Content

What is the Textile Market Size and Share?

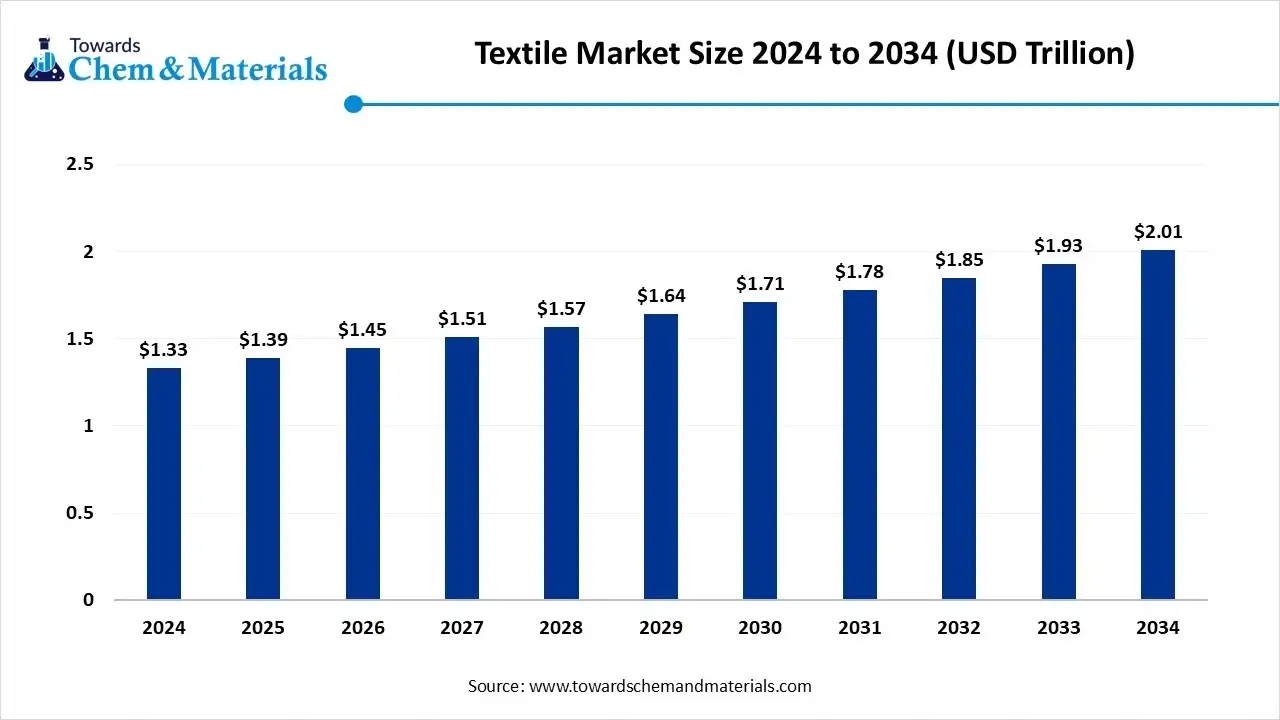

The textile market size was estimated at USD 1.33 trillion in 2024 and grew to USD 1.39 trillion in 2025, and is projected to reach around USD 2.01 trillion by 2034. The market is expanding at a CAGR of 4.24% between 2025 and 2034. Asia Pacific dominated the textile market with a market share of 50.11% the global market in 2024.Growth is driven by rising apparel consumption, sustainable fibre innovation, and the expansion of technical textile applications.

Key Takeaway

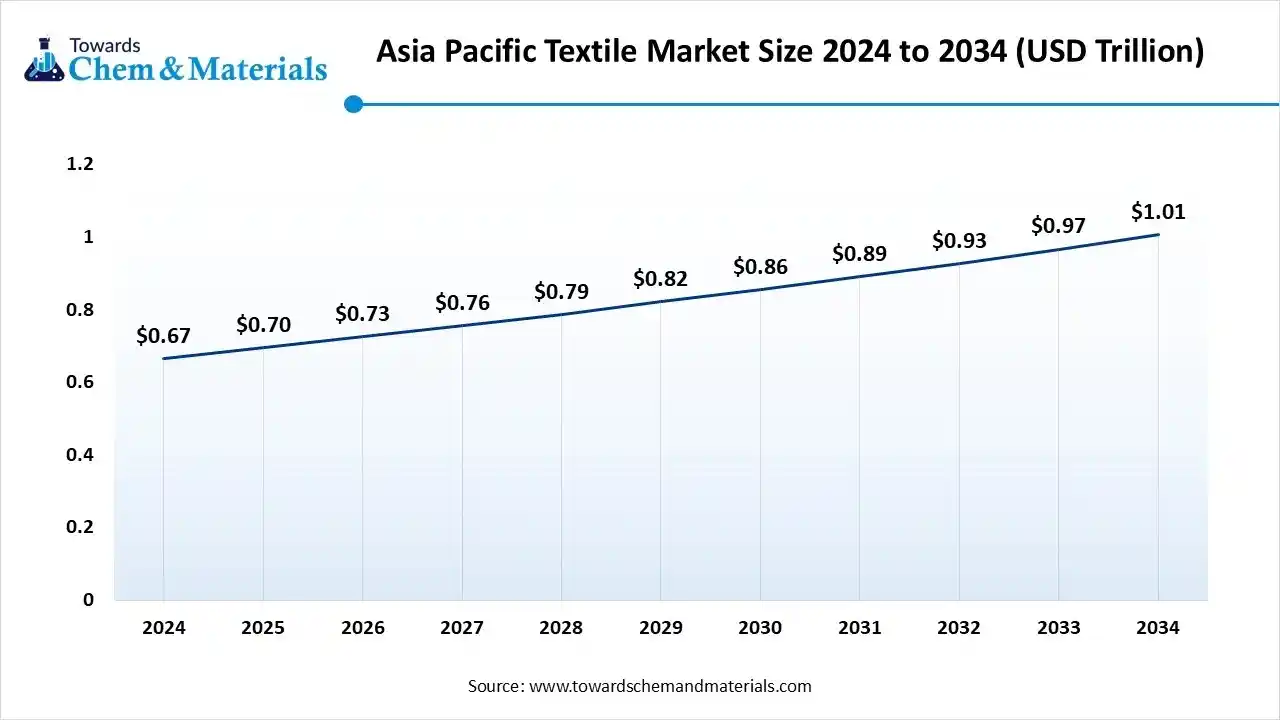

- By region, Asia Pacific dominated the market with a share of 50.11% in 2024.

- By region, North America is expected to have significant growth in the market in the forecast period.

- By material/fibre type, the synthetic fibres segment dominated the market with a share of 42.4% in 2024.

- By material/fibre type, the natural fibres segment is expected to grow significantly in the market during the forecast period.

- By fabric/form, the woven fabrics segment dominated the market with a share of 51.4% in 2024.

- By fabric/form, the non-woven fabrics segment is expected to grow in the forecast period.

- By product type, the fabric segment dominated the market with a share of 44.4% in 2024.

- By product type, the finished textile (garments, home textiles, technical textiles) segment is expected to grow in the forecast period.

- By application / end-use, the apparel/fashion segment dominated the market with a share of 54.5% in 2024.

- By application / end-use, the technical/industrial textiles (automotive, medical, protective, construction) segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Textile Market?

The significance of the textile market is its massive contribution to global and national economies through job creation and exports, its cultural importance, and its role in supporting other industries. It is a major source of employment, especially in developing countries, and provides essential products for daily life, while also linking agriculture to manufacturing and driving technological innovation through sectors like technical textiles.

Textile Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the global textile market is projected to grow steadily, driven by rising demand from apparel, home furnishing, and industrial applications. Rapid urbanisation, changing fashion trends, and expanding e-commerce platforms are accelerating textile consumption, particularly in the Asia-Pacific and Latin America.

- Sustainability Trends: Sustainability is transforming the textile industry, with growing emphasis on eco-friendly fibres, closed-loop recycling, and water-efficient dyeing processes. Companies are increasingly adopting organic cotton, recycled polyester, and bio-based fabrics to reduce environmental impact and align with circular economy principles.

- Global Expansion & Innovation: Leading textile manufacturers are expanding operations in low-cost regions and investing in advanced fibre technologies. Collaborations between fibre producers, fashion brands, and chemical companies are fostering innovation in performance textiles, antimicrobial fabrics, and biodegradable materials.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 1.45 Trillion |

| Expected Size by 2034 | USD 2.01 Trillion |

| Growth Rate from 2025 to 2034 | CAGR 4.24% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material / Fibre Type, By Fabric / Form, By Product Type, By Application / End-Use, Regional Insights |

| Key Companies Profiled | Hengli Petrochemical Co., Ltd.; Shenzhou International Group Holdings Ltd; Toray Industries, Inc.; Inditex; Chargeurs SA; Far Eastern New Century Corporation; Sasa Polyester Sanayi A.S.; Eclat Textile Co. Ltd; TJX Companies; Vardhman Textiles |

Key Technological Shifts In The Textile Market:

The textile industry is undergoing a significant technological renaissance driven by advancements in smart manufacturing, new materials, and digitalisation. New digital and waterless dyeing techniques are significantly reducing the textile industry's environmental footprint by using less water, energy, and chemicals. Digital printing also allows for faster turnaround times and mass customisation. These innovations are fundamentally reshaping how textiles are produced and consumed, with a strong focus on sustainability, efficiency, and customised functionality.

Trade Analysis Of Textile Market: Import & Export Statistics

- From November 2023 to October 2024 (TTM), India shipped a total of 11,065 Textile shipments. These were carried out by 861 Indian Exporters to 1,305 Buyers, reflecting a 13% increase over the previous twelve months.

- In October 2024 alone, India exported 824 Textile shipments. The primary destinations for Indian Textile exports are the United States, the United Arab Emirates, and Germany.

- Globally, the leading Textile exporters are China, Vietnam, and Mexico, with China at the top with 695,245 shipments, followed by Vietnam with 629,500 shipments, and Mexico with 353,960 shipments.(Source: www.volza.com)

- The World shipped out 78,050 Textile Fabric shipments from November 2023 to October 2024 (TTM). These exports were handled by 1,119 global exporters to 1,385 buyers, showing a growth rate of 31% over the previous 12 months.

- Globally, China, Vietnam, and Brazil are the top three exporters of Textile Fabric. China is the global leader in Textile Fabric exports with 114,081 shipments, followed closely by Vietnam with 36,209 shipments, and Brazil in third place with 25,795 shipments.(Source : www.volza.com)

Textile Market Value Chain Analysis

- Chemical Synthesis and Processing : Textiles are produced through fibre extraction, spinning, weaving or knitting, dyeing, and finishing processes. Both natural (cotton, wool, silk) and synthetic (polyester, nylon) fibres are used, with increasing adoption of sustainable and recycled fibres.

- Key players Toray Industries Inc., Indorama Ventures Public Co. Ltd., Arvind Limited, Reliance Industries Ltd., DuPont de Nemours Inc.

- Quality Testing and Certification : Textiles are tested for tensile strength, colourfastness, shrinkage, and chemical safety under global standards such as ISO 9001, OEKO-TEX Standard 100, and GOTS (Global Organic Textile Standard).

- Key players: SGS, Intertek, Bureau Veritas, TÜV SÜD.

- Distribution to Industrial Users : Textiles are supplied to apparel, home furnishing, automotive, and industrial applications through wholesalers, exporters, and retail networks.

- Key players: Aditya Birla Group, Vardhman Textiles Ltd., Arvind Limited, Toray Industries Inc.

Textile Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| Global / International | International Labour Organisation (ILO) ISO (International Organization for Standardization) |

- ILO Conventions (Labour Standards, Occupational Safety) - ISO 14001 (Environmental Management) - ISO 9001 (Quality Management) - OEKO-TEX® Standard 100 |

- Worker rights and fair labour practices - Environmental management systems - Product safety and textile certification |

The ILO and ISO frameworks form global baselines for ethical manufacturing, quality, and sustainability. OEKO-TEX® ensures textiles are free from harmful chemicals. |

| United States | U.S. Environmental Protection Agency (EPA) Federal Trade Commission (FTC) Occupational Safety and Health Administration (OSHA) |

- Clean Water Act (CWA) - Clean Air Act (CAA) - Textile Fibre Products Identification Act - Toxic Substances Control Act (TSCA) |

- Effluent and emission control - Chemical safety and labelling - Worker exposure and safety standards |

U.S. textile facilities are subject to strict effluent discharge permits (NPDES). The FTC enforces fibre labelling and marketing accuracy, while the EPA regulates dye and finishing chemical use. |

| European Union | European Chemicals Agency (ECHA) European Commission (DG GROW) |

- REACH Regulation (EC 1907/2006) - CLP Regulation (EC 1272/2008) - EU EcoLabel Regulation (66/2010) - Textile Strategy for Sustainable and Circular Textiles (2022) |

- Chemical registration and restriction - Consumer safety and transparency - Circular economy and eco-design |

The EU REACH framework restricts hazardous substances like azo dyes and PFAS. The EU Textile Strategy mandates durability, recyclability, and traceability in textile production. |

| China | Ministry of Ecology and Environment (MEE) State Administration for Market Regulation (SAMR) |

- GB National Standards for Textiles (GB 18401, GB/T 29862) - Cleaner Production Promotion Law (amended 2021) - Circular Economy Promotion Law (2021) |

- Product quality and chemical safety - Pollution prevention and cleaner production - Recycling and waste reduction |

China enforces GB 18401 to regulate harmful substances in textiles. Zero-discharge and eco-labelling standards are expanding under the national circular economy goals. |

| India | Ministry of Textiles Central Pollution Control Board (CPCB) Bureau of Indian Standards (BIS) |

- Textile Sector Effluent Standards under the Water Act (1974) - Zero Liquid Discharge (ZLD) Guidelines (2015) - BIS IS 17218:2019 – Safety of Textiles |

- Effluent treatment and water reuse - Sustainable dyeing and finishing - Worker safety and compliance certification |

India’s textile clusters (e.g., Tirupur, Surat) follow ZLD mandates for effluent recycling. BIS standards ensure product safety and consumer protection. |

| Japan | Ministry of Economy, Trade and Industry (METI) Ministry of the Environment (MOE) |

- Household Goods Quality Labelling Act - Chemical Substances Control Law (CSCL) - Green Purchasing Law (2001) |

- Product safety and labelling - Chemical safety assessment - Eco-friendly textile procurement |

Japan promotes sustainable textile sourcing through its Green Purchasing Network (GPN) and enforces eco-labels like EcoMark. |

Segmental Insights

Material / Fibre Type Insights

Which Material/Fibre Type Segment Dominated The Textile Market in 2024?

- The synthetic fibres segment dominated the textile market with a share of 42.4% in 2024. Synthetic fibres, including polyester, nylon, and acrylic, dominate global textile production due to their durability, cost-effectiveness, and easy processability. Growing demand for moisture-wicking, stretchable materials in activewear and performance clothing is accelerating synthetic fibre innovations and sustainability-focused recycling technologies.

- The natural fibres segment expects significant growth in the market during the forecast period. Natural fibres such as cotton, wool, and silk maintain strong demand, driven by consumer preference for comfort, breathability, and biodegradability. The market is witnessing a shift toward organic and sustainably sourced cotton to meet eco-conscious textile standards.

- The regenerated/man-made cellulosic fibres segment has seen notable growth in the market. Fibres like viscose, modal, and lyocell combine the comfort of natural fibres with the performance benefits of synthetics. Increasing adoption in premium apparel and home furnishings is driven by sustainability and biodegradability. Continuous innovations in closed-loop production processes, particularly in lyocell, strengthen the market for eco-friendly regenerated cellulosic textiles.

Fabric / Form Insights

How Did Woven Fabrics Segment Dominated The Textile Market 2024?

- The woven fabrics segment dominated the textile market with a share of 51.4% in 2024. Woven fabrics, known for their strength and versatility, are used extensively in apparel, home furnishings, and industrial applications. The segment continues to dominate structured garment manufacturing and upholstery markets worldwide.

- The non-woven fabrics segment expects significant growth in the market during the forecast period. Non-woven fabrics are expanding rapidly in hygiene, medical, and filtration applications due to their lightweight and disposable properties. Increasing focus on biodegradable and spunbond non-woven products supports sustainable material adoption in industrial and consumer sectors.

- The knitted fabrics segment has seen notable growth in the market. Knitted fabrics offer stretchability and comfort, making them ideal for sportswear, lingerie, and casual apparel. Technological advancements such as seamless knitting and 3d knitting enhance customisation and design flexibility. The rising popularity of athleisure and performance wear globally continues to propel the knitted fabric segment.

Product Type Insights

Which Product Type Segment Dominated The Textile Market in 2024?

- The fabric segment dominated the market with a share of 44.4% in 2024. The fabric segment remains the backbone of the textile industry, providing essential inputs for apparel, furnishings, and industrial uses. Demand for lightweight, breathable, and high-performance fabrics drives innovation in both woven and knitted fabric categories.

- The finished textile (garments, home textiles, technical textiles) segment expects significant growth in the market during the forecast period. Finished textiles account for a significant share of value-added output in the global market. Expanding urbanisation and consumer lifestyle upgrades stimulate home textile demand, while smart and protective textiles find increasing industrial applications.

- The fibre segment has seen notable growth in the market. Fibre production forms the foundation of the textile value chain, supplying raw material to yarn and fabric manufacturers. Continuous research in biopolymer and recycled fibre technologies enhances performance and sustainability. Expanding circular textile initiatives are promoting fibre recovery and closed-loop manufacturing systems.

Application / End-Use Insights

How Did the Apparel/Fashion Segment Dominated The Textile Market in 2024?

- The apparel/fashion segment dominated the market with a share of 54.5% in 2024. The apparel and fashion segment represents the largest share of the market, driven by fast fashion, e-commerce growth, and customisation trends. Growing consumer demand for functional and stylish apparel sustains steady market growth.

- The technical/industrial textiles (automotive, medical, protective, construction) segment expects significant growth in the market during the forecast period. Technical textiles are gaining momentum due to their specialised applications in automotive, medical, and construction sectors. Increasing investment in smart textiles, such as antimicrobial or fire-resistant materials, is transforming industrial textile innovation and performance standards.

- The home textiles (bed linen, curtains, upholstery, towels) segment has seen notable growth in the market. Home textiles benefit from rising disposable incomes and consumer focus on interior aesthetics. Innovations in fabric softness, colourfastness, and durability drive demand across bedding, upholstery, and bathroom textiles. Sustainable home décor and eco-friendly furnishings continue to influence consumer purchasing behaviour.

Regional Insights

The Asia Pacific textile market size is valued at USD 0.70 trillion in 2025 and is expected to surpass around USD 1.01 trillion by 2034, expanding at a compound annual growth rate (CAGR) of 4.19% over the forecast period from 2025 to 2034. Asia Pacific dominates the textile market share of 50.11% in 2024. Asia Pacific leads the global market, accounting for a dominant share in production and exports. Countries like China, India, and Bangladesh drive low-cost manufacturing and global supply chains. Rising domestic consumption, sustainable textile initiatives, and technological upgrades reinforce the region’s leadership in apparel and home textile production.

India: Integrated Textile Value Chain Support

India’s textile sector thrives on strong cotton availability, skilled labour, and government-backed initiatives like the Production Linked Incentive (PLI) scheme. Growth in technical textiles, eco-friendly fabrics, and digital printing expands market scope. The country’s integrated textile value chain supports both domestic and export-driven demand.

North America Textile Market: Growing Emphasis On Circularity And Sustainability

North America’s textile market is driven by demand for high-performance, sustainable fabrics and onshore manufacturing. The U.S. leads innovations in smart textiles, automation, and advanced polymer fibres. Growing emphasis on circularity and recycled materials enhances regional competitiveness in apparel and technical segments.

U.S. Textile Market: Growing Trends

The U.S. textile industry emphasises technological integration, sustainability, and local production efficiency. Increasing use of recycled polyester and biodegradable fibres aligns with ESG goals. Strong demand for performance wear and automotive textiles supports steady market growth amid shifting consumer preferences.

The Middle East And Africa Have Seen Significant Growth Driven By Industrialization

The Middle East and Africa region experiences growing textile manufacturing investments supported by trade diversification and industrialisation policies. Egypt and Turkey are emerging textile hubs. Expanding urban population and rising apparel consumption foster regional market growth.

GCC Countries' Textile Market: Sustainability-Oriented Initiatives

In the GCC, textile growth is driven by apparel imports, diversification programs, and government efforts to localise production. Saudi Arabia and the UAE are promoting technical and uniform textiles through sustainability-oriented initiatives. The region’s focus on non-oil industries strengthens long-term textile development prospects.

Europe Has Seen Growth In The Market, Driven By The Presence Of Key Textile Producers

The European textile market demonstrates strong recovery and innovation, driven by sustainability, circular fashion models, and advanced material technologies. Key textile producers focus on recycled fibres, eco-friendly dyes, and smart fabrics. The region’s fashion and technical textile sectors also benefit from government incentives promoting local manufacturing and reduced carbon footprints.

Higher Presence Of Fashion Industries Accelerate The Textile Market Growth In The Country

The UK textile market is experiencing consistent growth, the main drivers include growing consumer demand for sustainable and ethically produced textiles, rapid expansion of e-commerce, and rising spending on fashion and home furnishings. Segments such as household textiles and apparel show the strongest momentum. Although textile exports have faced challenges, domestic consumption continues to rise.

Latin America Experiencing The Rapid Growth In The Textile Market

The market in Latin America is expanding steadily, the market is driven by growing middle-class consumption, e-commerce expansion, and rising fashion awareness. Sustainability and eco-friendly materials are becoming key growth factors as consumer preferences shift toward ethical production. Countries such as Brazil, Mexico, and Colombia lead the regional market due to strong manufacturing bases and increasing domestic demand. Despite challenges like raw material costs and import dependencies, the Latin American textile industry continues to strengthen, supported by technological advancements and a growing focus on local production.

Brazil Textile Market

The textile market in Brazil is showing consistent growth across several segments. Key drivers include rising domestic consumption, growth of e-commerce and fashion retail, demand for sustainable and recycled fabrics, and a relatively complete textile supply chain (from fiber to retail) in Brazil. On the production side, many companies are investing in advanced machinery and moving toward more value-added manufacturing.

Recent Developments

- In October 2025, Lenzing and OceanSafe collaborated to create a new performance textile combining Lenzing's TENCEL™ Lyocell A100 fibres with OceanSafe's naNea co-polyester, aiming to produce sustainable and high-performance athletic wear.(Source: www.textileworld.com)

- In October 2025, India's government launched the "Swadeshi Campaign" in October 2025 to promote domestic textiles, aiming to increase the market size to $250 billion by 2030. The initiative seeks to reposition Indian textiles and expand opportunities for weavers and MSMEs through actions like encouraging institutional procurement.(Source: timesofindia.indiatimes.com)

- In July 2025, in response to California's new textile EPR law, a coalition of industry groups will establish the state's initial Producer Responsibility Organisation (PRO). This nonprofit entity will oversee a statewide textile collection, reuse, and recycling system to reduce landfill waste, financed through fees paid by textile producers.(Source: www.fibre2fashion.com)

Top Textile Market Companies

Toray Industries, Inc. (Japan)

Corporate Information

- Name: Toray Industries, Inc.

- Founded: January 1926.

- Headquarters: Nihonbashi Mitsui Tower, 1-1 Nihonbashi-Muromachi 2-chome, Chūō-ku, Tokyo 103-8666, Japan.

History and Background

- Toray was established in 1926 originally as a rayon yarn manufacturer (under the name Toyo Rayon Co., Ltd.) and over the decades diversified into synthetic fibres, plastics, films, carbon fibre composites, etc.

- In the 1930s and 1940s the company moved into nylon production, etc., expanding its technical base.

Key Developments and Strategic Initiatives

- Medium-Term Management Program: “Project AP-G 2025” the company’s roadmap emphasizing innovation, value creation, growth fields, and enhanced corporate value.

- Capital strategy: The company carried out share repurchases as part of capital return / shareholder value enhancement e.g., acquiring ~7.17 million shares for ~¥7.04 billion between Dec 1-31, 2024.

Mergers & Acquisitions

- Acquisition of Zoltek Companies, Inc. (USA) in 2013 for ~$584 million (to enter/expand large‐tow carbon fibre business).

- The deal strengthened Toray’s carbon fibre business and position in wind‐blade / automotive structural applications.

Partnerships & Collaborations

- With Hyundai Motor Group (and group affiliates): In April 2024 signed a strategic cooperation agreement to develop advanced materials (particularly carbon fibre‐reinforced composites) for future mobility vehicles, special‐purpose mobility like rovers/robots.

- With Epsilon Composite (France): A 15-year partnership to use Toray carbon fibre in composite core cables for electrical-infrastructure / power‐grid applications; new production line in Europe by end of 2025.

Product Launches / Innovations

- In October 2023, Toray developed the TORAYCA™ T1200 ultra-high-strength carbon fibre with tensile strength ~1,160 ksi (≈8 GPa), the world’s highest strength class in its category.

- Earlier, Toray launched the TORAYCA™ M46X carbon fibre (Jan 2024) with ~20% higher strength than previous fibres while maintaining high modulus, enabled by proprietary nano-structure control.

Key Technology Focus Areas

- Four core technology platforms: Polymer chemistry, Organic synthetic chemistry, Biotechnology, Nanotechnology.

- Materials / applications emphasis:

- Carbon fibre composites / high modulus, high strength fibres.

- Non-woven fabrics / advanced fibres & textiles (in the fibres & textiles business).

- Performance chemicals (resins, films, fine chemicals) for electronics, information/communications, automotive.

- Water treatment membranes / environmental engineering materials.

- Life-science/medical device materials.

- There is also an emphasis on sustainability: bio-circular carbon fibre (e.g., ISCC PLUS certified) and recycling/up-cycling of prepreg waste.

R&D Organisation & Investment

- While exact total R&D spend is not highlighted in the sources I found, Toray is actively investing in innovation: e.g., new facilities for carbon fibre, new product lines, nano-structure technology development.

- R&D organisation is global: multiple technical centres / production sites (for its plastics/resins division: 21 technical centres in 11 countries)

- The company emphasises co-creation with customers, global application development, long-term perspective management.

SWOT Analysis

Strengths

- Global scale, diversified materials portfolio (fibres/textiles, chemicals, composites, environment/engineering) reducing reliance on any one segment.

- Strong technological capability and core competencies (polymer science, nanotechnology etc).

- Leadership in carbon fibre and composites & advanced materials (e.g., world’s highest strength carbon fibre).

Weaknesses

- As a diversified materials company, complexity of managing many segments may dilute focus.

- Some legacy segments (traditional textiles) may face slower growth or commoditization.

- High R&D and capital investment required for advanced materials; longer payback periods and risk of technological obsolescence.

Opportunities

- Growth in electric vehicles (EVs), aerospace (especially lightweight composites), wind power / renewable energy (large-tow carbon fibre for wind turbine blades) all align with Toray’s material strengths.

- Sustainability / circular economy: increasing demand for bio-circular materials, recycled composites, up-cycling solutions.

- Emerging markets (e.g., India, Southeast Asia) for textiles, high-performance materials; partnerships and JV expansions (e.g., Toray MAS Apparel India).

Threats

- Intense competition in advanced materials (other large chemical/materials companies) can pressure pricing/margins.

- Macroeconomic cycles: downturns in auto, aerospace, or construction can reduce demand for high‐end materials.

- Technological disruption: new materials or manufacturing processes may obviate current technologies.

Recent News & Strategic Updates

- In September 2025: Entered joint venture in India with MAS Holdings (Sri Lanka) to establish “Toray MAS Apparel India” at MAS Apparel Park in Bhuinpur, Odisha. Operations are expected to be early 2026. This is part of textile/manufacturing expansion.

- October 27, 2025: Strategic joint development agreement with Hyundai Motor Group to develop advanced materials for future mobility (high-performance composite materials) covering full chain from R&D to production and commercialization.

- Toray Advanced Textile (Korea): Specialises in high-performance fabrics, nonwovens, and composites used in apparel, filtration, and industrial sectors, focusing on lightweight and durable materials.

Shandong Ruyi Technology Group Co., Ltd. (China): A major vertically integrated textile and apparel company producing fibres, yarns, fabrics, and garments with a strong focus on innovation and global fashion supply. - Hyosung TNC Corporation (South Korea): Produces synthetic fibres such as spandex, nylon, and polyester, known for brands like Creora® and Mipan®, widely used in activewear and industrial textiles.

- Aditya Birla Group (India): Through its textile subsidiaries like Birla Cellulose, it manufactures viscose, modal, and lyocell fibres derived from renewable wood pulp for sustainable textile applications.

- JCT Limited (India): Manufactures a variety of synthetic and blended fabrics for apparel, institutional, and industrial uses, integrating sustainability in textile processing.

TOP Key Textile Companies:

The following are the leading companies in the textile market. These companies collectively hold the largest market share and dictate industry trends.

- Hengli Petrochemical Co., Ltd.

- Shenzhou International Group Holdings Ltd

- Toray Industries, Inc.

- Inditex

- Chargeurs SA

- Far Eastern New Century Corporation

- Sasa Polyester Sanayi A.S.

- Eclat Textile Co. Ltd

- TJX Companies

- Vardhman Textiles

- Indorama Ventures Public Company Limited (Thailand)

- Lenzing AG (Austria)

- Reliance Industries Limited – Textiles & Fibres Division (India)

- Arvind Limited (India)

- Vardhman Textiles Ltd. (India)

- Texhong Textile Group (China)

- Shenzhou International Group Holdings Limited (China)

- Welspun India Ltd. (India)

- Trident Group (India)

- Nishat Mills Ltd. (Pakistan)

- Huafeng Textile Group (China)

- Raymond Ltd. (India)

- KPR Mill Limited (India)

- Bombay Dyeing & Manufacturing Co. Ltd. (India)

Segments Covered:

By Material / Fibre Type

- Natural Fibres (Cotton, Wool, Silk, Linen, Jute)

- Synthetic Fibres (Polyester, Nylon, Acrylic, Polypropylene)

- Regenerated / Man-Made Cellulosic Fibres (Viscose, Rayon, Lyocell)

- Blended Fibres

By Fabric / Form

- Woven Fabrics

- Knitted Fabrics

- Non-Woven Fabrics

By Product Type

- Fibre

- Yarn

- Fabric

- Finished Textile (Garments, Home Textiles, Technical Textiles)

By Application / End-Use

- Apparel / Fashion

- Home Textiles (Bed Linen, Curtains, Upholstery, Towels)

- Technical / Industrial Textiles (Automotive, Medical, Protective, Construction)

Regional Insights

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- France

- Italy

- UK

- Turkey

- Russia

Asia Pacific

- China

- India

- Japan

- Australia

Central & South America

- Brazil

Middle East & Africa

- Saudi Arabia

Iran