Content

Enzymes Market Volume and Share 2034

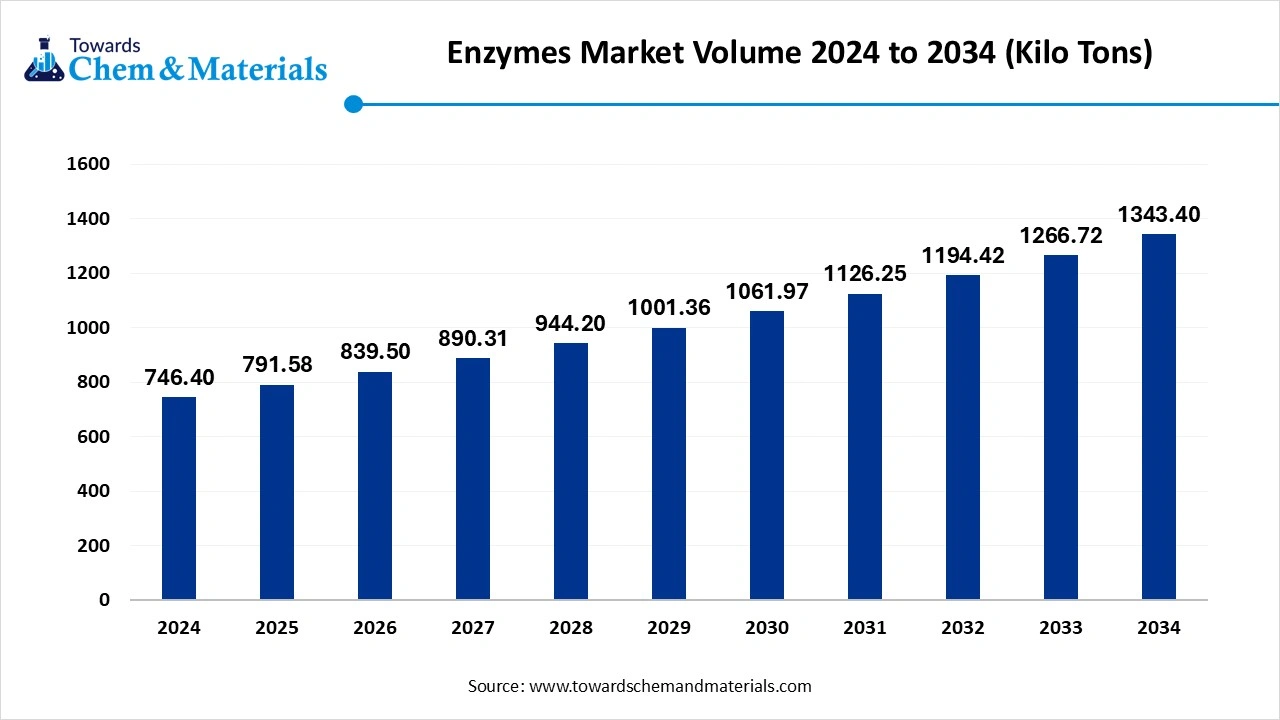

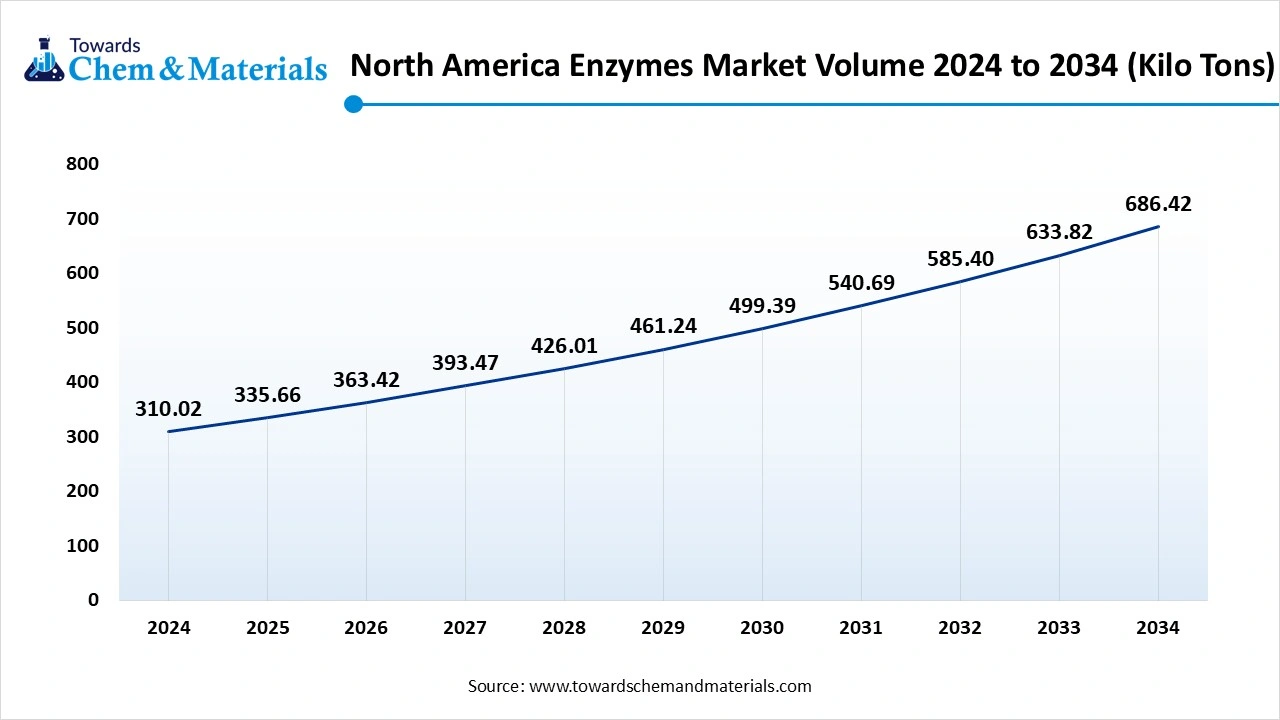

The global enzymes market volume was valued at 746.40 kilo tons in 2024 and is estimated to hit around 1343.40 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 6.05% during the forecast period 2025 to 2034. The heavy expansion of food and beverage industry is fueling the industrial growth in recent

Key Takeaways

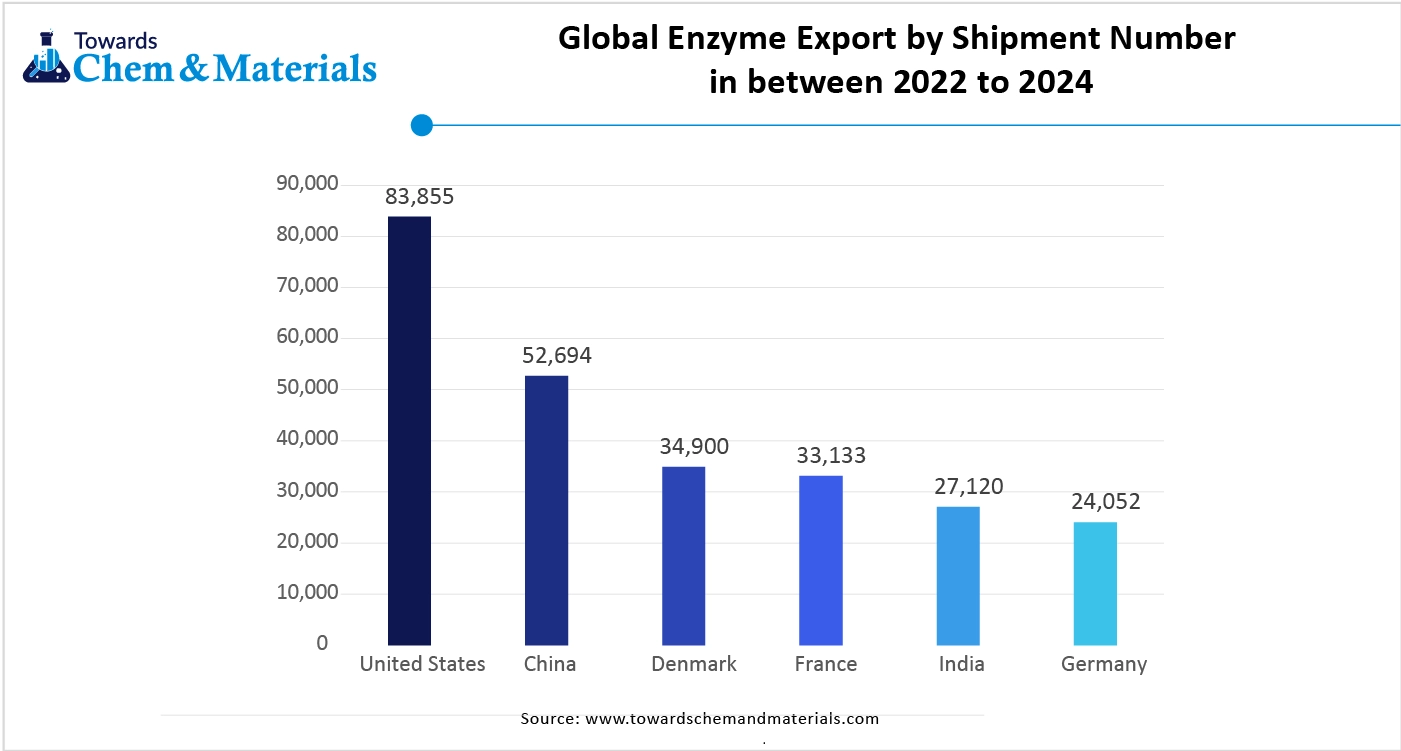

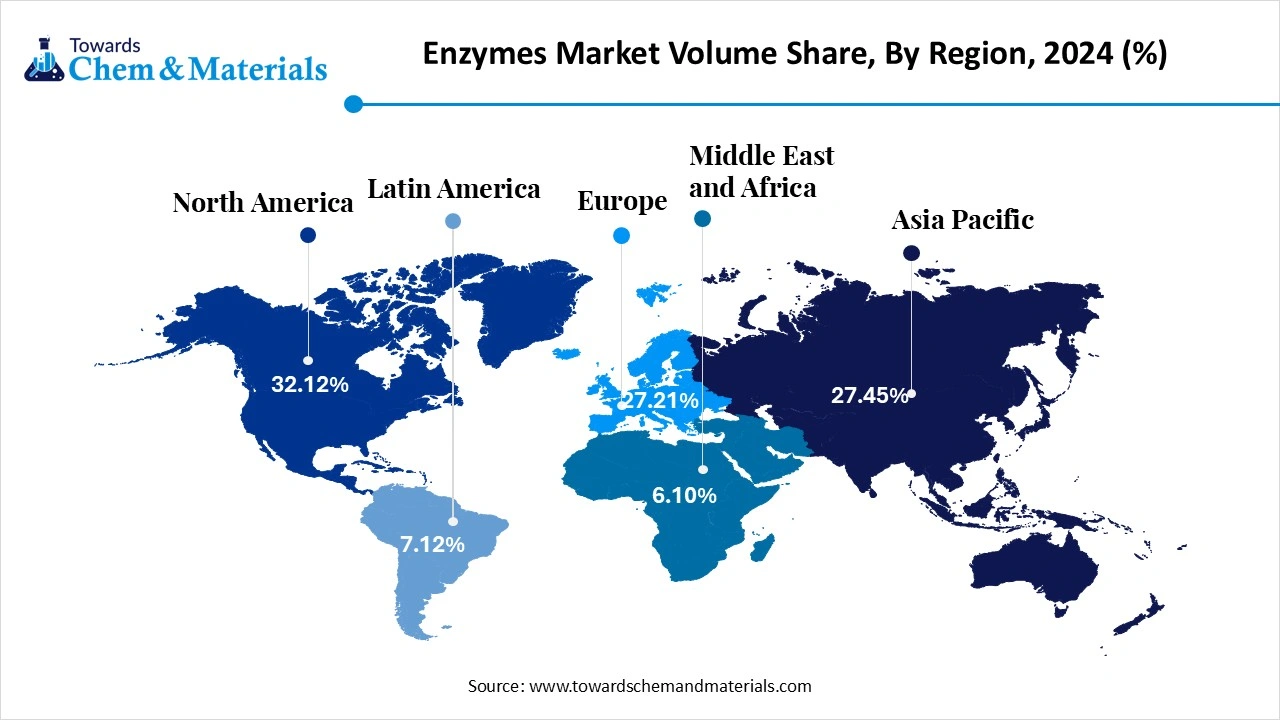

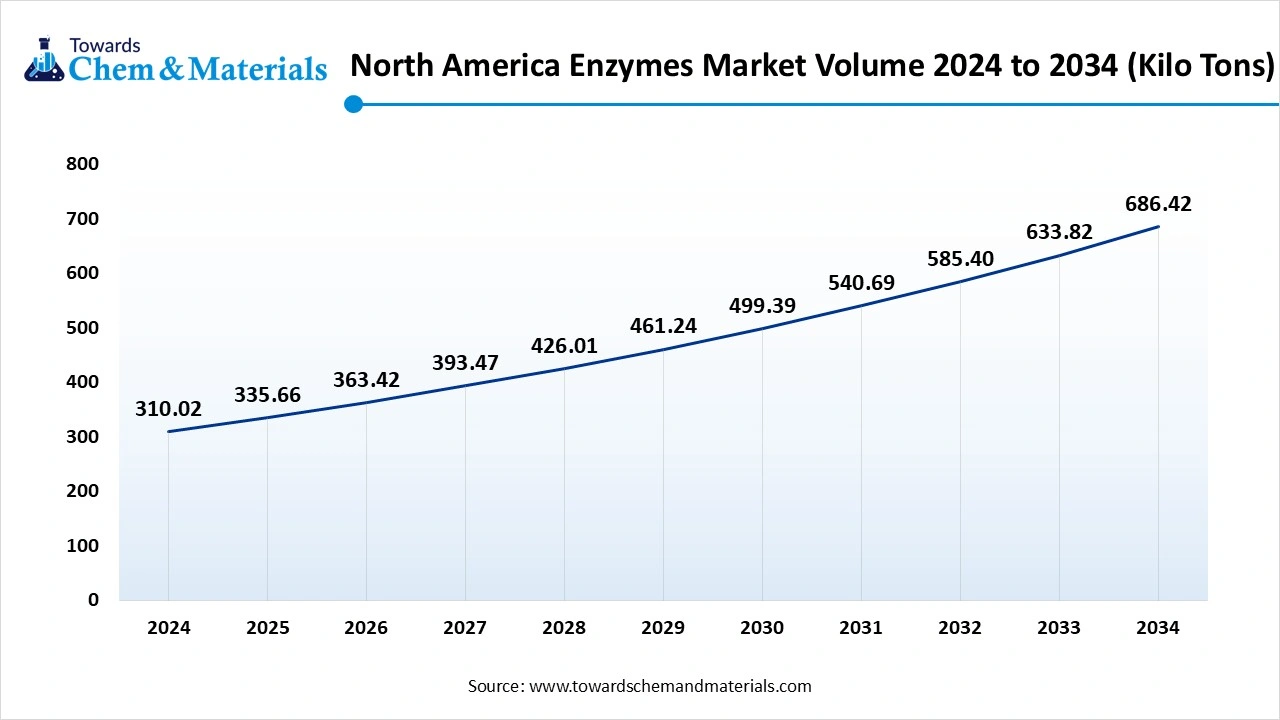

- The North America enzymes market is projected to grow from 250.79 Kilo Tons in 2025 to 376.29 Kilo Tons by 2034, at a CAGR of 4.61% from 2025 to 2034.

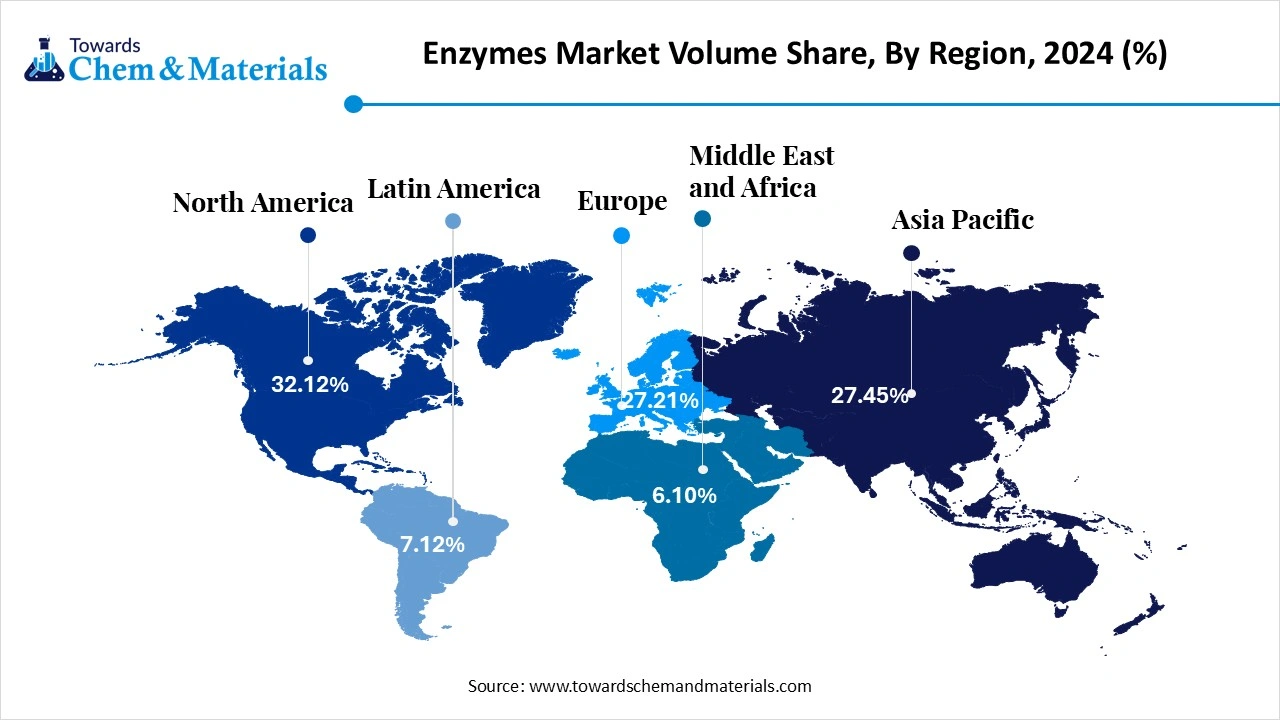

- North America dominated the enzymes market with the largest volume share of 32.12% in 2024 and is anticipated to grow at the fastest CAGR of 4.61% during the forecast period.

- The Europe has held volume share of around 27.21% in 2024.

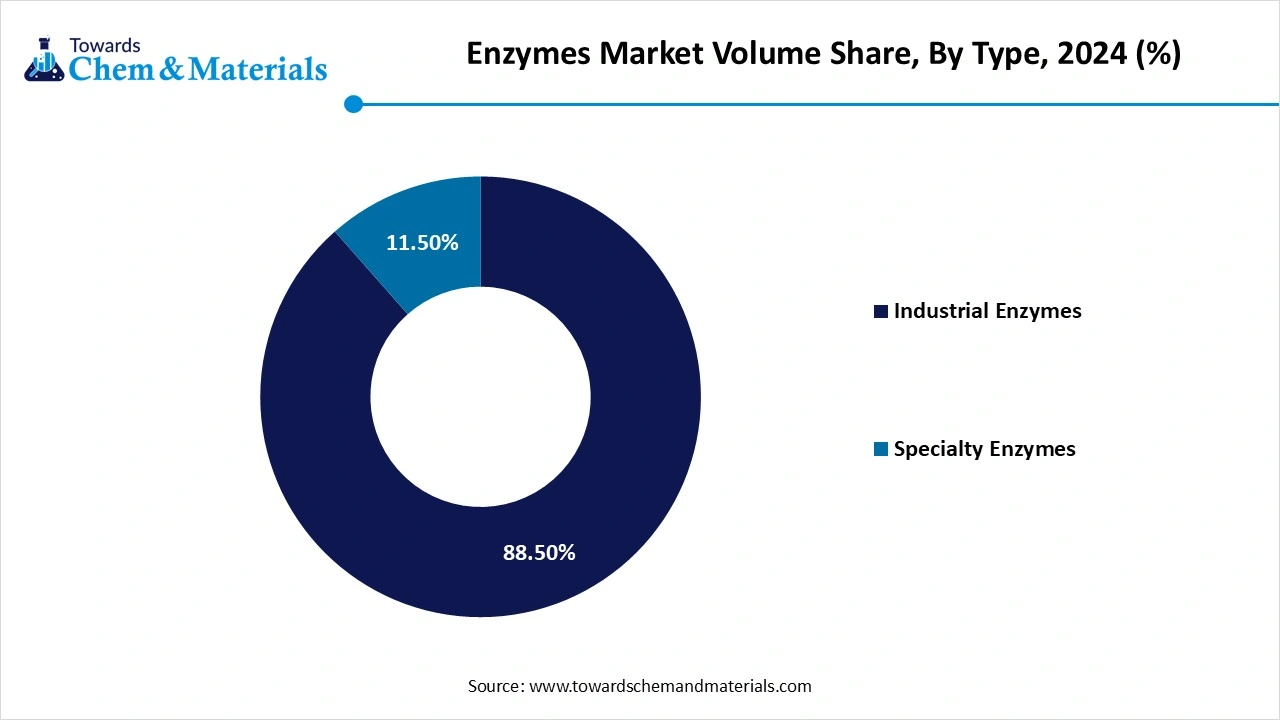

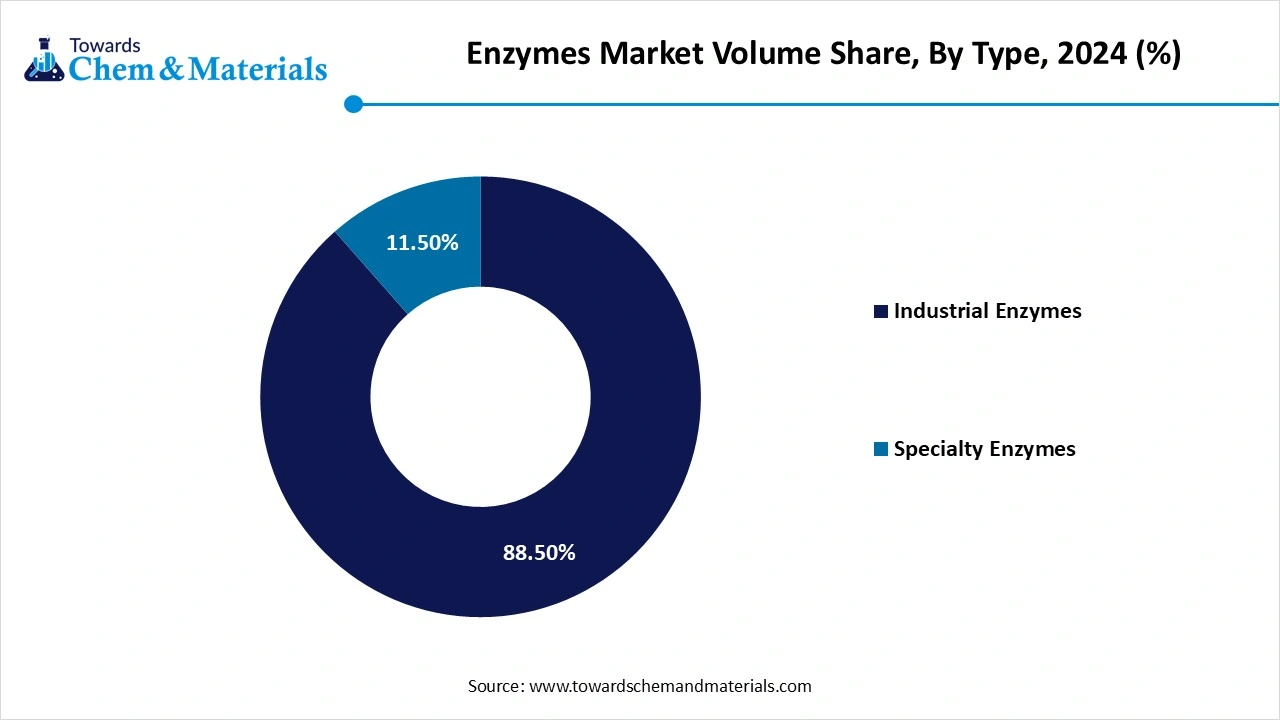

- By type, the industrial enzymes segment dominated the market with a volume share of over 88.50% in 2024.

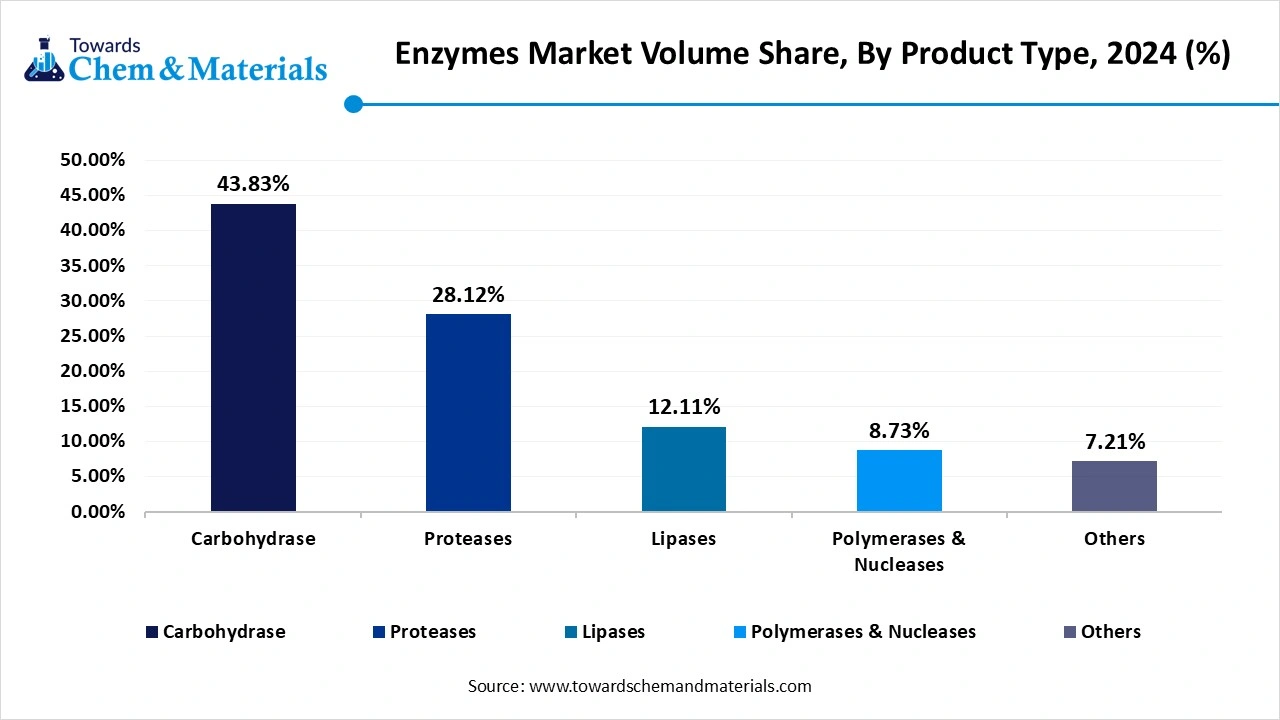

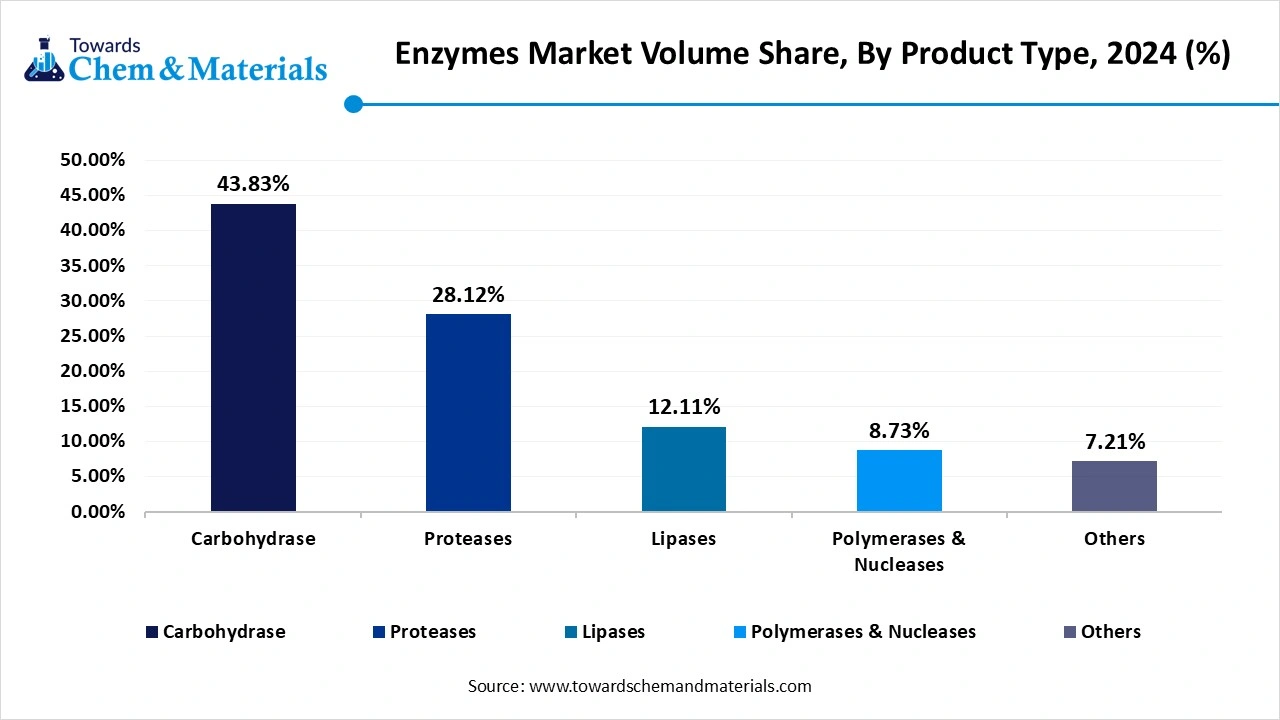

- By product type, the carbohydrase segment dominated the market with a volume share of over 43.83% in 2023.

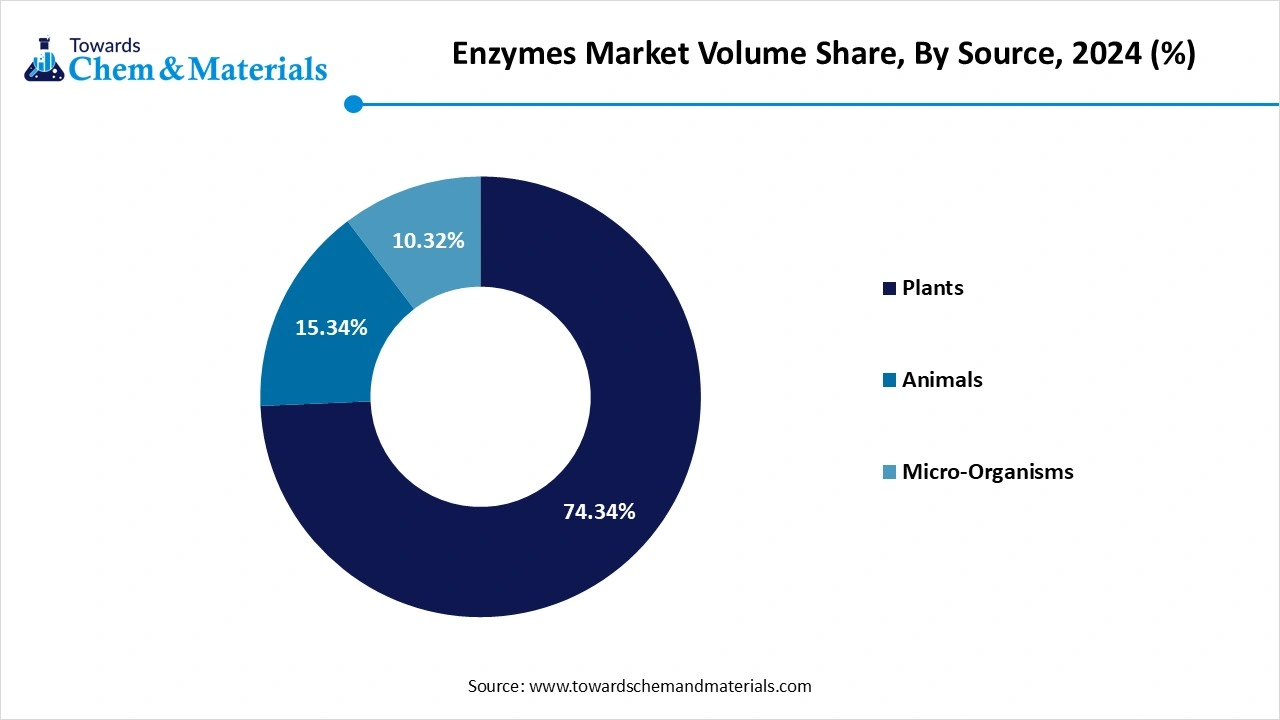

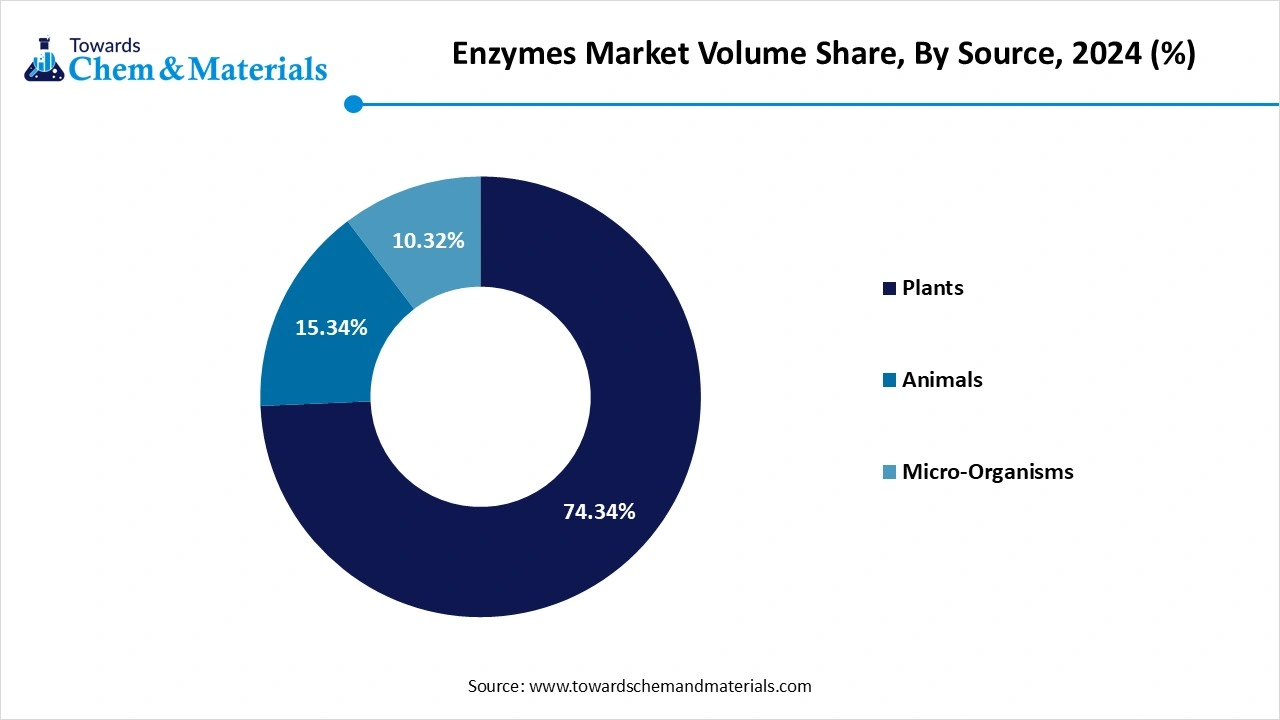

- By source, the Plants segment dominated the market with a volume share of over 74.34% in 2024.

Market Overview

Enzymes Powering the Future of Sustainable Industry

The enzymes market is expected to see consistent growth due to the widespread application of enzymes in food, pharmaceuticals, biofuels, and cleaning products in the current period. The rising demand for efficient, sustainable, and natural catalysts has reshaped production strategies in recent years. Industries are increasingly adopting enzyme-based processes to reduce energy consumption and improve product quality. Moreover, innovations in biotechnology and enzyme engineering are enabling precise formulations, making enzymes more accessible and cost-effective. In the past years, increased awareness regarding health and nutrition has also contributed to this trend. This transformation is encouraging.

Can Enzymes Replace Additives in Modern Food Production?

The rising demand for enzymes in the food and beverage industry is driving the industry's growth in the current period. Moreover, in recent years, food manufacturers have increasingly relied on enzymes to enhance texture, shelf life, and nutritional value. Also, this trend is driven by consumer preference for clean-label and additive-free products. Furthermore, enzymes are replacing chemical additives, providing more natural and health-conscious solutions. The demand is particularly high for enzymes used in the bakery, dairy, and brewing segments. As food production scales up globally, the need for efficient and sustainable enzyme solutions continues to support steady enzymes market expansion.

Enzymes Market Trends

- The rapid progress in biotechnology has led to the development of more efficient and specific enzymes is driving industry growth in the current period. In recent years, gene editing and protein engineering have enabled customized enzyme production with improved stability and reactivity, which allows for enhanced performance in extreme conditions, broadening their use across new applications. Moreover, the use of recombinant DNA technology has reduced production costs, making enzymes more affordable.

- Sustainability has become a major market trend, influencing enzyme applications in biofuels and biodegradable product development in recent years. Moreover, enzymes are increasingly used to reduce the environmental footprint of industrial processes. Moreover, in the current period, manufacturers are gaining advantages from enzymes to replace harsh chemicals in textile processing, waste management, and detergent formulations.

- In the current period, enzymes are witnessing increased demand in pharmaceutical manufacturing, particularly in drug formulation and diagnostics.

- Enzymes help improve bioavailability and reduce the side effects of medications. In the past years, enzyme-based therapies have shown promising results for conditions like cancer and genetic disorders. Moreover, the rise of personalized medicine is expanding the scope of enzyme applications.

- In recent years, there has been a noticeable increase in the use of enzymes in industries such as textiles, paper, and bioenergy. Industrial enzymes are helping manufacturers cut energy use, reduce waste, and enhance product performance in the current period. Moreover, enzyme-based processes improve the efficiency and sustainability of production lines. As a result, industries are gradually phasing out chemical-heavy methods.

Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 791.58 Kilo Tons |

| Market Volume by 2034 | 1343.40 Kilo Tons |

| Growth Rate from 2025 to 2034 | CAGR 6.05% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Type, By Product, By Source, By Region |

| Key Companies Profiled | BASF, Novozymes, DuPont Danisco, DSM, NOVUS International, Associated British Foods Plc, Chr.Hansen Holding A/S, Advanced Enzyme Technologies, Lesaffre, Adisseo |

Enzymes Market Opportunity

Bioplastics Boom: Enzyme–Powered Plastic Recycling Rises

The sudden shift toward eco-friendly materials is expected to create lucrative opportunities for the enzymes market. Moreover, the enzymes are being used to create and degrade bioplastics, reducing dependency on petrochemical-based products in recent years. Furthermore, enzyme-enabled plastic recycling is being explored as a scalable solution that can gain heavy industry share in the coming years.

High Cost & Tight Rules: Enzyme Industry Faces Growth Barriers

High production costs and regulatory approvals are expected to hinder the enzymes market growth during the forecast period. Moreover, stringent requirements for product quality and safety have increased, and investments are needed for launching new enzymes in recent years. Also, maintaining enzyme stability and activity during storage and transportation can create growth barriers in the coming years. This can impact small and mid-sized companies more severely. Furthermore, the lack of awareness about enzyme benefits in developing regions also hinders widespread adoption, slowing overall market penetration despite technological advances.

Regional Insights

The North America enzymes market volume was reached at 239.74 Kilo Tons in 2024 and is expected to be worth around 376.29 Kilo Tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 4.61% over the forecast period 2025 to 2034. North America dominated the enzymes market in 2024, akin to high industrial adoption and strong biotechnology infrastructure in the current period. In recent years, the region has shown strong demand in food, healthcare, and industrial sectors, backed by advanced research capabilities. Moreover, increasing awareness of sustainable practices is driving the use of enzymes across applications. Further, the presence of major global enzyme producers and supportive regulatory frameworks has strengthened market growth. The region's early integration of biotechnology into mainstream production processes gives it a first mover

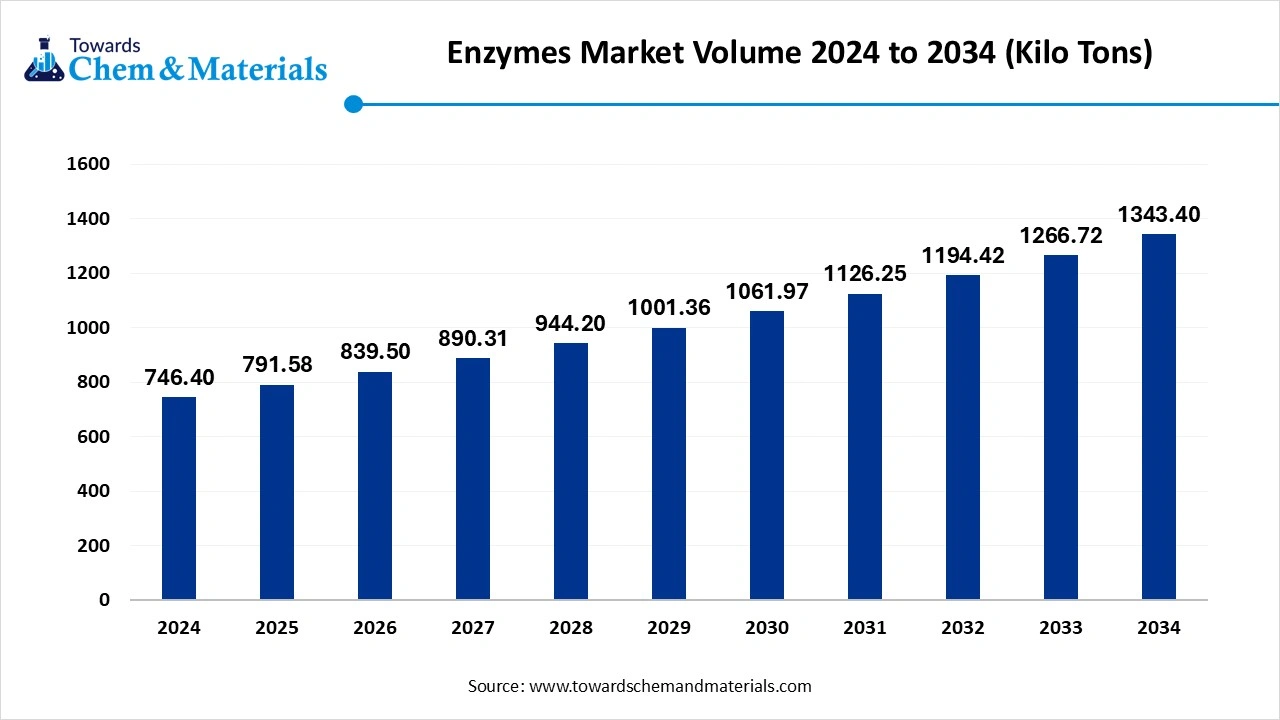

Is Sustainability the Next Big Driver for the United States Enzymes market Growth?

The United States maintained its dominance in the enzymes market owing to enzyme innovation. The country dominates due to strong R&D support, university-industry collaborations, and high domestic demand in the current period. In recent years, the pharmaceutical and food sectors have been contributing to the growth of the market. Moreover, increased funding for biotech startups and sustainability programs further supports expansion. From the other regions, the United States also has a large base of enzyme-consuming industries and advanced supply chain systems. Furthermore, regulatory guidance from the government, handled by platforms such as the FDA and EPA, has encouraged safer and more diverse enzyme product development in the current period.

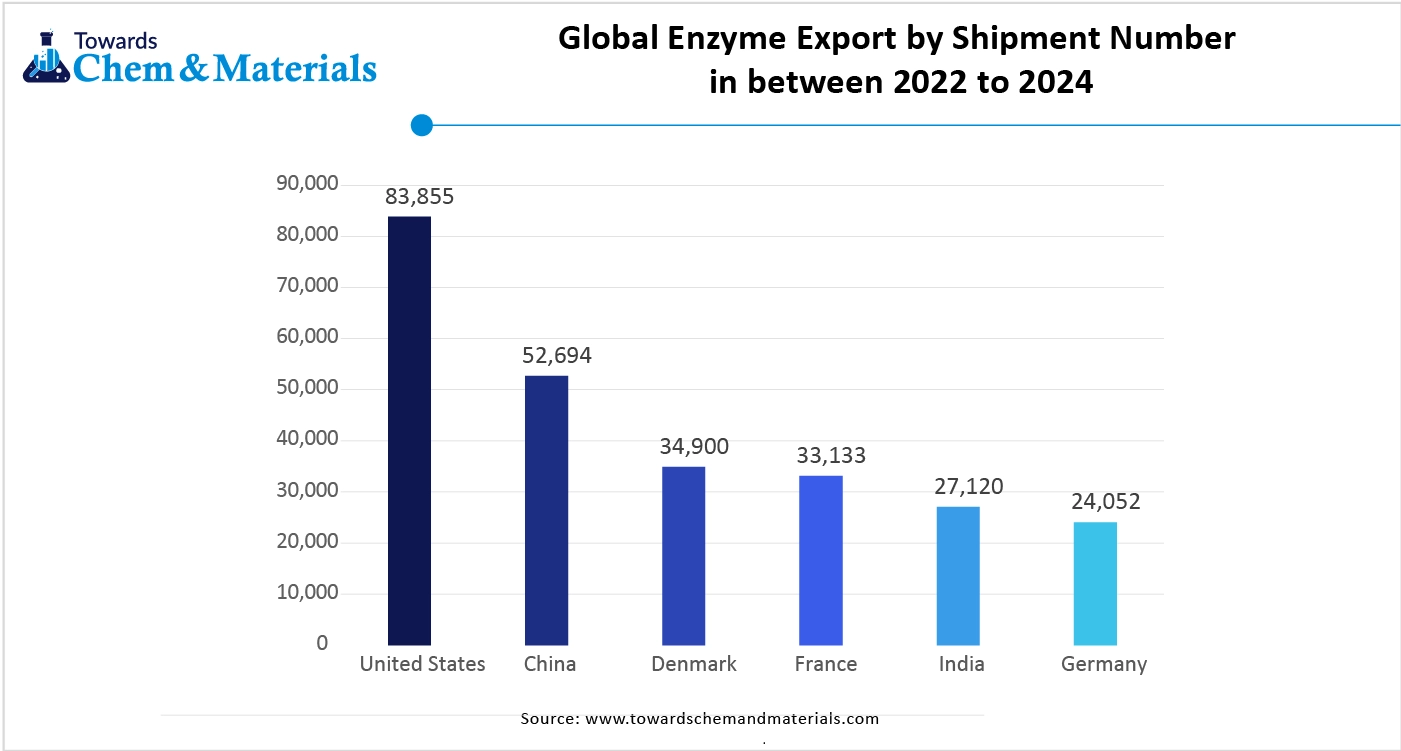

- Product Export: According to the report published by Observatory of Economic Complexity, the United States exported enzymes worth $ 1.1 billion in the years of 2023. Also, all exports of general enzymes fall under the chemical product section as per the report. (Source : oec.world )

Asia Pacific expects significant growth in the market during the forecast period, owing to the region emerging as a major future growth hub for the enzymes market. In recent years, rapid industrialization, rising consumer awareness, and expanding food and pharmaceutical sectors have set the foundation for strong demand. Moreover, governments are seen as promoting bio-based technologies and clean energy, where enzymes play a crucial role. Furthermore, lower production costs and increasing investments from global players are contributing to the region’s growing importance.

Will China Lead the Next Wave of Biotech Innovation?

China is expected to rise as a dominant country in the Asia Pacific region in the coming years. Government support for biotechnology and environmental sustainability is accelerating domestic enzyme production in the current period. In recent years, strong growth in food processing, pharmaceuticals, and textile industries has significantly raised enzyme demand. Moreover, China's growing middle class and health-conscious population are driving enzyme-based product consumption. Furthermore, the country is investing heavily in research and partnerships with global firms to boost innovation.

Enzymes Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| North America | 32.12% | 239.74 | 28.01% | 376.29 | 4.61% |

| Europe | 27.21% | 203.10 | 24.23% | 325.51 | 4.83% |

| Asia Pacific | 27.45% | 204.89 | 33.43% | 449.10 | 8.16% |

| Latin America | 7.12% | 53.14 | 8.12% | 109.08 | 7.46% |

| Middle East & Africa | 6.10% | 45.53 | 6.21% | 83.43 | 6.24% |

| Total | 100% | 746.40 | 100% | 1343.40 | 6.05% |

Segmental Insights

Application Type Insights

The industrial enzymes segment held the largest share of the enzymes market in 2024, akin to its widespread use across various industries such as food and beverages, textiles, paper and pulp, and biofuels. In recent years, industrial applications have seen a significant rise as enzymes help improve efficiency, reduce processing time, and cut energy usage. Moreover, cost-effective mass production and ease of integration into industrial processes further enhance adoption. Industries rely on enzymes to meet sustainability goals and maintain product quality, which boosts demand. This dominance continues as companies prioritize scalable and environmentally friendly production processes using industrial enzymes.

The specialty enzymes segment is seen to grow at a notable rate during the predicted timeframe owing to their advanced applications in healthcare, diagnostics, and biotechnology. In recent years, the rise in chronic diseases and the growth of personalized medicine have created demand for precise, targeted enzyme functions. Moreover, specialty enzymes offer higher specificity and efficiency, making them ideal for pharmaceutical and diagnostic use. Furthermore, biotechnology advances are enabling tailored enzyme production. As innovation grows, specialty enzymes are expected to lead future market growth due to their critical role in healthcare solutions, therapeutic treatments, and research-driven applications that require superior quality and performance.

Enzymes Market Volume Share, By Application Type, 2024-2034 (%)

| By Type | Volume Share, 2024 (%) | Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| Industrial Enzymes | 88.50% | 660.56 | 86.20% | 1158.01 | 5.77% |

| Specialty Enzymes | 11.50% | 85.84 | 13.80% | 185.39 | 8.00% |

| Total | 100% | 746.40 | 100% | 1343.40 | 6.05% |

Product Type Insights

The carbohydrase segment held the dominating share of the enzymes market in 2024 due to wide usage in food and beverage processing, especially in baking, brewing, and dairy. In the current period, their ability to break down carbohydrates into simple sugars continues to support large-scale industrial food production. Moreover, they enhance product taste, shelf life, and texture, aligning with consumer preferences. Further, they are commonly used in biofuel production, adding value to energy markets.

The proteas segment is seen to grow at a notable rate during the predicted timeframe, owing to their increasing use in pharmaceuticals, detergents, and food processing. In recent years, growing health concerns and demand for effective protein digestion solutions have boosted their usage. Moreover, they offer benefits like stain removal in detergents and meat tenderization in food industries. Furthermore, research advancements in enzyme engineering have enhanced their performance and stability.

Enzymes Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| Carbohydrase | 43.83% | 327.15 | 41.23% | 553.88 | 5.41% |

| Proteases | 28.12% | 209.89 | 30.21% | 405.84 | 6.82% |

| Lipases | 12.11% | 90.39 | 13.12% | 176.25 | 7.70% |

| Polymerases & Nucleases | 8.73% | 65.16 | 10.54% | 141.59 | 9.01% |

| Others | 7.21% | 53.82 | 4.90% | 65.83 | 2.26% |

| Total | 100% | 746.40 | 100.00% | 1343.40 | 6.05% |

Source Type Insights

The microorganisms segment dominated the market with the largest share in 2024, owing to their easy availability, fast growth, and high enzyme yield. In the current period, microbial enzymes are preferred for industrial and commercial applications due to their cost-effectiveness and ease of genetic modification. Moreover, fermentation techniques allow large-scale, consistent enzyme production. Furthermore, microbial enzymes are less affected by seasonal changes and offer stable performance, making them ideal for mass production.

The animals source segment is expected to grow at the fastest rate in the enzymes market during the forecast period due to their close similarity to human enzymes, which improves their effectiveness in healthcare and pharmaceutical applications. In recent years, rising demand for therapeutic enzymes and advancements in enzyme extraction have improved their market outlook. Moreover, animal-derived enzymes are commonly used in digestive aids, wound care, and diagnostic kits. Furthermore, as precision medicine and tailored treatments expand, enzymes sourced from animals are expected to see increased demand.

Enzymes Market Volume Share, By Source Type, 2024-2034 (%)

| By Source | Volume Share, 2024 (%) | Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| Plants | 74.34% | 554.87 | 79.12% | 1062.90 | 6.72% |

| Animals | 15.34% | 114.50 | 12.67% | 170.21 | 4.04% |

| Micro-Organisms | 10.32% | 77.03 | 8.21% | 110.29 | 3.65% |

| Total | 100% | 746.40 | 100% | 1343.40 | 6.05% |

Enzymes Market Recent Developments

- In February 2025, Thyssenkrupp Uhde and Novonesis introduced their latest technology for the enzymatic esterification. For this development, the company created a collaboration recently. Moreover, this technology is specifically designed for operating at lower temperatures as per the company report. (Source : ofimagazine )

- In April 2025, eXoZymes unveiled their latest innovation called BioClik. This innovation can support the enhancement of enzyme engineering and advanced chemical reactions in the coming years as per the report published by the company. (Source : globenewswire )

- In September 2024, TriLink Bio Technologies and Alphazyme created a partnership and introduced new CleanScribeTM RNA Polymerase. This is the newly introduced enzyme that can reduce dsRNA in mRna production, as per the company's claim.

(Source : businesswire )

Top Companies list

- BASF

- Novozymes

- DuPont Danisco

- DSM

- NOVUS International

- Associated British Foods Plc

- Chr.Hansen Holding A/S

- Advanced Enzyme Technologies

- Lesaffre

- Adisseo

Segment Covered in the Report

By Type

- Industrial Enzymes

- Food & Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp & Paper

- Nutraceutical

- Personal Care & Cosmetics

- Wastewater

- Others

- Specialty Enzymes

- Pharmaceutical

- Research & Biotechnology

- Diagnostics

- Biocatalyst

By Product

- Carbohydrases

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

By Source

- Plants

- Animals

- Microorganisms

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait