Content

What is the Current U.S. Recycled Polyolefins Market Size and Volume?

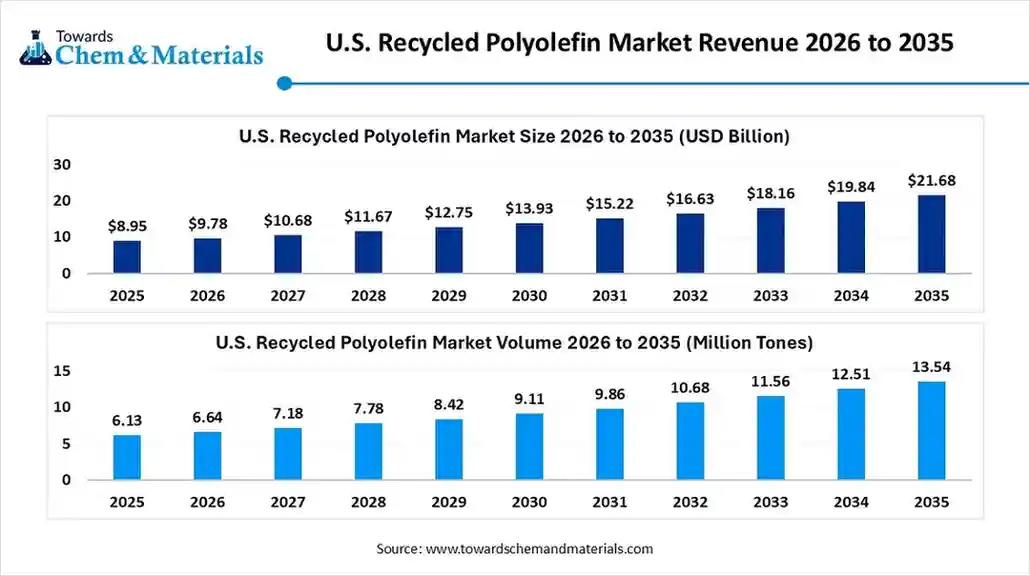

The U.S. recycled polyolefins market size was estimated at USD 8.95 billion in 2025 and is expected to increase from USD 9.78 billion in 2026 to USD 21.68 billion by 2035, growing at a CAGR of 9.25% from 2026 to 2035.

The U.S. recycled polyolefins market size was 6.13 million tons in 2025 and is predicted to increase from 6.64 million tons in 2026 and is expected to be worth around 13.54 million tons by 2035, exhibiting a compound annual growth rate (CAGR) of 8.24% over the forecast period from 2026 to 2035. The market is driven by growing consumer demand for sustainable products, strong corporate ESG commitments, stricter government regulations on plastic use, and technological advancements in sorting and chemical recycling.

Key Takeaways

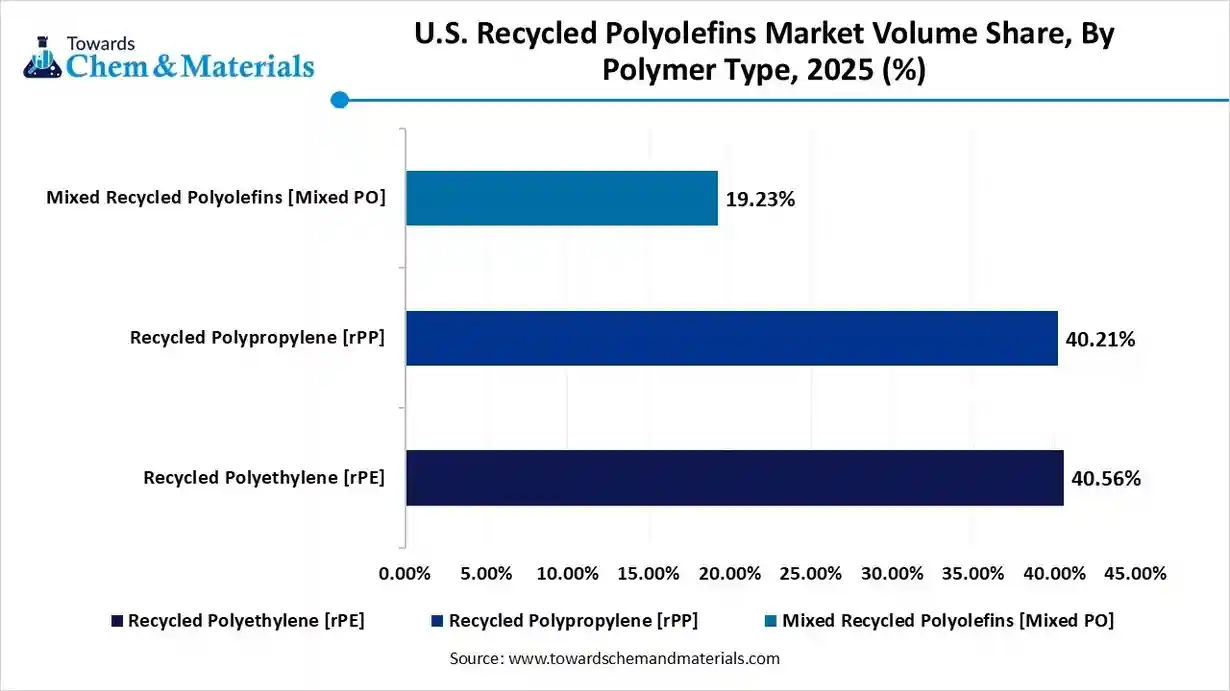

- By polymer type, the recycled polyethylene segment led the market with the largest revenue share of 40% in 2025. Strong demand from FMCG companies drives growth.

- By polymer type, the recycled polypropylene segment is projected to grow at a CAGR between 2026 and 2035. The growth is driven by increasing applications in automotive components.

- By source/feedstock, the post-consumer recycled segment led the market with the largest volume share of 65% in 2025. PCR materials sourced from household packaging waste are increasingly used in consumer-facing products.

- By source/feedstock, the post-industrial recycled segment is projected to grow at a CAGR between 2026 and 2035. Growing application from various sectors drives growth.

- By recycling technology, the mechanical recycling segment accounted for the largest revenue share of 80% in 2025. Continuous improvements in extrusion, filtration, and deodorization are expanding end-use possibilities.

- By recycling technology, the chemical/advanced recycling segment is projected to grow at a CAGR between 2026 and 2035. Strong investments from petrochemical companies and policy support drive the growth of the market.

- By product form/grade, the non-food grade segment dominated with the largest revenue share of 70% in 2025. These grades face fewer regulatory barriers and allow broader use of mechanically recycled materials.

- By product form/grade, the food grade segment is projected to grow at a CAGR between 2026 and 2035. Rising commitments from food and beverage brands drive growth.

- By application/end-use industry, the packaging segment dominated the market and accounted for the largest revenue share of 50% in 2025. Brand owners are actively partnering with recyclers to secure a long-term supply of high-quality recycled resins

- By application/end-use industry, the automotive segment is projected to grow at a CAGR between 2026 and 2035. Automakers are adopting recycled materials to meet carbon reduction targets and the circular economy goals.

Market Overview

What Is The Significance Of The U.S. Recycled Polyolefins Market?

The U.S. recycled polyolefins market is significant as a key driver for sustainability, reducing virgin plastic demand in major sectors like packaging, automotive, and construction, fueled by consumer demand, corporate goals, and government mandates (like California's PCR rules). Its importance lies in boosting the circular economy, enabling better material quality through advanced recycling (mechanical/chemical), creating value from waste, and meeting the rising demand for eco-friendly products, despite challenges such as contamination.

U.S. Recycled Polyolefins Market Growth Trends:

- Sustainability Push: Consumer and corporate demand for eco-friendly products and reduced plastic waste.

- Regulatory Landscape: State-level mandates (e.g., California's minimum content laws) compelling recycled content use.

- Investor Pressure: ESG-focused investors pushing for measurable sustainability in manufacturing.

- E-commerce Growth: Increased need for durable, lightweight, and recyclable packaging.

- Advanced Recycling: Chemical recycling and AI-driven sorting improve the quality and processing of contaminated streams.

Key Technological Shifts In The U.S. Recycled Polyolefins Market:

The U.S. recycled polyolefins market is undergoing a significant transformation driven by a shift towards a circular economy, stricter regulations, and consumer demand for sustainable products. Key technological shifts involve both mechanical and advanced (chemical) recycling methods, focusing on improving the quality, consistency, and range of applications for recycled materials.

Trade Analysis Of U.S. Recycled Polyolefins Market: Import & Export Statistics

- According to data on United States exports, the country shipped 3,735 shipments of recycled plastic, exported by 319 U.S. exporters to 96 Buyers. The primary destinations are India, Mexico, and France.

- Globally, Vietnam, the United States, and China are the leading exporters of recycled plastic, with Vietnam handling 26,888 shipments, the U.S. with 3,089 shipments, and China with 2,755 shipments.

- Similarly, the U.S. exported 167 shipments of Polyolefin Polymer through 38 U.S. exporters to 38 Buyers. The main destinations are Colombia, Vietnam, and Chile.

- The top three global exporters of Polyolefin Polymer are Thailand, South Korea, and Spain, with Thailand leading at 667 shipments, South Korea with 208 shipments, and Spain with 185 shipments.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 9.78 Billion / 6.64 Million Tons |

| Revenue Forecast in 2035 | USD 21.68 Billion/ 13.54 Million Tons |

| Growth Rate | CAGR 9.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Polymer Type, By Source/Feedstock, By Recycling Technology, By Product Form/Grade, By Application/End-Use Industry |

| Key companies profiled | Waste Management, Inc, Republic Services, Inc, MBA Polymers, Inc, KW Plastics, Avangard Innovative, CarbonLITE Industries, KW Plastics , Plastipak Holdings, Inc. , MBA Polymers Inc. , Custom Polymers , CarbonLITE Industries LLC , Avangard Innovative , Waste Management, Inc. , PureCycle Technologies, ExxonMobil Chemical , Dow Inc. , LyondellBasell Industries N.V. , SABIC , Green Line Polymers , Envision Plastics Industries LLC , Ultra Poly Corporation , InterGroup International, Ltd. , TerraCycle , Ravago Manufacturing Americas , Advanced Drainage Systems, Inc. (ADS) , Nexus Circular |

U.S. Recycled Polyolefins Market Value Chain Analysis

- Chemical Synthesis and Processing: Recycled Polyolefins are processed through collection, sorting, washing, shredding, mechanical recycling, melt filtration, re-pelletization, along with advanced recycling techniques.

- Key players: Avangard Innovative, KW Plastics, PureCycle Technologies, Republic Services.

- Quality Testing and Certification: Recycled polyolefins require certifications ensuring material consistency, food-contact safety (where applicable), recyclate traceability, and environmental compliance. Key certifications include FDA food-contact approval, ISCC PLUS, Global Recycled Standard (GRS), UL Environmental Claim Validation (ECV), and ISO quality standards.

- Key players: FDA (U.S. Food and Drug Administration), ISCC, Textile Exchange (GRS), UL Solutions, ISO (International Organization for Standardization).

- Distribution to Industrial Users: Recycled polyolefins are distributed to packaging manufacturers, consumer goods companies, automotive component producers, construction product manufacturers, and industrial plastic converters across the US.

- Key players: Avangard Innovative, KW Plastics, LyondellBasell (Circulen portfolio).

Recycled Polyolefins Regulatory Landscape in the U.S

| Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| U.S. Environmental Protection Agency (EPA) | Resource Conservation and Recovery Act (RCRA) EPA National Recycling Strategy Clean Water Act (CWA) / Clean Air Act (CAA) |

Waste classification & recycling standards End-of-life management of plastics Permits for recycling facilities and emissions control |

RCRA governs how recycled polyolefin plastics are classified (solid waste vs. commodity) and managed. EPA’s National Recycling Strategy (2021) aims to improve recycling infrastructure and recycled content use. |

| Food and Drug Administration (FDA) | FDA 21 CFR Part 177 (Indirect Food Additives) FDA guidance on recycled plastics in food contact |

Safety approval for recycled polyolefins in food packaging and contact applications | Recycled polyolefins used for food contact must meet stringent FDA migration and safety criteria. Chemical recycling streams (e.g., for HDPE/PET) often require additional safety evaluation. |

| Federal Trade Commission (FTC) | “Green Guides” (16 CFR Part 260) | Advertising and environmental claims for recycled content | FTC Green Guides regulate how companies can market products as “recycled” or “sustainable,” ensuring claims are truthful and substantiated. |

| Department of Transportation (DOT) / OSHA | Hazardous Materials Regulations (49 CFR) OSHA 29 CFR 1910 |

Transport safety for recycled resin shipments Worker safety in processing plants |

DOT rules affect the transportation of recycled resin and chemical additives. OSHA ensures workplace safety in recycling operations. |

| State Environmental Agencies (e.g., CalRecycle) | State Extended Producer Responsibility (EPR) laws State plastic recycling targets |

State mandates for recycled content and producer responsibility Bottle bills and recycling targets |

California and other states are implementing EPR and recycled content mandates that drive demand for recycled polyolefins beyond federal requirements. |

Segmental Insights

Polymer Type Insights

Which Polymer Type Segment Dominated The U.S. Recycled Polyolefins Market In 2025?

The recycled polyethylene segment dominated the market accounting for a 40% share in 2025. Recycled polyethylene represents the largest share of the market due to its extensive use in packaging films, bottles, containers, and agricultural applications. Strong demand from FMCG companies, regulatory pressure to increase recycled content, and advances in sorting and washing technologies are improving rPE quality, enabling broader adoption across rigid and flexible packaging applications.

The recycled polypropylene segment is projected to grow at a CAGR between 2026 and 2035 in the U.S. recycled polyolefins market. Recycled polypropylene is witnessing rapid growth in the U.S. market, driven by increasing applications in automotive components, consumer goods, and household products. Improvements in mechanical recycling and compatibilizer technologies are enhancing material performance, making rPP suitable for higher-value applications. Automotive OEM sustainability targets and brand-owner commitments are accelerating demand for recycled polypropylene grades.

U.S. Recycled Polyolefins Market Volume Share, By Polymer Type, 2025 (%)

| By Polymer Type | Market Share(%), 2025 | Market Volume(Million Tons) - 2025 | Market Volume (Million Tons) - 2035 | CAGR- 2026- 2035 | Market Share(%), 2035 |

| Recycled Polyethylene [rPE] | 40.56% | 2.49 | 4.95 | 7.12% | 36.54% |

| Recycled Polypropylene [rPP] | 40.21% | 2.46 | 6.53 | 10.23% | 48.23% |

| Mixed Recycled Polyolefins [Mixed PO] | 19.23% | 1.18 | 2.06 | 5.75% | 15.23% |

| Total | 100.00% | 6.13 | 13.54 | 8.25% | 100.00% |

Source/Feedstock Insights

How did the Post-Consumer Recycled Segment dominate the U.S. Recycled Polyolefins Market in 2025?

The post-consumer recycled segment dominated the market, accounting for a 65% share in 2025. Post-consumer recycled polyolefins dominate feedstock sourcing in the US due to regulatory mandates, brand sustainability goals, and growing collection infrastructure. PCR materials sourced from household packaging waste are increasingly used in consumer-facing products. However, contamination challenges and inconsistent quality continue to drive investments in advanced sorting, digital watermarks, and AI-enabled waste processing systems.

The post-industrial recycled segment is projected to grow at a CAGR between 2026 and 2035 in the U.S. recycled polyolefins market. Post-industrial recycled feedstock is valued for its higher purity, consistency, and lower contamination levels compared to PCR materials. Generated from manufacturing scrap and industrial waste, PIR polyolefins are widely used in automotive, industrial packaging, and construction applications. The availability of stable feedstock streams supports predictable supply chains and consistent product performance in recycled resin production.

Recycling Technology Insights

Which Recycling Technology Segment Dominated The U.S. Recycled Polyolefins Market In 2025?

The mechanical recycling segment dominated the market accounting for an 80% share in 2025. Mechanical recycling remains the most widely used technology in the market due to its cost efficiency and established infrastructure. The process is primarily applied to clean and sorted waste streams, producing resins suitable for non-food packaging, automotive parts, and industrial products. Continuous improvements in extrusion, filtration, and deodorization are expanding end-use possibilities.

The chemical/advanced recycling segment is projected to grow at a CAGR between 2026 and 2035 in the U.S. recycled polyolefins market. Chemical and advanced recycling technologies are gaining momentum in the US as solutions for hard-to-recycle polyolefin waste. Processes such as pyrolysis and depolymerization enable conversion of mixed and contaminated plastics into virgin-like feedstocks. Strong investments from petrochemical companies and policy support are positioning chemical recycling as a key growth driver for food-grade and high-performance applications.

Product Form/Grade Insights

How did the Non-Food Grade Segment Dominate the U.S. Recycled Polyolefins Market in 2025?

The non-food grade segment dominated the market accounting for a 70% share in 2025. Non-food grade recycled polyolefins account for most of the market volume, serving applications such as automotive components, construction materials, industrial packaging, and consumer goods. These grades face fewer regulatory barriers and allow broader use of mechanically recycled materials. Demand is supported by cost advantages and sustainability initiatives across industrial and commercial end-use sectors.

The food-grade segment is projected to grow at a CAGR between 2026 and 2035 in the U.S. recycled polyolefins market. Food-grade recycled polyolefins represent a fast-growing but highly regulated segment in the U.S. market. Achieving food-contact compliance requires advanced decontamination, traceability, and often chemical recycling processes. Rising commitments from food and beverage brands to incorporate recycled content are driving investments in FDA-approved recycling technologies and closed-loop packaging systems.

Application/End-Use Industry Insights

Which Application/End Use Industry Segment Dominated The U.S. Recycled Polyolefins Market In 2025?

The packaging segment dominated the market, accounting for approximately 40-50% share in 2025. Packaging is the largest application segment for recycled polyolefins in the US, driven by regulatory mandates, retailer commitments, and consumer demand for sustainable packaging. Recycled polyethylene and polypropylene are increasingly used in rigid containers, films, and flexible packaging formats. Brand owners are actively partnering with recyclers to secure a long-term supply of high-quality recycled resins.

The automotive segment is projected to grow at a CAGR between 2026 and 2035 in the U.S. recycled polyolefins market. The automotive sector is a key growth application for recycled polyolefins, particularly recycled polypropylene used in interior trims, battery housings, and under-the-hood components. Automakers are adopting recycled materials to meet carbon reduction targets and circular economy goals. Consistent quality, lightweight benefits, and regulatory incentives are supporting increased penetration of recycled resins in vehicle manufacturing.

Recent Developments

- In December 2025, Borealis and Borouge introduced Recleo™, a new global brand for mechanically recycled polyolefins (PO). This initiative aims to unify their mechanically recycled products into a single, worldwide offering that includes the U.S. market(Source: www.plasticstoday.com)

- In September 2025, Spain-based mechanical plastics recycler GCR Group launched CiclicNxt®, a new line of industrial-scale post-consumer recycled (PCR) polyolefins. The CiclicNxt® line is designed to offer mechanical, thermal, and processing properties like virgin plastics.(Source: www.recyclingtoday.com)

Top Players in the U.S. Recycled Polyolefins Market & Their Offerings:

- Waste Management, Inc: Waste Management operates large-scale recycling facilities that collect and process post-consumer polypropylene (PP) and polyethylene (PE) materials. The company supplies mechanically recycled polyolefin resins to packaging, automotive, and consumer goods sectors, supported by advanced sortation technologies.

- Republic Services, Inc: Republic Services provides comprehensive recycling services, including collection, sorting, and processing of polyolefin plastics. Its recycled PE and PP materials are supplied to manufacturers for injection molding, extrusion, and flexible packaging applications.

- MBA Polymers, Inc: MBA Polymers specializes in high-value recycling of mixed plastic waste, producing post-consumer recycled (PCR) polyolefin resins for automotive, appliance, and consumer goods applications. The company focuses on enhancing material purity and performance through advanced processing.

- KW Plastics: KW Plastics is one of the largest processors of post-consumer plastic scrap in the U.S., producing recycled HDPE, LDPE, and PP resins. Its recycled polyolefins are used in packaging, industrial drums, crates, and other durable applications.

- Avangard Innovative: Avangard Innovative supplies recycled polypropylene and polyethylene resins derived from post-industrial and post-consumer waste. The company’s PCR polyolefins serve consumer goods, packaging, and extruded plastic product markets.

- CarbonLITE Industries: CarbonLITE focuses primarily on recycled PET but is expanding capabilities in polyolefin recycling for packaging and food-contact applications. Its infrastructure supports circular polymer recovery and reprocessing.

Top Key Companies in the U.S. Recycled Polyolefins Market

- Waste Management, Inc

- Republic Services, Inc

- MBA Polymers, Inc

- KW Plastics

- Avangard Innovative

- CarbonLITE Industries

- KW Plastics

- Plastipak Holdings, Inc.

- MBA Polymers Inc.

- Custom Polymers

- Avangard Innovative

- Waste Management, Inc.

- PureCycle Technologies

- ExxonMobil Chemical

- Dow Inc.

- LyondellBasell Industries N.V.

- SABIC

- Green Line Polymers

- Envision Plastics Industries LLC

- Ultra Poly Corporation

- InterGroup International, Ltd.

- TerraCycle

- Ravago Manufacturing Americas

- Advanced Drainage Systems, Inc. (ADS)

- Nexus Circular

Segments Covered

By Polymer Type

- Recycled Polyethylene (rPE)

- Recycled High-Density Polyethylene (rHDPE)

- Recycled Low-Density Polyethylene (rLDPE) / Linear Low-Density Polyethylene (rLLDPE)

- Recycled Polypropylene (rPP)

- Mixed Recycled Polyolefins (Mixed PO)

By Source/Feedstock

- Post-Consumer Recycled (PCR)

- Plastic Bottles (HDPE and PP bottles)

- Plastic Films (Bags, Wraps, Liners)

- Rigid Containers (Tubs, Pails, Crates)

- Post-Industrial Recycled (PIR)

- Manufacturing Scrap/Trimmings

- Uncontaminated Off-Spec Material

By Recycling Technology

- Mechanical Recycling

- Flakes (Washed, ground material)

- Pellets (Melt-filtered, extruded, and pelletized material)

- Chemical/Advanced Recycling

- Pyrolysis (Yielding Pyrolysis Oil/Tars for Feedstock)

- Gasification/Solvolysis (Yielding Monomers/Chemical Feedstock)

By Product Form/Grade

- Non-Food Grade (Standard Grade)

- Food Grade (FDA-approved for food contact)

- High-Purity/Near-Virgin Grade (Often derived from advanced recycling)

- Color-Sorted Grade (e.g., Natural/Clear, Mixed Color, Black)

By Application/End-Use Industry

- Packaging

- Non-Food Packaging (Detergent bottles, personal care, industrial containers)

- Food Packaging (Trays, bottles, films with protective barrier)

- Flexible Packaging (Films, Bags, Shrink Wrap)

- Construction

- Pipes and Conduits

- Decking and Fencing

- Roofing and Insulation

- Automotive

- Interior Components (Trims, Panels)

- Exterior Components (Bumpers, Wheel Arch Liners)

- Under-the-Hood Components

- Consumer Goods & Home Appliances

- Household Containers and Storage Bins

- Toys and Recreational Items

- Agriculture

- Irrigation Tubing

- Greenhouse Films