Content

What is the Current Bioplastic Textiles Market Size and Volume?

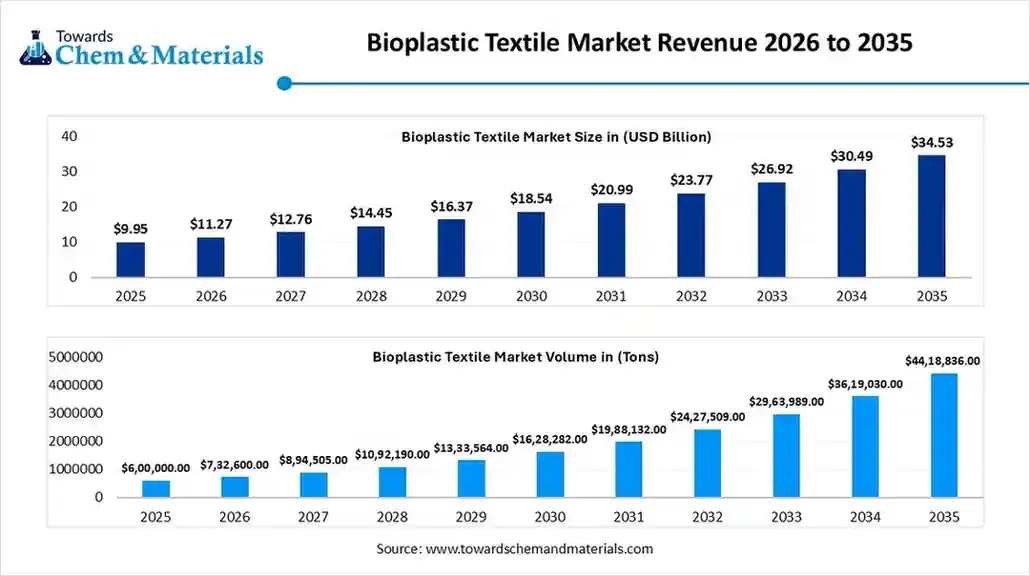

The global bioplastic textiles market size was estimated at USD 9.95 billion in 2025 and is predicted to increase from USD 11.27 billion in 2026 and is projected to reach around USD 34.53 billion by 2035, The market is expanding at a CAGR of 13.25% between 2026 and 2035.

The global bioplastic textiles market volume was approximately 600,000 tons in 2025 and is projected to reach approximately 4,418,836 tons by 2035 growing at a CAGR of 22.10% from 2026 to 2035. Asia Pacific dominated the bioplastic textiles market with a market volume share of 45% the global market in 2025. The market's growth is driven by consumer demand for sustainable materials, environmental concerns, and supportive regulations.

Key Takeaways

- By region, Asia Pacific dominated the market with a volume share of approximately 45% in 2025. The sustainability initiatives and support drive growth.

- By region, Europe is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The growth of the market is driven by growing awareness.

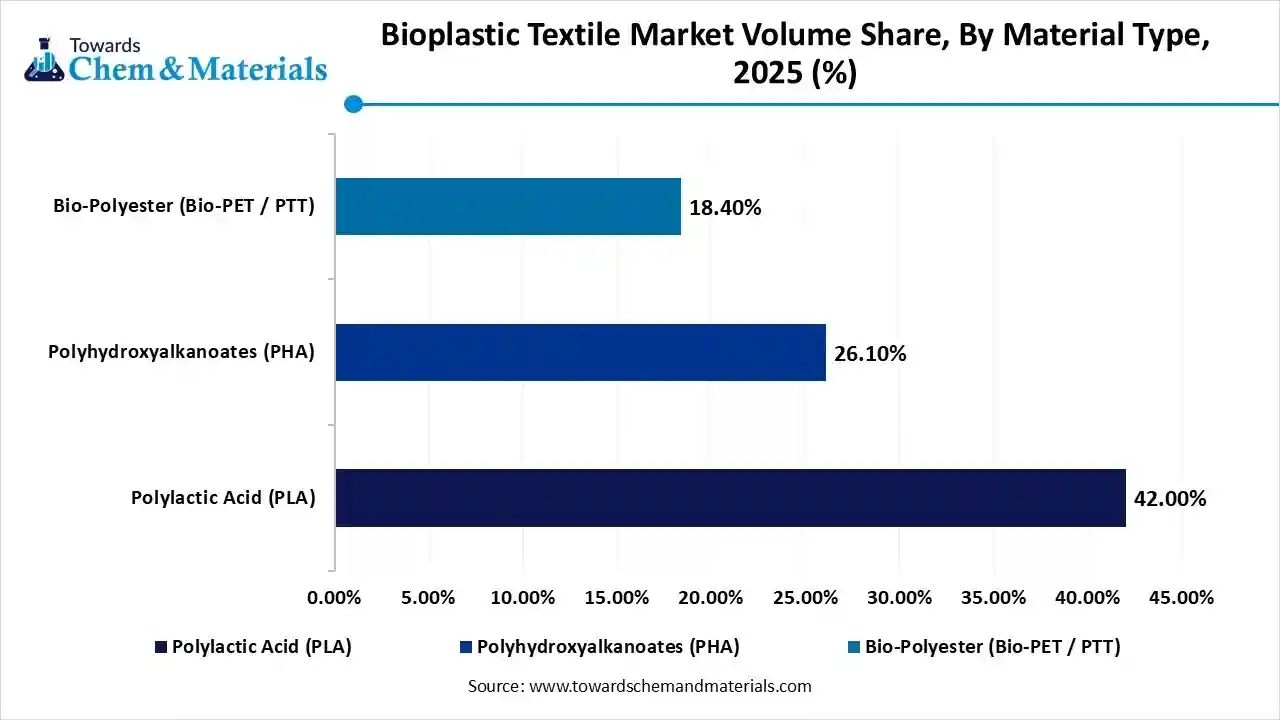

- By material type, the polylactic acid (PLA) segment dominated the market with a volume share of approximately 42% in 2025. biodegradability, good tensile strength, and increases the demand for the market.

- By material type, the polyhydroxyalkanoates (PHA) segment is projected to grow at a CAGR between 2026 and 2035. increasingly explored for specialty textile applications, including medical sutures and eco-luxury fashion.

- By feedstock source, the first-generation (1g) crops segment dominated the market with a volume share of approximately 58% in 2025. dominant due to established supply chains and cost-efficient fermentation processes.

- By feedstock source, the second generation (2g) / waste segment is projected to grow at a CAGR between 2026 and 2035. increasingly preferred for sustainability reasons.

- By process/technology, the melt spinning & extrusion segment dominated the market with a volume share of approximately 46% in 2025. These processes enable scalable production of bio-based fibers with controlled mechanical properties.

- By process/technology, the biochemical conversion segment is projected to grow at a CAGR between 2026 and 2035. Adoption is expanding in high-value textile applications.

- By end-use application, the apparel & fashion segment dominated the market with a volume share of approximately 47% in 2025. Regulatory pressure, circular fashion initiatives are accelerating growth.

- By end-use application, the medical & healthcare segment is projected to grow at a CAGR between 2026 and 2035. Their biocompatibility, biodegradability, and reduced risk of toxic residues make them suitable for disposable medical textiles.

Market Overview

What Is The Significance Of The Bioplastic Textiles Market?

The significance of the bioplastic textiles market lies in its role as a sustainable solution to the textile industry's environmental footprint, driven by consumer demand for eco-friendly products, regulations promoting green practices, and innovations creating biodegradable materials from renewable sources like corn starch. It's crucial for shifting away from petroleum-based fabrics, reducing plastic waste, fostering circular economies, and offering healthier, non-toxic alternatives for apparel, automotive, and home goods, with strong growth projected globally, especially in Europe and North America.

Bioplastic Textiles Market Growth Trends:

- Environmental Awareness: Growing consumer and industry concern over synthetic fiber pollution.

- Regulatory Support: Favorable government policies promoting biodegradable and bio-based materials.

- Fossil Fuel Dependency: Desire to reduce reliance on petroleum-based products.

- Innovation: Advances in material science and processing techniques.

- Performance Enhancement: Bio-polymer coatings and nanotechnology to improve strength and functionality.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 11.27 Billion / 732,600 Tons |

| Revenue Forecast in 2035 | USD 34.53 Billion / 4,418,836 Tons |

| Growth Rate | CAGR 13.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Feedstock Source, By Process/Technology, By End-Use Application, By Regions |

| Key companies profiled | Toray Industries, Inc. (Japan), Far Eastern New Century Corporation (Taiwan), Hyosung TNC (South Korea), Indorama Ventures (Thailand), DuPont (USA), NatureWorks LLC (USA), BASF SE , TotalEnergies Corbion , Braskem , Teijin Limited , Danimer Scientific , Novamont S.p.A. , Mitsubishi Chemical Group , Lenzing AG , Avantium N.V. , Bolt Threads , Spinnova Oyj , Evonik Industries |

Key Technological Shifts In The Bioplastic Textiles Market:

Key shifts in bioplastic textiles involve advanced bio-engineering for materials like spider silk protein, using renewable feedstocks, nanotechnology for strength, AI/3D printing for customized designs, circular economy focus, and eco-friendly processes to boost performance, sustainability, and market adoption against traditional materials.

Trade Analysis Of Bioplastic Textiles Market: Import & Export Statistics

- According to Global Export data, the world exported 1,010 shipments of biodegradable plastic. 292 exporters conducted these exports to 291 buyers.

- The majority of global biodegradable plastic exports are destined for the United States, Vietnam, and Colombia.

- The leading exporters of biodegradable plastic worldwide are China, Vietnam, and Italy. China dominates the global market with 650 shipments, followed by Vietnam with 112 shipments, and Italy ranking third with 59 shipments.

- According to India export data, India exported 35 shipments of biodegradable plastic. These exports handled by 5 Indian exporters to 4 buyers.

The primary destinations for Indian biodegradable plastic exports are Thailand, Vietnam, and the United States.

- Globally, the top three exporters are China, Vietnam, and Italy, with China leading at 650 shipments, followed by Vietnam with 112 shipments, and Italy with 59 shipments.

Bioplastic Textiles Market Value Chain Analysis

- Material Development and Processing: Bio-plastic textiles are produced using bio-based polymers such as PLA, PHA, bio-PET, and starch-based polymers through processes including bio-polymer synthesis, melt or solution spinning, fiber extrusion, drawing, weaving/knitting, and textile finishing. These materials are designed to reduce fossil-fuel dependency and improve sustainability in textile applications.

- Key players: NatureWorks LLC, BASF SE, DuPont, Toray Industries Inc.

- Quality Testing and Certification:Bio-plastic textiles require certifications related to bio-based content, biodegradability, compostability, textile safety, and environmental compliance. Key certifications include USDA BioPreferred, OEKO-TEX® Standard 100, Global Recycled Standard (GRS), ISO textile standards, and ASTM biodegradability testing.

- Key players: USDA BioPreferred Program, OEKO-TEX® Association, ISO (International Organization for Standardization), ASTM International, TÜV Austria.

- Distribution to Industrial Users:Bio-plastic textiles are distributed to apparel manufacturers, sustainable fashion brands, home textile producers, automotive interior suppliers, and technical textile manufacturers focused on eco-friendly materials.

- Key players: Teijin Limited, Far Eastern New Century, Hyosung Corporation.

Bioplastic Textiles Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. EPA; OSHA; FDA; Environment and Climate Change Canada (ECCC) | EPA Toxic Substances Control Act (TSCA) FDA 21 CFR (for bio-textile food contact) OSHA Hazard Communication Standard (HCS) Canada Environmental Protection Act (CEPA) |

Chemical safety and registration Worker safety and hazard communication Regulatory compliance for food-contact bio-textiles |

PLA/PHAs and bio-based textile additives must comply with TSCA/CEPA chemical inventories; FDA rules apply for bio-textiles intended for food contact. |

| Europe | European Commission; ECHA; European Committee for Standardization (CEN) | REACH Regulation CLP Regulation EU Textile Regulation (1007/2011)EU Green Deal / Circular Economy Action Plan |

Chemical safety and hazard communication Biodegradability/compostability criteriaProduct labeling and traceability |

REACH/CLP affects monomers and additives used in bioplastic fibers. EU textile rules require precise fiber content labeling; green policies drive demand for biodegradable alternatives. |

| Asia Pacific | China MEE; Japan METI/MOE; India MoEFCC & BIS; South Korea MoE/KATS | China GB Standards for biodegradable plastics (e.g., GB/T 41010) Japan BiomassPla and JIS textile standards India Plastic Waste Management (PWM) Rules Korea K-REACH (chemical registration) |

Standardization of biodegradable bio-textiles Chemical safety and environmental compliance Labeling and eco-certification |

China and Japan have national standards for biodegradable polymers; India’s PWM rules include EPR (Extended Producer Responsibility), impacting bioplastic textiles. K-REACH requires registration of chemicals in textile coatings and finishes. |

| South America | Brazil INMETRO; CONAMA; Mexico SEMARNAT/PROFEPA | ABNT Standards (Brazil) National Solid Waste Policy (Brazil) NOM Standards (Mexico) |

Product safety and labeling Waste management of textile products Import/export compliance |

Growing traction for bio-textiles due to plastic waste laws. INMETRO certification supports sustainable textile claims; waste disposal regs impact end-of-life bio-fabrics. |

| Middle East & Africa | GCC Standardization Organization (GSO); Saudi SASO; UAE MOCCAE; South African DFFE | GSO/SASO quality & labeling standards National environmental & waste laws |

Material quality and conformity Environmental protection Emerging bio-textile sustainability initiatives |

Regulatory frameworks are emerging; focus is largely on import conformity, quality standards, and aligning with international norms for sustainable textiles. |

Segmental Insights

Material Type Insights

Which Material Type Segment Dominates The Bioplastic Textiles Market In 2025?

The polylactic acid (PLA) segment dominated the market with a share of approximately 42% in 2025. PLA-based bio-plastic textiles hold a significant share due to their biodegradability, good tensile strength, and compatibility with conventional textile processing equipment. Derived primarily from fermented plant sugars, PLA fibers are widely used in apparel, nonwoven fabrics, and medical textiles. Growing sustainability mandates and consumer preference for eco-friendly clothing continue to drive adoption.

The polyhydroxyalkanoates (PHA) segment is projected to grow at a CAGR between 2026 and 2035 in the bioplastic textiles market. PHA-based textiles are gaining traction owing to their superior biodegradability, marine-safe disposal characteristics, and flexible material properties. Produced through microbial fermentation, PHAs are increasingly explored for specialty textile applications, including medical sutures and eco-luxury fashion. Higher production costs currently limit mass adoption, but ongoing technological advancements are improving scalability.

Feedstock Source Insights

How Did The First Generation Crops Segment Dominates The Bioplastic Textiles Market In 2025?

The first-generation (1g) crops segment dominated the market with a share of approximately 58% in 2025. First-generation crop feedstocks such as corn, sugarcane, and sugar beet remain dominant due to established supply chains and cost-efficient fermentation processes. These feedstocks enable consistent quality and large-scale production of bio-polymers like PLA. However, concerns over food-versus-fuel competition are encouraging gradual diversification toward alternative feedstocks.

The second generation (2g) / waste segment is projected to grow at a CAGR between 2026 and 2035 in the bioplastic textiles market. Second-generation feedstocks, including agricultural residues, food waste, and industrial by-products, are increasingly preferred for sustainability reasons. These sources reduce dependency on food crops and lower the overall carbon footprint of bio-plastic textiles. Advancements in biochemical conversion technologies are improving yield efficiency, supporting long-term adoption across textile manufacturers.

Process/Technology Insights

Which Process/Technology Segment Dominates The Bioplastic Textiles Market In 2025?

The melt spinning & extrusion segment dominated the market with a share of approximately 46% in 2025. Melt spinning and extrusion dominate bio-plastic textile manufacturing due to compatibility with existing synthetic fiber infrastructure. These processes enable scalable production of bio-based fibers with controlled mechanical properties. PLA fibers produced through melt spinning are widely used in apparel and technical textiles, benefiting from process efficiency and cost advantages.

The biochemical conversion segment is projected to grow at a CAGR between 2026 and 2035 in the market. Biochemical conversion processes involve microbial fermentation and enzymatic pathways to produce biopolymers from renewable feedstocks. While offering superior sustainability credentials, these methods involve higher capital investment and technical complexity. Adoption is expanding in high-value textile applications where biodegradability, performance customization, and regulatory compliance are critical differentiators.

End-Use Application Insights

How Did the Apparel And Fashion Segment Dominates The Bioplastic Textiles Market In 2025?

The apparel & fashion segment dominated the market with a share of approximately 47% in 2025. The apparel and fashion segment is a major growth driver for bio-plastic textiles, supported by sustainability-focused brands and eco-conscious consumers. Bio-based fibers are majorly used in casual clothing, sportswear, and luxury fashion collections. Regulatory pressure, circular fashion initiatives, and brand commitments to carbon neutrality are accelerating market penetration.

The medical & healthcare segment is projected to grow at a CAGR between 2026 and 2035 in the bioplastic textiles market. Bio-plastic textiles are increasingly utilized in medical and healthcare applications such as surgical gowns, wound dressings, sutures, and hygiene products. Their biocompatibility, biodegradability, and reduced risk of toxic residues make them suitable for disposable medical textiles. Rising healthcare waste concerns and stringent environmental regulations further support adoption.

Regional Insights

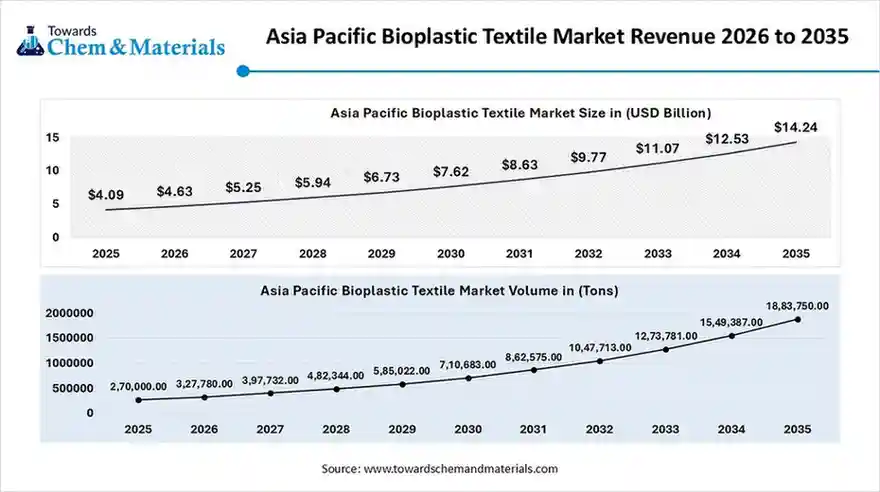

The Asia Pacific bioplastic textiles market size was valued at USD 4.09 billion in 2025 and is expected to reach USD 14.24 billion by 2035, growing at a CAGR of 13.29% from 2026 to 2035. Asia Pacific dominates the market with a share of approximately 45% in 2025.

The Asia Pacific bioplastic textiles market volume was estimated at 270,000 tons in 2025 and is anticipated to reach 1,883,750 tons by 2035, growing at a CAGR of 24.09% from 2026 to 2035.

The growth is supported by large textile manufacturing bases, cost-effective production, and increasing environmental awareness. Governments and manufacturers are gradually shifting toward bio-plastic fibers to address pollution concerns, while exports of sustainable textiles are rising in response to global brand sourcing requirements.

China: Bioplastic Textiles Market Growth Trends

China dominates regional production, leveraging its massive textile manufacturing capacity and expanding bio-polymer supply chains. The country is increasingly integrating PLA, bio-PET, and recycled bio-based fibers into apparel, home textiles, and industrial fabrics, supported by government sustainability initiatives and growing demand from international fashion brands.

Europe Bioplastic Textiles Market is Driven By the Circular Economy

Europe is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Europe is a leader in bioplastic textiles due to strict environmental regulations, circular economy policies, and strong adoption of sustainable materials across fashion and industrial textiles. Government incentives, eco-labeling standards, and growing demand for biodegradable and compostable fibers are accelerating the transition from conventional synthetic textiles to bio-based alternatives.

Germany: Bioplastic Textiles Market Growth Trends

Germany plays a key role in Europe’s market, driven by advanced textile engineering, automotive textile demand, and sustainability-focused manufacturing. Strong R&D capabilities, regulatory compliance, and industrial use of bio-based technical textiles in mobility, upholstery, and functional clothing continue to support steady market expansion.

North America's Growth in The Market Is Driven By the Growing Innovation

North America represents a mature and innovation-driven market for bio-plastic textiles, supported by strong sustainability mandates, advanced textile R&D, and rising demand for eco-friendly apparel and industrial fabrics. Brands are increasingly adopting bio-based fibers to meet ESG targets, while investments in circular textiles, recycling infrastructure, and bio-polymer innovation continue to strengthen regional market penetration.

United States: Bioplastic Textiles Market Growth Trends

The U.S. market is driven by strong consumer awareness, corporate sustainability commitments, and innovation in bio-polymer fibers such as PLA and bio-PET. Adoption is prominent in apparel, sportswear, and technical textiles, supported by collaborations between textile manufacturers, material science firms, and fashion brands focusing on low-carbon and recyclable textile solutions.

South America: Bioplastic Textiles Market is Driven By the Growing Adoption

South America is an emerging market for bio-plastic textiles, driven by abundant bio-based feedstock availability and growing sustainability awareness. The region is witnessing gradual adoption in apparel and industrial textiles, supported by local bio-polymer development and increasing exports of eco-friendly textile products.

Bioplastic Textile Market Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Tons)2025 | Market Volume (Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 19.00% | 114,000.0 | 874,045.8 | 25.40% | 19.78% |

| Europe | 29.00% | 174,000.0 | 1,336,256.0 | 25.42% | 30.24% |

| Asia Pacific | 45.00% | 270,000.0 | 1,883,749.8 | 24.09% | 42.63% |

| Latin America | 4.00% | 24,000.0 | 185,591.1 | 25.52% | 4.20% |

| Middle East & Africa | 3.00% | 18,000.0 | 139,193.3 | 25.52% | 3.15% |

Brazil: Bioplastic Textiles Market Growth Trends

Brazil benefits from strong access to renewable feedstocks such as sugarcane, enabling bio-based polymer production for textiles. The market is expanding across fashion, footwear, and home textiles, with sustainability-driven brands and government initiatives encouraging the use of biodegradable and bio-derived textile materials.

Middle East & Africa Bioplastic Textiles Market Sustainability Initiatives Drive Growth

The MEA region is at an early stage of adoption, with growth driven by sustainability initiatives, import substitution strategies, and diversification into eco-friendly manufacturing. Demand is emerging in technical textiles, uniforms, and lifestyle products as awareness of sustainable materials increases.

South Africa: Bioplastic Textiles Market Growth Trends

South Africa is witnessing the gradual adoption of bioplastic textiles, particularly in apparel, industrial workwear, and sustainability-focused fashion. Supportive environmental policies, increasing textile innovation, and partnerships with global sustainable brands are helping drive market development, although cost sensitivity remains a key challenge.

Recent Developments

- In December 2025, Archroma and Innovo Fiber formed a global distribution partnership to expand a sustainable textile processing system for cotton and cotton/polyester fabrics. This system utilizes patented Fibre52® technology for a more resource-efficient, low-temperature, and caustic-free textile preparation method.(Source: www.indianchemicalnews.com)

- In August 2025, the Uttar Pradesh government initiated a project to transform cow dung from stray cattle into sustainable products, such as bioplastics and textiles. The initiative aims to overcome plastic pollution, along with the promotion of organic farming, rural employment, and energy self-reliance under the “Har Gaon Urja Kendra” model.(Source: theprint.in)

- In October 2025, Sulzer and circular chemistry pioneer TripleW announced the launch of the world's first commercial-scale polylactic acid (PLA) bioplastic produced entirely from food waste.(Source: www.ofimagazine.com)

Top players in the Bioplastic Textiles Market & Their Offerings:

- NatureWorks LLC (USA): NatureWorks is a global leader in bio-based polymers, supplying Ingeo™ PLA resins used in bioplastic fibers and yarns. These materials are incorporated into textiles for apparel, nonwovens, and sustainable fashion brands focusing on lower carbon and compostable end products.

- DuPont (USA): DuPont provides advanced bio-based fibers and polymer technologies that support sustainable textile production. Leveraging its material science expertise, the company’s solutions are used in performance wear, industrial fabrics, and eco-friendly consumer textiles.

- Toray Industries, Inc. (Japan): Toray develops bio-based polyester and PLA-blended fibers for apparel, industrial, and technical textiles. The company emphasizes lightweight, durable, and sustainable textile solutions aligned with global fashion and performance fabric trends.

- Far Eastern New Century Corporation (Taiwan): Far Eastern supplies polyester and PLA bioplastic fibers for apparel, home textiles, and industrial applications. Its recycled and bio-based materials support circularity in textile supply chains across the Asia Pacific.

- Hyosung TNC (South Korea): Hyosung produces eco-friendly bio-based fibers, including Mipan Eco-Life™ polyester and PLA blends. These materials are used in performance textiles, activewear, and fashion garments marketed for sustainability and reduced environmental impact.

- Indorama Ventures (Thailand): Indorama offers bio-based and recycled polyester fibers used in sustainable textile applications. Its bio-plastic textiles support apparel, non-woven products, and technical fabrics with improved eco-credentials.

Other Top Companies in the Bioplastic Textiles Market

- Toray Industries, Inc. (Japan)

- Far Eastern New Century Corporation (Taiwan)

- Hyosung TNC (South Korea)

- Indorama Ventures (Thailand)

- DuPont (USA)

- NatureWorks LLC (USA)

- BASF SE

- TotalEnergies Corbion

- Braskem

- Teijin Limited

- Danimer Scientific

- Novamont S.p.A.

- Mitsubishi Chemical Group

- Lenzing AG

- Avantium N.V.

- Bolt Threads

- Spinnova Oyj

- Evonik Industries

Segments Covered:

By Material Type

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Bio-Polyester (Bio-PET / PTT)

- Bio-Polyamide (Bio-Nylon)

- Starch Blends

By Feedstock Source

- First Generation (1G) Crops

- Second Generation (2G) / Waste-Based

- Gaseous & Non-Biological Sources

By Process/Technology

- Biochemical Conversion

- Thermochemical/Chemical Synthesis

- Melt Spinning & Extrusion

By End-Use Application

- Apparel & Fashion

- Home Textiles

- Industrial & Technical Textiles

- Medical & Healthcare

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa