Content

Industrial Oil Market Volume and Forecast 2025 to 2034

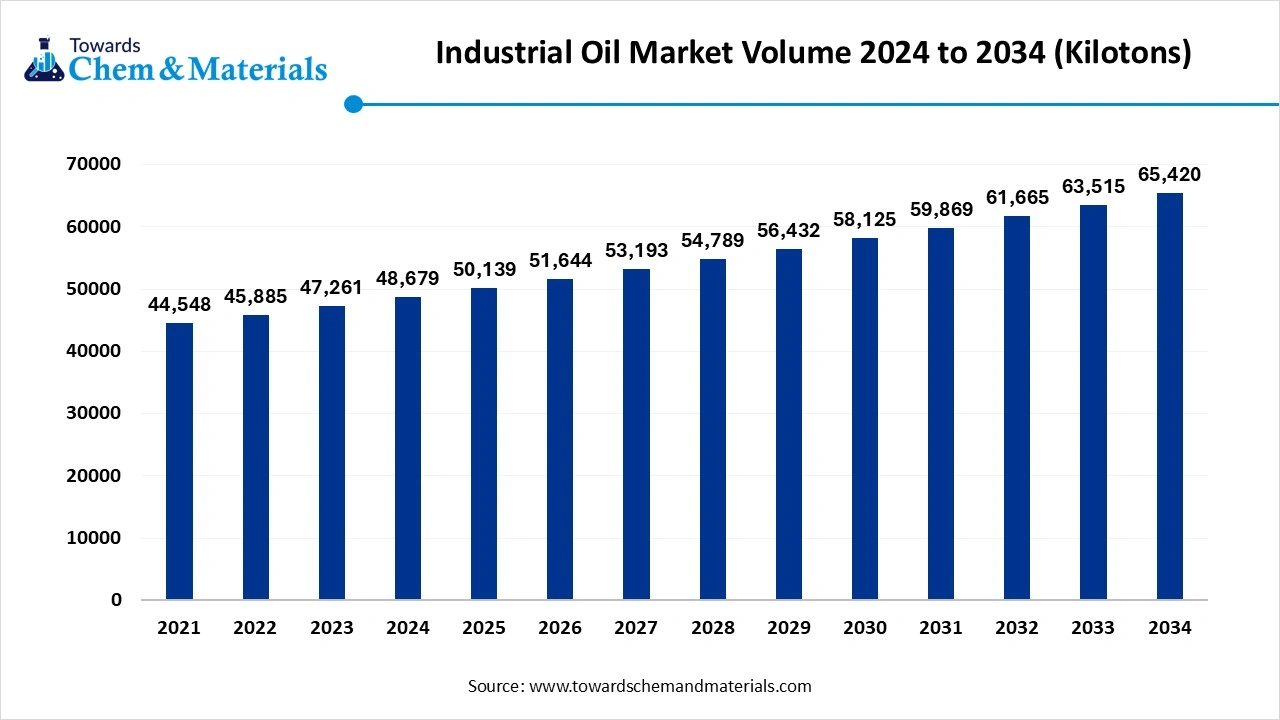

The industrial oil market volume accounted for 48,679.0 kilotons in 2024 and is predicted to increase from 50,139.3 kilotons in 2025 to approximately 65,420.4 kilotons by 2034, expanding at a CAGR of 3.00% from 2025 to 2034. Global expansion of manufacturing, automotive, and construction industry increased machinery usage, and rising industrialization in various sectors driving the market growth.

Industrial Oil Market Key Takeaways

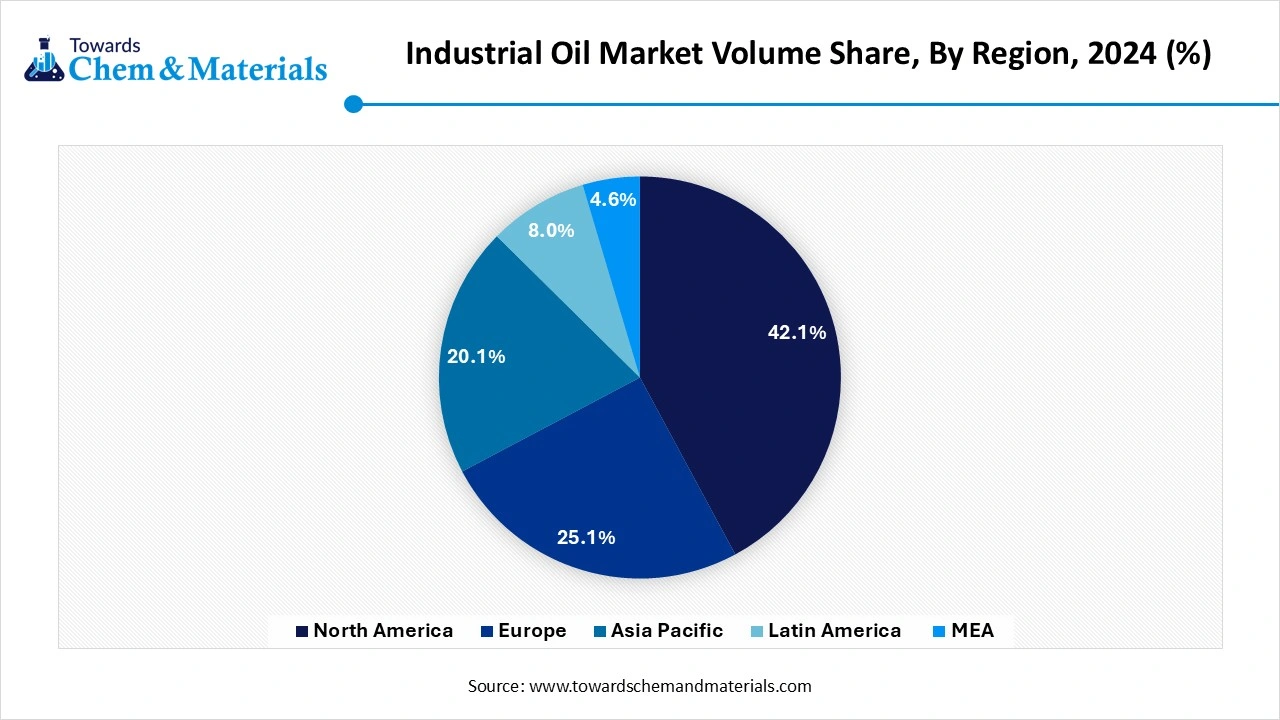

- By region, Asia Pacific dominated the Industrial oil market in 2024 due to the rising industrialization in the regional countries.

- By region, North America is expected to dominate the market in the coming

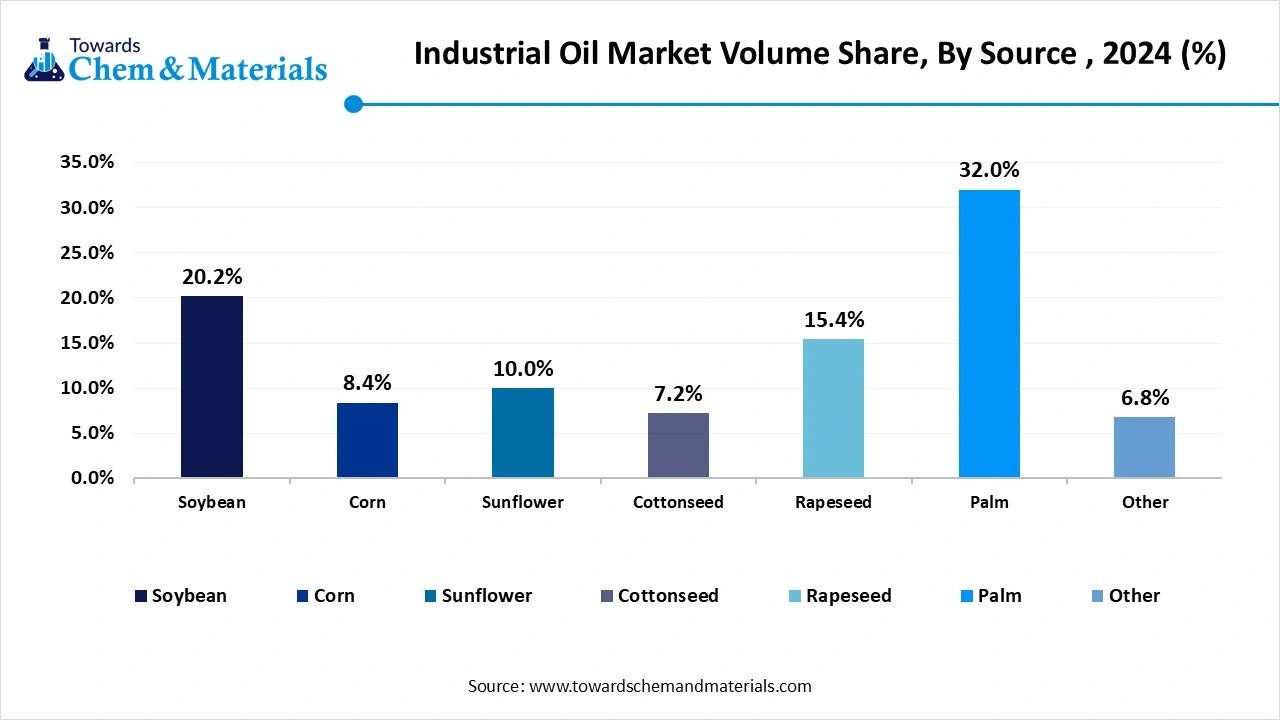

- By source, the soybean oil segment dominated the market in 2024, due to its easy availability and low production cost.

- By source, palm oil segment observed to grow at the fastest rate during the forecast period.

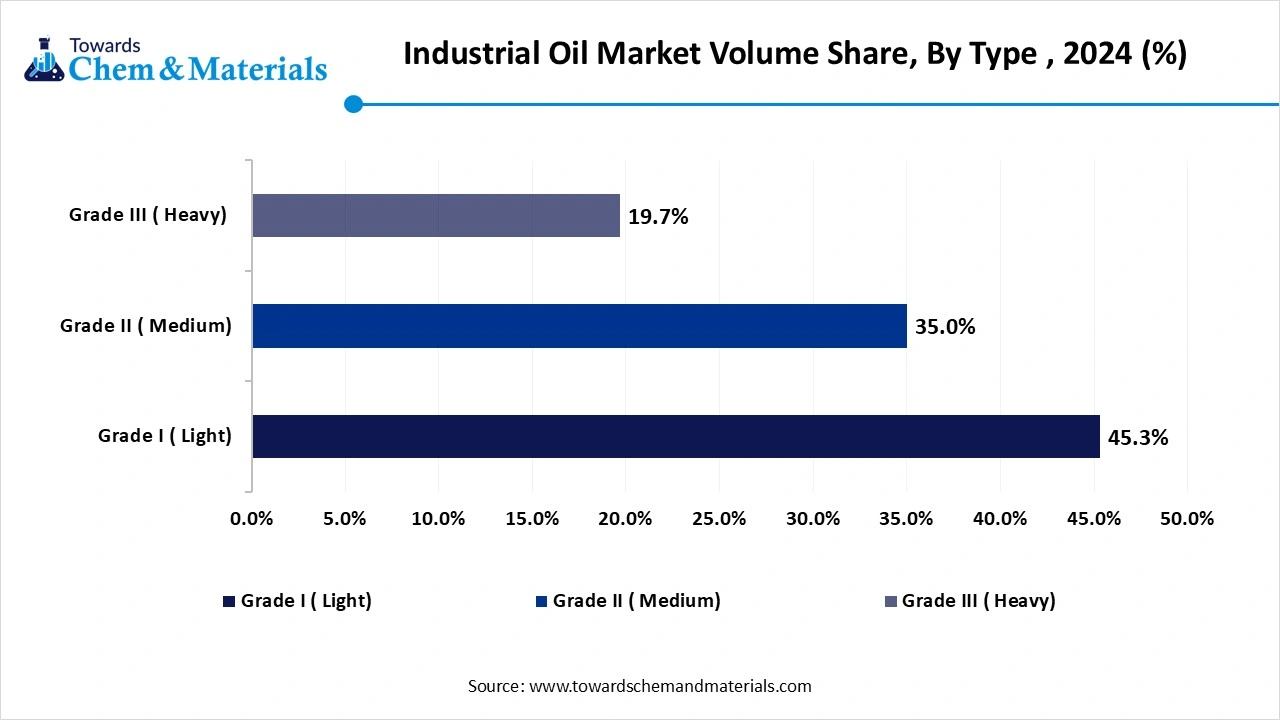

- By type, Grade I (light) segment held the dominating share of self-healing material market in 2024, due to it wide availability.

- By type, Grade II (medium) segment observed to grow at the fastest rate during the forecast period.

- By end use the biofuel segment held the dominating share of self-healing material market in 2024, due to it wide availability.

- By end use, the paint and coating segment observed to grow at the fastest rate during the forecast period.

Growing Demand of lubricants and grease from automotive, manufacturing, and construction industry accelerate the market expansion

Industrial oil is known as industrial lubricant, is a compound which is used in machinery and equipment to reduce friction, wear, and tear for smooth operation. They are specially developed to protect the machines from damage like rust and corrosion. Rapid economic development and industrialization are major factors contributing to increased demand of industrial oil. Expanded manufacturing process, increased use of machinery and demand of specialized lubricant boost market growth.

Automotive manufacturing process depends on various lubricants like engine oil, gear oil, and transmission fluids for functioning and maintenance of vehicles, propel the market growth. Construction industries use a variety of lubricants for heavy machinery like excavators and bulldozers for smooth operation. Use of industrial oil in this automotive and construction sector boosts the industrial oil market growth.

Industrial Oil Market Trends

- Growing demand from industrial oil in automotive and manufacturing industry- Expansion of automotive industry increases number of vehicles, demands the lubricants like engine oil, transmission fluids for proper functioning of vehicle.

- Increased Electric vehicle also requires specialized lubricants. Growing use of heavy machinery highly demands lubricants to reduce friction, prevent wear and tear, and maintain operational efficiency, boost market growth.

- Advancement in lubrication technology- Advancement in lubricant technology improves the functioning, efficiency and sustainability which drives the market.

- New advancement like synthetic lubricants, nanotechnology and other method improve performance, reduce friction and heat, overall improving the lifespan of equipment so increased demand of the advanced lubricant driving the market.

- Increasing trend towards sustainable lubricants- Increased awareness of environmental impact of traditional lubricants demands sustainable lubricants very highly. These sustainable lubricants are derived from renewable sources, biodegradable and nontoxic, which have no negative effect on environment.

- Biobased lubricants which derived from vegetable oil and animal fats possess low toxicity and biodegradability and low carbon footprint. So Increased demand of sustainable solution boosts the industrial oil market.

Industrial Oil Market Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 50,139.3 Kilotons |

| Expected Market Volume in 2034 | 65,420.4 Kilotons |

| Growth Rate | CAGR of 3% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Source, By Type, By End-Use, By region |

| Key Companies Profiled | Matole Ltd,Exxon Mobil Corporation,Bunge Limited,Castrol Limited,LLC PK “XimProm”,Wilmar International,Soya Mills SA,China Petrolium & Chemical Corporation,AAK Kanmani,Malplast Industries Limited, Royal Dutch Shell Plc,Chevron USA Inc,Buhler Group,KratanCorporation,Fujian Qian Trading Co. Ltd,Archer Daniels Midland ,Gemtek Products,Cargill Incorporated |

Industrial Oil Market Opportunity

Increased Environmental Regulation Demands Eco-Friendly Product

Government strict regulation and standards to reduce industrial pollution, sustainable practice demand the conventional alternative which are environment friendly and comply with regulation. Increased innovation to develop eco friendly sustainable product by utilizing renewable sources, drives the market. Rising innovation and development to develop biodegradable product, shows future market opportunities to boost the industrial oil market.

-

For instances, In October 2024, RSC Bio Solutions launched FUTERRA™ Compressor Oils which is developed by using renewable base oil and offers thermal stability, biodegradability. The main application of this synthetic lubricant is in marine and industrial applications.

Advancement In Sustainable Lubricant

Innovation and development in sustainable lubricant including water-based lubricants, bio based synthetic lubricants, vegetable-based lubricant, these are developed from renewable sources which are biodegradable and possess very less environmental impact boosting the market. Lubricants made from soybean oil, sunflower oil are biodegradable and offer excellent lubricant properties. The sustainable lubricants, which possess very little environmental impact, are showing significant market oppournities for industrial oil market.

Industrial Oil Market Challenges

Fluctuation In Crude Oil Prices

Rising crude oil prices cause higher production costs for industries that rely on oil derived products. Fluctuation in crude oil prices increases production cost, impacting the profitability which reduced investment in the industrial sector.

The unpredictability of oil prices is main challenge for investor because it can lead to a wait-and-see approach, so companies postpone investments until the market stabilizes which reduces the economic growth. This reduced investment negative impact on innovation, technological advancements, and overall industrial development, limits the industrial oil market.

Rising Environmental Concern

Government implementing strict environment regulation in amount of pollutant released in air and for waste disposal which demand biodegradable alternative. The oil industry is also facing challenges related to climate change, which I shifting a move towards renewable energy sources and cleaner technologies.

Industrial Oil Market Regional Insights

Asia pacific dominated industrial oil market in 2024. Rapid industrialization, urbanization and growing demand from various industries like automotive and manufacturing, boost the market growth. Rising infrastructure project and manufacturing sector particularly in India, china and Southeast Asian nations demands the industrial oil for construction, machinery and transportation.

China is a leading consumer of lubricants in the Asia-Pacific region due to its large automotive market and expanded industrial sector. In china The growth of the electric vehicle in China demands the specialized lubricant which boost the market in this region. In the countries like Japan and India are having strict emission regulation, driving the adoption of high-performance and synthetic lubricants. Their focus is on reducing greenhouse gas emission and promoting cleaner fuels.

North America is expecting significant growth in industrial oil market during the forecast period. Rising automotive and aerospace industries in this region demand lubricant boost the market in this region. North America, especially the US and Canada, has a well-established industrial sector they are dependent on the lubricants in various applications like automotive, industrial machinery, and metalworking. In this region there are Major investments in infrastructure projects, such as transportation and energy grids, are also contributing to the growth of the industrial lubricants market.

These projects require lubricants to support the operation and maintenance of heavy machinery. This region is major consumer of automotive and industrial lubricants and exporting lubricants contribute to global market growth. Technological advancement in lubricant formulation, increased environmental concern demand synthetic lubricants contributing to industrial oil market growth in this region.

Industrial Oil Market Volume Share, By Region, 2024-2034 (%)

| By Region | Market Volume Shares 2024 (%) | Volume (KiloTons)(2024) |

| North America | 42.1% | 20508.4 |

| Europe | 25.1% | 12233.0 |

| Asia Pacific | 20.1% | 9803.9 |

| Latin America | 8.0% | 3894.3 |

| Middle East & Africa | 4.6% | 2239.2 |

Industrial Oil Market Segmental Insights

By Source Insights

The soybean oil segment held the dominating share of the industrial oil market in 2024. Due to widespread use in food industry including cooking and frying, salad dressing increased demand of soybean oil. It has various applications in paints, coatings, biodiesel, and even pharmaceuticals boost the market growth of this segment. Due to popularity of fried food in Asia pacific increased demand of soybean oil for frying and cooking. Increasing global demand of edible oil contributes to dominance of soybean oil market.

The palm oil segment is observed to grow at the fastest rate during the forecast period. Due to high yield and versatility palm oil is used in various countries. It has various applications in food and beverages, cosmetic, and pharmaceutical use. In Fractionated palm oil is a refined form of palm oil, has a large market share due to its diverse properties and applications. Increasing global demand of palm oil and biofuel may boost the market growth In future.

Industrial Oil Market Volume Share, By Source, 2024-2034 (%)

| By Source | Volume Share, 2024 (%) | Market Volume (KiloTons)(2024) |

| Soybean | 20.2% | 9,838.0 |

| Corn | 8.4% | 4,089.0 |

| Sunflower | 10.0% | 4,867.9 |

| Cottonseed | 7.2% | 3,509.8 |

| Rapeseed | 15.4% | 7,496.6 |

| Palm | 32.0% | 15,577.3 |

| Other | 6.8% | 3,300.4 |

By Type Insights

The Grade I (light) segment held the dominating share of the industrial oil market in 2024. Grade I is a light oil base and typically derived from crude oil which possesses lower saturation percentage. It is used in gear oils to lubricate machinery and hydraulic fluids for power transmission. It is used as raw material in industries like cosmetics, personal care and pharmaceutical. Grade I oils associated with renewable sources attractive to business and consumer who prioritize sustainability. Growing industrial production is driving Grade I oil due to easy availibity and low manufacturing cost.

The Grade II (medium) segment was observed to grow at the fastest rate during the forecast period. This oil possesses better volatility, flashpoints, and viscosity index as compared to grade I base oils. Grade II oils have wide range of applications including oxidative stability and high temperature. These oils are preferred to be used in marine, gas engine, and trunk piston engine oils, as well as other industrial uses. Group II oils meet strict environment regulation, boost market growth. Its affordability, high performance and wider application contributed to its market growth.

Industrial Oil Market Volume Share, By Type, 2024-2034 (%)

| By Type | Market Volume Shares 2024(%) | Market Volume (KiloTons)(2024) |

| Grade I ( Light) | 45.3% | 22,051.6 |

| Grade II ( Medium) | 35.0% | 17,037.6 |

| Grade III ( Heavy) | 19.7% | 9,589.8 |

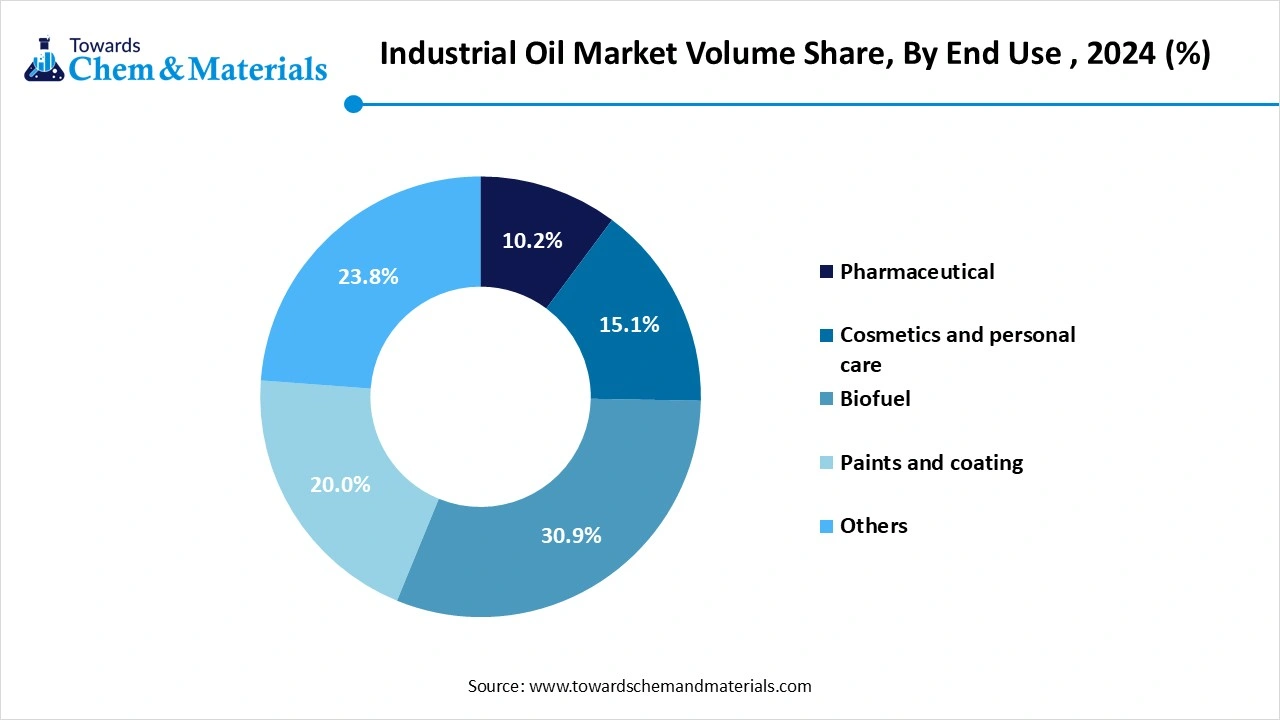

By End Use Insights

The biofuel segment held the dominating share of the industrial oil market in 2024. Biofuel is lower emission alternative to traditional fossil fuels which contributing to environmental protection. Particularly liquid biofuel which derived from vegetable oil led the market. growing demand for cleaner fuels, favorable government policies, and the increasing use of vegetable oils contributing to market growth of biofuel. Technological advancement for production of advanced biofuel with higher energy densities and cleaner combustion profiles and supportive government policies, boost the market growth of this segment.

The paints and coating segment observed to grow at the fastest rate during the forecast period. Increased need for protecting equipment and infrastructure from corrosion, especially in harsh environments like oil and gas operations.

Industrial oils can be incorporated into the formulation to improve the coating's resistance to various corrosive agents which extend lifespan of coated structures and equipment. Increased demand for solvent-borne and water-borne industrial coating because of durability, resistance to chemicals, and superior performance in various applications. The expansion of industries in oil and gas sector fuels the demand for paint and coating segment.

Industrial Oil Market Volume Share, By End Use, 2024-2034 (%)

| By End Use | Market Volume Shares 2024(%) | Market Volume (KiloTons)(2024) |

| Pharmaceutical | 10.2% | 4,955.5 |

| Cosmetics and personal care | 15.1% | 7,350.5 |

| Biofuel | 30.9% | 15,046.7 |

| Paints and coating | 20.0% | 9,735.8 |

| Others | 23.8% | 11,590.5 |

Industrial Oil Market Recent Developments

Grades of Kalama benzyl benzoate

- Product Launch: In April 2024, Savsol Lubricants launched Savsol Ester 5 which is a biodegradable lubricant targeted to use in automotives and Railways sector. Savsol Ester 5 is produced with edible oil fatty acid using molecules developed by the company in-house.

Environmentally friendly industrial oils

- Product Launch: In November 2023, Shell announced collaboration with the University of Manchester to develop new methods for producing environmentally friendly industrial oils. This mainly focuses on finding sustainable ways to manufacture commodity chemicals through industrial biotechnology.

Top Companies List Of Industrial Oil Market

- Matole Ltd

- Exxon Mobil Corporation

- Bunge Limited

- Castrol Limited

- LLC PK “XimProm”

- Wilmar International

- Soya Mills SA

- China Petrolium & Chemical Corporation

- AAK Kanmani

- Malplast Industries Limited

- Royal Dutch Shell Plc

- Chevron USA Inc

- Buhler Group

- Kratan Corporation

- Fujian Qian Trading Co. Ltd

- Archer Daniels Midland

- Gemtek Products

- Cargill Incorporated

Segments Covered in the Report

By Source

- Soybean

- Corn

- Sunflower

- Cottonseed

- Rapeseed

- Palm

- Other

By Type

- Grade I ( Light)

- Grade II ( Medium)

- Grade III ( Heavy)

By End Use

- Pharmaceutical

- Others

- Biofuel

- Paints and coating

- Cosmetics and personal care

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait