Content

What is the Europe green chemicals Market Size ?

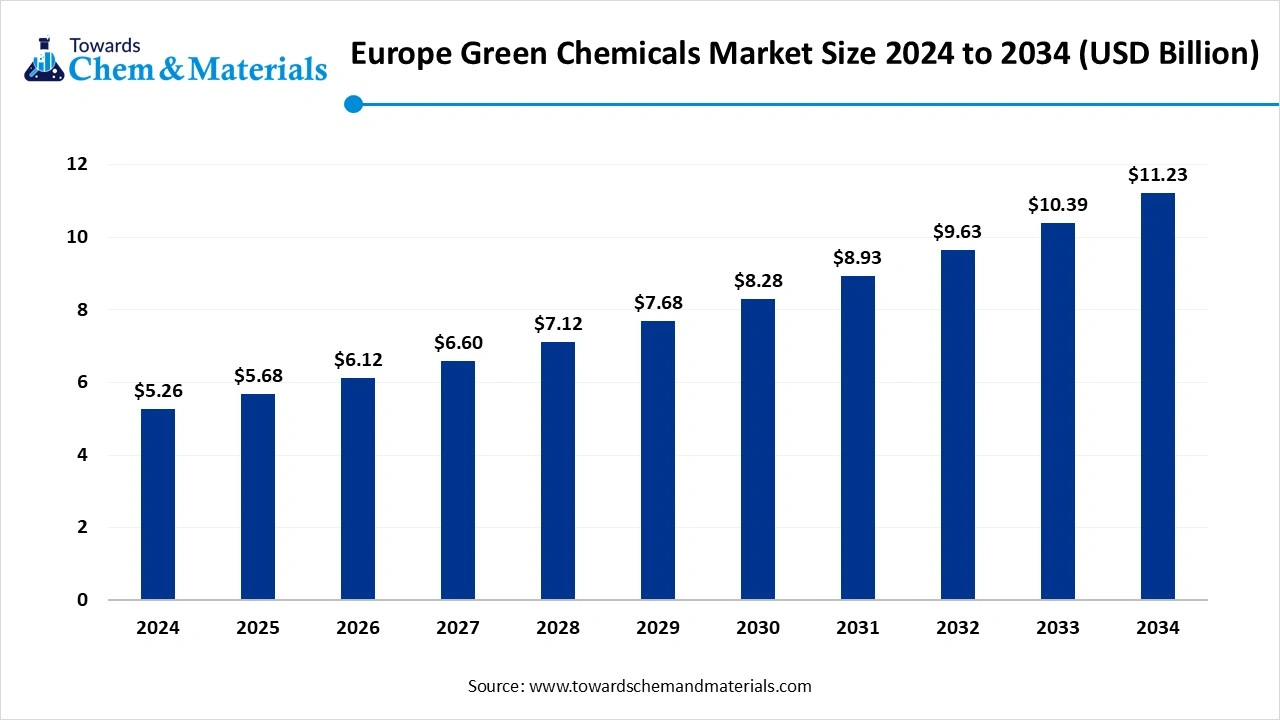

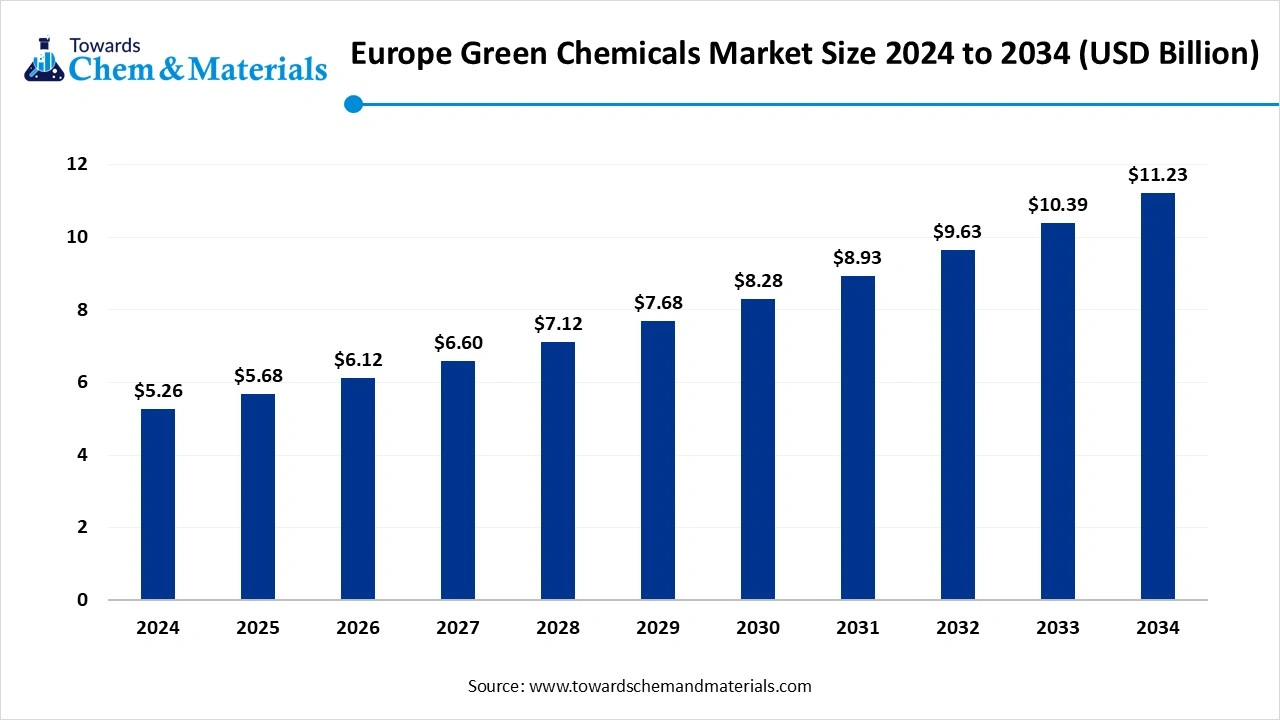

The Europe green chemicals market size is accounted for USD 5.68 billion in 2025 and is anticipated to hit around USD 11.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.88% over the forecast period from 2025 to 2034. Global shift towards non-toxic chemicals is set to enable high-return ventures for manufacturers in the coming years.

Key Takeaways

- By product type, the biobased polymers segment led the Europe green chemicals market with 40% industry share in 2024.

- By product type, the bio-based solvents segment is expected to grow at the fastest rate in the market during the forecast period.

- By application, the packaging & plastics segment emerged as the top-performing segment in the market with 35% of the industry share in 2024.

- By application, the agriculture and fertilizers segment is expected to lead the market in the coming years.

- By production process, the fermentation segment led the market with a 45% share in 2024.

- By production process, the biorefining segment is expected to capture the biggest portion of the market in the coming years.

- By feedstock, the sugar & starch-based segment led the market with 40% industry share in 2024.

- By feedstock, the waste and residue-based segment is expected to grow at the fastest rate in the market during the forecast period.

- By form, the liquid segment led the market with 50% industry share in 2024.

- By form, the powders/granules segment is expected to grow at the fastest rate in the market during the forecast period.

What is Green Chemical?

The chemical, which is derived by applying an eco-friendly process with sustainable raw materials called the green chemical. In the production of these chemicals, materials like plants, algae, and waste material play a major role. Moreover, the global shift towards environmental safety, green chemicals is likely to gain major industry share in the coming years.

Europe Green Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the European chemical industry has actively reduced its reliance on petroleum-based production in recent years. Also, factors like greater government support and carbon footprint minimization awareness have provided wide attention to the market in the past few years.

- Sustainability Trends: The industry’s aim towards carbon neutrality has been majorly supporting capital growth and economic activity in the sector in recent years. Also, the major manufacturers are seen under the heavy investment in research and development programs while establishing partnerships with waste management companies.

- Global Expansion: The European green chemical manufacturer is observed in the middle of technology export to Asia and the North American region in recent years. Furthermore, the industry is slowly growing as self-dependent, but in the years to come, the industry will need major imports across global as per the recent market observation.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.12 Billion |

| Expected Size by 2034 | USD 11.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.88% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application, By Production Process, By Feedstock, By Form |

| Key Companies Profiled | AkzoNobel, Clariant , Green Oleo , Greenchemicals , Novamont , Corbion , Borregaard , EnginZyme AB |

Key Technological Shifts in the Europe Green Chemicals Market:

The European green chemical industry is observing a greater technology shift towards CO2 utilization and electrochemical synthesis, as per the recent information. Also, digital tools and artificial intelligence are gaining increased attention in the manufacturing sectors, and manufacturers are focusing on cost-effectiveness and rapid production in recent years.

Trade Analysis of the Europe Green Chemicals Market: Import & Export Statistics

- Germany exported a large amount of organic chemicals in 2024, worth US$27.92 billion. (Source: tradingeconomics.com)

- The United Kingdom has exported a large amount of chemical liquids all over the world from 2023 to 2024, with 88 shipments. (Source: www.volza.com)

Valus Chain Analysis of the Europe Green Chemicals Market

- Distribution to Industrial Users : Majorly distributors in Europe green chemicals are providing the chemicals to the major chemical manufacturers in recent years.

- Key Players: Evonik, Solvay, BASF, and Azelis

- Chemical Synthesis and Processing : The chemical synthesis and the processing of the green chemicals in Europe include major steps such as carbon capture, biocatalysis, and sustainable feedstock management.

- Regulatory Compliance and Safety Monitoring : The safety and regulatory process of green chemicals in Europe is primarily handled by the European Chemicals Agency, which is under the European Green Deal as per the recent report.

Europe Green Chemicals Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| European Union | European Chemicals Agency (ECHA) | Section 8 (Restriction) | "Safe and sustainable by design" chemicals | ECHA manages the technical and administrative aspects of the implementation of the REACH Regulation. |

Segmental Insights

Product Type Insights

How did the Biobased Polymer Segment Dominate the Europe green chemicals market in 2024?

The bio-based polymer segment held a 40% share of the market in 2024, due to the increasing demand from the major sectors like packaging, consumer goods, and textiles in recent years. Furthermore, the major manufacturers in Europe are seen as demanding bio-based polymers such as PHA and PLA in the current period. Also, reducing fossil fuel dependency while meeting strict sustainability regulations, the biobased polymer segment has gained industry attention.

The bio-based solvents segment is expected to grow at a notable rate during the predicted timeframe, owing to the emerging stricter green regulations and industrial decarbonization in Europe. Furthermore, these solvents are actively seen in replacing the organic compounds like paints & coatings, and cleaning agents in Europe. Also, initiatives like research on enzyme-based solvent production will drive segment dominance in the coming years.

Application Insights

Why does the Packaging Segment Dominate the Europe Green Chemicals Market by Application?

The packaging and plastics segment held 35% of the Europe green chemicals market in 2024 as brands and consumers increasingly demanded eco-friendly alternatives to single-use packaging. Major food and beverage companies have committed to fully recyclable or biodegradable packaging under EU waste directives. Bio-based polymers and coatings provide high strength and flexibility while ensuring compostability.

The agriculture & fertilizers segment is expected to grow at a notable rate due to Europe's growing emphasis on sustainable farming and soil health restoration. With rising restrictions on synthetic agrochemicals, bio-based fertilizers and crop enhancers are gaining traction. These green inputs improve soil fertility and reduce environmental damage, aligning with the EU's Farm to Fork strategy.

Production Process Insights

How did the Fermentation Segment dominate the Europe Green Chemicals market in 2024?

The fermentation segment dominated the market with a 45% share in 2024, because it is one of the most established and scalable methods to produce green chemicals. Using microbes to convert renewable feedstocks into alcohols, acids, and polymers ensures high efficiency and low environmental impact. European chemical producers have invested heavily in fermentation-based biorefineries to produce bioplastics and green solvents.

The bio-refining segment is expected to grow at a significant rate as Europe moves toward integrated, zero-waste chemical manufacturing. Unlike single-product fermentation, bio-refineries produce multiple outputs-fuels, polymers, and specialty chemicals-from one biomass source. This multi-stream efficiency supports circular economy goals and carbon neutrality targets.

Feedstock Insights

Why does the Sugar and Starch-Based Segment Dominate the Europe Green Chemicals Market?

The sugar and starch-based segment held 40% of the Europe green chemicals market in 2024 due to their abundance, established processing infrastructure, and ease of fermentation. Crops like corn, wheat, and sugar beet are widely cultivated across Europe, providing a stable and low-cost source of carbohydrates for biopolymer and biofuel production.

The waste & residue-based segment is expected to grow at a notable rate as Europe prioritizes circular economy models and resource efficiency. Using agricultural waste, food residues, and forestry by-products as raw materials reduces landfill pressure and lowers carbon emissions. Governments are encouraging industries to valorize waste into high-value chemicals instead of relying on food crops.

From Insights

How did the Liquid Segment dominate the Europe Green Chemicals market in 2024?

The liquid segment dominated the market with a 50% share in 2024, because most green chemicals-such as biofuels, solvents, and industrial intermediates produced and consumed in liquid form. Liquids are easier to process, transport, and mix in chemical applications. Industries like coatings, pharmaceuticals, and packaging rely heavily on liquid-based formulations.

The powder and granule segment is expected to grow at a significant rate as industries seek stable, lightweight, and easily transportable green chemical alternatives. These forms have better shelf life and allow precise doses in industries like fertilizers, plastics, and pharmaceuticals.

Country Insights

Germany Green Chemicals Market Trends

What Makes Germany the Powerhouse of Green Chemical Innovation?

Germany dominated the Europe green chemicals market in 2024, owing to factors like advanced R&D facilities and a greater chemical manufacturing base. The regional government is actively seen in pushing decarbonization initiatives, where the major brands are rapidly switching towards green manufacturing. Also, the manufacturers are heavily investing in R&D development programs to enhance chemical production.

United Kingdom Green Chemicals Market Trends

Can Carbon Tech Propel the United Kingdom to the Forefront of Green Manufacturing?

The United Kingdom is expected to capture a major share of the Europe green chemicals market, akin to its heavy funding for the bio innovation startups in recent years. Also, the major manufacturers are heavily adopting carbon capture technologies while promoting these on websites and social media platforms in the United Kingdom.

Country-level Investments & Funding Trends for the Europe Green Chemical Industry:

- Germany has observed in sophisticated investment towards clean technologies, which is worth USD 89.12 billion according to reports.(Source: zerocarbon-analytics.org)

- The United Kingdom invested £9.8 billion in the research and development program for the chemical industry in 2023, as per the published report.(Source: cefic.org)

Recent Developments

- In March 2025, the startup called C1 Green Chemicals raised heavy funding for their replacement of fossil fuel initiatives and funds worth $22 million, as per the report published by the company recently.(Source: www.esgtoday.com)

Top Vendors in the Europe Green Chemicals Market & Their Offerings:

- BASF SE (Germany): A global leader in the green chemical market, known for its commitment to sustainable practices.

- Arkema (France): Offers a wide range of sustainable materials and is known for its strong focus on research and development.

- Evonik Industries (Germany): Specializes in high-performance materials and sustainable chemical solutions.

- Solvay (Belgium): A leading player in key areas of chemistry, focusing on developing innovative and sustainable solutions, including those for hydrogen peroxide production.

Other Key Players

- AkzoNobel

- Clariant

- Green Oleo

- Greenchemicals

- Novamont

- Corbion

- Borregaard

- EnginZyme AB

Segments Covered in the Report

By Product Type

- Bio-based Polymers

- Bio-polyethylene

- Bio-PET

- Bio-Polyamides

- Bio-based Solvents

- Ethyl Lactate

- Bioethanol

- Bio-butanol

- Bio-based Surfactants

- Anionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

- Bio-based Intermediates & Specialty Chemicals

- Organic Acids

- Amino Acids

- Enzymes

- Glycerol

By Application

- Packaging & Plastics

- Personal Care & Cosmetics

- Pharmaceuticals & Healthcare

- Agriculture & Fertilizers

- Paints & Coatings

- Textile & Fibers

- Food & Beverages

By Production Process

- Bio-refining

- Enzymatic/Biocatalysis

- Fermentation

- Catalytic Conversion

By Feedstock

- Sugar & Starch-Based

- Vegetable Oil-Based

- Lignocellulosic Biomass

- Algae-Based

- Waste & Residue-Based

By Form

- Liquid

- Powder/Granules

- Pellets