Content

What is the Current Monoethylene Glycol Market Size and Volume?

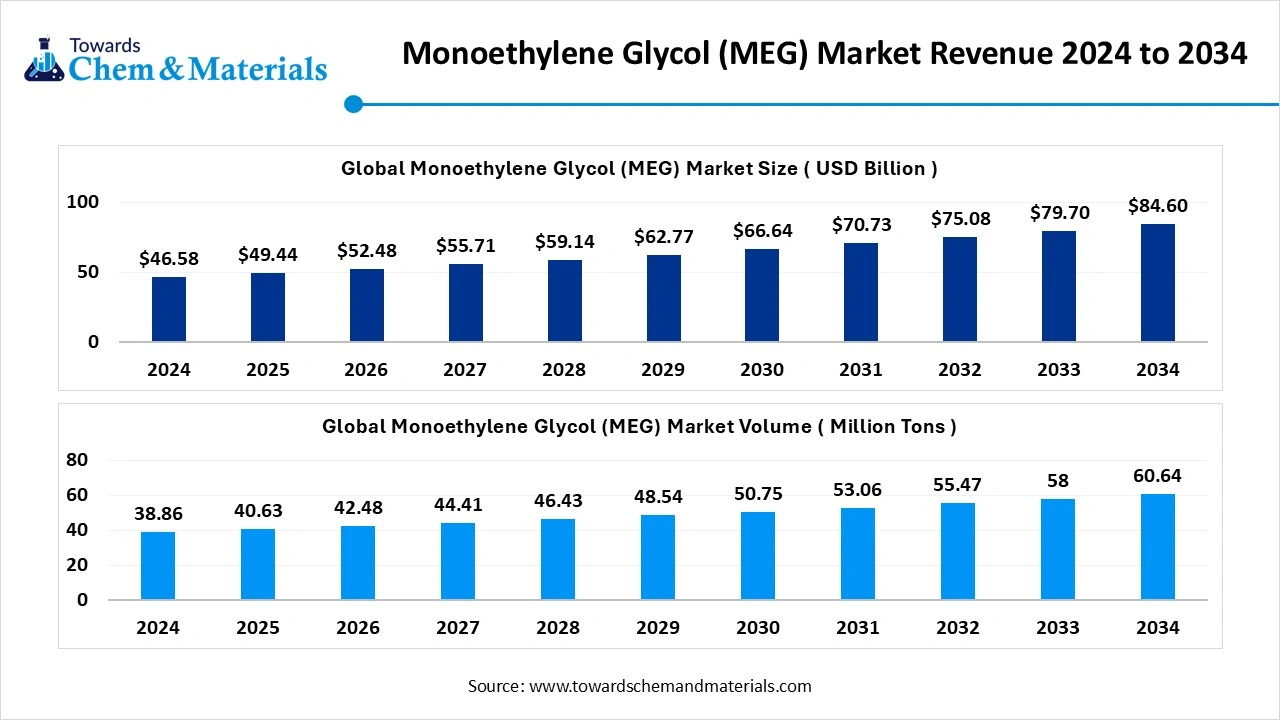

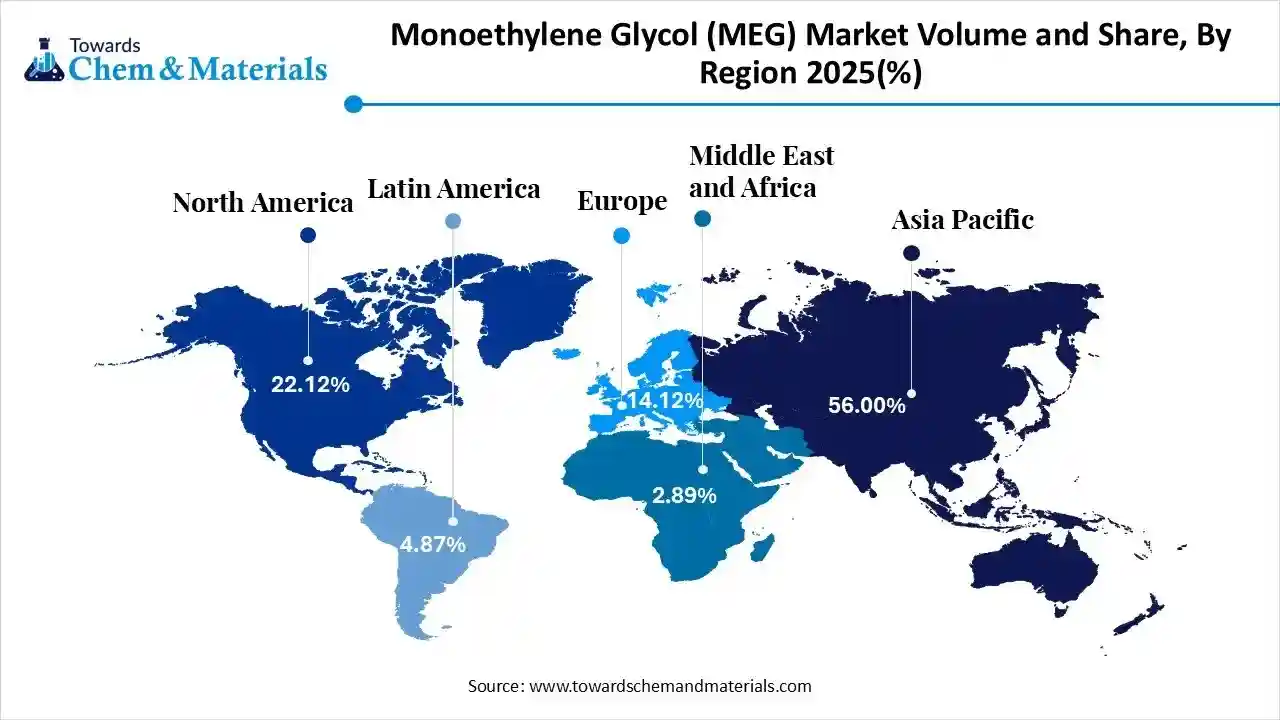

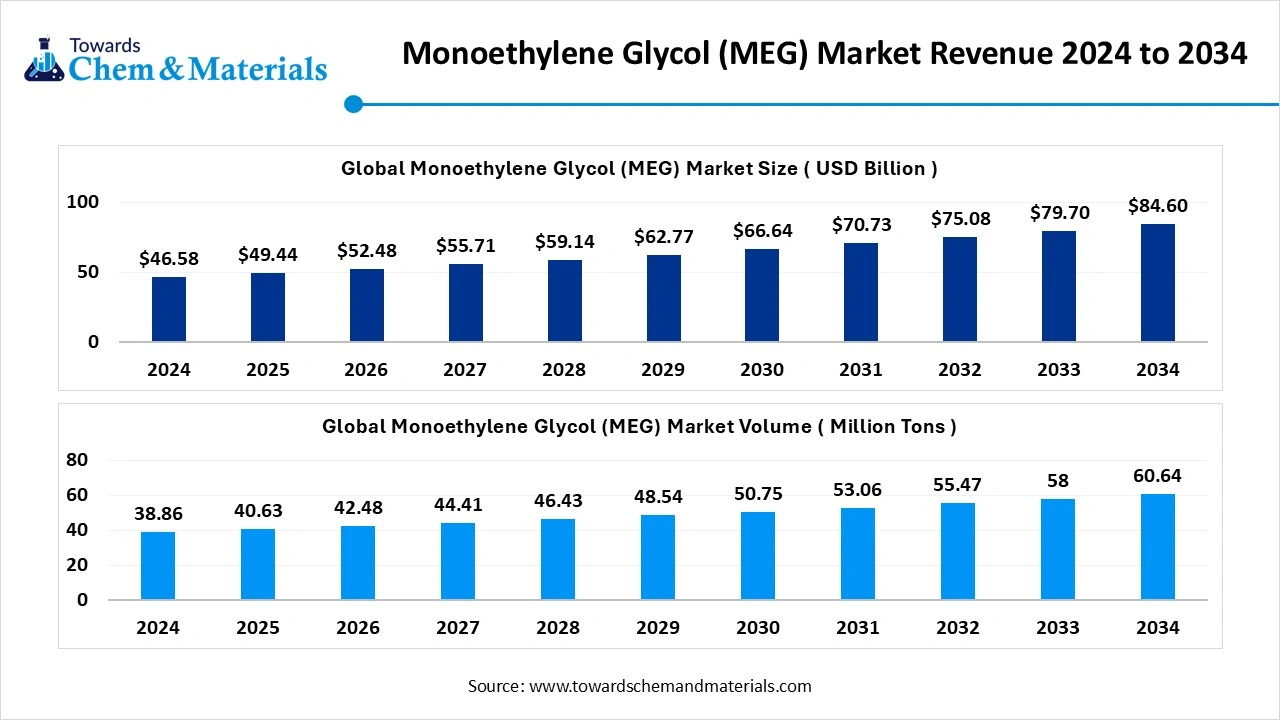

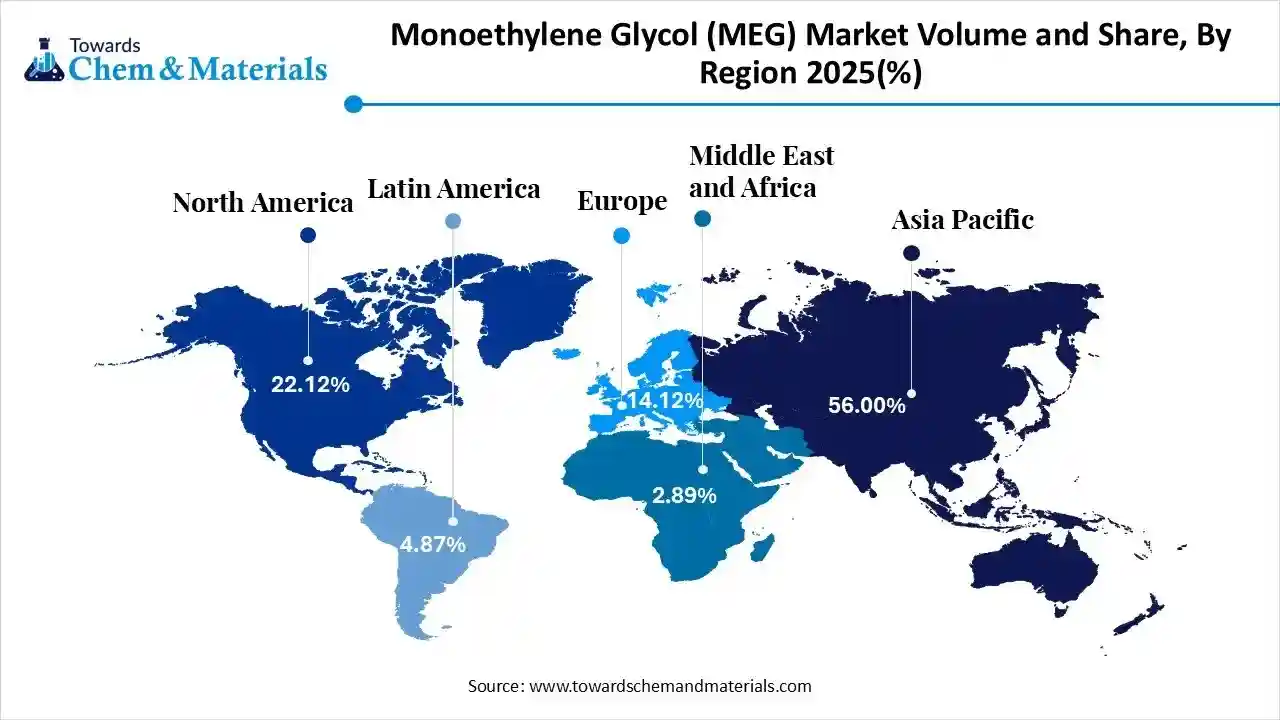

The global monoethylene glycol market size was estimated at USD 27.78 billion in 2025 and is expected to increase from USD 29.10 billion in 2026 to USD 44.18 billion by 2035, growing at a CAGR of 4.75% from 2026 to 2035. In terms of volume, the market is projected to grow from 38.10 million tons in 2025 to 68.90 million tons by 2035. growing at a CAGR of 6.10% from 2026 to 2035. Asia Pacific dominated the monoethylene glycol market with the largest volume share of 56% in 2025. The increasing need for engine coolants and the growing oil & gas industry drive the market growth.

The monoethylene glycol (MEG) is an organic and colorless compound which also known as ethylene glycol. The chemical formula of MEG is C2H6O2 and is highly toxic in nature. It is slightly viscous, sweet in taste, and hygroscopic in nature. It consists of a high boiling point and superior water solubility. It has good thermal conductivity and is non-corrosive. Monoethylene glycol is widely used in applications like PET resins, automotive coolants, hydraulic fluids, corrosion inhibitors, de-icing fluids, and coatings. the market is growing due to the growing apparel industry, expanding online shopping, increased production of bio-based MEG, growing e-commerce packaging, growth in vehicle production, expanding PET packaging, rising adhesive manufacturing, and the growing expansion of industrial activities.

Market Highlights

- The Asia Pacific dominated the global monoethylene glycol market with the largest volume share of 56% in 2025.

- The monoethylene glycol market in North America is expected to grow at a substantial CAGR of 6.25% from 2026 to 2035.

- The Europe monoethylene glycol market segment accounted for the major volume share of 14.12% in 2025.

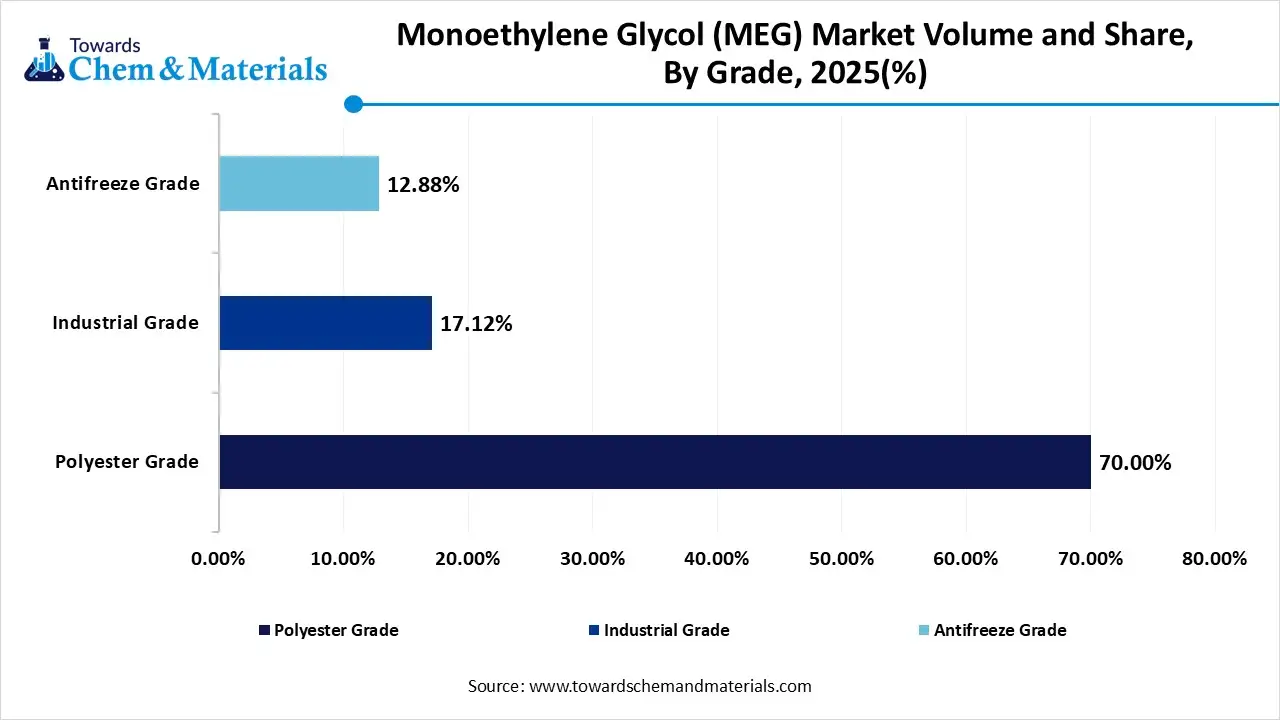

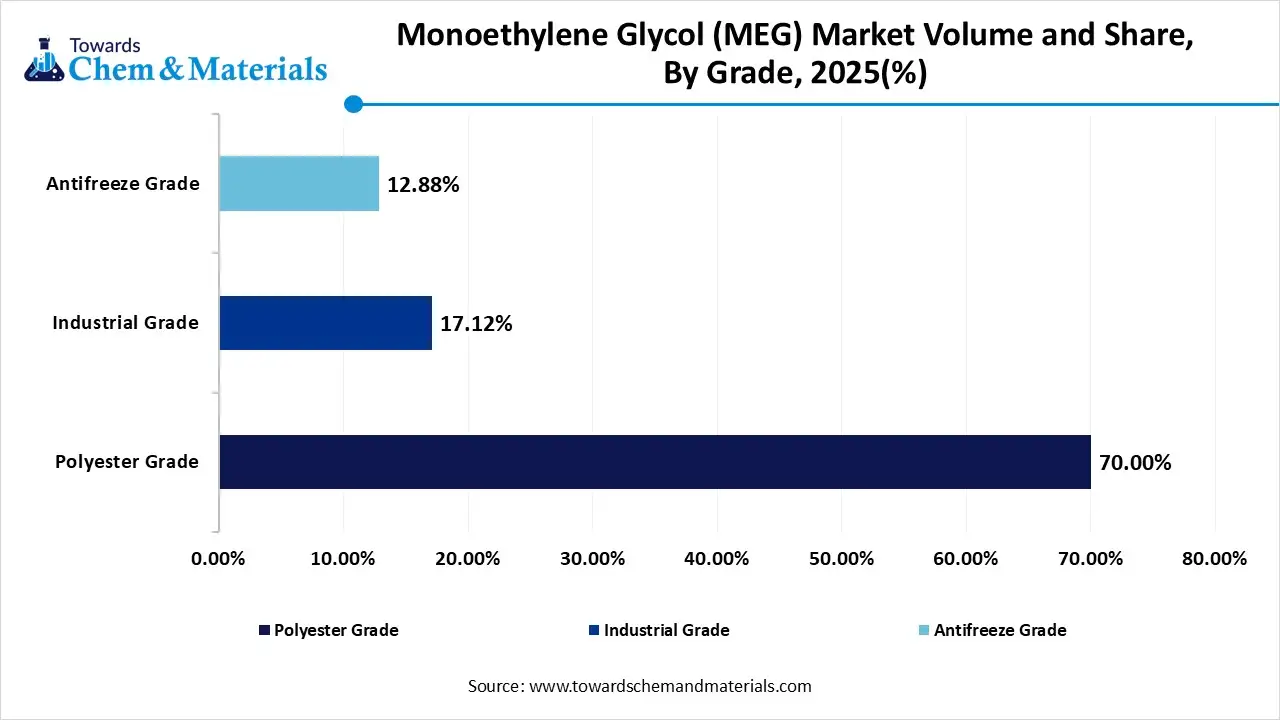

- By grade, the polyester grade segment dominated the market and accounted for the largest volume share of 70% in 2025.

- By grade, the industrial grade segment is expected to grow at the fastest CAGR of 8.85% from 2026 to 2035 in terms of volume.

- By application, the polyester fiber segment led the market with the largest revenue volume share of 59% in 2025.

- By technology, the gas-based segment dominated the market and accounted for the largest volume share of 49.3% in 2025.

- By end-user, the textiles & apparel segment led the market with the largest revenue volume share of 42% in 2025.

Market Trends:

- Expanding Automotive Application:- The increased manufacturing of cars and the growing sale of used vehicles increase demand for monoethylene glycol for the production of engine coolants.

- Surging E-Commerce:- The rise of online shopping and increasing online sales of textiles increases demand for MEG for packaging purposes. The increasing use of PET in packaging creates a higher demand for MEG.

- Development of Bio-Based MEG:- The strong focus on lowering carbon footprints and the abundance of natural feedstocks like biomass and others increase the production of bio-based MEG. The government's focus on lowering emissions increases demand for bio-based MEG.

- Growing Construction Projects:- The growth in infrastructure projects and the increasing use of heavy construction machinery increases demand for MEG for the production of paints, antifreeze, adhesives, and coatings.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 29.10 Billion / 40.40 MillionTons |

| Revenue Forecast in 2035 | USD 44.18 Billion / 68.90 Million Tons |

| Growth Rate | CAGR 4.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Application, By Technology (Feedstock), By End-User Industry, By Sales Channel, By Region |

| Key companies profiled | SABIC, Sinopec, MEGlobal, Reliance Industries Limited, Royal Dutch Shell PLC, Dow Inc., NAN YA PLASTICS CORPORATION, BASF SE, LOTTE Chemical Corporation, Mitsubishi Chemical Group, Exxon Mobil Corporation, Indorama Ventures Public Company Limited, Formosa Plastics Corporation, India Glycols Limited, Petro Rabigh, LyondellBasell Industries Holdings BV, INEOS AG, Sibur Holding, UPM Biochemicals (Bio-based Leader), Jiangsu Danhua Group |

Key Technological Shifts in the Monoethylene Glycol Market:

The monoethylene glycol market is undergoing key technological changes driven by the demand for sustainability, energy-efficient production, and higher yields. The technological advancements, like big data analytics, automation, supply chain digitalization, and the internet of things, increase efficiency and optimize the production process. The vital technological shift is the incorporation of AI enhances efficiency, optimizes reactions, and improves sustainability.

Artificial Intelligence focuses on the development of higher yields and reducing plant downtime. AI adjusts process parameters in real time and focuses on lowering waste. AI optimizes the schedules of production and minimizes excess inventory. AI supports the development of bio-based MEG and extends the life of assets. AI prevents the overproduction of MEG and optimizes the feedstock procurement process. Overall, AI is a key transformation in the production of MEG, which expands industrial applications.

Trade Analysis of Monoethylene Glycol Market: Import & Export Statistics

- Kuwait exported 5,630 shipments of monoethylene glycol.

- Canada exported C$1.07B of ethylene glycol in 2024.

- The United States imported $160M of ethylene glycol in 2024.

- China exported $103M of ethylene glycol in 2024.

- China imported $3.51B of ethylene glycol in 2024.

- Brazil exported $618K of ethylene glycol in 2024.

- Brazil imported $128M of ethylene glycol in 2024.

Market Value Chain Analysis

- Feedstock Procurement: Feedstock procurement is the process of acquiring raw materials, and ethylene is the main feedstock used for the production of monoethylene glycol.

- Key Players:- Shell plc, Reliance Industries, Sinopec, BASF SE, SABIC, IOCL, Dow Inc.

- Chemical Synthesis and Processing: The stage involves steps like ethylene oxidation conversion to ethylene oxide, hydration of ethylene oxide to glycols, separation, and purification of MEG.

- Key Players:- Reliance Industries, MEGlobal, Mitsubishi Chemical Corporation, Huntsman International LLC, SABIC

- Quality Testing and Certifications: The stage involves testing of properties like appearance, specific gravity, ash content, color, light transmittance, purity, and moisture content. MEG requires certifications like BIS, REACH, ASTM, ISO, and GHS.

- Key Players:- Intertek, Megsan Labs, SGS, Aleph INDIA, Bureau Veritas, ASTM, Absolute Veritas

Role of MEG-Based Product Across Industries

| Industry | MEG-Based Product | Growth Drivers |

| Textile |

|

|

| Packaging |

|

|

| Automotive |

|

|

| Construction |

|

|

Segmental Insights

Grade Insights

Why the Polyester Grade Segment Dominates the Monoethylene Glycol Market?

The polyester grade segment volume was valued at 26.7 million tons in 2025 and is projected to reach 46.3 million tons by 2035, expanding at a CAGR of 6.30%during the forecast period from 2025 to 2035. The polyester grade segment dominated the monoethylene glycol market with approximately 70% share in 2025. The increased utilization of synthetic fibers and the rapid growth in PET resin production increase demand for polyester grade. The growing production of PET films and the increased consumption of textile fibers create a higher demand for polyester grade. The cost-effectiveness and the availability of essential raw materials increase the production of polyester grade, driving the overall market growth.

The industrial grade segment volume was valued at 6.5 million tons in 2025 and is expected to surpass around 14.0 million tons by 2035, and it is anticipated to expand to 8.85% of CAGR during 2026 to 2035. The growing use of lightweight components in vehicles and the surging expansion of e-commerce increase demand for industrial grade MEG. The growth in construction chemicals and the booming oil & gas sector requires industrial grade MEG. The rapid industrialization supports the overall market growth.

Global Monoethylene Glycol (MEG) Market Volume and Share, By Grade, 2025-2035

| By Grade | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Polyester Grade | 70.00% | 26.7 | 46.3 | 6.30% | 67.12% |

| Industrial Grade | 17.12% | 6.5 | 14.0 | 8.85% | 20.31% |

| Antifreeze Grade | 12.88% | 4.9 | 8.7 | 6.51% | 12.57% |

Application Insights

How did the Polyester Fiber Segment hold the Largest Share in the Monoethylene Glycol Market?

The polyester fiber segment held the largest revenue share of 59% in the market in 2025. The growing popularity of fast-fashion and the increasing consumer demand for home textiles increase the adoption of polyester fiber. The strong presence of the apparel industry and the increasing consumer spending on textile products require polyester fibers. The expansion of industrial textiles and strong consumer preference for polyester fiber drive the overall market growth.

The PET film and sheets segment is experiencing the fastest growth in the market during the forecast period. The consumer shift towards ready-to-eat foods and the strong focus on creating a longer shelf life of food products increase demand for PET film. The rapid growth in packaged goods consumption and growing lamination activities increases demand for PET film & sheets. The increased development of automotive components supports the overall market growth.

Technology (Feedstock) Insights

Why is the Gas-Based Segment Dominating the Monoethylene Glycol Market?

The gas-based segment dominated the monoethylene glycol market with approximately 49.3% share in 2025. The strong focus on lowering carbon emissions and the strong presence of petrochemical complexes increase the use of gas-based feedstock. The low production cost, high scalability, efficiency, and the feedstock flexibility of gas-based feedstock drive the overall growth of the market.

The bio-based segment is the fastest-growing in the market during the forecast period. The stringent environmental policies and the consumer focus on eco-friendly products increase demand for bio-based feedstock. The growing environmental concerns and the company's sustainability goals increase demand for bio-based feedstock. The fluctuations in the petrochemical price support the overall market growth.

End-User Industry Insights

Which End-User Segment held the Largest Share in the Monoethylene Glycol Market?

The textiles & apparel segment held the largest revenue share of approximately 42% in the market in 2025. The growing consumer demand for non-woven materials and the increased production of industrial fabrics increase demand for MEG. The strong consumer focus on the utilization of polyester and the development of technical textiles increases demand for MEG. The increasing use of lightweight synthetic fabrics and the consumer shift towards affordable fashion increase demand for MEG. The expanding automotive textile drives the overall market growth.

The packaging segment is experiencing the fastest growth in the market during the forecast period. The growing development of beverage bottles and the increased consumption of drinks increase demand for MEG. The increasing demand for food containers and the rise in food delivery services increase demand for MEG. The increasing need for packaging across diverse applications and the shift towards sustainable packaging support the overall market growth.

Sales Channel Insights

Why the Indirect Sale Segment Dominates the Monoethylene Glycol Market?

The indirect sale segment dominated the monoethylene glycol market in 2025. The strong presence of smaller-sized businesses and a strong focus on warehousing expertise increase demand for indirect sales. The growing demand for small volumes and the focus on scaling operations efficiently require indirect sales. The cost-effectiveness, logistical efficiency, and the presence of local market knowledge in indirect sales drive the overall market growth.

The direct sale segment is the fastest-growing in the market during the forecast period. The presence of a large-scale consumer base and control over pricing increases the adoption of direct sales. The growing customization trend and the focus on technical support increase demand for direct sales. The consumer trust, reliability, and authenticity in direct sales support the overall market growth.

Regional Insights

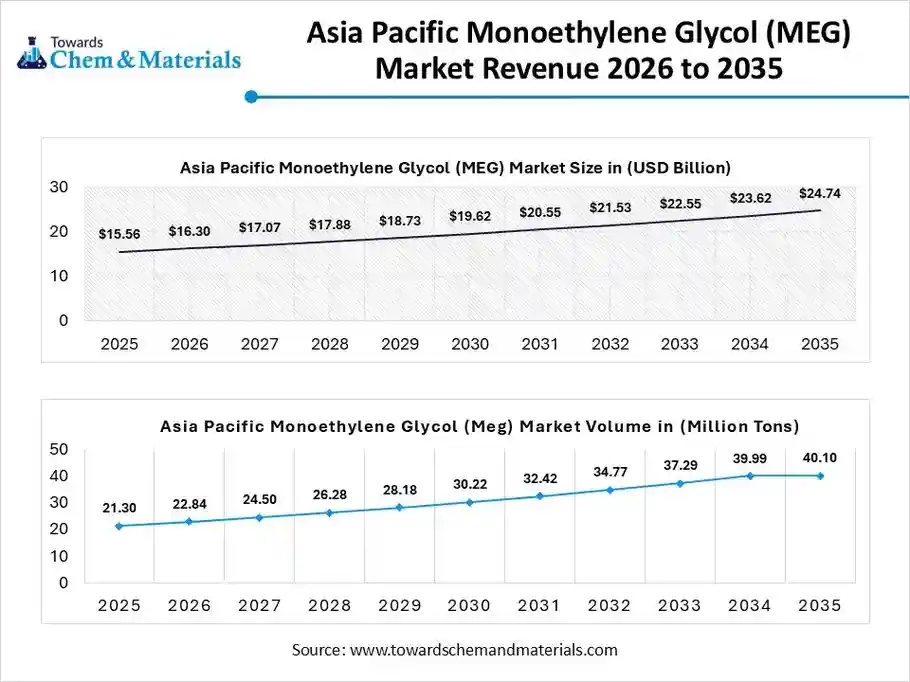

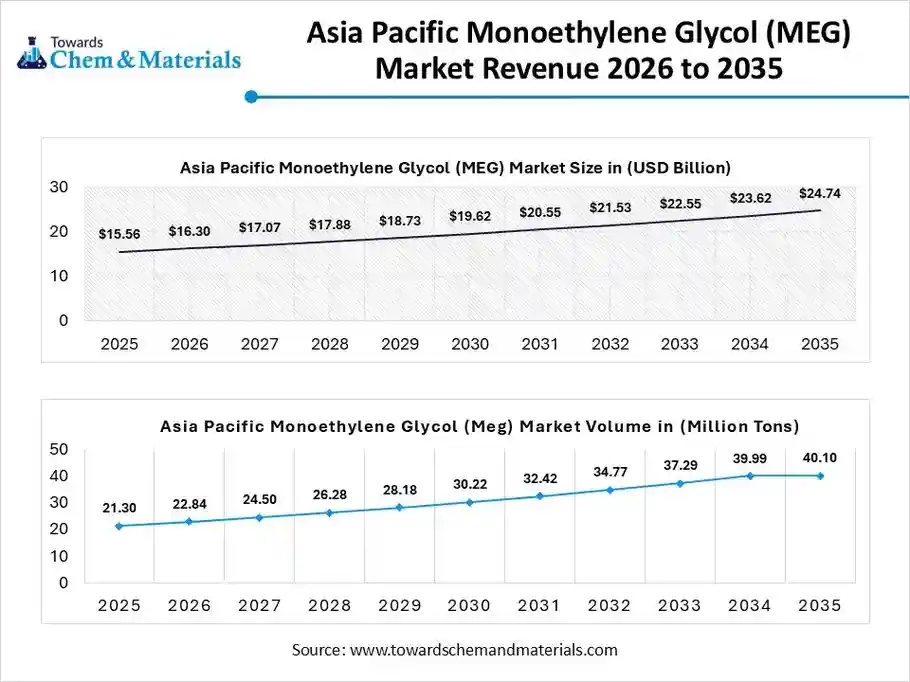

The Asia Pacific monoethylene glycol market size was valued at USD 15.56 billion in 2025 and is expected to be worth around USD 24.74 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.77% over the forecast period from 2026 to 2035.

The Asia Pacific monoethylene glycol market volume was estimated at 21.30 million tons in 2025 and is projected to reach 40.10 million tons by 2035, growing at a CAGR of 7.25% from 2026 to 2035. Asia Pacific dominated the market with a 56% share in 2025. The well-established textile production base and the high consumption rate of packaged goods increase demand for MEG. The strong presence of raw materials and the increasing need for polyester increase the production of MEG. The growing production of lightweight composites and the increased consumption of electronic products require MEG. The cost-effective manufacturing and the presence of massive production facilities support the overall market growth.

From Fibers to Formulations: Growth Story of MEG in India

India is rapidly growing in the market. The increased production of polyester fiber and the huge production of vehicles increase the demand for MEG. The high consumption rate of electronic products and the strong focus on PET recycling increase demand for MEG. The increasing government investment in domestic manufacturing and the expansion of general manufacturing drive the overall market growth.

India exported 3,752 shipments of monoethylene glycol.

North America Monoethylene Glycol Market Trends

The North America monoethylene glycol market volume was estimated at 8.4 million tons in 2025 and is projected to reach 14.6 million tons by 2035, growing at a CAGR of 6.25% from 2026 to 2035.North America is experiencing the fastest growth in the market during the forecast period. The growth in the production of electric vehicles and the increasing consumption of PET bottles increase demand for MEG. The stricter environmental regulations and the increasing investment in sustainable packaging increase demand for bio-based MEG. The strong presence of the automotive industry and the increased production of polyester materials increase demand for MEG, driving the overall market growth.

From Shale to Industry: United States MEG Momentum

The United States is a key contributor to the market. The abundance of natural gas and the growing expansion of production facilities increase the production of MEG. The increasing need for coolants and the rapid growth in construction activities increase demand for MEG. The growing demand for synthetic fibers and the expansion of nonwoven fabrics create a higher demand for MEG, supporting the overall market growth.

- The United States exported $1.75B of ethylene glycol in 2024.

Monoethylene Glycol (MEG) Market Volume Share, By Region 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.12% | 8.4 | 14.6 | 6.25% | 21.12% |

| Europe | 14.12% | 5.4 | 9.9 | 6.98% | 14.34% |

| Asia Pacific | 56.00% | 21.3 | 40.1 | 7.25% | 58.15% |

| Latin America | 4.87% | 1.9 | 2.9 | 5.22% | 4.26% |

| Middle East & Africa | 2.89% | 1.1 | 1.5 | 3.26% | 2.13% |

Europe Monoethylene Glycol Market Trends

The Europe monoethylene glycol market volume was estimated at 5.4 million tons in 2025 and is projected to reach 9.9 million tons by 2035, growing at a CAGR of 6.98% from 2026 to 2035. Europe is growing at a notable rate in the market. The strong focus on thermal management in automobiles and the expansion of food & beverage packaging increase demand for MEG. The increasing use of heat transfer fluids and the growth in battery manufacturing create demand for MEG. The strong presence of chemical bases and the diverse industrial activities increases demand for MEG. The expansion of bio-MEG and the strong focus on sustainability drive the overall market growth.

United Kingdom Expanding MEG Horizon

The United Kingdom is growing rapidly in the market. The growing production of high-performance antifreeze and the expansion of PET packaging increase demand for MEG. The growth in the production of polyester fibers and the well-established manufacturing industry increases demand for PEG. The rapid expansion of battery cooling systems and the strong presence of the online retail sector create higher demand for MEG, supporting the overall market growth.

Middle East & Africa Monoethylene Glycol Market Trends

The Middle East & Africa monoethylene glycol market volume was estimated at 1.1 million tons in 2025 and is projected to reach 1.5 million tons by 2035, growing at a CAGR of 3.26% from 2026 to 2035.The Middle East & Africa are growing in the market. The vast presence of the petrochemical industry and the high rate of packaged food consumption increase demand for MEG. The growing spending on packaged goods and well-established natural gas reserves increases the production of MEG. The increasing consumer demand for automotive products and the expansion of petrochemicals increase MEG production, driving the overall market growth.

Strengths of Saudi Arabia’s MEG Production

Saudi Arabia is growing substantially in the market. The increasing ownership rate of vehicles and the growing domestic consumption of polyester create demand for MEG. The increasing investment in advanced MEG infrastructure and the focus on expanding MEG production facilities support the overall growth of the market.

Saudi Arabia exported $2,783,951.66K of ethylene glycol in 2024.

Latin America Monoethylene Glycol Market Trends

The Latin America monoethylene glycol market volume was estimated at 1.9 million tons in 2025 and is projected to reach 2.9 million tons by 2035, growing at a CAGR of 5.22% from 2026 to 2035. Latin America is growing significantly in the market. The rapid expansion of packaged goods and the increasing need for industrial textiles create a higher demand for monoethylene glycol. The expanding construction projects and growing consumer demand for home furnishings require MEG. The surging production of PET bottles and the industrial development increase demand for

- MEG, driving the overall market growth.

From Automotive to Packaging: Role of Monoethylene Glycol in Brazil

Brazil is substantially growing in the market. The robust production of PET containers and the strong focus on vehicle engine maintenance increase demand for MEG. The expanding apparel sector and the growing need for various pharmaceuticals increase the adoption of MEG. The transition towards bio-based MEG and the shift towards eco-friendly packaging support the overall market growth.

Recent Developments

- In March 2024, PM Modi inaugurated IndianOil’s MEG project in Paradip Refinery. The project aims to minimize the import dependency of India and focuses on providing feedstock for the textile park present in Bhadrak.(Source: www.indianchemicalnews.com)

- In August 2024, Easter Industries collaborated with Loop Industries to launch the rMEG plant in India. The annual production capacity of the plant is 23000 tons. The plant focuses on meeting sustainability targets and lowering carbon emissions.(Source: www.indianchemicalnews.com)

Top Companies List

- SABIC:- The Saudi Arabia-based company major manufacturer of monoethylene glycol to serve diverse industries like construction, automotive, and packaging.

- Sinopec:- The Chinese chemical giant large-scale manufacturer of MEG and develops various products like diesel, lubricants, fertilizers, gasoline, petrochemicals, coal chemicals, and jet fuels.

- MEGlobal:- The company supplies and manufactures monoethylene glycol for the production of PET plastics, eicing fluids, polyester fibers, antifreeze, paints, coolants, and adhesives.

- Reliance Industries Limited:- The India-based company operates large-scale facilities of monoethylene glycol and supplies MEG for the production of PET resins and other chemicals.

- Royal Dutch Shell PLC:- The petrochemical and energy company manufactures a significant volume of MEG to serve industries like automotive, textile, and packaging.

- Dow Inc.

- NAN YA PLASTICS CORPORATION

- BASF SE

- LOTTE Chemical Corporation

- Mitsubishi Chemical Group

- Exxon Mobil Corporation

- Indorama Ventures Public Company Limited

- Formosa Plastics Corporation

- India Glycols Limited

- Petro Rabigh

- LyondellBasell Industries Holdings BV

- INEOS AG

- Sibur Holding

- UPM Biochemicals (Bio-based Leader)

- Jiangsu Danhua Group

Segments Covered

By Grade

- Polyester Grade

- Industrial Grade

- Antifreeze Grade

By Application

- Polyester Fiber

- PET Resins (Bottles, Containers)

- PET Film and Sheets

- Antifreeze & Coolants

- Chemical Intermediates (e.g., Alkyd Resins)

By Technology (Feedstock)

- Naphtha-Based

- Coal-Based

- Gas-Based (Ethane/Natural Gas)

- Bio-Based (Renewable Feedstocks)

By End-User Industry

- Textiles & Apparel

- Packaging

- Automotive & Transportation

- Chemicals

- Plastic & Construction

By Sales Channel

- Direct Sale

- Indirect Sale (Distributors)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa