Content

What is the Current Fertilizers Market Size and Volume?

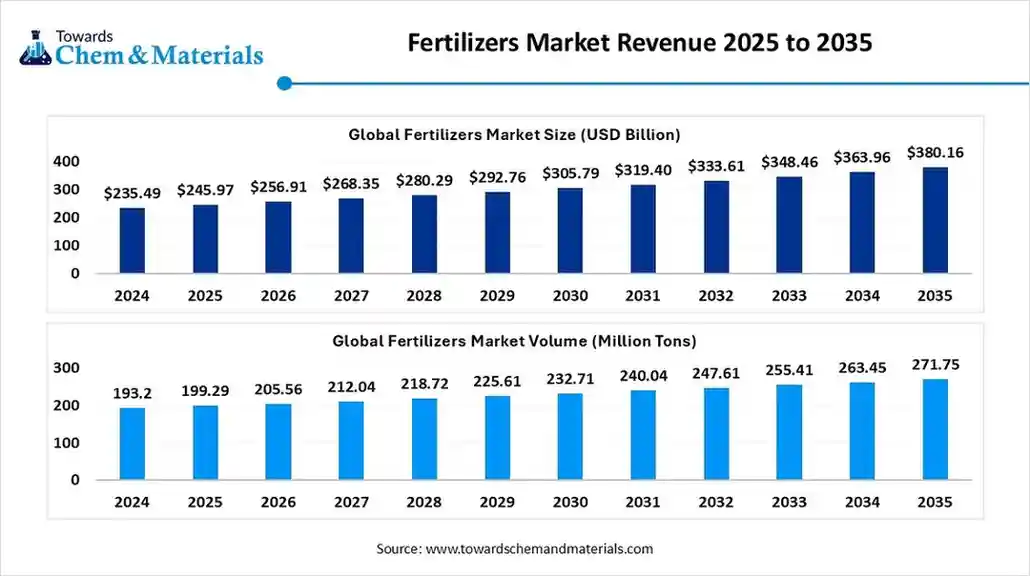

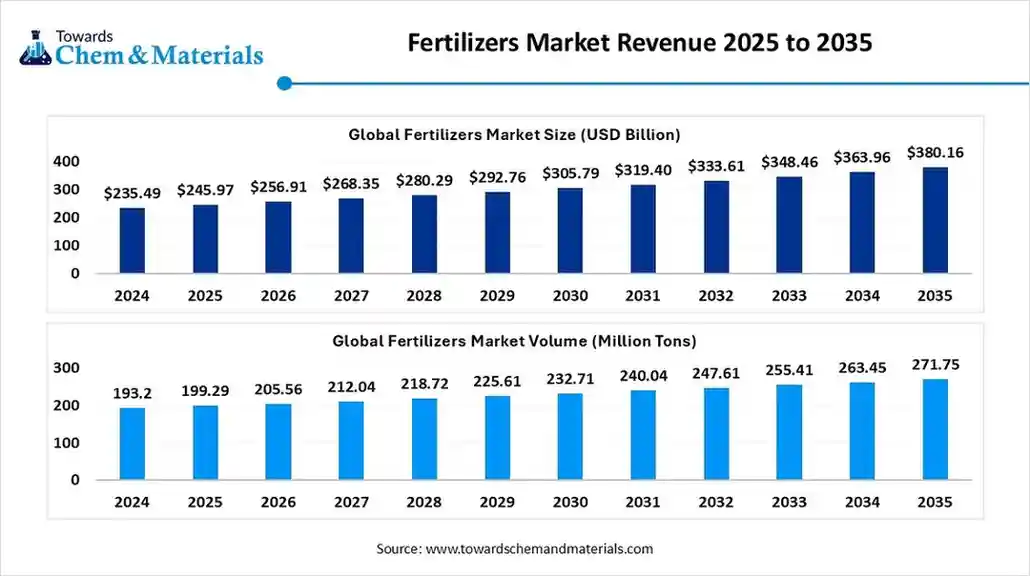

The global fertilizers market size is calculated at USD 245.97 billion in 2025 and is expected to hit around USD 380.16 billion by 2035 from USD 256.91 billion in 2026, growing at a CAGR of 4.45% from 2025 to 2035. The rising demand for fertilizers due to increasing food consumption and the requirement for advanced technology in the process and use drives the market's growth.

The global fertilizers market stands at 199.29 million tons in 2025 and is forecast to reach 271.75 million tons by 2035, growing at a CAGR of 3.15% from 2025 to 2035.

Key Takeaways

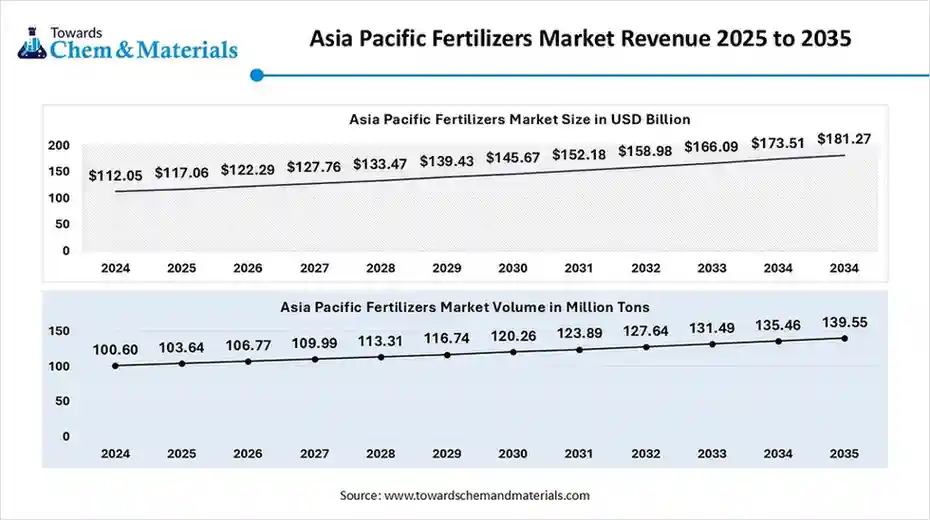

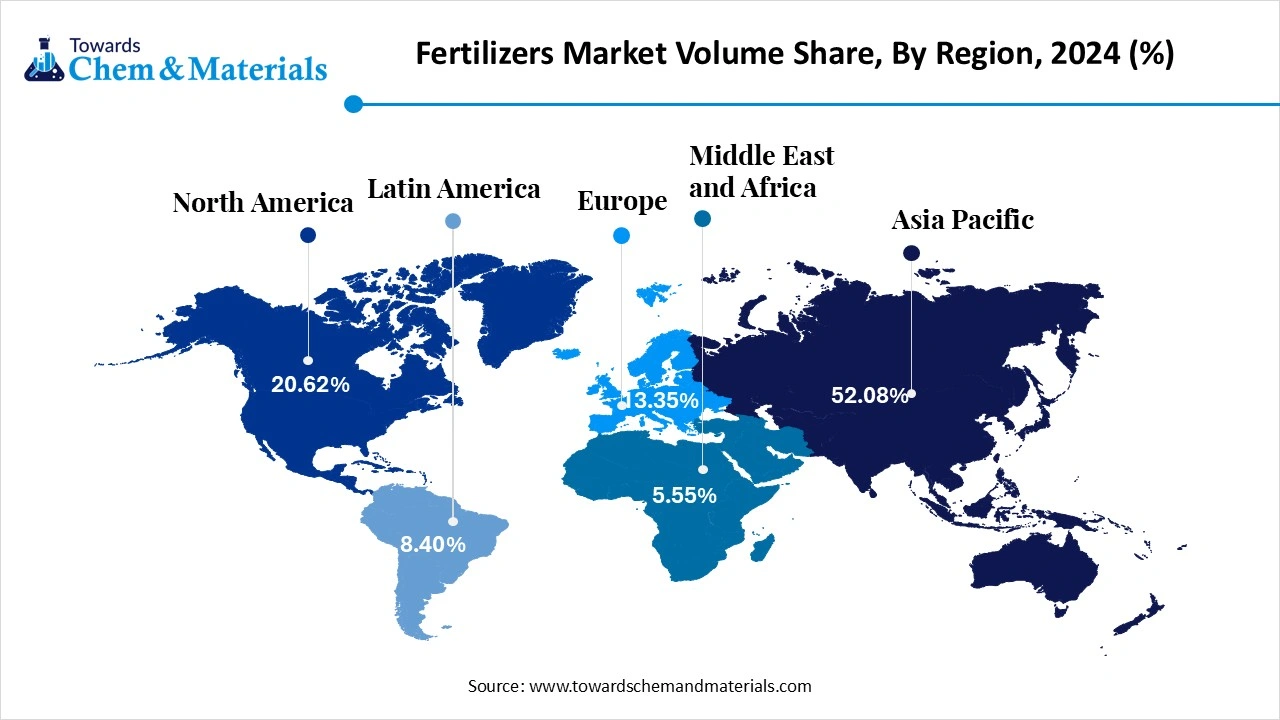

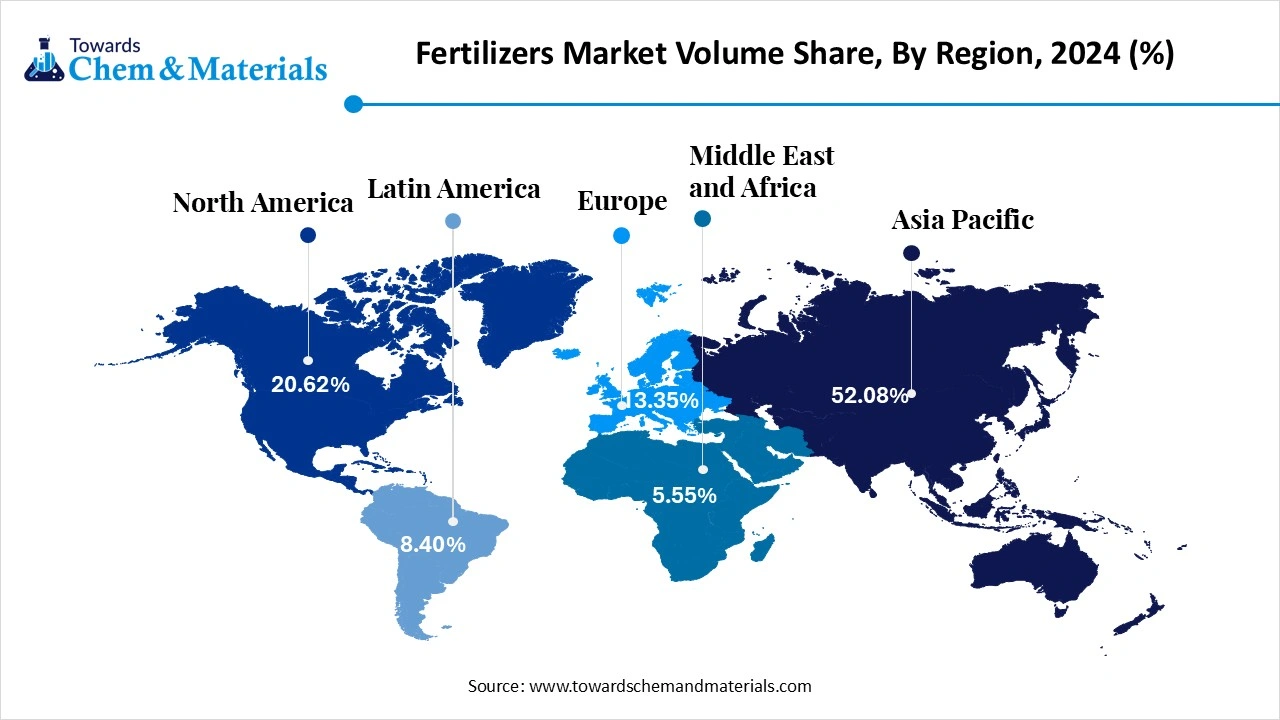

- The Asia Pacific fertilizers dominated the global market and accounted for the largest Volume Share of 52.08% in 2024.

- The North America fertilizers market is expected to grow at a CAGR of 2.76% over the forecast period.

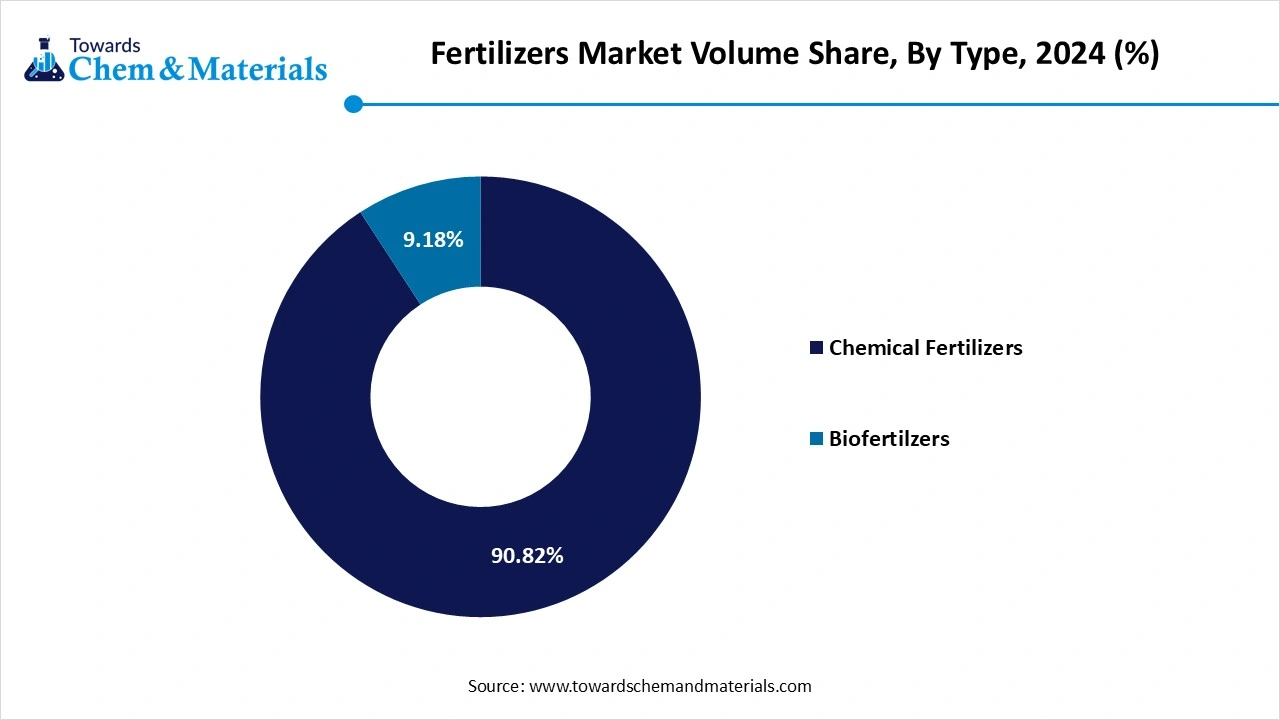

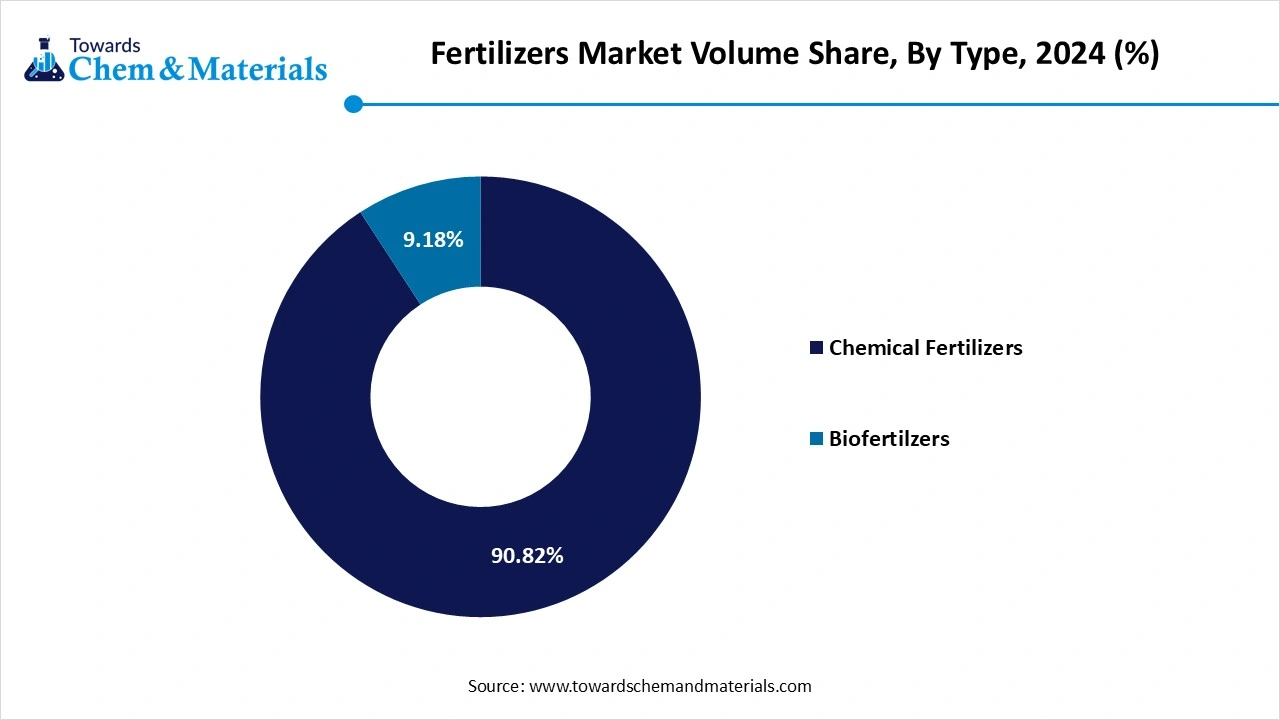

- By type, the chemical fertilizers segment led the market and accounted for the largest Volume Share of 90.82% in 2024

- By type, the biofertilzers segment is expected to grow at a CAGR of 4.47% over the forecast period.

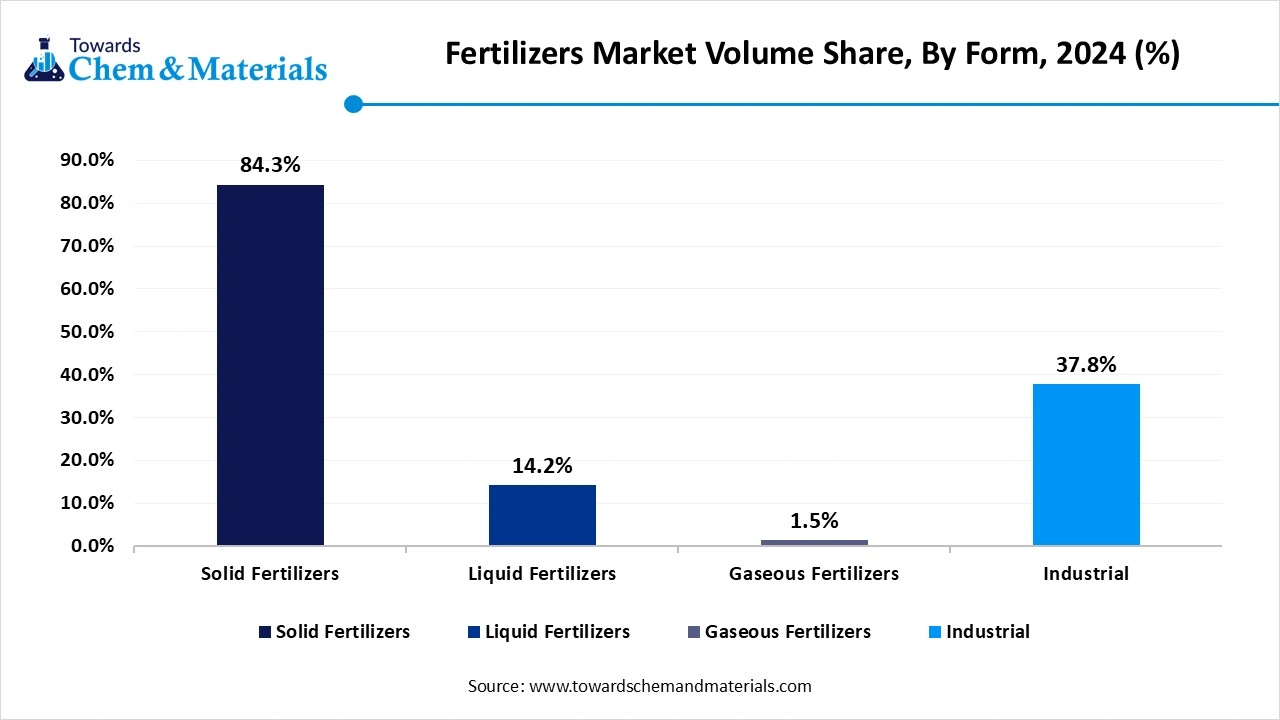

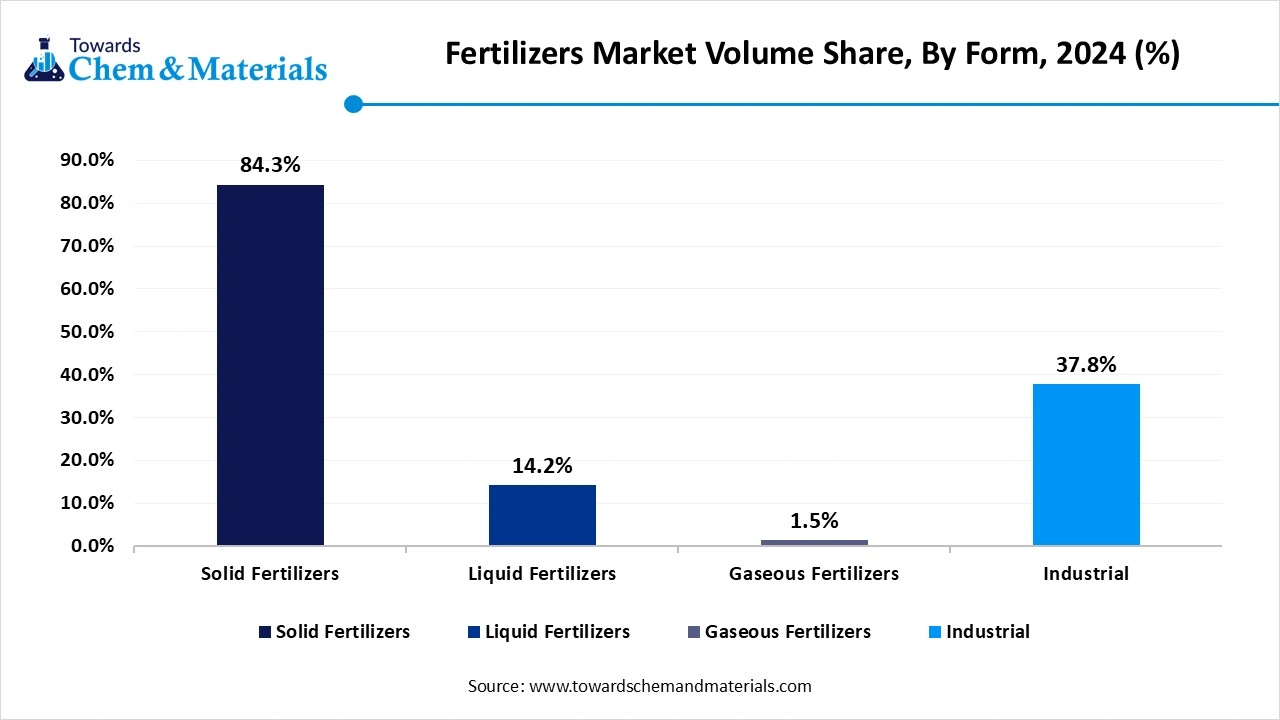

- By form, the solid fertilizers segment led the market with the largest Volume Share of 84.3% in 2024.

- By form, the liquid fertilizers segment is expected to grow at a CAGR of 3.93 over the forecast period

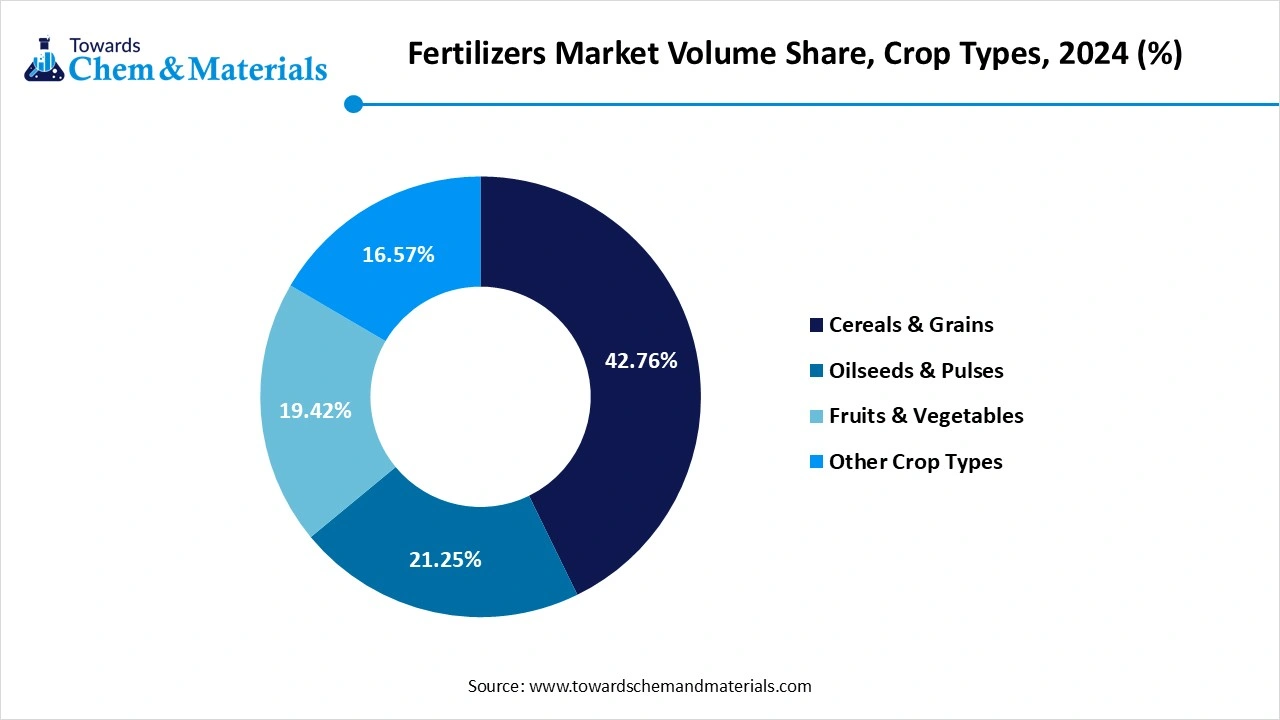

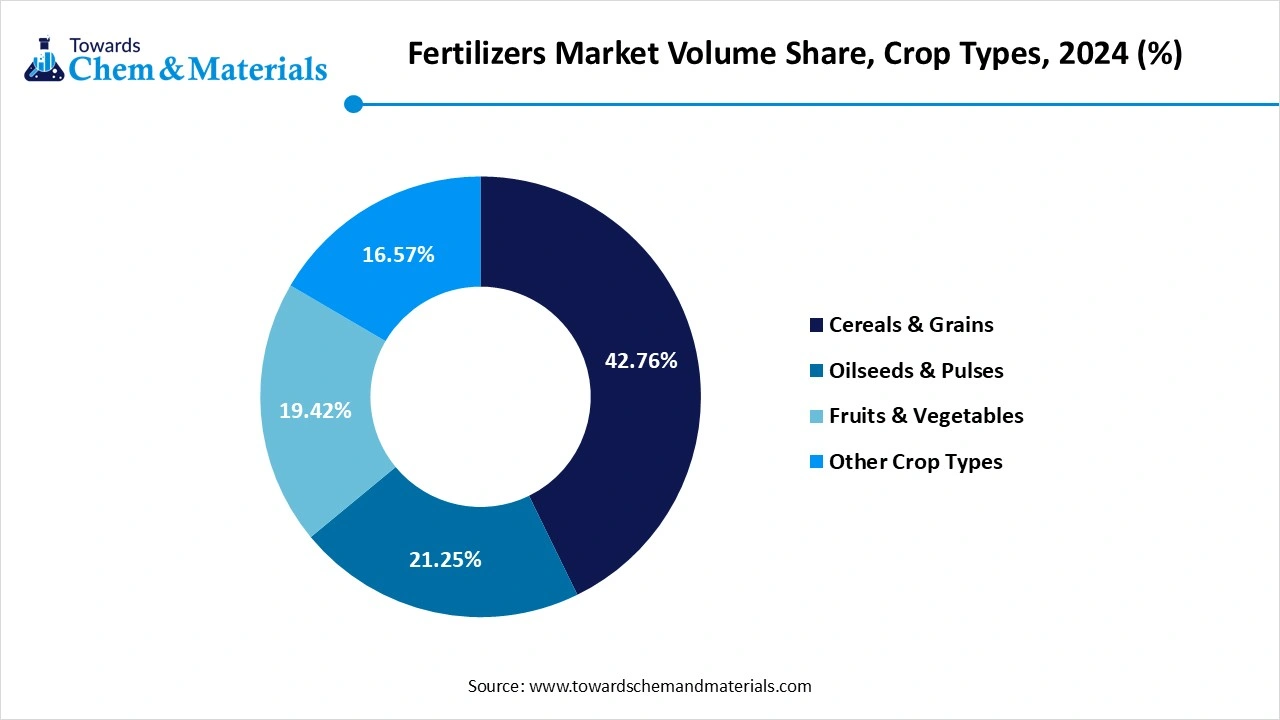

- By crop type, the Cereals & Grains segment led the market with the largest Volume Share of 42.76% in 2024.

- By crop type, the fruits & vegetables segment is expected to grow at a CAGR of 3.05% over the forecast period

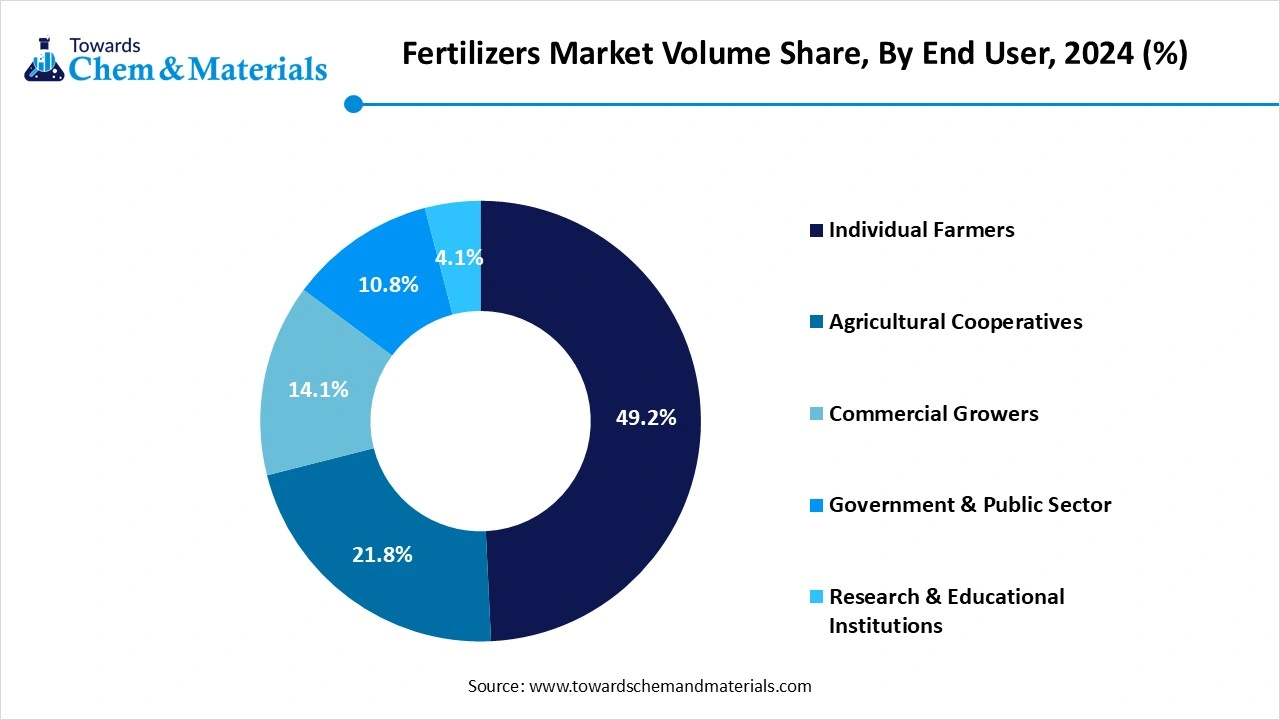

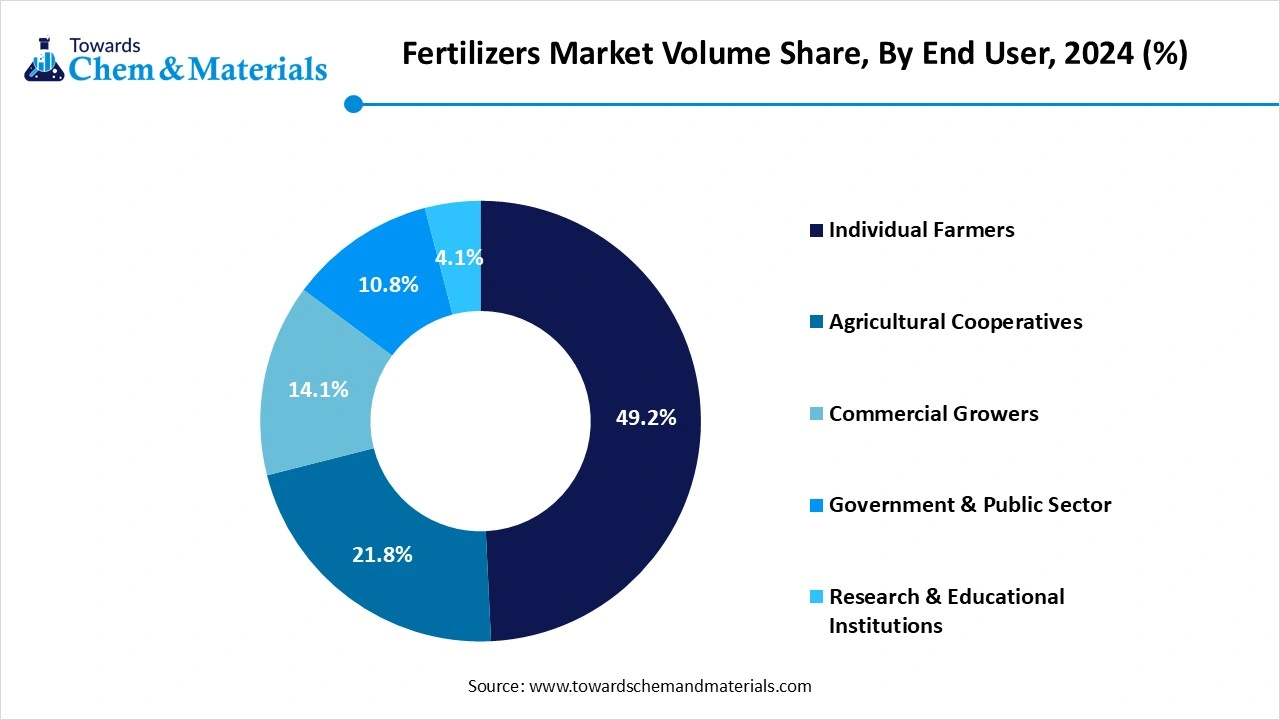

- By end-user, the individual farmers segment led the market and accounted for the largest Volume Share of 49.2% in 2024

- By end-user, the commercial growers segment is expected to grow at a CAGR of 3.72% over the forecast period.

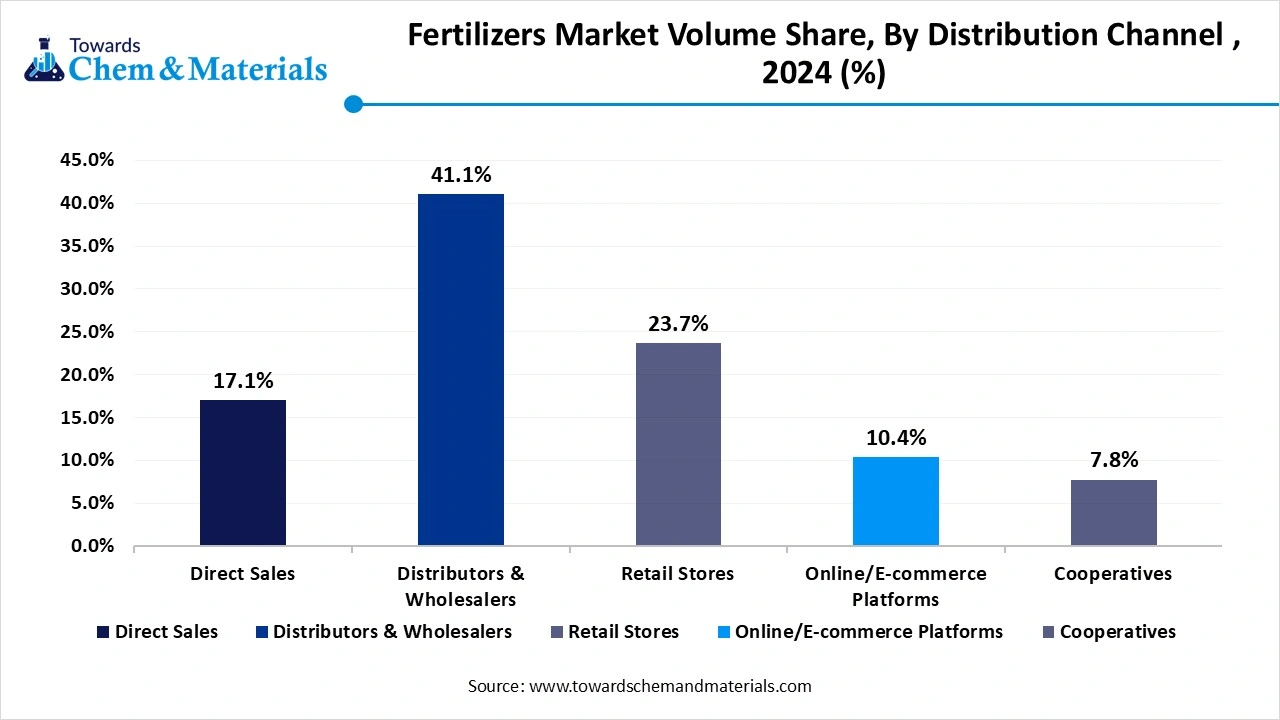

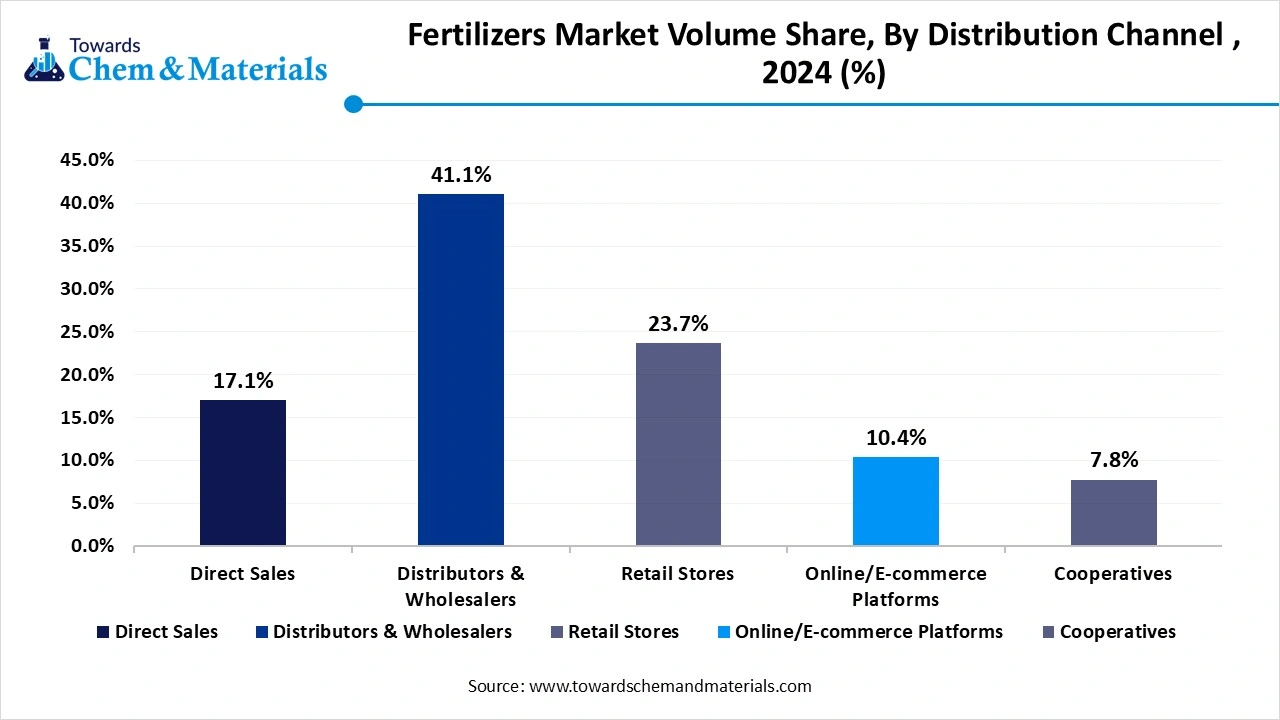

- By distribution channel, the distributors & wholesalers segment led the market with the largest Volume Share of 41.1% in 2024.

- By distribution channel, the Online/E-commerce platforms segment is expected to grow at a CAGR of 3.49% over the forecast period.

Rising Demand For Organic Materials: Fertilizers market To Expand

Fertilizers are natural and synthetic substances that are added to soil or plants to supply essential nutrients that help promote healthy growth and increase agricultural productivity. The components present in the products are nitrogen, phosphorus, and micronutrients. Fertilizers are organic and are usually derived from natural sources like compost and manure, and they can also be inorganic, which are manufactured through chemical processes.

They are used to replenish nutrients removed from the soil, which is caused by repeated crop harvesting, ensuring soil fertility and higher crop yield. The fertilizers market is driven by various key drivers which including rising food demand across the globe drives the demand and growth and increasing need and demand for higher agricultural productivity with organic and natural methods without the use of chemical fertilizers drives the growth of the market. The new and innovative government subsidies, which help farmers and support them in carrying out agricultural practices with less cost, drive the growth. And growing adoption of sustainable farming practices in the regions

- China, the United States, and Russia. China is the largest fertilizer exporter with 92,524 shipments, followed by the United States with 67,732 shipments, and Russia taking the third spot with 67,544 shipments.

Fertilizers Market Trends

- The growing awareness about the environment amid rising and growing concerns about the environment drives the growth and manufacturing of biobased fertilizers.

- The technological advancement in the process and manufacturing of the product drives the growth.

- The rising disposable income with the growing population in the growing economic region drives the growth of the market.

- The growing food industry and consumption and demand for eco-friendly and bio-based fertilizers are driving the growth and is a trend in the market.

Market Report Scope

| Report Attributes | Details |

| Market size value in 2026 | USD 256.91 billion |

| Revenue forecast in 2035 | USD 380.16 billion |

| Growth Rate from 2025 to 2035 | CAGR 4.45% |

| Base Year of Estiamation | 2025 |

| Forecast Period | 2025-2035 |

| High Dominant Region | Asia Pacific |

| Segment Covered | By Form, By Type, By Crop Type, By Application, By End User, By Distribution, By Region |

| Key Companies Profiled | ICL (Israel), Yara (Norway), K+S Aktiengesellschaft (Germany), Nutrien (Canada), Mosaic (US), CF Industries Holdings, Inc. (US), Grupa Azoty (Poland)SQM S.A. (Chile), OCP (Morocco), Syngenta Group (Switzerland), Saudi Basic Industries Corporation (Saudi Arabia), Koch IP Holdings, LLC (US), Haifa Negev technologies LTD (Israel), EuroChem Group (Switzerland), Lallemand Inc (Canada), IPL Biologicals (India), BIONEMA (UK), Multiplex Group of Companies (India)Vise Organic (India), Kula Bio,Inc. (US), Switch Bioworks (US), AgroLiquid (US), Rovensa Next (Spain), AgriLife (India), Gênica (Brazil) |

Market Opportunity

The Use And Adoption Of Bio-Fertilizers And Organic Fertilizers

The key opportunity in the fertilizers market is the growing demand for bio-fertilizers and organic fertilizers this is due to increasing awareness about sustainable agricultural practices and soil health, as consumers and the government policies prioritize eco-friendly farming practices the shift is seen from traditional chemical fertilizers toward biologically derived alternatives that enhances soil fertility without harming the environment. The trend is supported by government initiatives, subsidies, and research investments promoting organic farming, creating a fertile ground for companies to innovate and expand their bio-fertilizer product lines. As a result, these trends and initiatives drive the growth and create opportunities for the growth of the market.

Fertilizers Market Challenge

Lack Of Domestic Production Capacity And Raw Materials

The key challenge that hinders the growth of the market is the dependency on the import of key materials like potash and phosphates, which also makes the industry vulnerable to global price fluctuation and supply chain disruptions. The lack of sufficient domestic production capacity in a few countries faces risks from geopolitical tensions, trade restrictions, and rising transportation costs. This dependency increases the cost burden on farmers and also affects the timely availability of fertilizers during crucial planting seasons, which is a challenge to the growth of the market.

Segmental Insights

Type Insights

The chemical fertilizers segment held a notable share of fertilizers market in 2024. Chemical fertilizers provide precisely measured nutrients (nitrogen, phosphorus, potassium) that are immediately available to crops. This rapid action makes them preferable for short growing cycles and intensive farming practices, especially in high-demand crops like wheat, rice, and maize. Governments often support their distribution to ensure stable food prices and agricultural output. The global chemical fertilizer industry is supported by a robust supply chain, with established manufacturers, distributors, and global trade.

The biofertilizers segment is observed to grow at the fastest rate during the forecast period. These natural inputs, which include nitrogen-fixing bacteria, phosphate-solubilizing microorganisms, and mycorrhizal fungi, enhance soil fertility and crop productivity without harmful residues. In addition, growing consumer demand for organic and chemical-free produce, coupled with supportive government initiatives and subsidies for organic farming in regions like Europe, India, and Latin America, is accelerating adoption.

Fertilizers Market Volume and Share, By Type, 2024- 2034 (%)

| By Type | Market Volume Shares (%)2024 | Market Volume (Million Tons)2024 | Market Volume Shares (%)2034 | Market Volume (Million Tons)(2034) | Market CAGR (2025-2034) |

| Chemical Fertilizers | 90.82% | 175.5 | 89.52% | 234.7 | 2.95% |

| Biofertilzers | 9.18% | 17.7 | 10.48% | 27.5 | 4.47% |

Form Insights

The solid form segment led the fertilizers market in 2024. Solid fertilizers, including granular, pellet, and powdered forms, offer ease of handling, storage, and application, making them ideal for both large-scale commercial farming and smallholder agriculture. The solid form is also preferred for its longer shelf life and stable nutrient release, which can be more easily controlled through advanced formulations like slow-release or coated fertilizers. Additionally, solid fertilizers are compatible with existing farming infrastructure and equipment, contributing to their widespread use across different regions and farming systems.

The liquid form segment is seen to grow at the fastest rate. While solid fertilizers have long been the dominant choice in the market, the liquid form is gaining traction due to its unique advantages in certain agricultural applications. Liquid fertilizers, which include solutions and suspensions, provide nutrients in a readily available form that can be quickly absorbed by plants. This makes them particularly useful for precision agriculture, where nutrients can be delivered directly to the root zone or even through foliar feeding, promoting faster plant growth. Additionally, liquid fertilizers offer better control over nutrient application, allowing for more targeted and efficient use, which reduces the risk of over-fertilization and nutrient loss.

Fertilizers Market Volume and Share, By Form, 2024- 2034 (%)

| By Form | Market Volume Shares (%)2024 | Market Volume (Million Tons) 2024 | Market Volume Shares (%)2034 | Market Volume (Million Tons)(2034) | Market CAGR (2025-2034) |

| Solid Fertilizers | 84.3% | 162.9 | 83.2% | 218.1 | 2.96% |

| Liquid Fertilizers | 14.2% | 27.5 | 15.4% | 40.5 | 3.93% |

| Gaseous Fertilizers | 1.5% | 2.8 | 1.4% | 3.6 | 2.37% |

Crop Types Insights

The fruits & vegetables segment dominated the fertilizers market in 2024. The fruits and vegetables segment in the fertilizer market focuses on the specific nutrient requirements of crops like fruits, vegetables, and other horticultural plants. Fertilizers used for fruits and vegetables are often designed to provide a balanced mix of macronutrients as well as micronutrients, which are essential for promoting strong plant development, improving fruit quality, and increasing harvest volumes. The segment is increasingly driven by the need for higher crop quality, resistance to pests and diseases, and sustainability in farming practices.

The cereals and grains segment expects significant growth in the fertilizers market during the forecast period. The segment focuses on the specific nutritional needs of staple crops such as wheat, rice, maize, barley, and oats. Additionally, the segment is witnessing a shift towards sustainable practices, with farmers adopting precision agriculture technologies and nutrient management systems to improve fertilizer use efficiency and reduce environmental impact. As a result, the cereals and grains segment plays a vital role in ensuring stable food production while maintaining soil health.

Fertilizers Market Volume and Share, Crop Types, 2024 (%)

| By Crop Type | Market Volume Shares (%)2024 | Market Volume (Million Tons)2024 | Market Volume Shares (%)2034 | Market Volume (Million Tons)(2034) | Market CAGR (2025-2034) |

| Cereals & Grains | 42.76% | 82.6 | 42.30% | 110.9 | 2.99% |

| Oilseeds & Pulses | 21.25% | 41.1 | 21.05% | 55.2 | 3.00% |

| Fruits & Vegetables | 19.42% | 37.5 | 19.32% | 50.7 | 3.05% |

| Other Crop Types | 16.57% | 32.0 | 17.33% | 45.4 | 3.56% |

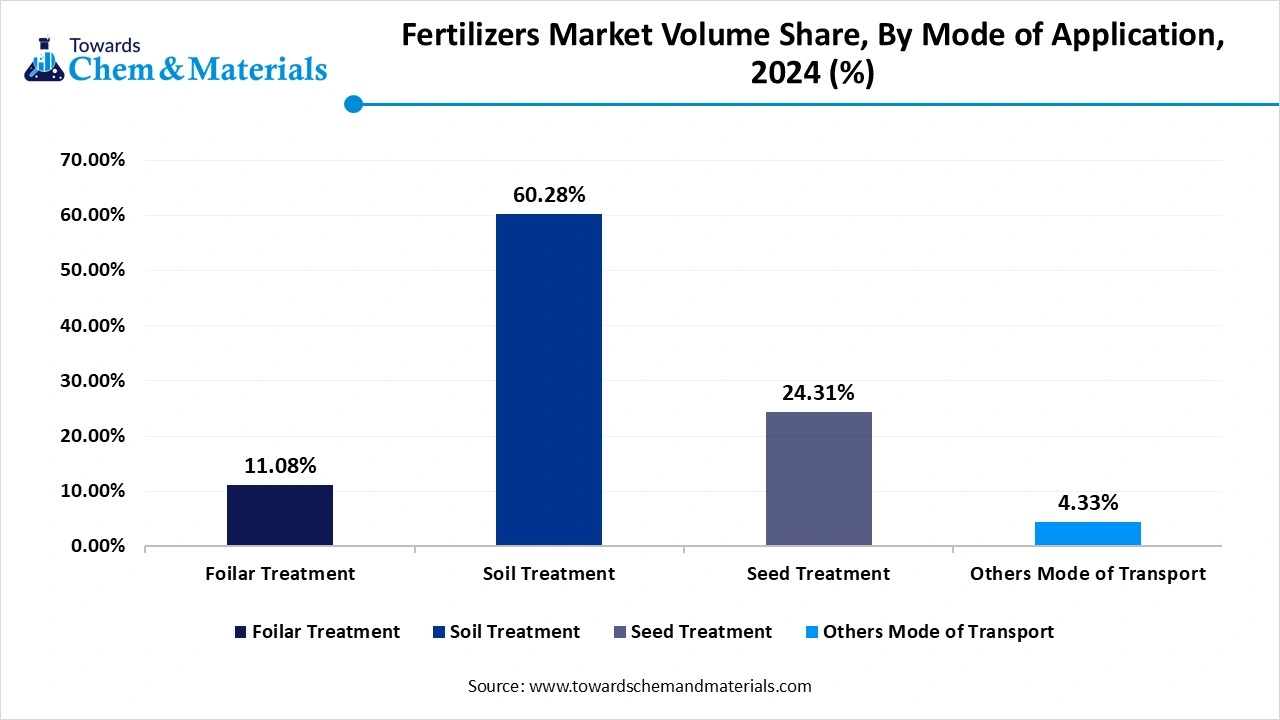

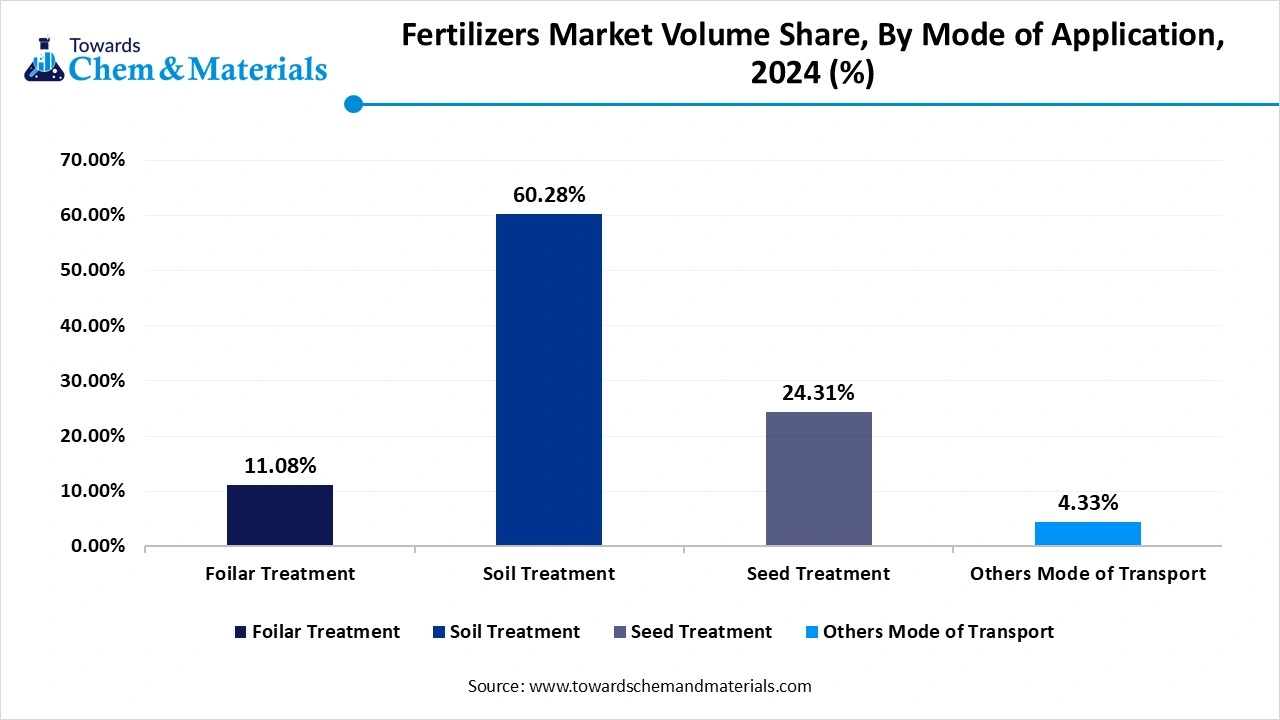

Mode of Application Insights

The Soil Treatment segment dominated the fertilizers market in 2024. Soil is the practice of applying fertilizers through an irrigation system, allowing nutrients to be delivered directly to plant roots in a highly efficient manner. This method ensures precise nutrient distribution, reducing fertilizer wastage and improving nutrient uptake by plants. Additionally, it allows for the simultaneous application of water and nutrients, optimizing both water and fertilizer use. This practice is increasingly popular in regions with limited water resources or where precise nutrient management is critical to achieving optimal crop yields and quality.

The foliar segment expects significant growth in the fertilizers market during the forecast period. The segment refers to the application of fertilizers directly to plant leaves in the form of sprays. This allows rapid absorption of nutrients, Foliar feeding is particularly effective in providing plants with essential nutrients like micronutrients and trace elements. The foliar fertilizer segment is gaining attention due to its ability to quickly correct nutrient imbalances, improve crop health, enhance yield quality, and increase resistance to diseases and environmental stresses. It is a valuable tool in precision agriculture, where targeted, efficient nutrient management is essential, which drives the growth of the market.

Fertilizers Market Volume and Share, By Mode of Application, 2024 (%)

| By Mode of Application | Market Volume Shares (%)2024 | Market Volume (Million Tons)2024 | Market Volume Shares (%)2034 | Market Volume (Million Tons)2034 | Market CAGR (2025-2034) |

| Foilar Treatment | 11.08% | 21.4 | 10.62% | 27.8 | 2.66% |

| Soil Treatment | 60.28% | 116.5 | 60.08% | 157.5 | 3.07% |

| Seed Treatment | 24.31% | 47.0 | 24.21% | 63.5 | 3.06% |

| Others Mode of Transport | 4.33% | 8.4 | 5.09% | 13.3 | 4.77% |

End User Insights:

The individual farmers segment led the fertilizers market in 2024. Globally, individual farmers, particularly in developing regions, remain the largest consumers of fertilizers. This is due to the widespread use of fertilizers in traditional farming practices, where they are essential for maintaining soil fertility and achieving desired crop yields. However, the segment's growth is increasingly influenced by factors such as the adoption of sustainable farming practices, access to affordable and efficient fertilizers, and government policies promoting agricultural productivity.

Fertilizers Market Volume and Share, By End User, 2024 - 2034(%)

| By End User | Market Volume Shares (%)2024 | Market Volume (Million Tons)(2024) | Market Volume Shares (%)2034 | Market Volume (Million Tons)(2034) | Market CAGR (2025-2034) |

| Individual Farmers | 49.2% | 95.1 | 48.3% | 126.5 | 2.89% |

| Agricultural Cooperatives | 21.8% | 42.1 | 21.7% | 56.9 | 3.04% |

| Commercial Growers | 14.1% | 27.3 | 15.0% | 39.3 | 3.72% |

| Government & Public Sector | 10.8% | 20.8 | 11.2% | 29.3 | 3.48% |

| Research & Educational Institutions | 4.1% | 7.9 | 3.9% | 10.3 | 2.69% |

Distribution Channel Insights:

The direct sales segment held the significant share in 2024. Direct sales offer several advantages, including personalized consultation, tailored product recommendations, and after-sales support, which are particularly beneficial for farmers seeking specific solutions for their agricultural needs. Additionally, direct sales often provide flexible financing options, such as credit policies and leasing, making it easier for farmers, especially those in developing regions, to invest in necessary equipment and inputs. This approach not only enhances customer satisfaction but also fosters long-term relationships between manufacturers and end-users, contributing to the sustained growth of the fertilizers market.

Fertilizers Market Volume and Share, By Distribution Channel , 2024 (%)

| By Distribution Channel | Volume (Million Tons)(2024) | Market Shares (%)2024 | Market Volume (Million Tons)(2034) | Market Volume Shares (%) 2034 | Market CAGR (2025-2034) |

| Direct Sales | 32.9 | 17.1% | 42.1 | 16.1% | 2.48% |

| Distributors & Wholesalers | 79.4 | 41.1% | 107.4 | 41.0% | 3.07% |

| Retail Stores | 45.7 | 23.7% | 64.3 | 24.5% | 3.47% |

| Online/E-commerce Platforms | 20.2 | 10.4% | 28.4 | 10.8% | 3.49% |

| Cooperatives | 15.0 | 7.8% | 20.0 | 7.6% | 2.89% |

Regional Insights

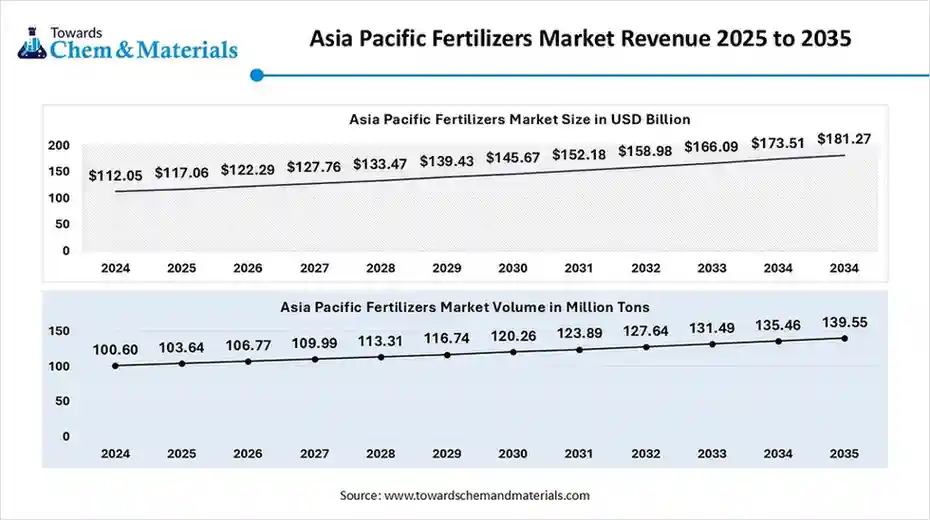

The Asia Pacific fertilizers market is was estimated at USD 117.06 billion in 2025 and is projected to reach USD 181.27 billion by 2035, growing at a CAGR of 4.47% from 2025 to 2035. The Asia Pacific fertilizers Market is expected to reach a volume of approximately 103.64 million tons in 2025, with a forecasted increase to 139.55 million tons by 2035, growing at a CAGR of 3.02% from 2025 to 2035.

Asia Pacific dominated the fertilizers market in 2024. The growth is seen in the market due to its large agricultural base and high demand for food production. The region's farming practices are becoming increasingly intensive, driving the need for consistent nutrient replenishment through fertilizers. Additionally, ongoing shifts toward modern agricultural techniques, along with increased awareness of soil health and balanced nutrient application, are contributing to market growth.

India's specialty fertilizer market is undergoing significant transformation, driven by policy reforms, sustainability mandates, and digital adoption. The growing emphasis on sustainable agriculture, increased demand for organic fertilizers, and government support for balanced nutrient application drive the growth. Overall, the Indian fertilizer market is poised for growth, supported by technological advancements and a shift towards sustainable farming practices.

- India exported 2,359 shipments of Fertilizer from Oct 2023 to Sep 2024 (TTM). These exports were made by 461 Indian Exporters to 727 Buyers.

North America is anticipated to grow significantly in the fertilizers market in the forecasted period. The growth is driven by technological advancements and evolving agricultural practices. The adoption of precision agriculture, including AI-powered tools and data analytics, is enabling farmers to optimize fertilizer application, enhancing efficiency and crop yields. Simultaneously, there's a growing emphasis on sustainable farming practices, leading to increased demand for organic and bio-based fertilizers. The sector is poised for growth, supported by innovations in fertilizer technology and a focus on sustainable agriculture.

Fertilizers Market Volume and Share, By Region, 2024- 2034 (%)

| By Region | Market Volume Shares (%)2024 | Market Volume (Million Tons)2024 | Market Volume Shares (%)2034 | Market Volume (Million Tons)(2034) | Market CAGR (2025-2034) |

| North America | 20.62% | 39.8 | 21.4% | 56.2 | 2.76% |

| Europe | 13.35% | 25.8 | 14.8% | 38.7 | 3.68% |

| Asia Pacific | 52.08% | 100.6 | 51.0% | 133.8 | 3.02% |

| Latin America | 8.40% | 16.2 | 7.7% | 20.1 | 2.98% |

| Middle East & Africa | 5.55% | 10.7 | 5.1% | 13.3 | 3.80% |

The U.S. specialty fertilizer market is seeing significant growth due to advancements in precision agriculture and sustainable farming practices are driving demand for innovative fertilizer solutions. Farmers are increasingly adopting technologies that enhance nutrient efficiency and reduce environmental impact, aligning with stricter environmental regulations and the push for eco-friendly additives. The market is projected to grow, supported by technological innovations and the need to meet rising food demand, which drives the growth of the market.

Fertilizers Market Recent Developments

IFFCO

- Launch: In December 2024, IFFCO, an Indian fertilizer giant, developed a new fertilizer, a nano NPK fertilizer, and is seeking government approval. The product will be produced in the Kandla plant, the company is ready to launch the product in the retail market.

Super Crop Safe Ltd.

- Launch: In January 2025, Super Crop Safe Ltd., a leading agrochemical and biotechnology company, announced the launch of the product, which is a biofertilizer Super Gold WP+. it is a unique combination of inoculated mycorrhiza and other essential nutrients. This is designed to reduce the use of chemical fertilizer and adopt the use of bio-fertilizer.

Haifa Group

- Launch: In January 2025, Haifa Group launched of its 18th subsidiary in India, "Haifa India Fertilizers and Technologies Private Limited". The company aims to promote plant nutrition solutions among Indian farmers.

Top Companies List

- ICL (Israel)

- Yara (Norway)

- K+S Aktiengesellschaft (Germany)

- Nutrien (Canada)

- Mosaic (US)

- CF Industries Holdings, Inc. (US)

- Grupa Azoty (Poland)

- SQM S.A. (Chile)

- OCP (Morocco)

- Syngenta Group (Switzerland)

- Saudi Basic Industries Corporation (Saudi Arabia)

- Koch IP Holdings, LLC (US)

- Haifa Negev technologies LTD (Israel)

- EuroChem Group (Switzerland)

- Lallemand Inc (Canada)

- IPL Biologicals (India)

- BIONEMA (UK)

- Multiplex Group of Companies (India)

- Vise Organic (India)

- Kula Bio,Inc. (US)

- Switch Bioworks (US)

- AgroLiquid (US)

- Rovensa Next (Spain)

- AgriLife (India)

- Gênica (Brazil)

Segments Covered in the Report

By Form

- Solid Fertilizers

- Granules

- Powder

- Liquid Fertilizers

- Solution

- Suspension

- Gaseous Fertilizers

- Ammonia (used in large-scale farming)

By Type

- Chemical Fertilizers

- Biofertilizers

By Crop-Type

- Cereals & Grains

- Frutis & Vegetables

- Oilseeds & Pulses

- Others

By Application

- Foilar Treatment

- Soil Treatment

- Seed Treatment

- Others Mode of Transport

By End User

- Individual Farmers

- Agricultural Cooperatives

- Commercial Growers

- Government & Public Sector

- Research & Educational Institutions

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Retail Stores

- Online/E-commerce Platforms

- Cooperatives

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait