Content

What is the Current Paints and Coatings Market Size and Share?

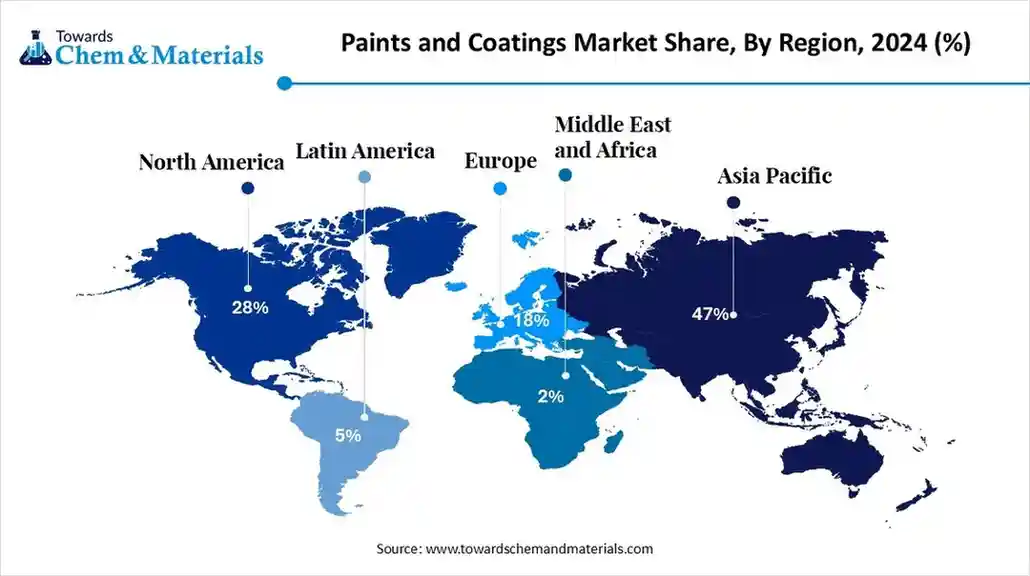

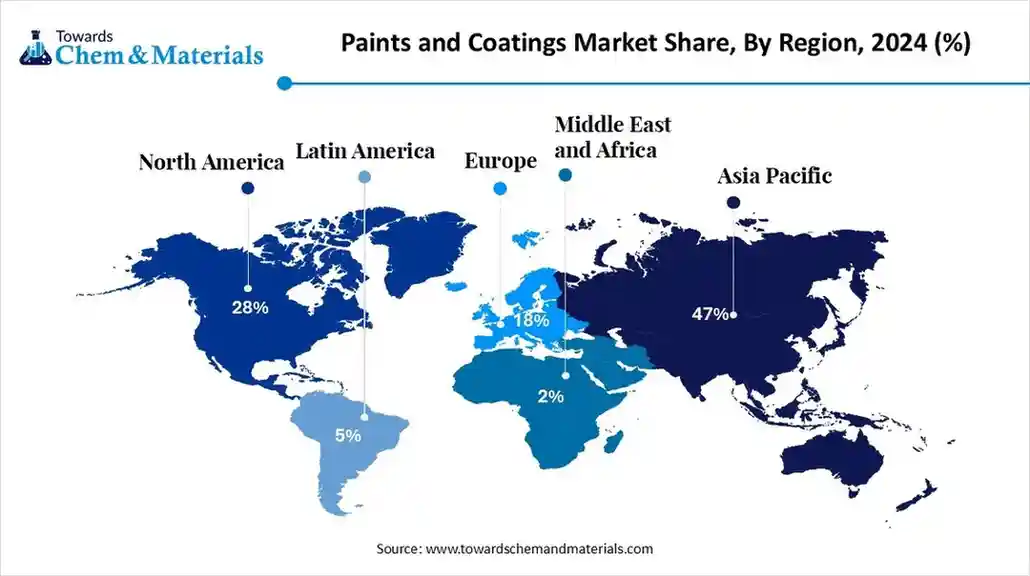

The global paints and coatings market size was estimated at USD 220.11 billion in 2025 and is expected to increase from USD 231.36 billion in 2026 to USD 362.31 billion by 2035, growing at a CAGR of 5.11% from 2026 to 2035. Asia Pacific dominated the paints and coatings market with the largest revenue share of 51% in 2025. The growth of the market is driven by the rising demand from various sectors, which drives the growth.

Market Highlights

- The Asia-Pacific dominated the paints and coatings market with the largest revenue share of 51% in 2025.

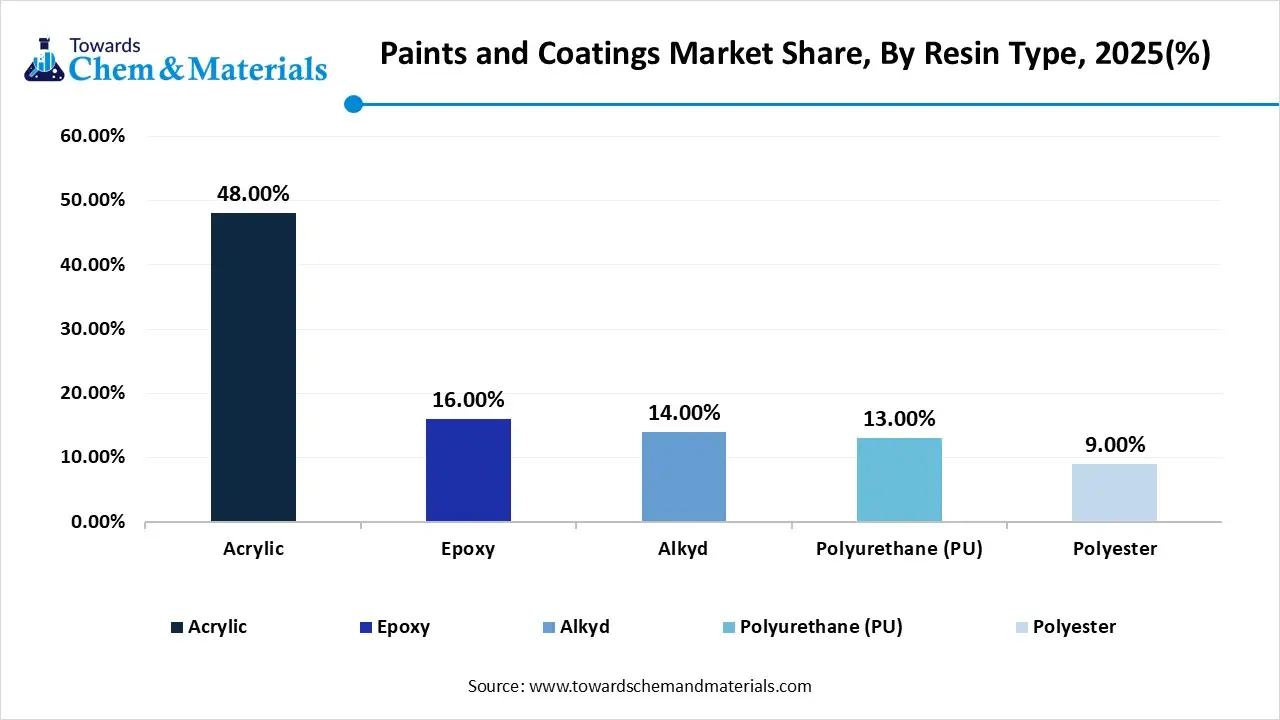

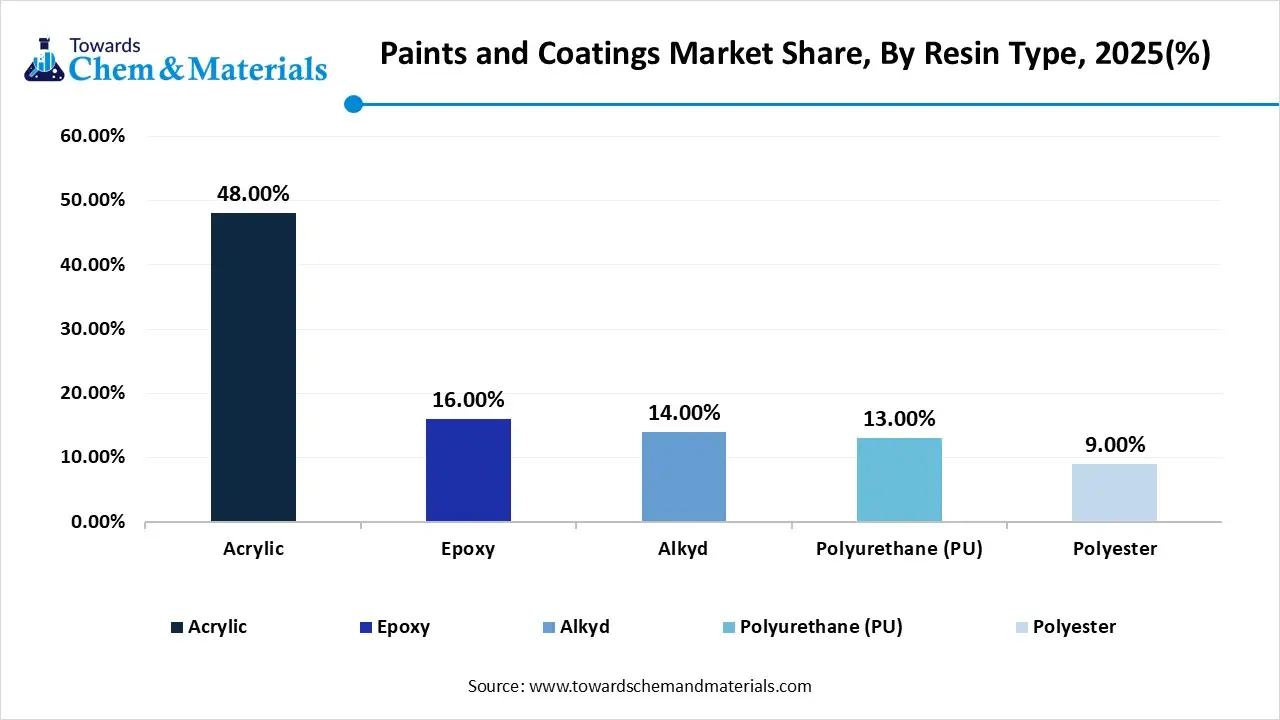

- By resin type, the acrylic segment dominated the market and accounted for the largest revenue share of 48.00% in 2025.

- By resin type, the epoxy segment is expected to grow at the fastest CAGR of 5.27% from 2026 to 2035 in terms of share.

- By technology, the water-based segment led the market with the largest revenue share of 44.00% in 2025.

- By application, the architectural coatings segment dominated the market and accounted for the largest revenue share of 49.00% in 2025.

- By end-use industry, the construction segment led the market with the largest revenue share of 50.00% in 2025.

Market Overview

What Is The Significance Of The Paints And Coatings Market?

The global paints and coatings market involves the production and application of liquid, powder, or semi-liquid coatings applied to surfaces to provide protection, decoration, and functional properties. These coatings are used across multiple industries, including automotive, construction, industrial, and consumer goods, to enhance durability, aesthetics, and performance. Market growth is driven by increasing urbanisation, industrialisation, demand for eco-friendly waterborne coatings, and technological innovations like UV-curable and high-solids coatings.

Trends in the Paints and Coatings Market

- Growing Demand for Eco-Friendly Coatings – Consumers and industries prefer low-VOC and water-based paints to reduce environmental impact.

- Technological Advancements in Coatings – Smart coatings with self-cleaning, anti-corrosion, and UV-resistant properties are increasingly used.

- Rise of Decorative Paints – Residential and commercial renovation projects are boosting demand for decorative and premium paints.

- Industrial Coatings Expansion – Automotive, aerospace, and marine industries are adopting advanced coatings for durability and performance.

- Growing Adoption of Powder Coatings – Powder coatings are popular due to efficiency, better finish, and low environmental impact.

- Increased Penetration of E-Commerce – Online sales channels allow manufacturers to reach a wider customer base.

Opportunities in the Paints and Coatings Market

- Expansion into Emerging Markets – Tapping into regions like Southeast Asia, Africa, and Latin America can boost growth.

- Innovation in Sustainable Coatings – Biodegradable, low-VOC, and eco-friendly paints can attract environmentally conscious consumers.

- Growth in Automotive and Aerospace Coatings – Advanced functional coatings offer high-margin opportunities.

- Smart Coatings and Functional Surfaces – Coatings with self-cleaning, anti-microbial, and energy-efficient properties have strong potential.

- Partnerships with Construction and Architecture Firms – Collaborations can provide customized coatings solutions and improve market share.

- Investment in Digital Marketing and E-Commerce – Strengthening online presence increases sales and customer engagement.

Key Technological Shifts In The Paints And Coatings Market :

Key technological shifts in the paints and coatings market include the development of sustainable, eco-friendly products like low-VOC and waterborne coatings, and the integration of digital technologies for product development and manufacturing. Additionally, advanced smart and intelligent coatings with functionalities such as self-healing, antimicrobial, and colour-changing properties are becoming more common, along with the use of nanotechnology to improve durability and performance.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 231.36 Billion |

| Expected Size by 2035 | USD 362.31 Billion |

| Growth Rate from 2025 to 2035 | CAGR 5.11% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2025 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Resin Type, By Technology, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Sherwin-Williams: , PPG Industries, AkzoNobel, BASF SE , Axalta Coating Systems , RPM International Inc., Nippon Paint Holdings , Kansai Paint Co., Ltd. , Jotun Group , Hempel A/S , Asian Paints Limited , Berger Paints India Ltd. ,DuluxGroup , Valspar Corporation , Tikkurila Oyj |

Trade Analysis Of Paints And Coatings Market: Import & Export Statistics

- The World exported 30,429 shipments of Paint Coatings from Nov 2023 to Oct 2024 (TTM).(Source: www.volza.com)

- These exports were made by 1,850 Exporters to 2,486 Buyers, marking a growth rate of 29% compared to the preceding twelve months.(Source: www.volza.com)

- 1,288 Paint Coating export shipments were made Worldwide.(Source: www.volza.com)

Most of the paint coatings exported from the World go to Ukraine, Vietnam, and Poland.(Source: www.volza.com) - Globally, the top three exporters of Paint Coatings are India, China, and the European Union.(Source: www.volza.com)

- India leads the world in Paint Coatings exports with 18,073 shipments, followed by China with 15,407 shipments, and the European Union taking the third spot with 7,775 shipments.(Source: www.volza.com)

- The leading Indian exporters by share are Nippon Paint India Pvt Ltd (41%), Axalta Coating Systems India Pvt Ltd (28%), and Akzo Nobel India Limited (9%).(Source: www.volza.com)

Paints And Coatings Market Value Chain Analysis

- Chemical Synthesis and Processing : Paints and coatings are produced through resin synthesis, pigment dispersion, solvent blending, and formulation of additives for desired colour, durability, and performance. Processes such as water-based, solvent-based, and UV-cured coating technologies are widely used.

- Key players: Akzo Nobel N.V., PPG Industries, Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Asian Paints Ltd.

- Quality Testing and Certification : Paints and coatings undergo testing for adhesion, viscosity, corrosion resistance, and weather durability under standards like ISO 9001, ASTM D standards, and environmental certifications such as LEED and Green Seal.

- Key players: ASTM International, UL Solutions, SGS, Intertek.

- Distribution to Industrial Users : Paints and coatings are distributed to architectural, automotive, aerospace, and industrial sectors through retail stores, distributors, and direct industrial supply chains.

- Key players: Kansai Paint Co. Ltd., Berger Paints India Ltd., RPM International Inc., Jotun Group.

Paints And Coatings Regulatory Landscape: Global Regulations

| Region / Country | Regulatory Body | Key Regulations / Standards | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), Consumer Product Safety Commission (CPSC) | - Clean Air Act (CAA) – VOC and HAP limits - Toxic Substances Control Act (TSCA) - OSHA Hazard Communication Standard (29 CFR 1910.1200) - EPA Method 24 (VOC determination) |

- VOC and hazardous air pollutant limits - Chemical inventory and labelling - Worker safety and exposure limits |

EPA enforces VOC limits for architectural and industrial coatings. TSCA requires pre-manufacture notification for new chemicals. Lead-based paints are banned under CPSC rules. |

| European Union | European Chemicals Agency (ECHA), European Commission (DG ENV), European Committee for Standardisation (CEN) | - REACH Regulation (EC 1907/2006) - CLP Regulation (EC 1272/2008) - VOC Directive (2004/42/EC) - EcoLabel Regulation (EC 66/2010) |

- Chemical safety and registration - VOC content limits - Labelling and classification - Green product certification |

REACH ensures registration of paint ingredients. The EU VOC Directive sets VOC content limits in grams per litre for different coating types. EcoLabel promotes sustainable, low-emission paints. |

| China | Ministry of Ecology and Environment (MEE), State Administration for Market Regulation (SAMR), Standardisation Administration of China (SAC) | - GB 18582-2021 – VOC limits for interior coatings - GB 30981-2020 – VOC limits for industrial coatings - Measures for Environmental Management of New Chemical Substances (MEE Order No. 12) |

- VOC control - New chemical approval - Product labelling and safety |

China enforces one of the strictest VOC policies in Asia. The new GB standards align with EU VOC benchmarks and promote waterborne and UV-cured coatings. |

| India | Bureau of Indian Standards (BIS), Ministry of Environment, Forest and Climate Change (MoEFCC), Central Pollution Control Board (CPCB) | - BIS IS 15489:2004 – VOC limits for paints - Hazardous and Other Wastes (Management and Transboundary Movement) Rules, 2016 - Chemical (Management and Safety) Rules, 2020 (proposed) |

- VOC limits and labelling - Hazardous waste disposal - Lead and heavy metal restrictions |

India is adopting the EU-style REACH framework. Several states have imposed lead paint bans. CPCB promotes low-VOC and eco-label paint formulations. |

| Japan | Ministry of the Environment (MOE), Ministry of Economy, Trade and Industry (METI), Japanese Industrial Standards Committee (JISC) | - Air Pollution Control Law (VOC Regulation) - Chemical Substances Control Law (CSCL) - JIS K 5660, K 5663 – standards for paints and varnishes |

- VOC emission limits - Chemical risk evaluation - Product performance standards |

Japan’s laws require VOC abatement in paint manufacturing and automotive refinishing. CSCL governs chemical safety similarly to REACH. |

| Middle East (UAE, Saudi Arabia) | Emirates Authority for Standardization and Metrology (ESMA), Saudi Standards, Metrology and Quality Organization (SASO) | - ESMA UAE.S 5010:2018 – VOC limits and labeling - SASO 2879:2021 – VOC standards for paints and varnishes |

- VOC content control - Product certification - Green building compliance |

GCC countries are aligning with EU VOC standards. Paints must meet LEED and Estidama green building requirements. |

Segmental Insights

Resin Type

How Did The Acrylic Segment Dominate The Paints And Coatings Market In 2025?

The acrylic segment dominated the market accounting for 48.00% of total revenue. Acrylic resins are widely used in paints and coatings due to their excellent UV resistance, colour retention, and quick-drying properties. They dominate architectural and decorative coatings, providing superior weather protection. The growing shift toward waterborne acrylic formulations supports eco-friendly applications in the construction and automotive sectors globally.

The epoxy segment is expected to grow significantly in the market during the forecast period. Epoxy-based coatings are preferred for their exceptional chemical, abrasion, and corrosion resistance. They are extensively used in industrial, marine, and automotive applications where durability is critical. Epoxy coatings also offer excellent adhesion to metal surfaces, making them ideal for protective coatings in infrastructure and heavy-duty environments.

Paints and Coatings Market Share, By Resin Type , 2025(%)

| Resin Type | Revenue Share, 2025 (%) |

| Acrylic | 48.00% |

| Epoxy | 16.00% |

| Alkyd | 14.00% |

| Polyurethane (PU) | 13.00% |

| Polyester | 9.00% |

Technology Insights

Which Technology Segment Dominates The Paints And Coatings Market In 2025?

The water-based segment dominated the market with a share of approximately 44.00% in 2025. Water-based coating technologies are gaining prominence due to their low VOC content and compliance with environmental regulations. They are widely used in residential and industrial applications for their ease of application, fast drying, and minimal odour. Ongoing advancements have improved performance in corrosion resistance and durability.

The UV-cured coatings segment is expected to grow in the forecast period. UV-cured coatings offer superior hardness, chemical resistance, and rapid curing times, enhancing productivity across manufacturing lines. These coatings are increasingly used in electronics, furniture, and automotive components. Their energy efficiency and ability to provide high-gloss, scratch-resistant finishes make them a sustainable choice for modern applications.

Paints and Coatings Market Share, By Technology , 2025(%)

| Technology Type | Revenue Share, 2025 (%) |

| Water-Based | 44.00% |

| Solvent-Based | 8.00% |

| Powder Coating | 14.00% |

| UV-Cured Coating | 24.00% |

| High Solids Coating | 10.00% |

Application Insights

How Did the Agricultural Coatings Segment Dominate The Paints And Coatings Market In 2025?

The architectural coatings segment dominated the market with a share of approximately 49.00% in 2025. Architectural coatings form the largest application segment, driven by global urbanisation and rising construction activities. These coatings provide decorative appeal and protection against moisture, UV radiation, and wear. Increasing demand for low-odour, washable, and sustainable paints continues to influence the product development strategies of major players.

The automotive coatings segment is expected to grow in the forecast period. Automotive coatings are vital for aesthetic enhancement and corrosion protection of vehicles. The growing EV market and technological innovation in lightweight materials have led to advanced coatings with heat resistance and superior adhesion. OEM and refinish coatings demand continues to rise with automotive production growth worldwide.

Paints and Coatings Market Share, By Application, 2025(%)

| Application | Revenue Share, 2025 (%) |

| Architectural Coatings | 49.00% |

| Industrial Coatings | 16.00% |

| Automotive Coatings | 21.00% |

| Protective Coatings | 14.00% |

End-Use Industry Insights

Which End Use Industry Segment Dominates The Paints And Coatings Market In 2025?

The construction segment dominated the market with a share of approximately 50.00% in 2025. The construction sector drives paints and coatings demand through large-scale infrastructure, commercial, and residential projects. Increasing emphasis on durability, thermal insulation, and eco-friendly coatings fuels market growth. Technological advancements in smart coatings with self-cleaning or anti-bacterial properties are also gaining attention in modern construction applications.

The automotive segment is expected to grow in the forecast period. In the automotive industry, coatings are used for protection, aesthetic appeal, and longevity. The trend toward lightweight vehicles, electric mobility, and sustainable manufacturing promotes the use of high-performance and UV-cured coatings. Growing automotive production in emerging markets continues to enhance the overall demand for advanced coating systems.

Paints and Coatings Market Share, By End-Use Industry, 2025(%)

| End-Use Industry | Revenue Share, 2025 (%) |

| Construction | 50.00% |

| Automotive | 18.00% |

| Industrial Equipment | 14.00% |

| Consumer Goods | 10.00% |

| Electronics | 8.00% |

Regional Insights

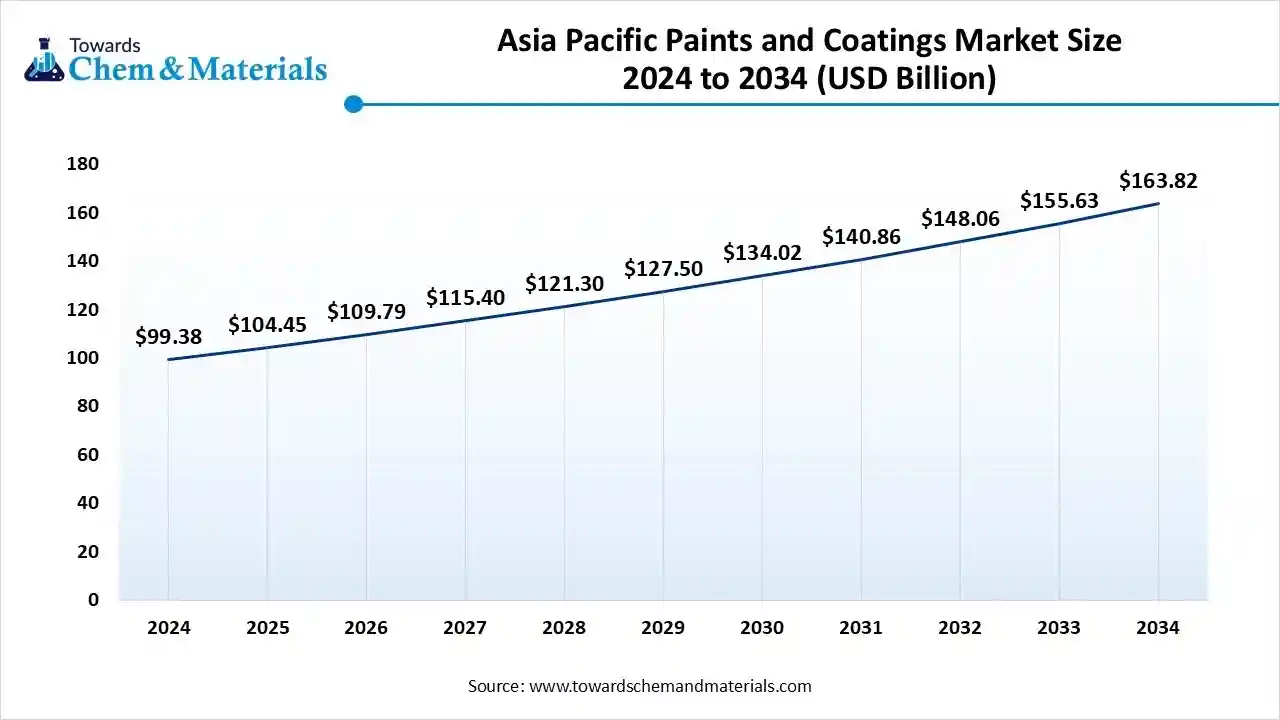

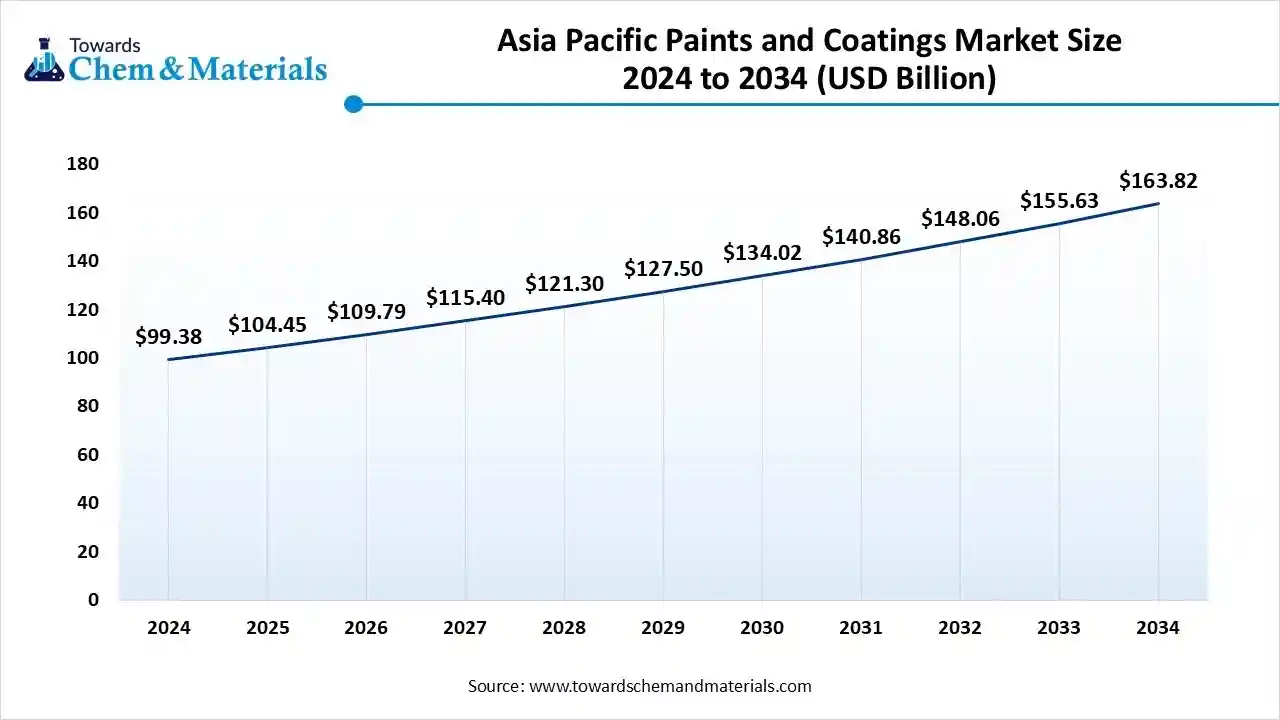

The Asia-Pacific paints and coatings market size was valued at USD 112.26 billion in 2025 and is expected to be worth around USD 186.59 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.14% over the forecast period from 2026 to 2035. The Asia-Pacific dominated the tire pyrolysis products market with the largest revenue share of 51% in 2025.

Asia Pacific dominates the market owing to strong growth in the construction, automotive, and industrial sectors. Rapid urbanisation in China, India, and Southeast Asia boosts demand for decorative and protective coatings. Increasing infrastructure investment and preference for water-based, low-VOC coatings are accelerating market expansion in the region.

India Has Seen Growth Driven By The Expanding Automotive Industry.

India represents one of the fastest-growing markets in Asia, driven by housing development, commercial real estate, and the expanding automotive industry. Rising disposable income and urban lifestyle shifts are increasing decorative paint consumption. Additionally, the government's infrastructure initiatives and manufacturing growth support industrial coating demand.

North America Paints And Coatings Market Analysis.

North America has seen significant growth in the market share 23.00% in the forecast period. North America’s paints and coatings market benefits from advanced technological innovation, sustainability initiatives, and strong automotive and aerospace sectors. The demand for high-performance coatings with corrosion resistance, low emissions, and UV stability continues to grow. Stringent environmental regulations are also driving a transition toward waterborne and UV-cured coating technologies.

U.S. Growth In The Market Is Driven By The Growing Adoption Of Eco-Friendly Materials.

The U.S. dominates the North American paints and coatings market due to high investments in R&D and robust industrial activity. Adoption of eco-friendly, low-VOC coatings is increasing in residential and commercial construction. Moreover, technological advancements in smart and self-healing coatings are shaping the market’s premium segment.

Europe Paints And Coatings Market Trends

Europe has seen notable growth in the market with 19.00% share. Europe’s paints and coatings market emphasises sustainability, innovation, and regulatory compliance. Demand for advanced coating technologies such as UV-cured and powder coatings is rising, driven by environmental legislation. The region’s construction recovery, coupled with strong demand from the automotive and industrial manufacturing sectors, supports stable market performance.

UK Green Building Initiatives Drive The Growth.

The UK market focuses on premium architectural coatings and automotive refinishing solutions. Green building standards and eco-label certifications are influencing manufacturers to develop water-based and bio-based products. Additionally, renovation projects and electric vehicle production are increasing the demand for advanced, high-durability, and energy-efficient coating formulations.

The paints and coatings market in Latin America is witnessing steady growth because of growing industrial development and construction activity. The use of protective and decorative coatings is growing in the area, and low-VOC and environmentally friendly products are becoming increasingly popular. While local manufacturers and international players continue to fight for market share, urbanization infrastructure projects and government initiatives to modernize commercial and residential spaces are also driving market demand.

Brazil Paints and Coatings Market Trends

Brazil's paints and coatings market is growing strongly, driven by building projects in both residential and commercial areas. Along with industrial growth in the automotive and manufacturing sectors, consumers growing preference for high-end and decorative paints is driving growth. To comply with increasingly stringent regulations and consumer demands, manufacturers are investing in water-based and environmentally friendly coatings, demonstrating the growing significance of sustainability trends.

Paints and Coatings Market Share, By Region, 2025(%)

| By Region | Revenue Share, 2025 (%) |

| North America | 23.00% |

| Europe | 19.00% |

| Asia Pacific | 51.00% |

| Latin America | 5.00% |

| Middle East & Africa | 2.00% |

MEA Paints and Coatings Market Trends

The MEA paints and coatings market is expanding steadily, propelled by extensive urban development and infrastructure initiatives. Because of the severe weather, which calls for long-lasting and corrosion-resistant solutions, protective and industrial coatings are in high demand. While decorative paints are becoming more and more popular in the residential sector, high-performance coatings are being supported by government initiatives to modernize cities.

UAE Paints and Coatings Market Trends

The UAE paints and coatings market is expanding rapidly owing to large-scale real estate tourism and building projects. High-end decorative paints and functional coatings are in high demand due to upscale commercial and residential construction. Manufacturers are encouraged to develop and provide sustainable solutions through regulatory frameworks that support low-VOC and environmentally friendly products. Additionally, industrial coatings are expanding in industries like infrastructure, aviation, and oil and gas.

Recent Developments

- In February 2025, AkzoNobel introduced several new products, including a waterborne wood coating with 20% bio-based content and a "sunscreen" coating system designed to reduce urban temperatures and energy consumption.(Source : www.akzonobel.com)

- In March 2025, Nippon Paint Automotive Americas, Inc. and Uchihamakasei jointly developed a next-generation in-mold coating (IMC) technology for large thermoplastic automotive exterior parts. This innovative process combines resin molding and coating into a single step, reducing CO2 emissions by 60% compared to traditional methods.(Source: www.nipponpaint-holdings.com)

- In February 2025, Arxada introduced Polyboost™, a multifunctional, VOC-free additive designed to enhance paint and coatings formulations while meeting regulatory and environmental standards. The additive aims to improve pH and viscosity stability, reduce the need for preservatives, and support compliance with eco-labels without affecting paint colour or requiring an H317 hazard label.(Source: www.coatingsworld.com)

- In February 2026, hubergroup Chemicals announced the launch of ELARA, a new brand offering tailored additives for coatings, printing inks, and various industrial applications. The ELARA product line focuses on high-performance defoamers, wetting agents, and dispersants to improve surface properties and processing efficiency. This specialized portfolio is designed to provide customized chemical components for the global specialty chemicals market.(Source: www.hubergroup.com)

- In December 2025, PPG announced its showcase of coating innovations and sustainable design solutions at the 2025 Guangzhou Design Week. The company highlighted its commitment to eco-friendly technologies and color trends for the Asian market.(Source: news.ppg.com)

Top Players In The Paints And Coatings Market & Their Offerings:

- PPG Industries: a global supplier of paints, coatings, and speciality materials, does not participate in the robotics in drug discovery market. Therefore, the challenges associated with this market are not directly applicable to PPG's core business

- AkzoNobel: a major player in the global paints and coatings market, consistently ranking among the top three companies worldwide based on sales. The company is based in the Netherlands and operates in over 150 countries.

- BASF SE: a significant player in the automotive original equipment manufacturer (OEM), automotive refinish, and surface treatment markets. However, the company has recently made a major strategic decision to divest this part of its business.

- Axalta Coating Systems: a global coatings company with operations focused on the transportation and industrial sectors. Axalta continues to invest in new products and technological advancements.

- Sherwin-Williams:

- PPG Industries

- AkzoNobel

- BASF SE

- Axalta Coating Systems

- RPM International Inc.

- Nippon Paint Holdings

- Kansai Paint Co., Ltd.

- Jotun Group

- Hempel A/S

- Asian Paints Limited

- Berger Paints India Ltd.

- DuluxGroup

- Valspar Corporation

- Tikkurila Oyj

Segments Covered:

By Resin Type

- Acrylic

- Waterborne Acrylic

- Solventborne Acrylic

- Epoxy

- Bisphenol-A Epoxy

- Novolac Epoxy

- Alkyd

- Polyurethane (PU)

- Polyester

By Technology

- Water-Based

- Solvent-Based

- Powder Coating

- UV-Cured Coating

- High Solids Coating

By Application

- Architectural Coatings

- Interior Wall Coatings

- Exterior Wall Coatings

- Industrial Coatings

- Automotive Coatings

- OEM Coatings

- Refinish Coatings

- Protective Coatings

By End-Use Industry

- Construction

- Automotive

- Industrial Equipment

- Consumer Goods

- Electronics

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait