Content

Polymers Market Size and Forecast 2025 to 2034

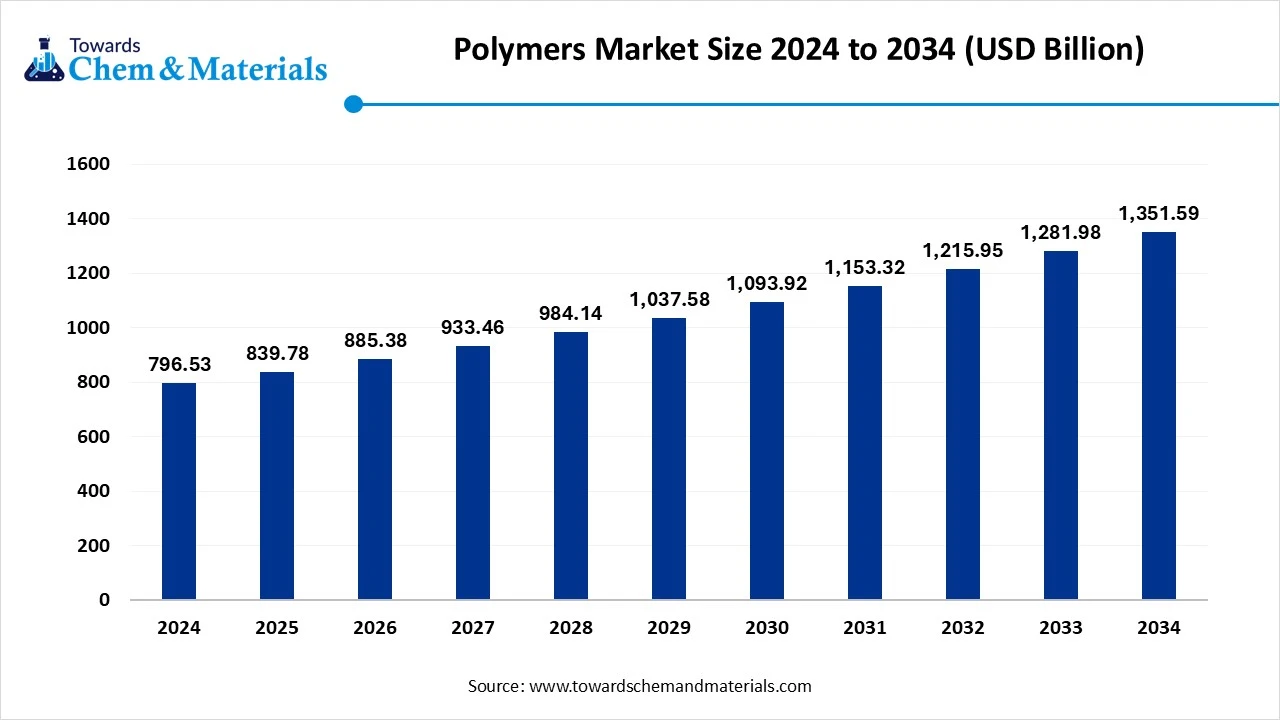

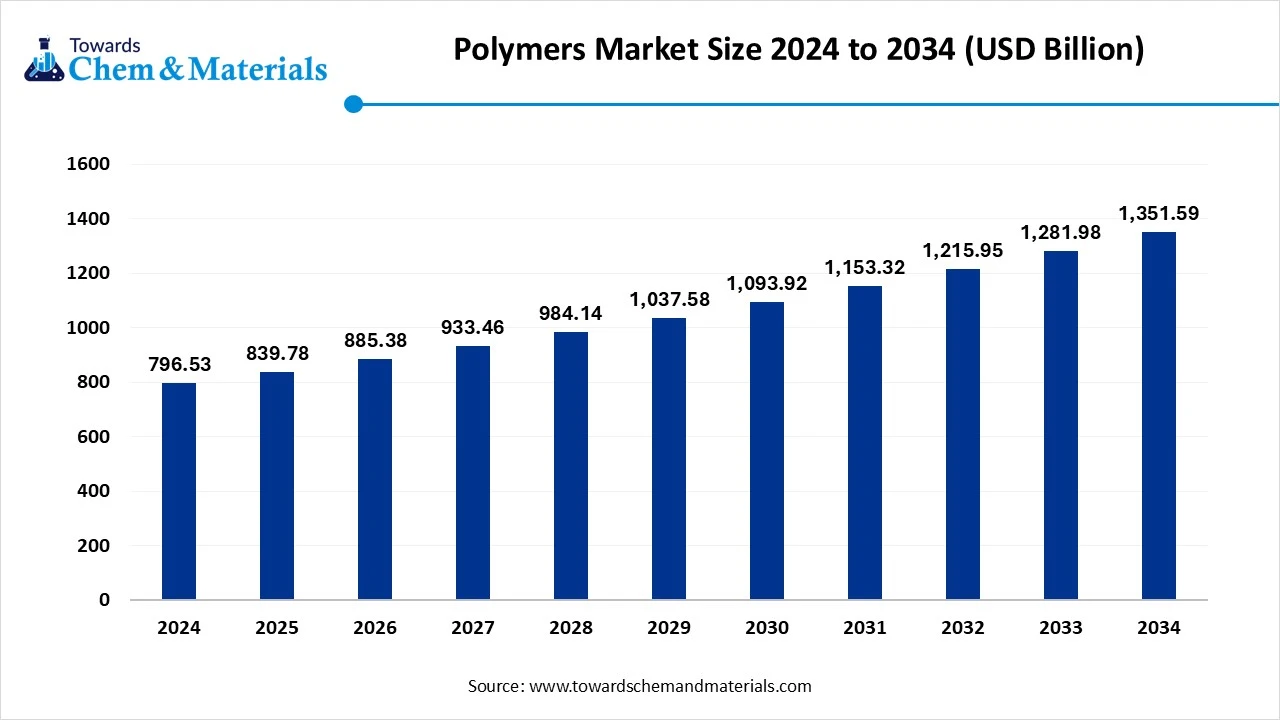

The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034. The enlarged expansion of the packaging industry has accelerated industry potential in recent years.

Key Takeaways

- By region, Asia Pacific dominated the polymers market in 2024 with 45% of the industry share, akin to an enlarged manufacturing structure and heavy consumer needs.

- By region, Europe is expected to grow at a notable rate in the future, owing to the advanced polymer technology usage in recent years.

- By type, the polyethylene segment led the market in 2024 with 25% market share, due to its various applications in sectors such as films, packaging, containers, and household products.

- By type, the polyethylene terephthalate segment is expected to grow at the fastest rate in the market during the forecast period, akin to the sudden shift towards sustainability and recyclability in the packaging industry.

- By origin, the synthetic polymers segment emerged as the top-performing segment in the market in 2024 with 90% industry share, due to its unique characteristics, such as large-scale accessibility and cost-effectiveness.

- By origin, natural polymers is expected to have the fastest growth in the market during the coming years, due to due to the sudden shift towards sustainable manufacturing initiatives.

- By processing technology, the injection moulding segment led the market in 2024 with 35% market share because it is the most common and cost-effective technique to produce complex polymer parts.

- By processing technology, the blow molding segment is expected to capture the biggest portion of the market in the coming years, because of the growing demand for bottles, containers, and hollow plastic products.

- By end-use industry, the FMCG segment led the polymers market in 2024 with 35% market share, due to the massive demand for packaging materials in food, beverages, cosmetics, and household goods.

- By end-use industry, the medical device manufacturers segment is expected to grow at the fastest rate in the market during the forecast period, due to growing demand for high-performance polymers in healthcare.

Market Overview

Polymers In Focus: Key Trends Driving Market Expansion

The polymers market refers to the global industry encompassing the production, distribution, and consumption of synthetic and natural macromolecules composed of repeating structural units (monomers). These materials are engineered to exhibit a wide range of physical, mechanical, and chemical properties, making them essential in applications across packaging, automotive, construction, electronics, healthcare, textiles, and other sectors.

What Factor is Driving the Polymers market?

The enlarged expansion of the packaging industry is spearheading industry growth in recent years, as polymers are considered as the ideal material used in packaging materials. Furthermore, the growth of the market is closely attached with sectors such as food delivery, e-commerce, and consumer goods, as per the recent industry survey. Also, the transportation industry is actively contributing to the industry potential as transportation materials like flexible plastic containers and films are made using polymers in recent years.

The increasing need for bio-based and biodegradable polymers has driven industry growth in recent years. Moreover, global governments have also supported these initiatives in recent years.

The integration of advanced technology in polymer production is contributing to the growth of the industry, as several manufacturers are investing in R&D for cost-effectiveness and other benefits.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 839.78 Billion |

| Expected Size by 2034 | USD 1,351.59 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.43% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Origin, By Processing Technology, By End-Use Industry, By Region |

| Key Companies Profiled | Dow Inc., Evonik Industries AG, Eastman Chemical Company, Covestro AG, Mitsui Chemicals Inc., Exxon Mobil Corporation, Royal DSM, BASF SE, Clariant International Limited, Huntsman Corporation |

Market Opportunity

Bio-Based Polymers to Lead the Charge for Sustainable Manufacturing in the Coming Years

The development of bio-based and natural polymers is expected to create lucrative opportunities for the polymers market. Global governments are seen as the heavy support for sustainable manufacturing by giving attractive benefits like tax reduction and subsidies for manufacturers in recent years.

Moreover, the manufacturer can invest in R&D for an affordable biobased polymer production method, which is likely to provide immense industry attention during the projected period, as per the future industry expectations.

Market Challenge

Eco–Friendly Production Costs May Delay Market Entry for New Players

The implementation of sustainable manufacturing initiatives is expected to hinder industry growth in the coming years, as several regions are actively implementing single-use plastic bans, which are creating growth barriers for traditional polymers in the current period. Also, the initial higher investment in eco-friendly polymer production is expected to create cost-related issues for the new market entrants and mid-sized businesses in the coming years.

Regional Insights

Asia Pacific Polymers Market Trends

Asia Pacific dominated the polymers market in 2024, akin to an enlarged manufacturing structure and heavy consumer needs. Moreover, the sectors such as the packaging, construction, and automotive are actively contributing to the industry potential in recent years as they are seen under the heavy usage of the polymer in their manufacturing. Also, the regional countries are observed putting heavy investment into the polymer-based companies to fulfill the ongoing polymer requirement in their respective regions.

Why is China the World’s Leading Force in Polymer Manufacturing?

China maintained its dominance in the market, owing to its enlarged production and consumption of polymers in the current period. Moreover, the country is considered one of the greatest plastic producers globally, which is primarily leading industry growth while getting global attention in the past few years. Furthermore, the greater government push for domestic manufacturing is likely to contribute to the future industry growth, as per the country’s latest market observation.

Europe Polymers Market Trends

Europe is expected to capture a major share of the market, owing to the advanced polymer technology usage in recent years. As the regional countries such as Germany, France, and the United Kingdom are actively involved in the innovation of modern polymer technologies, which is expected to provide a sophisticated consumer base in the upcoming years, as per the future industry expectations.

Segmental Insights

Type Insights

How Did The Polyethylene Segment Dominate The Polymers Market In 2024?

The polyethylene segment held the largest share of the market in 2024, due to its various applications in sectors such as films, packaging, containers, and household products. Moreover, having unique properties such as flexibility, lightweight, and durability, polyethylene has gained immense industry attention in recent years. Furthermore, the different grades availability, like polyethylene, is available in HDPE and LDPE form, which provided a wider consumer base to the segment in the past few years.

The polyethylene terephthalate segment is expected to grow at a notable rate during the predicted timeframe, akin to the sudden shift towards sustainability and recyclability in the packaging industry. Moreover, the increased use of beverage bottles, textiles, and food packaging has contributed to the industry growth of PET as it is considered the ideal option to produce these materials. Furthermore, the government's push towards sustainability is likely to create greater opportunities for the PET manufacturers in the upcoming years.

Origin Type Insights

Why does the Synthetic Polymers Segment Dominate the Polymers market by the Origin Type?

The synthetic polymers segment held the largest share of the market in 2024, due to its unique characteristics, such as large-scale accessibility and cost-effectiveness. Also, the shift towards heavy manufacturing processes, the sectors such as the automotive, textiles, and packaging are actively demanding synthetic polymers in recent years, while providing a sophisticated consumer base to the manufacturers.

The natural polymers segment is expected to grow at a notable rate due to the sudden shift towards sustainable manufacturing initiatives. Moreover, several manufacturers are seen under the heavy replacement of the traditional polymers with the natural ones in recent years. Furthermore, the food packaging consumers are heavily adopting these types of polymers owing to their properties such as eco-friendliness, safety, and non-toxicity in the past few years, as per the recent industry survey.

Processing Technology Insights

Why Does The Injection Molding Segment Dominate The Polymers Market In 2024?

The injection molding segment dominated the market with the largest share in 2024 because it is the most common and cost-effective technique to produce complex polymer parts. It allows manufacturers to make high volumes of products with precise dimensions and consistent quality. Industries such as automotive, consumer goods, electronics, and packaging widely rely on injection moulding for efficient mass production.

The blow molding segment is expected to grow at a significant rate because of the growing demand for bottles, containers, and hollow plastic products. With rapid expansion in packaging for beverages, personal care, and household products, blow moulding is becoming more important. It allows cost-efficient mass production of lightweight yet durable products.

End Use Industry Insights

Why Does The FMCG Segment Dominate The Polymers Market In 2024?

The FMCG segment held the largest share of the market in 2024 due to the massive demand for packaging materials in food, beverages, cosmetics, and household goods. Polymers like polyethylene and polypropylene are widely used to produce flexible and rigid packaging that is durable, lightweight, and cost-efficient. The fast-moving consumer goods industry requires high-quality packaging to preserve product freshness and improve shelf life, which polymers provide effectively.

The medical device manufacturers’ segment is expected to grow at a notable rate during the predicted timeframe, due to growing demand for high-performance polymers in healthcare. Polymers are being increasingly used in surgical instruments, implants, drug delivery systems, and diagnostic equipment because they are lightweight, flexible, biocompatible, and safe. With aging populations and rising healthcare expenditure worldwide, the demand for medical devices is increasing sharply.

Value Chain Analysis

Waste Management and Recycling : The waste management of polymers lies in to different methods like mechanical recycling, chemical recycling, and energy recovery

- Key Players: Waste Management Inc., Republic Services, and Clean Harbors

Chemical Synthesis and Processing : The chemical synthesis of the polymers is distributed to polymerization, living polymerization, ring-opening polymerization, and grafting.

- Key Players: BASF, DOW Inc., SABIC, and Research Institutes

Regulatory Compliance and Safety Monitoring : Polymerization processes require sophisticated regulatory compliance and safety monitoring to ensure worker safety and product quality and require regulations from institutions such as the REACH(EU), TSCA(US), GHS, and Others.

Recent Developments

- In February 2025, Tetra Pak introduced recycled polymer packaging. Moreover, the newly launched packaging material is certified by ISCC PLUS, as per the report published by the company recently.(Source: www.packaging-gateway.com)

- In January 2025, SCHOTT Pharma launched its line of syringe systems. The newly launched syringe system is called the next-gen polymer syringe system, as per the company's claim.(Source: www.contractpharma.com)

Polymers Market Top Companies

- Dow Inc.

- Evonik Industries AG

- Eastman Chemical Company

- Covestro AG

- Mitsui Chemicals Inc.

- Exxon Mobil Corporation

- Royal DSM

- BASF SE

- Clariant International Limited

- Huntsman Corporation

Segment Covered

By Type

- Thermoplastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide (PA)

- Polymethyl Methacrylate (PMMA)

- Others (EVA, POM, etc.)

- Thermosetting Polymers

- Epoxy Resins

- Phenolic Resins

- Polyurethane (PU)

- Unsaturated Polyester Resins (UPR)

- Melamine Formaldehyde (MF)

- Urea Formaldehyde (UF)

- Elastomers

- Natural Rubber (NR)

- Synthetic Rubber (SBR, NBR, EPDM, etc.)

- Thermoplastic Elastomers (TPE)

By Origin

- Synthetic Polymers

- Natural Polymers (Cellulose, Starch, Proteins, etc.)

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Rotational Molding

- Others (Thermoforming, Calendering, etc.)

By End-Use Industry

- FMCG

- Automotive OEMs

- Construction Firms

- Electronics Manufacturers

- Medical Device Manufacturers

- Textile Manufacturers

- Agricultural Input Producers

- Industrial Equipment Manufacturers

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE