Content

Sustainable Plastics Market Size and Growth 2025 to 2034

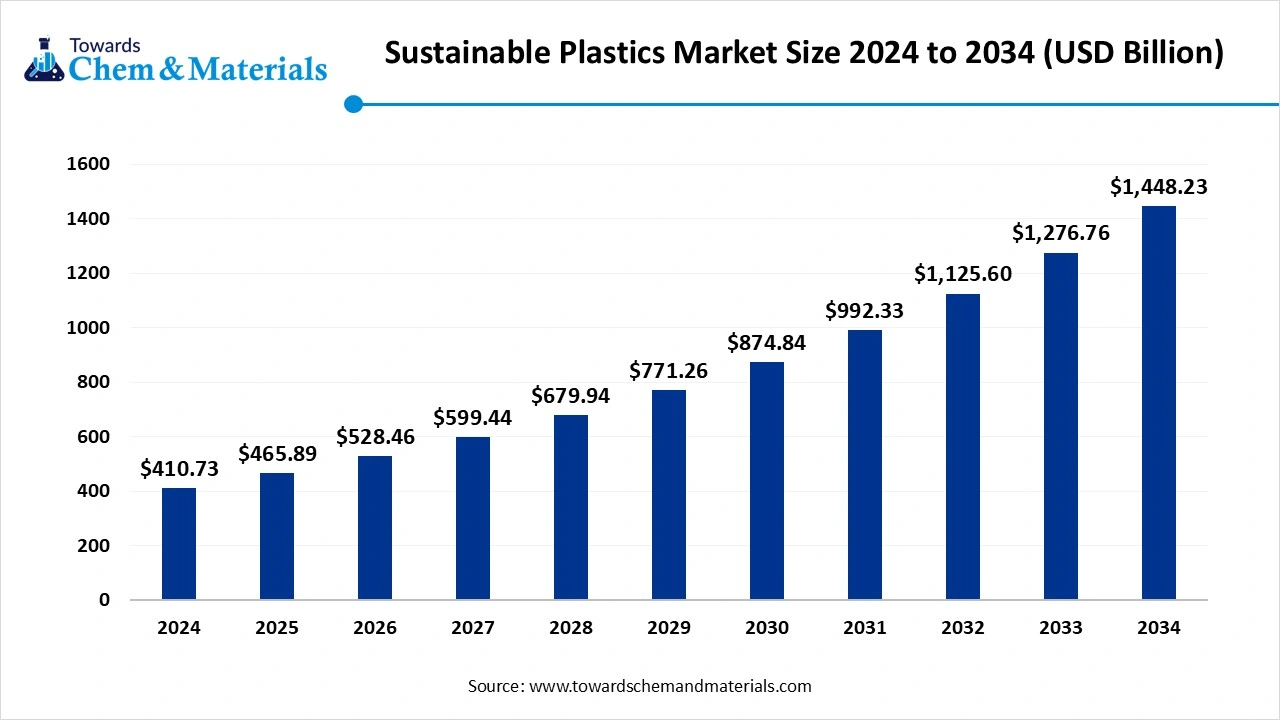

The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034. The growth of the market is driven by the growing environmental awareness and consumer demand for eco-friendly and sustainable alternatives, which fuels the growth of the market.

Key Takeaways

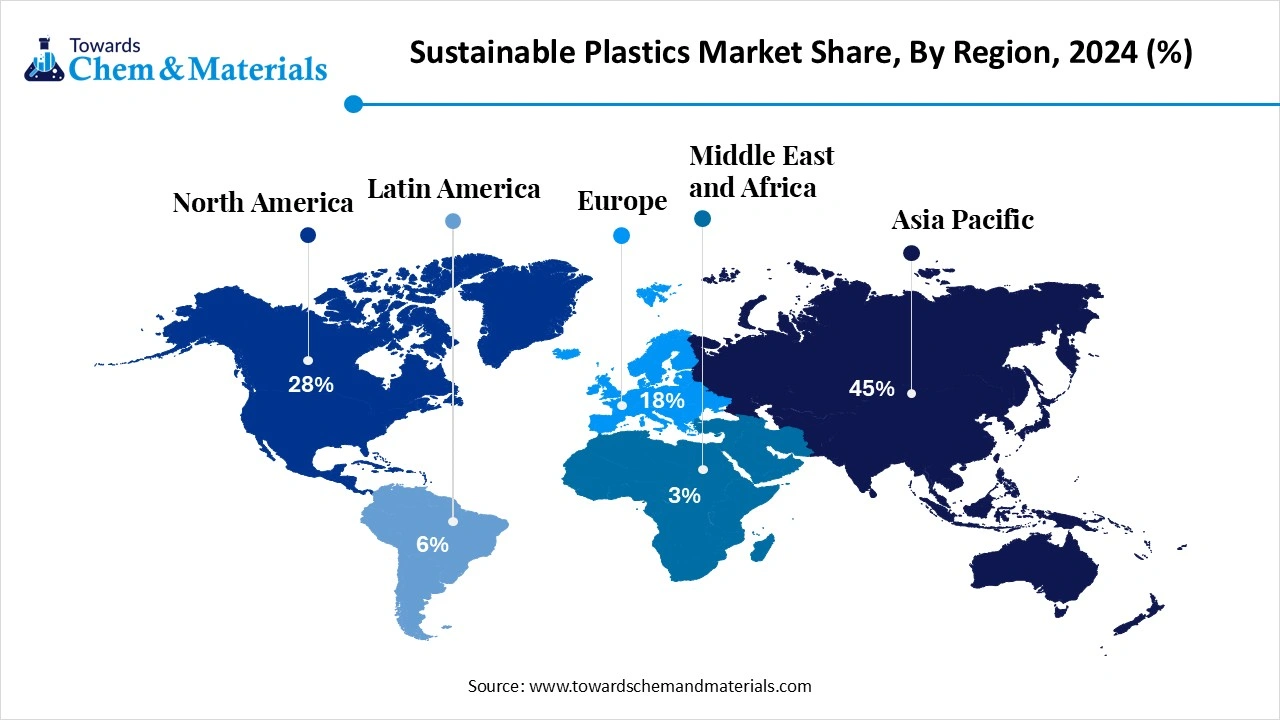

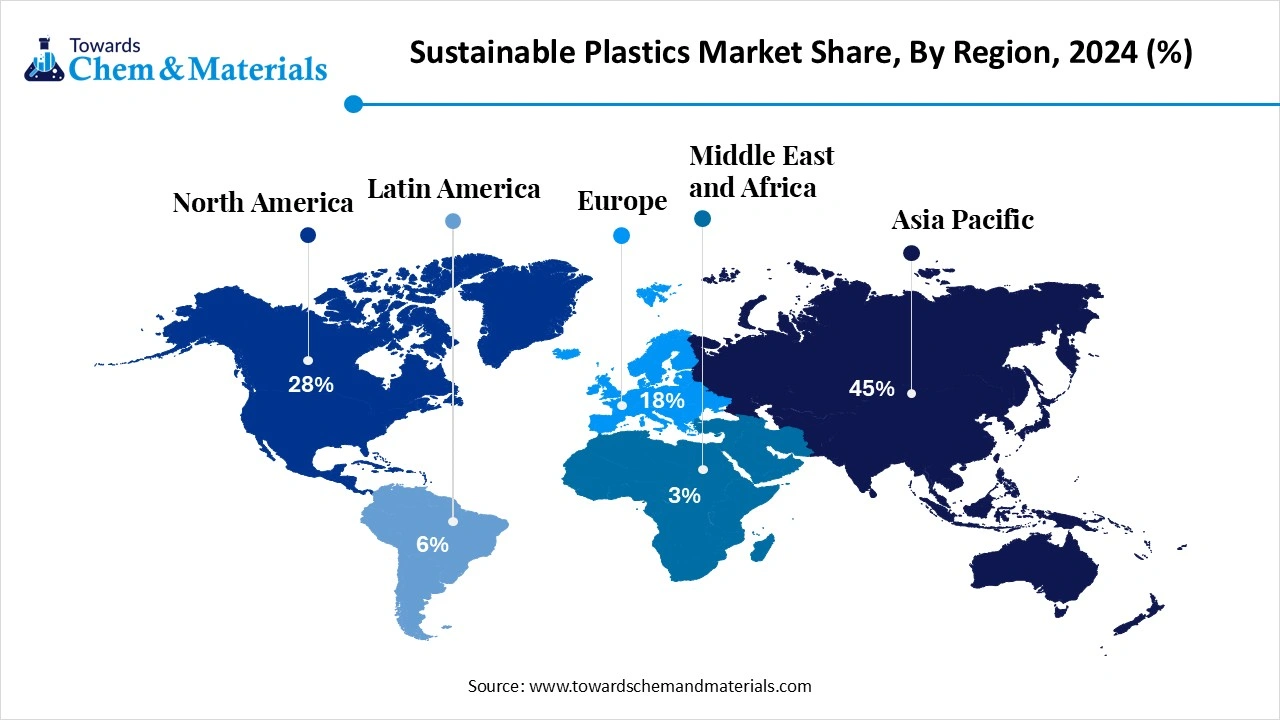

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 45% share in the market in 2024. The growth is driven by the growing demand for the market.

- By region, Europe is expected to have significant growth in the market in the forecast period. Rapid urbanization and industrialization fuel the growth of the market.

- By type, the recycled plastics segment dominated the market in 2024. The recycled plastics segment held approximately 55% share in the market in 2024. Strong government support and rising corporate sustainability commitments fuel the growth.

- By type, the bio-based plastics segment is expected to grow significantly in the market during the forecast period. Technological advancements are improving the durability and cost efficiency of biobased plastics.

- By material, the recycled PET (rPET) segment dominated the market in 2024. The recycled PET (rPET) segment held approximately 40% share in the market in 2024. The demand for rPET is fueled by food and beverage brands, regulatory mandates

- By material, the polyhydroxyalkanoates (PHA) segment is expected to grow in the forecast period. PHAs offer the advantage of complete biodegradability under natural conditions.

- By application, the packaging segment dominated the market in 2024. The packaging segment held approximately 60% share in the market in 2024. Companies are actively integrating sustainable packaging solutions into their portfolios to meet environmental goals

- By application, the automotive & transportation segment is expected to grow in the forecast period. The use of recycled plastics and biobased alternatives helps reduce vehicle weight, improving fuel efficiency and lowering emissions.

- By processing technology, the injection molding segment dominated the market in 2024. The injection molding segment held approximately 45% share in the market in 2024. It is widely used in industries such as packaging, automotive, consumer goods, and healthcare

- By processing technology, the 3D printing segment is expected to grow in the forecast period. The versatility of 3D printing enables prototyping and customized production.

- By end-use industry, the food & beverage segment dominated the market in 2024. The food & beverage segment held approximately 50% share in the market in 2024. Recycled PET has become a preferred choice due to its safety, durability, and compliance with food-grade standards.

- By end-use industry, the healthcare segment is expected to grow in the forecast period. Sustainability initiatives in healthcare supply chains, coupled with the need for high-quality and regulatory-compliant materials, are driving the growth.

Market Overview

Rising Demand For Durable Materials: Sustainable Plastics Market To Expand

The sustainable plastics market refers to plastics that are either bio-based, biodegradable, recycled, or developed through processes aimed at reducing environmental impact, while maintaining the performance characteristics of conventional plastics.

What Are The Key Growth Drivers That Support The Growth Of the Sustainable Plastics Market?

The growth of the market is driven by the growing environmental awareness due to increasing demand for sustainable and eco-friendly products, which drives the growth of the market. Regulatory initiatives to reduce plastic waste and promote the use of sustainable materials increase the adoption of greener solutions, which fuels the growth of the market.

The growing consumer demand for eco-friendly packaging and the shift of industries to invest in sustainable options which driving the growth. The other key drivers that fuel the growth are corporate sustainability goals and technological advancements, like the development of high-performance and eco-friendly plastics further fuel the growth of the market.

Market Trends

- The growing bioplastics growth and adoption of bioplastics products due to sustainability goals fuel the growth of the market.

- The circular economy initiatives with increased emphasis on the use of resources efficiently are a growing trend.

- Demand for sustainable packaging due to growing adoption and consumer shift towards environmental regulations fuels the growth.

- The stringent regulations, like the EU regarding single-use plastics and the adoption of sustainable plastics and recycled materials, drive the growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 465.89 Billion |

| Expected Size by 2034 | USD 1,448.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR 13.43% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Material, By Application, By Processing Technology, By End-Use Industry, Region |

| Key Companies Profiled | BASF SE, NatureWorks LLC , Total Corbion PLA , Braskem S.A. , Novamont S.p.A. , SABIC , Danimer Scientific , Mitsubishi Chemical Group , Biome Bioplastics , FKuR Kunststoff GmbH , Toray Industries, Inc. , Eastman Chemical Company , Indorama Ventures Public Company Limited , Alpla Werke Alwin Lehner GmbH & Co KG , Green Dot Bioplastics , Avantium N.V. , LyondellBasell Industries , Covestro AG , PTT Global Chemical Public Company Limited, (PTTGC) , Plastipak Holdings, Inc. |

Market Opportunity

What Are The Key Growth opportunities that support the Growth Of The Sustainable Plastics Market?

The key growth opportunity that fuels the growth is the innovation in biodegradable and recyclable packaging, and the promotion of sustainable packaging further fuels the growth of the market, creating opportunities for growth. Investments in advanced recycling technologies and the adoption of innovative recycling processes, such as chemical recycling, are creating opportunities. The other major opportunities are emerging markets and product innovation by using biomass-balanced plastics like the SIRIUS 3RV2 circuit breaker, creating opportunities for growth by aligning with the carbon emission reduction goals.

Market Challenge

What are the key challenges that hinder the growth of the Sustainable Plastics Market?

The key challenges that hinder the growth of the market are the high costs and raw material costs due to fluctuation in prices limit the growth of the market, and economic challenges, such as scalability, which limit the competitiveness. The other challenges include poor recycling infrastructure, manufacturing complexity, waste management, lack of awareness, varying regulations, supply chain integration, and environmental impact, balancing performance and carbon footprint. These factors are associated with restricting the growth of the market.

Regional Insights

How Did The Asia Pacific Dominate The Sustainable Plastics Market In 2024?

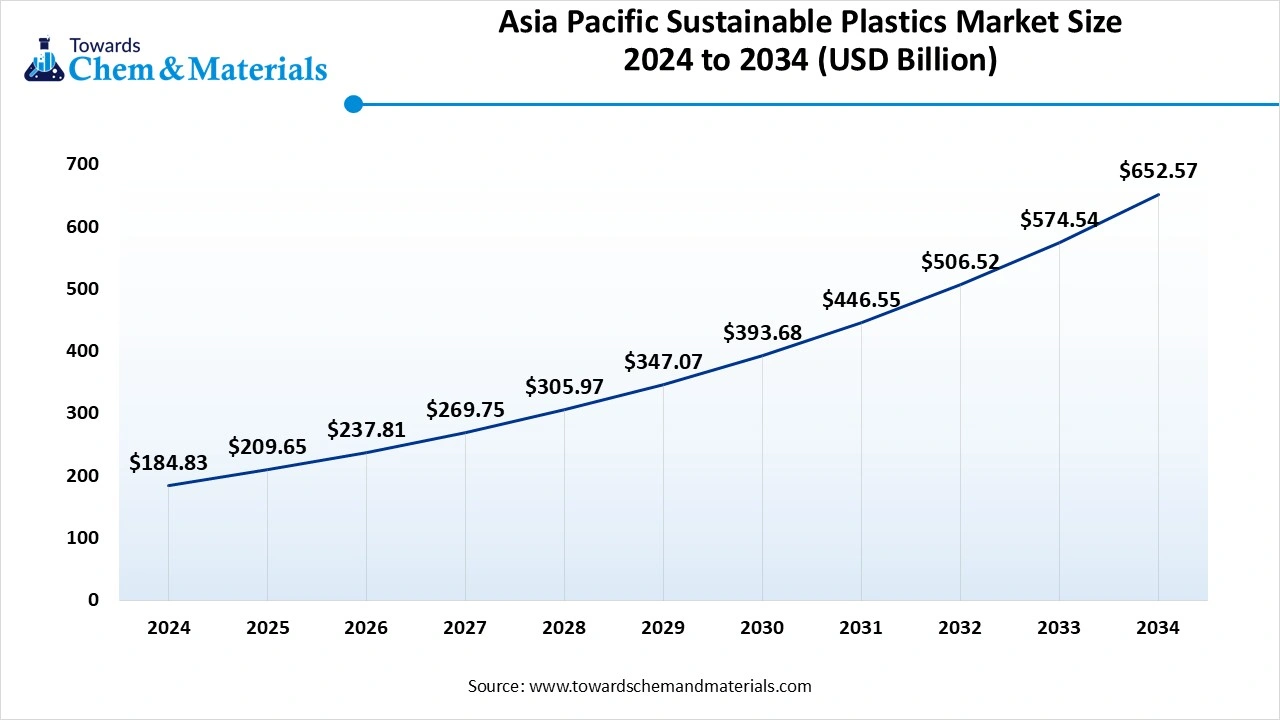

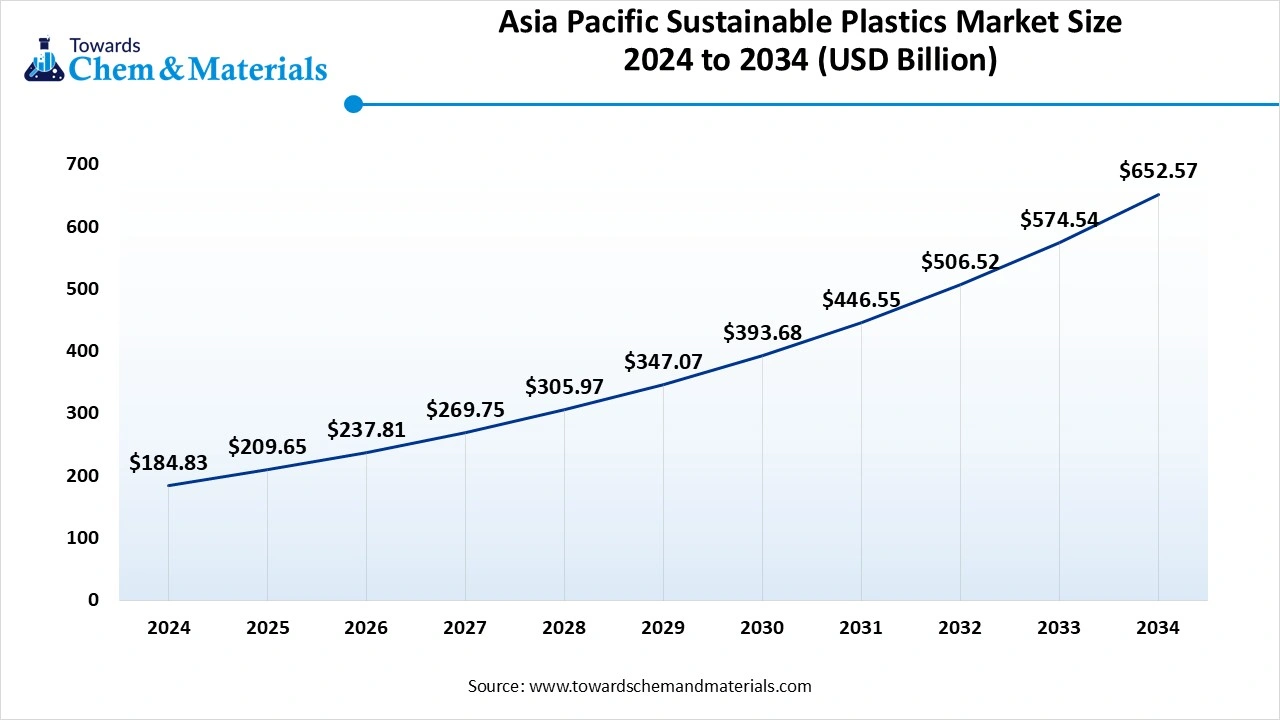

The Asia Pacific sustainable plastics market size was estimated at USD 184.83 billion in 2024 and is anticipated to reach USD 652.57 billion by 2034, growing at a CAGR of 13.45% from 2025 to 2034. Asia Pacific dominated the sustainable plastics market in 2024.

The growth of the market is driven by environmental awareness due to growing consumer preferences and demand for sustainable products further fuels the growth of the market in the region. The other key drivers are the use of bioplastics, recycled plastics for packaging, and the wide use in the food and beverage industry, consumer goods, automotive, and construction, further fueling the growth due to rapid industrialization. The major drivers are the government mandates, urbanization, population growth, and technological advancements fuel the growth and expansion of the market.

India has seen significant growth, the growth is driven by government regulations and commitment to sustainability, circular economy focus, environmental awareness, and technological advancements, which fuel the growth of the market in the country. The use of biodegradable and bioplastics due to the shift of consumer preferences to using sustainable products and materials further fuels the growth. Leading companies like Banyan Nation are specializing in plastic waste recycling to produce high-quality recycled plastic granules, offering sustainable alternatives contributing to the growth and expansion of the market in India.

The Growth Of The Market In Europe Is Driven By The Growing Consumer Preferences.

Europe is expected to experience significant growth in the sustainable plastics market in the forecast period. The growth of the market is driven by the regulatory framework, consumer preferences. A significant portion of European consumers prefer biodegradable or compostable packaging, which influences supply chains and production models and fuels the growth of the market. The other major drivers are circular economy initiatives, technological advancements, which further propel the growth and expansion of the market in the region.

Segmental Insights

Type Insights

Which Type Segment Dominated The Sustainable Plastics Market In 2024?

The recycled plastics segment dominated the market in 2024. Recycled plastics play a crucial role in promoting sustainability by reducing plastic waste and minimizing environmental impact. Derived from post-consumer and post-industrial sources, they are increasingly used in packaging, textiles, and consumer goods. Industries are adopting recycled plastics to meet circular economy goals and regulatory requirements. Continuous improvements in recycling technologies are enhancing material quality, making them suitable for wider applications. With strong government support and rising corporate sustainability commitments, recycled plastics are positioned as a dominant and rapidly growing category in the market.

The bio-based plastics segment expects significant growth in the market during the forecast period. Biobased plastics are gaining traction as an eco-friendly alternative, produced from renewable feedstocks such as corn, sugarcane, and another biomass. These plastics are designed to reduce reliance on fossil fuels while lowering carbon emissions.

They find applications in packaging, agriculture, automotive, and consumer goods, supported by growing awareness of climate change. Technological advancements are improving the durability and cost efficiency of biobased plastics, expanding their adoption. With strong policy support and brand initiatives for green materials, biobased plastics are emerging as a vital contributor to the market.

Material Insights

How did the Recycled PET (rPET) Segment Dominate the Sustainable Plastics Market in 2024?

The recycled PET (rPET) segment dominated the market in 2024. Recycled PET (rPET) is one of the most widely used sustainable materials, particularly in packaging applications such as bottles, containers, and films. It is derived from collected PET waste and reprocessed into high-quality resin suitable for multiple end uses. rPET reduces landfill burden and supports closed-loop recycling models, making it attractive for companies with sustainability targets. The demand for rPET is fueled by food and beverage brands, regulatory mandates, and consumer preference for eco-friendly packaging. Its cost-effectiveness and wide availability further strengthen its position in the market.

The polyhydroxyalkanoates (PHA) segment expects significant growth in the market during the forecast period. Polyhydroxyalkanoates are biobased, biodegradable plastics produced through microbial fermentation of renewable resources. They are increasingly being explored as alternatives to conventional plastics in packaging, agriculture, medical devices, and coatings. PHAs offer the advantage of complete biodegradability under natural conditions, addressing concerns about plastic pollution. Research and development efforts are enhancing their performance properties, such as flexibility and strength. Though production costs remain high, growing interest in sustainable solutions is encouraging investments in PHA technologies, making them one of the most promising materials in the market.

Application Insights

Which Application Segment Dominated The Sustainable Plastics Market In 2024?

The packaging segment dominated the market in 2024. Packaging remains the leading application segment for sustainable plastics, driven by strong consumer demand for eco-friendly alternatives and rising regulatory pressure on single-use plastics. Both recycled and biobased plastics are widely adopted in food, beverage, and e-commerce packaging. Companies are actively integrating sustainable packaging solutions into their portfolios to meet environmental goals. Lightweight, durable, and recyclable properties make sustainable plastics highly suitable for packaging. With global emphasis on reducing plastic waste and improving recyclability, this segment continues to drive large-scale adoption and innovation in the market.

The automotive & transportation segment expects significant growth in the market during the forecast period. The automotive and transportation sector is embracing sustainable plastics for lightweight components, interior parts, and non-structural applications. The use of recycled plastics and biobased alternatives helps reduce vehicle weight, improving fuel efficiency and lowering emissions. EV manufacturers are particularly inclined toward sustainable plastics to align with green mobility goals. Enhanced material strength and durability are enabling greater adoption in demanding automotive applications. As sustainability becomes a key pillar in transportation, the demand for innovative and cost-effective sustainable plastics is expected to accelerate in this segment.

Processing Technology Insights

How did the Processing Technology Segment Dominated The Sustainable Plastics Market in 2024?

The injection molding segment dominated the market in 2024. Injection molding is a dominant processing technology for sustainable plastics, enabling the mass production of high-quality and durable components. It is widely used in industries such as packaging, automotive, consumer goods, and healthcare. Recycled and biobased plastics can be seamlessly adapted to existing injection molding systems, ensuring cost efficiency and scalability. Continuous innovation is improving material compatibility and performance in this process. With its versatility and ability to handle complex designs, injection molding remains a key driver for sustainable plastic adoption across multiple industrial applications.

The 3D printing segment expects significant growth in the market during the forecast period. 3D printing using sustainable plastics is witnessing rapid growth as industries adopt eco-friendly filaments made from recycled and biobased materials. The versatility of 3D printing enables prototyping and customized production across automotive, healthcare, and consumer goods sectors. Recycled PET and polyhydroxyalkanoates are emerging as popular materials for additive manufacturing. This segment is gaining traction due to its reduced material wastage, improved cost-efficiency, and alignment with global sustainability and circular economy goals.

End-Use Industry Insights

Which End Use Segment Dominated The Sustainable Plastics Market In 2024?

The food & beverage segment dominated the market in 2024. In the food and beverage sector, sustainable plastics are extensively utilized for packaging applications such as bottles, containers, and films. Recycled PET has become a preferred choice due to its safety, durability, and compliance with food-grade standards. The industry is shifting towards lightweight, recyclable, and biobased materials to meet consumer demand for eco-friendly packaging. Adoption is further supported by brand commitments, government regulations, and rising awareness about reducing single-use plastic waste.

The healthcare segment expects significant growth in the sustainable plastics market during the forecast period.

The healthcare sector is adopting sustainable plastics to create safe, durable, and eco-conscious medical products and packaging. Applications include syringes, diagnostic devices, and sterile packaging materials. Biobased plastics like polyhydroxyalkanoates and recycled plastics are increasingly integrated to reduce reliance on fossil-based resins. Sustainability initiatives in healthcare supply chains, coupled with the need for high-quality and regulatory-compliant materials, are driving this segment. The trend reflects a balance between patient safety, performance, and environmental responsibility.

Sustainable Plastics Market Value Chain Analysis

Chemical Synthesis and Processing

The sustainable plastics are synthesised and processed through microbial fermentation, enzymatic reactions, and chemical modification.

Quality Testing and Certification

The sustainable plastics require EN 15343, ISO 14001, ISCC (International Sustainability and Carbon Certification), UL ECVP (Environmental Claim Validation Procedure), and APR PCR Certification.

Distribution to Industrial Users

The sustainable plastics are distributed to the packaging, automotive, electronics, and construction industries.

- Key players: Architectural Plastics Inc. and Arkay Plastics Inc.

Recent Developments

- In September 2024, in a major step toward addressing the global plastic waste problem, Australia’s national science agency CSIRO and Murdoch University launched the Bioplastics Innovation Hub. This $8 million initiative is focused on developing fully compostable plastics, aiming to provide a sustainable alternative to conventional plastic. The collaboration brings together researchers, industry experts, and innovators to fast-track the creation and commercialization of environmentally friendly packaging solutions.(Source : www.innovationnewsnetwork.com)

Sustainable Plastics Market Top Companies

- BASF SE

- NatureWorks LLC

- Total Corbion PLA

- Braskem S.A.

- Novamont S.p.A.

- SABIC

- Danimer Scientific

- Mitsubishi Chemical Group

- Biome Bioplastics

- FKuR Kunststoff GmbH

- Toray Industries, Inc.

- Eastman Chemical Company

- Indorama Ventures Public Company Limited

- Alpla Werke Alwin Lehner GmbH & Co KG

- Green Dot Bioplastics

- Avantium N.V.

- LyondellBasell Industries

- Covestro AG

- PTT Global Chemical Public Company Limited (PTTGC)

- Plastipak Holdings, Inc.

Segments Covered

By Type

- Bio-based Plastics

- Biodegradable Plastics

- Recycled Plastics

- Compostable Plastics

- Oxo-degradable Plastics

By Material

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Bio-based Polyethylene (Bio-PE)

- Bio-based Polypropylene (Bio-PP)

- Bio-based Polyethylene Terephthalate (Bio-PET)

- Polybutylene Succinate (PBS)

- Polytrimethylene Terephthalate (PTT)

- Recycled PET (rPET)

- Recycled PE (rPE)

- Recycled PP (rPP)

- Others

By Application

- Packaging

- Flexible Packaging

- Rigid Packaging

- Agriculture

- Mulch Films

- Greenhouse Films

- Others

- Automotive & Transportation

- Interior Components

- Exterior Components

- Under-the-hood Components

- Consumer Goods

- Electronics

- Household Items

- Toys & Personal Products

- Textiles & Fibers

- Apparel

- Industrial Textiles

- Building & Construction

- Pipes & Fittings

- Insulation

- Panels & Sheets

- Medical & Healthcare

- Medical Devices

- Drug Packaging

- Surgical Tools & Accessories

- Industrial Applications

- 3D Printing Filaments

- Industrial Components

By Processing Technology

- Injection Molding

- Blow Molding

- Extrusion

- Thermoforming

- 3D Printing

- Compression Molding

By End-Use Industry

- Food & Beverage

- Agriculture

- Automotive

- Electronics

- Construction

- Healthcare

- Textile & Apparel

- Consumer Goods

- Industrial

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait