Content

What is the Current Organic Acids Market Size and Volume?

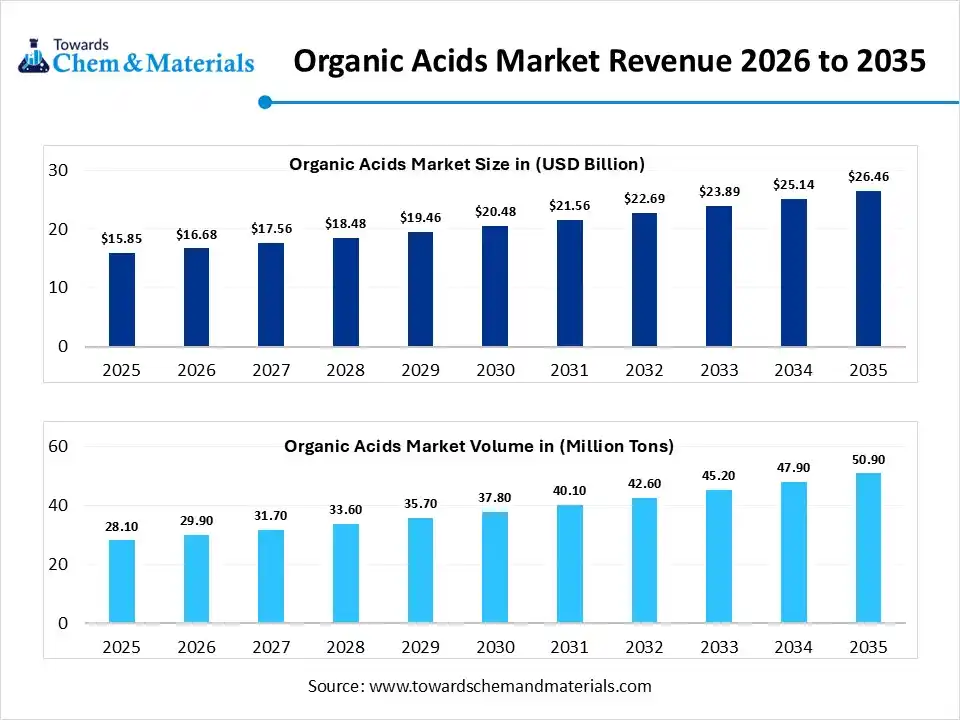

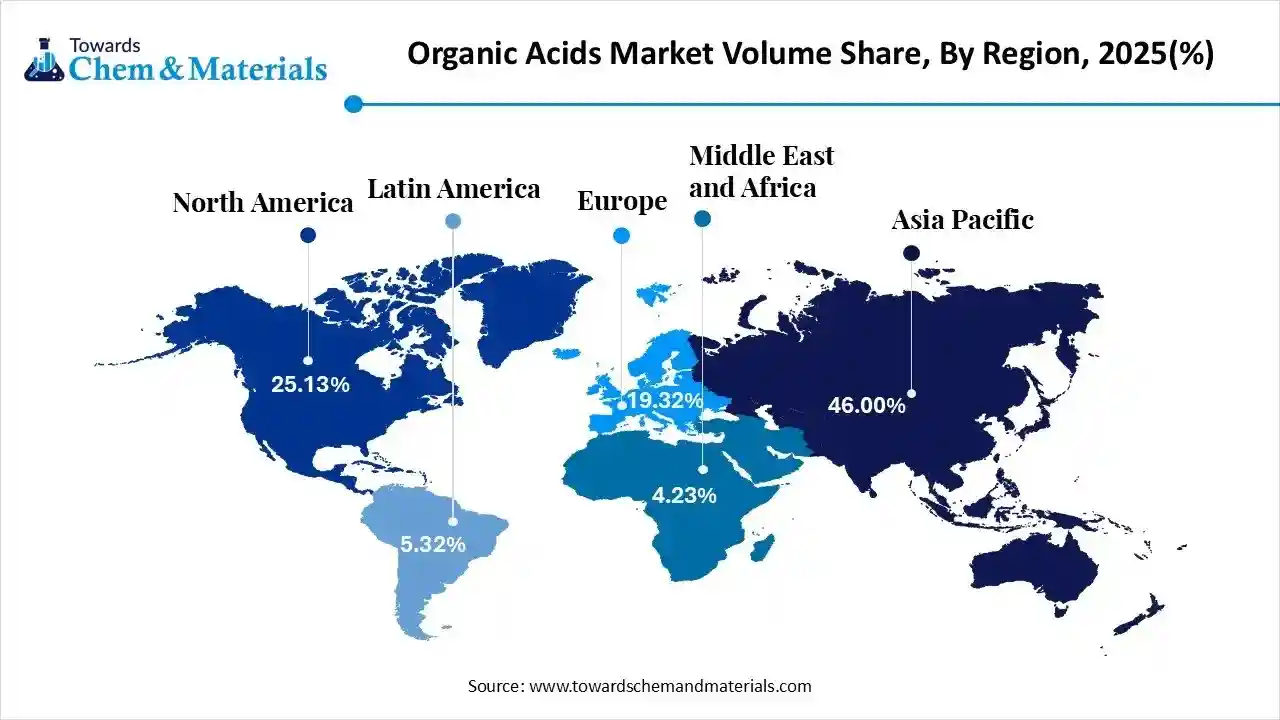

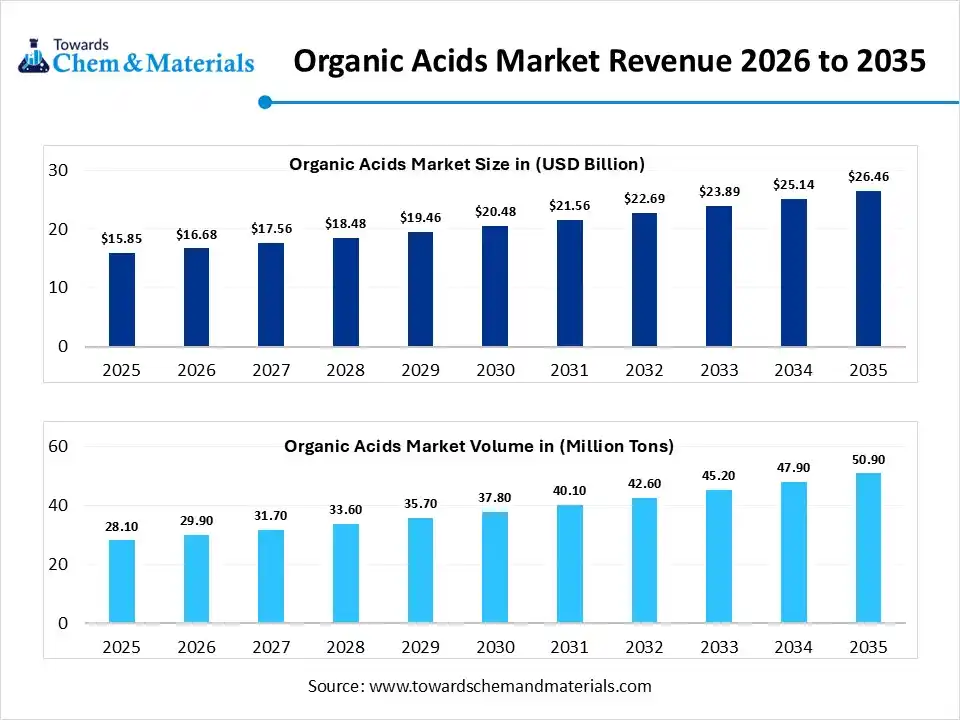

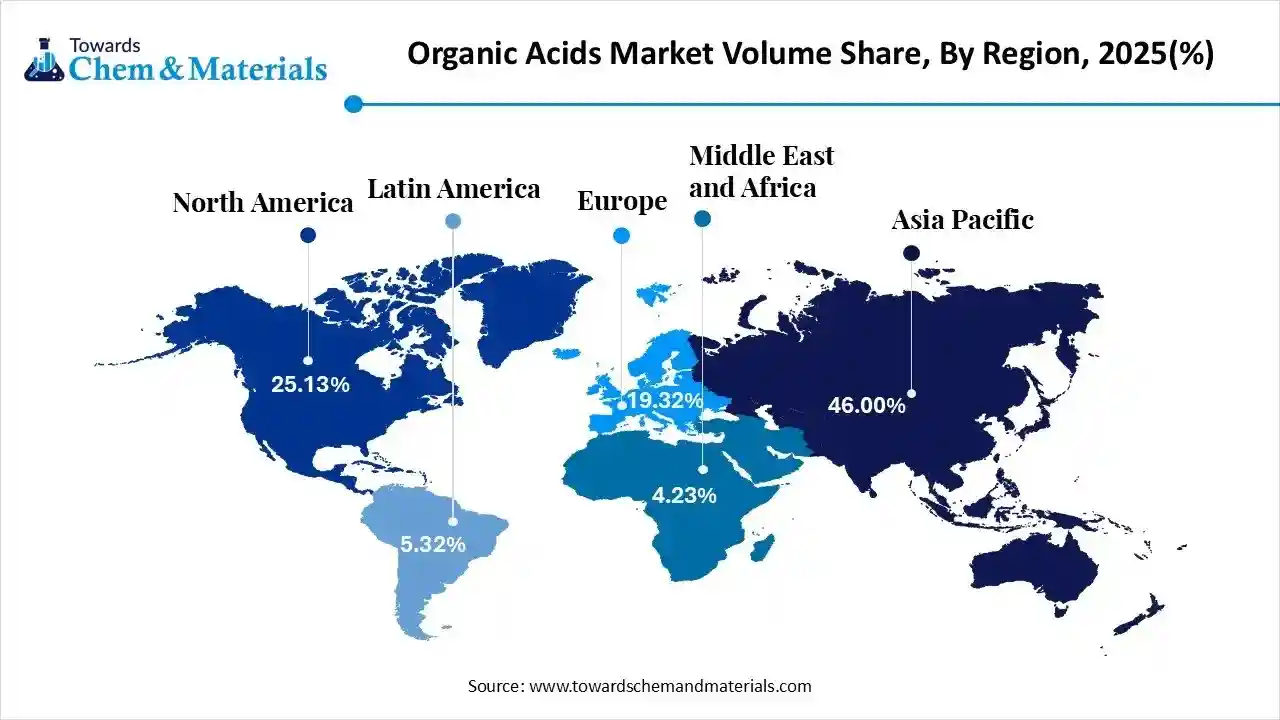

The global organic acids market size was estimated at USD 15.85 billion in 2025 and is expected to increase from USD 16.68 billion in 2026 to USD 26.46 billion by 2035, growing at a CAGR of 5.26% from 2026 to 2035. In terms of volume, the market is projected to grow from 28.1 million tons in 2025 to 50.9 million tons by 2035. growing at a CAGR of 6.10% from 2026 to 2035. Asia Pacific dominated the organic acids market with the largest volume share of 46.00% in 2025. Increasing preference for organic and natural food is the key factor driving market growth. Also, robust demand for functional properties coupled with the stringent regulations on artificial additives can fuel market growth further.

The organic acids market refers to the global industry involved in the production and application of carbon-based acids such as acetic acid, citric acid, lactic acid, formic acid, propionic acid, fumaric acid, malic acid, and tartaric acid. These acids are widely used due to their preservative, acidulant, chelating, antimicrobial, buffering, and pH-regulating properties. Organic acids play a critical role across food & beverages, animal feed, pharmaceuticals, personal care, chemicals, agriculture, and industrial processing.

Market Highlights

- The Asia Pacific dominated the global organic acids market with the largest volume share of 46% in 2025.

- The organic acids market in North America is expected to grow at a substantial CAGR of 6.31% from 2026 to 2035.

- The Europe organic acids market segment accounted for the major volume share of 19.32% in 2025.

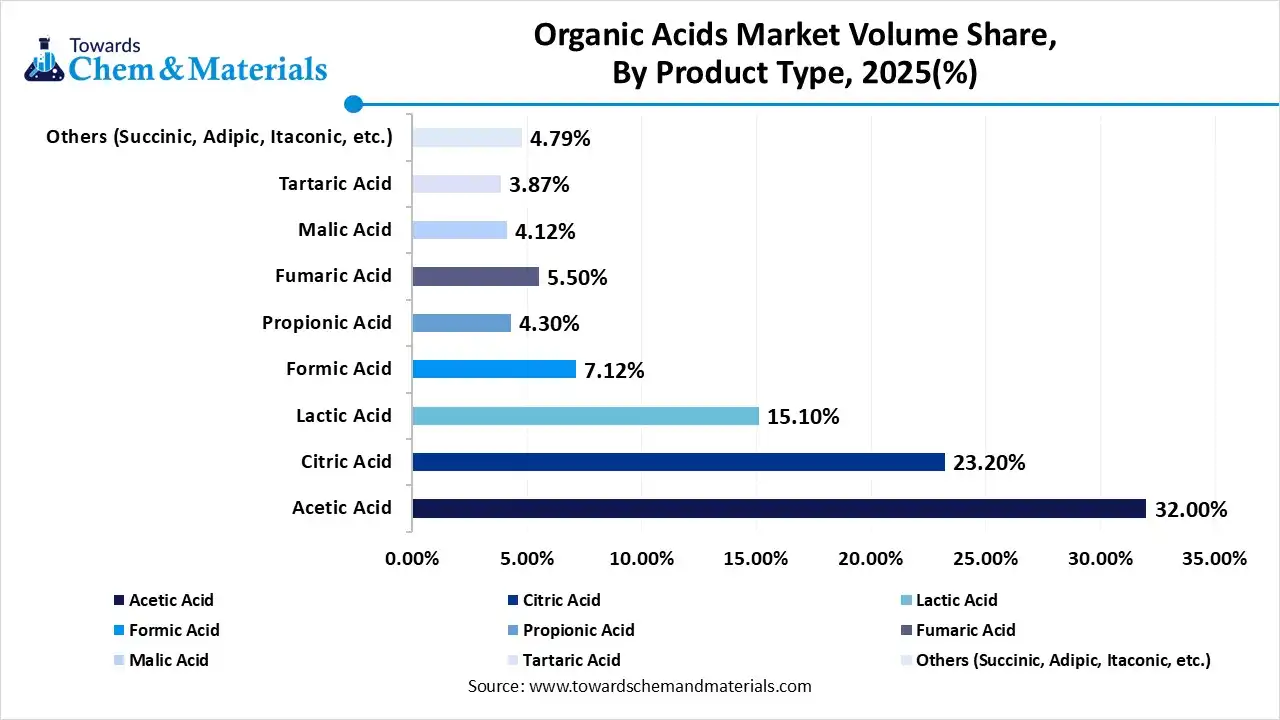

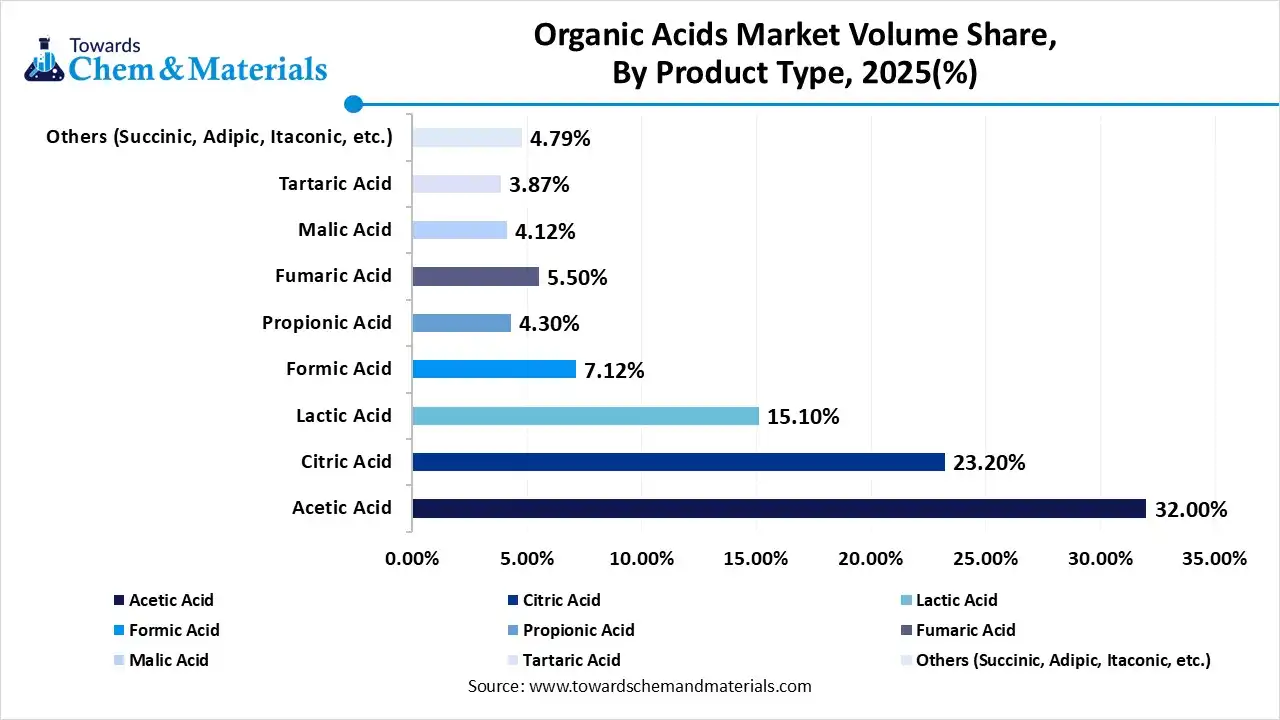

- By product type, the acetic acid segment dominated the market and accounted for the largest volume share of 32% in 2025.

- By product type, the others (Succinic, Adipic, Itaconic, etc.) segment is expected to grow at the fastest CAGR of 9.16% from 2026 to 2035 in terms of volume.

- By source, the synthetic-based segment led the market with the largest revenue volume share of 58% in 2025.

- By end-use, the food processing industry segment dominated the market and accounted for the largest volume share of 38% in 2025.

- By form, the liquid segment led the market with the largest revenue volume share of 62% in 2025.

Organic Acids Market Trends

- The rising demand for natural food additives, clean-label products, pharmaceutical manufacturing expansion, and bio-based chemical adoption are the major trends boosting overall market expansion in the upcoming years.

- The growing adoption of sustainable agriculture practises is the latest trend in the market. Organic acids can improve overall fertility and soil structure, supporting better microbial activity and nutrient availability, which is crucial for sustainable farming practices.

- The increasing product demand in animal feed is another major trend shaping positive market growth. Organic acids such as propionic acid and lactic acid are used as feed additives to improve digestion, gut health, and inhibit the growth of harmful bacteria in animals.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 16.68 Billion / 29.9 Million Tons |

| Revenue Forecast in 2035 | USD 26.46 Billion / 50.9 Million Tons |

| Growth Rate | CAGR 5.26% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Source, By End-Use Industry, By Form, By Region |

| Key companies profiled | BASF SE, Cargill, Incorporated, ADM (Archer Daniels Midland Company), Evonik Industries AG, Corbion N.V., Eastman Chemical Company, Celanese Corporation, Dow Inc., Jungbunzlauer Suisse AG, LANXESS AG, Tate & Lyle PLC, Royal DSM (DSM-Firmenich), Henan Jindan Lactic Acid Technology Co., Ltd., Weifang Ensign Industry Co., Ltd., Shandong Baoyuan Chemical Co., Ltd., Fuso Chemical Co., Ltd., Polynt Group, Yara International ASA, Anhui Sealong Biotechnology Co., Ltd., Zhejiang NHU Co., Ltd. |

How Cutting-Edge Technologies Are Revolutionizing the Organic Acids Market?

Cutting-edge technologies are transforming the market majorly by enabling a shift towards bio-based and sustainable methods, improving production efficiency, and optimising the development of high-purity products. Furthermore, rapid innovations in genetic engineering and synthetic biology enhance efficiency and facilitate the use of extensive, low-cost, renewable feedstocks.

Trade Analysis of Organic Acids Market: Import & Export Statistics

Exports

- China exported $82.7B of Organic chemicals in 2024, being the 9th most exported product in China.

- The main destinations of China's Organic chemicals exports in 2024 are the United States ($8.09B), India ($11B), Brazil ($4.21B), South Korea ($4.78B), and Japan ($3.68B).

Imports

- China imported $49.1B of Organic chemicals in 2024, being the 11th most imported product in China.

- The main origins of China's Organic chemicals imports in 2024 are the United States ($5.14B), South Korea ($10.9B), Saudi Arabia ($3.45B), Japan ($4.66B), and Chinese Taipei ($2.67B).

Organic Acids Market Value Chain Analysis

- Feedstock Procurement : It is the process of sourcing essential raw materials like sugars, biomass, or petrochemical derivatives for the production of organic acids. It is crucial for stable pricing and production.

- Major Players: Archer Daniels Midland (ADM), BASF SE

- Chemical Synthesis and Processing : It refers to the manufacturing of organic acids using artificial chemical reactions instead of bio-based fermentation. It depends on the proper execution of one or more chemical reactions.

- Major Players: Eastman Chemical Company, Celanese Corporation.

- Packaging and Labelling: It includes a shift towards sustainability, "clean-label" transparency, and strict regulatory compliance to meet the "natural" positioning of bio-based acids.

- Major Players: Corbion N.V., Tate & Lyle PLC.

- Regulatory Compliance and Safety Monitoring : It includes adhering to strict guidelines set by regulatory bodies such as the US FDA and the EFSA to ensure product quality, safety, and efficacy across various applications.

- Major Players: Corbion N.VKoninklijke DSM N.V.

Organic Acids Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (US): | Food-grade organic acids must comply with FDA standards outlined in the Code of Federal Regulations (e.g., 21 CFR). The U.S. Department of Agriculture (USDA)'s Organic Certification Program promotes the use of certified organic ingredients. |

| European Union (EU) | The EU employs a comprehensive regulatory framework, with the European Food Safety Authority (EFSA) establishing stringent guidelines for food additives. |

| India | The Food Safety and Standards Authority of India (FSSAI) is the primary regulatory body for organic foods, The "Jaivik Bharat" logo and "India Organic" logo (certified under the National Programme for Organic Production - NPOP) are mandatory labels for certified organic products. |

Segmental Insights

Product Type Insights

How Much Share Did the Acetic Acid Segment Held in 2025?

The acetic acid segment volume was valued at 9.0 million tons in 2025 and is projected to reach 15.8 million tons by 2035, expanding at a CAGR of 6.47% during the forecast period from 2025 to 2035. The acetic acid segment dominated the market with nearly 32% share in 2025. The dominance of the segment can be attributed to the rapid innovations in bio-production and growing demand for VAM (Vinyl Acetate Monomer) in adhesives and coatings. In addition, acetic acid serves as a solvent, chemical reagent, and stabilizer in drug formulations, such as the production of caffeine and aspirin tablets.

The others (Succinic, Adipic, Itaconic, etc.) segment segment volume was valued at 1.3 million tons in 2025 and is expected to surpass around 3.0 million tons by 2035, and it is anticipated to expand to 9.16% of CAGR during 2026 to 2035. This segment includes acids such as Adipic, Itaconic, and Succinic. Succinic acid is a crucial intermediate for Bio-Polybutylene BDO (Bio-BDO) and Polybutylene Succinate (PBS). It is also used as an alternative to adipic acid in the production of polyurethane solvent as a raw material.

Organic Acids Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Acetic Acid | 32.00% | 9.0 | 15.8 | 6.47% | 31.12% |

| Citric Acid | 23.20% | 6.5 | 11.3 | 6.34% | 22.31% |

| Lactic Acid | 15.10% | 4.2 | 7.8 | 6.96% | 15.31% |

| Formic Acid | 7.12% | 2.0 | 3.5 | 6.38% | 6.87% |

| Propionic Acid | 4.30% | 1.2 | 2.5 | 8.63% | 5.01% |

| Fumaric Acid | 5.50% | 1.5 | 2.6 | 5.98% | 5.13% |

| Malic Acid | 4.12% | 1.2 | 2.2 | 7.61% | 4.41% |

| Tartaric Acid | 3.87% | 1.1 | 2.0 | 7.22% | 4.01% |

| Others (Succinic, Adipic, Itaconic, etc.) | 4.79% | 1.3 | 3.0 | 9.16% | 5.83% |

Source Insights

Which Source Type Segment Dominated Organic Acids Market in 2025?

The synthetic-based segment held nearly 58% market share in 2025. The dominance of the segment can be linked to the rapid innovations in chemical synthesis, which give high purity and yields, making it a convenient method for specific industrial demands. Chemical synthesis is generally cheaper for large-scale manufacturing compared to fermentation, especially for established acids like acetic acid.

The bio-based fermentation expected to grow at the fastest CAGR during 2026 to 2035. The growth of the segment can be driven by a surge in health awareness among most of the population, coupled with supportive regulatory policies. Moreover, bio-based acids are increasingly being used as building blocks for various high-value products.

End-Use Industry Insights

How Much Share Did the Food Processing Industry Segment Held in 2025?

The food processing industry segment dominated the market with nearly 38% share in 2025. The dominance of the segment is owed to a robust demand for organic acids as a natural substitute for synthetic preservatives and growing consumer emphasis on organic foods and health. Also, organic acids are valued for their variety of roles such as flavor enhancers, acidulants, and pH regulators.

The bioplastics & bio-based materials segment expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to a rapid push to reduce carbon footprints and use renewable resources. Additionally, many industries and consumers favour non-toxic and natural ingredients, benefiting bio-based organic acids.

Form Insights

How Much Share Did the Liquid Segment Held in 2025?

The liquid segment held an approximately 62% market share in 2025. The dominance of the segment can be attributed to the ongoing shift to bio-based production, along with the increasing product use as a natural flavour enhancer, particularly citric and lactic acid. Furthermore, liquid organic acids are used as substitutes for antibiotics in animal feed.

The encapsulated / controlled-release segment expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rapid advancements in encapsulation methods, such as nanoencapsulation and microencapsulation, enabling more efficient and precise delivery systems. This further enhances the bioavailability and stability of the ingredients.

Regional Insights

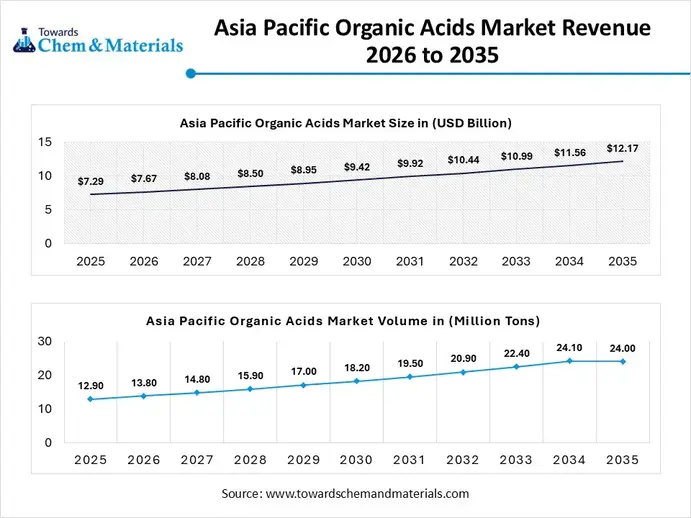

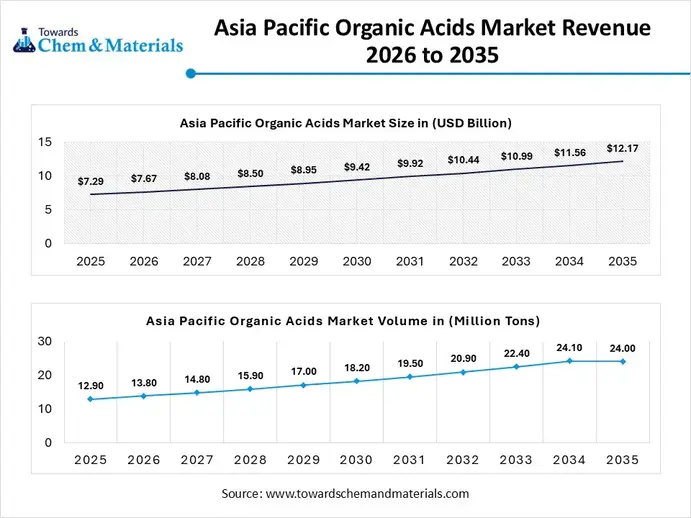

The Asia Pacific organic acids market size was valued at USD 7.29 billion in 2025 and is expected to be worth around USD 12.17 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.28% over the forecast period from 2026 to 2035.

The Asia Pacific organic acids market volume was estimated at 12.9 million tons in 2025 and is projected to reach 24 million tons by 2035, growing at a CAGR of 7.11% from 2026 to 2035. Asia Pacific dominated the market with nearly 46% share in 2025. The dominance of the region can be attributed to the increasing product demand from animal feed, food & beverage, and pharma sectors. In addition, rapid urbanisation in emerging nations and changing dietary practices lead to a higher consumption of packaged, processed, and ready-to-drink (RTD) foods, increasing the need for organic acids as flavor enhancers.

China Organic Acids Market Trends

In the Asia Pacific, China dominated the market owing to a surge in middle-class preference for processed foods along with the ongoing innovations in fermentation/biotech for cheaper production. Also, the country is a leading manufacturer and exporter of organic acids, supplying the regional and global market, particularly in developing economies.

North America Organic Acids Market Trends

The North America organic acids market volume was estimated at 7.1 million tons in 2025 and is projected to reach 12.3 million tons by 2035, growing at a CAGR of 6.31% from 2026 to 2035. North America is expected to grow at a notable CAGR over the forecast period. The growth of the country can be driven by extensive demand for flavor enhancers and natural preservatives, boosted by consumer shift towards organic, clean-label, and convenience foods. Moreover, strict FDA rules prefer bio-based and natural organic acids over harmful synthetic chemicals, supporting their adoption.

U.S. Organic Acids Market Trends

The growth of the market in the country can be fuelled by rapid advancements, research, and drug development initiatives into new applications, coupled with the innovations in biotechnology and fermentation processes. Strict government regulations from agencies such as the EPA and the FDA on the use of harmful synthetic chemicals are propelling the demand for sustainable acids.

Europe Organic Acids Market Trends

Europe organic acids market volume was estimated at 5.4 million tons in 2025 and is projected to reach 10.2 million tons by 2035, growing at a CAGR of 7.27% from 2026 to 2035. Europe held a significant market share in 2025. The growth of the region can be boosted by a surge in processed food consumption and rapid advancements in drug formulations, which propel demand for citric, acetic, and lactic acids as preservatives. Additionally, organic acids act as a renewable feedstock for bioplastics, which aligns with the region's push for sustainable production practices.

Germany Organic Acids Market Trends

In Europe, Germany dominated the market owing to the growing veganism trend, surge in health awareness, and ongoing use of organic acids in pharmaceuticals/cosmetics and animal feed. Also, consumers in the country are focusing on chemical-free, health food, fuelling the demand for acids such as lactic and citric as flavor enhancers and preservatives.

Latin America Organic Acids Market Trends

Latin America organic acids market volume was estimated at 1.5 million tons in 2025 and is projected to reach 2.5 million tons by 2035, growing at a CAGR of 6.09% from 2026 to 2035. Latin America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to its growing emphasis on sustainability, urbanization, affordability, and supportive government policies. Furthermore, consumer preference for clean-label, natural products fuels demands for organic acids as flavorings and preservatives like lactic acid and citric acid.

Brazil Organic Acids Market Trends

In South America, Brazil led the market due to the ongoing transition towards natural ingredients and technological innovations in biotech. The country's extensive agricultural sector offers ample corn, sugarcane, and agro-industrial residues, crucial for manufacturing bio-based organic acids such as lactic and citric acid. Consumer preference for chemical-free and natural products can fuel market expansion soon in the country.

Global Organic Acids Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 25.13% | 7.1 | 12.3 | 6.31% | 24.12% |

| Europe | 19.32% | 5.4 | 10.2 | 7.27% | 20.10% |

| Asia Pacific | 46.00% | 12.9 | 24.0 | 7.11% | 47.22% |

| Latin America | 5.32% | 1.5 | 2.5 | 6.09% | 5.01% |

| Middle East & Africa | 4.23% | 1.2 | 1.8 | 4.73% | 3.55% |

Middle East & Africa Organic Acids Market Trends

The Middle East & Africa organic acids market volume was estimated at 1.2 million tons in 2025 and is projected to reach 1.8 million tons by 2035, growing at a CAGR of 4.73% from 2026 to 2035. The growth of the market in the Middle East & Africa can be linked to the rising need for natural preservatives and ready-to-eat meals to extend the overall shelf life of the food products, along with the expanding healthcare infrastructure. Furthermore, rising demand for antibiotic-free animal products fuels the adoption of organic acids as feed additives to enhance digestion.

Saudi Arabia Organic Acids Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be propelled by robust product demand from its pharmaceutical, food & beverage, and agriculture sectors. In addition, a transition towards bio-fermentation and renewable resources for manufacturing organic acids is increasingly gaining traction, contributing to market expansion.

Recent Developments

- In December 2025, Pow. Bio collaborated with Bühler Group to bring an innovative biomanufacturing platform to market. This partnership aims to boost process development, enhance overall operational performance, and lower production costs. (Source: worldbiomarketinsights.com )

Organic Acids Market Companies

- BASF SE: Offers essential acids (formic, propionic, citric, methane sulfonic acid) for various applications, from feed preservation and silage improvement to industrial cleaning and electronics.

- Cargill, Incorporated: Cargill is a major player in the Organic Acids Market, leveraging fermentation and renewable resources (corn, sugar) to produce key acidulants like citric and lactic acid for food, beverage, animal feed, and bioplastics (PLA).

- ADM (Archer Daniels Midland Company)

- Evonik Industries AG

- Corbion N.V.

- Eastman Chemical Company

- Celanese Corporation

- Dow Inc.

- Jungbunzlauer Suisse AG

- LANXESS AG

- Tate & Lyle PLC

- Royal DSM (DSM-Firmenich)

- Henan Jindan Lactic Acid Technology Co., Ltd.

- Weifang Ensign Industry Co., Ltd.

- Shandong Baoyuan Chemical Co., Ltd.

- Fuso Chemical Co., Ltd.

- Polynt Group

- Yara International ASA

- Anhui Sealong Biotechnology Co., Ltd.

- Zhejiang NHU Co., Ltd.

Segments Covered in the Report

By Product Type

- Acetic Acid

- Citric Acid

- Lactic Acid

- Formic Acid

- Propionic Acid

- Fumaric Acid

- Malic Acid

- Tartaric Acid

- Others (Succinic, Adipic, Itaconic, etc.)

By Source

- Synthetic / Petrochemical-Based

- Fermentation-Based (Bio-based)

- Natural Extraction

- Bio-based Fermentation

By End-Use Industry

- Food Processing Industry

- Chemical Manufacturing

- Animal Nutrition

- Pharmaceutical Industry

- Textile & Leather

- Bioplastics & Bio-based Materials

By Form

- Liquid

- Solid / Crystalline

- Powder / Granular

- Encapsulated / Controlled-Release

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa