Content

What is the Current Europe Bioplastics and Biopolymers Market Size and Share?

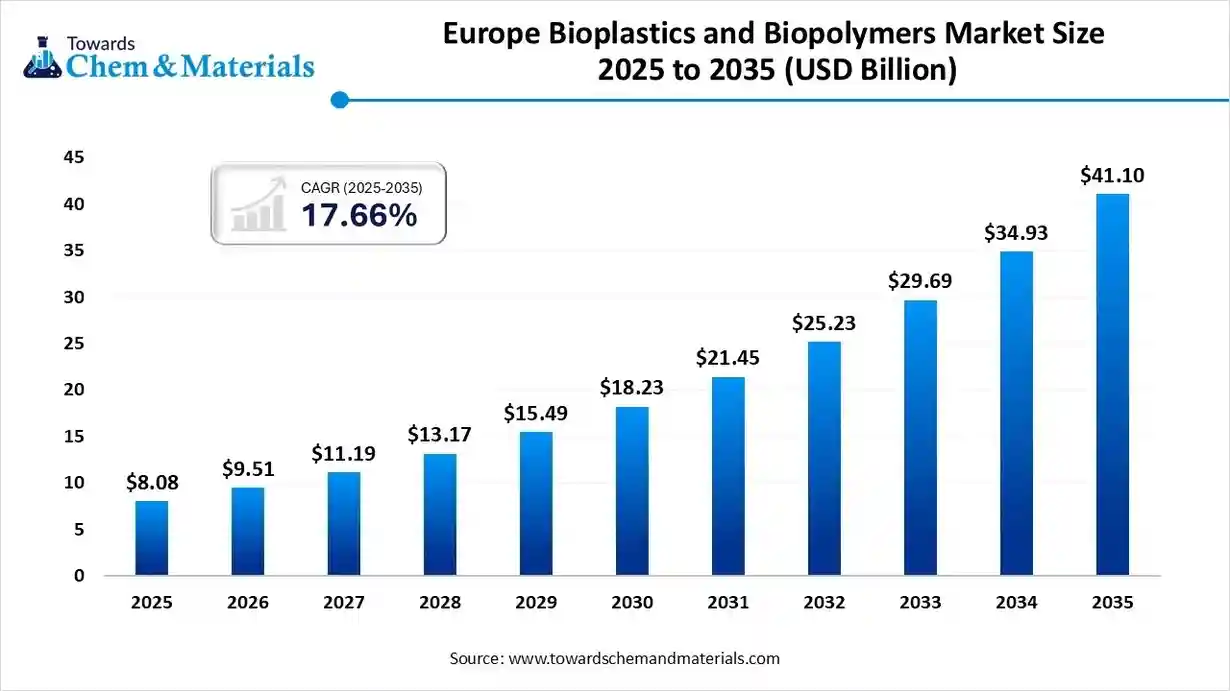

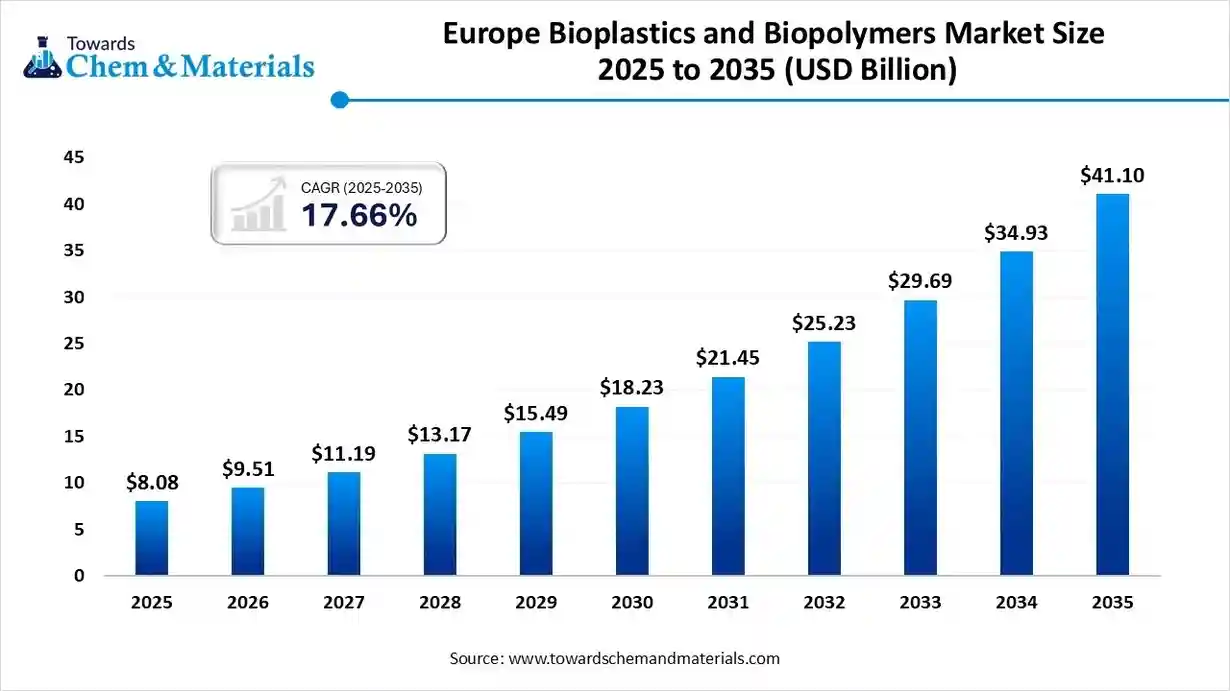

The Europe bioplastics and biopolymers market size is calculated at USD 8.08 billion in 2025 and is predicted to increase from USD 9.51 billion in 2026 and is projected to reach around USD 41.10 billion by 2035, The market is expanding at a CAGR of 17.66% between 2026 and 2035. The growth of the market is driven by rising sustainability regulations and increasing industry demand for eco-friendly, low-carbon packaging solutions.

Key Takeaways

- By type, the biodegradable segment has contributed the largest market share in 2025.

- By type, the non-biodegradable segment will grow at a notable CAGR between 2025 and 2034.

- By end-use industry, the packaging segment contributed the largest share in 2025.

- By end-use industry, the automotive & transportation segment will grow at a notable CAGR between 2025 and 2034.

Market Overview

Why Is Europe Rapidly Shifting Towards Bioplastics?

The Europe bioplastics and biopolymers market is expanding as businesses switch to eco-friendly materials to cut down on plastic waste and carbon footprints. Adoption in the packaging of consumer goods and automotive industries is being accelerated by strong policies supported, such as stringent EU sustainability regulations and plastic reduction mandates.

Product innovation is also accelerated by growing investments in R&D and circular economy projects. Demand for bio-based substitutes is still rising throughout the regions as companies pledge to use greener packaging.

Market Trends

- Strong Policy Support Accelerating Adoption: Europe’s strict environmental rules and bans on certain single-use plastics are pushing companies to switch to bioplastics faster than ever. Governments are actively encouraging biodegradable and bio-based alternatives, especially in packaging.

- Growing Preference for Flexible Packaging: Flexible bioplastic films are gaining the most traction because they easily fit into existing packaging machines. Brands in food, FMCG, and personal care prefer these materials as they require minimal operational changes.

- Rise of Plant-Based Raw Materials: Manufacturers are increasingly relying on natural feedstocks like corn, sugarcane, and wood residues. This shift helps reduce fossil fuel usage and makes the supply chain more sustainable.

- Advances in Processing & Material Technology: Breakthroughs in fermentation, polymerization, and 3D-printing–compatible biopolymers are improving strength, durability, and heat resistance. These improvements are opening doors to high-value sectors such as automotive, healthcare, and electronics.

- Cost Gap Between Bioplastics and Conventional Plastics: Despite rising demand, bioplastics remain more expensive to produce, limiting their adoption in cost-sensitive industries. Companies are investing in scale and innovation to narrow this price gap in the coming years.

- Stronger Push Toward Circular Materials: Europe is not only focused on bio-based production but also on composability, recyclability, and chemical recycling. This aligns with the region’s long-term goals of reducing waste and building a fully circular materials economy.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 9.51 Billion |

| Revenue Forecast in 2035 | USD 41.10 Billion |

| Growth Rate | CAGR 17.66% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Type, By End Use Industry |

| Key companies profiled | Arkema S.A. (France), Versalis S.p.A. (Italy), Biome Bioplastics Limited (UK), Biotec Biologische Naturverpackungen GmbH & Co. KG (Germany), FKuR Kunststoff GmbH (Germany), Futerro SA (Belgium), Lactips (France), Sulapac Oy (Finland), Carbios (France) |

Trade Analysis Of the Europe Bioplastics And Biopolymers Market: Import & Export Statistics

- Europe produced approximately 2.47 million tonnes of bioplastics in 2025. This growth reflects rising adoption of renewable materials, EU sustainability mandates, and increasing demand for packaging, consumer goods, and automotive applications.

- Most of the bioplastics produced in Europe are used in packaging, consumer goods, and automotive sectors, with packaging alone accounting for around 45% of total bioplastics production in 2025, highlighting its significance in the regional market.

- The leading polymer types in Europe are PLA, PHA, and bio-PE. PLA dominates due to its versatility and wide application in packaging and consumer goods, followed by PHA for high-value applications, and bio-PE as a renewable alternative to conventional polyethylene. These polymers are preferred for their biodegradability, renewability, and compatibility with existing processing infrastructure.

- Production capacity utilization in Europe is estimated at almost 60% in 2025, varying by polymer type. Market capacity is expected to grow steadily through 2029 as additional facilities are brought online to meet the expanding demand for bio-based plastics.

Value Chain Analysis

- Chemical Synthesis and Processing: Chemical synthesis in the Europe bioplastics and biopolymers market focuses on converting renewable feedstocks into durable, high-performance polymers. Companies are improving fermentation and polymerization processes to achieve stronger, more heat-resistant, and biodegradable materials.

- Key players such as NatureWorks, Novamont, BASF, and TotalEnergies Corbion are expanding biopolymer plants, investing in next-gen PLA and PHA technologies, and forming collaborations to strengthen Europe’s bio-based production capacity.

- Quality Testing and Certification: Quality testing ensures that bioplastics meet EU standards for composability, performance, and safety. Products undergo biodegradability checks, mechanical testing, and environmental impact assessments before entering the market.

- Key certification-focused players, including DIN CERTCO, TÜV Austria, and European Bioplastics, provide recognized labels like EN 13432 and OK Compost, helping brands validate sustainability claims and build trust with industrial buyers.

- Distribution to Industrial Users: Distribution networks are improving as logistics firms and manufacturers streamline supply chains for packaging converters, FMCG producers, and industrial users. Faster deliveries and stable inventories are reducing procurement delays.

- Key distributors and industry partners, such as FKuR, Biome Bioplastics, Corbion, and specialized European polymer distributors are expanding warehousing, offering technical support, and forming long-term supply agreements to ensure consistent biopolymer availability.

Segmental Insights

Type Insights

How Did The Biodegradable Segment Dominate The Europe Bioplastics And Biopolymers Market In 2025?

The biodegradable segment dominated the market in 2025, driven by its strong alignment with EU sustainability policies, waste management objectives, and consumer demand for packaging that is compostable. The market was further propelled forward by growing prohibitions on single-use plastics and the quick adoption of compostable materials by food FMCG and retail brands because of their versatility, regulatory acceptance, and broad packaging compatibility. Companies preferred biodegradable grades like PLA, PHA, and starch blends.

Non-biodegradable bio-based segment expects the fastest growth in the market during the forecast period, as businesses look for high-performing long long-lasting substitutes for petroleum-based plastics without switching to compostable materials. Bio PE, Bio PET, and Bio PA are examples of biobased but non-compostable materials that provide the strength, thermal stability, and recyclability required for use in consumer goods, beverages, and automotive components. Adoption is being accelerated by their cost advantage over compostable grades.

End Use Industry Insights

What Made The Packaging Segment Dominate The Europe Bioplastics And Biopolymers Market In 2025?

Packaging dominated the market in 2025, due to the increased adoption of renewable and compostable materials by food & beverage, e-commerce, and personal care businesses. Bioplastics are the easiest and fastest sector to transition to because of their lightweight advantages, food contact safety compliance, and compatibility with existing converting lines. Strong retailer pledges and EU circular economy goals strengthened packaging's position as the most popular application.

Automotive & transportation segment expects the fastest growth in the market during the forecast period, due to lightweight low-emission materials becoming more popular, and electric vehicle sustainability frameworks becoming more prevalent because of their strength and heat resistance bio Bio-based polymers like bio PA and bio PET are utilized for structural parts, under the hood components, and interior trims. To meet CO2 reduction goals and increase recyclability, automakers are implementing biopolymers.

Country Insights

Europe remains the world's largest hub for bioplastics and biopolymers due to the FMCG and packaging industries enormous demand, robust research efforts, and stringent environmental regulations. The region is making significant investments in advanced biopolymer processing technologies, feedstock innovations, and composting infrastructure to maintain strong adoption across various sectors.

Germany Bioplastics and Biopolymers Market Trends

Germany leads the European market with robust R&D capacity, strong chemical manufacturing ecosystems, and early adoption of bio-based materials in packaging and automotive industries. Germany is a major player in the development and commercialization of bioplastics thanks to government incentives, retailers that prioritize sustainability, and broad industrial partnerships.

UK Bioplastics and Biopolymers Market Trends

The U.K. is expanding due to brands increasing pledges to invest in recyclable and compostable alternatives and cut down on plastic waste. Strong policy pushes and growing consumer demand for eco-friendly packaging are driving businesses in the food service, retail, and consumer goods sectors to adopt PLA, PHA, and bio PE solutions.

Recent Developments

- In May 2025, TotalEnergies Corbion / AIMPLAS (Europe), the GRECO Horizon Europe project is launched to develop greener food-packaging PLA copolymers using sustainable catalysts, coatings, and additives. The 21-partner project will also validate the life-cycle performance and safety of these new bioplastics.(Source: www.european-bioplastics.org)

- In May 2025, ADBioplastics reveals its PLA-Premium compostable bioplastic innovations at Greenplast 2025 in Milan, including new applications for food, cosmetics, and closures. They will highlight a PLA-based “BioLoop Band” filament designed for compostable twist-band closures at their booth. (Source: adbioplastics.com)

Top Europe Bioplastics And Biopolymers Market Companies

Avantium N.V. (Netherlands)

Corporate Information

- Avantium is a chemical technology company headquartered in Amsterdam, Netherlands.

- It is publicly traded on Euronext Amsterdam and Euronext Brussels under ticker AVTX.

- As of recent data, Avantium operates through three segments: “Avantium R&D Solutions,” “Avantium Renewable Chemistries,” and “Avantium Renewable Polymers.”

History and Background

- Avantium was founded in 2000.

- Early work centered on high-throughput catalysis research and R&D systems, being one of the pioneers in applying advanced catalysis & chemical process techniques.

Key Developments and Strategic Initiatives

- Commercialization push: In December 2021, Avantium made a Final Investment Decision to build its first full scale FDCA plant. Construction began in April 2022.

- FDCA Flagship Plant inaugurated: The plant was officially opened in October 2025.

Partnerships & Collaborations

- In 2023, Avantium signed its first technology license agreement with Origin Materials enabling broader deployment of its FDCA / PEF technology.

- The company has secured offtake / supply agreements with several global brand owners for FDCA and its polymer product PEF. These include packaging, bottle, film, and textile customers.

Product Launches / Innovations

- YXY® Technology - FDCA & PEF (Releaf®): Converts plant-based sugars into FDCA (furandicarboxylic acid), which is then polymerized into Polyethylene Furanoate (PEF) a 100% plant based, recyclable polymer with strong barrier properties (O₂, CO₂), suitable for bottles, films, packaging, textiles. The commercial rollout via “FDCA Flagship Plant” began in 2025.

Key Technology Focus Areas

- Ray Technology™ - plantMEG / plantMPG: Converts industrial sugars to plant-based mono ethylene glycol (MEG) and mono propylene glycol (MPG), which are key building blocks for polyesters like PET or PEF enabling reduction in fossil based feedstocks.

R&D Organisation & Investment

Avantium boasts “over 20 years of expertise in catalysis, chemical process development, and polymers,” with a strong intellectual property (IP) portfolio: over 175 granted & pending patent families helping secure a competitive edge.

SWOT Analysis

Strengths

- Strong technological foundation & innovation portfolio decades of catalysis and polymer R&D.

- Diversified technology pipeline (sugars - FDCA/PEF; sugars - glycols; biomass - sugars; CO₂ - chemicals) reduces reliance on one feedstock/technology.

- Flagship commercial-scale plant for FDCA/PEF converting from pilot to production stage, which is a major step in scaling.

Weaknesses / Risks

- As of mid 2025, the company is still managing liquidity recent financing and debt draws suggest financial strain while scaling up operations.

- Scaling novel chemistries from lab/pilot to commercial scale carries technical, regulatory and market adoption risks; demand and supply must align.

Opportunities

- Growing global demand for sustainable packaging, textiles, and plastics: PEF (Releaf®) could substitute traditional PET and other fossil-based plastics especially for high-barrier needs (bottles, food packaging, films, etc.).

- Licensing and partnerships: Avantium’s model of licensing its technologies globally (rather than building all plants themselves) could accelerate adoption worldwide with lower capital burden.

Threats

- Market acceptance: End-users (brands, converters, regulators) may be slow to adopt new materials due to cost, certification, regulatory approvals, or supply chain inertia.

- Feedstock supply / cost volatility: Since Avantium relies on plant sugars and biomass (or future CO₂ routes), supply chain constraints or cost competition could pose challenges.

Recent News & Strategic Updates

- August 2025: Avantium launched a refreshed corporate brand identity and a redesigned website. This move signals its transformation from pure R&D to a commercial stage enterprise with broader global ambitions.

- December 2025: The company secured up to €35 million in financing (via debt facilities) to support the start-up of its FDCA Flagship Plant; also launched a bookbuild equity offering for up to 8% of outstanding shares.

Other Top Players

- Arkema S.A. (France): Focuses heavily on R&D in renewable raw materials to produce bioplastics and green chemicals.

- Versalis S.p.A. (Italy): The chemical arm of Italian energy giant Eni S.p.A., Versalis is integrated with Novamont and involved in the production of various biopolymers.

- Biome Bioplastics Limited (UK): Specializes in developing innovative, high-performance bioplastics derived from renewable resources, with a strong focus on compostable solutions and a global presence.

- Biotec Biologische Naturverpackungen GmbH & Co. KG (Germany): A German pioneer in the field, offering a range of biodegradable plastics, especially starch-based blends and films.

- FKuR Kunststoff GmbH (Germany): Known for a broad portfolio of bioplastics, including biodegradable PLA blends, bio-PE, and bio-PA, and acts as a key distributor.

- Futerro SA (Belgium): A key player in PLA production and technology development.

- Lactips (France): Focuses on developing a water-soluble, biodegradable, and food-contact-approved plastic-free polymer based on milk protein (casein).

- Sulapac Oy (Finland): A Finnish startup known for its bio-based, microplastic-free material used as a sustainable alternative in cosmetics packaging and other applications.

- Carbios (France): Specializes in enzymatic recycling technology to break down existing plastics (including PET and PLA) and create virgin-grade, bio-based polymers, promoting a circular economy model.

Segments Covered

By Type

- Non-Biodegradable

- Biodegradable

By End Use Industry

- Packaging

- Consumer Goods

- Agriculture & horticulture

- Textile

- Automotive & Transportation

- Others