Content

Biopolymers Market Size and Share 2034

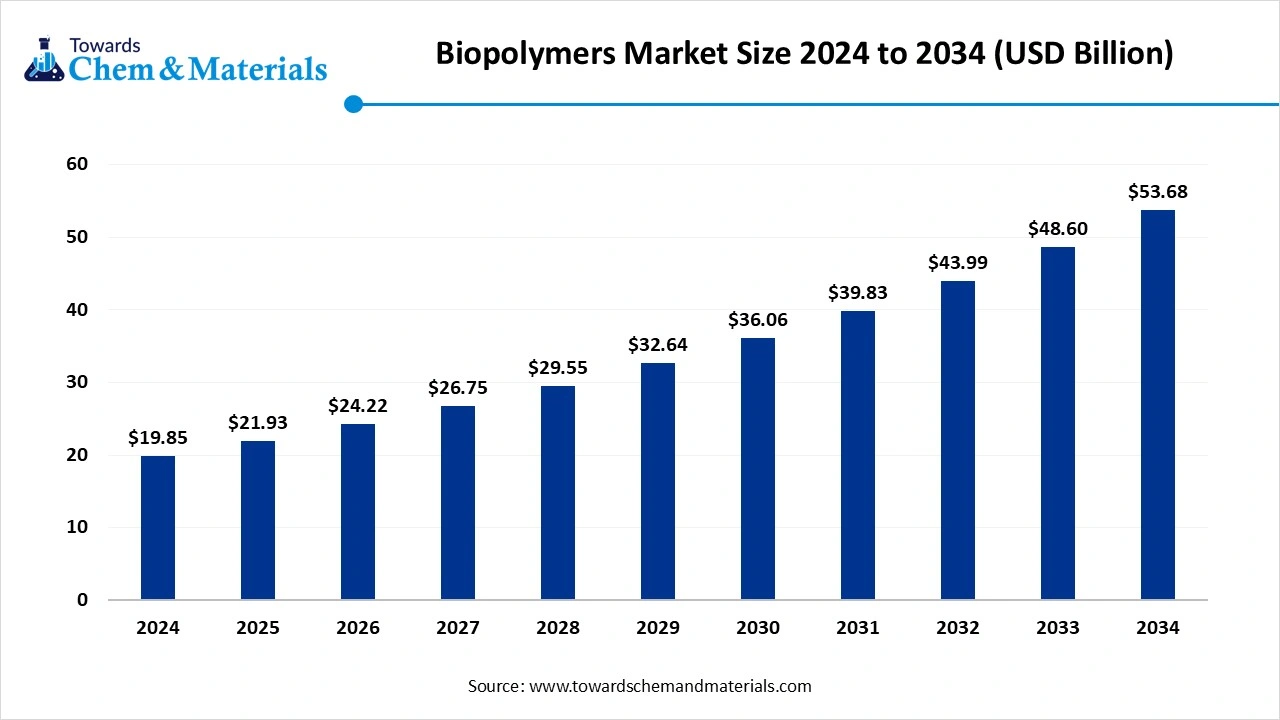

The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034. The sudden shift towards sustainable manufacturing practices is expected to attract increased capital and investment in manufacturing.

Key Takeaways

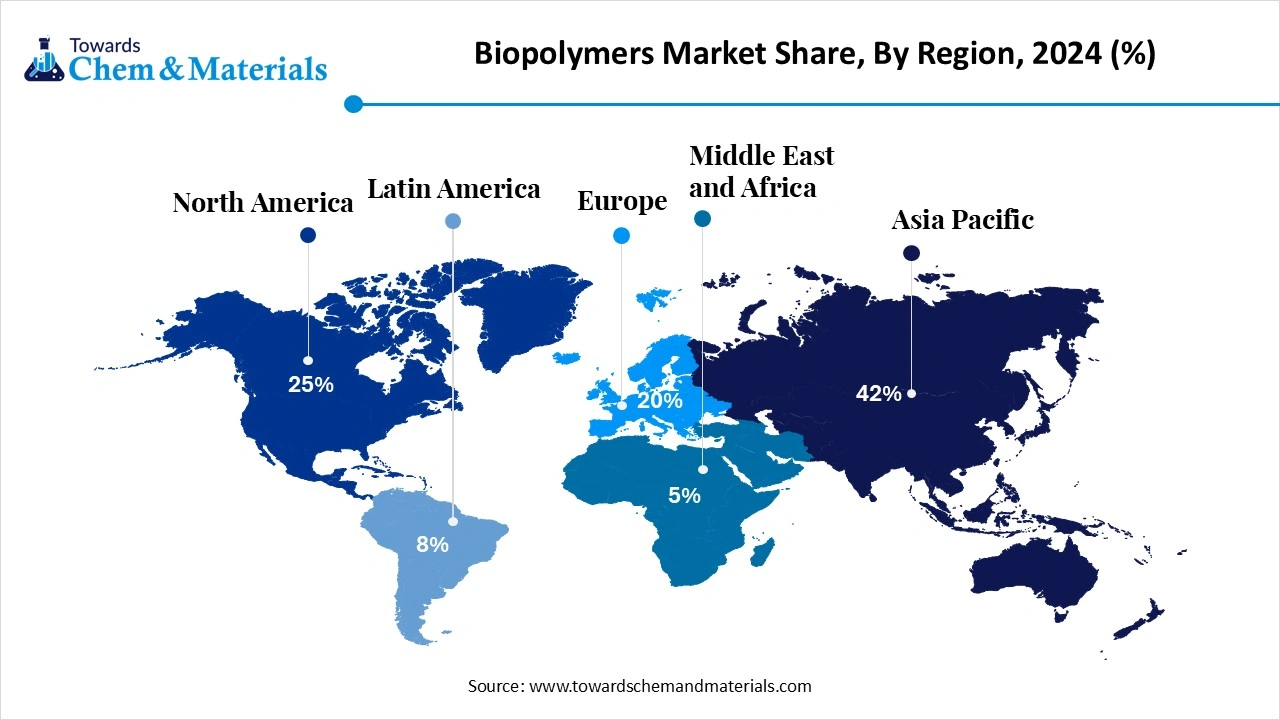

- By region, Asia Pacific dominated the biopolymers market with 42% industry share in 2024.

- By region, Europe is expected to grow at a notable rate in the future.

- By polymer type, the PLA segment led the market with 38% industry share in 2024.

- By polymer type, the polyhydroxylkanoates chemicals segment is expected to grow at the fastest rate in the market during the forecast period.

- By feedstock source, the starch crops segment emerged as the top-performing segment in the market with 45% industry share in 2024.

- By feedstock source, the algae/seaweed segment is expected to lead the market in the coming years.

- By product form, the films and sheets segment led the market with a 40% share in 2024.

- By product form, the fiber and yarns segment is expected to capture the biggest portion of the market in the coming years.

- By processing technology, the extrusion segment emerged as the top-performing segment in the market with 50% industry share in 2024.

- By processing technology, the additive manufacturing segment is expected to lead the market in the coming years.

- By end-use industry, the packaging segment led the biopolymers market with a 45% share in 2024.

- By end-use industry, the medical and healthcare segment is expected to capture the biggest portion of the market in the coming years.

What are the Biopolymers and Their Current Market Conditions?

The polymers which derived from renewable biological feedstocks or produced via microbial/enzymatic processes, with biodegradable or bio-based properties, are applied across packaging, textiles, medical, automotive, agriculture, and other industries. The biopolymers industry has experienced a rapid growth rate in recent years as the global shift towards sustainability.

Biopolymers Market Outlook:

- Industry Growth Overview: Between 2025 and 2030, the industry is anticipated to experience greater growth while innovative production routes are discovered. Also, these productions can minimize the overall product cost and push the availability of the wide feedstocks.

- Sustainability Trends: The biopolymer manufacturers can gain major industry attention akin to a sudden shift towards eco-friendly manufacturing practices. Also, the major consumers like fast-moving goods and industrial buyers are seen in switching from petroplastic to biobased nowadays.

- Global Expansion: the regions such as North America and Europe are shifting focus towards the waste streams, local agriculture, and policy alignment. Moreover, the Asia Pacific is under a heavy technology transition, which is leading the industry growth in the coming years by establishing major plastic recycling plants as per the expectations.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 21.93 Billion |

| Expected Size by 2034 | USD 53.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.46% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Polymer Type (Chemical family), By Feedstock Source, By Product Form, By Processing Technology, By End-Use Industry, By Region |

| Key Companies Profiled | Braskem, DuPont de Nemours , Mitsubishi Chemical Corporation , Kaneka Corporation , PTT MCC Biochem , FKuR Kunststoff GmbH , Biome Bioplastics , Futamura Group , Toray Industries , Arkema , Green Dot Bioplastics , Zhejiang Hisun Biomaterials , CJ CheilJedang , eSUN (Shenzhen eSUN) , Avient Corporation |

Key Technological Shifts in the Biopolymers Market:

The biopolymers market is increasingly seen under heavy technology adoption, where artificial intelligence is likely to play a crucial role in the coming years. Moreover, the industry is shifting towards AI-driven molecular designs, and the motive behind the shift is to predict future polymer performance.

The manufacturers are preferring technology-driven processes instead of the error-prone and trail lab work. Furthermore, several new market entrants and biopolymers startups are observed in between training for algorithms and different microbial pathways for the production of biobased polymers.

Trade Analysis of the Biopolymers Market: Import & Export Statistics

- China is known for its exports across the globe. China has exported the commodity polymer with a volume of 9.9 million tons in 2024.(Source: blog.itpweb.com)

- Germany has seen under heavy polymer profile exports, with the 3,740 shipments in 2023 to 2024. Also, the country exported to Mexico, Chile, and Russia.(Source: www.volza.com)

- The United States is the largest and prominent country for the biopolymer export. Also, the United States exported the biopolymers with 6,296 shipments between 2023 to 2024.(Source: www.volza.com)

- India is a major exporter of the virgin biopolymer in the current period. Also, the country has seen exports of polymer with 15 shipments from 2023 to 2024.(Source : www.volza.com )

Biopolymers Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. FDA and EPA | Title 21 of the Code of Federal Regulations and Toxic Substances Control Act (TSCA) |

- food safety and impact on pesticides | These agencies are closely watching the manufacturers' activity within the major sectors. |

| European Union | European Medicines Agency and European Food Safety Authority | Regulations (EU) 2023/ 2055 Microplastic Restriction | Food and food pacakaging and biopharmaceuticals | The European Union has sectoral safety standards, like EM has its own standards, and EFSA has its own |

| China | Inventory of Existing Chemical Substances in China (IECSC). | MEE Order No. 12 | Observe and regulate the latest chemical substances | This regulatory body has seen under the heavy implementation and safety standards in China while observing the environmental impact of chemical substances. |

| India | Genetic Engineering Appraisal Committee (GEAC) and Food Safety and Standards Authority of India (FSSAI) | Not having primary regulation and depending upon these regulatory bodies | Major approval of the genetically engineered organism | India is seeking the primary regulation that can lead to safety standards and compliance. |

Segmental Insights

Polymer Type Insights

How did the PLA Segment Dominate the Biopolymers Market in 2024?

The PLA segment held a 38% share of the market in 2024, due to its unique advantage, as it can easily scale using traditional methods like industrial fermentation and extrusion infrastructure. Moreover, by offering cost advantages and stronger supply chain support has provided a sophisticated consumer base to the segment in recent years. Also, the demand from the major sectors, such as packaging and 3D printing, is driving the segment potential.

The polyhydroxyalkanoates segment is expected to grow at a notable rate during the predicted timeframe, owing to its greater biodegradability. Also, the global shift towards sustainability can create lucrative opportunities for the segment during the forecast period. Also, it can fit these latest industrial standards, which are likely to gain major industry attention in the coming years.

Feedstocks Source Insights

Why does the Starch Crops Segment Dominate the Biopolymers Market by Feedstock Source?

The starch crops segment held 45% of the biopolymers market in 2024 because they provide a stable, low-cost, and abundant supply chain. Com, potatoes, and cassava have established farming and logistics networks, making them reliable raw materials for large-scale biopolymer production.

The algae/seaweed segment is expected to grow at a notable rate during the forecast period, because they do not compete with food crops and grow rapidly in oceans, requiring no arable land or freshwater. This answers sustainability concerns linked to starch-based feedstocks. Algae-based biopolymers are rich in carbohydrates and lipids, making them suitable for packaging, coatings, and even textiles.

Product Form Insights

How did the Films and Sheets Segment Dominate the Biopolymers Market in 2024?

The films and sheets segment dominated the market with a 40% share in 2024, because packaging is the largest application area for biopolymers, and these formats are directly compatible with existing machinery. PLA and starch-based biopolymers easily form transparent films for food wraps, shopping bags, and agricultural mulch films

The fibers and yarns processes segment is expected to grow at a significant rate during the forecast period, because the textile and fashion industry is under huge pressure to reduce its plastic footprint. Synthetic fibers like polyester are major polluters, so biopolymer-based yarns offer an eco-alternative. Advances in PLA and PHA spinning technologies now allow the production of durable and soft biopolymer-based textiles.

Processing Technology Insights

Could Extrusion Be the Game-Changer in Biopolymer Manufacturing?

The extrusion segment dominated the market with a 50% share in 2024 because it is the most cost-effective and widely available method. Biopolymer granules like PLA and starch blends can be processed using the same extrusion equipment as traditional plastics, minimizing the need for new investments.

The additive manufacturing segment is expected to grow at a significant rate during the forecast period, because biopolymers like PLA and PHA are ideal for customized, small-batch production. With 3D printing adoption rising in healthcare, aerospace, and prototyping, demand for sustainable filaments is surging. Biopolymer filaments not only reduce environmental impact but also offer specialized properties, such as controlled biodegradation in medical implants.

End Use Industry Insights

Is Our Packaging Sector Getting Consumer Attention?

The packaging segment dominated the market with a 45% share in 2024 because it faces direct regulatory pressure against single-use plastics. PLA, starch blends, and PHA-based packaging solutions align perfectly with bans on non-biodegradable bags, food containers, and wraps. Packaging is also the most visible consumer-facing sector, where eco-friendly labels strongly influence buying behavior.

The medical and healthcare segment is expected to grow at a significant rate during the forecast period, because it faces direct regulatory pressure against single-use plastics. PLA, starch blends, and PHA-based packaging solutions align perfectly with bans on non-biodegradable bags, food containers, and wraps. Packaging is also the most visible consumer-facing sector, where eco-friendly labels strongly influence buying behavior.

Regional Insights

Biopolymers Market Size, Industry Report 2034

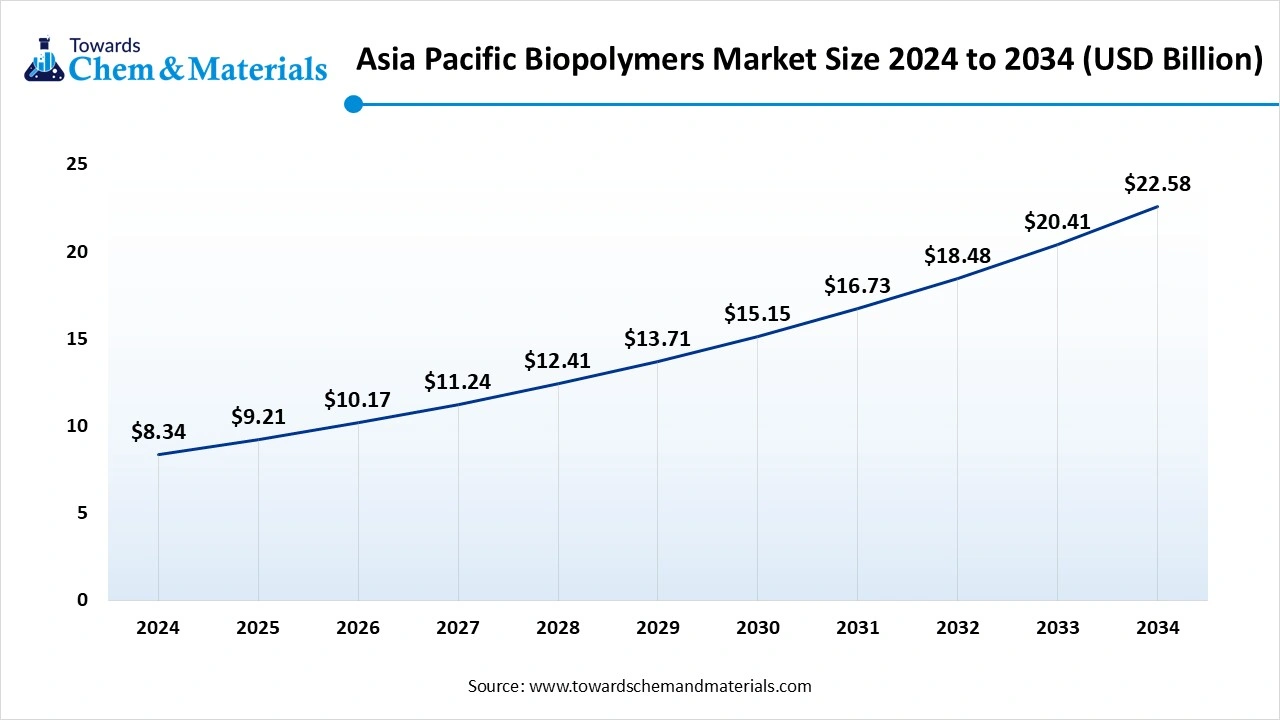

The Asia Pacific biopolymers market size was estimated at USD 8.34 billion in 2024 and is projected to reach USD 22.58 billion by 2034, growing at a CAGR of 10.47% from 2025 to 2034. Asia Pacific dominated the biopolymers market with 42% share in 2024,

owing to the availability of a huge feedstock due to the enlarged agricultural area. Furthermore, factors like low-cost manufacturing and domestic consumption are actively supporting capital growth and economic activity in the region nowadays. Also, the regional countries like China, India, and Thailand have seen an abundant feedstock supply, which is creating significant opportunities in the regional industry.

How is China Leading the Charge in Bioplastics Consumption?

China maintained its dominance in the market, owing to the country's increasing local consumption of bioplastics. China is known for its huge exports, while it also consumes enlarged plastic products, which has significantly provided advantages to the industry in recent years. Furthermore, China has made a significant investment in the production of advanced technology for the marine biodegradable PHA in the present period.

Europe Biopolymers Market Trends

Europe is expected to capture a major share of the biopolymers market during the forecast period, akin to the region’s stricter sustainability initiatives and advanced recycling infrastructure. Also, the regional countries such as Germany United Kingdom, and Italy is actively investing in the production and research on specialized biopolymers in recent years, as per the survey.

Country level Investments & Funding Trends for the Biopolymers Industry:

- India: The renowned sugar company in India, called Balrampur Chini Mills, is planning to invest in a biopolymer plant in India. The investment is worth 2,850 crore as per the published report.(Source: www.thehindubusinessline.com)

- China – the government of China is estimated to impose CO2 emissions in the coming years, where the estimated demand for biobased plastic is 2.53 million tons, according to a survey.(Source: www.plasticstoday.com )

- Europe- the European Union has launched an action plan development of biopolymers, with boosting the capacity of bioplastic production.(Source: www.european-bioplastics.org)

Valus Chain Analysis of Biopolymers Market:

- Distribution to Industrial Users: The major distributors and industrial users are providing custom blends and on-time deliveries, where the eco-friendly shift is contributing to the industry's potential.

- Key Players: Total Corbion PLA, BASF, and Nature Works

- Chemical Synthesis and Processing: Chemical synthesis and processing of biopolymers are divided into various processes, such as dehydration, hydrolysis, esterification, and polycondensation.

- Regulatory Compliance and Safety Monitoring: The regulatory and safety framework depends upon the national and international standards. Mostly, the regulations are implemented according to the respective regional regulatory bodies.

Recent Development

- In June 2025, Sulzer established its latest biopolymer engineering and scale-up center. Moreover, this facility is in Switzerland, according to the report published by the company. (Source : www.sulzer.com)

Top Vendors in the Biopolymers Market & Their Offerings:

- Nature Works : NatureWorks is one of the prominent biomaterial companies that focuses on Ingeo polylactic acid biopolymers manufacturing and chemicals.

- Corbion: Corbion is a leading biobased polymer manufacturing brand, which is distributed across various sectors like home, personal care, and pharmaceutical.

- Novamont: Novamont is a renowned company to produce renewable and compostable bioplastics, which was founded in 1989.

- BASF: BASF is an integrated chemical company that operates in different sectors like automotive, agriculture, consumer goods, and construction.

Other Key players

- Braskem

- DuPont de Nemours

- Mitsubishi Chemical Corporation

- Kaneka Corporation

- PTT MCC Biochem

- FKuR Kunststoff GmbH

- Biome Bioplastics

- Futamura Group

- Toray Industries

- Arkema

- Green Dot Bioplastics

- Zhejiang Hisun Biomaterials

- CJ CheilJedang

- eSUN (Shenzhen eSUN)

- Avient Corporation

Segments Covered in the Report

By Polymer Type (Chemical family)

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA: PHB, PHBV, mcl-PHA, scl-PHA)

- Polybutylene Succinate (PBS)

- Polycaprolactone (PCL)

- Polybutylene Adipate Terephthalate (PBAT)

- Starch-based Polymers (Thermoplastic starch, starch blends)

- Cellulose-based Polymers (Cellulose acetate, regenerated cellulose)

- Chitosan & Polysaccharides (alginate, pectin derivatives)

- Bio-Polyethylene (Bio-PE)

- Bio-Polyethylene Terephthalate (Bio-PET)

- Bio-Polyamides (Bio-PA11, Bio-PA12)

- Lignin-derived Polymers

- Furan-based Polymers (PEF)

By Feedstock Source

- Starch crops (corn, maize, potato)

- Sugar crops (sugarcane, sugar beet, molasses)

- Lignocellulosic biomass (wood pulp, bagasse, agri residues)

- Vegetable oils (castor, soybean, palm derivatives)

- Algae/seaweed

- Microbial fermentation (bacteria, yeast, mixed cultures)

- Waste-derived feedstocks (food waste, glycerol, organic residues)

By Product Form

- Resin pellets/granules

- Films & sheets

- Rigid packaging & thermoformed products

- Fibers & yarns

- Foams

- Powders & microspheres

- Compounds & masterbatches

- 3D printing filaments

By Processing Technology

- Extrusion (film, sheet, pipe)

- Injection moulding

- Blow moulding

- Thermoforming

- Melt spinning/fiber extrusion

- Additive manufacturing (3D printing)

- Coating & lamination

By End-Use Industry

- Packaging

- Flexible packaging

- Rigid packaging

- Food service disposables (cups, cutlery, plates)

- Agriculture & Horticulture

- Mulch films

- Plant pots & trays

- Controlled-release carriers

- Medical & Healthcare

- Implantable devices

- Drug-delivery systems

- Medical disposables & packaging

- Textiles & Nonwovens

- Apparel & fashion

- Technical textiles & geotextiles

- Hygiene & personal care nonwovens

- Consumer Goods & Durables

- Automotive & Transportation

- Electronics & Electrical

- Construction & Building

- 3D Printing & Prototyping

- Industrial Applications (adhesives, coatings, machinery parts, membranes)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait