Content

What is the Current U.S. Solvents Market Size and Volume?

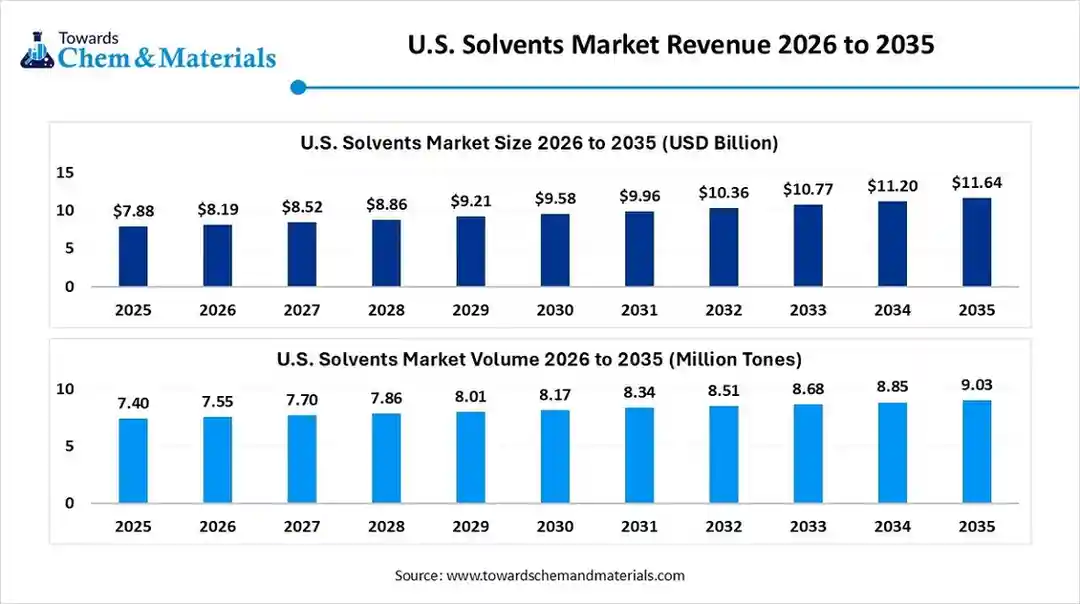

The U.S. solvents market size was estimated at USD 7.88 billion in 2025 and is expected to increase from USD 8.19 billion in 2026 to USD 11.64 billion by 2035, growing at a CAGR of 3.98% from 2026 to 2035.

The U.S. solvents market size was 7.40 million tons in 2025 and is predicted to increase from 7.55 million tons in 2026 and is expected to be worth around 9.03 million tons by 2035, exhibiting a compound annual growth rate (CAGR) of 2.01% over the forecast period from 2026 to 2035. The manufacturing surge and shift towards bio-based solvents drive the market growth.

Key Takeaways

- By type, the oxygenated solvents segment led the market with the largest revenue volume share of 60% in 2025, due to the lower toxicity and excellent solvency power.

- By Product Type, the aluminum segment is expected to grow at the fastest CAGR of 2.54% from 2026 to 2035 due to the thriving advanced technological infrastructure.

- By source, the petrochemical-based solvents segment led the market with the largest volume share of 85% in 2025, due to the versatility and excellent performance.

- By source, the bio-based solvents segment is growing at the fastest CAGR in the market during the forecast period due to the growing sustainability initiatives.

- By grade, the industrial grade solvents segment dominated with the largest revenue volume share of 75% in 2025, due to the strong industrial growth.

- By grade, the high-purity or specialty-grade solvents segment is growing at the fastest CAGR in the market during the forecast period due to increased wafer cleaning activity.

- By application, the paints, coatings, and adhesives segment dominated the market and accounted for the largest revenue volume share of 56% in 2025 due to the expanding automotive sector.

- By application, the pharmaceuticals & healthcare segment is growing at the fastest CAGR in the market during the forecast period due to increasing demand for drugs.

- By sales channel, the direct sales segment accounted for the largest market revenue volume share of 65% in 2025, due to the better pricing offer.

- By sales channel, the indirect sales segment is expected to grow at the fastest CAGR in the market during the forecast period due to specialized local support.

What Drives the U.S. Solvents Market Growth?

The U.S. solvents market growth is driven by rising vehicle production, surging construction activities, increasing need for decorative coatings, development of aerospace parts, rapid growth in semiconductor manufacturing, rise in reshore manufacturing, and expanding healthcare infrastructure.

A solvent is a substance that forms a uniform mixture and easily dissolves another substance. It is available in liquid form mostly and can the diverse types of solvents be aprotic, polar, nonpolar, & protic. Solvents having low boiling points and highly flammable. Solvents are useful across applications like paints, hair sprays, printing inks, drug synthesis, paint removers, spot removers, essential oil extraction, and others. The common examples of solvents are methanol, ethanol, hexane, water, and toluene.

U.S. Solvents Market Trends:

- Increased Spending on Personal Care Items: The increasing focus on self-care and evolving trends of beauty increases the adoption of personal care product that requires solvents. The growing use of products like nail polish, lotions, hair sprays, lip balms, toners, and foundations requires solvents.

- Growing Paints Use: The growing painting activities in homes, increased refining of vehicles, and a rise in renovation activities increase demand for paints that require solvents for pigment purposes.

- Green Solvents Demand: The growing awareness about environmental issues and stringent rules for VOC emissions increases demand for the development of environmentally friendly solvents like green solvents.

- Ultra-Pure Solvent Requirement: The booming drug development, rise in chip manufacturing, and expanding industrial operations increase demand for ultra-pure solvent.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 11.64 Billion / 7.55 Million Tons |

| Revenue Forecast in 2035 | USD 8.19 Billion/ 9.03 Million Tons |

| Growth Rate | CAGR 3.98% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Type, By Source, By Grade, By Application, By Sales Channel, |

| Key companies profiled | Exxon Mobil Corporation, Celanese Corporation, The Dow Chemical Company, LyondellBasell Industries Holdings B.V, Eastman Chemical Company, BASF SE , Shell plc , Huntsman International LLC , Chevron Phillips Chemical Company LLC , Honeywell International Inc. , Ashland Global Holdings Inc. , Sasol Limited , TotalEnergies SE , INEOS Group Holdings S.A. , Mitsubishi Chemical Corporation , Kuraray Co., Ltd., PPG Industries , Calumet Specialty Products Partners, L.P. , Vertec Biosolvents Inc. , Cargill, Incorporated |

Key Technological Shifts in the U.S. Solvents Market:

The U.S. solvents market is undergoing key technological changes driven by stricter regulations, enhancing efficiency, better performance, and sustainability. The key technological shifts are Internet of Things integration, carbon capture technology, digitalization, and advanced recovery. One of the major advancements is the incorporation of AI enables the development of green solvents and optimizes the process.

Artificial Intelligence supports the discovery of new eco-friendly solvents and easily predicts solvent solubility. AI designs the overall system and focuses on maximizing yield. AI detects operational parameters and minimizes the amount of waste. AI helps in preventing hazardous accidents and supports the recycling of solvents. AI improves inventory management and lowers experimental trials. Overall, AI is a robust catalyst for the solvent industry.

Trade Analysis of the U.S. Solvents Market: Import & Export Statistics

- The United States exported $308M of organic composite solvents in 2023.

- The United States exported $217K of halogenated waste organic solvents in 2023.

- The United States exported $981M methyl alcohol in 2023.

- The United States imported $532M of toluene in 2023.

- The United States exported $24.5M of tetrachloroethylene in 2023.

U.S. Solvents Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement is a method of acquiring raw materials, like natural gas, starches, biomass, crude oil, vegetable oils, and sugars.

- Key Players:- Dow Inc., LyondellBasell, Shell Chemicals, BASF, Exxon Mobil Corporation

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like preparing a uniform reaction environment, extraction, separation, purification, cleaning, sterilization, and formulation.

- Key Players:- ExxonMobil Chemical, Celanese, Olin, Dow Inc., Eastman Chemical Company

- Quality Testing and Certifications: The quality testing is a systematic evaluation of attributes such as solubility, flash point, GC, toxicity, purity, distillation range, LC, and consistency. Certifications like EPA Safer Choice, OSHA, UL GREENGUARD Gold, CAS, and TSCA are required for U.S. solvents.

- Key Players:- SGS, Pace Analytical, Eurofins Scientific, Impact Analytical, Intertek

Solvents Powering the United States Industries

| Solvent | Used For | Major Manufacturers | Key States |

| Ethanol |

|

|

|

| Toulene |

|

|

|

| Acetone |

|

|

|

| Ethyl Acetate |

|

|

|

Segmental Insights

Product Type Insights

Why the Oxygenated Solvents Segment Dominates the U.S. Solvents Market?

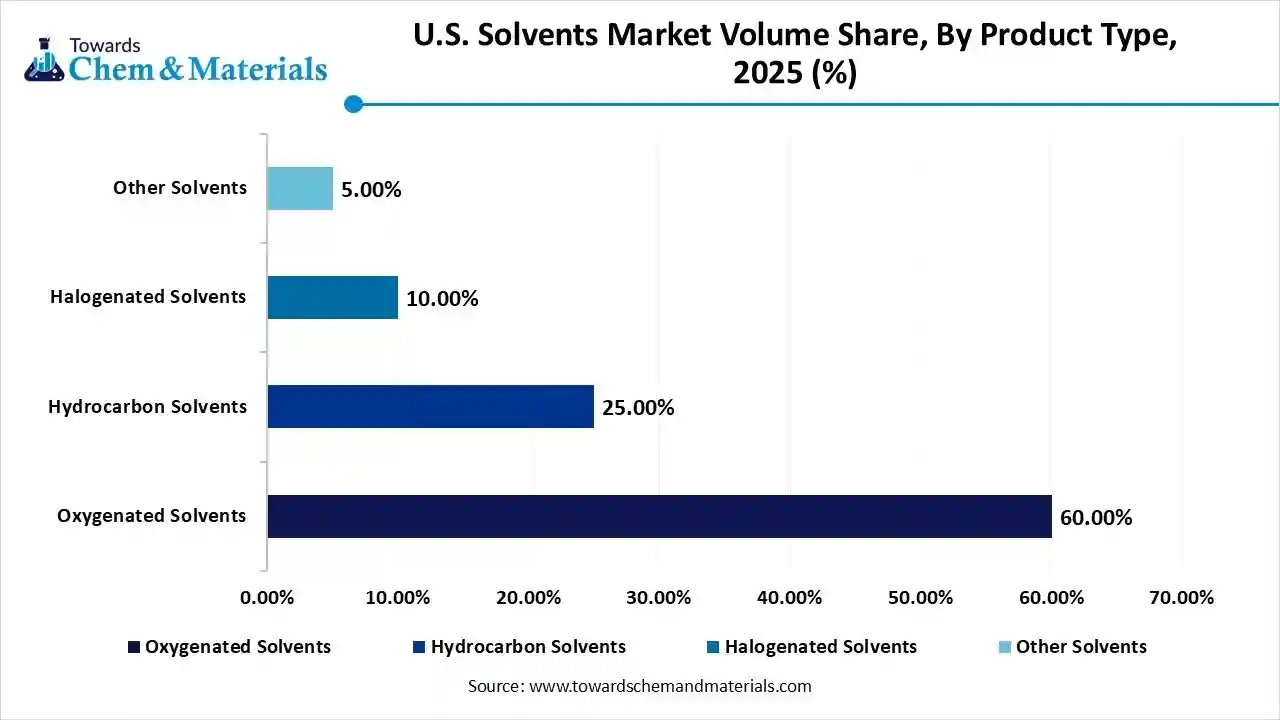

The oxygenated solvents segment dominated the U.S. solvents market with a 60% share in 2025. The increasing demand for automotive coatings and growing formulations of medicines increases the adoption of oxygenated solvents. The growing production of perfumes and rising construction activities require oxygenated solvents. The huge demand for industrial cleaners and growth in manufacturing create demand for oxygenated solvents, driving the overall growth of the market.

The hydrocarbon solvents segment is the fastest-growing in the market during the forecast period. The development of infrastructure and the increasing need for degreasing vehicles boost demand for hydrocarbon solvents. The expanding electronic gadget production and growing drug extraction require hydrocarbon solvents. The increased formulation of printing inks and the rise in sanitizing increase demand for hydrocarbon solvents, supporting the overall growth of the market.

U.S. Solvents Market Volume Share, By Product Type, 2025 (%)

| By Product Type | Market Share (%), 2025 | Market Volume (Million Tons)- 2025 | Market Volume (Million Tons)- 2035 | CAGR | Market Share (%), 2035 |

| Oxygenated Solvents | 60.00% | 4.44 | 5.64 | 2.42% | 62.45% |

| Hydrocarbon Solvents | 25.00% | 1.85 | 2.38 | 2.54% | 26.34% |

| Halogenated Solvents | 10.00% | 0.74 | 1.01 | 3.18% | 11.21% |

| Other Solvents | 5.00% | 0.37 | 0.56 | 4.23% | 6.20% |

| Total | 100.00% | 7.40 | 9.03 | 2.01% | 100.00% |

Source Insights

How did Petrochemical-Based Solvents hold the Largest Revenue Share of the U.S. Solvents Market?

The petrochemical-based solvents segment held the largest revenue share of 85% in the U.S. solvents market in 2025. The strong presence of a petroleum refining base increases production of petrochemical-based solvents. The controlled evaporation rates, cost efficiency, and high solvency of petrochemical-based solvents help the expansion of the market. The increasing use of adhesives and the growing production of pharmaceutical products create a huge demand for petrochemical-based solvents, driving the overall growth of the market.

The bio-based solvents segment is experiencing the fastest growth in the market during the forecast period. The strong focus on lowering emissions and increasing consumer awareness about environmental issues increases the production of bio-based solvents. The increasing need to lower carbon emissions and government support for sustainable production increase demand for bio-based solvents. The high availability of renewable raw materials supports the overall growth of the market.

Grade Insights

Why are Industrial Grade Solvents Dominating the U.S. Solvents Market?

The industrial grade solvents segment dominated the U.S. solvents market with a 75% share in 2025. The surge in manufacturing activities and a well-established industrial infrastructure increases demand for industrial grade solvents. The rapidly expanding electronic industry and increased automotive manufacturing capabilities require industrial grade solvents. The cost-effectiveness and excellent performance of industrial grade solvents drive the overall growth of the market.

The high-purity or specialty grade solvents segment is the fastest-growing in the market during the forecast period. The rise in advanced chip production and increased demand for biologic medicines increases demand for high-purity solvents. The growth in the development of solar panels and the increasing use of cosmetics increases demand for specialty grade solvents. The growing production of EV batteries requires high-purity solvent, supporting the overall growth of the market.

Application Insights

Which Application Held the Largest Share in the U.S. Solvents Market?

The paints, coatings, and adhesives segment held the largest revenue share of 56% in the U.S. solvents market in 2025. The accelerated expansion of construction projects and a strong focus on decorating buildings increase demand for paints & coatings. The increasing need for enhancing the aesthetic appeal of vehicles and the growing use of industrial machinery require coatings. The aircraft manufacturing and growing development of affordable housing increase demand for paints, coatings, and adhesives, driving the overall market growth.

The pharmaceuticals and healthcare segment is experiencing the fastest growth in the market during the forecast period. The thriving prevalence of chronic diseases and the increased development of complex biologic drugs increase the adoption of solvents. The increasing need for specialty drugs and the growing demand for personalised medicines require solvents. The increased creation of API and the booming biopharmaceutical industry increase demand for solvents, supporting the overall growth of the market.

Sales Channel Insights

Why the Direct Sales Segment Dominates the U.S. Solvents Market?

The direct sales segment dominated the U.S. solvents market with a 65% share in 2025. The growing demand for customization of solvents and the availability of technical expertise increase the adoption of direct sales. The growing large-scale buying of solvents and focus on efficient supply chain operations require direct sales. The cost optimization and stronger customer relationships in direct sales drive the overall growth of the market.

The indirect sales segment is the fastest-growing in the market during the forecast period. The strong focus on lowering operational burden and increasing demand for specialized services increases the adoption of indirect sales. The ability to provide solvent to the mid-sized industry and regulatory compliance support creates demand for indirect sales. The strong presence of wholesalers and the growing demand for specialty solvents support the overall market growth.

State-Level Insights

Lone Star State: Texas at the Centre of Solvents Production

Texas is a major contributor to the market. The abundance of petroleum reserves and strong chemical plants infrastructure increases the production of solvents. The rapid development of construction projects and increased formulations of drugs increases demand for solvents. The increasing use of agricultural chemicals and strong automotive sector growth boost demand for solvents. The presence of key players like BASF, Chevron Phillips, and ExxonMobil drives the overall growth of the market.

Golden State: California Leading Solvent Manufacturing Way

California is a key contributor to the market. The increasing need for vehicle maintenance and the rise in home improvement activities increase demand for solvents. The growing electronics manufacturing activities and increased utilization of coatings require solvents. The sustainability transition and stricter policies for VOC emissions increase the development of green solvents. The growing manufacturing base supports the overall growth of the market.

Buckeye State: Ohio’s Expanding Landscape of Solvent

Ohio is substantially growing in the market. The diverse industries and thriving coatings & paints sectors create demand for solvents. The fastest-growing automotive industry and the rise in chemical synthesis activities increase demand for solvents. The increasing demand for bio-based solvents supports the overall growth of the market.

Recent Developments

- In December 2025, GFS Chemicals launched Veritas® Ultimate GC-Headspace solvents. The solvent is widely used across applications like environmental laboratories, pharmaceutical, and food. The diverse solvent formulations include DMF, NMP, DMAc, DMSO, & benzyl alcohol. (Source: www.cbs42.com )

- In August 2024, Eastman introduced the latest electronic grade solvent, EastaPure isopropyl alcohol. The solvent is used in the semiconductor manufacturing process and is used as a cleaning agent.(Source: www.indianchemicalnews.com)

Top Companies List

- Exxon Mobil Corporation:- The company supplies oxygenated and hydrocarbon solvents to serve industries like paints, mining, cleaning, & oil & gas. The company’s solvent product portfolio includes FLEXSORB, Exxsol, and Escaid.

- Eastman Chemical Company:- The manufacturer of diverse types of solvents like ketones, glycol ethers, alcohols, glycol ether esters, and esters to be used across various industries.

- Celanese Corporation:- The company manufactures specialty and organic solvents to support industries like adhesives, agriculture, paints & coatings, food & beverage, and pharmaceuticals.

- The Dow Chemical Company:- The company's solvent portfolio includes alcohols, glycol ethers, esters, and ketones to serve diverse industrial sectors.

- LyondellBasell Industries Holdings B.V.:- The company’s solvent portfolio includes diverse products like glycol ethers, propylene oxide derivatives, NMP, acetone, TBAc, and methanol to support a diverse industrial base.

Top Companies in the U.S. Solvents Market

- Exxon Mobil Corporation

- Celanese Corporation

- The Dow Chemical Company

- LyondellBasell Industries Holdings B.V

- Eastman Chemical Company

- BASF SE

- Shell plc

- Huntsman International LLC

- Chevron Phillips Chemical Company LLC

- Honeywell International Inc.

- Ashland Global Holdings Inc.

- Sasol Limited

- TotalEnergies SE

- INEOS Group Holdings S.A.

- Mitsubishi Chemical Corporation

- Kuraray Co., Ltd.

- PPG Industries

- Calumet Specialty Products Partners, L.P.

- Vertec Biosolvents Inc.

- Cargill, Incorporated

Segments Covered

By Product Type

- Oxygenated Solvents

- Alcohols

- Methanol

- Ethanol (Industrial Grade)

- Isopropanol (IPA)

- Butanol (n-Butanol, Isobutanol)

- Ketones

- Acetone

- Methyl Ethyl Ketone (MEK)

- Methyl Isobutyl Ketone (MIBK)

- Esters

- Ethyl Acetate

- Butyl Acetate

- Propyl Acetate

- Glycol Ethers

- E-Series Glycol Ethers (Ethylene Glycol Ethers)

- P-Series Glycol Ethers (Propylene Glycol Ethers)

- Alcohols

- Hydrocarbon Solvents

- Aliphatic Hydrocarbons

- Hexane

- Mineral Spirits (White Spirit)

- Paraffinic Solvents

- Aromatic Hydrocarbons

- Toluene

- Xylene

- Solvent Naphtha

- Aliphatic Hydrocarbons

- Halogenated Solvents

- Chlorinated Solvents

- Methylene Chloride (Dichloromethane)

- Perchloroethylene (Tetrachloroethylene)

- Trichloroethylene (TCE)

- Chlorinated Solvents

- Other Solvents

- Terpenes

- N-Methyl-2-pyrrolidone (NMP)

- Dimethyl Sulfoxide (DMSO)

- Water (as a "Green" Solvent)

By Source

- Petrochemical-Based Solvents

- Bio-Based Solvents (Green Solvents)

- Lactates (e.g., Ethyl Lactate)

- Terpenes (e.g., D-Limonene)

- Alcohols (Bio-Ethanol, Bio-Butanol)

- Esters (Bio-Esters)

- Other Natural-Source Solvents (e.g., Methyl Soyate)

By Grade

- Industrial Grade Solvents

- High-Purity/Specialty Grade Solvents

- Pharmaceutical Grade (USP/EP)

- Electronic Grade (High Purity for Semiconductors)

- Analytical/Laboratory Grade

- Food Grade

By Application

- Paints, Coatings, and Adhesives

- Decorative Coatings

- Industrial & Protective Coatings

- Automotive Coatings (OEM/Refinish)

- Printing Inks

- Sealants and Adhesives

- Pharmaceuticals and Healthcare

- Drug Synthesis and Extraction

- Drug Formulation

- API (Active Pharmaceutical Ingredient) Purification

- Specialty Cleaning (Medical Devices)

- Industrial and Institutional (I&I) Cleaning

- Metal Cleaning and Degreasing

- Electronic Component Cleaning

- Equipment Maintenance

- Cosmetics and Personal Care

- Fragrances and Perfumes

- Nail Care (Removers, Lacquers)

- Hair Care Products

- Agricultural Chemicals

- Pesticide and Herbicide Formulation

- Adjuvants and Carriers

- Chemical Synthesis & Processing

- Polymer Production

- Intermediate Chemicals Synthesis

- Electronics and Semiconductors

- Photoresist Strippers

- Cleaning Agents for Wafers/Components

- Specialty Etchants

By Sales Channel

- Direct Sales

- Rail-based Tank Cars

- Truck/Tanker Distribution

- Pipeline

- Indirect Sales

- Chemical Distributors (e.g., Brenntag, Univar Solutions)

- Packaged/Container Sales (Drums, IBCs, Totes)