Content

What is the Current U.S. Bioplastics and Biopolymers Market Size and Share?

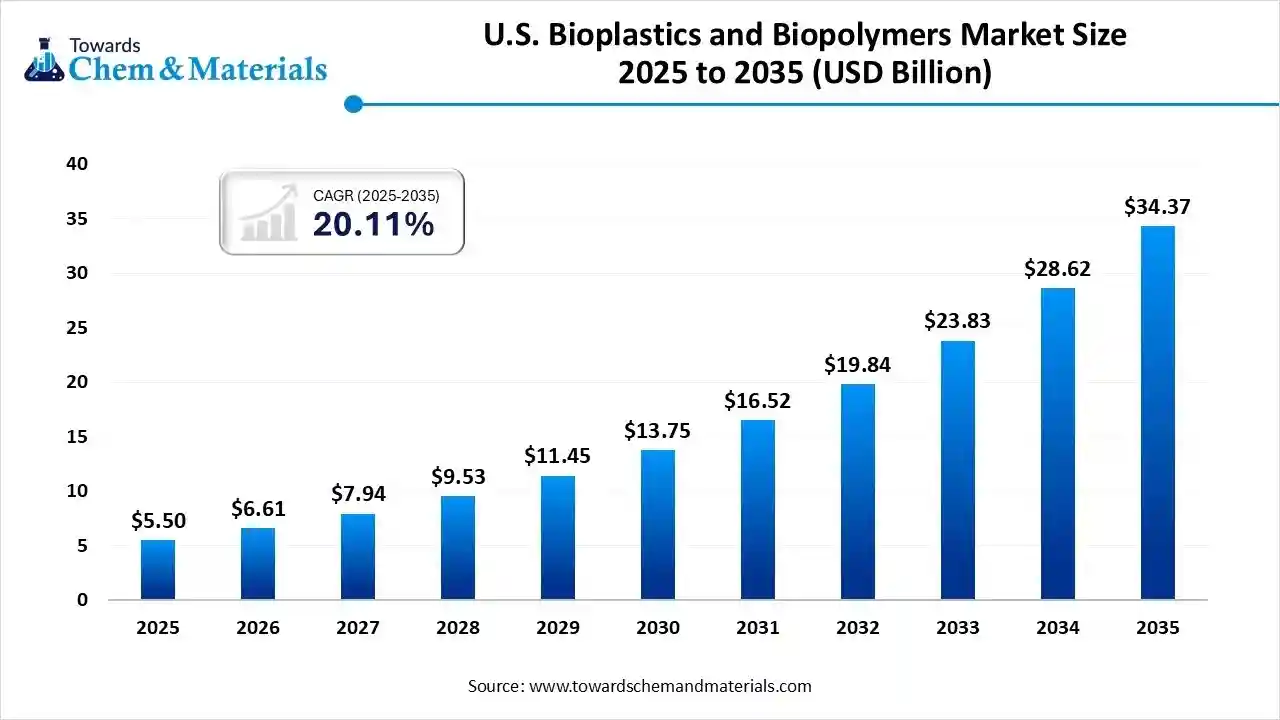

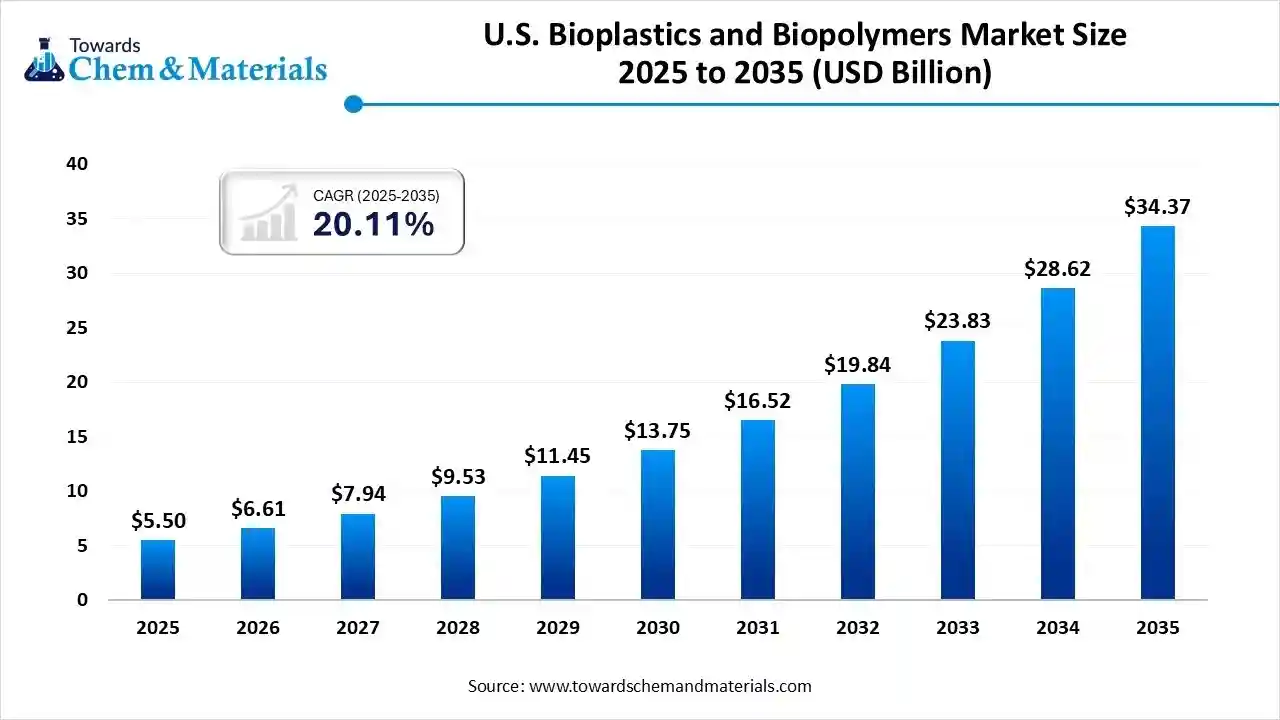

The U.S. bioplastics and biopolymers market size is calculated at USD 5.50 billion in 2025 and is predicted to increase from USD 6.61 billion in 2026 and is projected to reach around USD 34.37 billion by 2035, The market is expanding at a CAGR of 20.11% between 2026 and 2035. The global shift towards sustainability has accelerated market potential in the past few years.

Key Takeaways

- By application, the packaging segment held the largest revenue share of 58% in 2025 in terms of value.

- By raw material source, the corn starch segment led the market with the largest revenue share of 42% in 2025.

- By product form, the flexible bioplastics segment led the market with the largest revenue share of 60% in 2025.

- By distribution channel, the direct sales segment accounted for the largest revenue share of 52% in 2025.

From Waste to Wonder: The Rise of Bioplastic

The bioplastics are known as the plastics that are made from more natural or renewable sources instead of petroleum raw material, whereas biopolymers refer to large natural molecules that are made by living organisms, waste, and microbes. Furthermore, the biopolymers are considered the crucial material in the production of bioplastics.

U.S. Bioplastics and Biopolymers Market Trends

- The shift towards compostable packaging in the e-commerce sector is driving the regional manufacturing expansion through local sourcing trends in recent years. Also, the major e-commerce brands are looking for the compostable films, mailers, and cushioning where the PHA, PLA, and starch-based polymers are ideal materials.

- The heavy demand in food services and quick-serve chains is presenting new business models for the current bioplastic manufacturers. Moreover, the companies are implementing various promotion strategies, while attached materials like lids, straws, containers, and cutlery are mainly seen as eco-friendly or made by biopolymers.

- The adoption of bioplastics in the electronics and automotive sectors has aligned with evolving consumer preferences while offering fresh prospects in the past few years. Also, the manufacturers are actively trying to use polyester, polyimides, and cellulose blends, which are being offered with similar strength to the traditional parts in the current period

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 6.61 Billion |

| Revenue Forecast in 2035 | USD 34.37 Billion |

| Growth Rate | CAGR 20.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Application, By Raw Material Source, By Product Form, By Distribution Channel, |

| Key companies profiled | NatureWorks LLC, Braskem, Tate & Lyle, Danimer Scientific, TotalEnergies Corbion, Danimer Scientific, Eastman Chemical Company, Futerro, Novamont S.p.A., Biomer S.A., Cargill |

From Microbes to Markets: The Rise of Bio-PET and PHA

The shift towards precision bio-manufacturing and microbial fermentation is stimulating demand-led growth in manufacturing during the forecast period. Several companies have seen under significant investment and usage of the engineered microbes for the production of bio-PET, PHA, and advanced biopolymers with advanced purity in the past few years.

Value Chain Analysis of the U.S. Bioplastics and Biopolymers Market:

- Distribution to Industrial Users: The distribution of bioplastics and biopolymers to U.S. industrial users primarily involves direct supply from major manufacturers and compounders to a wide range of end-use industries, including packaging, automotive, textiles, and consumer goods. There are a limited number of specialized distributors who facilitate this supply chain.

- Key Players: NatureWorks LLC and Danimer Scientific

- Chemical Synthesis and Processing : The industry involves the use of advanced chemical synthesis and processing technologies, primarily fermentation and polymerization, to convert renewable biomass into sustainable materials. Key players in this market are involved in producing and refining these materials for various industrial applications.

- Key Players: Braskem and Eastman Chemical Company

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring for the U.S. bioplastics and biopolymers market are managed by a framework of federal agencies, primarily the Food and Drug Administration (FDA), the U.S. Department of Agriculture (USDA), and the Federal Trade Commission (FTC), each addressing different aspects of the product lifecycle and claims.

U.S. Bioplastics and Biopolymers Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

|

United States |

Environmental Protection Agency (EPA) | FTC Green Guides | Consumer protection and clear labeling, Waste management and recycling contamination |

Segmental Insights

Application Insights

How did the Packaging Segment Dominate the U.S. Bioplastics and Biopolymers Market in 2025?

The packaging segment dominated the market with approximately 58% industry share in 2025 due to it being considered the largest source of single-use plastic waste in the region. Moreover, the increasing need for cleaner alternatives has contributed to the segment's growth in recent years. Also, offering faster certifications and lower production costs is likely to create lucrative opportunities in the coming years.

The medical and healthcare products segment is expected to grow at approximately 15 to 17% CAGR, owing to the biopolymers becoming safe, sterile, and eco-friendly medical materials. Also, several hospitals are observed in the heavy usage of single-use items like wound dressings, syringes, and diagnostic strips.

The agriculture segment is also notably growing, akin to farmers are shifting towards reducing soil and plastic pollution. Moreover, the farming sector in the United States has seen under heavy pressure reduction in the usage of microplastics and single-use plastics nowadays. Moreover, several biopolymers have been seen in improving soil health with moisture retention.

Raw Material Insights

Why Does the Corn Starch Segment Dominate the U.S. Bioplastics and Biopolymers Market by Raw Material?

The corn starch segment dominated the market with approximately 42% industry share in 2025 because the U.S. is one of the world's largest corn producers, ensuring reliable, affordable, and abundant feedstock. Corn starch is easy to process into PLA and other biopolymers using established technology, making it the most commercially mature raw material.

The sugarcane segment is expected to grow at approximately 14 to 16% CAGR because companies are shifting toward bio-based polyethylene (bio-PE) and advanced biopolymers made from sugarcane ethanol. Sugarcane-derived materials have better mechanical strength, higher purity, and lower carbon emissions compared to corn-based alternatives.

The soy segment is also notably growing because the U.S. soybean industry is large, well-supported, and highly innovative. Soy proteins and oils can be converted into adhesive films, coatings, and biodegradable plastics with excellent flexibility and moisture resistance.

Product Form Insights

How did the Flexible Bioplastics Segment Dominate the U.S. Bioplastics and Biopolymers Market in 2025?

The flexible bioplastics segment dominated the market with approximately 60% market share in 2025 because they are ideal for the largest-volume applications like bags, pouches, packaging films, labels, and wraps. These products require lightweight, stretchable, cost-effective materials, which flexible biopolymers like PLA blends and starch-based films provide.

The rigid bioplastics segment is expected to grow at approximately 13 to 14% CAGR, because industries like electronics, home goods, cosmetics, and automotive parts need strong, durable, and heat-resistant materials. New bio-based polyesters, polyamides, and composite biopolymers offer performance equal to or better than traditional plastics.

Distribution Channel Insights

How did the Direct Sales Segment Dominate the U.S. Bioplastics and Biopolymers Market in 2025?

The direct sales segment dominated the market with approximately 52% industry share in 2025 because bioplastic manufacturers work closely with packaging companies, brands, and industrial buyers who require technical support, customization, and consistent supply. These large customers prefer direct sourcing to negotiate pricing, secure long-term contracts, and ensure quality standards.

The online B2B platforms segment is expected to grow at approximately 17% CAGR, because buyers now want fast price comparisons, real-time inventory, transparent sourcing, and easy bulk ordering. Digital marketplaces make it simple for businesses to purchase bioplastics without negotiating through long sales cycles.

The distributors and traders segment is also notably growing because the market needs fast, flexible, and region-wide supply networks as more industries adopt bioplastics. Many customers require smaller order quantities or diverse grades, which distributors can provide more efficiently than manufacturers.

Recent Developments

- In August 2025, Cortec unveiled a biobased bioplastic called the Eco Works 100. Also, this newly launched product has 100% compatibility and has USDA certification as per the published report by the company.(Source: www.plasticsnews.com)

Top Vendors in the U.S. Bioplastics and Biopolymers Market & Their Offerings:

NatureWorks LLC

Corporate Information

- NatureWorks LLC is a U.S.-based bioplastics/biopolymer company.

- Headquarters: Plymouth / Minnetonka, Minnesota, USA.

- Parent / Ownership: Jointly owned by Cargill Incorporated (U.S. agribusiness conglomerate) and PTT Global Chemical (Thai petrochemical/chemical company).

- Core Product / Brand: Polylactic acid (PLA) biopolymer marketed under the brand name Ingeo.

History and Background

- The origin of NatureWorks dates to 1989, when it began as a research project by Cargill exploring the use of plant carbohydrates (e.g., from corn or other starches) to produce more sustainable plastics.

- In 2002, the Blair, Nebraska facility started operations making NatureWorks one of the first companies to produce PLA at commercial scale.

Key Developments and Strategic Initiatives

- Global capacity expansion: New PLA facility in Thailand: In 2021, NatureWorks obtained final authorization from its parent companies to invest over US$ 600 million to build a fully integrated PLA manufacturing complex in Thailand (lactic acid - lactide - polymer stages).

- Construction progress of Thailand complex: In 2022–2023, NatureWorks selected a general contractor and commenced early works construction at the Nakhon Sawan Biocomplex. The plant is expected to have 75,000 t/year capacity and produce the full portfolio of Ingeo grades. As of late 2023, the project is on track, with full production anticipated by 2025.

Mergers & Acquisitions

- In 2012, NatureWorks formed a joint venture with BioAmber (a bio-chemicals company) called AmberWorks. The purpose was to commercialize new bio-based polymer compositions combining NatureWorks’ PLA platform with BioAmber’s biochemical building blocks (such as succinic acid / PBS).

- Partnerships & Collaborations : More recently (2025), NatureWorks entered into a master collaboration agreement with CJ Biomaterials (CJ BIO) to develop novel biopolymer solutions. The collaboration focuses on combining PLA with PHA (or PHA based polymers) to broaden mechanical properties, degradation profiles, and application scope (e.g. nonwovens for hygiene, compostable films).

- Product Launches / Innovations: The core Ingeo™ PLA biopolymer line, offering a renewable, low-carbon alternative to traditional plastics, suitable for packaging, fibers, films, rigid and flexible formats.

Ingeo™ Extend an advanced PLA platform aiming to improve film processing, enable higher stretch in biaxial films, reduce production costs, and accelerate compostability (reportedly up to 8× faster than standard PLA in some cases).

Key Technology Focus Areas

- NatureWorks emphasizes renewable feedstocks: The company transforms plant-derived sugars often from corn or other starch sources into lactic acid via fermentation, then into lactide and ultimately polymerizes to produce PLA.

- They seem committed to circular-economy thinking: Their materials are designed to be used, composted, chemically recycled, or landfilled offering multiple after use pathways.

R&D Organisation & Investment

Their R&D and applications development center (in Minnesota) works on tailoring material properties (barrier, heat resistance, thermoformability), enabling PLA to compete with petroleum-based plastics across many applications.

SWOT Analysis

Strengths

- Largest global PLA production capacity (150,000 MT/yr in Nebraska, with further expansion ongoing) gives them scale advantage.

- Strong brand recognition and first mover advantage: Ingeo is one of the earliest and best-known PLA biopolymer brands globally.

- Robust global distribution and presence serves North America, Europe, Asia-Pacific, etc.

Weaknesses

- Heavy reliance on a single polymer class (PLA), which makes NatureWorks vulnerable to fluctuations in feedstock cost (corn or agricultural sugars) and commodity price volatility.

- Some limitations inherent to PLA: for example, heat resistance, mechanical toughness, or biodegradation limitations under certain conditions which restricts use in some high-performance applications.

Opportunities

- Growing global demand for sustainable, low-carbon, compostable materials, especially in packaging, foodservice, 3D printing, nonwovens and hygiene supporting strong long-term growth potential.

- Expansion into new application domains beyond traditional packaging e.g. 3D printing, medical, hygiene/nonwovens, compostable films where bioplastics may gain premium value.

Threats

- Emergence of competitors other biopolymer producers (PLA alternatives like PHA, or blends), or petrochemical backed “bio-attributed” polymers could erode market share.

- Feedstock supply risk & volatility: biopolymer feedstocks depend on agriculture (corn, sugar, etc.), which may be affected by climate, crop yields, competing demands (food vs plastics). This can cause cost unpredictability.

Recent News & Strategic Updates

- In November 2022, NatureWorks selected general contractor TTCL Public Company Limited for its new fully integrated PLA manufacturing facility in Thailand, marking the start of large-scale construction for the 75,000 t/year plant.

- On February 1, 2023, the company held a cornerstone laying ceremony for the Thailand facility, symbolizing a major milestone in its global expansion strategy.

Other Key Players

- NatureWorks LLC: A leading producer of Ingeo biopolymer (polylactic acid or PLA) from renewable resources, used in a wide range of applications from packaging and food service ware to textiles and industrial parts.

- Braskem: A major petrochemical company with a strong focus on sustainability, known for its "I'm green" brand of ethylene vinyl acetate (EVA) and polyethylene (PE) made from sugarcane ethanol.

- Tate & Lyle: A global provider of food and beverage ingredients that also supplies starches and other raw materials used in the production of bioplastics and biopolymers.

- Danimer Scientific: An American company specializing in the creation of biodegradable biopolymers known as Nodax PHA (polyhydroxyalkanoates), which can replace many conventional petroleum-based plastics.

- TotalEnergies Corbion

- Danimer Scientific

- Eastman Chemical Company

- Futerro

- Novamont S.p.A.

- Biomer S.A.

- Cargill

Segment Covered

By Application

- Packaging

- Food Packaging

- Beverage Packaging

- Flexible Packaging

- Agriculture

- Mulch Films

- Seed Coatings

- Consumer Goods

- Textiles

- Automotive Components

- Medical & Healthcare Products

By Raw Material Source

- Corn Starch

- Sugarcane

- Soy

- Cellulose

- Vegetable Oils

By Product Form

- Rigid Bioplastics

- Flexible Bioplastics

By Distribution Channel

- Direct Sales (Manufacturers)

- Distributors & Traders

- Online B2B Platforms