Content

Polypropylene Market Size and Growth 2025 to 2034

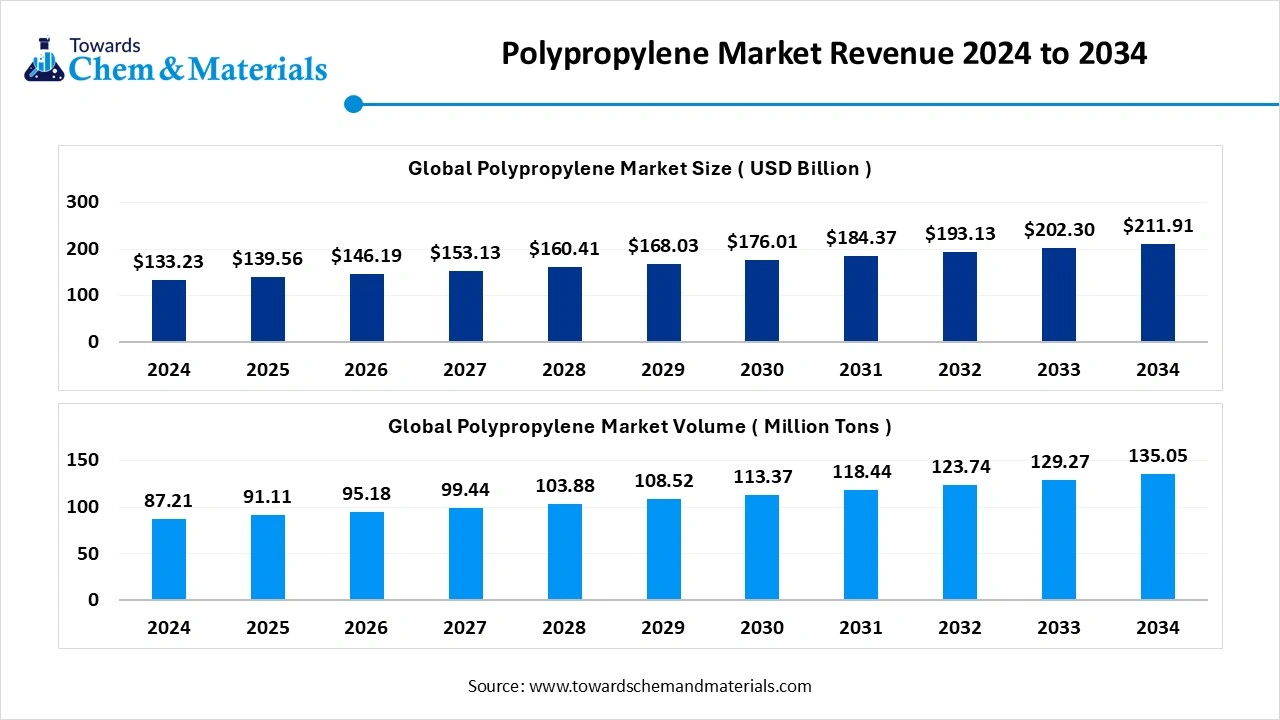

The global polypropylene market size is estimated at USD 139.56 billion in 2025 and is expected to hit around USD 211.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.75% over the forecast period from 2025 to 2034.

The global polypropylene market volume was reached at 87.21 million tons in 2024 and is expected to be worth around 135.05 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.47% over the forecast period 2025 to 2034. The expansion of the healthcare industry, growing demand for packaging, and increased development of lightweight vehicle materials drive the market growth.

Key Takeaways

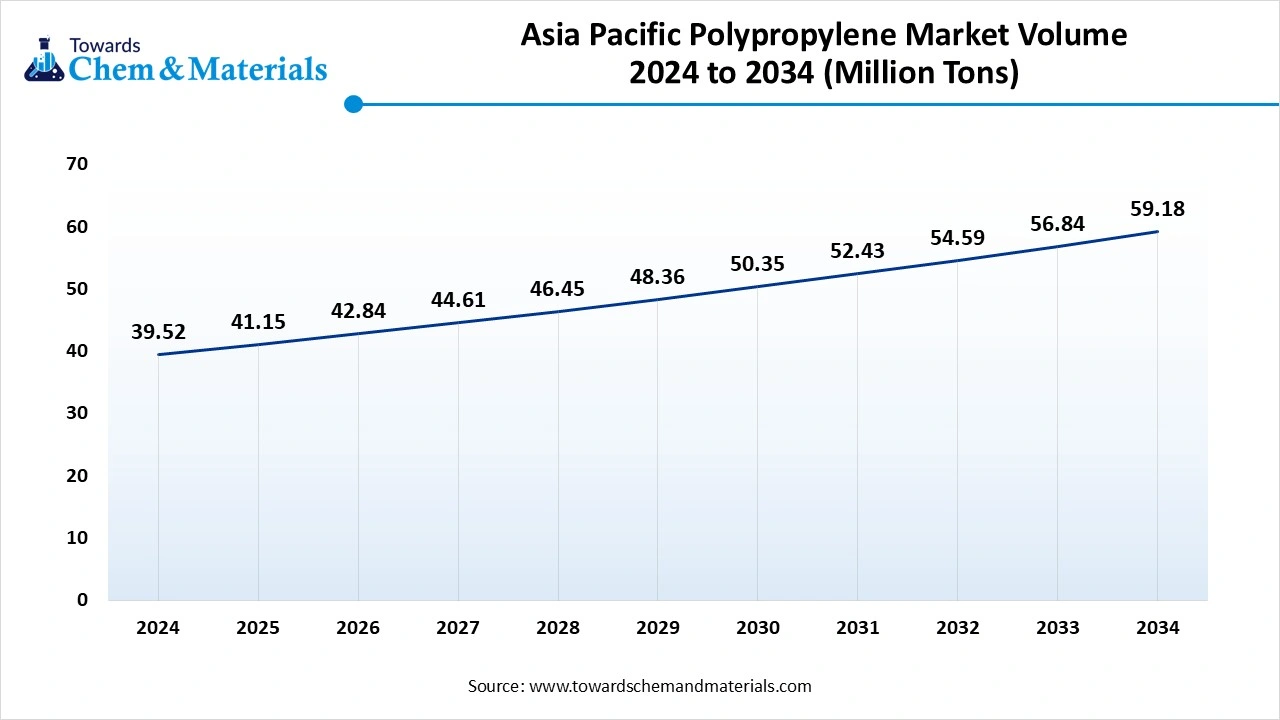

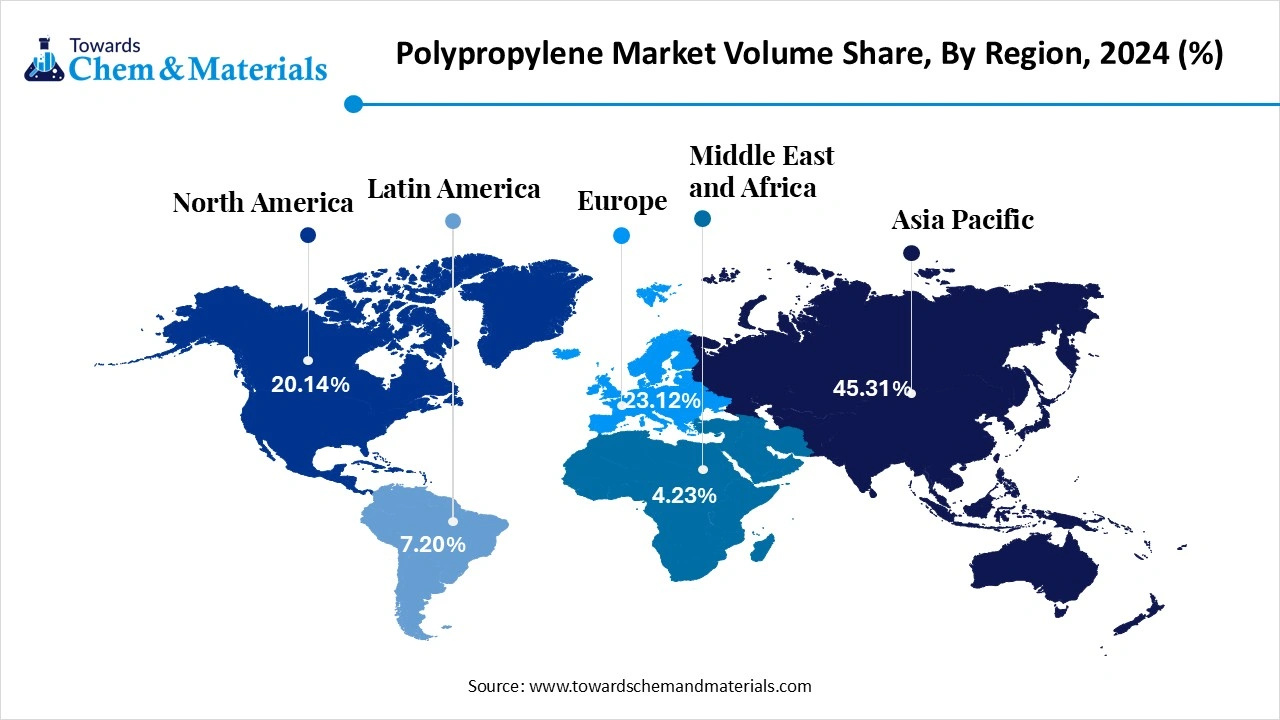

- The Asia Pacific polypropylene market volume was estimated at 39.52 million tons in 2024 and is expected to reach 59.18 million tons by 2034, growing at a CAGR of 34.12% from 2025 to 2034.

- The Asia Pacific polypropylene market held the largest volume Share of 45.31% of the global market in 2024.

- The North America polypropylene market is expected to register the fastest CAGR of 5.54% over the forecast period by 2025-2034.

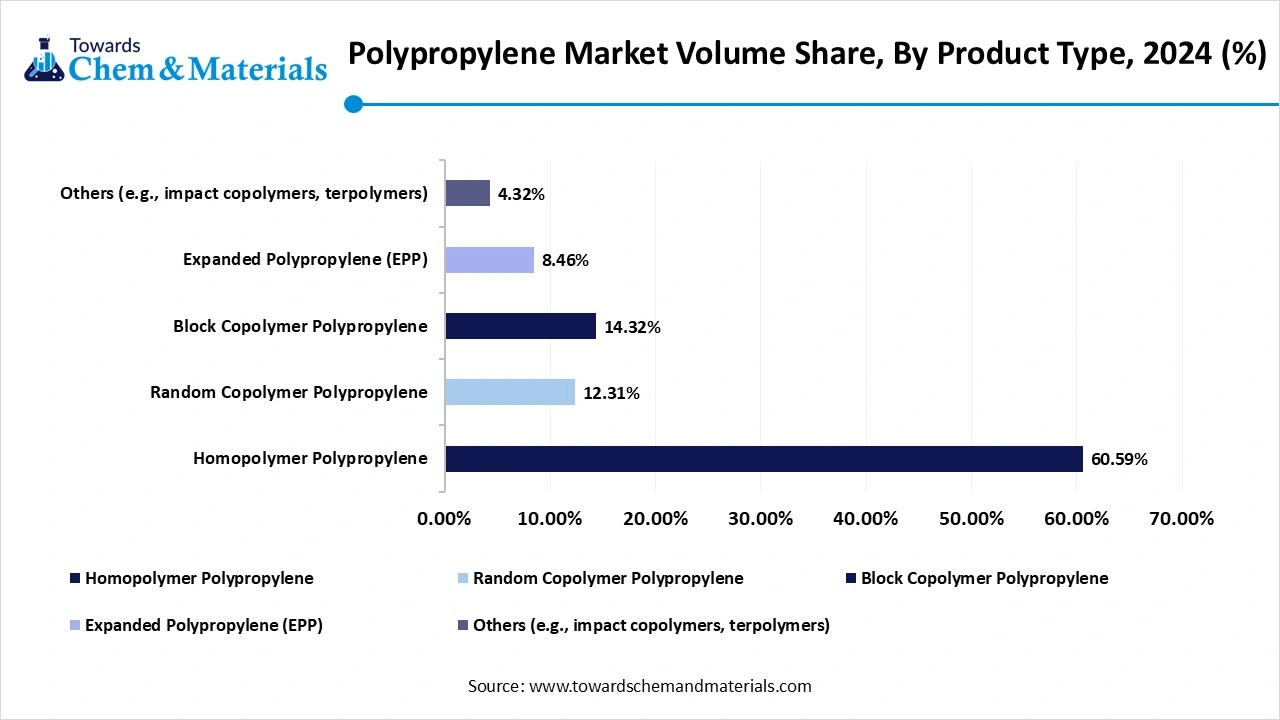

- By product type, the homopolymer polypropylene segment dominated the market with the largest volume Share of 60.59% in 2024.

- By product type, the expanded polypropylene (EPP) segment is projected to grow at the fastest CAGR of 6.12% over the forecast period by 2025-2034.

- By processing technology, the injection molding segment held a 35% share in the market in 2024 due to the growing creation of complex packaging designs.

- By processing technology, the thermoforming segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing focus on sustainability.

- By end-use industry, the packaging segment held a 38% share in the market in 2024 due to the increasing demand for food packaging.

- By end-use industry, the healthcare & pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing production of medical devices.

Market Size & Forecast Insights

- 2024 Market Size: USD 133.23 Billion

- 2034 Projected Market Size: USD 211.91 Billion

- CAGR (2024-2034): 4.75%

- Asia Pacific: Largest market share of 40.11% in 2024

Polypropylene: The Unsung Hero of Everyday Lives and Industrial Innovation

Polypropylene (PP) is a thermoplastic polymer that provides excellent fatigue, chemical, and electric resistance at high temperatures. The chemical formula of polypropylene is (C3H6)n and is developed by polymerizing propylene. It consists of low density and high melting points. It offers excellent resistance to solvents, acids, and bases. Polypropylene is a great electrical insulator and has a semicrystalline structure. It is recyclable in various products like textiles, automotive parts, and storage containers.

The growing production of various packaging products like containers, caps, bottles, and films increases demand for polypropylene. The increasing production of various automotive parts like battery cases, bumpers, and dashboards fuels demand for polypropylene. The increasing demand for various consumer products like storage containers, toys, and furniture requires polypropylene. The growing production of various medical devices like petri dishes, syringes, and test tubes fuels demand for polypropylene. The growing demand across various sectors like textiles, medical devices, electronics, packaging, automotive parts, and consumer goods contributes to the growth of the polypropylene market.

- Mexico exported $23.8M of polypropylene in 2023.(Source: oec.world)

- Austria exported $468M of polypropylene in 2023.(Source: oec.world)

- India exported 346,874 shipments of polypropylene.(Source: www.volza.com)

- The United States exported 222,367 shipments of polypropylene.(Source: www.volza.com)

- Kuwait exported $145M of polypropylene in 2023.(Source: oec.world )

Growing Automotive Industry Drives Polypropylene Market Growth

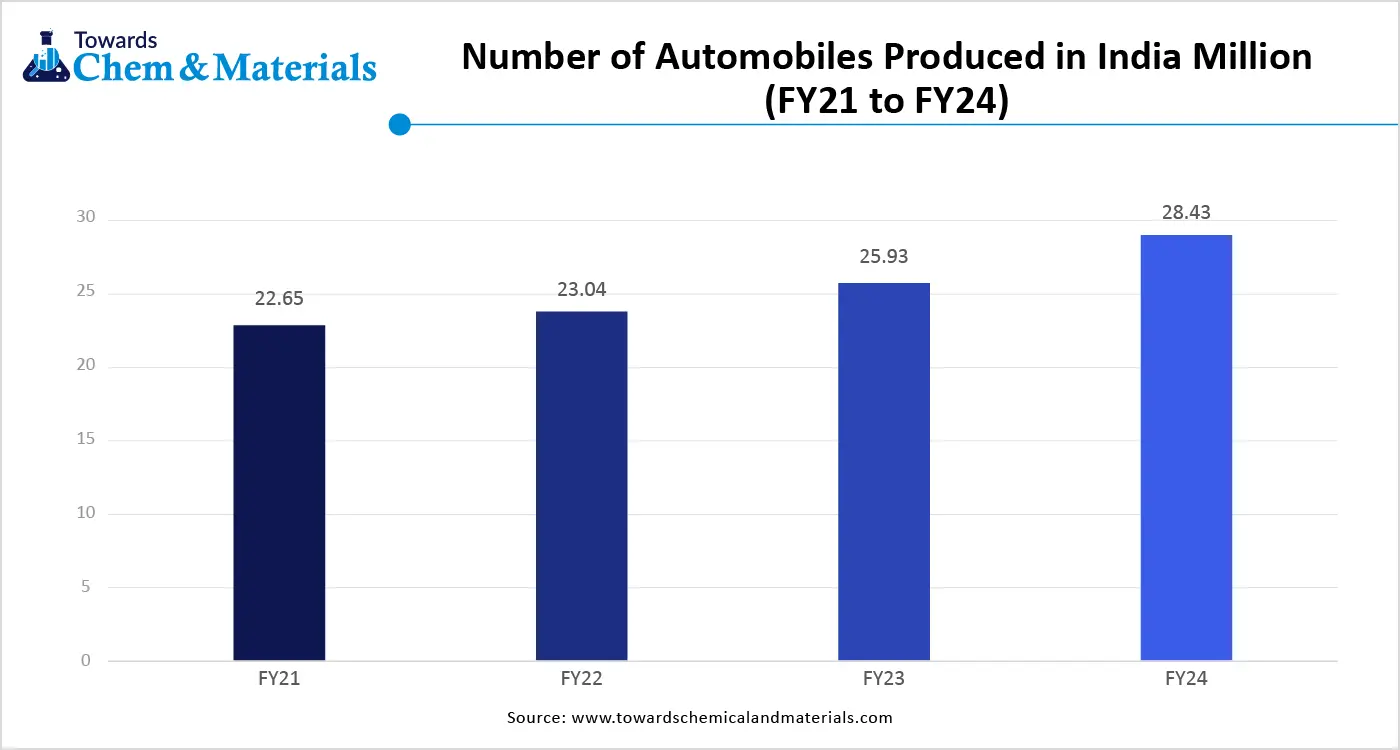

The growing production of vehicles and the growth in the automotive industry increase demand for polypropylene for the production of vehicle parts. The focus on improving the fuel efficiency of vehicles and the production of lightweight materials increases demand for polypropylene. The growing production of automotive components like interior trims, bumpers, door panels, and dashboards increases the adoption of polypropylene.

The rapid growth in electric vehicles increases demand for PP for the production of high-voltage insulating cables, interior components, and EV battery housing. The increasing automotive industry focus on sustainability fuels the adoption of polypropylene. The increasing development of advanced vehicles and the focus on vehicles' aesthetics increases demand for PP. The growing production of electric vehicles and hybrid vehicles increases demand for PP. The growing automotive industry is a key driver for the growth of the polypropylene market.

Market Trends

- Growing Demand for Electric Vehicles: The rise in electric vehicles and increasing adoption of EVs fuels demand for polypropylene for the development of various components EV battery housing and high-voltage cables.

- Increasing Demand for Packaging: The high demand for packaging in various sectors like consumer goods, food & beverage, and pharmaceuticals increases demand for polypropylene due to durability. The growing demand for various packaging applications like bottles, food containers, and films helps the market growth.

- Growing Expansion of Consumer Goods: The growing expansion of consumer goods and increasing production of various consumer goods products like toys, storage boxes, textiles, and electronic products requires polypropylene.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 91.11 Million Tons |

| Expected Volume by 2034 | 135.05 Million Tons |

| Growth Rate from 2025 to 2034 | 4.47% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Processing Technology, By End-Use Industry, By Region |

| Key Companies Profiled | LyondellBasell Industries, ExxonMobil Chemical, SABIC, Braskem, Borealis AG, TotalEnergies Petrochemicals, Reliance Industries Limited, Indian Oil Corporation, HMC Polymers, Formosa Plastics Group, PetroChina Company Limited, Sinopec Group, Mitsui Chemicals, LG Chem, Hanwha Total Petrochemical, Hyosung Chemical, Japan Polypropylene Corporation, Westlake Corporation, INEOS Olefins & Polymers, Qatar Petrochemical Company (QAPCO) |

Market Opportunity

Growing Construction Activities Surge Demand for Polypropylene

The rapid urbanization increases construction activities in various regions, which fuels demand for polypropylene. The growth in commercial and residential construction increases demand for polypropylene for building materials. The growing infrastructure development, like bridges, roads, and many more construction projects, increases demand for polypropylene for erosion control & concrete reinforcement applications.

The growing demand for construction applications like waterproofing membranes, geotextiles, piping systems, insulation, siding, and other materials increases demand for polypropylene. The focus on modular construction elements increases demand for polypropylene for minimizing construction time and easy transportation of components. The increasing construction of commercial real estate, like offices & shopping malls, fuels demand for PP for wall coverings & flooring applications. The development of green buildings and sustainable construction increases the adoption of PP. The growing construction activities create an opportunity for growth of the polypropylene market.

Market Challenge

Fluctuations in Feedstock Prices Limit the Expansion of Polypropylene

Despite several benefits of polypropylene in various industries, the fluctuations in feedstock prices restrict the market growth. Fluctuating prices of natural gas and crude oil directly affect the market growth. The volatility in crude oil prices is responsible for fluctuating fossil fuel prices. Fluctuation in feedstock prices increases the production cost of polypropylene. Supply chain disruptions like logistical bottlenecks, natural disasters, and political instability are responsible for fluctuating feedstock prices. The increasing oil & gas prices are responsible for fluctuations in crude oil prices. Factors like geopolitical events and trade policies increase crude oil prices. Fluctuations in feedstock prices hamper the growth of the polypropylene market.

Segmental Insights

Product Type Insights

Why did Homopolymer Segment Dominate the Polypropylene Market?

The homopolymer segment dominated the polypropylene market in 2024. The growing production of automotive parts like interior panels and bumpers increases demand for homopolymer propylene. The increasing demand for closures, rigid containers, and food packaging fuels demand for homopolymers, helping the market growth. The expansion of consumer goods like textiles, household products & appliances increases the adoption of homopolymer. It consists of excellent mechanical strength and has a good balance of cost & performance. The growth in the packaging industry and the growing use of injection molding drive the market growth.

The expanded polypropylene (EPP) segment is the fastest growing in the market during the forecast period. The increasing demand for lightweight materials in various industries fuels the adoption of expanded polypropylene. The rapid growth in e-commerce increases demand for EPP for eco-friendly & durable packaging. The growing production of automotive parts like door panels, bumpers, and dashboards, and the rise in electric vehicles, is driving demand for EPP. The growing demand across applications like consumer goods and construction supports the overall growth of the market.

Polypropylene Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| Homopolymer Polypropylene | 60.59% | 52.84 | 56.56% | 76.38 | 4.18% |

| Random Copolymer Polypropylene | 12.31% | 10.74 | 13.14% | 17.75 | 5.74% |

| Block Copolymer Polypropylene | 14.32% | 12.49 | 15.54% | 20.99 | 5.94% |

| Expanded Polypropylene (EPP) | 8.46% | 7.38 | 9.32% | 12.59 | 6.12% |

| Others (e.g., impact copolymers, terpolymers) | 4.32% | 3.77 | 5.44% | 7.35 | 7.70% |

| Total | 100% | 87.21 | 100% | 135.05 | 4.47% |

Processing Technology Insights

How Injection Molding Segment Held the Largest Share in the Polypropylene Market?

The injection molding segment held the largest revenue share in the polypropylene market in 2024. The growing creation of intricate & complex shapes of packaging and automotive components increases the adoption of injection molding. The increasing demand for automated & rapid production of polypropylene parts fuels demand for injection molding. The increasing production of caps, containers, and closures for packaging applications fuels demand for injection molding. It consists of a low cost per unit and supports high-speed production. The growing demand across applications like household goods, electrical contacts, automotive components, and packaging drives the overall market growth.

The thermoforming segment is experiencing the fastest growth in the market during the forecast period. The growing medical device packaging increases the demand for the thermoforming process due to features like contamination protection, sterility, and tamper-evidence. The increasing demand for the creation of a versatile range of shapes & sizes fuels demand for thermoforming. It is cost-effective and provides a good balance between production efficiency and material usage. The increasing production of protective covers, trays, and blister packs increases demand for thermoforming. The growing demand for food packaging and the focus on recyclable & biodegradable packaging support the overall growth of the market.

End-Use Industry Insights

Which End-Use Industry Dominated the Polypropylene Market?

The packaging segment dominated the polypropylene market in 2024. The growing demand for various consumer goods increases the demand for packaging. The increasing production of various packaging forms, like breathable packaging, rigid containers, and flexible films, helps market growth. The rise in online shopping and the expansion of e-commerce increase demand for packaging. The growing production of labels, food wraps, and containers for food packaging increases demand for polypropylene.

The growing demand for sustainable packaging materials drives market growth.

The healthcare & pharmaceuticals segment is the fastest growing in the market during the forecast period. The increasing production of medical devices like surgical instruments, syringes, single-use devices, drug delivery systems, and IV containers fuels demand for polypropylene. The growing demand for the packaging of medical devices and pharmaceuticals helps the market growth. The growing medicine packaging, like blister packs, bottles, and closures, increases demand for polypropylene. The increasing demand for disposable and sterile materials in the healthcare & pharmaceuticals industry fuels demand for polypropylene. The growing demand for non-woven fabrics for gowns & masks, and growing healthcare expenditure, support the overall growth of the market.

Regional Insights

How Asia Pacific Dominated the Polypropylene Market?

The Asia Pacific polypropylene market Volume was estimated at 39.52 million tons in 2024 and is anticipated to reach 59.18 million tons by 2034, growing at a CAGR of 34.12% from 2025 to 2034.

Asia Pacific dominated the market in 2024. The rapid urbanization and growth in infrastructure development increase demand for polypropylene. The strong government support for domestic manufacturing of polypropylene helps market growth. The growing expansion of the textile and apparel industry fuels demand for polypropylene. The growing expansion of the plastic processing industry increases the adoption of polypropylene. The increasing demand across end-user industries like automotive, consumer goods, packaging, and construction drives the overall growth of the market.

China Polypropylene Market Trends

China is a major contributor to the polypropylene market. The growing industrialization and well-established manufacturing base across various sectors increase demand for polypropylene. The increasing domestic production of polypropylene helps market growth. The growth in the development of infrastructure projects like ports, roads, and railways increases demand for polypropylene. The increasing demand for packaging materials and consumer goods fuels the adoption of polypropylene. The growing demand across sectors like automotive, electronics, and construction supports the overall growth of the market.

- China exported 525,061 shipments of polypropylene. (Source: www.volza.com )

- China exported $130M of rigid, tube, pipe, or hose of polypropylene in 2024.(Source: oec.world)

- CRE8 Direct Anhui Co Ltd is the leading supplier of polypropylene plastic sheet in China.(Source: www.volza.com)

Which Region is the Fastest Growing in the Polypropylene Market?

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing demand for consumer goods increase the adoption of polypropylene. The growth in the development of infrastructure projects like industrial corridors and smart cities helps the market growth. The growing expansion of e-commerce and the increasing need for sustainable packaging solutions fuel the adoption of polypropylene. The increasing consumer demand for frozen and packaged food fuels demand for polypropylene for packaging purposes. The expansion of end-user industries like construction, consumer goods, packaging, and automotive drives the market growth.

Polypropylene Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| North America | 20.14% | 17.56 | 21.13% | 28.54 | 5.54% |

| Europe | 23.12% | 20.16 | 24.13% | 32.59 | 5.48% |

| Asia Pacific | 45.31% | 39.52 | 42.08% | 56.83 | 4.12% |

| Latin America | 7.20% | 6.28 | 7.88% | 10.64 | 6.04% |

| Middle East & Africa | 4.23% | 3.69 | 4.78% | 6.46 | 6.41% |

| Total | 100.00% | 87.21 | 100.00% | 135.05 | 4.47% |

Saudi Arabia Polypropylene Market Trends

Saudi Arabia is growing in the polypropylene market. The government's focus on the development of the petrochemical industry increases the production of polypropylene. The growing expansion of infrastructure, like manufacturing sites & industrial parks, increases demand for polypropylene. The rapid growth in industries like packaging, automotive, and construction supports the overall growth of the market.

- Saudi Arabia exported $4.7B of polypropylene in 2023.(Source: oec.world)

Who is the Leading Supplier of Polypropylene in Saudi Arabia?

| Company Name | Shipments | Share in % |

| Sabic Asia Pacific PTE Ltd | 991 Shipments | 53% |

| Saudi Basic Industries Corporation SABIC | 177 Shipments | 9% |

| Basell International Trading FZE | 123 Shipments | 7% |

Recent Developments

- In September 2024, Braskem launched bio-circular polypropylene for snack food & restaurants. The innovation focuses on sustainability and lowers reliance on fossil fuels. It is applicable for various packaging applications like consumer goods, food packaging, and flexible packaging.(Source: www.indianchemicalnews.com)

- In June 2025, Maillefer, Premix, and LyondellBasell launch a polypropylene-based power cable solution. The solution is applicable for semiconductive screens and HV & MV cable insulation. The company includes a catenary and horizontal CV system for the development of a cable solution and offers reliable performance.(Source: www.indianchemicalnews.com)

- In April 2025, Ronesans Holding launched a polypropylene production plant in Turkey. The company announced an investment of $2 billion for the development of a plant. The annual production capacity of the plant is 472500 tonnes. The project is divided into two components: the development of a production plant and the storage terminal development. (Source: energynews.pro)

- In September 2024, Tri-Tech 3D launched SAF polypropylene material. It is applicable for applications like industrial machinery, prosthetics, automotive, and orthotics. The material is developed using a power bed fusion system and provides superior chemical resistance. (Source: www.voxelmatters.com)

Top Companies List

- LyondellBasell Industries

- ExxonMobil Chemical

- SABIC

- Braskem

- Borealis AG

- TotalEnergies Petrochemicals

- Reliance Industries Limited

- Indian Oil Corporation

- HMC Polymers

- Formosa Plastics Group

- PetroChina Company Limited

- Sinopec Group

- Mitsui Chemicals

- LG Chem

- Hanwha Total Petrochemical

- Hyosung Chemical

- Japan Polypropylene Corporation

- Westlake Corporation

- INEOS Olefins & Polymers

- Qatar Petrochemical Company (QAPCO)

Segments Covered

By Product Type

- Homopolymer Polypropylene

- Random Copolymer Polypropylene

- Block Copolymer Polypropylene

- Expanded Polypropylene (EPP)

- Others (e.g., impact copolymers, terpolymers)

By Processing Technology

- Injection Molding

- Blow Molding

- Extrusion

- Film & Sheet

- Fiber & Filament

- Thermoforming

- Others (e.g., 3D printing, rotomolding)

By End-Use Industry

- Packaging Industry

- Automotive Industry

- Construction Industry

- Healthcare & Pharmaceuticals

- Textile Industry

- Electrical & Electronics

- Consumer Goods

- Agriculture

- Industrial Manufacturing

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait