Content

What is the Current Europe Petrochemicals Market Size and Volume?

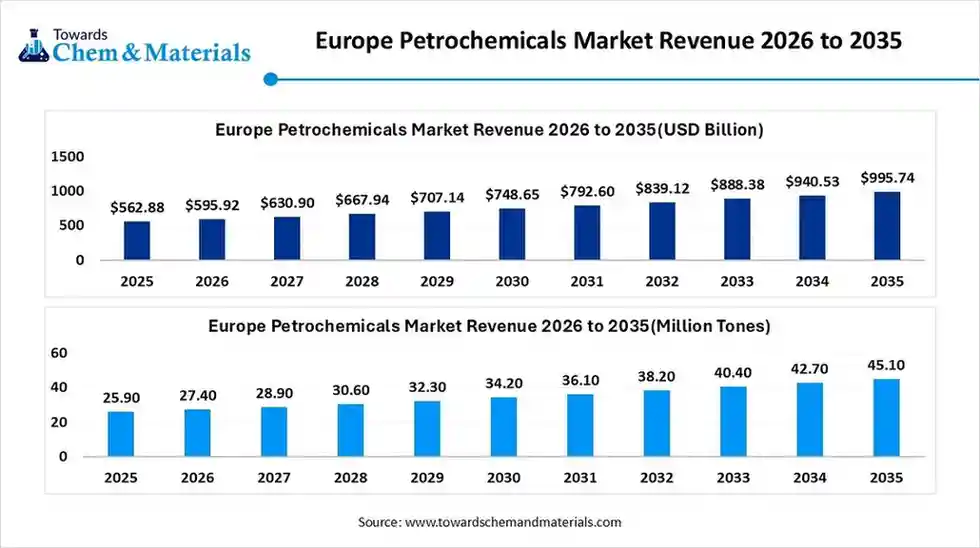

The Europe petrochemicals market volume was estimated at 25.90 million tonnes in 2025 and is expected to increase from 27.40 million tonnes in 2026 to 45.10 million tonnes by 2035, growing at a CAGR of 5.70% from 2026 to 2035. The growing petrochemical demand from major sectors is the key factor driving market growth. Wetsern Europe dominated the Europe petrochemicals market with the largest revenue share of 74.00% in 2025.

The Europe petrochemicals market size was valued at USD 562.88 billion in 2025 and is expected to hit around USD 995.74 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.87% over the forecast period from 2026 to 2035. Also, growing ethylene production in emerging economies, coupled with the technological innovations in the manufacturing process, can fuel market growth further.

Key Takeaways

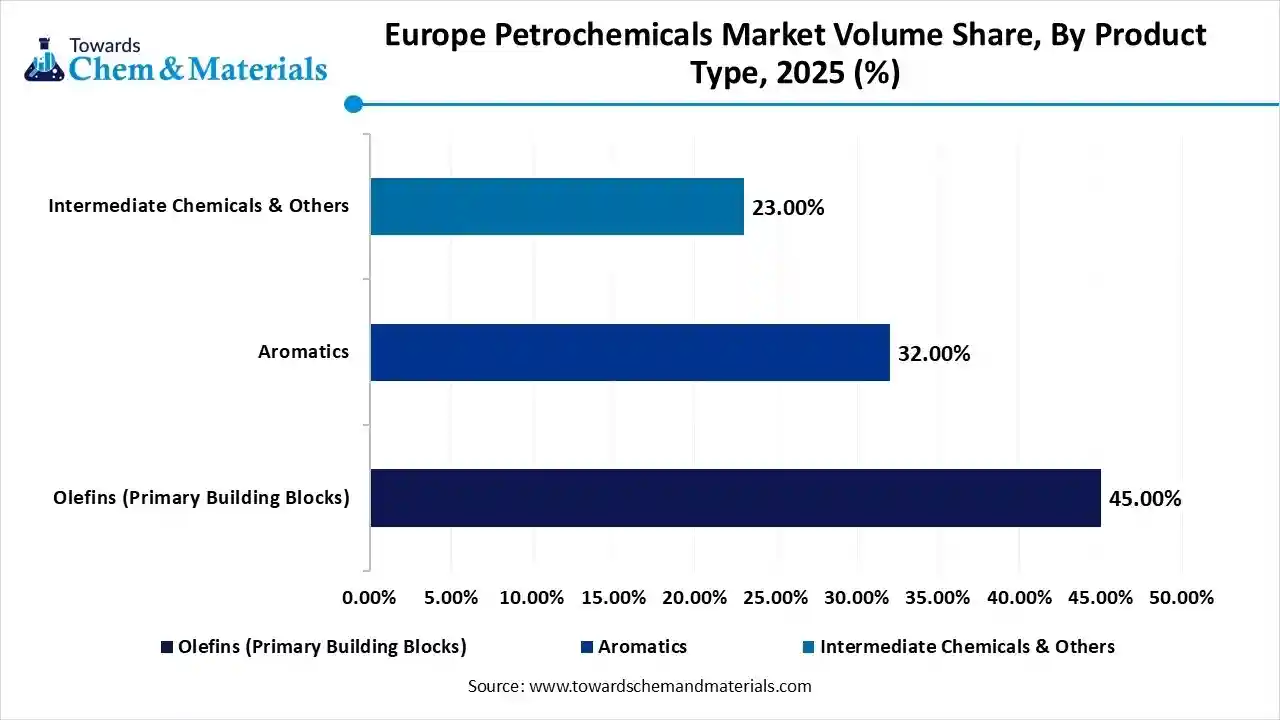

- By product type, the olefins segment led the market with the largest revenue volume share of 45% in 2025. The dominance of the segment can be attributed to the growing regional emphasis on decarbonization.

- By product type, the methanol segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing product demand from the automotive sector.

- By feedstock, the naphtha segment led the market with the largest volume share of 65% in 2025. The dominance of the segment can be linked to the ongoing tech innovations fuelling cracking efficiency.

- By feedstock, the bio-based feedstocks segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a rapid shift towards low-carbon solutions.

- By manufacturing process, the steam cracking segment accounted for the largest volume revenue share of 72% in 2025. The dominance of the segment can be attributed to the ongoing shift towards high-value chemicals.

- By manufacturing process, the fluid catalytic cracking (FCC) segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the increasing need for high-value petrochemicals.

- By end use, the packaging segment dominated with the largest revenue volume share of 35% in 2025. The dominance of the segment is owed to growing consumer demand for lightweight and durable plastics.

- By end use, the automotive segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to a rapid surge in urban populations.

What are Petrochemicals?

The market comprises the industrial sector dedicated to the production of chemical compounds derived from hydrocarbons (crude oil and natural gas) and increasingly from bio-based and recycled feedstocks. It serves as the primary supplier of building blocks such as olefins and aromatics used in the manufacture of plastics, resins, synthetic fibers, and specialty chemicals across the European continent.

Europe Petrochemicals Market Trends

- The increasing demand for aromatics and olefins is the latest trend in the market. Consumers are increasingly preferring resins with recycled content and lower emissions outputs; hence it remains anchored to construction, packaging, and automotive sectors.

- The growing demand for petrochemicals in the electronics sector is impacting positive market expansion. The proliferation of laptops, tablets, and smartphones has seen an exponential increase, fuelled by innovations in technology and shifts in consumer behavior.

- The growing need for bio-based and sustainable petrochemical alternatives is another major trend in the market. Major market players are heavily investing in green technologies like carbon capture, utilization, and bio-refineries, and circular economy models to minimize their carbon footprint.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 27.40 Million Tons |

| Revenue Forecast in 2035 | USD 45.1 Million Tons |

| Growth Rate | CAGR 5.70% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product Type, By Feedstock Source, By Manufacturing Process, By End-Use Industry |

| Key companies profiled | INEOS Group, BASF SE, Shell plc, TotalEnergies SE, LyondellBasell Industries N.V., SABIC (European Operations), Borealis AG, Covestro AG, Evonik Industries AG, Arkema S.A., Repsol S.A., Eni S.p.A. (Versalis), PKN Orlen, MOL Group, LANXESS AG, Solvay S.A., Clariant AG, Wacker Chemie AG, Bayer AG, OMV Aktiengesellschaft |

How Cutting Edge Technologies are revolutionizing the Europe Petrochemicals Market?

Advanced technologies are transforming the market by optimizing supply chains, enabling predictive maintenance, and propelling efficiency through more data-driven and smarter operations towards a circular economy. Furthermore, robotics and automation can enhance accuracy in material handling, increase worker safety, and minimize human error, particularly with collaborative robots.

Trade Analysis of the Europe Petrochemicals Market Import & Export Statistics:

Germany's petrochemical exports were valued at around $80 billion USD in 2023, a significant figure from its robust chemical sector.

Exports

- In 2024, the United Kingdom exported £45.8B of Chemical Products, being the 4th most exported product in the United Kingdom.

- In 2024, the main destinations of the United Kingdom's Chemical Products exports were: the United States (£9.36B), Belgium (£4.83B), Germany (£3.8B), Ireland (£3.66B), and the Netherlands (£3.2B).

Imports

- In 2024, the United Kingdom imported £50.9B of Chemical Products, being the 5th most imported product in the United Kingdom.

- In 2024, the main origins of the United Kingdom's Chemical Products imports were: Netherlands (£6.27B), United States (£6.02B), Germany (£5.91B), Belgium (£5.69B), and France (£4.32B).

Europe Petrochemicals Market Value Chain Analysis

- Feedstock Procurement: It is the sourcing of necessary raw materials, basically natural gas liquids and naphtha from international and domestic resources.

- Major Players: INEOS, Shell plc.

- Chemical Synthesis and Processing :It involves the intricate industrial and technological methods utilised to convert raw hydrocarbon feedstocks into necessary chemical building blocks and specialized derivatives.

- Major Players: TotalEnergies, Borealis.

- Packaging and Labelling :It refers to the highly controlled processes and materials used to contain, transport, and identify chemical substances.

- Major Players: Amcor Plc, Mauser Packaging Solutions.

- Regulatory Compliance and Safety Monitoring : It involves comprehensive operational oversight systems and a legal framework created to prevent industrial disasters and mitigate environmental impact.

- Major Players:Lumar Química,Lumar Química.

Europe Petrochemicals Market 's Regulatory Landscape

| Countries | Key Regulations |

| European Union | In August 2025, the European Chemicals Agency (ECHA) updated its proposal to restrict "forever chemicals" (PFAS), expanding the scope to eight additional sectors. |

| Germany and the Netherlands | Regulations here are heavily focused on the electrification of steam crackers and the integration of Carbon Capture and Storage (CCS) to preserve industrial viability. |

| United Kingdom (UK) | The UK is increasingly pursuing its own timeline for substance restrictions, requiring companies operating in both markets to manage two separate compliance databases. |

Segmental Insights

Product Type Insights

How Much Share Did the Olefins Segment Held in 2025?

The olefins segment dominated the market with approximately 45% share in 2025. The dominance of the segment can be attributed to the growing regional emphasis on decarbonization and the increased production of polymers in the emerging economies. In addition, the need for olefins is sustained by their wide use in manufacturing plastics and other adhesives.

The methanol segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing product demand from the automotive and chemicals sectors for sustainable inputs. Advancements in CCU technology are revolutionising industrial emissions into crucial chemical feedstocks.

Europe Petrochemicals Market Volume and Share, By Product Type, 2025- 2035 (%)

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Olefins (Primary Building Blocks) | 45.00% | 11.7 | 18.8 | 5.47% | 41.76% |

| Aromatics | 32.00% | 8.3 | 15.4 | 7.11% | 34.12% |

| Intermediate Chemicals & Others | 23.00% | 6.0 | 10.9 | 6.92% | 24.12% |

| Total | 100.00% | 25.9 | 45.1 | 5.70% | 100.00% |

Feedstock Source Insights

Which Feedstock Type Segment Dominated the Europe Petrochemicals Market in 2025?

The naphtha segment held nearly 65% market share in 2025. The dominance of the segment can be linked to the ongoing tech innovations fuelling cracking efficiency and growing product demand for automotive and plastics materials. Naphtha is a crucial feedstock for manufacturing base chemicals such as propylene and aromatics through catalytic reforming.

The bio-based feedstocks segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a rapid shift towards low-carbon solutions and the region's commitment to the Green Deal. Moreover, growing demand for bio-based ethylene and propylene used in packaging, automotive, and personal care can drive segment expansion soon.

Manufacturing Process Insight

Which Manufacturing Process Type Segment Dominated the Europe Petrochemicals Market in 2025?

The steam cracking segment held a nearly 72% market share in 2025. The dominance of the segment can be attributed to the ongoing shift towards high-value chemicals and the growing demand for plastics in automotive and packaging. Regulatory frameworks are making conventional gas-fired furnaces more costly to operate, driving demand for the steam cracking process.

The fluid catalytic cracking (FCC) segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the increasing need for high-value petrochemicals (olefins) and stringent environmental regulations pushing cleaner fuels. Additionally, the demand for FCC additives is growing as it fulfils stringent standards while keeping high product yields.

End-Use Industry Insights

How Much Share Did the Packaging Segment Held in 2025?

The packaging segment dominated the market with approximately 35% share in 2025. The dominance of the segment is owed to growing consumer demand for lightweight and durable plastics, with the increasing environmental regulations and concerns. Also, the extensive growth in online shopping for robust, convenient, and lightweight packaging boosts the demand for plastic polymers.

The automotive segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to a rapid surge in urban populations in the region and robust demand for advanced vehicles. Furthermore, the growth of EV charging networks across Europe necessitates weather-resistant, durable, and electrical insulation materials.

Country Insights

How did the Germany Thrive in the Europe Petrochemicals Market in 2025?

Germany (ARRRA Cluster) dominated the market with nearly 32% share in 2025. The dominance of the country can be attributed to its cutting-edge automotive and production sectors, along with the country's emphasis on manufacturing high-quality products. Also, substantial investments in chemical recycling and bio-based feedstocks can impact positive market growth further in the country.

Europe Petrochemicals Market Volume and Share, By Country, 2025- 2035 (%)

| By Country | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Western Europe | 74.00% | 19.2 | 32.4 | 6.01% | 71.88% |

| Eastern Europe | 26.00% | 6.7 | 12.7 | 7.28% | 28.12% |

Which is the Fastest Growing Region in the Market?

Central and Eastern Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for plastics in the automotive and construction sectors, coupled with the EU's push towards sustainable solutions. Furthermore, ongoing investments in R&D for sustainable processes, AI, and automation improve efficiency and competitiveness, leading to regional growth soon.

The UK is expected to grow at a notable CAGR over the forecast period. The growth of the country can be driven by a robust focus on specialized applications in sectors such as packaging and pharmaceuticals, along with the heavy investment in sustainable chemical technologies. The presence of major players helps stabilize the market and attract consumers.

Recent Developments

- In June 2025, LyondellBasell (LYB) entered into an agreement with European petrochemical giant AEQUITA for the sale of polyolefins& olefins assets and the associated business in Europe.(Source: www.hydrocarbonprocessing.com)

Europe Petrochemicals Market Companies

- BASF SE: BASF SE stands as a foundational pillar of the European petrochemicals market, headquartered in Ludwigshafen, Germany, where it operates the world's largest integrated chemical complex.

- INEOS Group: INEOS Group is a dominant force in the European petrochemical market, known for its extensive manufacturing capabilities, strategic facility integration, and entrepreneurial approach to business.

Other Companies in the Market

- INEOS Group

- BASF SE

- Shell plc

- TotalEnergies SE

- LyondellBasell Industries N.V.

- SABIC (European Operations)

- Borealis AG

- Covestro AG

- Evonik Industries AG

- Arkema S.A.

- Repsol S.A.

- Eni S.p.A. (Versalis)

- PKN Orlen

- MOL Group

- LANXESS AG

- Solvay S.A.

- Clariant AG

- Wacker Chemie AG

- Bayer AG

- OMV Aktiengesellschaft

Segments Covered in the Report

By Product Type

- Olefins (Primary Building Blocks)

- Ethylene

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Ethylene Oxide.

- Propylene

- Polypropylene (PP)

- Propylene Oxide

- Acrylonitrile.

- Butadiene

- Ethylene

- Aromatics

- Benzene:

- Ethylbenzene (Styrene)

- Cumene (Phenol)

- Cyclohexane.

- Xylenes

- Ortho-xylene (Phthalic Anhydride)

- Para-xylene (PET/Polyester).

- Toluene: Solvents, TDI (Polyurethanes).

- Benzene:

- Intermediate Chemicals & Others

- Methanol

- Formaldehyde

- Acetic Acid

- MTBE.

- Vinyls

- Polyvinyl Chloride (PVC)

- Vinyl Acetate Monomer (VAM).

- Styrenics

- Polystyrene (PS)

- Expandable Polystyrene (EPS).

- Methanol

By Feedstock Source

- Fossil-Based

- Naphtha

- Ethane / Natural Gas Liquids (NGLs)

- Gas Oil / Refinery Off gases

- Sustainable/Circular

- Bio-based Feedstocks

- Vegetable oils

- Others (Agricultural waste, etc.)

- Recycled Feedstocks

- Renewable Methanol

- Bio-based Feedstocks

By Manufacturing Process

- Steam Cracking

- Fluid Catalytic Cracking (FCC)

- Catalytic Reforming

- Others

By End-Use Industry

- Packaging

- Food & Beverage

- Industrial, and Consumer Goods packaging.

- Others

- Automotive

- Lightweight polymers

- Battery components

- Tires

- Others (Adhesives, etc.)

- Construction

- Insulation (EPS/PUR)

- PVC Pipes

- Flooring

- Others (Sealants, etc.)

- Electronics & Electrical

- Housing for appliances

- Circuit boards

- Others (Insulation, etc.)

- Agriculture

- Fertilizers

- Pesticide intermediates

- Others (Plastic mulching, etc.)

- Pharmaceuticals & Healthcare

- Medical tubing

- Syringes

- Others (Active Ingredient intermediates, etc.)