Content

What is the Current Recycled Polyester Market Size and Share?

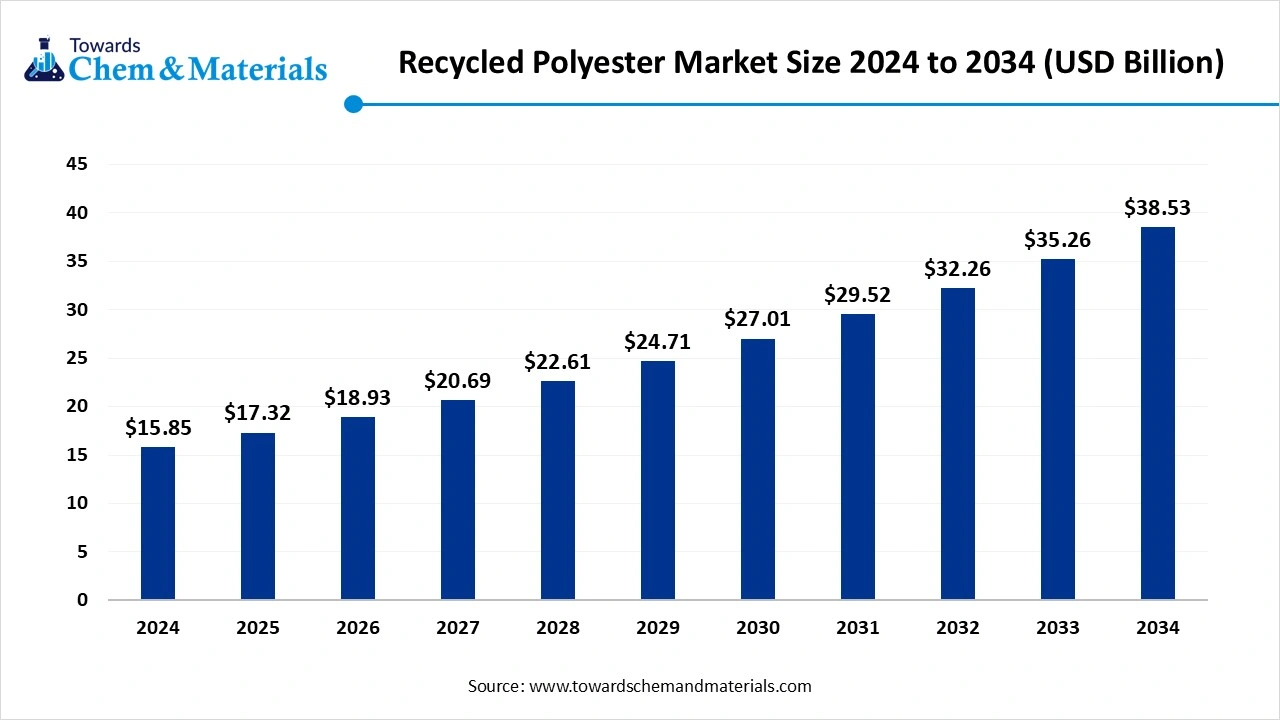

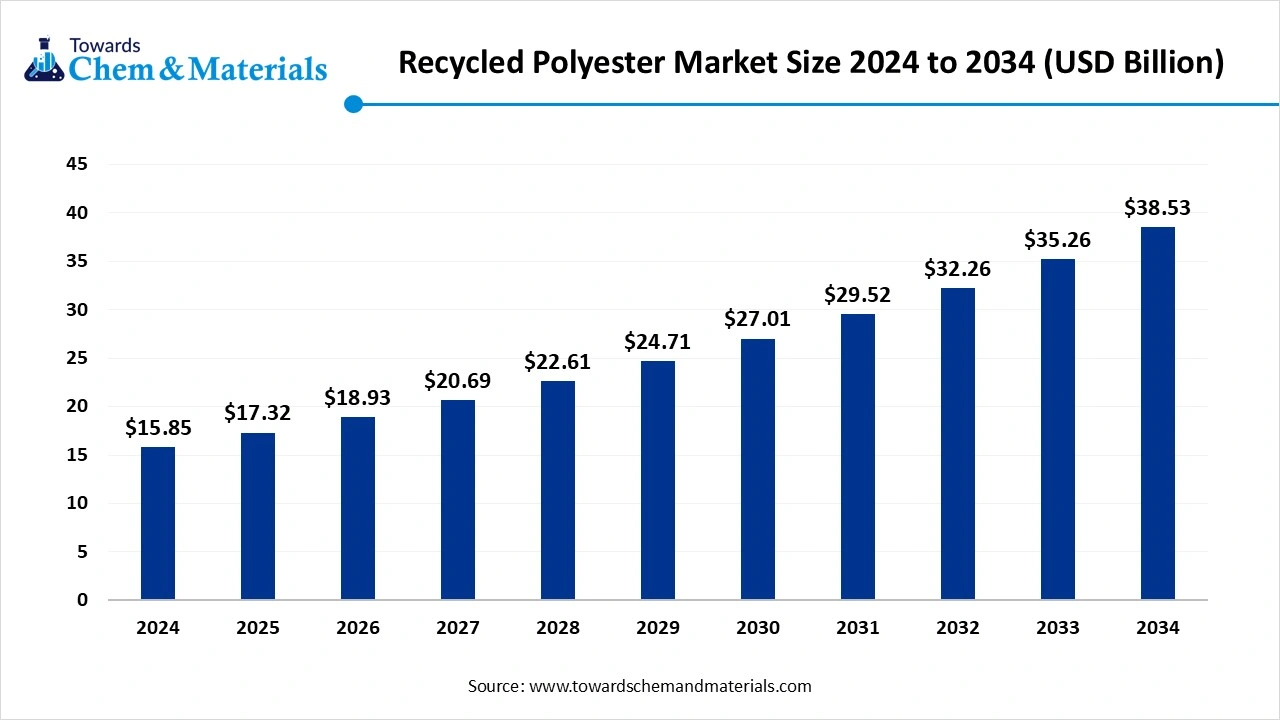

The global recycled polyester market size was estimated at USD 17.32billion in 2025 and is expected to increase from USD 18.93billion in 2026 to USD 42.11billion by 2035, growing at a CAGR of 9.29% from 2026 to 2035. Asia Pacific dominated the recycled polyester market with the largest revenue share of 51.01% in 2025.The ongoing sustainability standards in the manufacturing industry have fueled the industry's potential in recent years.

Key Takeaways

- The Asia-Pacific dominated the recycled polyester market with the largest revenue share of 51.01% in 2025.

- By product type, the Cotton spinning material segment dominated the market and accounted for the largest revenue share of 44.00% in 2025.

- By product type, the filling material segment is expected to grow at the fastest CAGR of 12.96% from 2026 to 2035 in terms of volume.

- By application type, the Apparel application segment led the market with the largest revenue share of 54.94% in 2025.

Market Overview

From Waste to Worth: Recycled Polyester Powers Tomorrow’s Industries

The recycled polyester market is expected to see steady growth owing to the rapidly increasing initiatives for sustainability around the globe. Moreover, the major industries such as home textiles, packaging, and fashion are heavily adopting this type of recycled plastic while following global eco-friendly initiatives.

Moreover, the global governments are trying to reduce the total dependence on petroleum-based products, where recycled polyester has emerged as the ideal product in recent years, as per industry observation. Furthermore, technological advances are anticipated to play a major role in recycling industries, akin to the heavy investment in research and development programs from all over the world.

Which Factor Is Driving the Growth of the Recycled Polyester Market?

The sudden expansion of sustainable fashion trends is spearheading the industry's growth in the current period. Moreover, individuals all around the globe have become more aware of eco-friendly initiatives contributing to industry growth in recent years. Also, the global governments are increasingly implementing sustainability initiatives, which have apparently affected the enlarged industries, and these heavy industries are using recycled products as raw materials by replacing traditional plastic in the past few years. Moreover, some of the brands are actively seen in promoting their sustainability via digital platforms, which has been severely contributing to the industry's growth in the past few years.

Market Trends

- The development of technologically advanced recycling systems is driving industry growth in the current period. Moreover, the new recycling methods were developed by technology that is expected to have a heavy impact on the recycling industry for the next years and is anticipated to contribute to the growth.

- The increasing governmental support for recycling and sustainability initiatives has been contributing to the market potential in recent years, as several global governments are seen as providing benefits such as subsidies and tax reductions to manufacturers who apply eco-friendly initiatives in their manufacturing processes.

- The sudden expansion of the non-apparel application is fueling the industry's growth in recent years. Moreover, applications like automotive interiors, home textiles, and packaging have seen the heavy usage of recycled polyester in recent years. Also, having flexibility and cost effectiveness is making them preferred for these applications.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 18.93Billion |

| Expected Size by 2035 | USD 42.11Billiion |

| Growth Rate from 2025 to 2034 | CAGR 9.29% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2025 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Indorama Ventures, Far Eastern New Century, Unifi Inc., Reliance Industries Limited, Sinopec Yizheng Chemical Fibre, Alpek Polyester, Zhejiang Jiaren New Materials Co., Ltd., Polyfibre Industries Pvt. Ltd., Bottloop, Margasa Group |

Market Opportunity

Local Textile Growth Fuels Recycling Opportunities in Developing Regions

The increasing demand from the developing regions is expected to create lucrative opportunities for manufacturers in the coming years. Regions such as Southeast Asia, Latin America, and others are seen under the advancements of the sectors, such as local textiles and others. Moreover, these local textile manufacturers are increasingly seen in seeking cost-effective and eco-friendly solutions in the current period, which is likely to provide a sophisticated consumer base in the coming years. Also, the manufacturers can provide them with an affordable solution when they establish the local recycling plant, which can drive growth further.

Market Challenge

Contamination Challenges Threaten Trust in Recycled Materials

Maintaining the quality of the recycled material is expected to hinder the industry growth in the coming years, as several times these recycled materials are detected as contaminated with plastics, which can cause manufacturers to lose their trust policies. Also, the unpurified plastics are not easily recycled, which increases the manufacturer's efforts, time, a cost sometimes, which is anticipated to create delays and decrease the industry's potential as per future expectations. However, manufacturers can gain an advantage from the latest technology, which helps manufacturers with the latest machinery and precision results during the forecast period.

Value Chain Analysis

Collection and Sourcing

- This involves gathering post-consumer polyester bottles and, increasingly, post-industrial polyester textiles.

- Key Players: Gavin Environmental Group and I: Collect.

Sorting and Pre-Processing

- In this, at material recovery facilities, the collected waste is sorted, often using a combination of manual labor and advanced optical scanners to separate polyester from other materials and by color.

- Key Players: Boer Group, REMONDIS, and Boretech.

Recycling and Repolymerization

- In this, the clean polyester flakes are processed into recycled material, either through mechanical or chemical recycling methods.

- Key Players: Indorama Ventures, Teijin Limited, Unifi, Eastman Chemical Company, Far Eastern New Century, and Carbios.

Product Manufacturing

- In this, recycled polyester chips and pellets are used as a raw material to produce new items, potentially incorporating dyes and finishes.

- Key Players: Textile mills, Badri Group, Reliance Industries Limited, Alpla Werke, and PepsiCo.

Distribution and Commercialization

- In this, finished products are distributed globally through established supply chains and retail channels.

- Key Players: Patagonia, H&M, Adidas, The North Face, and DHL Group.

Segmental Insights

Product Type Insights

How the Cotton Spinning Material Segment Dominated the Recycled Polyester Market in 2025?

The cotton spinning material segment held the largest share of the market in 2025, accounting for 44.00% of total revenue,due to its wide application in the apparel and textile industry. Moreover, the strong demand from the fashion industry is massively leading industry growth in the current period, as polyester is playing a major role in the production of various clothing items. Furthermore, by having lightweight, durability, and moisture resistance, the cotton spinning material gained industry attention in recent years.

The filling material segment is seen to grow at a notable rate during the predicted timeframe, owing to the increasing need for the automotive interiors, home textiles, and soft furnishings in recent years. by having softness, light weight properties, and thermal insulations, the recycled polyester becomes ideal in the filling application as per the recent industry observation. Moreover, the major brands are actively promoting their eco-friendly product lines, which are expected to support the segment's growth during the forecast period.

Recycled Polyester Market Share, By Product, 2025 (%)

| By Product | Revenue Share, 2025 (%) |

| Cotton Spinning Material | 44.00% |

| Filling Material | 56.00% |

Application Type Insights

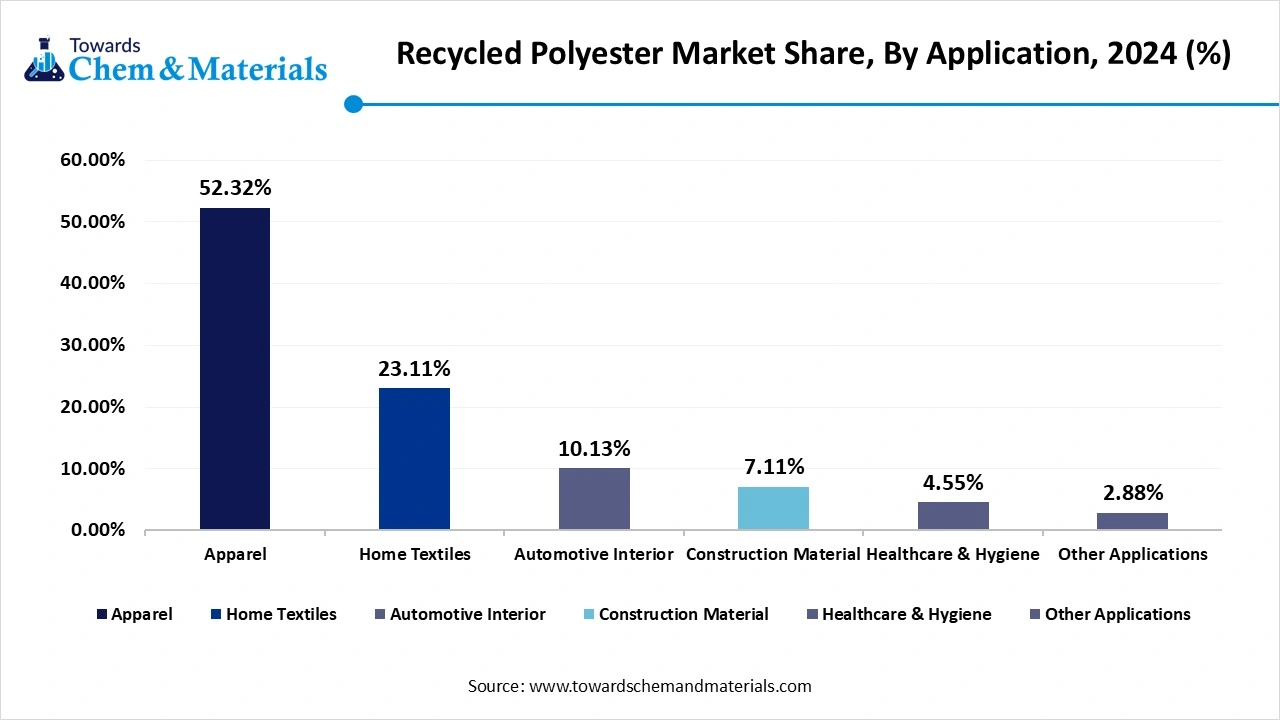

Why Apparel Segment Dominated the Recycled Polyester Market by Application Type?

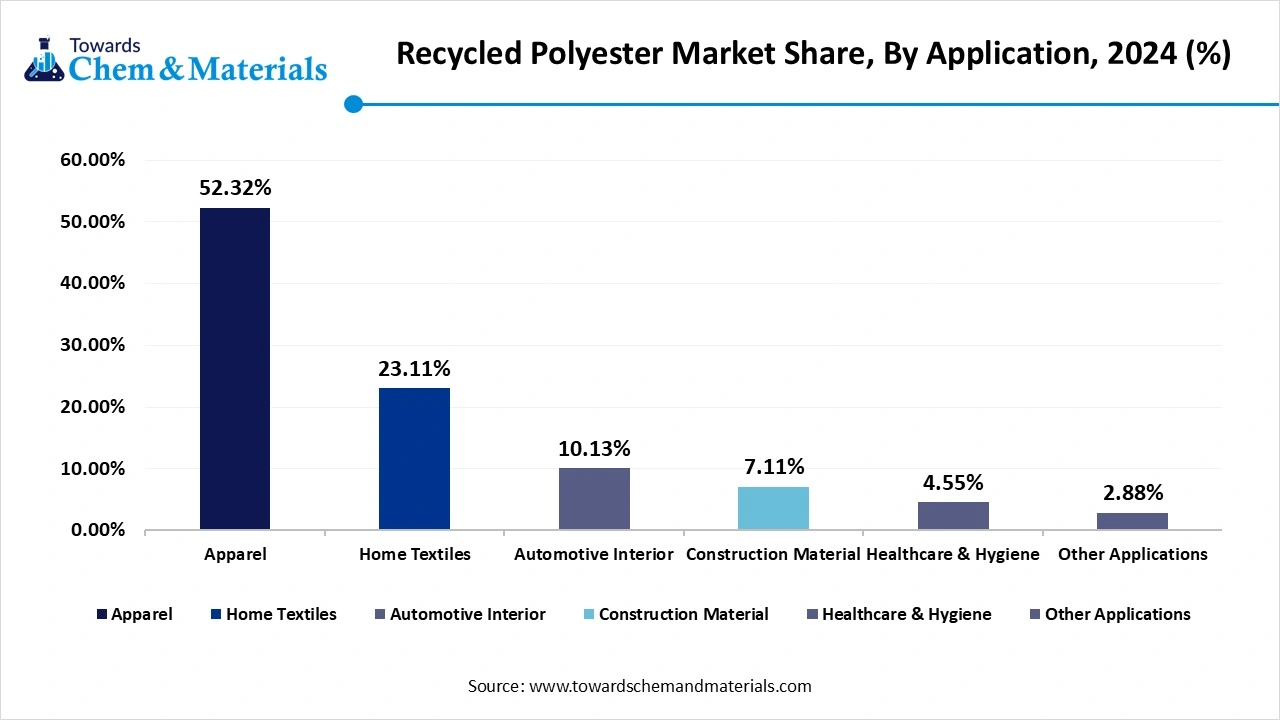

The apparel segment held the largest share of the recycled polyester market in 2025, akin to the massive demand for clothing and the fashion industry's shift toward sustainable materials. Many global apparel brands now use recycled polyester in t-shirts, sportswear, jackets, and fashion wear to meet environmental commitments. It provides strength, flexibility, and comfort, making it a reliable choice for high-volume production. Also, consumers are becoming more aware of sustainable fashion, leading to higher sales of recycled clothing. As a result, the apparel industry has emerged as the largest application for recycled polyester in recent years.

The home textiles segment is expected to grow at a notable rate, due to rising eco-consciousness in home décor and furnishing. Consumers are increasingly choosing sustainable options for curtains, upholstery, carpets, and bed linens. Recycled polyester offers excellent durability, color retention, and softness-ideal for home applications. Additionally, retailers and brands are promoting green alternatives, pushing the use of recycled materials in household items. With growing emphasis on sustainability in interior design, recycled polyester is likely to become a key material in the future of home textiles.

Recycled Polyester Market Share, By Application, 2025 (%)

| By Application | Revenue Share, 2025 (%) |

| Apparel Application | 54.94% |

| Home Textile | 24.27% |

| Automotive Interior | 10.64% |

| Construction Material | 7.46% |

| Healthcare & Hygiene | 4.78% |

| Others | 3.02% |

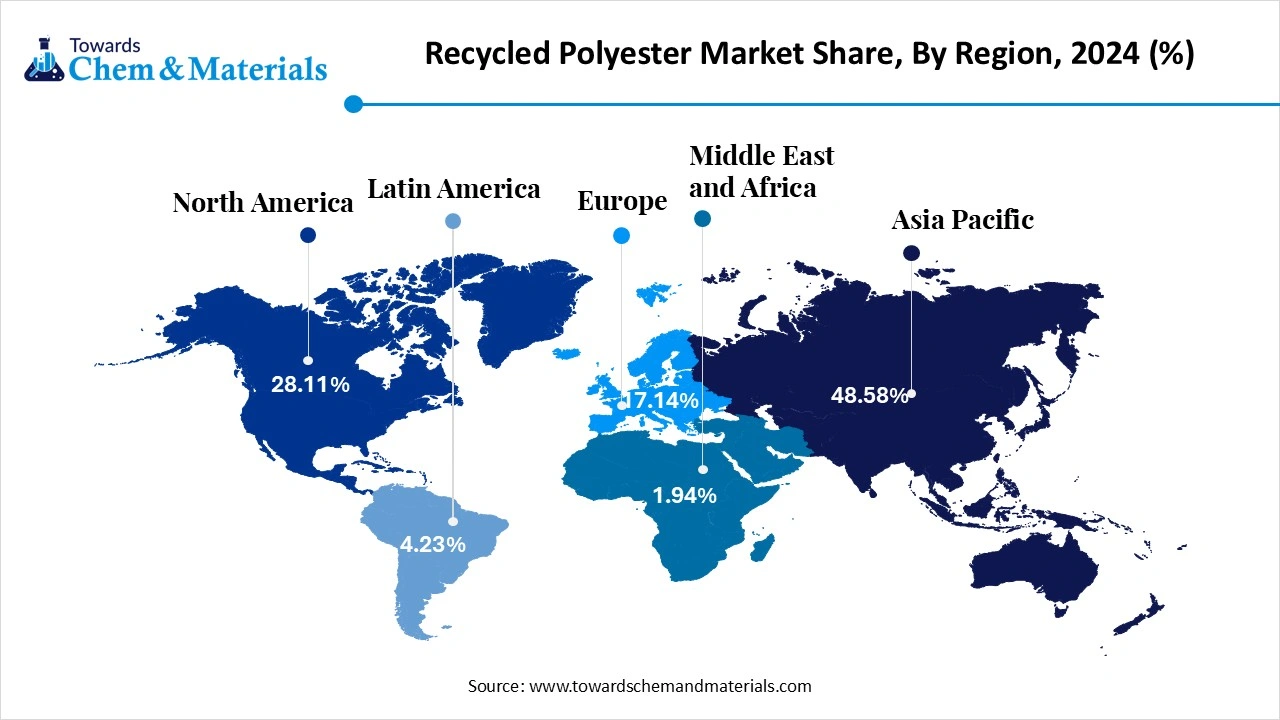

Regional Insights

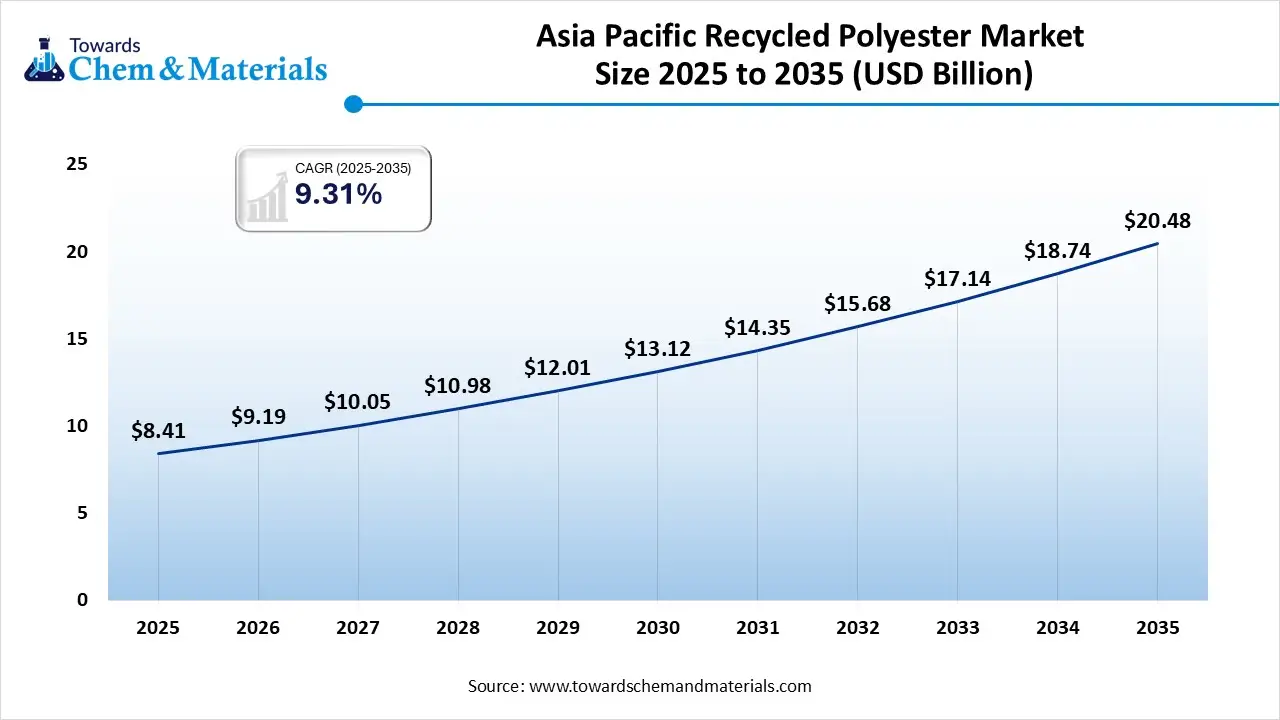

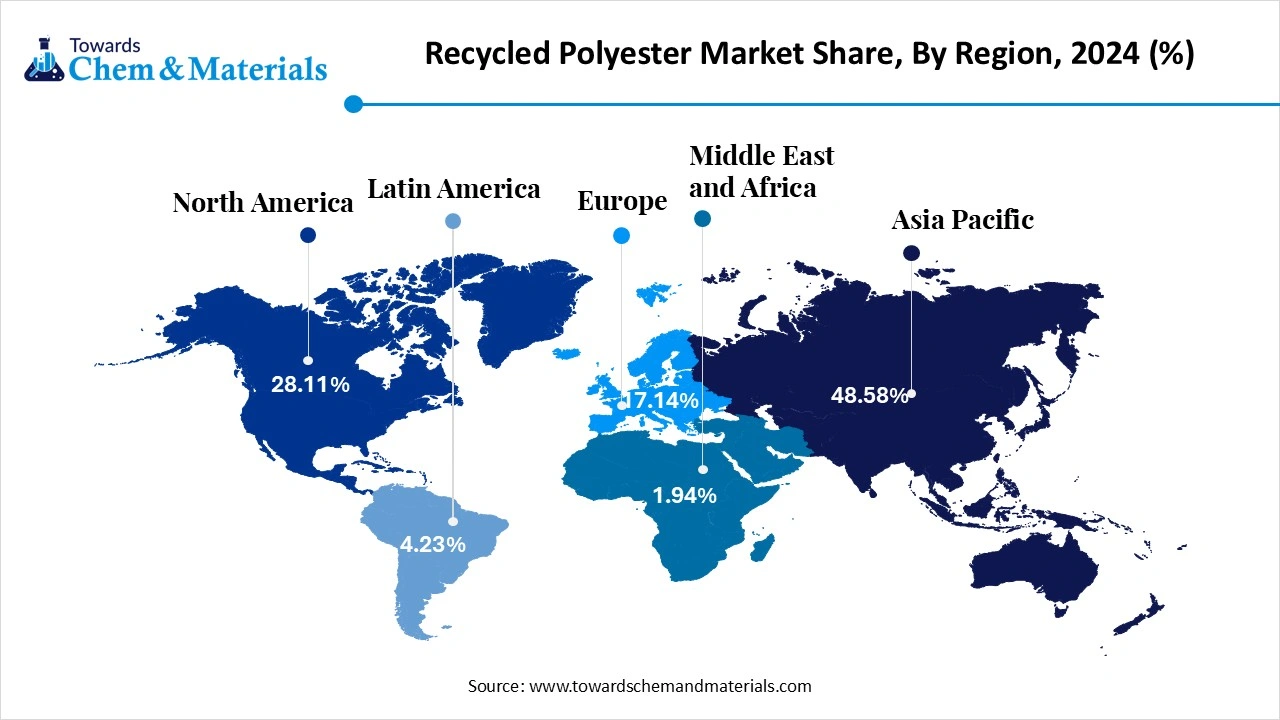

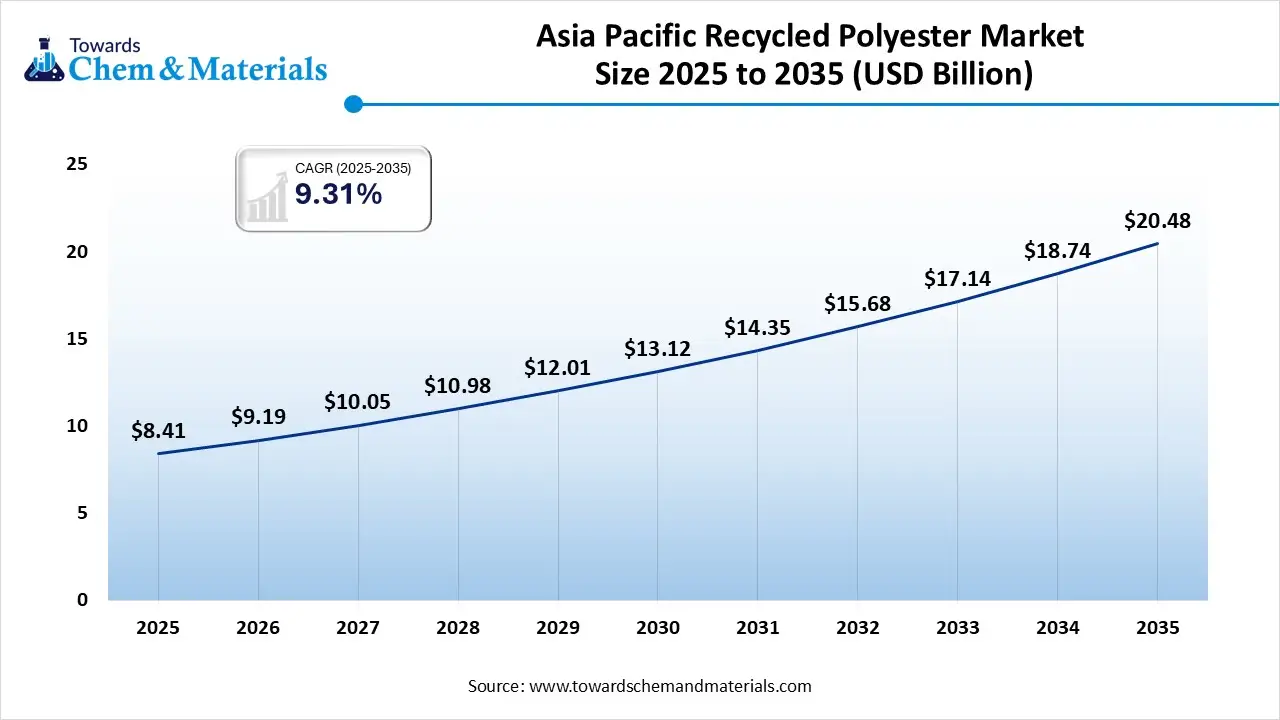

The Asia Pacific recycled polyester market size was valued at USD 8.41 billion in 2025 and is expected to be worth around USD 20.48 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.31% over the forecast period from 2026 to 2035. Asia Pacific dominated the market in 2025, akin to the region is considered a major manufacturing and textile hub globally in the current period. Moreover, the regional countries like China, India, and Vietnam have seen a heavy domestic demand for sustainable and cost-effective textiles in recent years. Also, the regional governments are increasingly contributing to the market potential by implementing stricter environmental regulations for the large-scale manufacturing domains in the past few years, as per the recent regional observation.

Is the World Turning to China for Recycled Polyester Supply?

China maintained its dominance in the recycled polyester market owing to the heavy polyester manufacturing industry with enlarged exports. Moreover, China has a technologically advanced recycling infrastructure, which is leading the recycled plastic industry while providing a sophisticated consumer base from around the globe. Also, China is seen under the heavy sustainability infrastructure development, which is expected to maintain its dominant position in the Asia Pacific region, according to the country’s recent movements.

North America is expected to capture a major share of the market during the forecast period, owing to increasing awareness of sustainability and eco-friendly products. Moreover, the individuals are increasingly demanding eco-friendly and sustainable product lines. The regional countries like the United States and Canada have seen under the usage of recycled fabric in the wide applications such as automotive, fashion, and others in recent years. Also, the regional manufacturers are heavily investing in R&D activities for the advanced recycling systems, which are anticipated to capture major industry share in the coming years.

Can America Become North America’s Sustainability Powerhouse?

The United States is expected to rise as a dominant country in the North America region in the coming years, owing to its strong consumer base, which prefers modern sustainability practices. Moreover, most brands are increasingly seen as using recycled fabric in their manufacturing processes. Also, technological advances are playing a major role in the United States' recycled polyester industry, as continued innovations and expansion of the recycled polyesters.

How will Europe be considered a Notable Region in the Recycled Polyester Market?

Europe is recognized as a notably growing region primarily due to stringent government regulations, heightened consumer environmental awareness, and strong corporate commitments to sustainability. The European Union has implemented ambitious policies, such as the EU Circular Economy Action Plan and the EU Strategy for Sustainable and Circular Textiles. Countries like Germany and the Netherlands have advanced waste management and recycling infrastructures that support the efficient collection and processing of post-consumer PET waste, ensuring a more stable supply of feedstock for the market.

Germany Recycled Polyester Market Trends

Germany is particularly notable for its sophisticated waste management systems and strong regulatory emphasis on sustainability and circularity. Additionally, recycled materials are extensively used in high-value applications, such as technical textiles for the automotive industry, home furnishings, and performance apparel, with major brands like Puma setting ambitious sustainability targets for incorporating recycled content.

How will Latin America surge in the Recycled Polyester Market?

Latin America is also experiencing significant growth in the global market, driven by increasing consumer awareness of sustainability, rising investments in local recycling capacity, and strong demand from the textile industry for eco-friendly products for both domestic use and export. The region boasts a robust and expanding textile and apparel industry, with major manufacturing hubs in Brazil and Mexico. This growth facilitates exports of sustainable textiles to environmentally conscious markets, making the region an attractive choice for manufacturers in price-sensitive sectors.

Brazil Recycled Polyester Market Trends

Brazil is an emerging market within Latin America, and the expanding textile and apparel sectors, along with increasing consumer awareness of eco-friendly products, are driving demand for sustainable fibers. Brazil presents opportunities for investment in advanced recycling facilities and the development of high-performance recycled polyester for various applications, including sportswear and industrial materials.

Recycled Polyester Market Share, By Region, 2025(%)

| By Region | Revenue Share, 2025 (%) |

| North America | 29.51% |

| Europe | 17.99% |

| Asia Pacific | 51.01% |

| Latin America | 4.44% |

| Middle East & Africa | 2.04% |

How will the Middle East and Africa contribute to the Recycled Polyester Market?

The Middle East and Africa is a key contributor to the global market, primarily due to rising environmental awareness, proactive government initiatives supporting recycling, and an expanding textile and apparel industry that demands sustainable materials. Governments in the region are implementing supportive regulations and incentives to promote the circular economy and effective waste management. Initiatives include waste management regulations, recycling mandates, and financial incentives for recycling businesses, which create a favorable environment for market growth.

The UAE Recycled Polyester Market Trends

The UAE is poised to become a major player in the region, driven by government visions for sustainability and a focus on industrial diversification. The UAE government has established proactive sustainability goals and initiatives, such as the Dubai Recycling Program and the Extended Producer Responsibility Policy for Packaging Waste. These efforts encourage waste reduction and the use of recycled materials, positioning the UAE as an emerging leader in the MEA region for sustainable polyester production and export.

Recent Developments

- In November 2024, Kvadrat introduced its latest recycled polyester textiles. Also, the company is worked with designer teruhiro Yanagihara for these developments ass per the report published by company recently. Also, these textiles are made from waste fabric as per the company's claim.(Source: dezeen.com)

- In May 2025, Teijin unveiled its latest recycled polyester, like natural fabrics. Also, this fabric is mainly made from post-consumer plastic waste, as per the report published by the company recently.(Source: texspacetoday.com)

Top Companies list

- Indorama Ventures

- Far Eastern New Century

- Unifi Inc.

- Reliance Industries Limited

- Sinopec Yizheng Chemical Fibre

- Alpek Polyester

- Zhejiang Jiaren New Materials Co., Ltd.

- Polyfibre Industries Pvt. Ltd.

- Bottloop

- Margasa Group

Segment Covered in the Report

By Product

- Cotton Spinning Material

- Filling Material

- Non-woven

- Other Products

By Application

- Apparel

- Home Textiles

- Automotive Interior

- Construction Material

- Healthcare & Hygiene

- Other Applications

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE