Content

What is the Current Carbon Capture Utilization Chemicals Market Size and Volume?

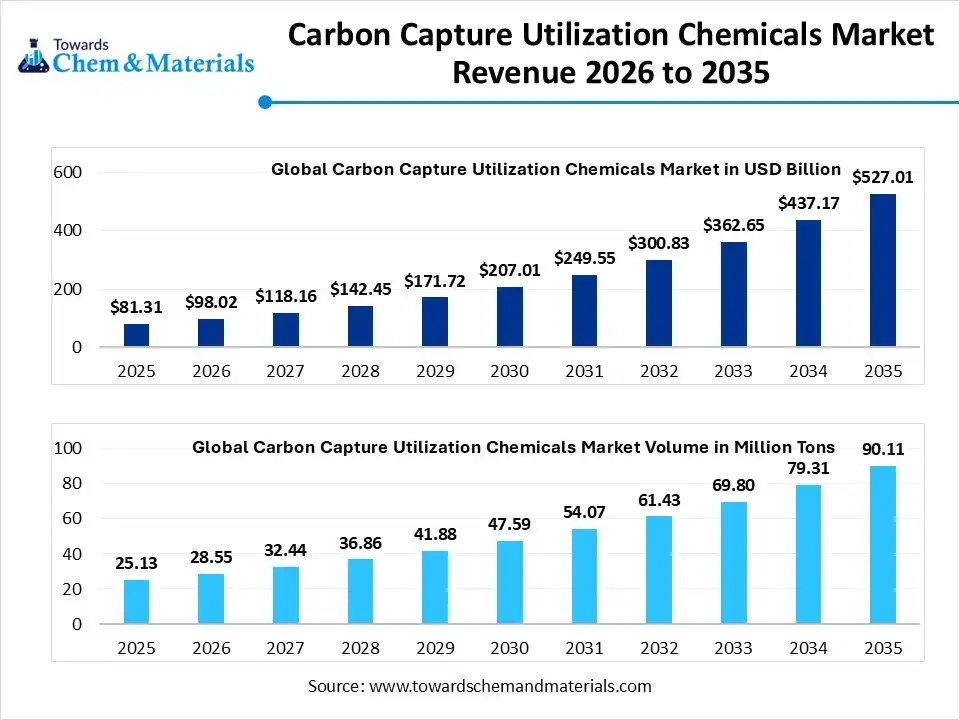

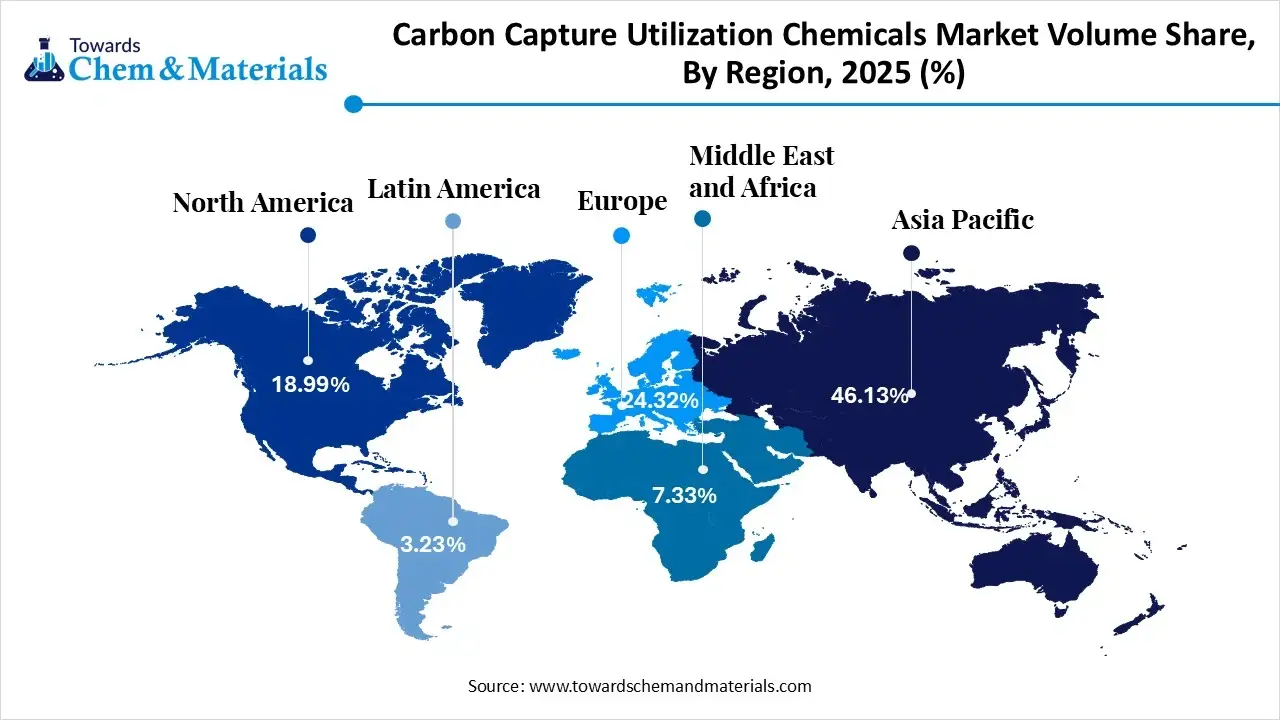

The global carbon capture utilization chemicals market size was estimated at USD 81.31 billion in 2025 and is expected to increase from USD 98.02 billion in 2026 to USD 527.01 billion by 2035, growing at a CAGR of 20.55%. In terms of volume, the market is projected to grow from 28.55 million tons in 2026 to 90.11 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 13.62% over the forecast period 2026 to 2035. The Asia Pacific dominated the carbon capture utilization chemicals market with the largest volume share of 46.13% in 2025. The stringent decarbonization goals and focus on energy independence drive the market growth.

The carbon capture utilization chemicals market is growing due to stricter emission targets, increasing investment in CCUS, expansion of direct air capture technologies, the growing cement industry, development of large-scale CCUS, rise in enhanced oil recovery, expanding oil & gas sector, and strong focus on energy security. the Carbon capture utilization (CCU) chemicals are specialized chemicals designed to separate carbon dioxide from industrial gases. These uses processes like solvent scrubbing, mineral carbonation, and electrochemical conversion. The various types of chemicals are catalysts, solvents, and adsorbents. These chemicals convert captured CO2 into products like building materials, synthetic fuels, and chemical feedstocks.

Report Highlights

- Asia Pacific dominated the global capture utilization chemicals market with the largest volume share of 46.13% in 2025.

- The capture utilization chemicals market in Europe is expected to grow at a substantial CAGR of 16.64% from 2026 to 2035.

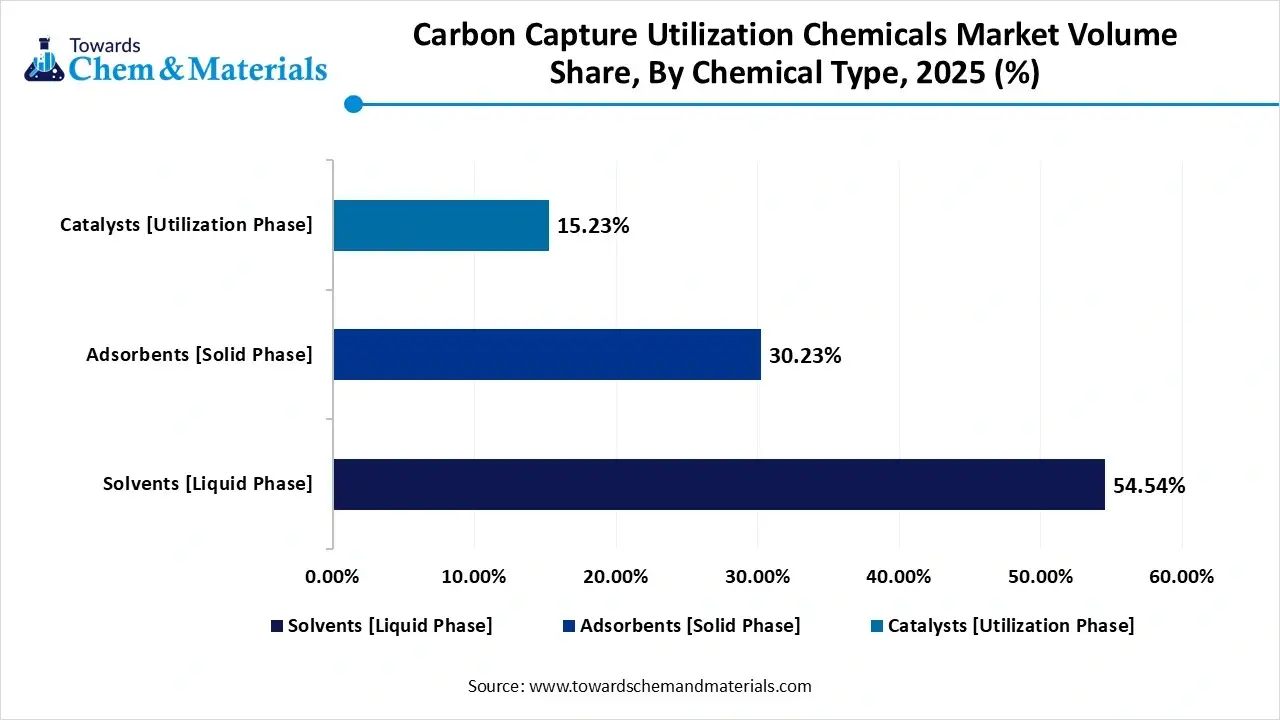

- By chemical type, the solvents segment dominated the market and accounted for the largest volume share of 55% in 2025.

- By chemical type, the adsorbents segment is expected to grow at the fastest CAGR of 18.25% from 2026 to 2035 in terms of volume.

- By capture technology, the post-combustion segment led the market with the largest revenue volume share of 58% in 2025.

- By utilization pathway, the enhanced recovery segment dominated the market and accounted for the largest volume share of 44.5% in 2025.

- By end-use industry, the power generation segment led the market with the largest revenue volume share of 38.3% in 2025.

Carbon Capture Utilization Chemicals Market Trends:

- Growing Sustainable Products Demand: The strong focus on limiting fossil fuel use and increasing consumer awareness about the negative effects of CO2 increases demand for sustainable products like SAF.

- Surging Steel Manufacturing: The increasing use of steel products across construction & other industries and growing use of the BF-BOF method during steel manufacturing generates a high amount of CO2 that increases demand for CCU chemicals.

- Growing Construction Projects: The increased use of binders & precast concrete in construction activities and transition towards using low-carbon building materials increases demand for CCU chemicals to capture CO2.

- Environmental Regulations: The government's strict emission reduction rules and focus on national net-zero targets increase the development of CCU chemicals.

Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 98.02 Billion / 28.55 million tons |

| Revenue Forecast in 2035 | USD 527.01 Billion / 90.11 million tons |

| Growth Rate | CAGR 20.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Chemical Type, By Capture Technology, By Utilization Pathway, By End-Use Industry, By Region |

| Key companies profiled | Air Liquide S.A., Aker Carbon Capture ASA, Avantium N.V., BASF SE, Blue Planet Systems Corporation, Carbon Clean Solutions Ltd., Carbon Recycling International (CRI), Carbon Upcycling Technologies Inc., CarbonCure Technologies Inc., Climeworks AG, Covestro AG, Econic Technologies Ltd., LanzaTech Global, Inc., Liquid Wind AB, Mitsubishi Chemical Group Corporation, Novomer Inc., SABIC, SK Innovation Co., Ltd., Solidia Technologies, Inc., TotalEnergies SE |

Key Technological Shifts in the Carbon Capture Utilization Chemicals Market:

The carbon capture utilization chemicals market is undergoing key technological changes driven by the demand for performance efficiency and lowering cost. The technological innovations, like machine learning, data analytics, process simulation, big data, and digital twin, accelerate material development. The major technological shift is the integration of AI accelerates material discovery and minimizes the cost.

AI adjusts the parameters of processing and accelerates the screening of novel materials. AI prevents costly downtime and manufactures efficient novel catalysts. AI lowers the use of chemicals and enhances the reliability of the plant. AI optimizes the conversion process of captured CO2 and analyzes stable sites for storage. Overall, AI is a smart method that transforms captured CO2 into valuable products.

Trade Analysis of Carbon Capture Utilization Chemicals Market: Import & Export Statistics

- Saudi Arabia exported 1,380 shipments of monoethanolamide.

- Saudi Arabia exported 1,271 shipments of diethanolamine.

- China exported $336M of sodium hydroxide solid in 2023.

- South Korea exported $148M of potassium carbonates in 2023.

- Vietnam imported $44.4M of sodium hydroxide solid in 2023.

- India exported $322M of activated carbon in 2023.

- Germany imported $276M of activated carbon in 2023.

Carbon Capture Utilization Chemicals Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement is acquiring feedstocks like hydrogen, catalysts, minerals, carbon dioxide, waste streams, and methanol.

- Key Players:- Cemex, Tata Steel, ExxonMobil, Linde Plc, Carbon Clean, Heidelberg Materials

- Chemical Synthesis and Processing : The chemical synthesis and processing include diverse methods like electrochemical synthesis, polymerization, thermochemical conversion, biochemical synthesis, and mineral carbonation.

- Key Players:- Covestro, Linde, CarbonFree, CRI, BASF, Mitsubishi Heavy Industries, Carbon Clean

- Quality Testing and Certifications : The quality testing is a process of measuring attributes like impurities, energy consumption, structural integrity, purity, operational stability, and composition analysis. Certification includes ISCC CFC, ISO Standards, and Carbon Assured Certification for carbon capture utilization chemicals.

- Key Players:- TUV SUD, Intertek, Verra, ACR, SGS, LRQA

Uses of CCU Products Across Diverse Industries

| CCU Products | Used in Industries | Applications |

| Plastics | Construction Consumer Goods |

Packaging Building Materials Durable Goods |

| Synthetic Fuels | Transportation |

Renewable Energy Storage Aviation Shipping |

| Synthetic Fuels | Energy Chemicals |

Power Generation Methanol Production |

| Carbonates | Construction Agriculture |

Cement Concrete |

Segmental Insights

By Chemical Type Insights

Why Solvent Segment Dominates the Carbon Capture Utilization Chemicals Market?

The solvents segment dominated the carbon capture utilization chemicals market in 2025 with a 55% share. The rapid growth in steel manufacturing and well-established power plants increases demand for solvents. The expanding natural gas processing industry and the presence of industrial exhaust systems require solvents. The high capture efficiency and excellent scalability of solvents drive the overall market growth.

The adsorbents segment is the fastest-growing in the market during the forecast period. The growing post-combustion capture and rise in manufacturing of chemicals require adsorbents. The strong focus on using energy-efficient solutions and lowering the corrosion of equipment increases demand for adsorbents. The environmental compatibility, high selectivity, and excellent flexibility of adsorbents support the overall market growth.

Carbon Capture Utilization Chemicals Market Volume and Share, By Chemical Type 2025-2035

| By Chemical Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Solvents [Liquid Phase] | 54.54% | 13.71 | 43.05 | 13.56% | 47.77% |

| Adsorbents [Solid Phase] | 30.23% | 7.60 | 34.35 | 18.25% | 38.12% |

| Catalysts [Utilization Phase] | 15.23% | 3.83 | 12.71 | 14.27% | 14.11% |

By Capture Technology Insights

How did the Post-Combustion Capture Segment hold the Largest Share in the Carbon Capture Utilization Chemicals Market?

The post-combustion capture segment held the largest revenue share of 58% in the market in 2025. The strong focus on lowering the need for the development of new plants and heavy industrial infrastructure increases demand for post-combustion capture. The focus on immediate reduction of emissions requires post-combustion capture. The operational flexibility, reliable efficiency, easy implementation, and retrofit compatibility of post-combustion capture drive the market growth.

The direct air capture (DAC) segment is experiencing the fastest growth in the market during the forecast period. The growing low-concentration CO2 emission and focus on achieving climate goals increases the adoption of DAC. The increased production of sustainable aviation fuels and growth in chemical manufacturing processes require DAC. The high scalability and innovations like metal-organic frameworks support the overall market growth.

By Utilization Pathway Insights

Why Enhanced Recovery Segment Dominates the Carbon Capture Utilization Chemicals Market?

The enhanced recovery segment dominated the carbon capture utilization chemicals market in 2025 with a 44.5% share. The increased production of additional oil and stringent emission reduction standards increase demand for enhanced recovery. The increasing demand for crude oil and the strong presence of pipelines increase the demand for enhanced recovery. The increased utilization of enhanced oil recovery drives the market growth.

The fuel synthesis segment is the fastest-growing in the market during the forecast period. The growing production of renewable fuels and increasing focus on energy security increase demand for fuel synthesis. The need to lower reliance on fossil fuels and the production of synthetic kerosene requires CCU chemicals. The growing production of sustainable aviation fuel, methanol, and synthetic diesel supports the market growth.

By End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the Carbon Capture Utilization Chemicals Market?

The power generation segment held the largest revenue share of 38.3% in the market in 2025. The increasing need for lower energy independence and the presence of large-scale power generation operations increase demand for CCU chemicals. The rise in the development of thermal power plants and the shift towards cleaner energy require CCU chemicals. The continuous growth in electricity production and the regulatory push for energy independence drive the market growth.

The chemical & petrochemical segment is experiencing the fastest growth in the market during the forecast period. The increased need for building materials and growth in the utilization of chemicals across diverse sectors create a higher demand for CCU chemicals. The creation of high-value products and the higher use of plastics require CCU chemicals.

By Regional Insights

Asia Pacific Carbon Capture Utilization Chemicals Market Trends

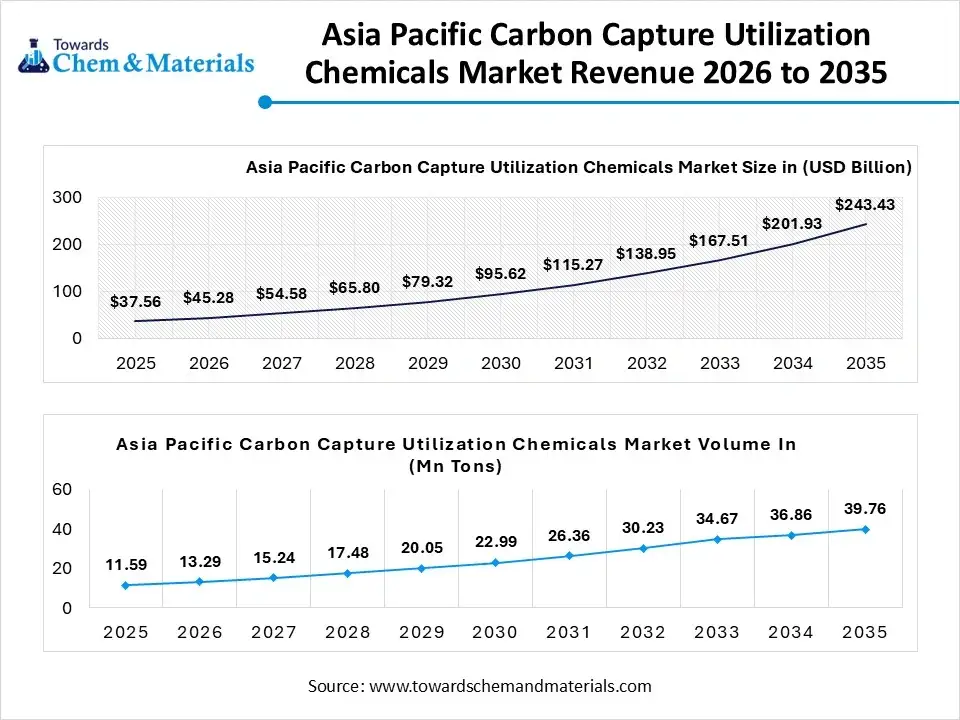

The Asia Pacific carbon capture utilization chemicals market size was valued at USD 37.56 billion in 2025 and is expected to be worth around USD 243.43 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 20.57% over the forecast period from 2026 to 2035. The Asia Pacific carbon capture utilization chemicals market volume is approximately 13.29 million tons in 2026 and is projected to reach approximately 39.76 million tons by 2035 growing at a CAGR of 16.68% from 2026 to 2035.

Asia Pacific dominated the market with a 46% share in 2025. The growing emissions in regions and the rise in industrial operations increase demand for carbon capture utilization chemicals. The increasing need for air purification and the expansion of ammonia production increase demand for CCU chemicals. The rapid growth of steel industries and the increasing need for power require CCU chemicals. The increasing investment in CCU chemicals and ongoing innovations in CCU chemicals drive the market growth.

China Leading Force Behind Carbon Capture Utilization Chemicals

China is a key contributor to the market. The growing production of petrochemicals and the increased generation of power require CCU chemicals. The strong government focus on dual carbon goals and the rise in production of synthetic ammonia increase demand for CCU chemicals. The growing enhanced oil recovery and strong government support for CCU chemicals support the overall market growth.

- China exported 1,997 shipments of monoethanolamine.

Carbon Capture Utilization Chemicals Market Volume and Share, By Region 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 18.99% | 4.77 | 19.38 | 16.85% | 21.51% |

| Europe | 24.32% | 6.11 | 24.43 | 16.64% | 27.11% |

| Asia Pacific | 46.13% | 11.59 | 39.76 | 14.68% | 44.12% |

| South America | 3.23% | 0.81 | 1.92 | 10.03% | 2.13% |

| Middle East & Africa | 7.33% | 1.84 | 4.62 | 10.76% | 5.13% |

North America Carbon Capture Utilization Chemicals Market Trends

North America’s Carbon Capture Utilization Chemicals market expects the fastest growth as the region leads global adoption of CO₂ to chemicals technologies, driven by strong federal incentives like the U.S. 45Q tax credit, major infrastructure funding, and supportive regulatory frameworks that enhance project economics. North America holds a large share of the global market and is transitioning from pilot projects to commercial-scale facilities producing methanol, polymers, and other CO₂-derived chemicals. Demand is boosted by industrial decarbonization, construction materials using CO₂, and corporate sustainability targets.

Carbon Reimagined: United States Story of CCU Chemicals

The United States is a major contributor to the market in the region. The strong focus on decarbonization in industrial activities and the surge in the production of oil require CCU chemicals. The strong presence of power plants and corporate companies that focus on net-zero targets increases demand for CCU chemicals. The strong government backing for capturing CO2 supports the overall market growth.

- The United States exported 1,173 shipments of monoethanolamine.

Europe Carbon Capture Utilization Chemicals Market Trends

Europe is growing at a notable rate in the market. The focus on the reduction of CO2 and supportive policies for the development of CO2 utilization increases demand for CCU chemicals. The presence of a heavy industrial base and the development of projects like Northern Lights in Norway require CCU chemicals. The aggressive climate targets increase the adoption of CCU chemicals, driving the overall market growth.

Turning Carbon into Craft: Germany’s Journey of CCU Chemicals

Germany is growing substantially in the market. The significant base of chemical industries and the ambitious target for climate neutrality increase demand for CCU chemicals. The increased production of renewable hydrogen and well-established industrial sectors increases demand for CCU chemicals. The supportive financial policies for CCU chemicals development support the overall growth of the market.

Middle East & Africa Carbon Capture Utilization Chemicals Market Trends

The Middle East & Africa are growing in the market. The large presence of petrochemical operations and the push towards decarbonization increase demand for CCU chemicals. The increasing need for water treatment and the higher production of synthetic methanol require CCU chemicals. The development of large-scale energy projects and the shift towards carbon-neutral processes increase demand for CCU chemicals, driving the overall market growth.

Carbon Capture Power: How the UAE is Transforming CCU Chemicals

The United Arab Emirates is growing in the market. The net-zero targets across industries and expansion in enhanced oil recovery increase demand for CCU chemicals. The well-developed Abu Dhabi Industrial City hub and growing applications like food & beverage carbonation increase demand for CCU chemicals. The heavy investment in CCU chemicals supports the overall market growth.

South America Carbon Capture Utilization Chemicals Market Trends

South America is growing significantly in the market. The stringent emission standards and growing extraction of oil increase demand for CCU chemicals. The increasing need for air filtration and growing manufacturing activity increases demand for CCU chemicals. The strong focus on the development of a large-scale CCU chemicals hub drives the overall market growth.

Turning Carbon Green: Brazil’s Rise in CCU Chemical

Brazil is growing substantially in the market. The increasing pressure for decarbonization and the rise in the production of ammonia require CCU chemicals. The increased bioethanol production and growth in oil refining activities require CCU chemicals. The development of industrial CCU hubs supports the overall growth of the market.

Recent Developments

- In May 2025, the Department of Science and Technology launched the first cluster of CCU testbeds in India for the cement industry. The testbeds focus on achieving net-zero goals and developing innovative materials, reactors, catalysts, electronics, & electrolyser technology. (Source: https://www.pib.gov.in/)

- In January 2024, Celanese started carbon capture and utilization operations at the Clear Lake, Texas, facility. The facility’s low-carbon methanol production capacity yearly is 130000 metric tons and it develops diverse products. (Source: https://www.celanese.com)

- In October 2024, LanzaTech partnered with Eramet to announce the development of a CCUS project in Norway. The project's first phase is the development of CCU, and the second phase is CCS development. The first phase focuses on producing ethanol, and the yearly production capacity is 24000 tonnes. (Source: https://www.eramet.com)

Market Top Companies

- BASF SE: The Germany-based leading chemical company converts captured CO2 into diverse chemicals like ethanol, urea, & carbonates and provides OASE blue technology for captured CO2.

- Ecolab Inc. (Nalco): The company produces direct air capture chemicals to minimize water use, GHG emissions, & energy to serve diverse industrial processes.

- Solvay S.A.: The Belgium-based chemical company develops an innovative process for reintegrating & capturing CO2 emissions to serve diverse sectors.

- Air Products and Chemicals, Inc.: The company is a leading player in industrial gases that offers core techniques for capturing CO2 emissions across industrial processes.

- Tosoh Corporation

- Honeywell International Inc. (UOP)

- Zeochem AG

- Mitsubishi Chemical Group Corporation

- Huntsman Corporation

- INEOS Group

- Occidental Petroleum Corporation (OxyChem)

- Westlake Corporation

- Formosa Plastics Corporation

- Yara International ASA

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Graymont Limited

- Carmeuse

- Wacker Chemie AG

- Dow Inc.

Segments Covered

By Chemical Type

- Solvents (Liquid Phase)

- Amine-based Chemicals

- Monoethanolamine (MEA)

- Methyldiethanolamine (MDEA)

- Diethanolamine (DEA)

- Piperazine (PZ)

- Sterically Hindered Amines

- Alkaline-based Chemicals

- Sodium Hydroxide (NaOH)

- Potassium Hydroxide (KOH)

- Sodium Carbonate

- Potassium Carbonate

- Ammonia-based Solutions

- Ionic Liquids

- Amine-based Chemicals

- Adsorbents (Solid Phase)

- Zeolites (Molecular Sieves)

- Metal-Organic Frameworks (MOFs)

- Activated Carbon

- Silica Gel

- Alumina-based Adsorbents

- Catalysts (Utilization Phase)

- Hydrogenation Catalysts (Copper/Zinc-based)

- Electrochemical Catalysts

- Carbonation Catalysts

- Biological/Enzymatic Catalysts

By Capture Technology

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

- Direct Air Capture (DAC)

By Utilization Pathway

- Chemical Synthesis

- Methanol Production

- Urea Production

- Polymer & Plastic Synthesis

- Organic Acid Production (Formic, Acetic)

- Fuel Synthesis

- Synthetic Natural Gas (Methane)

- Aviation e-Fuels

- Diesel Replacements

- Mineralization & Construction

- CO2-cured Concrete

- Aggregates Production

- Pre-cast Building Materials

- Biological Utilization

- Algae-based Biomass

- Greenhouse Enrichment

- Enhanced Recovery

- Enhanced Oil Recovery (EOR)

- Enhanced Gas Recovery (EGR)

By End-Use Industry

- Oil & Gas

- Power Generation

- Chemical & Petrochemical

- Iron & Steel

- Cement & Lime

- Pulp & Paper

- Food & Beverage

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa