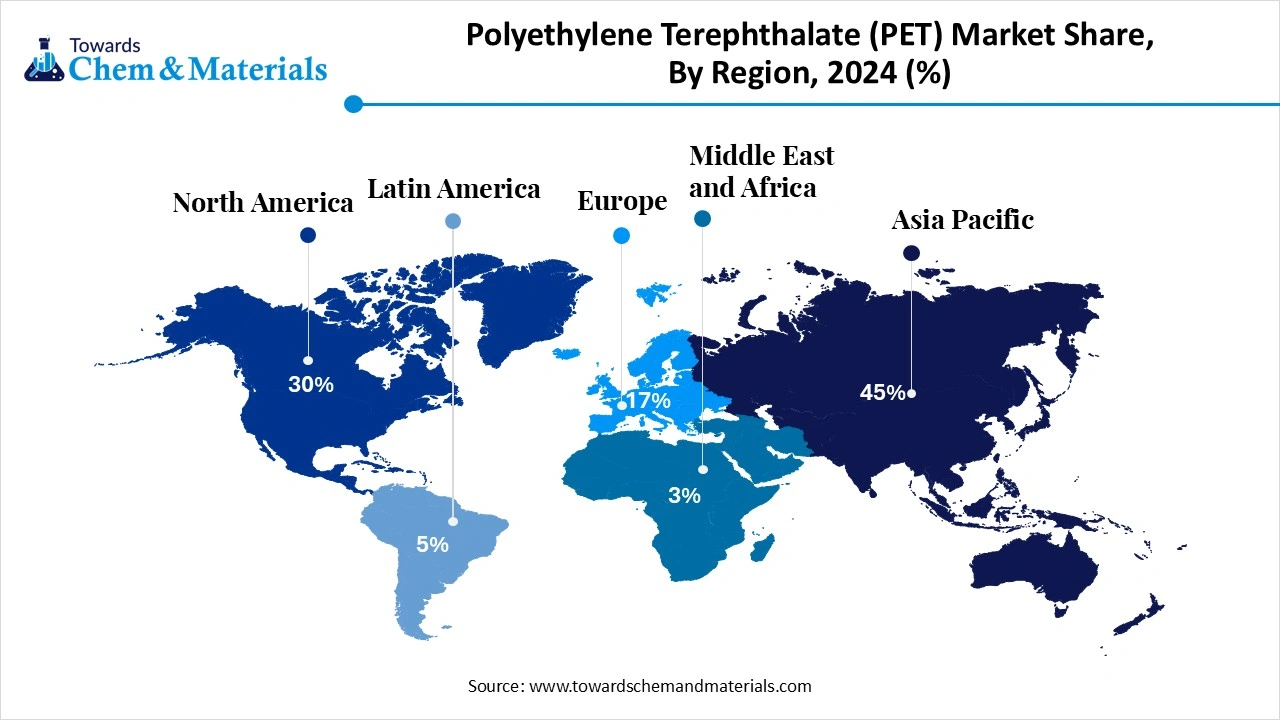

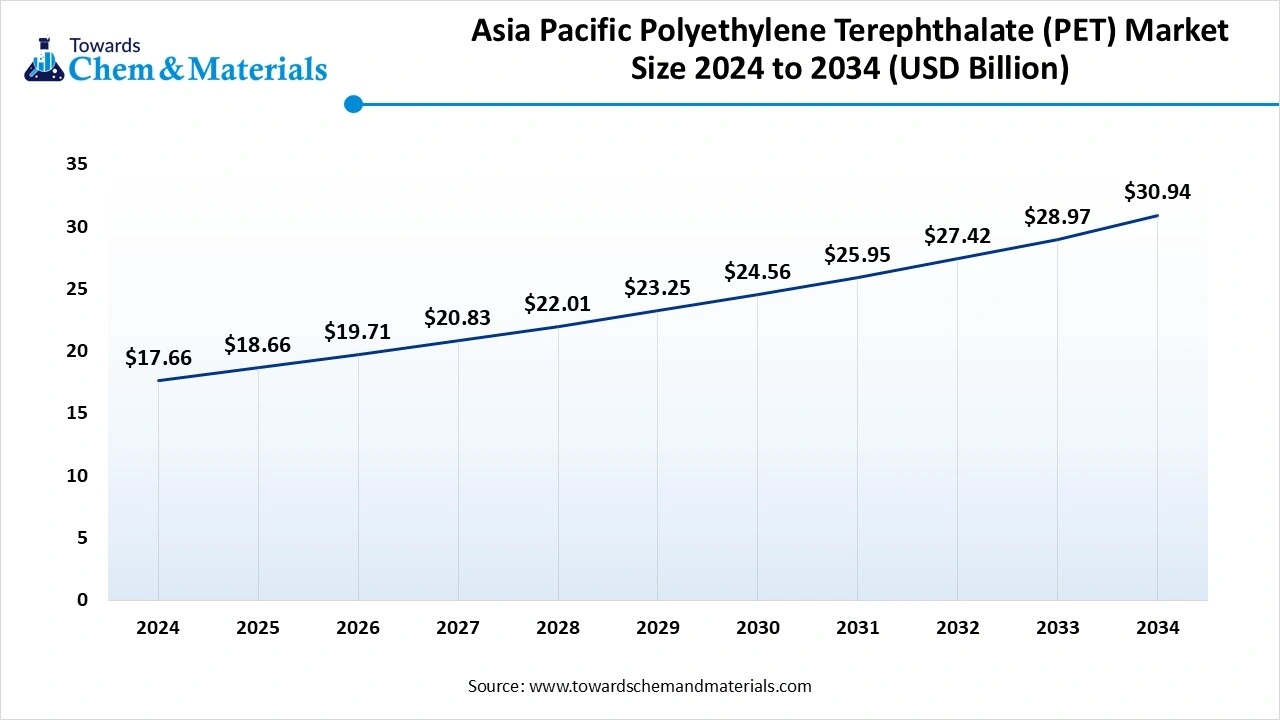

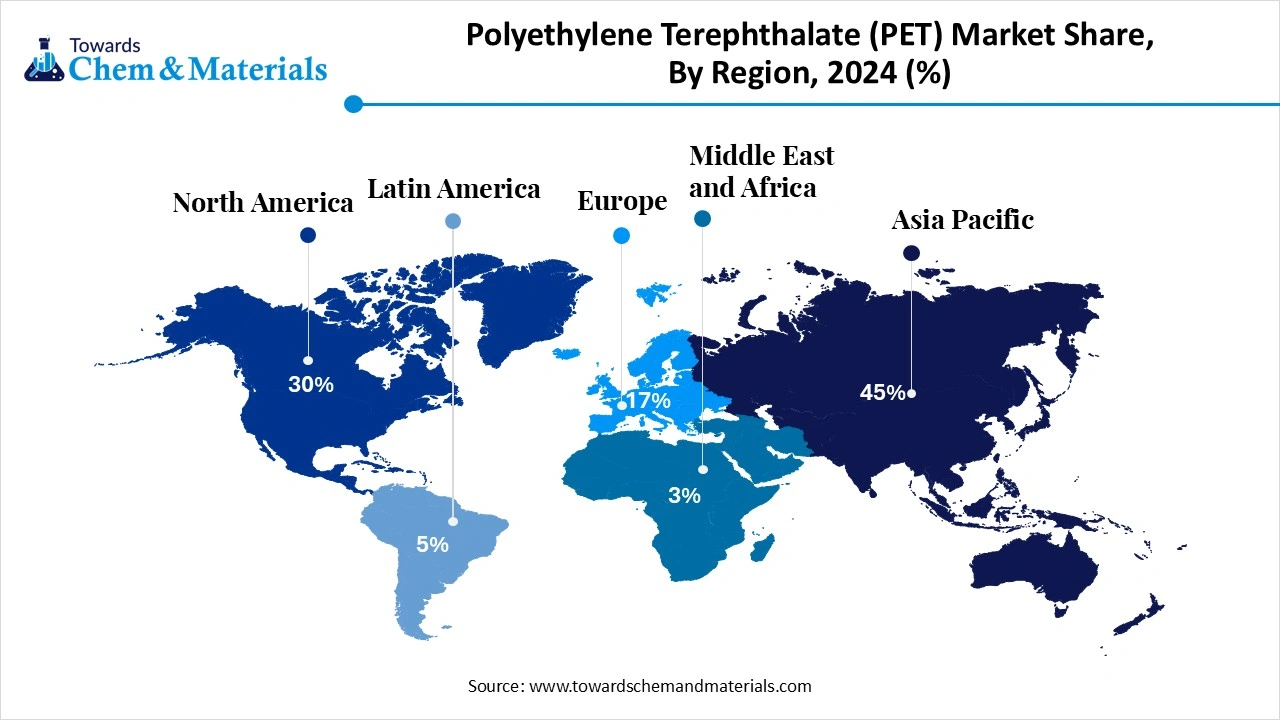

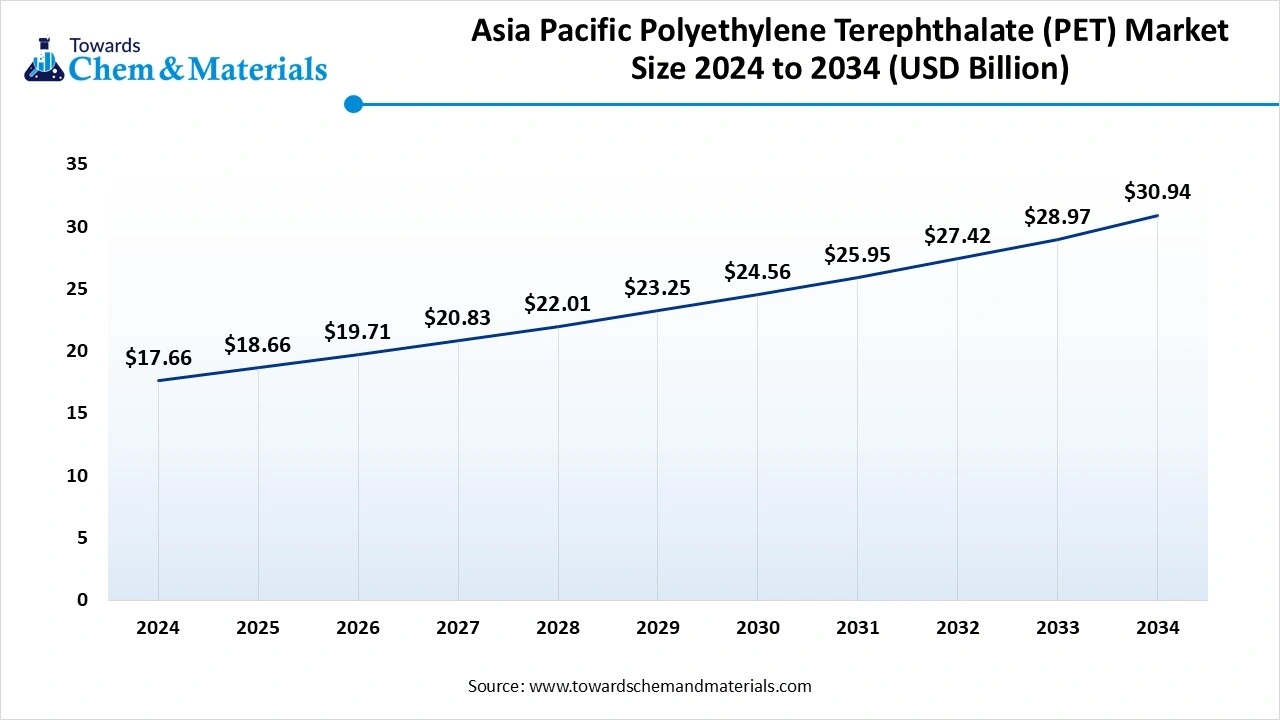

- The Asia Pacific polyethylene terephthalate (PET) market size was estimated at USD 17.66 billion in 2024 and is expected to reach USD 30.94 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

- By region, the Middle East and Africa are expected to have significant growth in the market in the forecast period. Government initiatives and supports helps in the growth of the market.

- By product type, the virgin PET – PET-bottle-grade segment dominated the market in 2024. The virgin PET–bottle–grade segment held a 45% share in the market in 2024. Transparency and clarity, and thermal properties boost the growth.

- By product type, the recycled PET – clear PET segment is expected to grow significantly in the market during the forecast period. Demand for recycled and clean products propels the demand.

- By form, the amorphous pet (APET) segment dominated the market in 2024. The amorphous pet (APET) segment held a 38% share in the market in 2024. Strength and stiffness offered by the product drive the growth.

- By form, the crystalline PET (CPET) segment is expected to grow in the forecast period. The higher heat resistance offered boosts the growth of the market.

- By application, the bottles (packaging) segment dominated the market in 2024. The bottles (packaging) segment held a 60% share in the market in 2024. The clarity and strength offered fuel the demand for the market.

- By application, the films & sheets segment is expected to grow in the forecast period. the key properties and demand from various industries drive the growth.

- By end use, the food & beverage segment dominated the market in 2024. The food & beverage segment held a 50% share in the market in 2024. The packaging of food and beverage products, due to its barrier properties, drives the growth.

- By end use, the healthcare segment is expected to grow in the forecast period. The growing demand for PET for implants and medical devices drives the growth.

- By processing technology, the blow molding segment dominated the market in 2024. The blow molding segment held a 52% share in the market in 2024. The lightweight property and reduced cost of production fuel the demand for the segment.

- By processing technology, the thermoforming segment is expected to grow in the forecast period. common applications like food packaging, electronic trays and blister packs fuels the growth.

- By distribution channel, the direct sale segment dominated the market in 2024. The direct sale segment held a 55% share in the market in 2024. The ease of supply of large volume material drives the demand.

- By distribution channel, the online retail segment is expected to grow in the forecast period. The easy accessibility fuels the growth of the market.

Market Overview

Rising Demand for Durable Materials: The Polyethylene Terephthalate (PET) Market to Expand

Polyethylene Terephthalate (PET or PETE) is a thermoplastic polymer resin of the polyester family. It is widely used in packaging, especially for beverages, food containers, and synthetic fibers, due to its strength, thermo-stability, and transparency. PET can be virgin or recycled (rPET), offering sustainability benefits.

What Are the Key Drivers Responsible for The Growth of The Polyethylene Terephthalate (PET) Market?

The PET (Polyethylene Terephthalate) market mainly grows due to higher demand for lightweight, durable, and recyclable packaging, especially in the food and beverage sector. This expansion is supported by increasing urbanization, a growing middle class, and the rise of e-commerce. Moreover, PET's versatility, used in textiles and electronics as well as packaging, further drives its market growth.

Market Trends

- The integration of PET in smart textiles, particularly for fashion, healthcare, and electronics drives the growth of the market.

- The use of PET fibers for textile-like sportswear, outdoor panes, and automotive applications to enhance breathability, UV resistance, and moisture-wicking properties is a growing trend in the market.

- The growing application in automotive and aerospace due to its lightweight and high-strength characteristics is a growing trend in the market.

- The growing demand for PET from the packaging industry for food and beverages, consumer goods, due to its properties like durability, lightweight, and recyclability, drives the growth.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 41.47 Billion |

| Expected Size by 2034 | USD 68 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Form, By Application, By End-Use Industry, By Processing Technology, By Distribution Channel, By Region |

| Key Companies Profiled | Indorama Ventures Public Company Limited (Thailand), SABIC (Saudi Arabia), Alpek S.A.B. de C.V. (Mexico), DAK Americas LLC (USA), Reliance Industries Limited (India), Far Eastern New Century Corporation (Taiwan), China Resources Chemical Innovative Materials Holdings Limited (China) , Toray Industries Inc. (Japan) , Nan Ya Plastics Corporation (Taiwan) , Sinopec Yizheng Chemical Fibre Company (China), JBF Industries Ltd. (India), SK Chemicals (South Korea), Lotte Chemical Corporation (South Korea), Petkim Petrokimya Holding A.Ş. (Turkey), Kolon Industries Inc. (South Korea) , Quadrant AG (Mitsubishi Chemical) (Europe) , Equipolymers GmbH (Germany), Plastiverd (Spain), Tri Ocean Plastic (China), Polisan Holding (Turkey) |

Market Opportunity

What Are the Key Growth Opportunities Responsible for The Growth of The Polyethylene Terephthalate (PET) Market?

The PET (Polyethylene Terephthalate) market is expanding rapidly, fueled by its popularity in packaging, textiles, and other sectors. Its recyclability, lightweight design, and durability contribute to its favourability across industries. Emerging markets, especially in Asia-Pacific, present opportunities due to increasing consumer activity and the growth of e-commerce, which boosts demand for PET packaging.

Market Challenge

What Are the Key Challenges That Hinder the Growth of The Polyethylene Terephthalate (PET) Market?

The PET (Polyethylene Terephthalate) market encounters multiple challenges, such as environmental issues surrounding plastic waste, variable raw material costs, and strict regulations, all of which restrict market growth. Moreover, negative public perception of plastics, including recyclable PET, acts as a barrier. The limited supply of high-quality recycled PET (rPET) further hampers the market’s development.

Regional Insights

How Did Asia Pacific Dominate the Polyethylene Terephthalate (PET) Market?

The Asia Pacific polyethylene terephthalate (PET) market size was estimated at USD 17.66 billion in 2024 and is anticipated to reach USD 30.94 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034. the Asia Pacific has accounted highest revenue share of around 45% in 2024.

Asia Pacific dominated the polyethylene terephthalate (PET) market in 2024. The growth of the market is driven by the growing and expanding industries due to rapid industrialization in the region, like electronics, packaging, and automotive industries, which drive the growth of the market in the region. The growth is also seen in the region due to increasing demand from especially the packaging industry for packaging with advanced technology like recycling, taking into consideration the environmental regulation due to rising environmental concerns, which drives the growth of the market in the region. The key players also play a crucial role in the growth and expansion of the market in the region.

India Has Seen Significant Growth Due To the Increasing Demand for Packaged Goods.

The growth of the market in the India is driven by the growing demand for packaged goods in the country, which drives the growth of the market in the country. The other key drivers that support the growth of the market in the country are the growing electronic and automotive industries, dominance of packaging and large consumer of PET, sustainability initiatives due to growing awareness, large production hub align with large export base, stringent regulation for strict plastic usage regulation also supports and contributes in the growth of the market in the country.

The Strong Demand from Industries and Government Support in The Region Drives Growth.

The Middle East and Africa are expected to have a significant growth in the polyethylene terephthalate (PET) market in the forecast period. The growth if the market is driven by the growing government support and rising urbanization, changing lifestyle and expansion of e-commerce in the region drives the growth of the market. The digital economy ad focuses on the non-oil industry and also contributes to the growth. The key players like SABIC, Indorama Ventures, and LyondellBasell Industries play a crucial role. The heavy investment in technological advancements and infrastructure development in the region also supports the growth and expansion of the market in the region.

Saudi Arabia Is Experiencing Growth Due To a Rapid Sustainability Focus

Saudi Arabia's growing focus on sustainability is due to growing awareness of demand for sustainable packaging solutions, which fuels the growth of the market in the country. The increased use of recycled PET also supports the growth. Major players like Indorama Ventures, DuPont, SABIC, DAK Americas, and Reliance Industries in the country also contribute tie the growth as they help in the development of sustainable and recyclable products, which supports the growth and expansion of the market in the country.

- The World shipped out 108,644 Polyethylene Terephthalate shipments from November 2023 to October 2024 (TTM). These exports were made by 5,670 exporters to 6,903 buyers, with a growth rate of 40% over the previous year.(Source: www.volza.com)

- Globally, India, China, and South Korea are the top three exporters of Polyethylene Terephthalate. India is the global leader in Polyethylene Terephthalate exports with 110,964 shipments, followed closely by China with 93,104 shipments, and South Korea in third place with 62,443 shipments.(Source : www.volza.com)

Segmental Insights

Product Type Insights

Which Product Segment Dominated the Polyethylene Terephthalate (PET) Market In 2024?

The virgin PET – PET-bottle-grade segment dominated the market in 2024. They are made directly from the raw materials and are of high purity and is a preferred for application which requires strict quality standards which increases the demand for the market. the growing application in food containers, beverages bottles, personal care products and pharmaceutical due to its properties like barrier properties, thermal properties, and chemical resistance further fuels the growth of the market and supports expansion.

The recycled PET – clear PET segment expects significant growth in the polyethylene terephthalate (PET) market during the forecast period. The recycled PET (rPET) is created by reprocessing used PET materials, and it's a crucial part of the effort to reduce plastic waste, which fuels the growth. The properties like clarity, strength, chemical resistance, and moisture resistance, especially for reducing contamination and formulation, io =f new factors of similar quality demand for clean PET, which boosts the demand and growth of the market.

Form Insights

How Did the Amorphous PET (APET) Segment Dominate the Polyethylene Terephthalate (PET) Market In 2024?

The amorphous PET (APET) segment dominated the market in 2024. The market is driven due to its excellent clarity, lightweight nature, and strong barrier properties. APET is widely used in packaging applications, especially for food and beverages, as it helps in enhancing the appeal while maintaining freshness. Its ease of thermoforming and recyclability also contribute to the growing demand for consumer goods and electronics packaging. Rising sustainability initiatives and increasing preference for transparent packaging further drive this segment’s growth overall.

The crystalline PET (CPET) segment expects significant growth in the polyethylene terephthalate (PET) market during the forecast period. the segment is gaining attention in the PET market due to its superior heat resistance and toughness. CPET can withstand higher temperatures, making it ideal for applications such as oven-ready and microwaveable food trays. It offers excellent dimensional stability and impact strength, ensuring product safety during handling and heating. Additionally, CPET's recyclability and versatility support its use in both rigid and semi-rigid packaging, catering to the growing demand for convenient, heatable food packaging solutions.

Application Insights

Which Application Segment Dominated the Polyethylene Terephthalate (PET) Market In 2024?

The bottles (packaging) segment dominated the market in 2024. The growing demand due to their properties like clarity, strength, durability, barrier properties, lightweight, and recyclability for environmentally friendly packaging options fuels the growth of the market. They are extensively used for the application of packaging of bottles for pharmaceutical, cosmetics, personal care, and household products due to their safety and barrier properties, which do not harm the product. This boosts the growth and expansion of the market.

The films & sheets segment expects significant growth in the polyethylene terephthalate (PET) market during the forecast period. The growing application and demand from various industries like packaging, electronics, industrial applications, medical, and pharmaceuticals are increasing the growth of the market. The PET films are extensively known and used for their clarity and protection against oxygen and moisture to withstand the wide temperature range, which boosts the growth and expansion of the market.

End Use Insights

How Did the Food and Beverages Segment Dominate the Polyethylene Terephthalate (PET) Market In 2024?

The food & beverage segment dominated the market in 2024. The growth is driven by the due to use of PET in food and beverage packaging, which is due to its safety profile meeting the regulatory standards from the Food and Drug Administration, contributing to the growth of the market. The use of PET in bottles for drinks and other food and beverage containers for storage and packaging fuels the growth. The key properties like strength, clarity, and barrier properties make it an ideal option for the food industry, supporting the growth and expansion of the market.

The healthcare segment expects significant growth in the polyethylene terephthalate (PET) market during the forecast period. The healthcare segment expects significant growth in the market during the forecast period. The key properties make it an ideal product to be used in healthcare due to properties like biocompatibility, which does not cause adverse reactions, strength, which makes it suitable for load-bearing applications, and chemical resistance, which is important for medical devices, contributing to the growth of the market. They are commonly used for sutures, implants, tubing, packaging, and antimicrobial modification, which increases the demand and contributes to the growth and expansion.

Processing Technology Insights

Which Processing Technology Segment Dominated the Polyethylene Terephthalate (PET) Market In 2024?

The blow molding segment dominated the market in 2024. The growth of the market is primarily driven by the extensive use of PET in manufacturing bottles and containers. Blow molding technology allows to produce lightweight, durable, and highly transparent packaging solutions, especially for beverages, household products, and personal care items. Its efficiency in producing complex shapes with minimal material waste makes it cost-effective and sustainable. The rising demand for bottled water, carbonated drinks, and ready-to-drink beverages globally continues to propel the growth of this segment.

The thermoforming segment expects significant growth in the polyethylene terephthalate (PET) market during the forecast period. The growth of the segment is fueled by its widespread use in creating lightweight, clear, and versatile packaging. PET sheets are heated and molded into various shapes, making this process ideal for producing trays, clamshells, blisters, and other disposable food packaging. Thermoforming offers cost-effectiveness, design flexibility, and high production efficiency, which cater to the food, medical, and consumer goods sectors. Rising demand for ready-to-eat meals, on-the-go snacks, and hygienic packaging solutions continues to drive this segment’s expansion worldwide.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Polyethylene Terephthalate (PET) Market In 2024?

The direct sale segment dominated the polyethylene terephthalate (PET) market in 2024. The direct sale segment is growing as it allows manufacturers to supply PET products directly to large end users without intermediaries. This channel is particularly preferred by major beverage companies, food packaging firms, and industrial packaging producers who require bulk quantities and consistent, customized quality. Direct sales enable manufacturers to build long-term relationships, offer tailored technical support, and ensure reliable supply chains. Additionally, this approach helps improve profit margins and provides better control over pricing and delivery schedules.

The online retail segment expects significant growth in the market during the forecast period.

The online retail segment is expanding steadily, driven by the rise of e-commerce platforms and the increasing digitalization of procurement processes. This channel offers convenience, broader reach, and quick access to various PET products, catering especially to small and medium-sized enterprises and regional converters. Online platforms enable buyers to compare prices, check product specifications, and place orders efficiently. Growing preference for contactless transactions and the demand for faster, transparent supply chains further boost this segment’s growth.

Recent Developments

- In May 2025, a drive was launched to ensure the limiting the sunlight exposure of packaged drinks to avoid any harm from the PET bottles. The aim is to limit the harmful effects of sunlight on plastic bottles containing water and soft drinks/juices.(Source: kashmirobserver.net)

- In November 2024, Bayer, a Switzerland-based company, launched polyethylene terephthalate (PET) blister packaging for their healthcare brand. The collaboration was done with the pharmaceutical company Liveo Research for the product development.(Source: www.recyclingtoday.com)

Top Companies List

- Indorama Ventures Public Company Limited (Thailand)

- SABIC (Saudi Arabia)

- Alpek S.A.B. de C.V. (Mexico)

- DAK Americas LLC (USA)

- Reliance Industries Limited (India)

- Far Eastern New Century Corporation (Taiwan)

- China Resources Chemical Innovative Materials Holdings Limited (China)

- Toray Industries Inc. (Japan)

- Nan Ya Plastics Corporation (Taiwan)

- Sinopec Yizheng Chemical Fibre Company (China)

- JBF Industries Ltd. (India)

- SK Chemicals (South Korea)

- Lotte Chemical Corporation (South Korea)

- Petkim Petrokimya Holding A.Ş. (Turkey)

- Kolon Industries Inc. (South Korea)

- Quadrant AG (Mitsubishi Chemical) (Europe)

- Equipolymers GmbH (Germany)

- Plastiverd (Spain)

- Tri Ocean Plastic (China)

- Polisan Holding (Turkey)

Segments Covered

By Product Type

- Virgin PET

- Bottle-grade PET

- Film-grade PET

- Fiber-grade PET

- Recycled PET (rPET)

- Clear rPET

- Colored rPET

By Form

- Amorphous PET (APET)

- Crystalline PET (CPET)

- C-PET Trays

- Sheet & Films

- Granules/Resin

By Application

- Packaging

- Bottles

- Water

- Carbonated Soft Drinks

- Juices

- Alcoholic Beverages

- Others

- Jars & Containers

- Films & Sheets

- Textiles

- Fibers & Yarns

- Industrial Threads

- Electronics

- Insulation Films

- Semiconductor Encapsulation

- Automotive

- Under-the-hood parts

- Seat belts

- Others

- Construction

- Medical Devices

By End-Use Industry

- Food & Beverage

- Textile

- Automotive

- Electrical & Electronics

- Healthcare

- Consumer Goods

- Industrial

By Processing Technology

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

By Distribution Channel

- Direct Sales (OEMs)

- Distributors / Resellers

- Online Retail

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait