Content

What is the Current Ulexite Market Size and Volume?

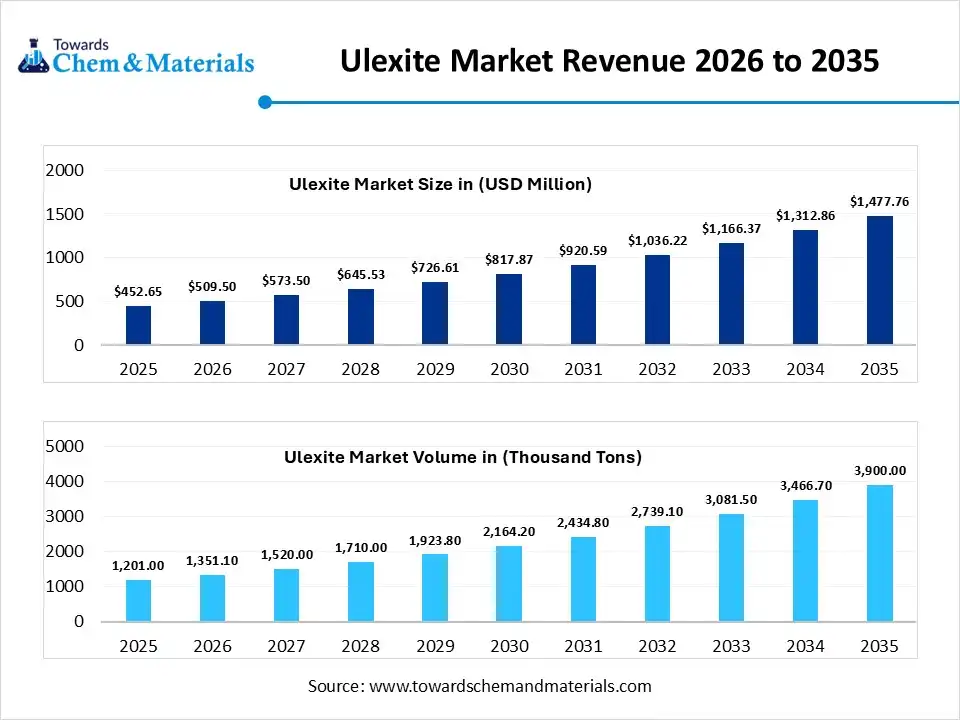

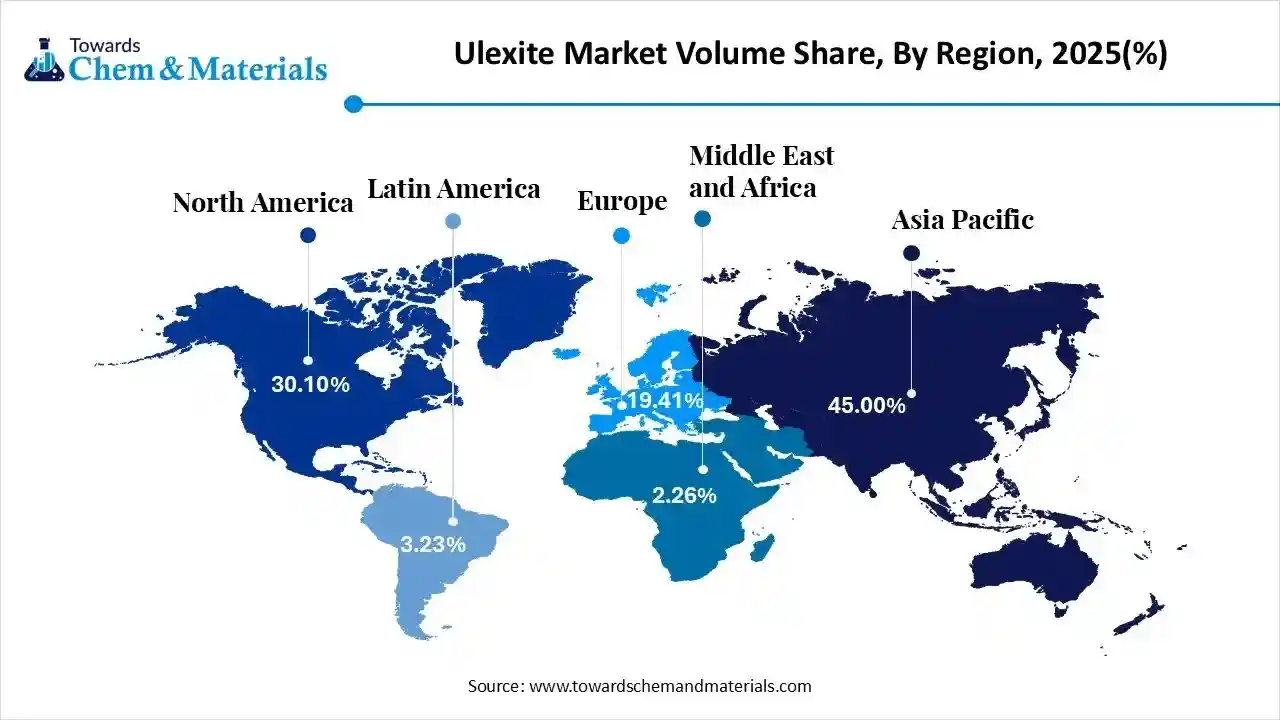

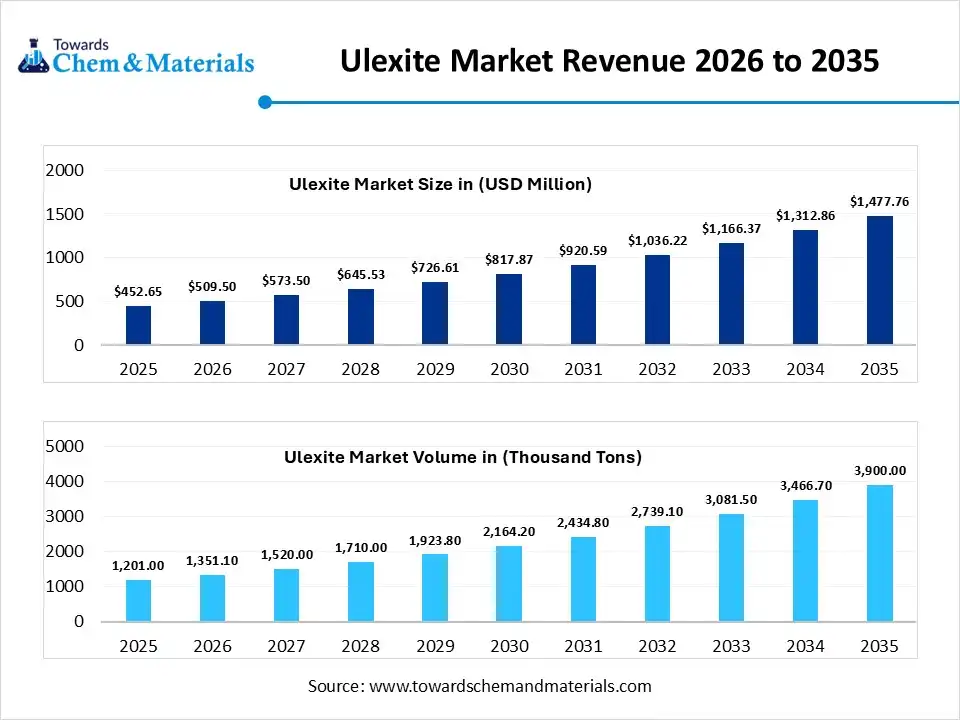

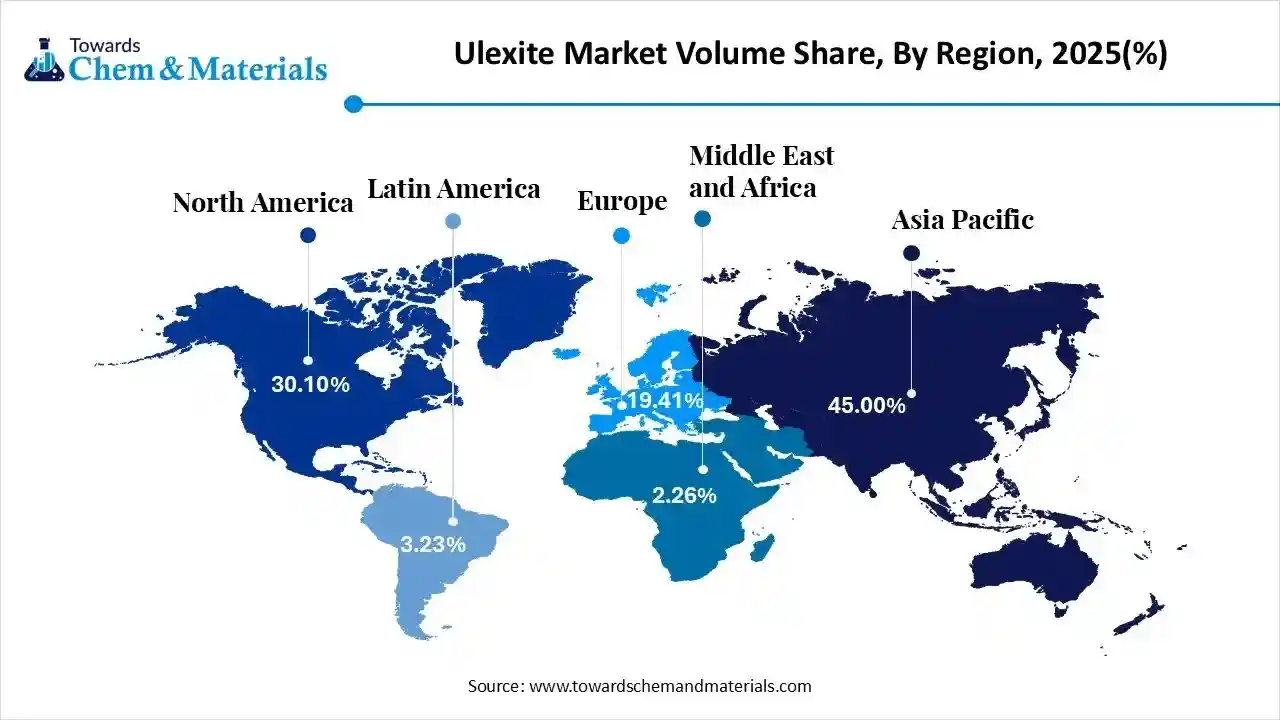

The global ulexite market size was estimated at USD 452.65 million in 2025 and is expected to increase from USD 509.50 million in 2026 to USD 1,477.76 million by 2035, growing at a CAGR of 12.56% from 2026 to 2035. In terms of volume, the market is projected to grow from 1,201.0 thousand tons in 2025 to 3,900.0 thousand tons by 2035. growing at a CAGR of 12.50% from 2026 to 2035. Asia Pacific dominated the ulexite market with the largest volume share of 45% in 2025. The growing use of specialty glass in electronic devices and the expansion of construction drive the market growth.

The ulexite or television rock is a combination of calcium borate and hydrated sodium. It is a borate mineral that consists of a fibrous structure. The chemical formula of ulexite is NaCaB5O6(OH)6.5H2O and appears in a silky white color. It consists of satiny luster and specific gravity range between 1.95 to 1.96. It is widely used in applications like ceramic glazes, fertilizers, radiation shielding, borosilicate glass, and others. The ulexite market growth is driven by the increasing use of fiberglass insulation in infrastructure, focus on enhancing soil quality, need for increasing vehicle durability, growth in utilization of borosilicate glass in labware, increasing renewable energy investment, expanding glass applications, emphasis on sustainability, and rapid industrial development.

Market Highlights

- The Asia Pacific dominated the global ulexite market with the largest volume share of 45% in 2025.

- The ulexite market in North America is expected to grow at a substantial CAGR of 13.57% from 2026 to 2035.

- The Europe ulexite market segment accounted for the major volume share of 19.41% in 2025.

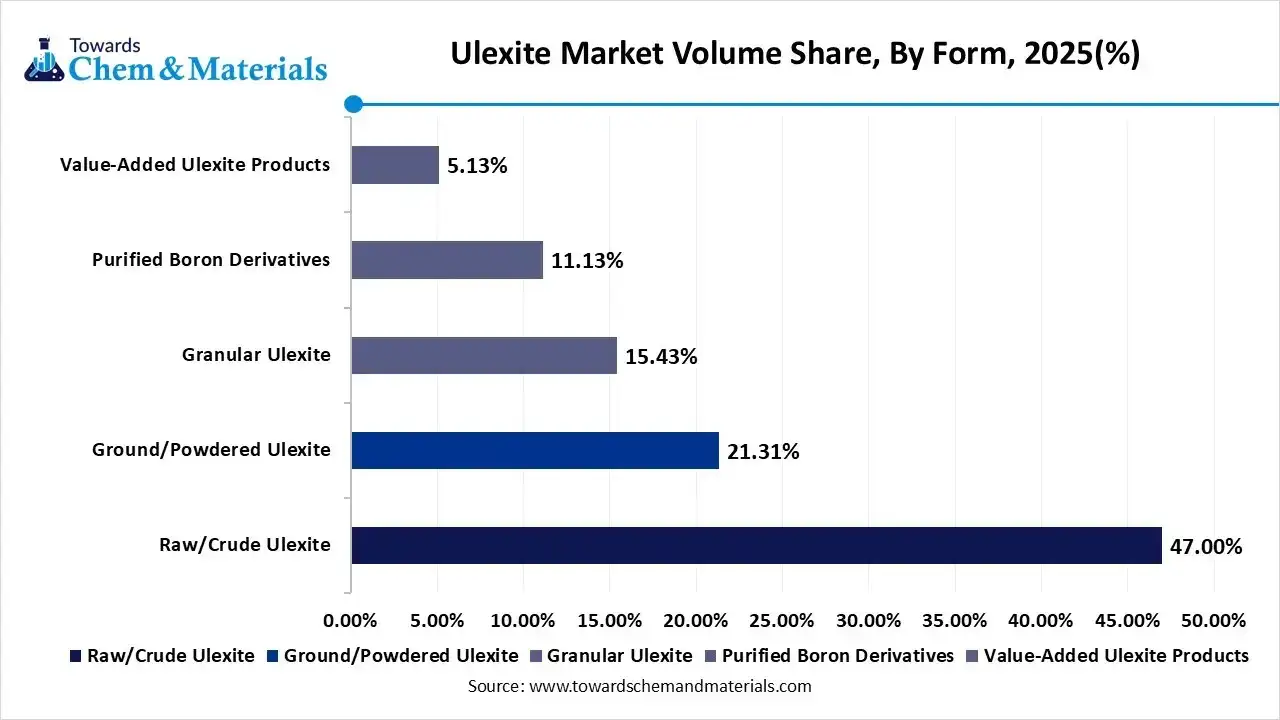

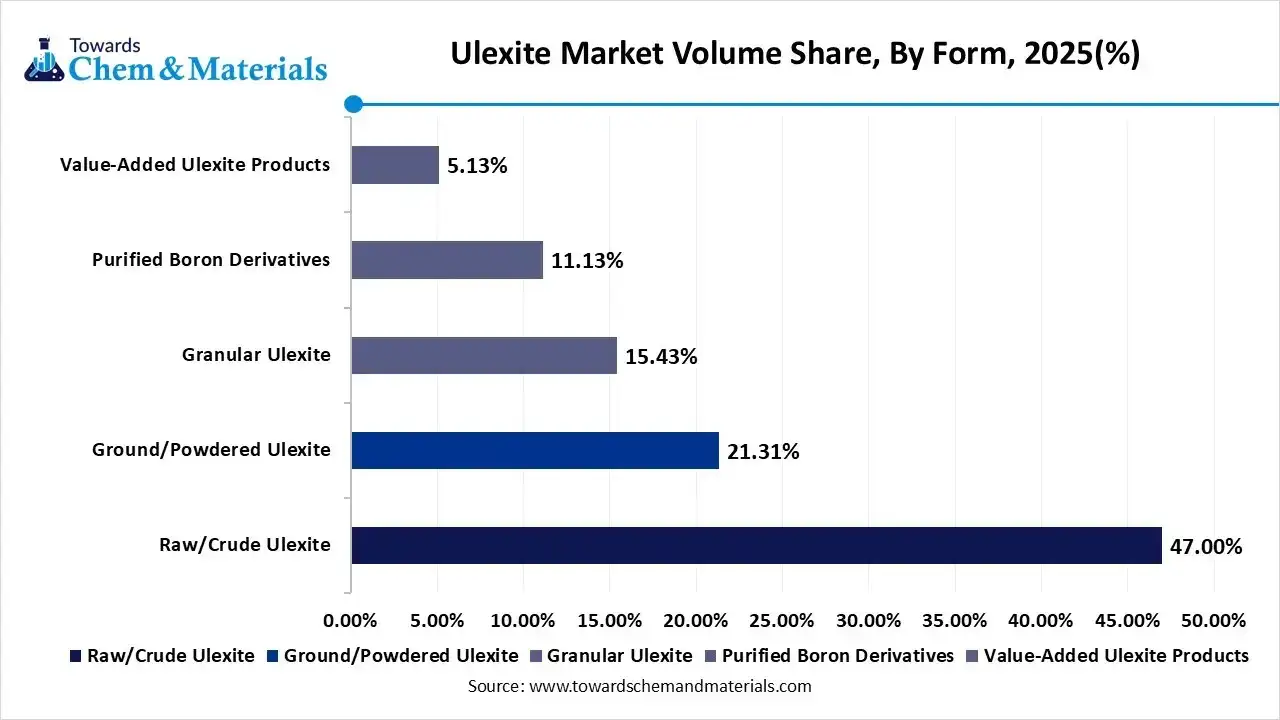

- By form, the raw or crude ulexite segment dominated the market and accounted for the largest volume share of 47% in 2025.

- By form, the ground/powdered ulexite segment is expected to grow at the fastest CAGR of 13.26% from 2026 to 2035 in terms of volume.

- By application, the glass & ceramics segment dominated the market and accounted for the largest volume share of 36% in 2025.

- By end-use industry, the construction & building segment led the market with the largest revenue volume share of 42% in 2025.

- By sales channel, the direct industrial supply segment led the market with the largest revenue volume share of 54% in 2025.

Market Trends:

- Growing Construction:- The rapid urbanization and the strong focus on using superior insulation materials in construction projects increase demand for ulexite. The growth in the development of architectural projects and increasing investment in public transport systems requires ulexite-based construction materials.

- Expanding Electronic Devices Use:- The strong companies focus on the production of smart display technology, and the increasing use of advanced electronic gadgets increases demand for ulexite to enhance thermal resistance.

- Focus on Renewable Energy:- The global transition towards renewable energy and increased production of solar panels, energy storage, and wind turbines increases demand for ulexite for energy-efficient insulation and heat resistance.

- Growth of Boron-Based Fertilizers:- The strong focus on plants' reproductive growth and increasing boron deficiency in agricultural land increases the development of boron-based fertilizers that require ulexite.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 509.50 Million / 1,351.1 Thousand Tons |

| Revenue Forecast in 2035 | USD 1,477.76 Million / 3,900.0 Thousand Tons |

| Growth Rate | CAGR 12.56% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Thousand Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Application, By End-Use Industry, By Form, By Sales Channel, By Region |

| Key companies profiled | Rio Tinto Group, ETI Maden AS, American Borate Company, Minera Santa Rita S.R.L., Orocobre Limited (Allkem), Quiborax S.A., Searles Valley Minerals Inc., Boron Specialties LLC, Industrial Tierra S.A., Groupe Roullier, 3M Company, U.S. Borax (Rio Tinto subsidiary), InCide Technologies, Inc., JSC Aviabor, Jinhui Chemical Co., Ltd., Zhengzhou DAFU Mechanical & Electrical Co., Ltd., Shandong Jinao Technology Advanced Materials Co., Ltd., Liaoning Pengda Technology Development Co., Ltd., Bisley & Company Pty Ltd, Amalgamated Metal Corporation Sdn. Bhd. |

Key Technological Shifts in the Ulexite Market:

The ulexite market is undergoing key technological shifts driven by the demand for sustainability and performance efficiency. The technological advancements, like the integration of 3D printing, data analytics, green chemistry, and advanced mineral processing, enable the development of high-purity ulexite and increase efficiency. The major change is that the integration of artificial intelligence (AI) increases operational efficiency and optimizes processes.

AI supports in optimizing ore extraction processes and easily identifies impurities in ulexite. AI manages inventory and lowers the environmental impact of ulexite. AI easily classifies diverse grades of ulexite products and monitors performance in real-time. AI lowers extraction effects and automates the analysis process. AI easily discovers new ulexite materials and manufactures high-purity products. Overall, AI is an intelligent process for manufacturing ulexite that manages risk and improves efficiency.

Trade Analysis of Ulexite Market: Import & Export Statistics

- Turkey exported 573 shipments of ulexite.

- Brazil imported 983 shipments of ulexite.

- From May 2024 to April 2025, the United States imported 75 shipments of ulexite.

- The United States exported 14,028 shipments of boron oxide.

- Bolivia exported 1,454 shipments of ulexite.

Market Value Chain Analysis

- Feedstock Procurement: This stage focuses on sourcing raw materials like oxygen, sodium, boron, hydrogen, and calcium.

- Key Players:- Rio Tinto Group, Searles Valley Minerals, Eti Maden, Bisley & Company, Quiborax SA, American Borate Company

- Chemical Synthesis and Processing: The stage performs processes like characterization, milling, grinding, calcination of ulexite, leaching, separation of products, and purification.

- Key Players:- Minera Santa Rita, Quiborax, Eti Maden, American Borate Company, Bisley & Company

- Quality Testing and Certifications: The quality testing measures properties like impurity levels, chemical composition, particle hardness, density, B2O3 content, particle size, solubility, and water content. The certifications, like IEC 17025, ISO 9001, OSHA, ASTM, and REACH, are needed for ulexite.

- Key Players:- Intertek, Cotecna, SGS, Eurofins, Bureau Veritas

Ulexite Applications Across Modern Industries

| Industry | Product | Application |

| Agriculture |

|

|

| Electronics |

|

|

| Glass |

|

|

| Construction |

|

|

Segmental Insights

Form Insights

How Raw or Crude Ulexite Segment Dominated the Ulexite Market?

The raw or crude ulexite segment volume was valued at 564.5 thousand tons in 2025 and is projected to reach 1,763.2 thousand tons by 2035, expanding at a CAGR of 13.49% during the forecast period from 2025 to 2035. The raw or crude ulexite segment dominated the ulexite market with approximately 47% share in 2025. The increasing use of boron-based fertilizers and the higher production of standard ceramics require raw or crude ulexite. The expanding fiberglass insulation and the growing industrial applications require raw or crude ulexite. The ease of use and cost-effective processing of raw ulexite drive the overall market growth.

The ground/powdered ulexite segment volume was valued at 255.9 thousand tons in 2025 and is expected to surpass around 785.1 thousand tons by 2035, and it is anticipated to expand to 13.26% of CAGR during 2026 to 2035. The strong focus on enhancing plant health and the increased production of high-tech glass require value-added ulexite products. The development of fire-resistant materials and the increasing use of detergents require value-added ulexite products. The production of lightweight automotive parts and the increasing use of synergistic components support the overall market growth.

Ulexite Market Volume and Share, By Form, 2025-2035

| By Form | Market Volume Share (%), 2025 | Market Volume (Thousand Tons)2025 | Market Volume (Thousand Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Raw/Crude Ulexite | 47.00% | 564.5 | 1,763.2 | 13.49% | 45.21% |

| Ground/Powdered Ulexite | 21.31% | 255.9 | 785.1 | 13.26% | 20.13% |

| Granular Ulexite | 15.43% | 185.3 | 640.0 | 14.76% | 16.41% |

| Purified Boron Derivatives | 11.13% | 133.7 | 459.4 | 14.70% | 11.78% |

| Value-Added Ulexite Products | 5.13% | 61.6 | 252.3 | 16.96% | 6.47% |

Application Insights

Which Application Segment Dominates the Ulexite Market?

The glass and ceramics segment expanding at a CAGR of 36% during the forecast period from 2025 to 2035. The growing production of abrasion-resistant screens and the higher utilization of solar panels increase demand for glass. The development of construction projects and increased manufacturing of electronic components requires glass & ceramics. The superior dielectric performance, high thermal resistance, and enhanced durability of glass & ceramics drive the overall market growth.

The agriculture segment is significantly growing in the market. The lack of boron in soil and the growing demand for food require ulexite. The strong focus on enhancing the nutrient utilization of soil and the adoption of modern farming practices requires ulexite. The intensive farming practices and the growing expansion of precision agriculture practices increase demand for ulexite, supporting the overall market growth.

End-Use Industry Insights

Why did the Construction & Building Segment hold the Largest Share in the Ulexite Market?

The construction & building segment held the largest revenue share of approximately 42% in the market in 2025. The major development of infrastructure projects and the stringent building codes increases the adoption of ulexite. The strong emphasis on green construction standards and the development of architectural building elements requires ulexite. The development of long-lasting construction and the adoption of energy-efficient windows increase demand for ulexite, driving the overall market growth.

The specialty chemical applications segment is experiencing the fastest growth in the market during the forecast period. The growing utilization of fiberglass and the focus on enhancing clean power increase demand for ulexite. The increased production of detergents and the growth in utilization of boron chemicals require ulexite. The emphasis on metal hardening and the focus on enhancing finish require ulexite, supporting the overall market growth.

Sales Channel Insights

How did the Direct Industrial Supply Segment hold the Largest Share in the Ulexite Market?

The direct industrial supply segment held the largest revenue share of approximately 54% in the ulexite market in 2025. The increasing need for high-quality products and the focus on consistent production increase demand for direct industrial supply. The growing bulk purchasing and the focus on optimizing logistics require direct industrial supply. The technical collaboration and the assured product quality of direct industrial supply drive the overall market growth.

The specialty industrial retail segment is experiencing the fastest growth in the market during the forecast period. The increased development of wind turbine blades and the growth in precision agriculture increase demand for specialty industrial retail. The availability of technical expertise and the availability of reliable distribution networks in specialty industrial retail support the overall market growth.

Regional Insights

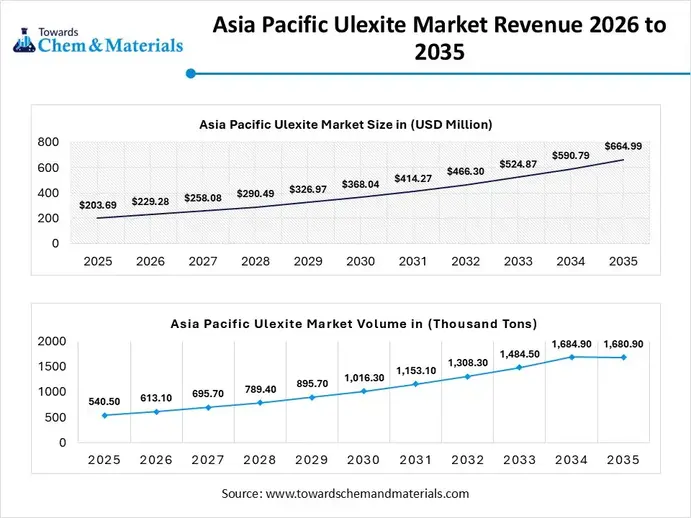

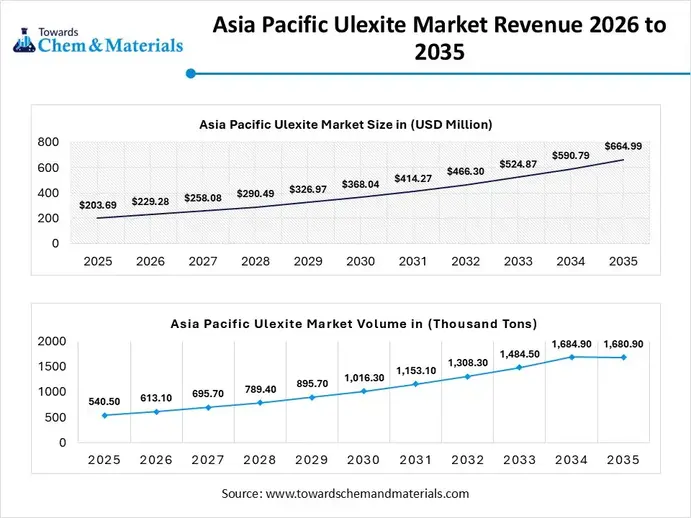

The Asia Pacific ulexite market size was valued at USD 203.69 million in 2025 and is expected to be worth around USD 664.99 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 12.57% over the forecast period from 2026 to 2035.

The Asia Pacific ulexite market volume was estimated at 540.5 thousand tons in 2025 and is projected to reach 1,680.90 thousand tons by 2035, growing at a CAGR of 3.90% from 2026 to 2035. Asia Pacific dominated the market with approximately 45% share in 2025. The increased manufacturing of high-performance semiconductor substrates and the presence of a vast agricultural base increase demand for ulexite. The growth in infrastructure project development and the increasing use of solar panels increases demand for ulexite. The increased consumption of consumer goods and the growing production of optical lenses require ulexite, driving the overall market growth.

From Mineral to Material: China’s Footprint in Ulexite

China is a major contributor to the market. The increasing use of energy-efficient building materials and the production of micronutrient fertilizers increase demand for ulexite. The expanding ceramics sector and the rapid growth in industrial activities require ulexite. The supportive government policies for the consumption of ulexite and the strong presence of domestic reserves support the overall market growth.

China exported 32 shipments of ulexite.

North America Ulexite Market Trends

North America ulexite market volume was estimated at 361.5 thousand tons in 2025 and is projected to reach 1,136.1 thousand tons by 2035, growing at a CAGR of 13.57% from 2026 to 2035. North America dominated the market with approximately 30.10% share in 2025. North America is growing at a notable rate in the market. The increasing awareness about sustainable farming practices and the rising use of fiberglass insulation require ulexite. The strong presence of a high-technological base and the expansion of renewables increase demand for ulexite. The growth in utilization of boron-enriched fertilizers and the presence of green building standards require ulexite, driving the overall market growth.

Industrial Growth Powers Boron Expansion in the United States

The United States is growing rapidly in the market. The growing construction of non-residential buildings and the increasing use of advanced glass create demand for ulexite. The strong focus on improving soil health and the government's focus on securing critical minerals increase demand for ulexite. The development of energy storage systems and the consumer focus on advanced displays increase demand for ulexite, supporting the overall market growth.

Ulexite Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Thousand Tons)2025 | Market Volume (Thousand Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 30.10% | 361.5 | 1,136.1 | 13.57% | 29.13% |

| Europe | 19.41% | 233.1 | 785.1 | 14.44% | 20.13% |

| Asia Pacific | 45.00% | 540.5 | 1,680.9 | 13.44% | 43.10% |

| Latin America | 3.23% | 38.8 | 156.5 | 16.76% | 4.01% |

| Middle East & Africa | 2.26% | 27.1 | 141.5 | 20.14% | 3.63% |

Europe Ulexite Market Trends

Europe ulexite market volume was estimated at 233.1 thousand tons in 2025 and is projected to reach 785.1 thousand tons by 2035, growing at a CAGR of 14.44% from 2026 to 2035. Europe is growing substantially in the market. The growing demand for industrial ceramics and the increased manufacturing of borosilicate glass increases demand for ulexite. The increasing focus on micronutrient management and the growing utilization of high-performance construction materials require ulexite. The expanding solar panel manufacturing and the increasing need for advanced materials require ulexite, driving the overall market growth.

Sustainable Farming Booms Production of Ulexite in France

France is growing significantly in the market. The growing production of energy-efficient borosilicate and the increasing adoption of sustainable farming practices require ulexite. The shift towards energy-efficient buildings and the growing consumption of high-value crops increases demand for ulexite. The strong manufacturing base supports the overall market growth.

Latin America Ulexite Market Trends

Latin America ulexite market volume was estimated at 38.8 thousand tons in 2025 and is projected to reach 156.5 thousand tons by 2035, growing at a CAGR of 16.76% from 2026 to 2035. Latin America is experiencing the fastest growth in the market during the forecast period. The presence of boron-deficient soil and intensive farming activities creates demand for ulexite. The well-established automotive industry and the focus on enhancing the thermal resistance of electronic products increase demand for ulexite. The higher demand for advanced ceramics and the abundance of natural resources increase the production of ulexite, driving the overall growth of the market.

Construction Activities Surge Boron Demand in Brazil

Brazil is a key contributor to the market. The increased production of high-value crops and the increased percentage of boron-deficient soils increase demand for ulexite. The growing construction activities and the increased production of wind turbines require ulexite. The strong focus on maximizing crop yield increases demand for ulexite for fertilizer production, supporting the overall growth of the market.

Middle East & Africa Ulexite Market Trends

The Middle East & Africa ulexite market volume was estimated at 27.1 thousand tons in 2025 and is projected to reach 141.5 thousand tons by 2035, growing at a CAGR of 20.14% from 2026 to 2035. The Middle East & Africa are growing in the market. The increasing need for heat-resistant construction materials and the growing development of large-scale projects increase demand for ulexite. The rising boron deficiency in soil and the strong presence of untapped mineral reserves increase the production of ulexite. The presence of advanced mining technology and the growing demand for value-added ulexite products drive the overall market growth.

Rise of Boron in the United Arab Emirates

The United Arab Emirates is substantially growing in the market. The booming construction activities and growing need for superior insulation increase demand for ulexite. The increased modernization of electronics and the emphasis on improving soil health create demand for ulexite. The rapid growth in the production of borosilicate glass supports the overall market growth.

Recent Developments

- In November 2025, 5E Advanced Materials announced an increase of total indicated and measured borate resources by 61% for the Fort Cady Project. The upgraded capacity of indicated and measured borate is 28.3M tons. The upgrade capacity of measured boric acid is 9.1M tons.(Source: www.pekintimes.com)

- In November 2025, Rio Tinto plans to sell boron assets in California, U.S. The sale focuses on simplifying operations and boron used across applications like glass manufacturing, fiberglass insulation, fertilizer production, & ceramics manufacturing.(Source: www.mining.com)

Market Top Companies

- Rio Tinto Group:- The mining and metals company produces boron-based minerals like kernite, colemanite, tincal, and ulexite to serve diverse industrial applications.

- ETI Maden AS:- The Turkish company supplies and processes ulexite and its products for manufacturing products like agricultural fertilizer, glass, insulation, and ceramics.

- American Borate Company:- The company processes and supplies diverse grades of ulexite to serve applications like fiberglass, detergents, agriculture, and ceramics.

- Minera Santa Rita S.R.L.:- The Argentine company extracts ulexite to manufacture products like Aquabor, boric acid, Aquabor 2, and granulated ulexite products.

- Orocobre Limited (Allkem)

- Quiborax S.A.

- Searles Valley Minerals Inc.

- Boron Specialties LLC

- Industrial Tierra S.A.

- Groupe Roullier

- 3M Company

- U.S. Borax (Rio Tinto subsidiary)

- InCide Technologies, Inc.

- JSC Aviabor

- Jinhui Chemical Co., Ltd.

- Zhengzhou DAFU Mechanical & Electrical Co., Ltd.

- Shandong Jinao Technology Advanced Materials Co., Ltd.

- Liaoning Pengda Technology Development Co., Ltd.

- Bisley & Company Pty Ltd

- Amalgamated Metal Corporation Sdn. Bhd.

Segments Covered

By Application

- Glass & Ceramics

- Agriculture (Fertilizers & Boron Micronutrients)

- Fiberglass & Insulation

- Detergents & Cleaning Chemicals

- Cosmetics & Personal Care

- Others

By End-Use Industry

- Construction & Building

- Industrial Manufacturing

- Agriculture

- Automotive

- Electronics & Electrical

- Specialty Chemical Applications

By Form

- Raw/Crude Ulexite

- Ground/Powdered Ulexite

- Granular Ulexite

- Purified Boron Derivatives

- Value-Added Ulexite Products

By Sales Channel

- Direct Industrial Supply

- Distributors & Traders

- E-Commerce/Online Industrial Marketplaces

- Specialty Industrial Retail

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa