Content

What is the Green Chemicals Market Size ?

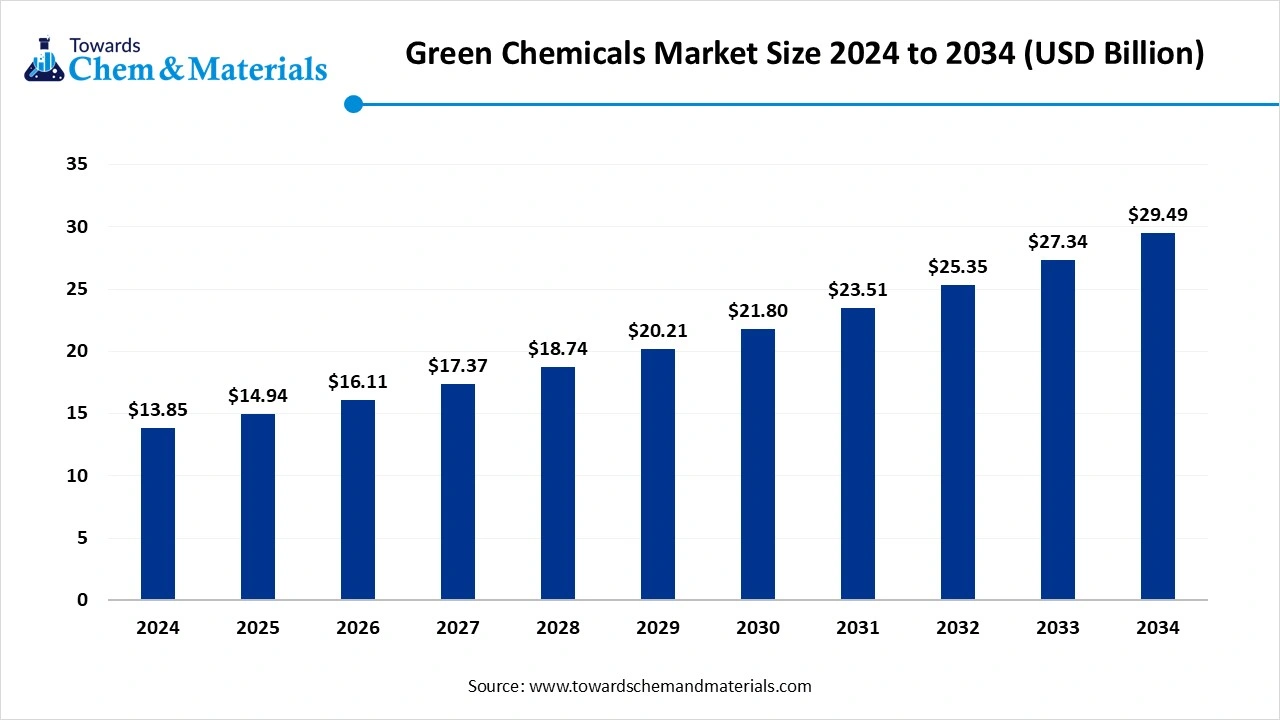

The global green chemicals market size was estimated at USD 14.94 billion in 2025 and is predicted to increase from USD 16.11 billion in 2026 to approximately USD 29.49 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034. The growing demand for eco-friendly products and stricter government regulations drive the market growth.

Key Takeaways

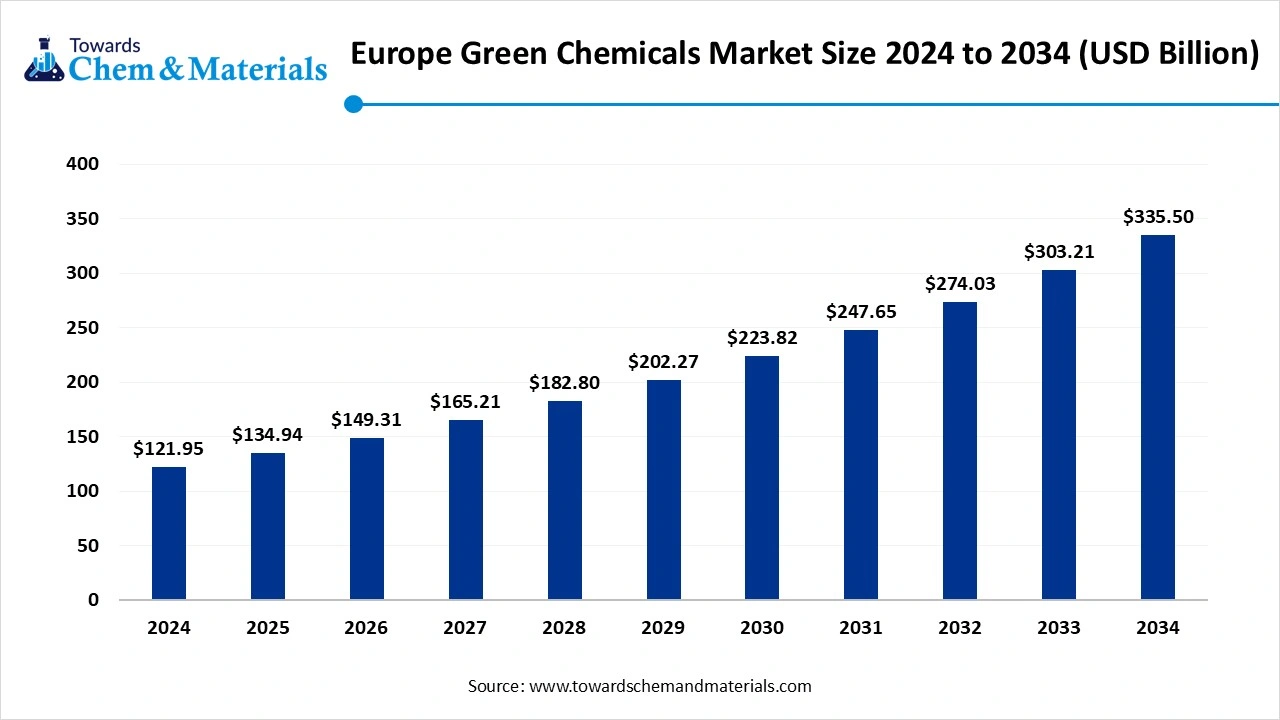

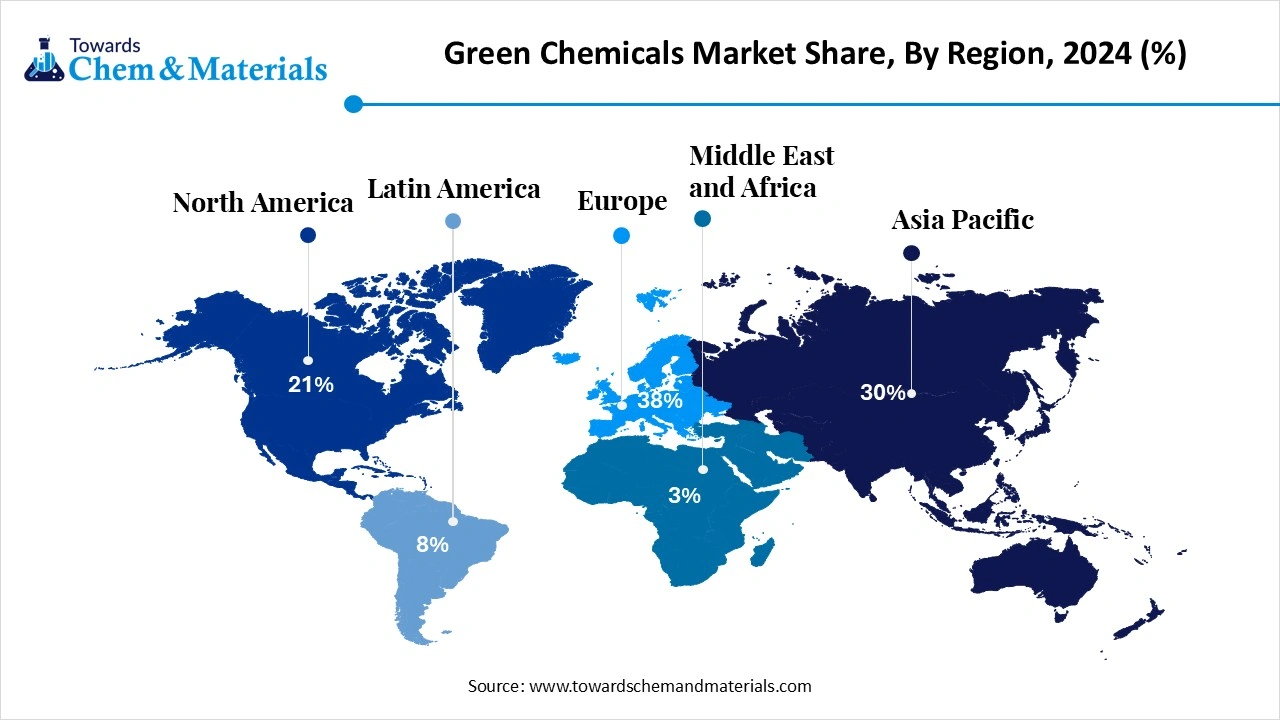

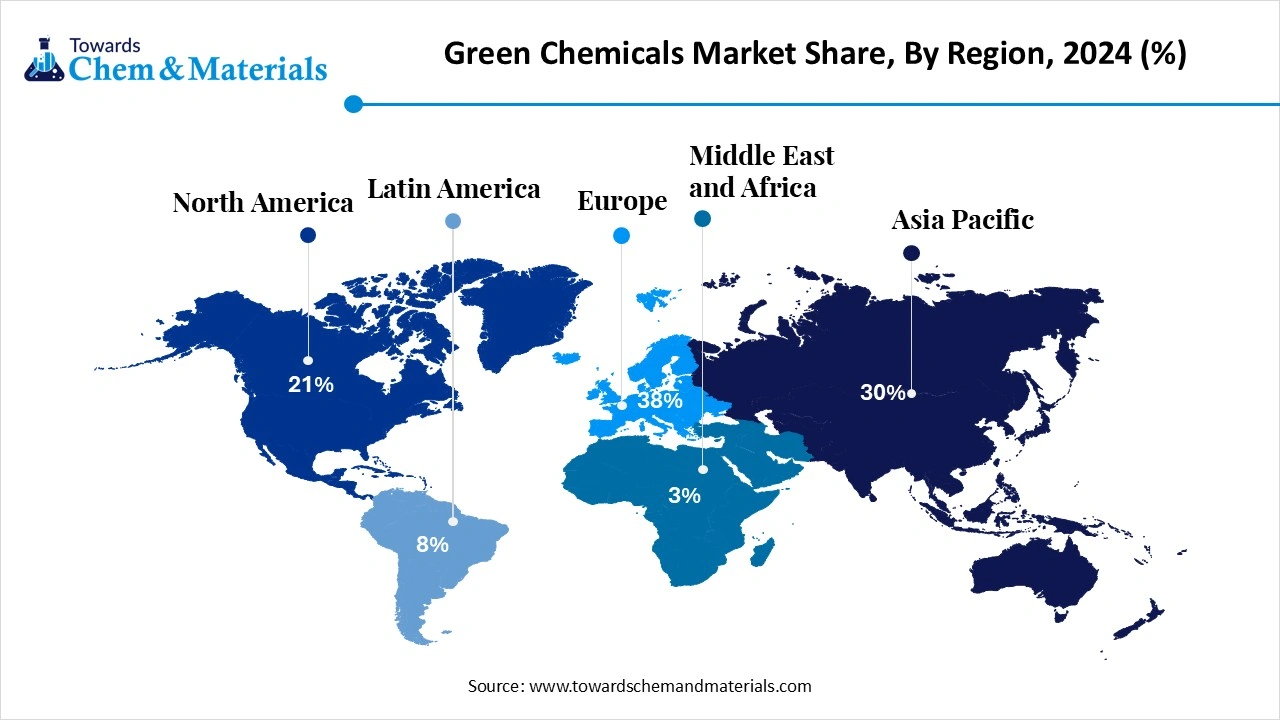

- The Europe green chemicals market held the largest share of 38% of the global market in 2024.

- By product category, the bio-based polymers & resins segment held the highest market share of 32% in 2024.

- By feedstock source, the first-generation sugars/oils segment held the highest market share of 41% in 2024.

- By process technology, the fermentation & biocatalysis segment held the largest revenue share of 47% in 2024.

- By functional class, the polymers & resins segment held the largest market share of 36% in 2024.

- By application, the packaging segment held the highest market share of 44% in 2024.

What are Green Chemicals and their Uses?

The green chemicals market growth is driven by growing environmental issues, corporate sustainability goals, depletion of non-renewable resources, increasing need for bio-polymers, development of green solvents, and increasing consumer demand for sustainable products.

Green chemicals is a process of manufacturing chemical products using green chemistry principles to minimize the generation of hazardous substances. The characteristics of green chemicals are energy efficiency, minimizing toxicity, preventing pollution, and preventing long-term environmental harm. The uses of green chemicals are manufacturing cleaning products, creating biofertilizers, developing renewable energy sources, and creating sustainable packaging solutions.

Green Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expanding in high-margin niches such as automotive, packaging, construction, and agriculture. Growth is driven by stringent emission control regulations, a ban on plastic use, and a rise in the number of eco-conscious consumers, particularly in Europe & Asia Pacific region.

- Sustainability Trends: Sustainability is reshaping the green chemicals industry, with a rise in the use of plant-based materials, development of biodegradable polymers, and production of green solvents. For instance, Holiferm company upgraded its traditional fermentation processes to manufacture bio-based surfactants.

- Global Expansion: Leading players are expanding globally to align with corporate & consumer demand for sustainable products and government regulations, particularly in North America, Asia Pacific, & Europe. For instance, Birla Carbon plans to expand of green manufacturing plants in Thailand & India to manufacture sustainable carbon black.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 16.11 Billion |

| Expected Size by 2034 | USD 29.49 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Product Category, By Feedstock Source, By Process Technology, By Functional Class, By Application / End-Use, By Region |

| Key Companies Profiled | Avantium, LanzaTech, BASF, Evonik, Croda, Genomatica, Danimer Scientific, RWDC Industries, UPM Biochemicals, Neste |

Key Technological Shifts in the Green Chemicals Market:

The green chemicals market is undergoing key technological shifts driven by the strong focus on waste management, optimizing manufacturing processes, and regulatory compliance. The major technological advancement in the market is the adoption of Artificial Intelligence (AI). It helps in process optimization, enhancing manufacturing efficiency, and predicting toxicity.

AI focuses on minimizing greenhouse gas emissions, generating less waste, and automating the chemical synthesis process. It predicts reaction outcomes and discovers new materials. AI accelerates the research process and helps in making complex decisions. For instance, Mitsui Chemicals collaborated with IBM to use AI for the faster discovery of new products.

Trade Analysis of Green Chemicals Market: Import & Export Statistics

- The United States exported 8,265 shipments of biopolymer.(Source: www.volza.com)

- China exported 588 shipments of biodegradable resin.(Source: www.volza.com)

- The United States exported 10,524 shipments of organic acid.(Source: www.volza.com)

- Germany exported 111 shipments of biodiesel.(Source: www.volza.com)

Green Chemicals Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement for green chemicals involves the sourcing of renewable raw materials like agricultural waste and biomass.

- Key Players: BASF SE, Wacker Chemie, Dow Chemical, and Neste

- Chemical Synthesis and Processing : The chemical synthesis and processing involve electrochemical synthesis, catalytic processes, bio-inspired synthesis, modular synthesis, and solvent-free reactions.

- Key Players: Holiferm, Capot Chemical, DUDE CHEM, and Zenfold Sustainable Technologies

- Quality Testing and Certifications : The quality testing involves testing of properties like mass spectrometry, qNMR, chromatography, bio-based carbon content, ecotoxicity, & biodegradability, and certifications like ISO 14001, Green Seal, and GreenPro.

What are the Types of Green Chemicals?

| Types | Uses |

| Biodegradable Polymers |

|

| Green Solvents |

|

| Biofuels |

|

| Bio-Surfactants |

|

Market Opportunity

Growing Automotive Sector Drives Green Chemicals Market

The growing expansion of the automotive industry and the increasing production of automobiles increase demand for green chemicals. The development of environmentally friendly vehicles and stringent environmental regulations requires green chemicals. The manufacturing of interior vehicle components like seat foams, dashboards, & door panels requires bio-based polymers.

The need for coolants, lubricants, & adhesives for vehicles requires green chemicals. The focus on lowering the weight of vehicles and the development of greener battery components requires green chemicals. The strong focus on enhancing the fuel efficiency of vehicles and the rise in electric vehicles increase the adoption of green chemicals. The growing automotive sector is a driver for the growth of the green chemicals market.

Market Challenge

High Manufacturing Cost Limits Expansion of Green Chemicals

Despite several benefits of green chemicals across various industries, the high manufacturing cost restricts the market growth. Factors like high feedstock prices, specialized personnel, new technologies, complex production processes, and high cost of research & development are responsible for high manufacturing costs.

The fluctuations in the prices of renewable feedstocks like agricultural waste, vegetable oils, & sugars, and the high investment in production facilities, increase the cost. The complex manufacturing processes, like fermentation & biocatalysis, and the need for specialized expertise, require high cost. The specialized equipment and certification increase the cost. The high manufacturing cost hampers the growth of the green chemicals market.

Segmental Insights

Product Category Insights

Why Bio-Based Polymers & Resins Segment Dominates the Green Chemicals Market?

The bio-based polymers & resins segment dominated the green chemicals market with a 32% share in 2024. The focus on lowering the carbon footprint and minimizing landfill waste increases demand for bio-based polymers. The need to lower carbon dioxide emissions and the growing demand for sustainable products increase the adoption of bio-based polymers & resins. The growing industries like construction, food & beverage, and packaging require bio-based polymers & resins, driving the overall market growth.

The green ammonia & e-methanol segment is the fastest-growing in the market during the forecast period. The strong focus on industrial decarbonization and stringent climate goals increases the adoption of e-methanol & green ammonia. The supportive government policies and the rising demand for sustainable marine fuels require green ammonia. The growing demand for e-methanol in sectors like power generation and maritime shipping supports the overall market growth.

Feedstock Source Insights

How the First-Generation Sugars or Oils Segment Held the Largest Share in the Green Chemicals Market?

The first-generation sugars or oils segment held the largest share of 41% in the market in 2024. The large-scale agricultural operation and low production cost increase the adoption of first-generation sugars. The biochemical conversion process and increasing generation of biofuels require first-generation oils or sugars. The production of first-generation green chemicals drives the overall market growth.

The captured CO2 segment is experiencing the fastest growth in the market during the forecast period. The stringent emission regulations and corporate sustainability initiatives increase the adoption of captured CO2. The growing industries like consumer goods, packaging, and textiles increase the adoption of captured CO2. The increasing manufacturing of building aggregates and carbonated concrete requires captured CO2, supporting the overall market growth.

Process Technology Insights

Why Fermentation & Biocatalysis Segment Dominating the Green Chemicals Market?

The fermentation & biocatalysis segment dominated the market with a 47% share in 2024. The strong focus on lower energy consumption and the need for the minimization of hazardous waste increases the adoption of fermentation & biocatalysis. The growing demand for eco-friendly products and corporate sustainability goals requires fermentation & biocatalysis. The growing production of bioplastics, chemical products, and food ingredients uses fermentation & biocatalysis processes, driving the overall market growth.

The electrochemical & Power-to-X routes segment is the fastest-growing in the market during the forecast period. The focus on minimizing greenhouse gas emissions and reducing dependence on fossil fuels uses electrochemical & power-to-X routes. The abundance of renewable energy and focus on the efficient production of green chemicals require electrochemical & power-to-X routes, supporting the overall market growth.

Functional Class Insights

How did the Polymers & Resins Segment Hold the Largest Share in the Green Chemicals Market?

The polymers & resins segment held the largest share of 36% in the market in 2024. The production of packaging formats like containers, bottles, and films increases demand for polymers & resins. The increasing manufacturing of vehicle components and the rise in the use of coatings, sealants, & adhesives in construction increase the adoption of polymers & resins. The ban on single-use plastics and emission reduction targets requires polymer & resins, driving the overall market growth.

The surfactants segment is experiencing the fastest growth in the market during the forecast period. The growing biopharmaceuticals and food processing industry increases demand for surfactants. The strong focus on industrial maintenance and the growing use of household cleaning products requires surfactants. The growing manufacturing of bio-based surfactants supports the overall market growth.

Application Insights

Which Application Dominated the Green Chemicals Market?

The packaging segment dominated the market with a 44% share in 2024. The growing demand for sustainable packaging solutions and strong government support for the development of sustainable packaging increase the adoption of green chemicals. The rapid growth in e-commerce and increasing consumption of packaged foods requires green chemicals. The expansion of the FMCG sector requires green chemicals, driving the overall market growth.

The home & personal care segment is the fastest-growing in the market during the forecast period. The growing demand for organic personal care products and the shift towards clean beauty increase demand for green chemicals. The growing production of plant-based, herbal, and organic skin care & hair care products requires green chemicals. The increasing awareness about hygiene and increased manufacturing of cleaning products require green chemicals, supporting the overall market growth.

Regional Insights

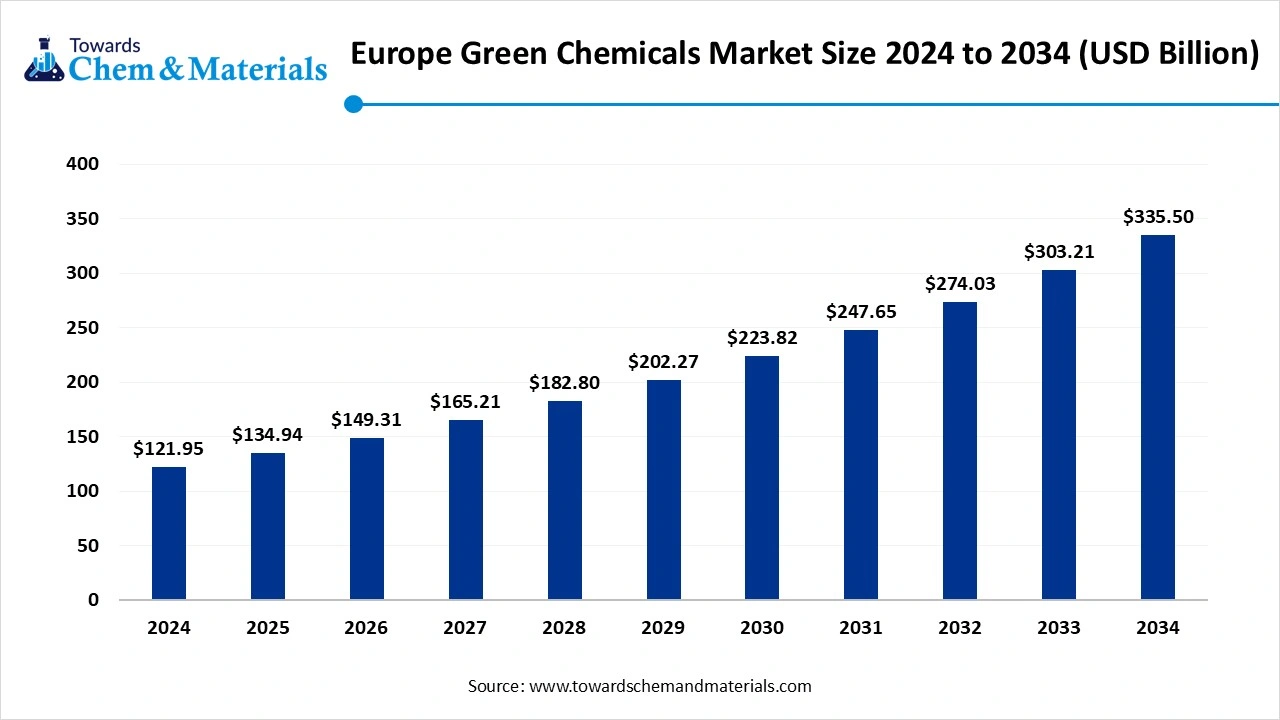

Europe Green Chemicals Market Size, Industry Report 2034

The Europe green chemicals market size was valued at USD 5.68 billion in 2025 and is expected to surpass around USD 11.23 billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.88% over the forecast period from 2025 to 2034. Europe dominated the market with a 38% share in 2024.

The growing awareness about environmental issues and a well-established chemical manufacturing base increase the production of green chemicals. The stricter environmental regulations, like REACH & EU Green Deal, and the growing demand for eco-friendly products, increase the adoption of green chemicals. The growing industries like food & beverage, packaging, automotive, and personal care require green chemicals, driving the overall market growth.

Germany’s Role in Green Chemicals Production

Germany is a key contributor to the green chemicals market. The stricter environmental regulations and strong government support for decarbonization increase demand for green chemicals. The presence of a large chemical manufacturing base and innovations in bio-based feedstocks increase the production of green chemicals. The growing construction activities and manufacturing of vehicles require green chemicals, supporting the overall market growth.

Asia Pacific Green Chemicals Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing awareness about non-toxic products and supportive environmental regulations increases the production of green chemicals. The growing industries like textiles, packaging, and automotive increase the adoption of green chemicals. The growing awareness about environmental issues and the abundance of renewable feedstocks increase the production of green chemicals, supporting the overall market growth.

Industrialization Drives Green Chemicals Demand in China

China is a major contributor to the market. The growing expansion of industries like packaging, personal care, textiles, and automotive increases demand for green chemicals. The increasing consumer shift towards bio-based products and the rise in water pollution require green chemicals. The presence of abundant agricultural residues and high investment in a chemical manufacturing base produces green chemicals, supporting the overall market growth.

- China exported 2,196 shipments of organic cosmetics.(Source: www.volza.com)

Recent Developments

- In September 2023, Mitsubishi Chemical Group launched bio-based compostable polymer, BioPBS, in EN TEA teabag pouches. The polymer is used in zipper closures & sealant layers and is applicable for food packaging.(Source: www.mcgc.com)

- In April 2023, Bluepha launched marine degradable biopolymers, Bluepha PHA. The biopolymers are produced using microorganisms and have excellent barrier properties, toughness, & heat resistance. The Bluepha PHA is widely used in the manufacturing of fabrics, green packaging, & cosmetics.(Source: worldbiomarketinsights.com)

- In October 2025, Sasol launched a bio-circular surfactant made from insect oil, LIVINEX IO 7. The surfactant is used in industrial, fabric, institutional, & home care cleaning.(Source: in.investing.com)

- In March 2025, AGAE Technologies launched Asia’s largest rhamnolipid biosurfactant production plant. The plant is present across 41000 square feet and used for applications like home care products, pharmaceuticals, environmental remediation, personal care products, enhanced oil recovery, & cosmetics.(Source: www.chemanalyst.com)

Top Companies List

- Braskem: The petrochemical company manufactures and supplies products like biopolymers, polypropylene, polyethylene, & polyvinyl chloride across diverse industries.

- NatureWorks: The leading biomaterials & bioplastics company manufactures Ingeo biopolymers to support sustainability.

- TotalEnergies: The multi-energy company manufactures diverse energy products such as electricity, green gases, oil & biofuels, renewable energy, & natural gas, and focuses on expanding bio-based & sustainable polymers.

- Corbion: The global supplier and manufacturer of sustainable ingredients solutions using biotechnology & fermentation.

- Novamont: The Italian-based company produces biochemicals & biodegradable bioplastics like Origo-Bi & Mater-Bi.

Other Companies List

- Avantium

- LanzaTech

- BASF

- Evonik

- Croda

- Genomatica

- Danimer Scientific

- RWDC Industries

- UPM Biochemicals

- Neste

Segments Covered

By Product Category

- Bio-based Polymers & Resins

- Green Solvents

- Bio-surfactants

- Organic Acids & Intermediates

- Green Ammonia & e-Methanol

- CO₂-Derived Chemicals

By Feedstock Source

- First-Generation Sugars/Oils

- Wastes & Residues

- Lignocellulosic biomass

- Used cooking oil/fats

- Captured CO₂

- Renewable Hydrogen (H₂)

By Process Technology

- Fermentation & Biocatalysis

- Catalytic Conversion of Biofeedstocks

- Carbon Capture & Utilization (CCU)

- Electrochemical / Power-to-X Routes

By Functional Class

- Polymers & Resins

- Solvents

- Surfactants

- Acids & Platform Intermediates

- Specialty Additives

By Application / End-Use

- Packaging

- Textiles & Apparel

- Home & Personal Care

- Automotive & Transport

- Construction & Building Materials

- Electronics & Industrial

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait