Content

What is the Current Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Size and Volume?

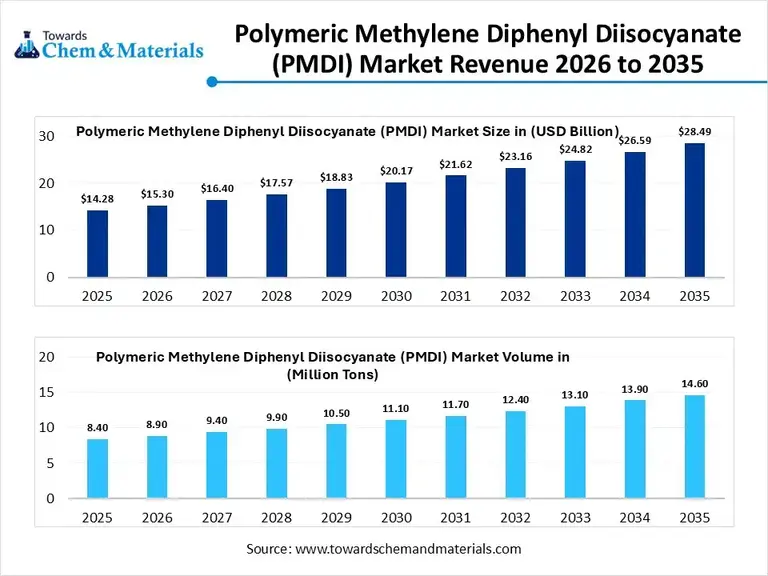

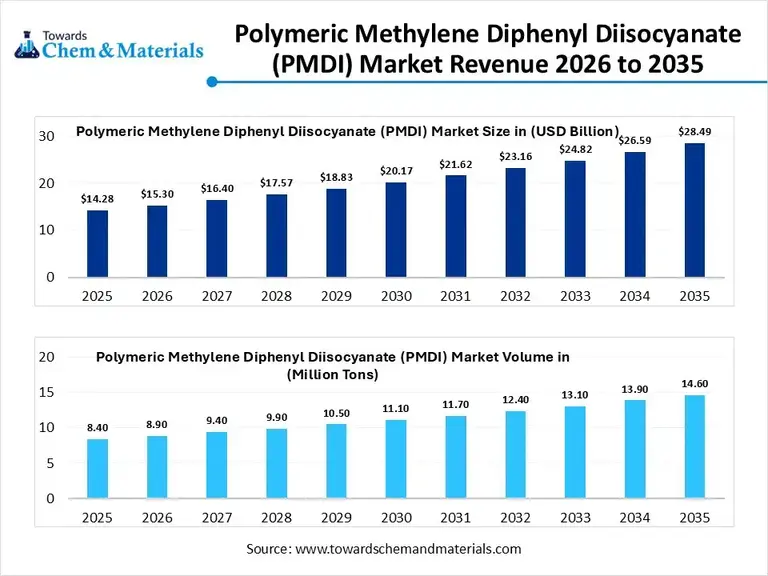

The global polymeric methylene diphenyl diisocyanate (PMDI) market size was estimated at USD 14.28 billion in 2025 and is expected to increase from USD 15.30 billion in 2026 to USD 28.49 billion by 2035, growing at a CAGR of 7.15% from 2026 to 2035. In terms of volume, the market is projected to grow from 8.4 million tons in 2025 to 14.6 million tons by 2035. growing at a CAGR of 5.70% from 2026 to 2035. Asia Pacific dominated the polymeric methylene diphenyl diisocyanate (PMDI) market with the largest volume share of 44% in 2025. The growth of the market is driven by the growing demand from various sectors and rapid urbanization.

Market Highlights

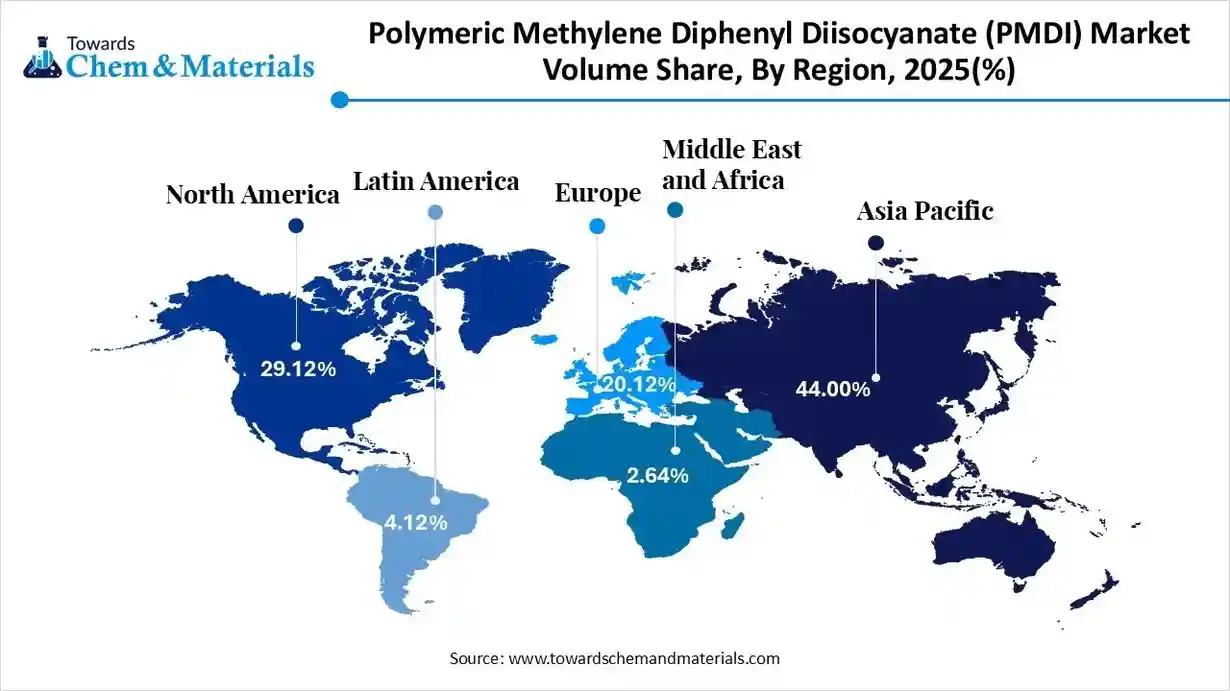

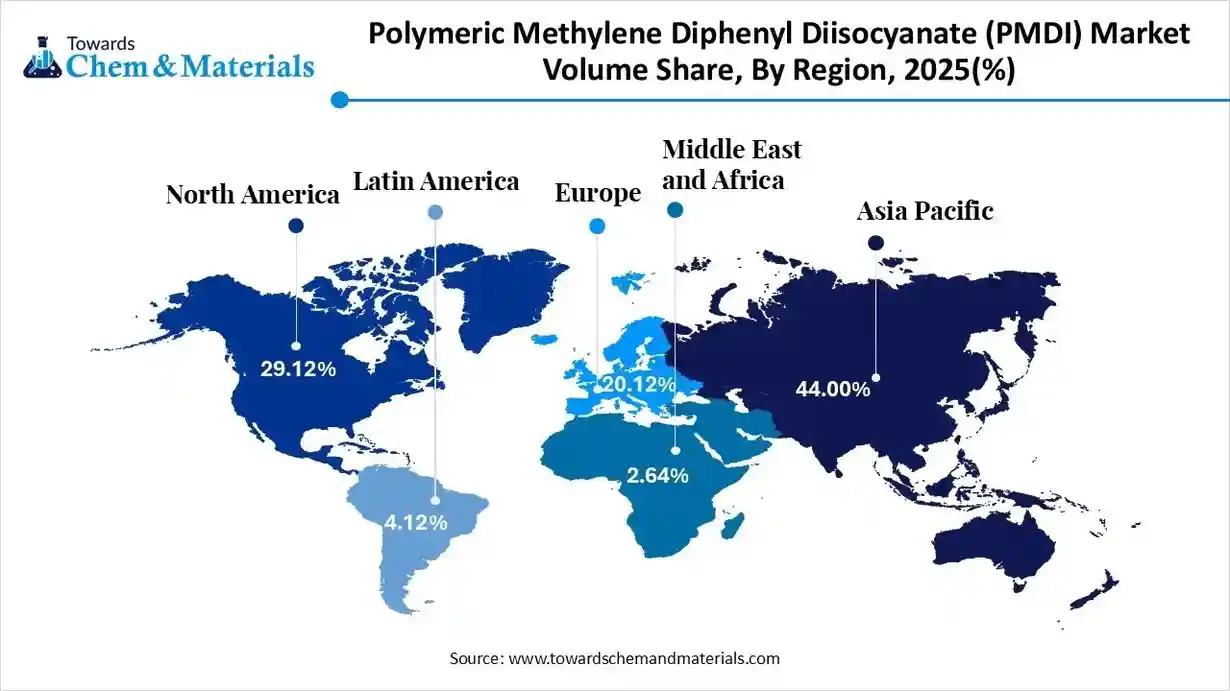

- The Asia Pacific dominated the global polymeric methylene diphenyl diisocyanate (PMDI) market with the largest volume share of 44% in 2025.

- The polymeric methylene diphenyl diisocyanate (PMDI) market in North America is expected to grow at a substantial CAGR of 6.48% from 2026 to 2035.

- The Europe polymeric methylene diphenyl diisocyanate (PMDI) market segment accounted for the major volume share of 20.12% in 2025.

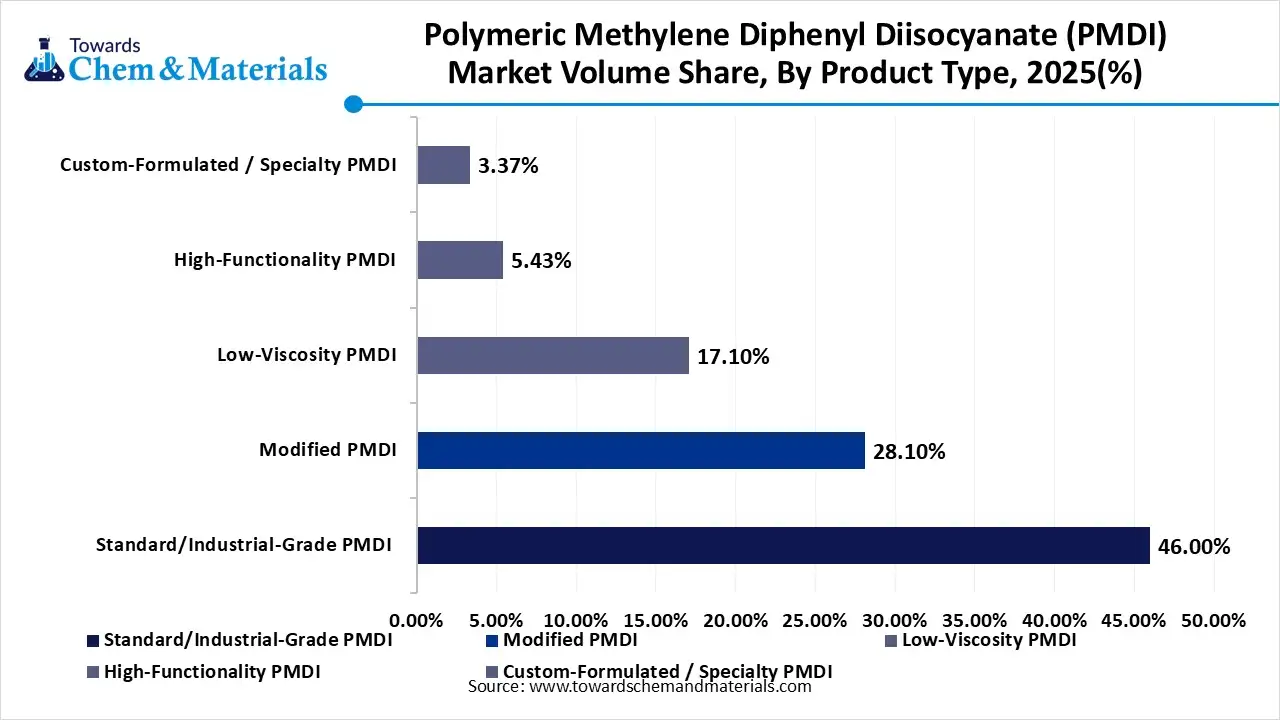

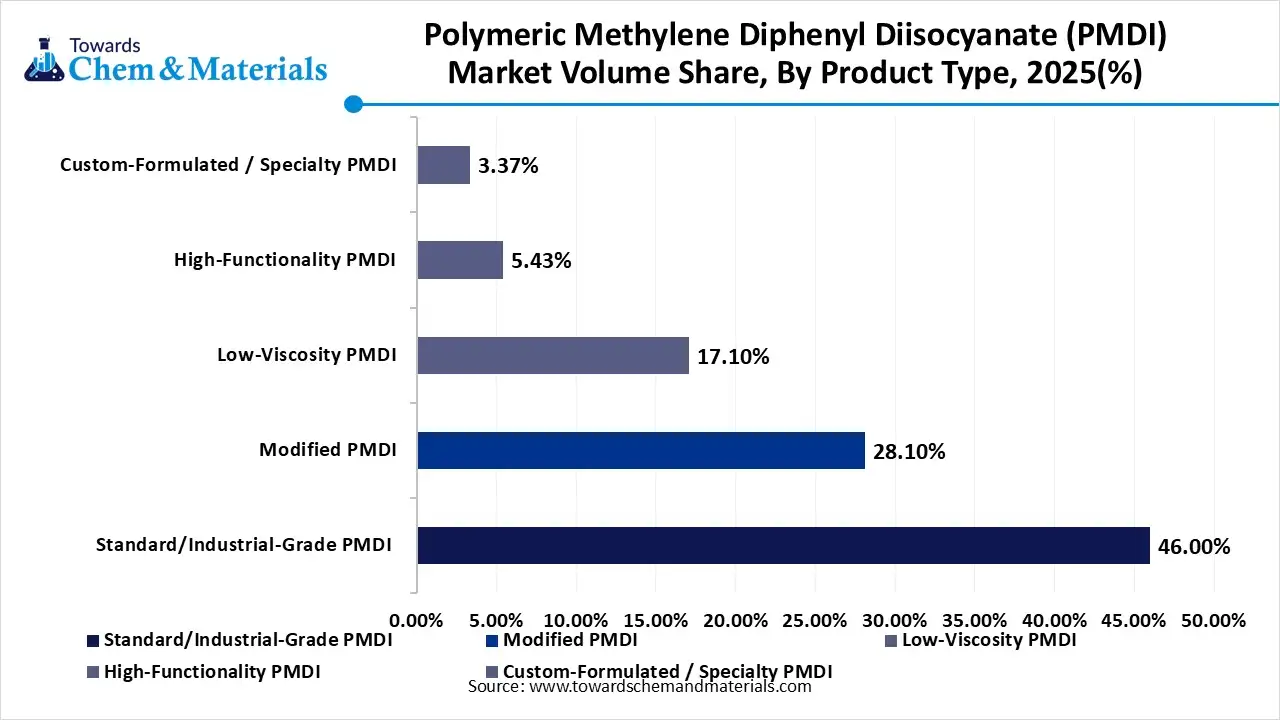

- By product type, the standard/industrial-grade PMDI segment dominated the market and accounted for the largest volume share of 46% in 2025.

- By product type, the modified PMDI segment is expected to grow at the fastest CAGR of 6.48% from 2026 to 2035 in terms of volume

- By application, the rigid polyurethane foam (insulation) segment dominated the market and accounted for the largest volume share of 48% in 2025..

- By end-use industry, the construction & building segment led the market with the largest revenue volume share of 52% in 2025.

- By form, the liquid PMDI segment led the market with the largest revenue volume share of 90% in 2025.

- By distribution channel, the direct sales to OEMs & large manufacturers segment dominated the market and accounted for the largest volume share of 60% in 2025.

Market Overview

What Is The Significance Of The Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market?

The polymeric methylene diphenyl diisocyanate (PMDI) market refers to the global industry focused on the production and use of PMDI, a key aromatic isocyanate primarily used in the manufacture of polyurethane (PU) foams, binders, coatings, adhesives, and elastomers. PMDI is widely valued for its high reactivity, excellent mechanical strength, thermal insulation properties, and durability.

Market growth is driven by energy-efficient building regulations, rising demand for insulation materials, lightweight automotive components, and rapid urbanization, particularly in emerging economies.

Market Trends

- Construction Sector: Rising demand for MDI-based rigid foams for thermal insulation in buildings, driven by energy efficiency regulations and new construction.

- Automotive Industry: Adoption of lightweight MDI-based materials for fuel efficiency and performance, especially in rigid foam applications.

- Emerging Economies: Rapid growth in China, India, and the Middle East due to infrastructure and industrial development.

- Sustainability Focus: Increasing demand for MDI in sustainable building and automotive solutions.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 15.30 Billion / 8.9 Million Tons |

| Revenue Forecast in 2035 | USD 29.9 Billion / 14.6 Million Tons |

| Growth Rate | CAGR 7.15% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Application, By End-Use Industry, By Product Type, By Form, By Distribution Channel, By Regions |

| Key companies profiled | Wanhua Chemical Group Co., Ltd. (China), BASF SE (Germany), Covestro AG (Germany), Dow Inc. (USA), Huntsman Corporation (USA), Tosoh Corporation Mitsui Chemicals, Inc. Kumho Mitsui Chemicals LANXESS AG Chevron Phillips Chemical GNFC (Gujarat Narmada Valley Fertilizers & Chemicals) Sadara Chemical Company Yantai Juli Fine Chemical Co., Ltd. Shandong Yisheng Chemical Co., Ltd. Anhui Huayi Chemical Co., Ltd. Anderson Development Company Tokyo Chemical Industry Co., Ltd. (TCI) Alberdingk Boley GmbH Cangzhou Dahua Group PU SYSTEMS / System Houses (Regional PMDI Integrators) |

Key Technological Shifts In The Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market:

Key technological shifts in the market center on sustainability (bio-based MDI, low-GWP products), process digitalization (AI, IoT for efficiency), and high-performance formulations, driven by strict regulations, rising demand for energy-efficient PU materials in construction, automotive (EVs), and packaging, and new applications like wind turbine blades, all pushing for greener, smarter production and advanced end-products.

Market Trade Analysis

- Based on India Export data, India shipped 19 shipments of Diphenylmethane Diisocyanate between April 2024 and March 2025 (TTM). 6 Indian exporters supplied these shipments to 7 buyers.

- The majority of India's Diphenylmethane Diisocyanate exports go to China, Sri Lanka, and Vietnam.

- Globally, the leading exporters are China, Vietnam, and Saudi Arabia, with China at the top with 1,467 shipments, followed by Vietnam with 763 shipments, and Saudi Arabia with 361 shipments.

- According to Global Export data, the world exported 603 shipments of MDI Diphenyl from June 2024 to May 2025 (TTM). 110 exporters supplied these shipments to 108 buyers, showing an 8% increase over the previous year.

- The primary destinations for MDI Diphenyl exports from the world are destined to Russia, India, and the United States.

- Globally, the top exporters are China, the Netherlands, and South Korea, with China leading at 458 shipments, the Netherlands with 317 shipments , and South Korea with 211 shipments.

Market Value Chain Analysis

- Chemical Synthesis and Processing: Polymeric MDI is produced through processes such as aniline and formaldehyde condensation to form MDA, phosgenation to produce MDI, polymerization control, distillation, and formulation to achieve the required isomer composition for polyurethane applications.

- Key players: BASF SE, Covestro AG, Wanhua Chemical Group, Huntsman Corporation.

- Quality Testing and Certification: Polymeric MDI requires certifications ensuring chemical purity, reactivity control, occupational safety, and environmental compliance. Key certifications include ISO 9001 quality standards, REACH compliance, OSHA workplace safety standards, and material safety data validation.

- Key players: ISO (International Organization for Standardization), ECHA (REACH), UL Solutions, TÜV SÜD.

- Distribution to Industrial Users: Polymeric MDI is supplied to rigid and flexible polyurethane foam manufacturers, construction insulation producers, automotive component suppliers, appliance manufacturers, and industrial coatings and adhesives formulators.

- Key players: BASF SE, Covestro AG, Huntsman Corporation

Polymeric Methylene Diphenyl Diisocyanate (PMDI) Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) Clean Air Act (CAA) – NESHAP & MACT Clean Water Act (CWA) |

Pre-manufacture notices & inventory status Air emissions from isocyanate processing (air toxics, VOCs) Wastewater discharge compliance |

pMDI and its precursors must be TSCA-compliant; EPA’s air toxics and VOC rules affect manufacturing/handling emissions. |

| Occupational Safety and Health Administration (OSHA) | OSHA 29 CFR 1910 – Hazard Communication (HCS) OSHA Respiratory Protection & PSM standards |

Worker exposure limits (isocyanate sensitizer) Hazard communication & PPE requirements |

OSHA considers isocyanates, including pMDI, as potent sensitizers; strict PPE, training, and monitoring are required. | |

| Department of Transportation (DOT) | Hazardous Materials Regulations (49 CFR Parts 171–180) | Transport classification, packaging, labeling | pMDI is classified as a hazardous material for transport; proper placarding and documentation are required. | |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) |

Registration of pMDI and intermediates Hazard classification & labeling (skin/respiratory sensitizer) |

Under REACH, pMDI must be registered, with Substance Information & Safety Data including respiratory sensitization hazards. CLP ensures harmonized hazard communication. |

| European Environment Agency + National Agencies | Industrial Emissions Directive (IED) EU VOC Solvents Emissions Directive |

Emission limits from manufacturing sites Solvent & VOC management |

Emissions of isocyanate vapors and VOCs from foam/adhesive production must meet strict limits under EU air quality regulations. | |

| China | Ministry of Ecology and Environment (MEE) | MEE Order No. 12 (New Chemical Substance Registration) Air and Water Pollution Prevention & Control Laws |

New chemical registration Environmental risk control |

pMDI and related chemicals require MEE registration for manufacture/import; environmental monitoring & permits are enforced. |

| Japan | Ministry of Economy, Trade and Industry (METI) Ministry of the Environment (MOE) |

Chemical Substances Control Law (CSCL) PRTR Law |

Pre-market notification Pollutant reporting |

Japan requires CSCL compliance for new chemicals like pMDI; PRTR mandates annual reporting if thresholds are exceeded. |

| South Korea | Ministry of Environment (MoE) | K-REACH Chemical Control Act |

Chemical registration & evaluation Hazard communication |

K-REACH closely mirrors REACH; pMDI and related substances must be registered and hazards communicated properly. |

Segmental Insights

Product Type Insights

How Did the Standard/Industrial-Grade PMDI Segment Dominate The Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market In 2025?

The standard/industrial-grade PMDI segment volume was valued at 3.9 million tons in 2025 and is projected to reach 6.7 million tons by 2035, expanding at a CAGR of 6.32% during the forecast period from 2025 to 2035. The standard/industrial-grade PMDI segment dominated the market with a share of approximately 46% in 2025. Standard or industrial-grade PMDI is widely used in high-volume applications such as rigid foams and general insulation products. This segment benefits from cost efficiency, reliable performance characteristics, and established processing compatibility with large-scale manufacturing systems. Demand remains strong in mass construction, appliance manufacturing, and industrial insulation, particularly in emerging economies where volume-driven consumption dominates market growth.

The Modified PMDI segment volume was valued at 2.4 million tons in 2025 and is expected to surpass around 4.2 million tons by 2035, and it is anticipated to expand to 6.48% of CAGR during 2026 to 2035., Custom-formulated or specialty PMDI products are designed to meet specific performance requirements such as faster curing, improved fire resistance, or enhanced flexibility. The segment is driven by innovation, regulatory compliance, and customer demand for tailored solutions, making it a key growth area despite comparatively higher costs.

Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Standard/Industrial-Grade PMDI | 46.00% | 3.9 | 6.7 | 6.32% | 45.87% |

| Modified PMDI | 28.10% | 2.4 | 4.2 | 6.48% | 28.41% |

| Low-Viscosity PMDI | 17.10% | 1.4 | 2.4 | 5.67% | 16.13% |

| High-Functionality PMDI | 5.43% | 0.5 | 0.8 | 6.72% | 5.60% |

| Custom-Formulated / Specialty PMDI | 3.37% | 0.3 | 0.6 | 8.37% | 3.99% |

Application Insights

How Did The Rigid Polyurethane Foam Segment Dominate The Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market In 2025?

The rigid polyurethane foam (insulation) segment dominated the market with a share of approximately 48% in 2025. Rigid polyurethane foam represents the largest application segment for PMDI, driven by its extensive use in thermal insulation for buildings, cold storage, refrigeration, and appliances. Growing green building initiatives, stricter energy codes, and increasing demand for insulated panels and appliances continue to support the steady growth of PMDI consumption in this application.

The agriculture segment is projected to grow at a of CAGR during 2026 to 2035. Specialty and high-performance PMDI applications include elastomers, coatings, adhesives and sealants, and advanced composite materials. Growth in industrial manufacturing, transportation equipment, and specialty construction materials is driving demand for customized PMDI solutions, particularly in sectors emphasizing performance, longevity, and compliance with advanced material standards.

End-Use Industry Insights

Which End Use Industry Segment Dominates The Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market In 2025?

The construction & building segment dominated the market with a share of approximately 52% in 2025. The construction and building industry is the dominant end-use segment for PMDI, largely due to its widespread application in insulation materials, structural panels, and sandwich panels. The push for sustainable construction practices and reduced carbon footprints further strengthens the role of PMDI-based insulation solutions in both residential and commercial construction projects.

The industrial and infrastructure segment is projected to grow at a CAGR between 2026 and 2035. In industrial and infrastructure applications, PMDI is used in insulation systems, protective coatings, and engineered materials for factories, pipelines, warehouses, and transportation infrastructure. PMDI’s resistance to moisture, chemicals, and mechanical stress makes it well-suited for harsh industrial environments and long-life infrastructure assets.

Form Insights

Which Form Segment Dominates the Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market In 2025?

The liquid PMDI segment dominated the market with a share of approximately 90% in 2025. Liquid PMDI dominates the market due to its ease of handling, consistent reactivity, and compatibility with automated production systems. The liquid form supports high-speed manufacturing, reduced material waste, and improved quality control, making it the preferred choice for large-scale industrial and construction applications.

The solid / semi-solid PMDI segment is projected to grow at a CAGR between 2026 and 2035. Solid or semi-solid PMDI is used in niche applications where controlled reactivity, extended shelf life, or specific processing conditions are required. Demand is influenced by application-specific needs, storage considerations, and transport stability, particularly in regions with challenging logistics or temperature conditions.

Distribution Channel Insights

How Did Direct Sales To OEMs And Large Manufacturers Segment Dominate The Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market In 2025?

The direct sales to OEMs & large manufacturers segment dominated the market with a share of approximately 60% in 2025. Direct sales to OEMs and large manufacturers account for a significant share of PMDI distribution, as bulk buyers prefer long-term supply contracts, technical support, and pricing stability. It is especially dominant in construction materials, appliance manufacturing, and large industrial insulation producers.

The specialty chemical suppliers segment is projected to grow at a CAGR between 2026 and 2035. Specialty chemical suppliers and distributors play a critical role in serving small and mid-scale customers, specialty formulators, and regional markets. Growth is supported by increasing demand for customized PMDI solutions, fragmented industrial demand, and the expansion of specialty chemical distribution networks globally.

Regional Insights

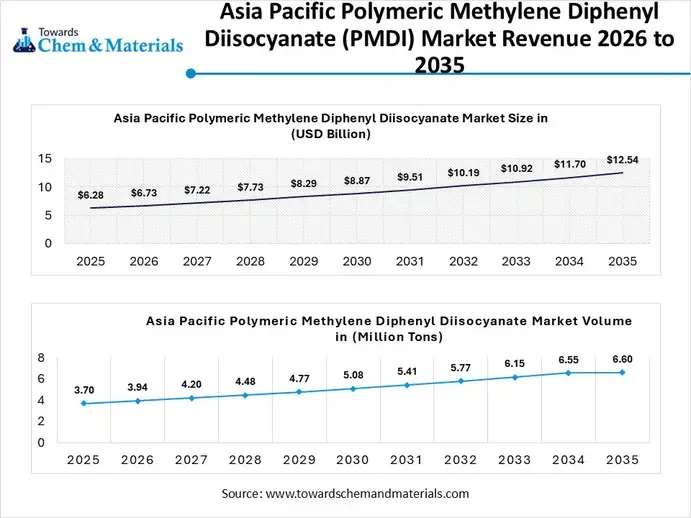

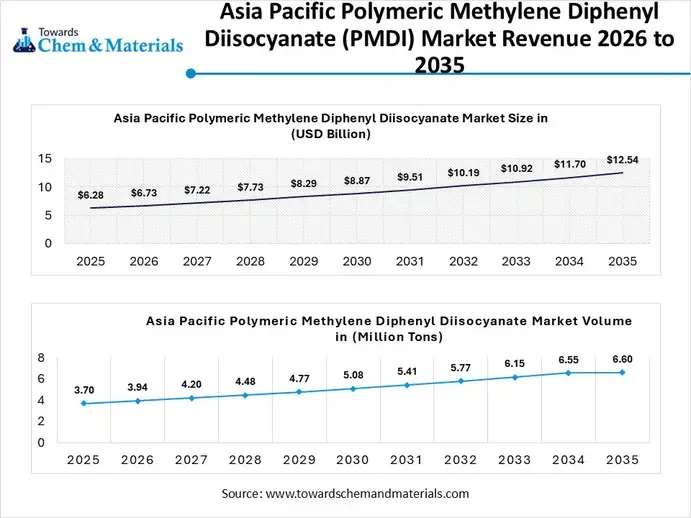

The Asia Pacific polymeric methylene diphenyl diisocyanate (PMDI) market size was valued at USD 6.28 billion in 2025 and is expected to be worth around USD 12.54 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.17% over the forecast period from 2026 to 2035.

The Asia Pacific polymeric methylene diphenyl diisocyanate (PMDI) market volume was estimated at 3.7 million tons in 2025 and is projected to reach 6.6 million tons by 2035, growing at a CAGR of 6.58% from 2026 to 2035.Asia Pacific dominated the market with a share of approximately 44% in 2025. Asia Pacific represents the largest and fastest-growing market for polymeric MDI, driven by rapid industrialization, urban infrastructure development, and expanding insulation demand. Strong growth in construction, appliances, automotive manufacturing, and cold-chain logistics fuels PMDI consumption. Government energy-efficiency mandates and rising polyurethane foam usage further reinforce long-term regional demand.

China: Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Growth Trends

China dominates the Asia Pacific polymeric methylene diphenyl diisocyanate (PMDI) market due to its massive construction sector, large-scale appliance manufacturing base, and leadership in polyurethane foam production. Domestic chemical manufacturers benefit from integrated supply chains and economies of scale. Continued investments in green buildings, electric vehicles, and insulation materials sustain strong PMDI demand growth.

North America Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Driven By Growing Demand

The North America Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market volume was estimated at 2.4 million tons in 2025 and is projected to reach 4.3 million tons by 2035, growing at a CAGR of 6.48% from 2026 to 2035. North America dominated the magnesium powder market with approximately 29.12% share in 2025, North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. North America shows steady market growth supported by demand for rigid polyurethane foams. Stringent energy-efficiency standards and refurbishment of aging infrastructure promote insulation material adoption. Advanced manufacturing capabilities and innovation in sustainable polyurethane formulations strengthen regional market stability.

United States: Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Growth Trends

The U.S. market benefits from high construction spending, strong HVAC demand, and widespread adoption of energy-efficient insulation solutions. Automotive lightweighting trends and the increasing use of structural foams further support consumption. Regulatory emphasis on building performance and cold-chain expansion positively influences long-term PMDI demand across industries.

Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 29.12% | 2.4 | 4.3 | 6.48% | 29.44% |

| Europe | 20.12% | 1.7 | 2.8 | 5.74% | 19.10% |

| Asia Pacific | 44.00% | 3.7 | 6.6 | 6.58% | 44.87% |

| Latin America | 4.12% | 0.3 | 0.6 | 6.52% | 4.18% |

| Middle East & Africa | 2.64% | 0.2 | 0.4 | 5.28% | 2.41% |

Europe's growth in the market is driven by the strict environmental regulations.

The Europe polymeric methylene diphenyl diisocyanate (PMDI) market volume was estimated at 1.7 million tons in 2025 and is projected to reach 2.8 million tons by 2035, growing at a CAGR of 5.74% from 2026 to 2035. Europe’s market is driven by strict environmental regulations, strong thermal insulation standards, and demand for sustainable building materials. The region emphasizes energy-efficient construction, electric vehicle adoption, and advanced industrial applications. Growth is supported by innovation in low-emission polyurethane systems and increased recycling initiatives across the chemical sector.

Germany: Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Growth Trends

Germany leads the European market due to its strong automotive industry, advanced construction standards, and focus on energy-efficient buildings. High adoption of polyurethane insulation in residential and industrial projects drives demand. Domestic chemical manufacturers invest heavily in sustainable PMDI production technologies and specialty polyurethane applications.

Latin America Market Growth Is Driven By The Rising Urbanization

The Latin America’s market is expanding gradually, supported by infrastructure development, housing construction, and appliance manufacturing growth. Rising urbanization and demand for affordable insulation materials contribute to market expansion. However, growth remains moderated by economic volatility and limited domestic production capacities in several countries.

Brazil: Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Growth Trends

Brazil is the primary PMDI consumer in South America, driven by residential construction, refrigeration equipment manufacturing, and furniture production. Growing investments in energy-efficient buildings and cold-storage infrastructure support market growth. Imports remain significant, while the gradual expansion of domestic polyurethane processing capabilities strengthens the demand outlook.

Middle East & Africa : Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Growth Trends

The Middle East & Africa polymeric methylene diphenyl diisocyanate (PMDI) market volume was estimated at 0.2 million tons in 2025 and is projected to reach 0.4 million tons by 2035, growing at a CAGR of 5.28% from 2026 to 2035. The Middle East & Africa market is driven by large-scale construction projects, industrial insulation demand, and expanding cold-chain infrastructure. Harsh climatic conditions increase the need for thermal insulation materials. Government-led infrastructure investments and urban development initiatives create long-term growth opportunities for PMDI consumption.

GCC Countries: Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market Growth Trends

GCC countries represent the core PMDI demand centers in the region, supported by megaproject construction, commercial real estate expansion, and district cooling systems. Strong focus on energy-efficient buildings and industrial insulation drives polyurethane foam usage. Dependence on imports remains high, though downstream polyurethane processing continues to expand.

Recent Developments

- In December 2025, Mitsui Chemicals plans to expand the methylene diphenyl diisocyanate (MDI) production capacity of its affiliate, Kumho Mitsui Chemicals (KMC), at its facility in Yeosu, South Korea.(Source: www.indianchemicalnews.com)

Top players in the Polymeric Methylene Diphenyl Diisocyanate (PMDI) Market & Their Offerings:

Wanhua Chemical Group Co., Ltd. (China): Wanhua is one of the largest manufacturers of MDI globally, offering high-purity polymeric MDI used in rigid and flexible polyurethane foams, coatings, and elastomers. The company’s extensive production capacity, integrated facilities, and investments in sustainable feedstock and low-emission manufacturing enhance its position in construction and automotive applications.

- BASF SE (Germany): BASF supplies polymeric MDI and related isocyanate products with tailored formulations for insulation, adhesives, and sealants used in construction, automotive, and industrial applications. The company emphasizes R&D to deliver performance-enhanced polyurethanes and energy-efficient solutions tied to sustainability initiatives.

- Covestro AG (Germany): Covestro offers advanced polymeric MDI systems engineered for high-performance rigid foams, structural composites, and specialty coatings. The company is noted for its investment in sustainable chemistries and production capacity expansion to meet growing market demand.

- Dow Inc. (USA): Dow produces polymeric MDI used in a wide range of polyurethane applications, including insulation, automotive components, and packaging materials. Its market strategy focuses on sustainable product solutions and customer-centric innovations backed by global production and distribution networks.

- Huntsman Corporation (USA): Huntsman supplies high-quality polymeric MDI for rigid foams, elastomers, and specialty polyurethane products. The company leverages strong chemical manufacturing expertise and global reach to address evolving performance and sustainability requirements in the construction and industrial markets.

- Tosoh Corporation

- Mitsui Chemicals, Inc.

- Kumho Mitsui Chemicals

- LANXESS AG

- Chevron Phillips Chemical

- GNFC (Gujarat Narmada Valley Fertilizers & Chemicals)

- Sadara Chemical Company

- Yantai Juli Fine Chemical Co., Ltd.

- Shandong Yisheng Chemical Co., Ltd.

- Anhui Huayi Chemical Co., Ltd.

- Anderson Development Company

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Alberdingk Boley GmbH

- Cangzhou Dahua Group

- PU SYSTEMS / System Houses (Regional PMDI Integrators)

Segments Covered

By Application

- Rigid Polyurethane Foam (Insulation)

- Flexible Polyurethane Foam

- Binders for Wood Panels (OSB, MDF, Particleboard)

- Coatings, Adhesives, Sealants & Elastomers (CASE)

- Specialty & High-Performance Applications

By End-Use Industry

- Construction & Building

- Furniture & Bedding

- Automotive & Transportation

- Electrical Appliances (Refrigeration, HVAC)

- Industrial & Infrastructure

By Product Type

- Standard/Industrial-Grade PMDI

- Modified PMDI

- Low-Viscosity PMDI

- High-Functionality PMDI

- Custom-Formulated / Specialty PMDI

Form

- Liquid PMDI

- Solid / Semi-Solid PMDI

By Distribution Channel

- Direct Sales to OEMs & Large Manufacturers

- Chemical Distributors

- Regional Traders

- Specialty Chemical Suppliers

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa