Content

What is the Current U.S. Recycled Tire Rubber Market Size and Volume?

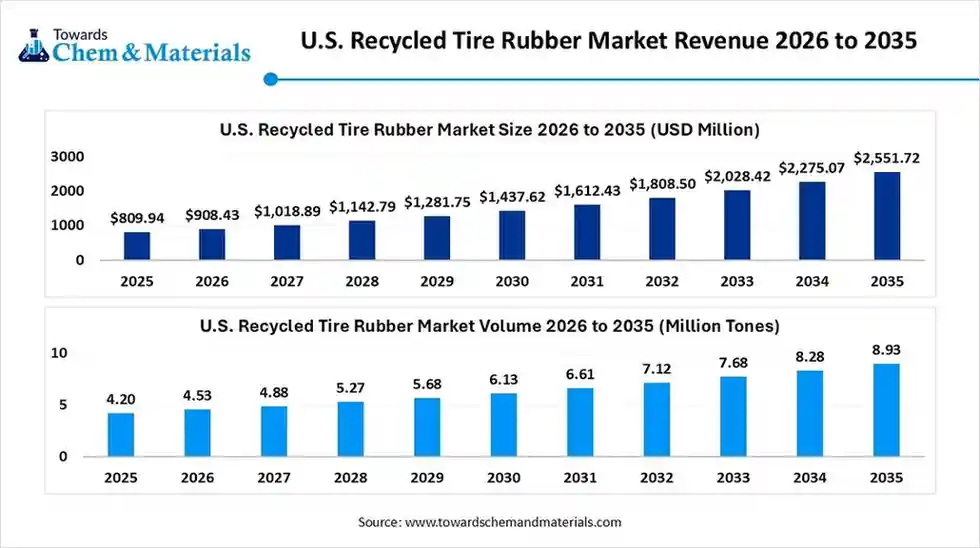

The U.S. recycled tire rubber market size was estimated at USD 809.94 million in 2025 and is predicted to increase from USD 908.43 million in 2026 and is projected to reach around USD 2,551.72 million by 2035, The market is expanding at a CAGR of 12.16% between 2026 and 2035.

The U.S. recycled tire rubber market size was estimated at 4.20 million tons in 2025 and is expected to increase from 4.53 million tons in 2026 to 8.93 million tons by 2035, growing at a CAGR of 7.84% from 2026 to 2035. The shift towards sustainability has accelerated the industry's potential in recent years.

Key Takeaways

- By product type, the tire-derived materials segment led the market with the largest revenue share of 65% in 2025, due to factors like being easier to process, usable on a large scale, and cheap.

- By product type, the recycled chemical products segment is expected to grow during the forecast period, akin to the increasing demand for higher-value products, not just volume, in industries nowadays.

- By process type, the mechanical recycling segment led the market with the largest volume share of 70% in 2025.

akin to its operational simplicity and established infrastructure. - By process type, the chemical and thermal recycling segment is expected to grow at a rapid CAGR during the forecast period, as a sudden shift from waste handling to material engineering.

- By application type, the infrastructure and construction segment accounted for the largest revenue share of 54% in 2025, due to it absorbed supply efficiently rather than innovatively.

- By application type, the automotive and transportation segment is expected to grow during the forecast period, due to a shift towards design innovation rather than regulation alone.

Reducing Waste, Preserving Resources: The Promise of Recycled Tire Rubber

The recycled tire rubber refers to the material that is made by reusing old and worn-out vehicle tires instead of throwing them. Moreover, by converting it into small granules, reusable rubber compounds, and soft rubber sheets, the recycled tire rubber has enhanced market readiness and future industry capabilities in recent years, as per the observation. Also, saving raw material usage and lowering environmental damage, the recycled tire rubber is likely to create lucrative opportunities in the coming years.

U.S. Recycled Tire Rubber Market Trends:

- The regional manufacturers' shift towards the low-value uses to high-value products has allowed the stakeholders to capitalize on growth opportunities in the current period. Moreover, by improving the processing qualities for the increasing rubber standard, which can further be used in industrial goods and molded parts, the recycled tire rubber has gained major industry attention in recent years.

- Emergence of the innovation and mixed recycling methods instead of using only one is strengthening the foundation for future sector growth. Several manufacturers are seen in combining different methods in one facility, such as thermal, combining mechanical, and chemical processes, without relying on just one method, like grinding.

- The development of the local recycled plants near commercial or city areas has offered substantial growth prospects for manufacturing firms in recent years. Moreover, several manufacturers are taking advantage of the low transport costing due to these near-city establishments of plants, as per the recent observation in united states.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 908.43 Million/ 4.53 Million Tons |

| Revenue Forecast in 2035 | USD 2,551.72 Million/ 8.93 Million Tons |

| Growth Rate | CAGR 12.16% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product Type, By Process/Technology, By Application/End-Use Industry |

| Key companies profiled | Liberty Tire Recycling LLC, Genan Inc. (U.S. Operations), Emanuel Tire, LLC, Lakin Tire, CRM Rubber Manufacturers (Crumb Rubber Manufacturers) , Lehigh Technologies, Inc. , Ecore International (Recycling Technologies International LLC) , Tyromer Inc. (U.S. Presence) , Ragn-Sells Group (U.S. Presence) , Titan Tire Corporation , Baling Technologies International (BTI) , Quest Resource Management Group (QuestRMG) , Rumpke Tire Recycling , Entech Inc. , Rubber-Cal , Klean Industries Inc. , BDR Recycling (BDS Tire Recycling) , Tire Disposal & Recycling, Inc. , Crumb Rubber Manufacturers, LLC , Front Range Tire Recycle, Inc. |

Next Generation Recycling Systems Enable Multi-Grade Rubber Output

The move toward integrated, multi-output processing platforms is set to enable high-return ventures for manufacturers. Also, these systems combine selective material separation, precision bond-breaking techniques, and flexible production lines to generate multiple grades of recycled rubber from a single tire stream. By aligning processing intensity with end-use requirements, recyclers maximize material recovery and economic return.

Trade Analysis of the U.S. Recycled Tire Rubber Market: Import, Export, Consumption, and Production Statistics

- The United States has seen under stable export of used rubber tires in 2024, and the export valued approximately $154 million as per the published report.

Value Chain Analysis of the U.S. Recycled Tire Rubber Market:

-

- Distribution to Industrial Users: The U.S. recycled tire rubber market focuses on providing sustainable material to various industrial end-users, with construction and energy recovery being the largest applications. The distribution channels primarily rely on direct sales and specialized industrial logistics.

- Key Players: Genan Inc, and Lehigh Technologies (A Michelin Company)

- Chemical Synthesis and Processing :The U.S. recycled tire rubber market is shifting from traditional mechanical grinding toward advanced chemical and thermal processing methods to produce higher-value, chemically treated inputs that can replace virgin materials.

- Key Players: Bolder Industries and Austin Rubber Company LLC

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring in the market are managed through a combination of federal and state environmental mandates, occupational safety standards, and industry-specific certifications.

- Key Agencies: U.S. Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA)

U.S. Recycled Tire Rubber Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Resource Conservation and Recovery Act (RCRA) (Subtitle D) | Waste management and disposal |

Segmental Insights

Product Type Insights

How did the Tire-Derived Materials Segment Dominate the U.S. Recycled Tire Rubber Market in 2025?

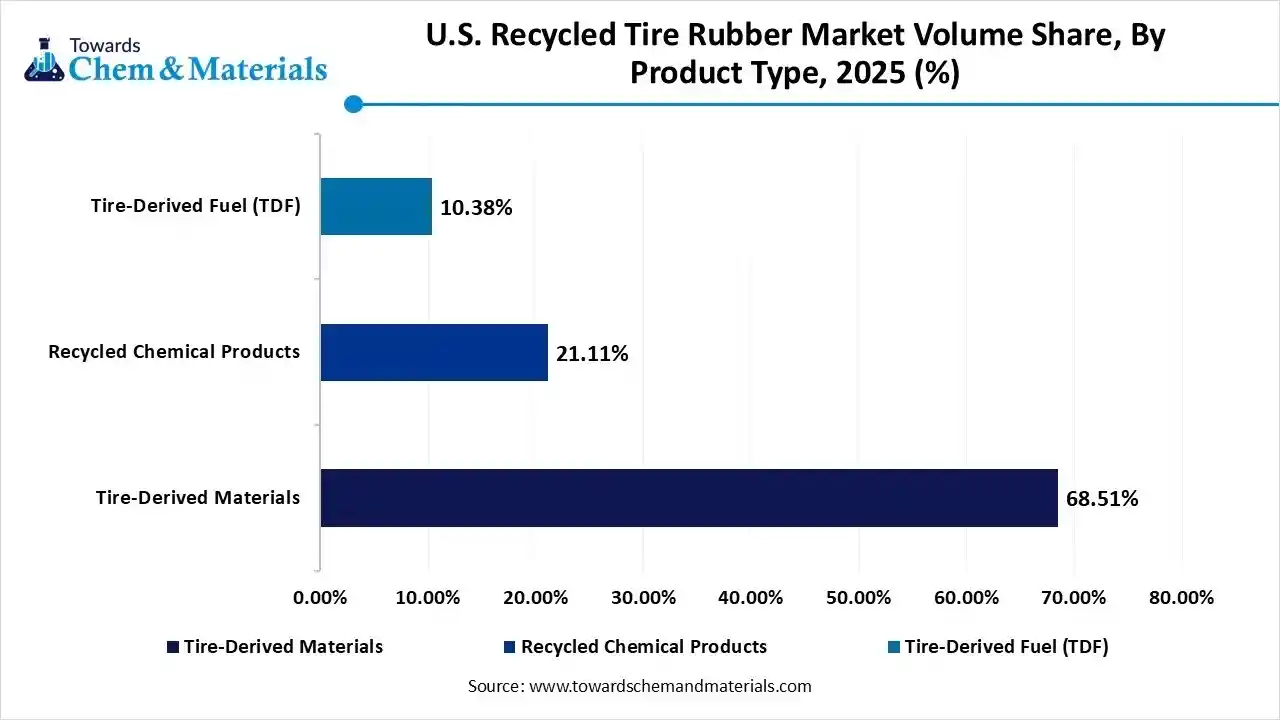

The tire-derived materials segment dominated the market with approximately 65% industry share in 2025, akin to factors like easier to process, usable on a large scale, and cheap. Moreover, by not requiring any complex processing, the manufacturer has preferred the tire-derived material with lower investments and quick returns in the past few years.

The recycled chemical products segment is expected to grow with a rapid CAGR, due to the increasing demand for higher-value products, not just volume, in industries nowadays. Moreover, having the ability to replace fossil fuel-based materials like plastic, fuels, and rubber, the recycled chemical products are forecasted to support the long-term expansion of manufacturing operations in recent years.

U.S. Recycled Tire Rubber Market Volume Share, By Product Type, 2025 (%)

| By Product Type | Market Share(%), 2025 | Market Volume (Million Tons)- 2025 | Market Volume(Million Tons) - 2035 | CAGR | Market Share(%), 2035 |

| Tire-Derived Materials | 68.51% | 2.88 | 5.57 | 6.83% | 62.35% |

| Recycled Chemical Products | 21.11% | 0.89 | 2.19 | 9.47% | 24.53% |

| Tire-Derived Fuel (TDF) | 10.38% | 0.44 | 1.17 | 10.40% | 13.12% |

| Total | 100.00% | 4.20 | 8.93 | 7.84% | 100.00% |

Process Type Insights

Why does the Mechanical Recycling Segment Dominate the U.S. Recycled Tire Rubber Market?

The mechanical recycling segment dominated the market with approximately 70% industry share in 2025, owing to its operational simplicity and established infrastructure. The process enables consistent production of crumb and granulated rubber suitable for mass-market applications. Its low capital requirements and predictable output quality support widespread adoption across regional recycling facilities.

The chemical/ thermal recycling segment is expected to grow at a rapid CAGR, as a sudden shift from waste handling to material engineering. These technologies allow recyclers to control molecular outcomes, producing feedstocks that behave like conventional industrial materials. Also, this control reduces buyer risk and increases market acceptance.

Application Type Insights

Why does the Infrastructure & Construction Segment Dominate the U.S. Recycled Tire Rubber Market?

The infrastructure & construction segment dominated the market with approximately 54% industry share in 2025. Large-scale projects could use mixed-quality rubber without affecting safety or function. This created a reliable outlet for recyclers but limited innovation. As recycled rubber quality improves, the reliance on construction alone restricts market value expansion while turning a future shift toward higher-performance sectors.

The automotive and transportation segment is expected to grow at a rapid CAGR, akin to a shift towards design innovation rather than regulation alone. Moreover, vehicle manufacturers have increasingly integrated recycled materials at the design stage in recent years. Recycled rubber fits well into this approach when quality is controlled. As mobility platforms evolve, recycled rubber becomes a functional component, not just a sustainability symbol in the coming years.

Recent Developments

- In November 2025, Liberty Tire Recycling LLC plans to expand its facilities in Puerto Rico and Western Canada. Moreover, the company is likely to produce tire-derived fuel and crumb rubber as per the published report.(Source: www.rubbernews.com)

Top Vendors in the U.S. Recycled Tire Rubber Market & Their Offerings:

- Liberty Tire Recycling LLC: As the largest tire recycler in North America, Liberty collects and processes over 215 million tires annually, converting more than 4.5 billion pounds of rubber into innovative products like rubberized asphalt, mulch, and tire-derived fuel.

- Lakin Tire: A premier nationwide provider of tire collection and removal services founded in 1918, Lakin was acquired by Liberty Tire Recycling in 2020 to expand their combined geographic reach and service capacity.

- Genan Inc. (U.S. Operations): The American division of Denmark-based Genan Holding A/S operates one of the world's largest tire recycling plants in Houston, Texas, specializing in high-quality rubber granulate, powder, and pellets for industrial applications.

- Emanuel Tire, LLC: Based in Baltimore and operating several plants across the Mid-Atlantic, this family of companies pioneered industry standards for scrap tire disposal and specializes in wholesale and retail used tire sales alongside tire-derived engineering products.

Top Companies in the U.S. Recycled Tire Rubber Market

- Liberty Tire Recycling LLC

- Genan Inc. (U.S. Operations)

- Emanuel Tire, LLC

- Lakin Tire

- CRM Rubber Manufacturers (Crumb Rubber Manufacturers)

- Lehigh Technologies, Inc.

- Ecore International (Recycling Technologies International LLC)

- Tyromer Inc. (U.S. Presence)

- Ragn-Sells Group (U.S. Presence)

- Titan Tire Corporation

- Baling Technologies International (BTI)

- Quest Resource Management Group (QuestRMG)

- Rumpke Tire Recycling

- Entech Inc.

- Rubber-Cal

- Klean Industries Inc.

- BDR Recycling (BDS Tire Recycling)

- Tire Disposal & Recycling, Inc.

- Crumb Rubber Manufacturers, LLC

- Front Range Tire Recycle, Inc.

Segments Covered in the Report

By Product Type

- Tire-Derived Materials

- Crumb Rubber (Ground Rubber)

- Ambient Ground Crumb Rubber

- Cryogenic Ground Crumb Rubber

- Fine Crumb Rubber (e.g., 30 Mesh and Finer)

- Coarse Crumb Rubber (e.g., 10-30 Mesh)

- Rubber Powder (Micronized Rubber Powder - MRP)

- Ultra-Fine Powder (e.g., < 80 Mesh)

- Fine Powder (e.g., 40-80 Mesh)

- Rubber Mulch (Nuggets/Shreds)

- Colored Rubber Mulch

- Black/Natural Rubber Mulch

- Tire-Derived Aggregate (TDA) / Tire Chips for Civil Engineering

- Civil Engineering Grade TDA (2-3 inch chips)

- Tire Chips for Drainage/Landfill Applications

- Crumb Rubber (Ground Rubber)

- Recycled Chemical Products

- Reclaimed Rubber (Devulcanized Rubber)

- Whole Tire Reclaim Rubber

- Butyl Reclaim Rubber

- EPDM Reclaim Rubber

- Natural Rubber Reclaim

- Recovered Carbon Black (rCB)

- Pyrolysis Oil (Tire Pyrolysis Oil - TPO)

- Steel Wire/Scrap

- Textile Fiber/Fluff

- Reclaimed Rubber (Devulcanized Rubber)

- Tire-Derived Fuel (TDF)

- TDF Shreds (Standard Fuel Grade)

- TDF Chips (High BTU Value Grade)

By Process/Technology

- Mechanical Recycling

- Ambient Grinding

- Cryogenic Grinding

- Shredding (Primary and Secondary)

- Milling and Pulverization

- Chemical/Thermal Recycling

- Pyrolysis

- Batch Pyrolysis

- Continuous Pyrolysis

- Devulcanization/Reclaiming

- Chemical Devulcanization

- Thermal/Dynamic Devulcanization

- Gasification

- Hydrothermal Treatment

- Pyrolysis

By Application/End-Use Industry

- Infrastructure & Construction

- Rubber-Modified Asphalt (RMA) / Crumb Rubber Modified Asphalt (CRMA)

- Tire-Derived Aggregate (TDA) for Civil Engineering (Embankments, Drainage Layers, Landfills)

- Roofing Materials (Membranes, Shingles)

- Sound/Vibration Dampening Barriers and Pads

- Automotive & Transportation

- New Tire Manufacturing (using Reclaimed Rubber/MRP/rCB)

- Retreading of Commercial Tires

- Molded Automotive Parts (Floor Mats, Gaskets, Bumpers, Mudguards)

- Brake Pads/Friction Materials

- Sports & Leisure

- Synthetic Turf Infill (Crumb Rubber)

- Poured-in-Place (PIP) Surfaces (Playgrounds, Running Tracks)

- Sporting Goods (Mats, Tiles, Equipment)

- Molded & Extruded Rubber Products

- Flooring Tiles and Mats (Commercial, Gym, Industrial)

- Weather Stripping and Seals

- Hoses and Belts

- Railroad Crossing Surfaces

- Energy & Fuel

- Cement Kilns (TDF)

- Pulp and Paper Mills (TDF)

- Utility/Industrial Boilers (TDF)

- Pyrolysis Oil as Industrial Fuel

- Agriculture & Landscaping

- Rubber Mulch for Gardens and Playgrounds

- Animal/Livestock Mats