Content

Plastic Injection Molding Market Size | Top Companies Analysis

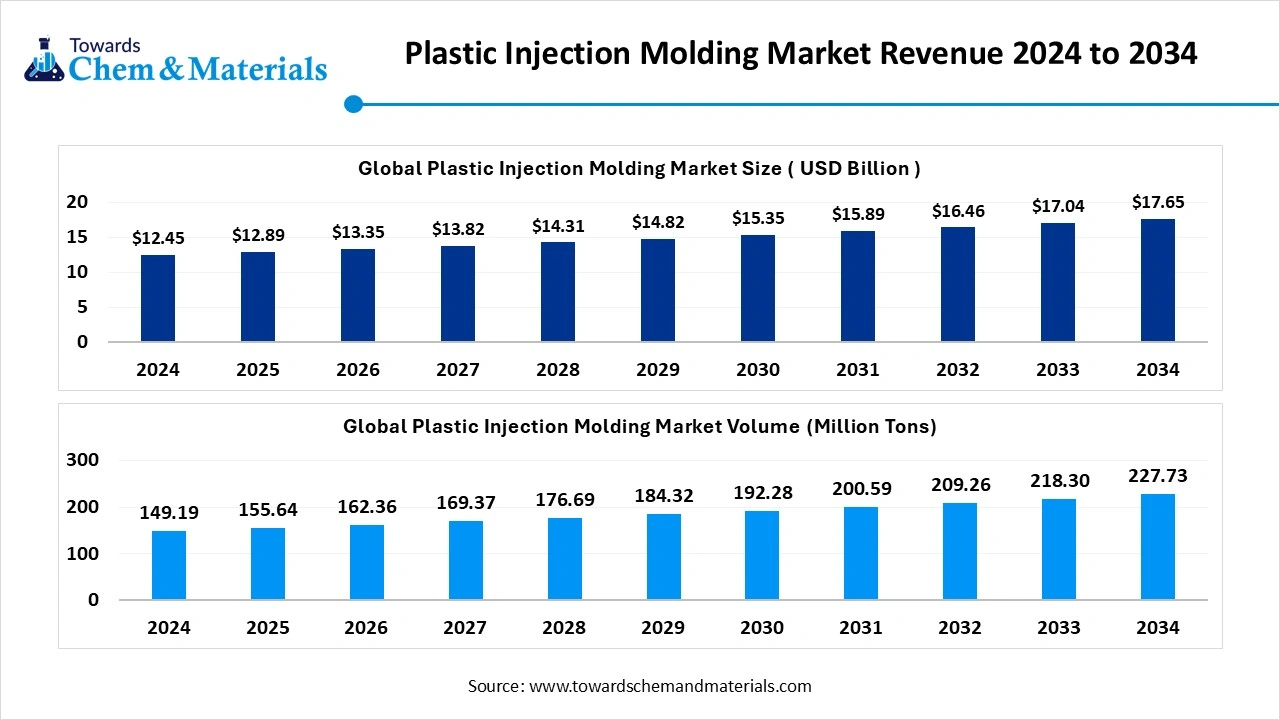

The global plastic injection molding market volume is approximately 155.64 million tons in 2025 and is forecast to reach 227.73 million tons by 2034, growing at a CAGR of 4.32% from 2025 to 2034.

The global plastic injection molding market size accounted for USD 12.45 billion in 2024 and is predicted to increase from USD 12.89 billion in 2025 to approximately USD 17.65 billion by 2034, expanding at a CAGR of 3.55% from 2025 to 2034. The heavy expansion of the packaging and automotive industry is industry is accelerating the market momentum in the current industry environment.

Key Takeaways

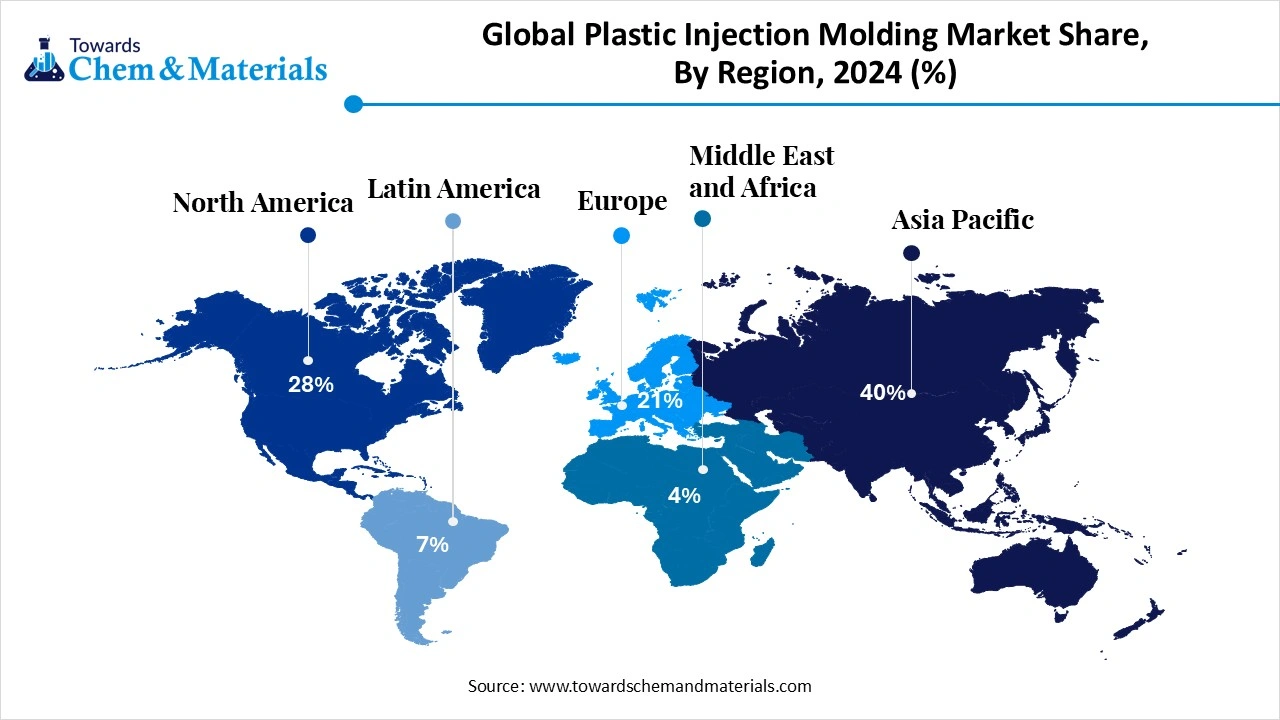

- By region, Asia Pacific dominated the plastic injection molding market in 2024, akin to fast-paced industrialization.

- By region, Europe is anticipated to experience the fastest growth rate during the

- By raw material, the polyethylene segment held the dominating share of the plastic injection molding market in 2024 due to higher adoption in heavy industries.

- By raw material, the polypropylene segment is expected to experience significant market growth in the future, owing to its performance efficiency.

- By application, the packaging segment dominated the market with the largest share in 2024 due to the growing need for durable and lightweight packaging material.

- By application, the automotive & transport segment is expected to grow at the fastest rate in the market during the forecast period, owing to increasing demand for plastic components in vehicle manufacturing.

Smart, Sustainable, Scalable: The Rise of Injection Molding in a Rapidly Evolving Market

The plastic injection molding market is witnessing a fast-paced growth transformation, owing to the growing reliance of multiple industries on precision-engineered plastic components. In the current market environment, the surge in demand for lightweight, durable, and cost-efficient solutions is largely influencing market behavior.

Manufacturers are seen in expanding their operational footprint, blending automation and advanced molding technologies for better production outputs. This shift is notably observable across key sectors such as consumer electronics, healthcare, packaging, and construction, each contributing uniquely to the demand. Furthermore, the increasing shift toward recyclable and biodegradable plastic materials has contributed to the sustainability roadmap, offering both challenges and opportunities for market players in the current period.

The enlarged expansion of the packaging sector is spearheading the industry's growth in recent years. As industries such as food and beverage, personal care, and pharmaceuticals continue to rely on robust and aesthetically appealing packaging, the dependency on injection-molded plastic components has significantly increased.

Manufacturers are actively expanding their capabilities to meet bulk and customized packaging needs, while also adhering to the modern sustainability trend. The flexibility of injection molding allows the shaping of complex designs at high volumes, making it an ideal choice for packaging solutions that demand both function and visual appeal. Moreover, the ongoing boom in e-commerce and direct-to-consumer channels has contributed heavily to the growth of the plastic injection

Market Trends

- In recent years, there has been a significant transformation in consumer and regulatory expectations towards sustainability, which is reshaping the plastic injection molding industry. Manufacturers are increasingly shifting towards incorporating biodegradable and recyclable polymers into their production lines. This trend is driven by governmental regulations, public awareness campaigns, and the evolving preferences of eco-friendly brands.

- As the plastic injection molding market is seen as undergoing a phase of robust technological transformation, manufacturers are increasingly implementing automation and smart manufacturing technologies to stay relevant in a competitive global market environment.

- The medical and healthcare industry is driving the plastic injection molding sector. As the increasing global demand for precision-manufactured components in medical devices and equipment. The ongoing innovations in minimally invasive surgical tools, diagnostics, and drug delivery systems are expanding the need for intricate plastic components produced with high accuracy and hygiene standards. Also, the manufacturers are responding to this demand by adopting medical-grade polymers and injection molding capabilities.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 12.89 Billion |

| Expected Size by 2034 | USD 17.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Raw Material, By Application, By Region |

| Key Companies Profiled | ALPLA, BERICAP, Berry Global Inc., EVCO Plastics, HTI Plastics, IAC Group, Amcor PLC, AptarGroup Inc. (CSP Technologies), Magna International, Quantum Plastics, Silgan Holdings Inc, The Rodon Group |

Market Opportunity

From Petro to Plant-Based: Injection Molding Goes Green

Amid the rapid push towards environmentally sustainable solutions, the rising demand for biodegradable and bio-based plastics is expected to create significant opportunities for plastic injection molding market. Industries are actively shifting towards eco-friendly alternatives, encouraging producers to re-engineer traditional production practices to accommodate bioplastics like PLA and PHA. This shift is not just a response to regulatory pressures but also an evolving consumer mindset favoring green-packaged products.

Market Challenge

Smarter Machines, Low Skills: The Workforce Challenge in Injection Molding

As the injection molding industry progresses toward automation and digital integration, the lack of skilled personnel is expected to hamper growth of the market during the forecast period. With technologies like IoT-enabled machines, real-time monitoring systems, and AI-driven quality control gradually becoming the new normal, there’s an urgent need for a workforce equipped with advanced technical expertise. However, the sector is increasingly observed to face skill shortages, especially in areas requiring programming, robotics, and precision engineering knowledge, creating a technological gap that delays productivity.

Regional Insights

Asia Pacific Plastic Injection Molding Market Size, Industry Report 2034

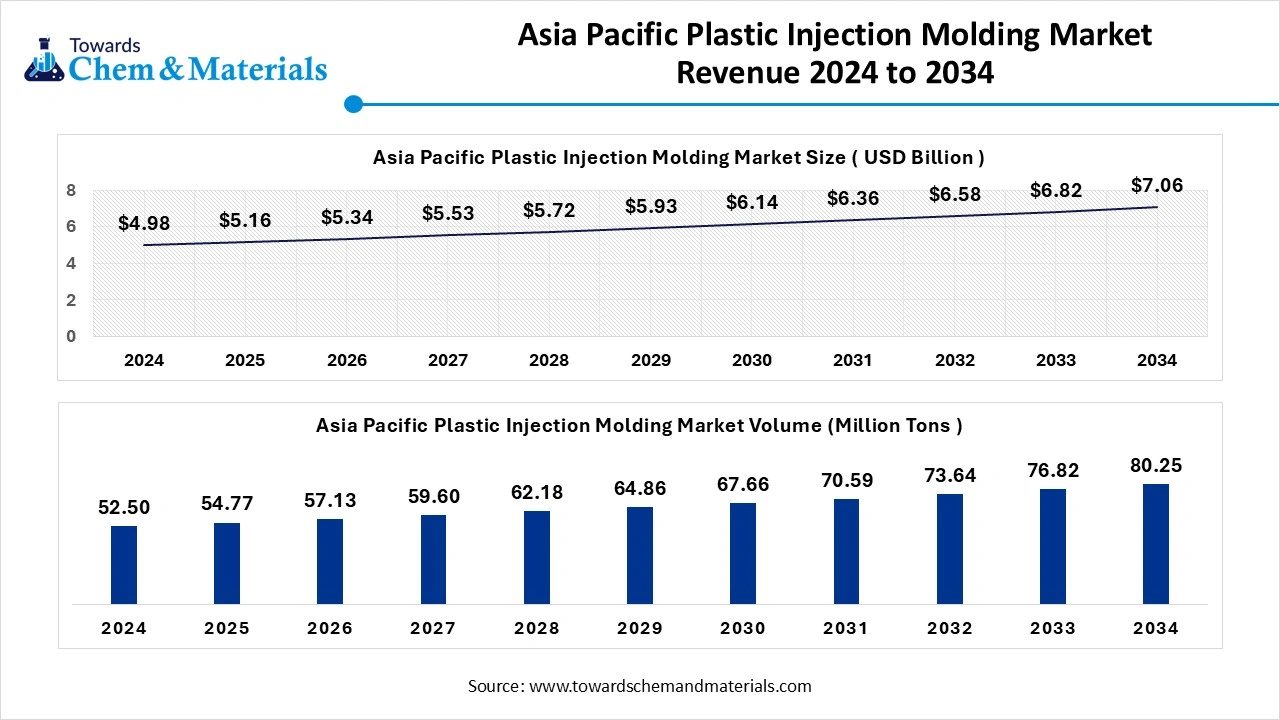

The Asia Pacific plastic injection molding market volume is expected to produce approximately 54.77 million tons in 2025, with a forecasted increase to 80.25 million tons by 2034, growing at a CAGR of 4.34% from 2025 to 2034.

The asia pacific plastic injection molding market size was estimated at USD 4.98 billion in 2024 and is projected to reach USD 7.06 billion by 2034, growing at a CAGR of 6.82% from 2025 to 2034. The Asia Pacific dominated the plastic injection molding market in 2024.

The region is driven by fast-paced industrialization and rapid urban expansion across emerging economies. Countries like India, Japan, South Korea, and Southeast Asian nations are actively channeling their focus towards manufacturing excellence, akin to favorable government initiatives and lower production costs. Moreover, the region’s increasing population, growing consumer demand, and surge in middle-class income levels are creating solid, lucrative opportunities for plastic product applications in packaging, automotive, electronics, and healthcare.

- Additionally, the skilled labor force and availability of raw materials at lower rates are amplifying the production capabilities of manufacturers across the region. As sustainability becomes a key focus, Asia-Pacific is gradually shifting towards recyclable and biodegradable plastics following global sustainability trends.

From Raw Materials to High-Tech Molds: China’s Manufacturing Power

China has maintained its dominance in the Asia Pacific region for the past period. The country is considered a global production powerhouse, where injection molding has become increasingly integrated into automotive, electronics, consumer goods, and medical manufacturing.

The producers are not only expanding production capacities but also embedding cutting-edge technologies such as automation, precision tooling, and AI-driven molding processes to boost efficiency and reduce wastage. Additionally, the government’s strong push for industrial upgrades through initiatives like “Made in China 2025” is driving technological innovation across plastic processing sectors. Furthermore, China's continued dominance in raw material production, specifically.

Europe is expected to grow at the fastest pace in the plastic injection molding market during the coming period.

The growth of the market is attributed in the market due to the rising investment in the industrialization in the regional countries like the United Kingdom, Germany, and France. The growing emphasis on the advance material and technologies into the industrial application accelerates the demand for the market. The well availability of the automotive industry in the

Segmental Insights

Raw Material Insights

The polyethylene segment held the dominating share of the plastic injection molding market in 2024. In recent times, industries such as packaging, automotive, and consumer goods have significantly adopted polyethylene-based components to enhance functionality while maintaining cost-efficiency. This increased demand has encouraged producers to expand their production capabilities and optimize the material for advanced molding processes.

Additionally, the rise in sustainable initiatives has led to a growing shift toward recyclable and eco-friendly materials, where polyethylene plays a key role due to its reusability and environmental adaptability. Moreover, manufacturers are continuously exploring new grades of polyethylene to meet evolving product requirements, especially in sectors with high performance expectations.

The polypropylene segment is expected to experience significant plastic injection molding market growth in the future. The segment growth is attributed to its widespread adaptability and performance efficiency across various industries. In the current landscape, manufacturers are increasingly opting for polypropylene due to its lightweight nature, excellent chemical resistance, and cost-effectiveness, which suits the dynamic demand of mass production. The automotive sector, which is significantly expanding, is a major contributor polypropylene is being utilized for dashboards, bumpers, and interior trims, driven by the need for fuel efficiency and lightweight vehicles. As industries continue to shift towards efficient, versatile, and eco-compatible solutions, the polypropylene segment is emerging as a key raw material, anchoring its lead in the injection molding market.

Applications Insights

The packaging segment dominated the plastic injection molding market with the largest share in 2024. The growing need for durable, lightweight, and cost-effective packaging solutions is contributing to the segment's growth in the current period. Companies want packaging that’s lightweight, strong, and cost-effective, exactly what plastic injection molding provides. This method allows fast and large-scale production of packaging items like bottles, caps, containers, and wrappers. It also helps in making packaging in different shapes and sizes, which is important for branding and product safety.

Additionally, with people shopping more online, the need for safe and durable packaging has grown even more. Many businesses are also switching to eco-friendly plastics, and injection molding works well with these materials, too. So overall, the speed, flexibility, and cost-effectiveness of plastic injection molding make it the top choice for packaging, pushing this segment to lead the market.

The automotive and transportation segment are expected to grow at the fastest rate in the market during the forecast period. In recent years, vehicle manufacturers have steadily incorporated plastic components for applications such as dashboards, bumpers, lighting systems, and under-the-hood parts. This sudden shift is highly influenced by the growing need for lightweight materials to improve fuel efficiency and reduce emissions, aligning with the global shift toward sustainability.

Moreover, as the electric vehicle (EV) movement gains momentum, there’s an increasing need for durable, heat-resistant, and customizable plastic parts that can be produced efficiently and at high volumes. Manufacturers are also seen expanding production capabilities and adopting advanced molding technologies to meet evolving design complexities and safety standards. Simultaneously, sectors like aerospace and railway transport are further amplifying demand for high-

Recent Developments

- Milacron Product Launch : In 2024, Milacron introduced its latest injection molding machine line. The machine belongs to the M series, and it has a large clamp stroke. Also, the machine is known as a compact footprint machine.

- Milacron Product Launch: In 2024, Milacron unveiled its all-electric injection molding machine, the eQ180, at Fakuma 2024. The machine uses Mon sandwich technology to produce multi-layer parts efficiently. It supports sustainable manufacturing by utilizing post-consumer recyclable (PCR) materials.

- Nurel Product Launch: In 2024, NUREL launched a new division called NUREL Injection Solutions, focused on eco-friendly injection molding. This division will design and produce components using compostable, biodegradable, and water-soluble plastics. It marks a strong step toward sustainability and innovation in short-lived plastic products.

Top Companies list

- ALPLA

- BERICAP

- Berry Global Inc.

- EVCO Plastics

- HTI Plastics

- IAC Group

- Amcor PLC

- AptarGroup Inc. (CSP Technologies)

- Magna International

- Quantum Plastics

- Silgan Holdings Inc

- The Rodon Group

Segment covered

By Raw Material

- Polypropylene

- Acrylonitrile Butadiene Styrene (ABS)

- Polystyrene

- Polyethylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Polyamide

- AcrylonitrileButadieneStyrene

- High Density Polyethylene

- Other Raw Materials

By Application

- Packaging

- Building and Construction

- Consumer Goods

- Electronics

- Automotive and Transportation

- Healthcare

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait