Content

What is the Current U.S. Oleochemicals Market Size and Volume?

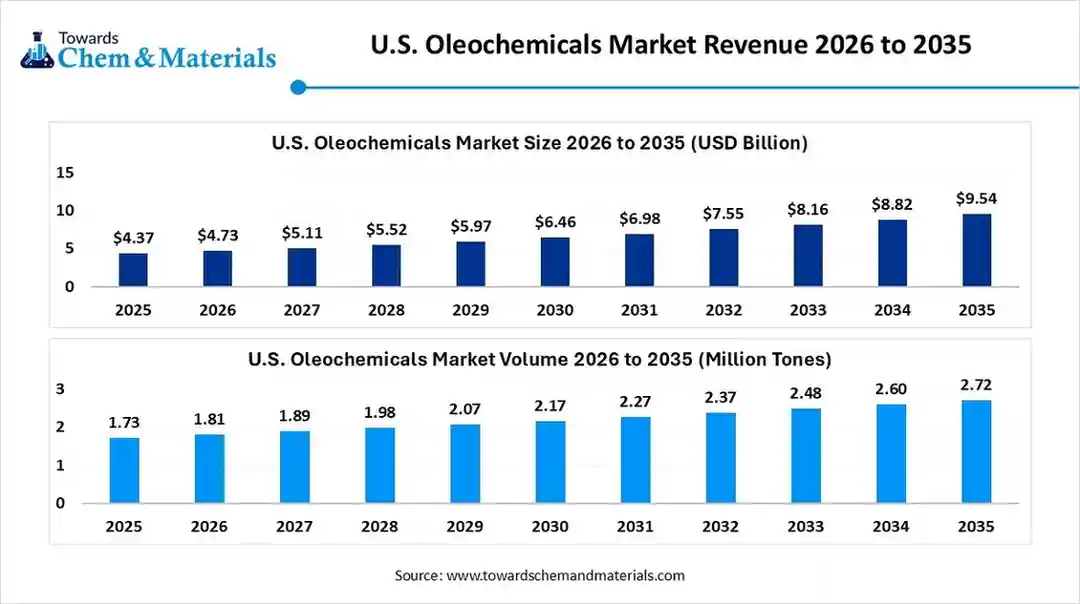

The U.S. oleochemicals market size was estimated at USD 4.37 billion in 2025 and is expected to increase from USD 4.73 billion in 2026 to USD 9.54 billion by 2035, growing at a CAGR of 8.11% from 2026 to 2035.

The U.S. oleochemicals market size was 1.73 million tons in 2025 and is predicted to increase from 1.81 million tons in 2026 and is expected to be worth around 2.72 million tons by 2035, exhibiting a compound annual growth rate (CAGR) of 4.63% over the forecast period from 2026 to 2035. The increasing demand for natural and sustainable products is the key factor driving market growth. Also, stringent regulations favouring bio-based alternatives, coupled with the ongoing development of new applications, can fuel market growth further.

Key Takeaways

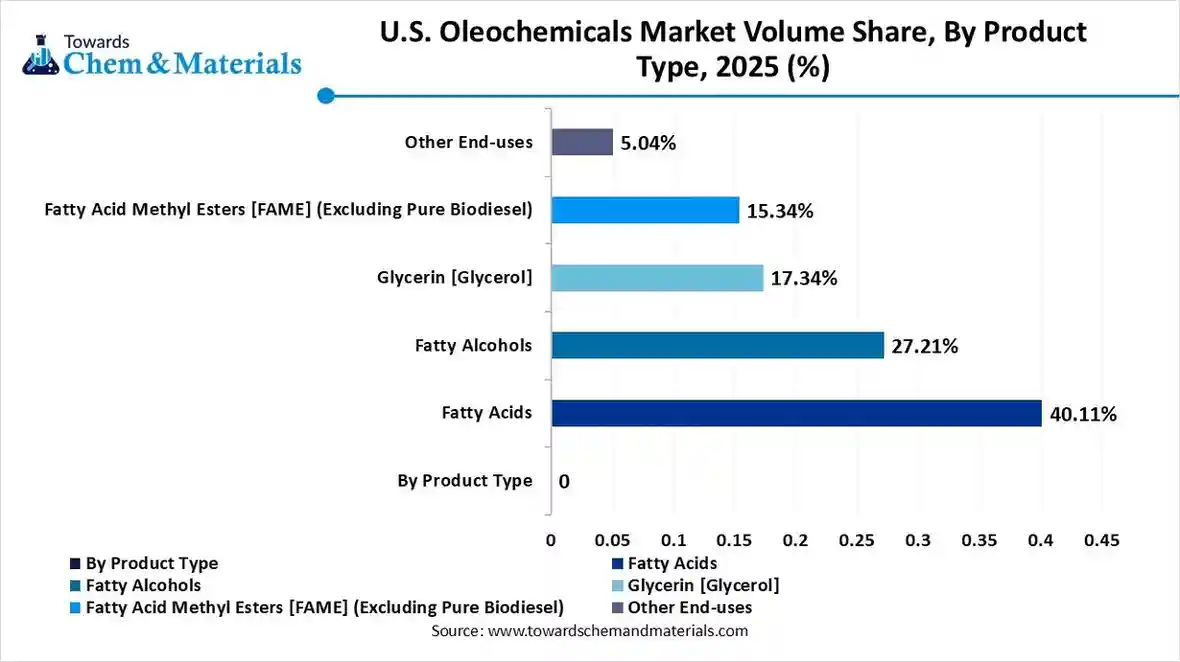

- By product type, the fatty acids segment led the market with the largest revenue share of 40% in 2025. The dominance of the segment can be attributed to the robust industry and consumer demand for biodegradable alternatives.

- By product type, the glycerine segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing product demand in the food and pharma sectors.

- By derivative type, the specialty esters segment led the market with the largest volume share of 40% in 2025. The dominance of the segment can be linked to the government policies focusing on versatile and renewable applications.

- By derivative type, the alkoxylates segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by favorable government policies supporting green chemistry.

- By feedstock source, the plant-based segment accounted for the largest revenue share of 70% in 2025. The dominance of the segment is owing to changing consumer preferences and rapid industrial advancements.

- By feedstock source, the animal fat-based segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the ongoing push for bio-based and sustainable alternatives to petrochemicals.

- By application, the personal care & cosmetics segment dominated with the largest revenue share of 30% in 2025. The dominance of the segment can be attributed to the growing demand for fatty acids and glycerine in lotions, soaps, and cosmetics.

- By application, the pharmaceuticals and healthcare segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing emphasis on bio-based alternatives.

What are Oleochemicals?

The U.S. oleochemicals market comprises the production, supply, and consumption of chemical compounds derived from natural, renewable raw materials specifically animal fats (tallow, lard) and vegetable oils (soy, corn, canola, palm). The strong regulatory and consumer push for renewable, biodegradable materials over synthetic ones is the major factor driving market growth.

U.S. Oleochemicals Market Trends

- The growing popularity of green chemicals is driving positive market expansion soon. These chemicals are produced from bio-based feedstocks. The rise in the cost of petrochemicals has fueled the popularity of green chemicals.

- The surge in popularity of biodegradable products is another major trend in the market. This growth is propelled by an extensive socio-economic shift towards eco-friendly and sustainable products.

- Rapid innovations in manufacturing methods like green chemistry and enzymatic catalysis are enhancing the purity and efficiency of oleochemicals while decreasing the need for harmful chemical processes, leading to further market expansion.

- The U.S. government is enforcing policies that favor renewable resources over fossil fuels. Many initiatives are pushing market players to adopt oleochemicals to decrease their carbon footprints.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 4.73 Billion/ 1.81 Million Tons |

| Revenue Forecast in 2035 | USD 9.54 Billion/ 2.72 MillionTons |

| Growth Rate | CAGR 8.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product Type, By Derivative Type, By Feedstock Source, By Application |

| Key companies profiled | Cargill, Incorporated, Vantage Specialty Chemicals, Inc., P&G Chemicals , Stepan Company , Emery Oleochemicals , Twin Rivers Technologies, Inc., Wilmar International Ltd., KLK OLEO , Oleon NV, Evonik Industries AG , BASF SE , Kao Chemicals Global, Ecogreen Oleochemicals , Corbion N.V. , Elevance Renewable Sciences , IOI Corporation Berhad , IOI Oleochemical, Godrej Industries, Axcelis Technologies , Arkema |

How Cutting Edge Technologies are revolutionizing the U.S. Oleochemicals Market?

Advanced technologies are transforming the market by fuelling efficiency, sustainability, and product versatility through novel extraction methods and AI-driven process control. Furthermore, innovations in metabolic engineering led to genetically enhanced microbes, extensively increasing oleochemical yields and creating new opportunities.

Trade Analysis of Industrial U.S. Oleochemicals Market: Import & Export Statistics

- U.S. chemical imports peaked at over $20 billion in March 2025, a multi-year high, before falling to $17 billion in April as importers front-loaded orders; this pattern suggests similar pre-tariff buying if new tariffs are introduced.

U.S. Oleochemicals Market Value Chain Analysis

- Feedstock Procurement: It involves the sourcing of various organic materials that are trans esterified or hydrolyzed into usable chemical intermediates.

- Major Players: Archer Daniels Midland (ADM), P&G Chemicals.

- Chemical Synthesis and Processing: It refers to the primary industrial transformation of natural fats and oils into core chemical high-value derivatives and building blocks.

- Major Players: Emery Oleochemicals, Stepan Company.

- Packaging and Labelling: It involves the critical regulatory and logistical phase where bio-based chemical products like fatty alcohols, glycerin, and fatty acids are secured for transport.

- Major Players: Wilmar International Ltd., BASF SE.

- Regulatory Compliance and Safety Monitoring: It refers to the compulsory adherence to federal and state laws controlling the manufacturing, handling, and environmental impact of bio-based chemicals derived from animal fats and plants.

- Major Players: Oleon NV, Kao Chemicals.

U.S. Oleochemicals Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| U.S. | Environmental Protection Agency (EPA): The EPA regulates oleochemicals under the Toxic Substances Control Act (TSCA), which was recently amended (effective January 2, 2025) to require mandatory determinations on all new chemical notices before manufacturing can begin. |

| In 2025, the FDA launched a significant initiative to phase out petroleum-based synthetic dyes in favor of natural alternatives, many of which are oleochemical-based. | |

| In 2025, there is an increased focus on updated Hazard Communication Standards (HCS) to align with global GHS labeling requirements. |

Segmental Insights

Product Type Insights

How Much Share Did the Fatty Acids Segment Held in 2025?

The fatty acids segment dominated the market with a 40% share in 2025. The dominance of the segment can be attributed to the robust industry and consumer demand for biodegradable, renewable, and sustainable alternatives to petroleum-based products. In addition, Fatty acids are major feedstocks for manufacturing Fatty Acid Methyl Esters (FAME), meeting with renewable energy goals.

The glycerine segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing product demand in the food, pharma, and personal care industries. Also, glycerine is a primary ingredient in skincare because of its superior emollient and moisturizing properties.

U.S. Oleochemicals Market Volume Share, By Product Type, 2025 (%)

| By Product Type | Market Share (%), 2025 | Market Volume(Million tons)- 2025 | Market Volume(Million tons)- 2035 | CAGR- 2026- 2035 | Market Share (%), 2035 |

| Fatty Acids | 40.11% | 0.69 | 1.01 | 3.87% | 37.31% |

| Fatty Alcohols | 27.21% | 0.47 | 0.82 | 5.70% | 30.13% |

| Glycerin [Glycerol] | 17.34% | 0.30 | 0.44 | 3.94% | 16.23% |

| Fatty Acid Methyl Esters [FAME] (Excluding Pure Biodiesel) | 15.34% | 0.27 | 0.44 | 5.29% | 16.33% |

| Total | 100.00% | 1.73 | 2.72 | 4.63% | 100.00% |

Derivative Type Insights

Which Derivative Type Segment Dominated the U.S. Oleochemicals Market in 2025?

The specialty esters segment held a 40% market share in 2025. The dominance of the segment can be linked to the government policies focusing on versatile and renewable applications, which makes them a key replacement for petroleum-based chemicals. Specialty esters provide a superior functionality, like stability, texture, and shelf life, in different formulations.

The alkoxylates segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by favorable government policies supporting green chemistry and advancements in bio-based production. Alkoxylates offer exceptional emulsifying, foaming, and cleaning properties, which make them crucial replacements for synthetic surfactants.

Feedstock Source Insights

Which Feedstock Source Type Segment Dominated the U.S. Oleochemicals Market in 2025?

The plant-based segment dominated the market with a 70% share in 2025. The dominance of the segment is owed to changing consumer preferences and rapid industrial advancements. Plant-based oleochemicals generally have lower toxicity and are naturally biodegradable, which makes them highly preferred in various industries.

The animal fat-based segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the ongoing push for bio-based and sustainable alternatives to petrochemicals. Furthermore, Animal-derived fatty acids are valuable in the manufacturing of high-end creams and lotions for their superior moisturizing properties.

Application Insights

How Much Share Did the Personal Care & Cosmetics Segment Held in 2025?

The personal care & cosmetics segment held a 30% market share in 2025. The dominance of the segment can be attributed to the growing demand for fatty acids and glycerine in lotions, soaps, and cosmetics, along with the rapid implementation of various government initiatives. Surge in spending power, among most populations, aligns with consumer pressure for greener formulations.

The pharmaceuticals and healthcare segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the growing emphasis on bio-based and high-purity alternatives to petroleum-derived ingredients. Rapid research and development have improved the cost-effectiveness and efficiency of producing high-quality oleochemical derivatives.

Country Insights

Which U.S. Region Dominated the U.S. Oleochemicals Market in 2025?

The Midwest region dominated the market with a 40% share in 2025. The dominance of the region can be attributed to its robust soybean feedstock availability, along with growing local demand for sustainable biodiesel. Moreover, this region is home to some of the largest food processing clusters, contributing to positive market expansion soon.

The West region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing consumer demand for plant-based and natural products, coupled with the strict environmental regulations supporting sustainability. Furthermore, Western states such as California are at the forefront in enforcing rigorous environmental policies.

Recent Development

- In November 2025, Novonesis and thyssenkrupp Uhde introduce an advanced enzymatic fat-splitting tech. These innovations improve producers' profitability and agility and support a more promising future for the oleochemicals industry.(Source: www.indianchemicalnews.com)

Top U.S. Oleochemicals Market Companies

- Cargill, Incorporated: The company actively markets its vegetable oil-derived products as direct replacements for petroleum-based mineral oils and natural gas derivatives.

- Vantage Specialty Chemicals, Inc.: Vantage Specialty Chemicals, Inc. is one of the largest and most influential merchant producers in the U.S. oleochemicals market as of 2025. It occupies a critical position as a vertically integrated manufacturer that transforms natural fats and oils into high-value specialty ingredients.

Other Companies in the Market

- Cargill, Incorporated

- Vantage Specialty Chemicals, Inc.

- P&G Chemicals

- Stepan Company

- Emery Oleochemicals

- Twin Rivers Technologies, Inc.

- Wilmar International Ltd.

- KLK OLEO

- Oleon NV

- Evonik Industries AG

- BASF SE

- Kao Chemicals Global

- Ecogreen Oleochemicals

- Corbion N.V.

- Elevance Renewable Sciences

- IOI Corporation Berhad

- IOI Oleochemical

- Godrej Industries

- Axcelis Technologies

- Arkema

Segments Covered in the Report

By Product Type

- Fatty Acids

- Saturated Fatty Acids

- Stearic

- Palmitic Acid

- Unsaturated Fatty Acids

- Oleic

- Linoleic Acid

- Saturated Fatty Acids

- Fatty Alcohols

- Short/Mid-Chain (C6-C12)

- Long-Chain (C14+)

- Glycerin (Glycerol)

- Crude Glycerin (Byproduct from Biodiesel/Fatty Acid Production)

- Refined Glycerin (USP/Kosher Grade)

- Fatty Acid Methyl Esters (FAME) (Excluding pure Biodiesel)

By Derivative Type

- Specialty Esters

- Glycerol Esters

- Polyol Esters

- Isopropyl Esters

- Fatty Amines

- Alkylamines

- Ethoxylated Amines

- Alkoxylates

- Ethoxylates and Propoxylates of Alcohols

- Acids

- Amines

- Other Derivatives (Quaternary Ammonium Compounds (Quats), Amides)

By Feedstock Source

- Plant-Based

- Soybean Oil

- Canola/Rapeseed Oil

- Corn Oil

- Coconut/Palm Kernel Oil (PKO) Derivatives

- Other Vegetable Oils

- Animal Fat-Based

- Tallow

- Lard

By Application

- Personal Care & Cosmetics

- Soaps and Detergents (I&I and Consumer Grade)

- Skincare and Creams

- Haircare

- Food & Beverages

- Emulsifiers and Stabilizers (Mono- & Diglycerides)

- Food Additives

- Industrial & Institutional (I&I)

- Industrial Cleaning and Surfactants

- Lubricants and Greases (Bio-lubricants)

- Metalworking Fluids

- Pharmaceuticals and Healthcare

- Excipients

- Drug Delivery Systems

- Polymers and Plastics

- Green Polymer Additives

- Bio-plasticizers

- Agrochemicals

- Surfactants

- Emulsifiers

By Region

- Europe

- Germany

- UK

- France

- Italy

- Spain