Content

Polyvinyl Chloride (PVC) Market Size and Growth 2025 to 2034

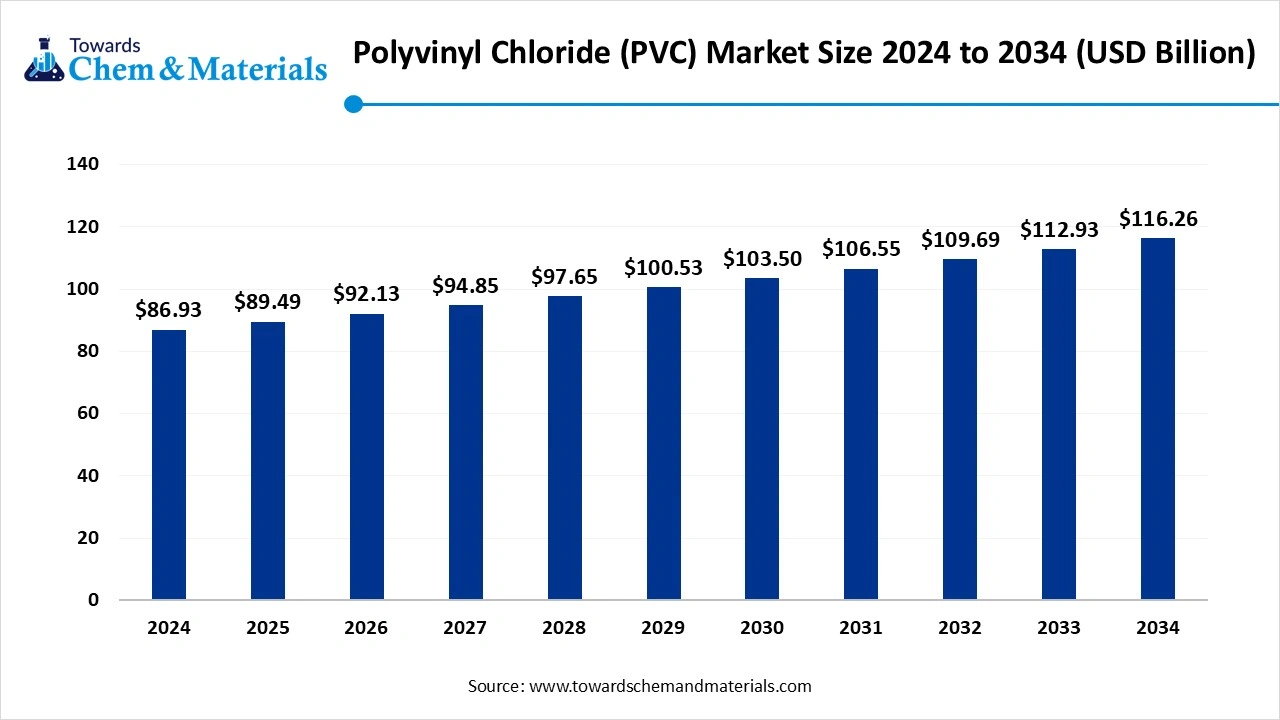

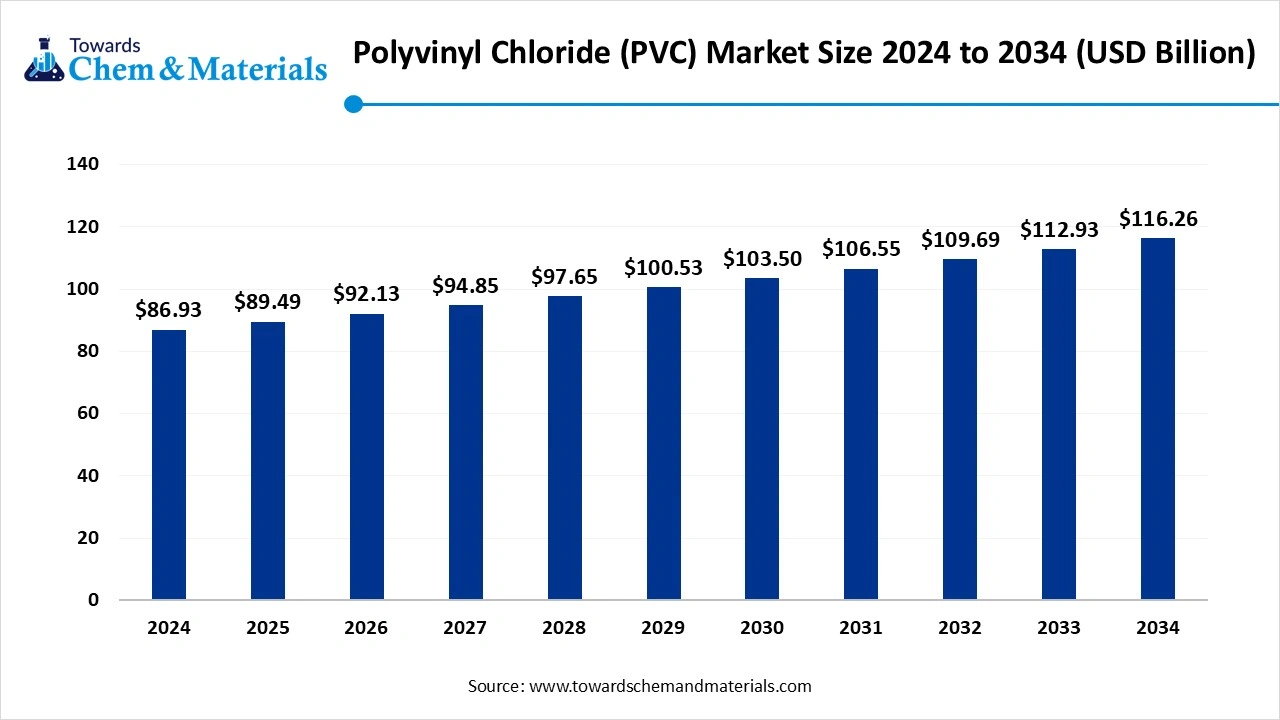

The global polyvinyl chloride (PVC) market size was estimated at USD 86.93 billion in 2024 and is expected to hit around USD 116.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034. The sudden expansion of the construction industry is fueling industry potential in the current period.

Key Takeaways

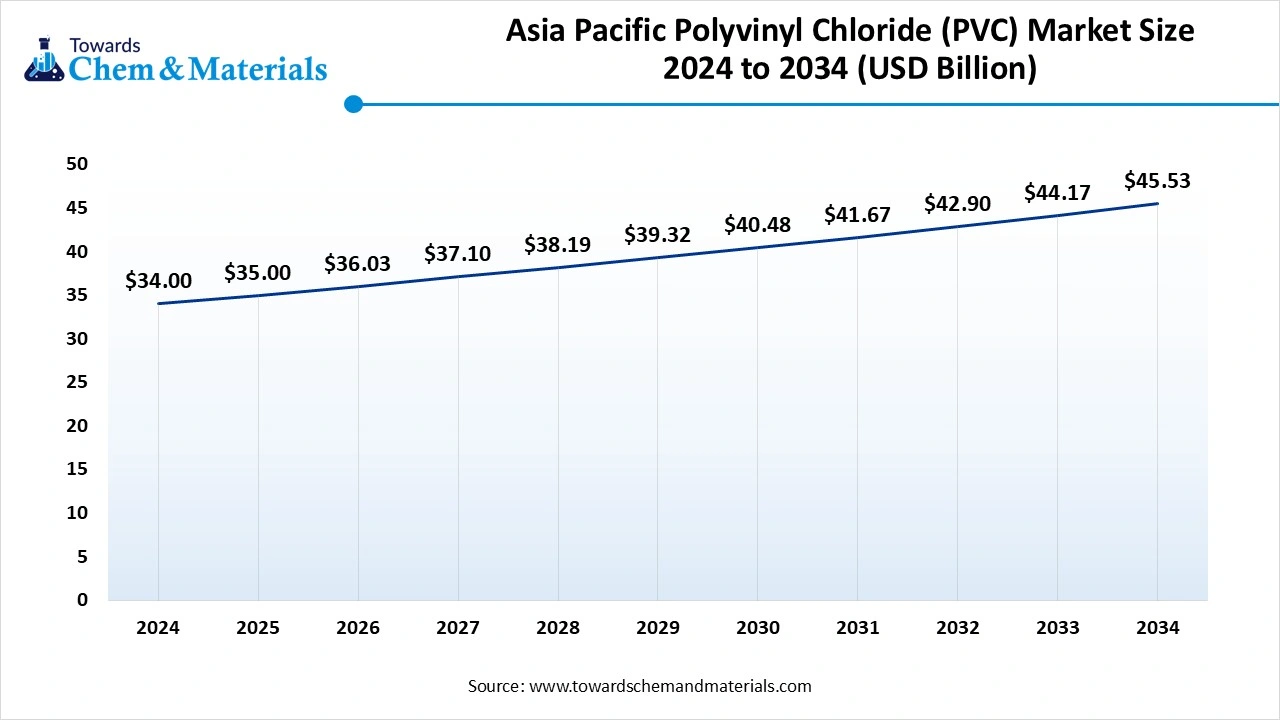

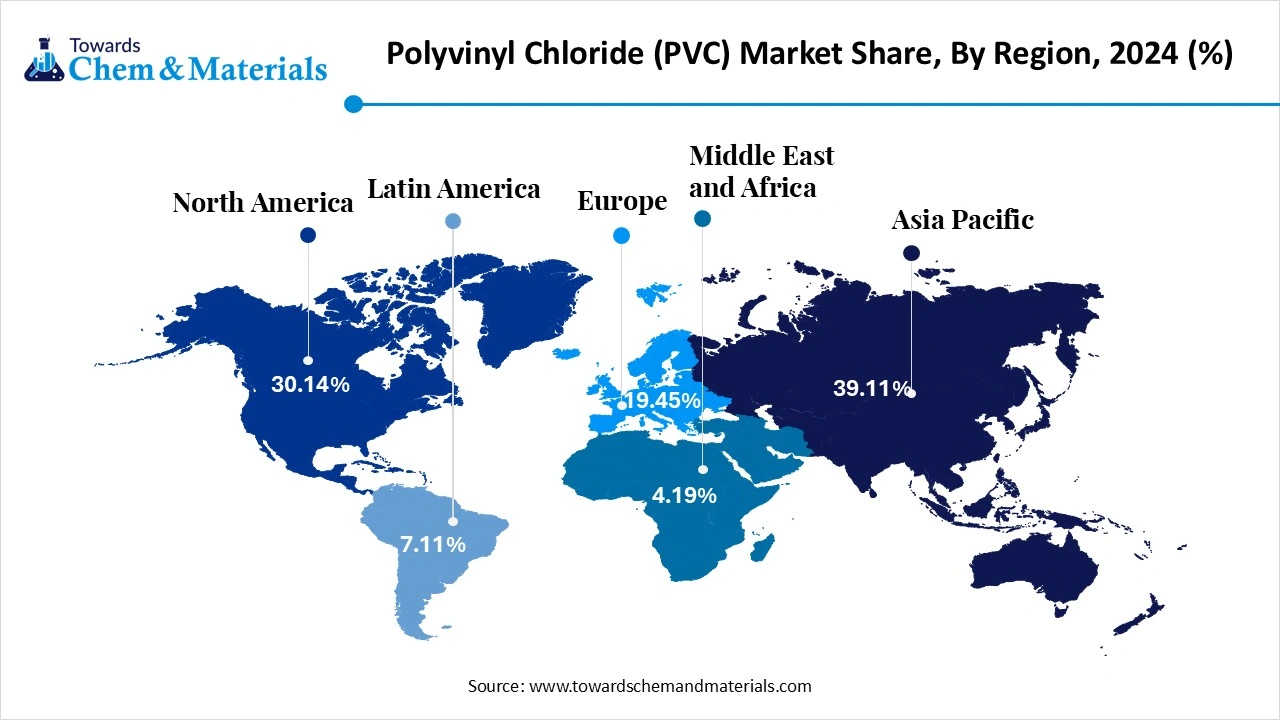

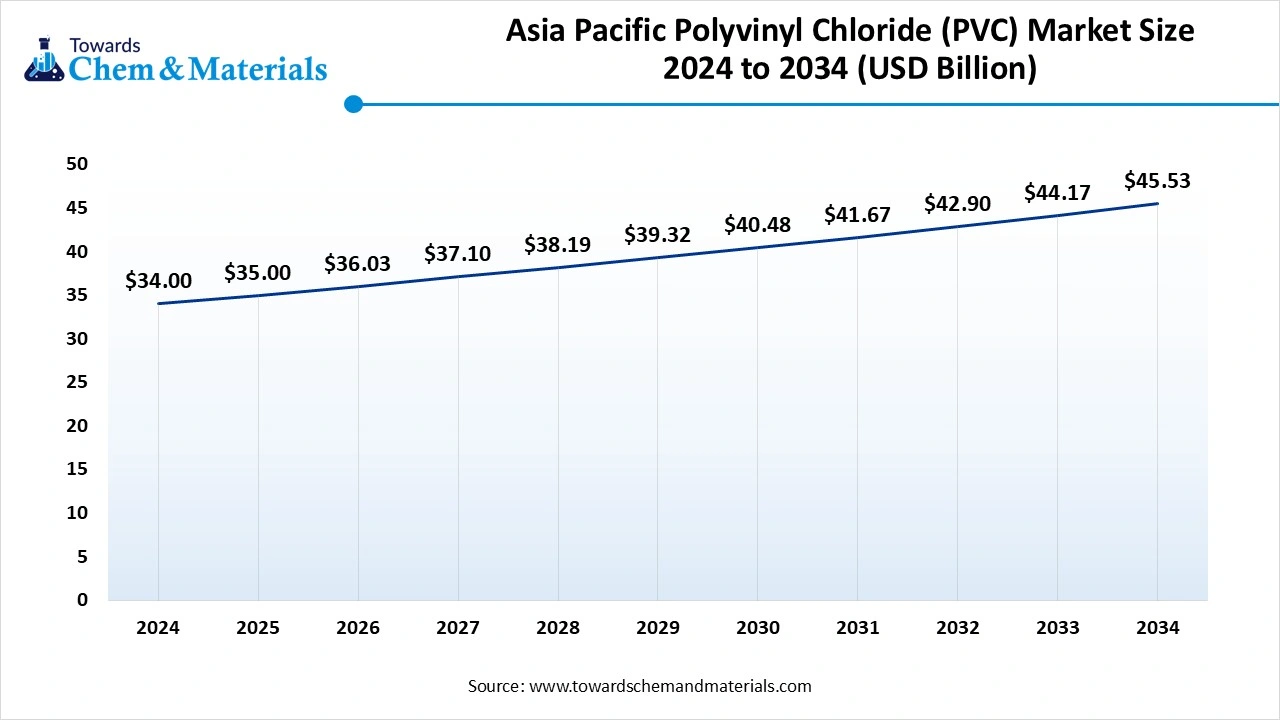

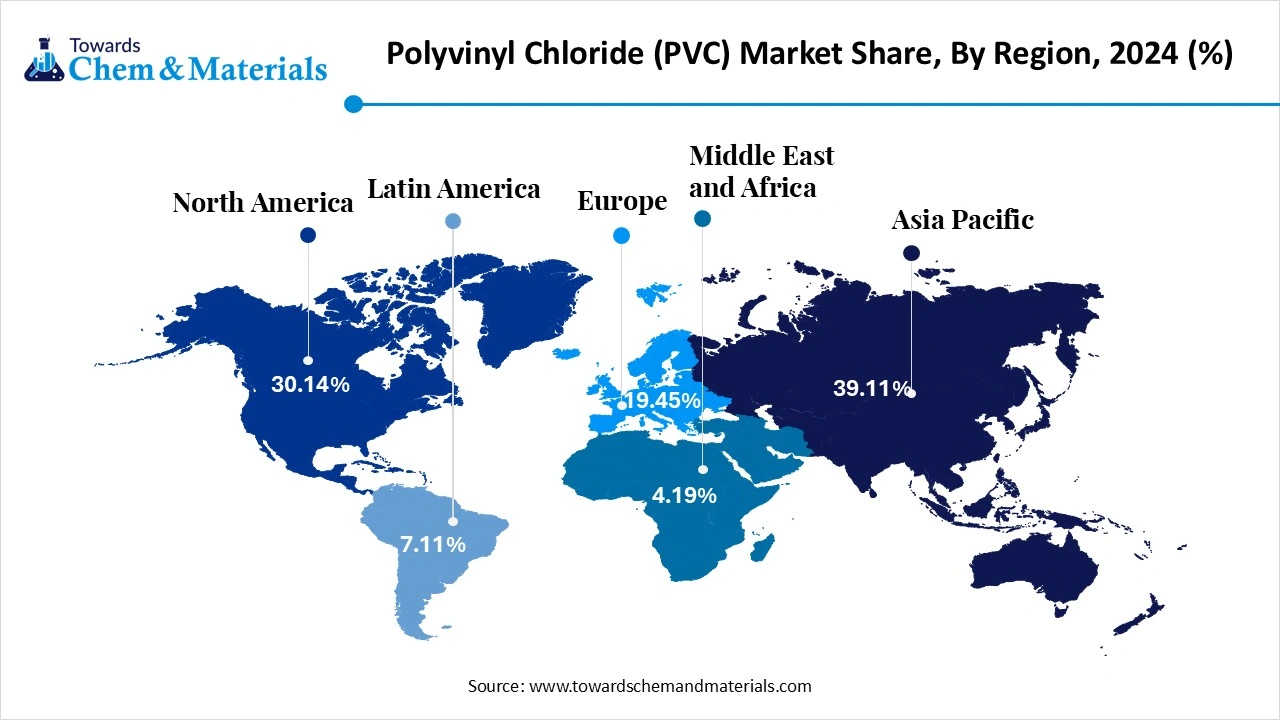

- The Asia Pacific polyvinyl chloride (PVC) market size was estimated at USD 34 billion in 2024 and is expected to reach USD 45.53 billion by 2034, growing at a CAGR of 2.96% from 2025 to 2034.

- By region, North America is expected to grow at a notable rate in the future, akin to having access to advanced technology and the sustainable construction needs in recent years.

- By type, the rigid PVC segment led the market in 2024, due to its unique properties such as strength, durability, and lightweight in the current period.

- By type, the flexible PVC segment is expected to grow at the fastest rate in the market during the forecast period, akin to having properties, such as softness, flexibility, and a versatile nature.

- By process type, the suspension polymerization segment emerged as the top-performing segment in 2024, due to its effectiveness in the production of high-quality resin

- By process type, the emulsion polymerization segment is expected to lead the market in the coming years, as its production of finer particles, which drives the demand in sectors such as synthetic leather, coatings, and medical applications.

- By formulation type, the plasticizers segment led the market in 2024, as plasticizers are chemicals added to PVC to make it soft, flexible, and easier to work with.

- By formulation type, the stabilizers segment captured the biggest portion of the market in 2024, as they help PVC resist heat, light, and weather damage, especially for long-lasting outdoor applications.

- By end use industry, the building and construction segment captured the biggest portion of the market in 2024, as PVC is used in pipes, doors, windows, flooring, and roofing.

- By end use industry, the automotive segment is anticipated to expand at the highest rate in the coming years, as the industry is expected to use more PVC in the future for interior panels, cables, seat covers, and under-the-hood components.

- By distribution channel, the direct sales segment led the market in 2024. As manufacturers often supply large volumes directly to industrial users, like construction companies or OEMs.

- By distribution channel, the online portals segment is expected to grow at the fastest rate in the market during the forecast period due to their convenience, transparency, and wider product access.

Market Overview

Built to Last: How PVC Becomes the Cornerstone of Industrial Application?

Polyvinyl chloride (PVC) is a synthetic thermoplastic polymer made by the vinyl chloride monomers’ polymerization. It is one of the heavily used plastics globally due to its durability, affordability, and versatile properties. PVC is used in both rigid and flexible forms and finds applications across construction, automotive, packaging, electrical, healthcare, and consumer goods industries. Their usage in wide applications such as pipes, cables, flooring, windows, and medical devices is contributing to the industry’s growth in recent years.

Which Factor is Driving the Polyvinyl Chloride (PVC) Market?

The increased expansion of the construction industry is spearheading the industry's growth in the current period. As several developers are actively using the PVC in their construction works, and applications such as pipes and window frames. Furthermore, having unique properties such as affordability, easy installations, and lightweight, the PVC gained immense industry attention in the past few years, as per the recent industry survey.

Market Trends

- The sudden shift towards lead-free stabilizers is driving industry growth in recent years. As several regions are implementing sustainability regulations, manufacturers are actively using zinc and Ti-based stabilizers to produce PVC.

- The increased demand for medical-grade PVC is severely contributing to the growth of the market. Having flexibility, safety, and durability, several healthcare organizations and professionals are heavily preferring the medical grade PVCs.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 89.49 Billion |

| Expected Size by 2034 | USD 116.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR 2.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Polymerization Process, By Additives / Formulation, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Shin-Etsu Chemical Co., Ltd. (Japan), Formosa Plastics Group (Taiwan), Westlake Corporation (USA) , LG Chem Ltd. (South Korea) , INEOS Group Holdings S.A. (UK), Orbia (Mexichem) (Mexico), Kem One (France) , Reliance Industries Limited (India), Hanwha Solutions Corporation (South Korea), Vinnolit GmbH & Co. KG (Germany – part of Westlake), SABIC (Saudi Arabia), Xinjiang Zhongtai Chemical Co., Ltd. (China), Occidental Petroleum Corporation (OxyChem) (USA), Thai Plastic and Chemicals Public Company Ltd. (Thailand – SCG), DCW Ltd. (India), Braskem (Brazil) , Petro Rabigh (Saudi Arabia), KEMIRA (Europe), Ercros S.A. (Spain), Tianjin Dagu Chemical Co., Ltd. (China) |

Market Opportunity

Next-Gen PVC Products Fuel Sustainability in Manufacturing

The development of bio-based and environmentally friendly PVC is expected to create lucrative opportunities for polyvinyl chloride (PVC) market in the coming years, as the global shift towards eco-friendly manufacturing, several manufacturing companies are increasingly promoting their sustainable production and the latest products. For this development, manufacturers can use the latest technology, which can play a major role in the production of biobased PVC in the coming years.

Market Challenge

Global Plastic Regulation Threatens PVC Stability

The increasing regulations on plastic use globally are expected to hinder the industry's growth in the coming years, as PVC is mainly used in plastic applications such as pipes and others, which is likely to create growth barriers for the industry in the upcoming years, as per industry observation.

Regional Insights

The Asia Pacific polyvinyl chloride (PVC) market size was estimated at USD 34 billion in 2024 and is anticipated to reach USD 45.53 billion by 2034, growing at a CAGR of 2.96% from 2025 to 2034. the Asia Pacific has accounted highest revenue share of around 39.11% in 2024.

Asia Pacific dominated the market in 2024, akin to a sudden construction boom and the large-scale manufacturing in the region. Moreover, the region has benefits like an affordable labor base and the availability of raw materials, which provides immense global attention towards the whole region. Furthermore, the regional countries such India, China, and Japan are seen as putting investment in the housing, infrastructure projects, and water pipelines, which is actively contributing to the regional growth in recent years.

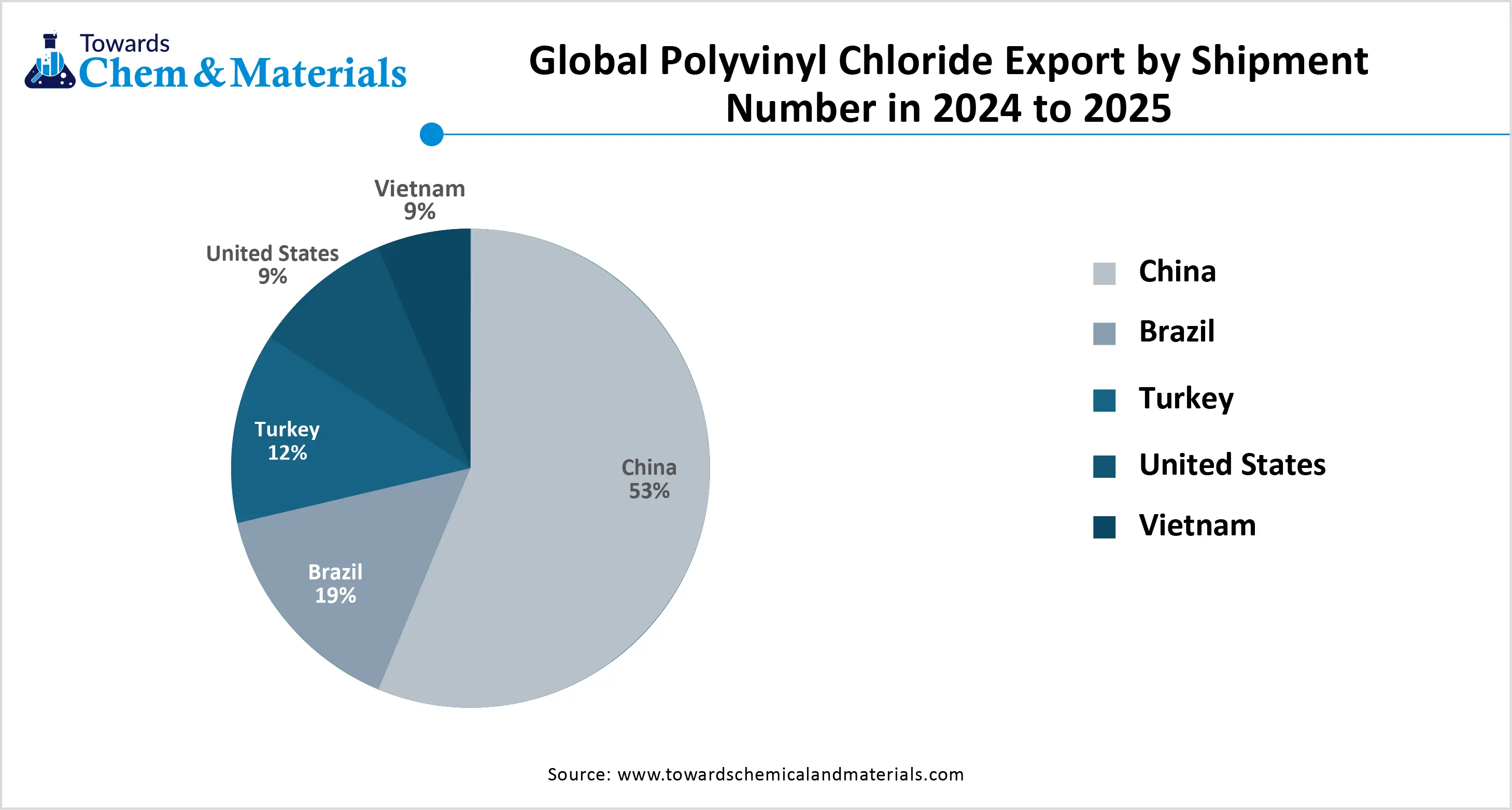

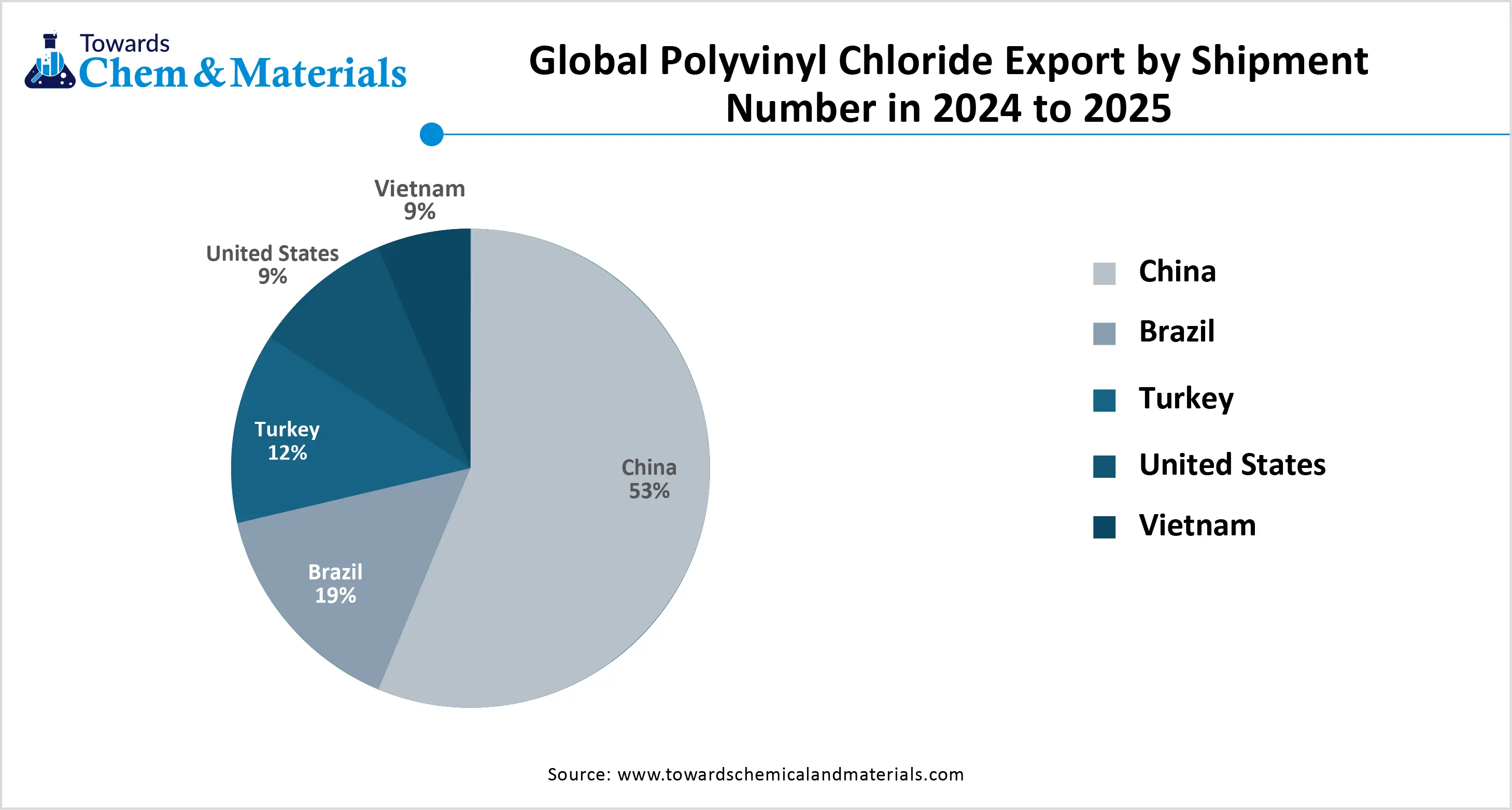

How is China’s Domestic Manufacturing Power Fueling Its PVC Domination?

China maintained its dominance in the polyvinyl chloride (PVC) market, owing to the country being considered the largest producer of PVC with a heavy consumer base itself. Moreover, having higher domestic manufacturing and enlarged expansion of the infrastructure projects are providing a huge base pf the consumer to the PVC manufacturer in recent years, as per the country survey.

North America is expected to capture a major share of the market during forecast period, owing to having access to advanced technology and the sustainable construction needs in recent years. Furthermore, the region is undergoing heavy renovation, and the infrastructure upgrade needs where the PVC becomes a crucial material in the upcoming years.

Will the Healthcare and Construction Boom Make the U.S a PVC Powerhouse?

The United States is expected to rise as a dominant country in the region in the coming years, owing to the presence of advanced PVC manufacturing companies and the heavy healthcare and construction sectors. Furthermore, the manufacturers in the country are increasingly seen in demanding recyclable PVC alternatives in recent years, which can create significant opportunities for the manufacturers in the coming years. Also, the country is heavily investing in automation production technologies.

Segmental Insights

Type Insights

How did the Rigid PVC Segment Dominate the Polyvinyl Chloride (PVC) Market in 2024?

The rigid PVC segment held the largest share of the market in 2024, due to its unique properties such as strength, durability, and lightweight in the current period. As pipe makers, window frame manufacturers have increasingly seen the heavy use of rigid PVC in recent years. Furthermore, having characteristics like toughness and weather resistance, several individuals are using rigid PVC in long-term installation sectors where strength matters, as per recent observations.

The flexible PVC segment is expected to grow at a notable rate during the predicted timeframe due to having properties, such as softness, flexibility, and a versatile nature. The increased need for medical tubing, flexible wiring, and automobile interiors has provided a huge consumer base to the segment in recent years. Moreover, the increased demand for consumer goods can contribute immensely to the growth of the segment in the coming years, as per recent observations.

Process Type Insights

Why does Suspension Polymerization Segment Dominated the Polyvinyl Chloride (PVC) Market by Process Type?

The suspension polymerization segment held the largest share of the polyvinyl chloride (PVC) market in 2024, owing to its effectiveness in the production of high-quality resin. Moreover, the production benefits, such as the easy control of the particle size and increased demand for the large-scale industrial spaces, have actively provided attention towards the suspension polymerization method in the past few years.

The emulsion polymerization segment is expected to grow at a notable rate during forecast period, owing to its production of finer particles, which drive the demand in sectors such as synthetic leather, coatings, and medical applications. Moreover, the increased need for high-performance, flexibility, and skin-contact materials is anticipated to drive segment growth in the upcoming years, as per the future industry expectations.

Formulation Type Insights

Why Did the Plasticizers Segment Dominate the Polyvinyl Chloride (PVC) Market in 2024?

The plasticizers segment dominated the market with the largest share in 2024. Plasticizers are chemicals added to PVC to make it soft, flexible, and easier to work with. Because of their use in cables, hoses, synthetic leather, and medical tubing, plasticized PVC products are found everywhere. The plastic segment dominates because most flexible PVC applications need these additives to function properly. They improve durability, transparency, and elasticity, making PVC suitable for industries like automotive, healthcare, and construction..

The stabilizer segments are expected to grow at a notable rate during the forecast period, as they help PVC resist heat, light, and weather damage, especially for long-lasting outdoor applications. With rising concerns about product durability and environmental safety, manufacturers are using modern stabilizers that are non-toxic and eco-friendly. These additives ensure that PVC doesn't degrade over time when exposed to sunlight or high temperatures. As regulations become stricter and end-users demand safer, longer-lasting products, the use of advanced stabilizers in formulations will increase.

End Use Industry Insights

How does the Building and Construction Segment Maintain Dominance in the End Use Industry Type?

The building and construction segment held the largest share of the market in 2024. Due to its use in pipes, doors, windows, flooring, and roofing. PVC offers durability, fire resistance, moisture resistance, and easy maintenance, making it ideal for infrastructure applications. It helps reduce building costs while offering long-lasting performance. Governments and the private sector investing in housing and infrastructure projects further boost demand.

The automotive segment is expected to grow at the fastest rate during the forecast period. The industry is expected to use more PVC in the future for interior panels, cables, seat covers, and under-the-hood components. PVC is lightweight, flexible, and resistant to chemicals and fire, making it ideal for various vehicle parts. As electric vehicles (EVs) grow in popularity, there's more demand for durable, lightweight materials that improve energy efficiency.

Distribution Channel Insights

Why is the Direct Sales Segment Dominating the Polyvinyl Chloride (PVC) Market in 2024?

The direct sales segment led the market in 2024. Manufacturers often supply large volumes directly to industrial users, like construction companies or OEMs. This helps build stronger business relationships, ensures consistent quality, and allows for better pricing and customized delivery. Bulk buyers prefer dealing directly with suppliers to avoid third-party markups and delays. In large-scale projects, direct contracts simplify logistics and technical support.

The online and E-commerce platforms segment is expected to grow at the fastest rate in the market during the forecast period, akin to their convenience, transparency, and wider product access. Smaller businesses and buyers in remote areas can easily compare prices, order in flexible quantities, and receive quick deliveries. As digital platforms expand in industrial sectors, more suppliers are setting up B2B online stores for bulk PVC sales. With digital inventory systems and real-time order tracking, online channels offer better customer experience.

Recent Developments

- In April 2025, Prayag Polymers introduced their latest range of PVC pipes. The newly launched pipe series is named PVC-O pipes, as per the report published by the company recently.(Source: www.indianchemicalnews.com)

- In February 2024, Rollepaal established a strategic collaboration with Sintex. The motive of the partnership is to create products with Rollepaal’s pipe extrusion technology, as per the report published by the company recently(Source : www.indianchemicalnews.com)

Top Companies List

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Formosa Plastics Group (Taiwan)

- Westlake Corporation (USA)

- LG Chem Ltd. (South Korea)

- INEOS Group Holdings S.A. (UK)

- Orbia (Mexichem) (Mexico)

- Kem One (France)

- Reliance Industries Limited (India)

- Hanwha Solutions Corporation (South Korea)

- Vinnolit GmbH & Co. KG (Germany – part of Westlake)

- SABIC (Saudi Arabia)

- Xinjiang Zhongtai Chemical Co., Ltd. (China)

- Occidental Petroleum Corporation (OxyChem) (USA)

- Thai Plastic and Chemicals Public Company Ltd. (Thailand – SCG)

- DCW Ltd. (India)

- Braskem (Brazil)

- Petro Rabigh (Saudi Arabia)

- KEMIRA (Europe)

- Ercros S.A. (Spain)

- Tianjin Dagu Chemical Co., Ltd. (China)

Segment Covered

By Type

- Rigid PVC

- Pipes & Fittings

- Profiles & Sections

- Sheets & Films

- Flexible PVC

- Wires & Cables

- Flooring & Wall Coverings

- Medical Tubing

- Chlorinated PVC (CPVC)

- Hot Water Pipes

- Industrial Applications

- Plasticized PVC

- Footwear

- Upholstery

- Unplasticized PVC (uPVC)

- Windows & Doors

- Building Panels

By Polymerization Process

- Suspension Polymerization (S-PVC)

- Emulsion Polymerization (E-PVC)

- Bulk/ Mass Polymerization

- Solution Polymerization

By Additives / Formulation

- Plasticizers (e.g., phthalates, bio-based)

- Stabilizers

- Lead-based

- Calcium-Zinc

- Tin-based

- Fillers (Calcium carbonate, Silica)

- Modifiers (Impact modifiers, Processing aids)

By End-Use Industry

- Building & Construction

- Automotive

- Electrical & Electronics

- Healthcare / Medical

- Packaging

- Footwear

- Consumer Goods

- Agriculture (pipes, greenhouse films)

By Distribution Channel

- Direct Sales

- Distributors / Traders

- Online / E-commerce Platforms

- Retail / Dealer Network

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE