Content

Bioplastics Market Volume and Growth 2025 to 2034

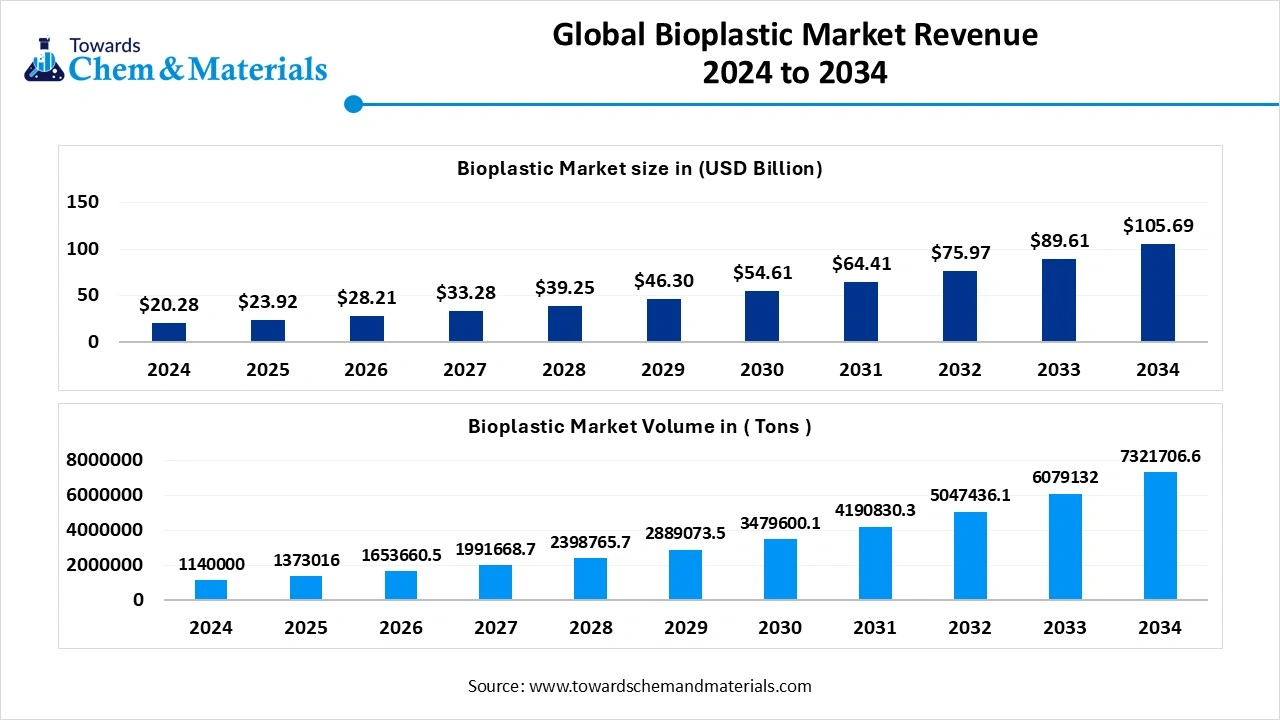

The global bioplastics market volume was reached at 11,40,000.0 tons in 2024 and is expected to be worth around 73,21,706.6 tons by 2034, growing at a compound annual growth rate (CAGR) of 20.44% over the forecast period 2025 to 2034. The growing environmental concerns, increasing demand for food packaging, and government regulations for sustainable packaging materials drive the market growth.

Key Takeaways

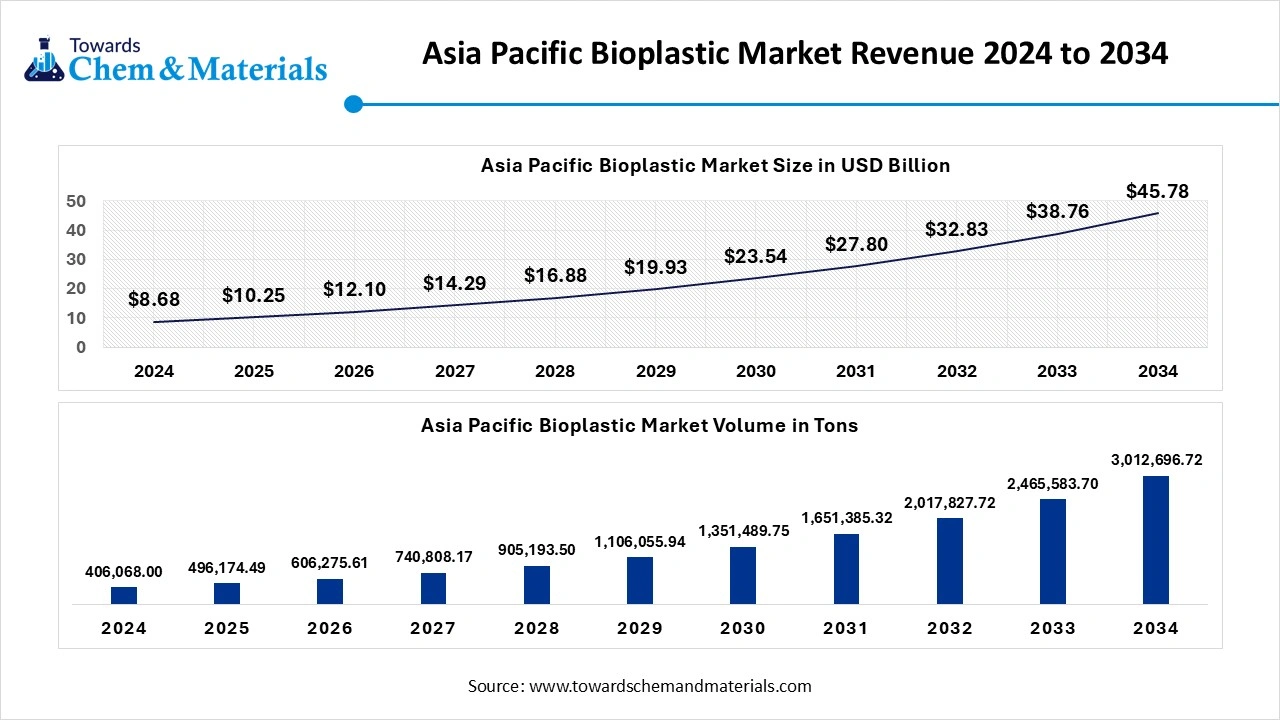

- The Asia Pacific bioplastic market volume is estimated at 496,174.49 tons in 2025 and is expected to reach 3,012,696.72 tons by 2034, growing at a CAGR of 22.19% from 2025 to 2034.

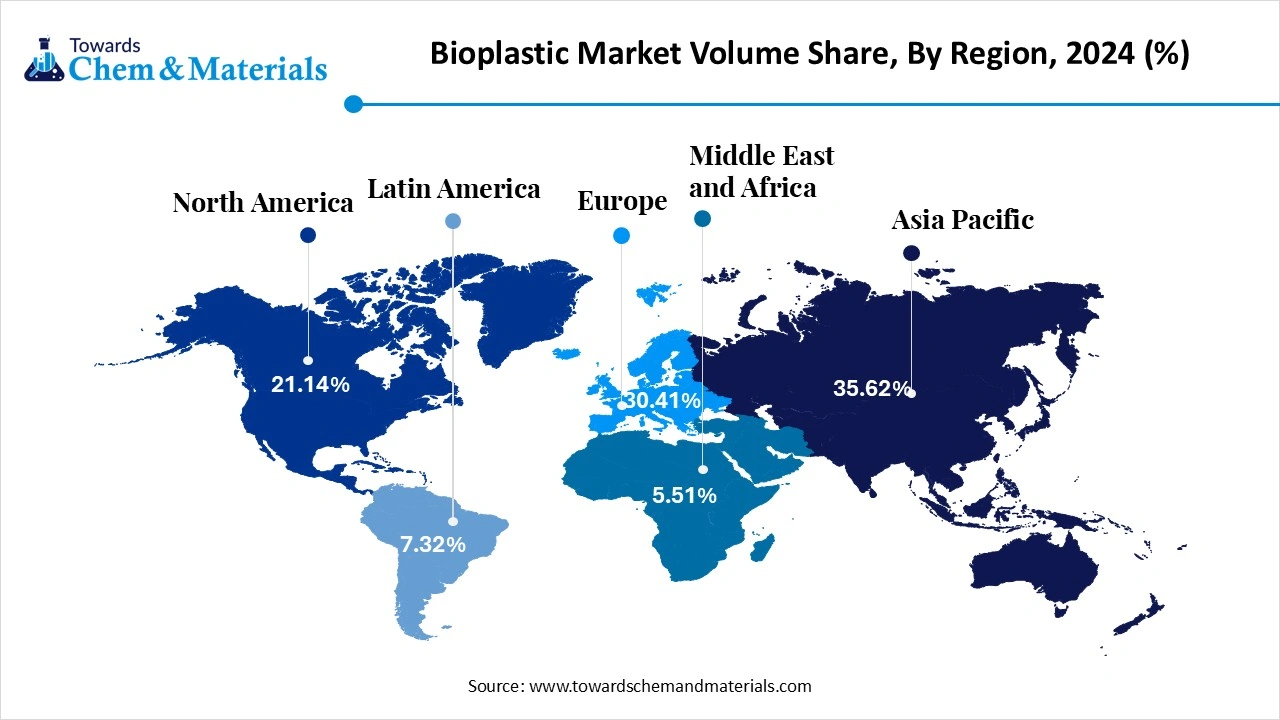

- The Asia Pacific bioplastic market held the largest volume share of 35.62% of the global market in 2024.

- The Europe bioplastic market is expected to register the fastest CAGR of 22.49% over the forecast period by 2025-2034.

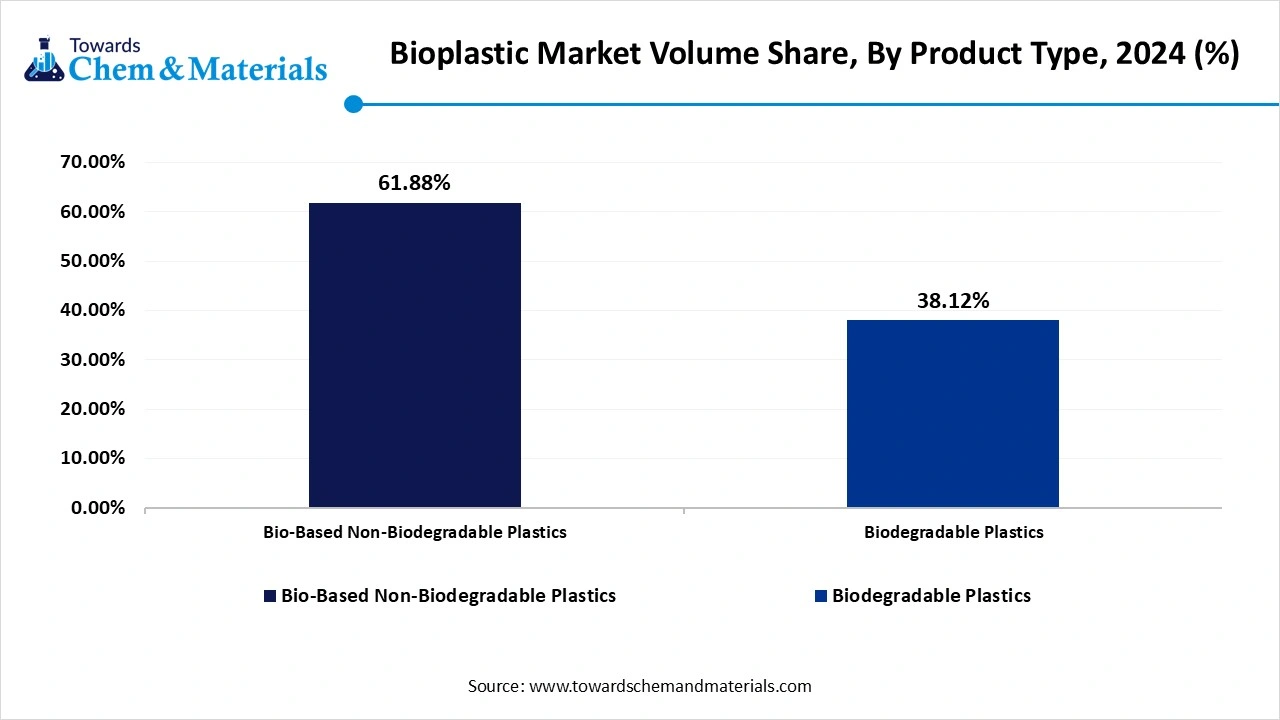

- By Product Type, the Bio-Based Non-Biodegradable plastics segment dominated the market with the largest volume share of 61.88% in 2024.

- By Product Type, the biodegradable plastics segment is projected to grow at the fastest CAGR of 23.66% over the forecast period by 2025-2034.

- By feedstock source, the starch-based segment held approximately a 35% share in the bioplastics market in 2024 due to the growing production of automotive parts.

- By feedstock source, the algae-based segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for naturally decomposing bioplastics.

- By processing technology, the injection molding segment held approximately 30% share in the market in 2024 due to the increasing production of intricate shapes of bioplastics.

- By processing technology, the 3D printing segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of customized designs.

- By end-use industry, the packaging segment held approximately a 55% share in the market in 2024 due to the increasing demand for food packaging.

- By end-use industry, the medical & healthcare segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing production of surgical instruments.

Bioplastics: Silent Hero Behind Sustainable Future and Cleaner Planet

Bioplastics are plastic materials derived from renewable resources like biodegradable materials and plants like sugarcane, & cornstarch. Bioplastics are biodegradable, reduce carbon footprint, and are compostable. It consists of varying tensile strengths and offers good barrier properties against gases & moisture. Bioplastics can be bio-based, biodegradable, or both. They save energy in production and do not contain harmful additives. Bioplastics are widely used in packaging materials, hygiene products, and food containers.

The increasing traditional plastic pollution increases demand for bioplastics. The focus on lowering the environmental carbon footprint increases the adoption of bioplastics. Factors like growing demand for packaging, increasing production of automotive parts, and growing development of various textiles contribute to the growth of the bioplastics market.

- South Korea exported 71 shipments of bioplastics.(Source: www.volza.com)

- Vietnam exported 5,733 shipments of biodegradable plastics.(Source: www.volza.com)

- Biosphere Plastic LLP is the leading supplier of biodegradable plastic additive. (Source: www.volza.com)

Who are the Leading Suppliers of Biodegradable Plastics in the World?

| Company | Shipments | Share(%) |

| IMARKET VIETNAM CO, LTD | 949 Shipments | 36% |

| Cong Ty TNHH Imarket Viet Nam | 949 Shipments | 36% |

| Ningbo Zhuomei Import Export Co. Ltd. | 261 shipments | 10% |

The Growing Automotive Industry Drives Bioplastics Market Growth

The growing automotive industry in various regions increases demand for bioplastics for various automotive applications. The increasing adoption of sustainable practices in the automotive industry fuels demand for bioplastics. The production of lightweight vehicle parts requires bioplastics. The focus on lowering emissions and improving the fuel efficiency of vehicles increases demand for bioplastics. The need to maximize the range of electric vehicles fuels demand for bioplastics.

The increasing production of interior automotive parts like door panels, trims, seat covers, dashboards, upholstery, ventilation ducts, and carpets fuels the adoption of bioplastics. The exterior parts like bumpers, exterior lights, hoods & trims increase demand for bioplastics for the reduction of vehicle weight. The under-the-hood applications like battery covers, engine covers, and air ducts require bioplastics. The growing automotive industry is a key driver for the growth of the market.

Market Trends

- Growing Demand for Consumer Goods: The increasing demand for various consumer goods products like personal care products, electronics, toys, and textiles increases the adoption of bioplastics.

- Stringent Government Regulations: The stricter government regulations, like single-use plastic bags, increase demand for sustainable solutions like bioplastics. The strong government support for the adoption of bioplastics helps the market growth.

- Expansion of Packaging Industry: The growing demand for packaging in electronics, food, and cosmetics sectors increases demand for bioplastics. The increasing consumer demand for sustainable packaging fuels the adoption of bioplastics.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 13,73,016.0 Tons |

| Expected Volume by 2034 | 73,21,706.6 Tons |

| Growth Rate from 2025 to 2034 | 8.68% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Feedstock Source, By Processing Technology, By End-Use Industry, By Region |

| Key Companies Profiled | NatureWorks LLC, TotalEnergies Corbion, BASF SE, Novamont S.p.A., Biome Bioplastics, Mitsubishi Chemical Group, Danimer Scientific, FKuR Kunststoff GmbH, Braskem S.A., Toray Industries Inc., Evonik Industries AG, Green Dot Bioplastics, Plantic Technologies (Kuraray Co. Ltd.), Teijin Limited, Tipa Corp. Ltd., Biotec GmbH, Anellotech Inc., Trifilon AB, Cardia Bioplastics, Synbra Technology BV |

Market Opportunity

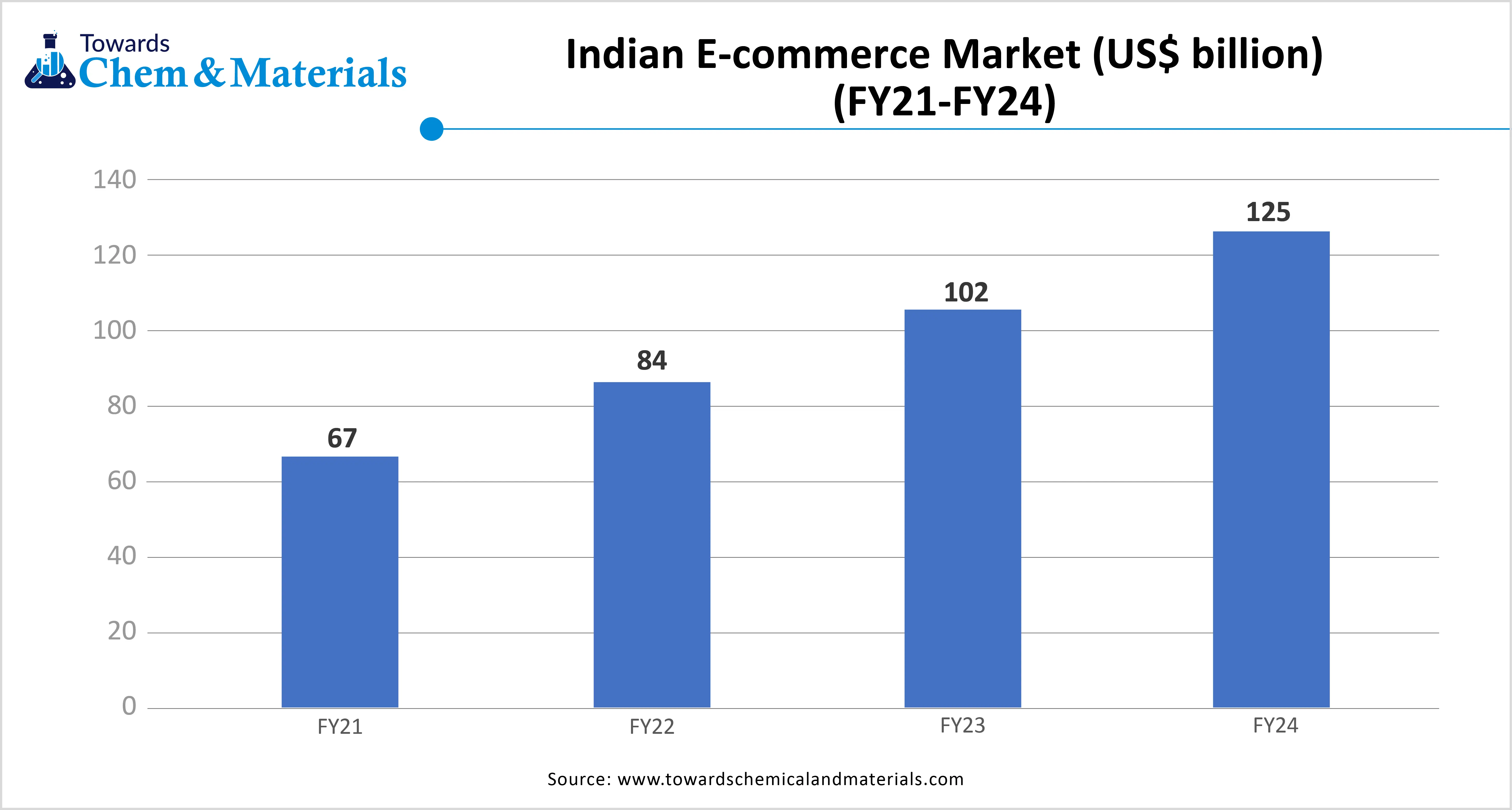

Growing Expansion of E-Commerce Surges Demand for Bioplastics

The rise of e-commerce in various regions increases demand for bioplastics for various applications. The growth in online shopping increases demand for packaging, which requires bioplastics to reduce packaging waste. The increasing demand for reliable and robust packaging materials in e-commerce to withstand handling and shipping requires bioplastics. The focus on the protection of items during transit increases demand for bioplastic packaging.

The increasing demand for moisture-resistant, durable, and lightweight packaging in e-commerce increases demand for bioplastics. The growing consumer demand for eco-friendly packaging increases the adoption of bioplastics. The growing online shopping of textiles and electronics increases demand for bioplastics. The growing expansion of e-commerce creates an opportunity for the market.

Market Challenge

High Production Cost Limits Expansion of the Bioplastics Market

Despite several benefits of bioplastics in various industries, the high production cost restricts the market growth. Factors like limited material availability, high cost of raw materials, and specialized manufacturing processes increase the production cost. The high cost of feedstocks like algae, corn, and sugarcane directly affects the market.

The complex manufacturing processes, like specialized downstream processes and fermentation, increase the production cost. The availability of specialized recycling facilities and the lack of industrial composting increase the production cost. The increasing improvement in production processes and the development of new formulations of bioplastics increase the cost. The high production cost hampers the growth of the bioplastics market.

Regional Insights

Which Region Dominated the Bioplastics Market?

The Asia Pacific bioplastic market volume was estimated at 406,068.00 tons in 2024 and is anticipated to reach 3,012,696.72 Tons by 2034, growing at a CAGR of 22.19% from 2025 to 2034.

Asia Pacific led the market in 2024 and is seen to sustain the dominance during the forecast period. The growing consumer environmental awareness about traditional bioplastics increases the adoption of bioplastics. The growing packaging industry in countries like India and China increases demand for bioplastics, helping the market growth. The growing advancements in manufacturing processes and bio-based raw materials increase the production of bioplastics. The well-established manufacturing base and growing demand across end-user industries like consumer goods, automotive, and agriculture drive the market growth.

China Bioplastics Market Trends

China is a key contributor to the market. The well-established manufacturing infrastructure for the production of bioplastics helps the market growth. The growth in packaged food consumption and e-commerce increases demand for bioplastics. The strong presence of abundant renewable raw materials and strong government support increases the production of bioplastics. The growing demand across end-user industries like automotive, packaging, and agriculture supports the overall growth of the market.

- China exported 411 shipments of bioplastics.(Source: www.volza.com )

- China exported 2,346 shipments of biodegradable plastics.(Source: www.volza.com )

- Shanghai Guan Ye Trading Co Ltd is the leading supplier of bioplastics in China.(Source: www.volza.com)

Europe is observed to grow at the fastest rate during the forecast period. The stricter regulatory policies, like the Circular Economy Action Plan and the EU Green Deal, increase demand for bioplastics. The increasing consumer awareness about plastic waste increases demand for bioplastics. The well-established research & development for the production of new bioplastics helps the market growth. The increasing development of soil biodegradable mulch films increases the adoption of bioplastics. The growing packaging and automotive industry fuels demand for bioplastics, driving the overall growth of the market.

Germany Bioplastics Market Trends

Germany is a major contributor to the market. The extensive government support for the bio-based packaging increases demand for bioplastics. The strong presence of bioplastics production and well-established industrial infrastructure helps the market growth. The growing automotive industry increases demand for bioplastics for minimizing emissions and the development of lightweight vehicles. The increasing demand for bioplastics for the packaging of personal care products and food supports the overall growth of the market.

- Germany exported 319 shipments of bioplastics.(Source: www.volza.com )

- Germany exported 585 shipments of biodegradable plastics.(Source: www.volza.com )

Bioplastics Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| North America | 21.14% | 2,40,996.0 | 22.31% | 16,33,472.7 | 23.69% |

| Europe | 30.41% | 3,46,674.0 | 29.40% | 21,52,581.7 | 22.49% |

| Asia Pacific | 35.62% | 4,06,068.0 | 33.68% | 24,65,950.8 | 22.19% |

| Latin America | 7.32% | 83,448.0 | 8.10% | 5,93,058.2 | 24.35% |

| Middle East & Africa | 5.51% | 62,814.0 | 6.51% | 4,76,643.1 | 25.25% |

| Total | 100% | 11,40,000.0 | 100% | 73,21,706.6 | 20.44% |

Segmental Insights

Product Type Insights

Why did the bio-based non-biodegradable plastics Segment Dominate the Bioplastics Market?

The bio-based non-biodegradable plastics segment dominated the market in 2024. The focus on reducing the carbon footprint increases demand for bio-based non-biodegradable plastics. The increasing integration with existing recycling infrastructure increases the production of bio-based non-biodegradable plastics. The growing demand across applications like construction materials, automotive parts, and electronics supports the market growth.

The biodegradable plastics segment is seen to grow at the fastest rate during the forecast period. The segment is observed to sustain the position during the forecast period. The growing environmental concerns about plastic pollution increase demand for bioplastics. The growing expansion of the packaging industry increases demand for bioplastics. The growing production of various biodegradable agricultural products like plant pots, mulching films, and others increases demand for biodegradable plastics. It is made up of biomass materials, cornstarch, and sugarcane. The growing demand across the consumer goods and textile industries drives the market growth.

Bioplastics Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| Bio-Based Non-Biodegradable Plastics | 61.88% | 7,05,432.0 | 59.88% | 43,84,237.9 | 22.51% |

| Biodegradable Plastics | 38.12% | 4,34,568.0 | 40.12% | 29,37,468.7 | 23.66% |

| Total | 100.00% | 11,40,000.0 | 100.00% | 73,21,706.6 | 20.44% |

Feedstock Source Insights

How the Starch-Based Segment Held the Largest Share in the Bioplastics Market?

The starch-based segment held the largest revenue share of the bioplastics market in 2024. The increasing demand for packaging for consumer goods, food containers, and bottles increases the demand for starch-based bioplastics. The growing demand for sustainable products and packaging increases the demand for starch-based bioplastics. The increasing production of mulch films, agricultural films, and other agricultural products fuels demand for starch-based bioplastics. Starch is made up of renewable resources like potatoes, corn, and others. The growing demand across sectors like automotive parts, textiles, and consumer goods drives the market growth.

The algae-based segment is experiencing the fastest growth in the market during the forecast period. The increasing consumer awareness about plastic waste fuels demand for algae-based bioplastics. The stricter government regulations about sustainability increase the adoption of algae-based bioplastics. The increasing focus on reducing carbon emissions and naturally decomposing bioplastics increases the adoption of algae-based bioplastics. The growing demand across industries like healthcare, packaging, and agriculture supports the overall market growth.

Processing Technology Insights

What Made the Injection Molding Segment Dominate the Bioplastics Market?

The injection molding segment dominated the bioplastics market in 2024. The increasing demand for the production of complex shapes in various applications fuels the adoption of the injection molding process. The growing demand for mass production increases the demand for injection molding, helping the market growth. It processes various kinds of bioplastics materials like starch-based bioplastics, PHA, & PLA, and is a cost-effective method. The increasing demand for food & beverage packaging fuels the adoption of injection molding. The growing demand across sectors like healthcare and automotive drives the market growth.

The 3D printing segment is the fastest growing in the market during the forecast period. The growing production of customized designs and creation of intricate shapes of various bioplastics products increases demand for 3D printing. The focus on on-demand production and faster product development increases adoption of 3D printing. The growing demand for bioplastics in consumer products, packaging, and toys increases demand for 3D printing. The increasing demand for bioplastics in functional automotive parts and lightweight vehicle components supports the overall growth of the market.

End-Use Industry Insights

Which End-User Segment Held the Largest Share in the Bioplastics Market?

The packaging segment held the largest revenue share of the market in 2024. The increasing production of various packaging forms like cups, films, bottles, trays, and bags fuels the adoption of bioplastics. The growing environmental concerns due to traditional plastic packaging increase demand for bioplastic packaging. The increasing demand for compostable and biodegradable packaging solutions helps the market growth. The increasing demand for packaging of food items, ready-to-eat meals, and snacks fuels the adoption of bioplastics. The increasing demand for packaging across agriculture, pharmaceuticals, and retail drives the market growth.

The medical & healthcare segment is experiencing the fastest growth in the market during the forecast period. The increasing demand for medical packaging fuels the adoption of bioplastics. The increasing production of medical devices, surgical instruments, and prosthetics fuels demand for bioplastics. The growing development of customized medical devices and implants increases the adoption of bioplastics. The increasing demand for PCL & PLA in drug delivery systems and the expansion of the medical & healthcare sector support the overall growth of the market.

Recent Developments

- In June 2025, UKHI launched farm waste-based bioplastic, Ecograms. The bioplastic is made up of farm waste that helps to minimize pollution and increase farmers' income.(Source: krishijagran.com)

- In December 2023, Sulzer launched a biodegradable polymer technology, CAPSULTM for bioplastics. The CAPSULTM produces higher-quality PCL grades and is easily adapted broad range of industrial scales. The premium quality PCL is widely used in 3D printing, agricultural films, medical devices, consumer packaging, footwear, and textiles.(Source: worldbiomarketinsights.com)

- In May 2025, Intec Bioplastics Inc. launched sustainable stretch wrap packaging, EarthPlus. The company aims to reduce landfill waste, net zero carbon footprint, and achieve net zero plastics. The material is made up of renewable plant-based materials and is widely used for food wrap and pallet applications.(Source: interplasinsights.com)

- In January 2025, India’s IIT-Madras launched a zero-waste bioplastic initiative. The centre aims to make bioplastics commercially accessible and lower the production cost of bioplastics. The centre focuses on the development of bioplastics from agricultural waste for medical textiles and medical implants.(Source: finance.yahoo.com)

Top Companies List

- NatureWorks LLC

- TotalEnergies Corbion

- BASF SE

- Novamont S.p.A.

- Biome Bioplastics

- Mitsubishi Chemical Group

- Danimer Scientific

- FKuR Kunststoff GmbH

- Braskem S.A.

- Toray Industries Inc.

- Evonik Industries AG

- Green Dot Bioplastics

- Plantic Technologies (Kuraray Co. Ltd.)

- Teijin Limited

- Tipa Corp. Ltd.

- Biotec GmbH

- Anellotech Inc.

- Trifilon AB

- Cardia Bioplastics

- Synbra Technology BV

Segments Covered

By Product Type

- Bio-Based Non-Biodegradable Plastics

- Bio-Polyethylene (Bio-PE)

- Bio-Polyethylene Terephthalate (Bio-PET)

- Bio-Polyamides (Bio-PA)

- Bio-Polypropylene (Bio-PP)

- Biodegradable Plastics

-

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Cellulose-based Plastics

-

By Feedstock Source

- Starch-based

- Sugarcane-based

- Cellulose-based

- Vegetable Oils & Fats

- Agricultural Waste

- Algae-based

- Others (e.g., wood chips, food waste)

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Others (e.g., 3D printing, rotational molding)

By End-Use Industry

- Packaging

- Rigid Packaging

- Flexible Packaging

- Consumer Goods

- Electronics

- Household Items

- Toys

- Automotive & Transportation

- Interiors

- Exterior Panels

- Textiles

- Apparel

- Industrial Fabrics

- Agriculture

- Mulch Films

- Plant Pots

- Building & Construction

- Insulation

- Panels

- Medical & Healthcare

- Drug Delivery Systems

- Sutures

- Others

- 3D Printing

- Coatings & Adhesives

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait