Content

Biomaterials Market Size, Share & Growth Report, 2034

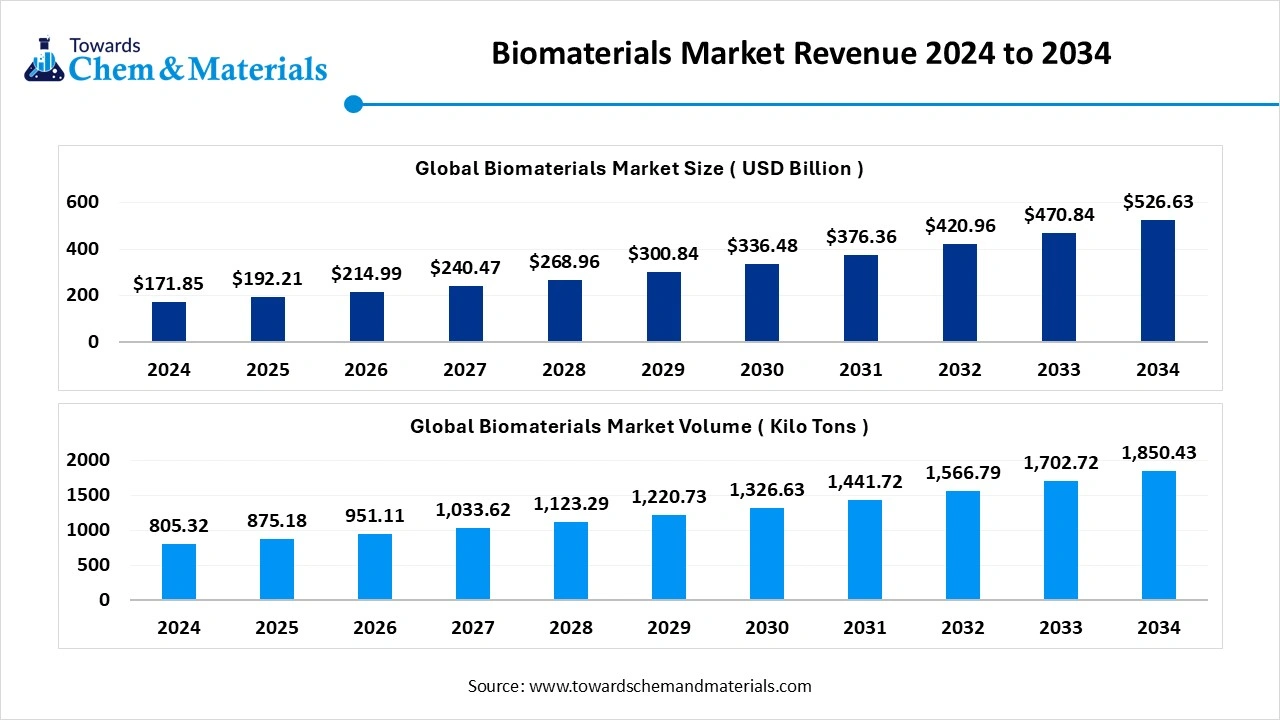

The global biomaterials market size was valued at USD 171.85 billion in 2024 and is anticipated to reach around USD 526.63 billion by 2034, growing at a CAGR of 11.85% from 2025 to 2034.

The global biomaterials market volume was reached at 805.32 kilo tons in 2024 and is expected to be worth around 1850.43 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 8.68% over the forecast period 2025 to 2034. The growth of the market is driven by the growing demand for sustainable and eco-friendly materials, and due to the rising prevalence of chronic diseases with an increased aging population, which fuels the growth.

Key Takeaways

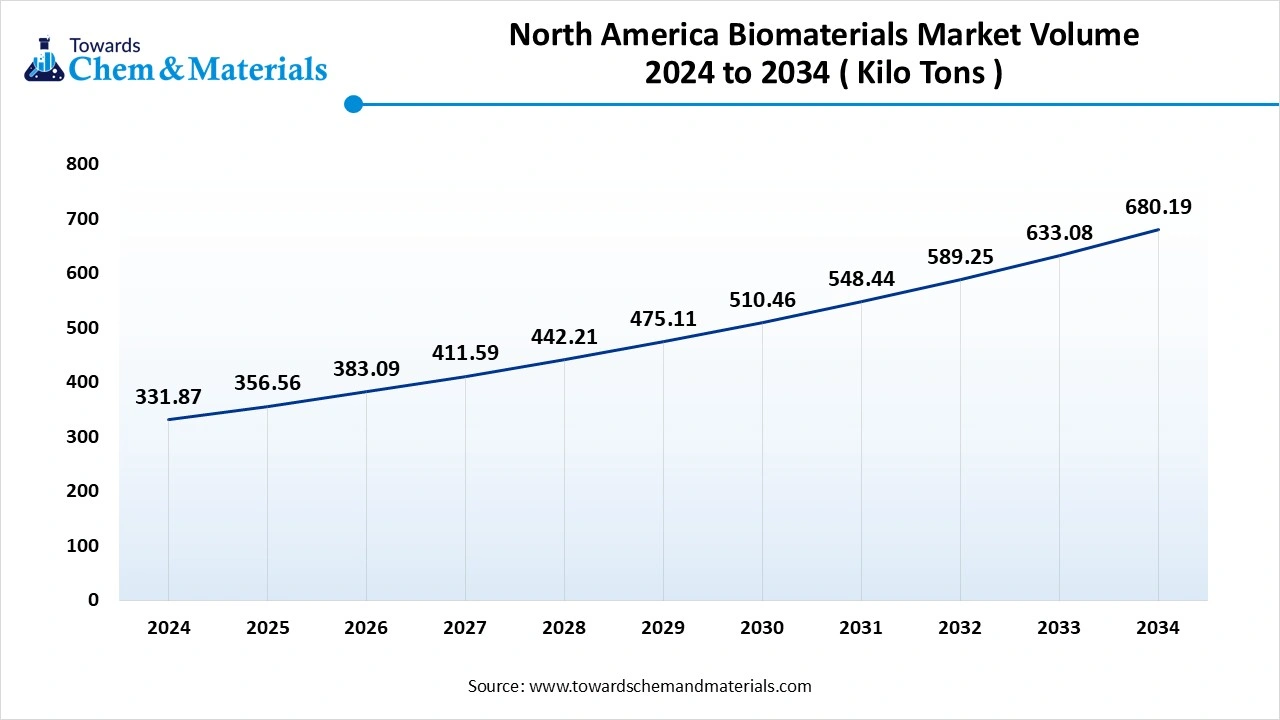

- The North America biomaterials market Volume is estimated at 356.56 Kilo Tons in 2025 and is expected to reach 680.19 Kilo Tons by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

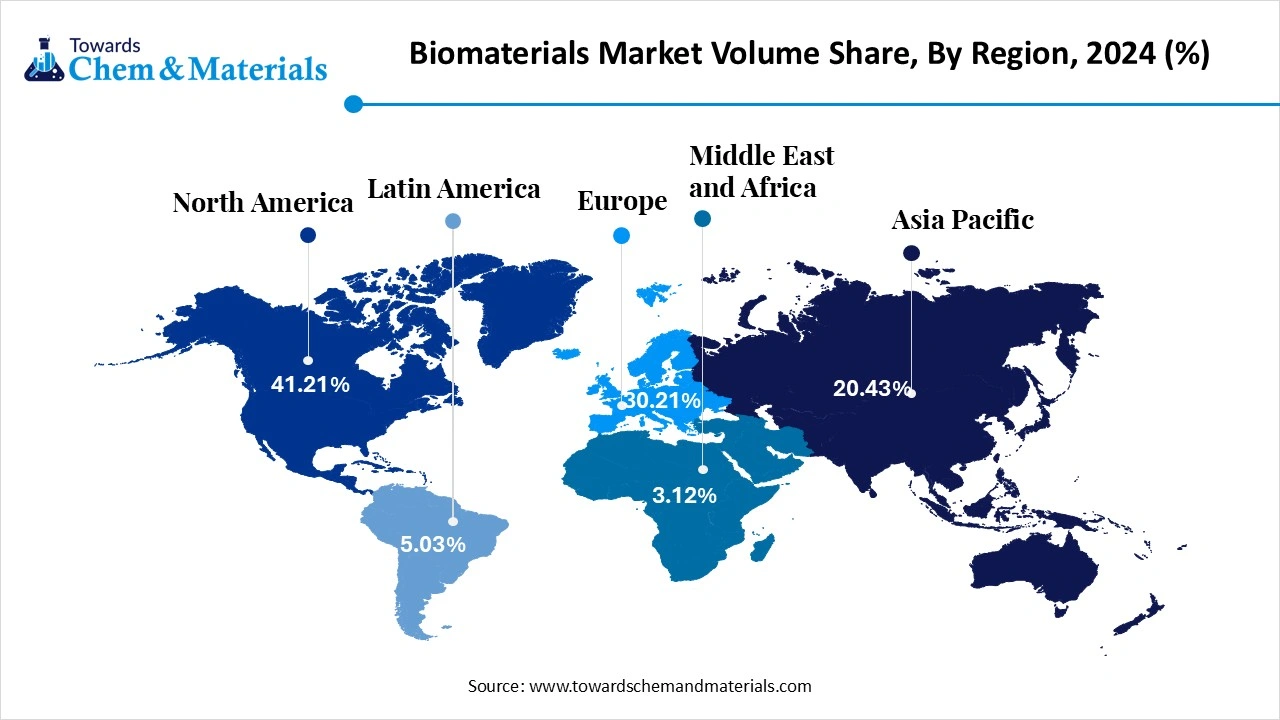

- The North America biomaterials market held the largest volume share of 41.21% of the global market in 2024.

- The Asia Pacific biomaterials market is expected to register the fastest CAGR of 14.96% over the forecast period by 2025-2034.

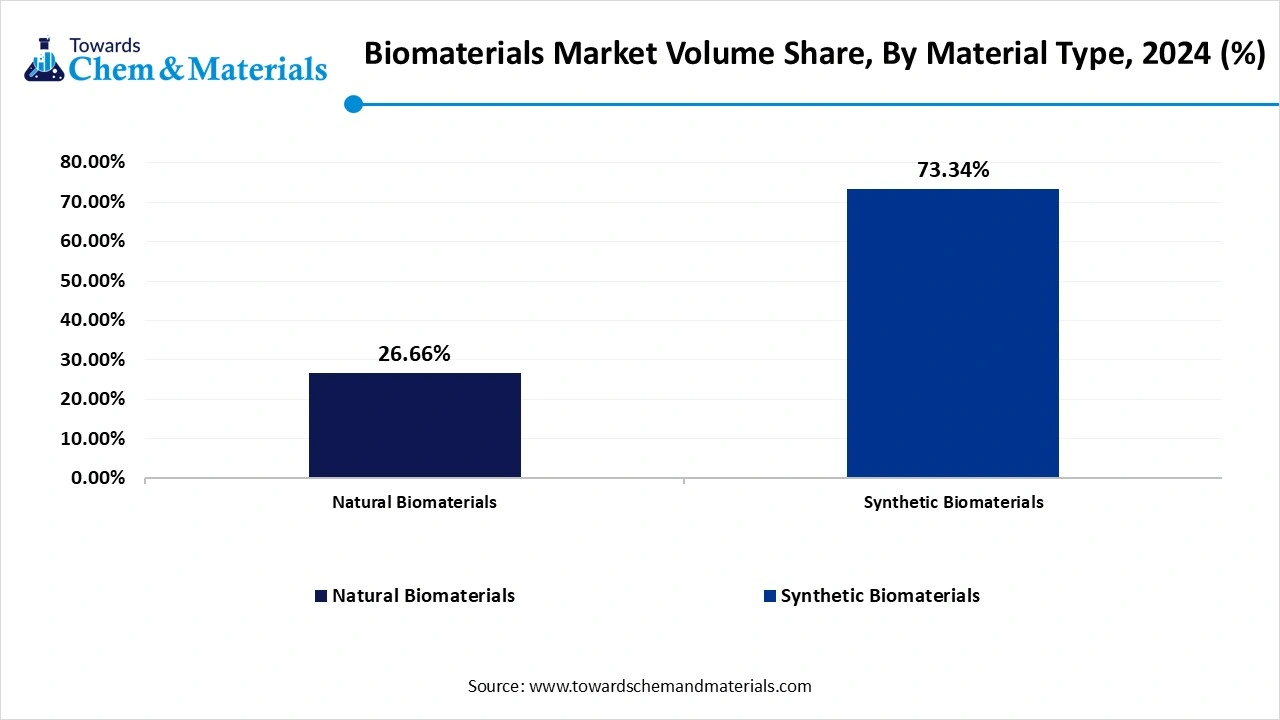

- By Material Type, the synthetic biomaterials segment dominated the market with the largest volume share of 73.34% in 2024.

- By Material Type, the natural biomaterials segment is projected to grow at the fastest CAGR of 13.15% over the forecast period by 2025-2034.

- By application, the orthopaedic segment dominated the market in 2024. The orthopaedic segment held a 35% share in the market in 2024. The growing application in the department fuels the growth of the market.

- By application, the tissue engineering segment is expected to grow in the forecast period. The technological advancements in the procedure and materials drive the growth.

Market Overview

Rising Demand For Durable Materials: Biomaterials Market To Expand

The biomaterials market refers to the global industry involving the development, manufacturing, and application of natural or synthetic materials engineered to interact with biological systems for medical purposes, either as a therapeutic (e.g., implants, scaffolds) or a diagnostic aid. These materials are used in fields such as tissue engineering, regenerative medicine, orthopaedics, cardiovascular, dental, and wound healing.

What Are The Key Growth Drivers Responsible For The Growth Of The Biomaterials Market?

The growth of the market is driven by the growing aging population and increased prevalence of chronic diseases like cardiovascular disease and orthopaedic conditions, which increases the demand for medical equipment. Advancements in material science and rising demand for medical devices and implants with minimally invasive surgeries surge the demand for the market, which propels growth.

The Government funding and research for innovative and advanced biomaterial technologies drive the demand for the market. Other key growth drivers are customization and personalization, like 3D printing and other advanced technologies, fueling the growth. The growing healthcare industry in emerging economies is due to increasing healthcare investments, and the adoption of advanced medical technologies boosts the growth and expansion of the market.

Market Trends

- The rising demand for biodegradable materials that can be absorbed by the body safely fuels the growth of the market.

- The growing demand for 3D printing for revolutionizing the design and manufacturing of medical implants and devices for complex and patient monitoring increases the growth of the market.

- The growing focus on sustainability and demand for sustainable biomaterials boosts the growth of the market.

- The growing application in cardiovascular and orthopaedic applications drives the growth of the market.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 875.18 Kilo Tons |

| Expected Volume by 2034 | 1850.43 Kilo Tons |

| Growth Rate from 2025 to 2034 | 8.68% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Material Type , By Application , By Region |

| Key Companies Profiled | Evonik Industries AG , BASF SE, Covestro AG , Corbion N.V. , DSM Biomedical , Berkley Advanced Biomaterials , Zimmer Biomet Holdings, Inc. , Medtronic plc , Stryker Corporation , Johnson & Johnson (DePuy Synthes), Royal DSM , Celanese Corporation , Invibio Ltd (Victrex plc) , NUSIL (Avantor) , Bioretec Ltd , CoorsTek Medical , Aran Biomedical , REVA Medical, LLC , Astra Tech (Dentsply Sirona) , Acumed LLC |

Market Opportunity

What Are The Key Growth Opportunities That Influence The Growth Of The Biomaterials Market?

The growing application in various departments created a great opportunity for the growth of the market. The application in cardiovascular, orthopaedic, and dental for dental implants, bone grafts, restorative materials, tissue regeneration, wound healing, development of artificial organs, in cardiovascular diseases for the development of stents, artificial heart valves, and other cardiovascular devices, which increases the growth of the market. The growing demand for spinal implants, joint replacements, and other orthopaedic procedures also increases the growth and expansion of the market, creating great opportunities for growth.

Market Challenge

What Are The Key Challenges That Limit The Growth Of The Biomaterials Market?

The key challenges that limit the growth of the market are the high development costs and regulatory hurdles. The development of biomaterials requires heavy investments in research with financial inputs, which limits the growth of the market. The stringent biocompatibility and toxicity testing delays product approvals. The limited availability and cost of materials, which are expensive, affect and hinder the affordability, which leads to disruption of the supply chain, which limits the growth and expansion of the market.

Segmental Insights

Material Type Insights

Which Material Type Segment Dominated The Biomaterials Market In 2024?

The synthetic biomaterial segment the synthetic biomaterial segment dominated the market in 2024. Synthetic biomaterials are man-made compounds such as polymers, ceramics, and metals engineered to perform specific biological functions. These materials offer superior strength, controlled degradation rates, and design flexibility, making them ideal for orthopedic implants, dental devices, cardiovascular stents, and drug delivery systems. Common examples include polyethylene, polylactic acid (PLA), titanium alloys, and bioinert ceramics. Their consistent quality, scalability, and adaptability to advanced manufacturing methods like 3D printing drive widespread use. Continued innovation in surface modification and composite formulation is enhancing tissue integration and reducing rejection risks, ensuring synthetic biomaterials remain a dominant force across diverse medical applications.

The natural biomaterial segment is expected to experience notable growth in the market. Natural biomaterials are derived from biological sources such as collagen, gelatin, chitosan, alginate, silk, and hyaluronic acid, and are widely used for their excellent biocompatibility and biodegradability. These materials play a vital role in wound healing, tissue engineering, drug delivery, and surgical sutures. The segment is gaining traction due to growing preference for bio-based, non-toxic materials that integrate well with human tissues. Advances in processing techniques and material customization have improved their mechanical properties and stability. As research progresses in regenerative medicine and cell therapy, natural biomaterials continue to be a key focus area, especially in soft tissue applications..

Biomaterials Market Volume Share, By Material Type, 2024-2034 (%)

| By Material Type | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| Natural Biomaterials | 26.66% | 214.70 | 35.27% | 652.65 | 13.15% |

| Synthetic Biomaterials | 73.34% | 590.62 | 64.73% | 1197.78 | 8.17% |

| Total | 100.00% | 805.32 | 100.00% | 1850.43 | 8.68% |

Application Insights

How Did Orthopaedic Segment Dominated The Biomaterials Market In 2024?

The orthopaedic segment dominated the market in 2024. Orthopaedic applications form the largest segment of the market, driven by rising incidences of bone injuries, osteoarthritis, and joint replacement surgeries. Biomaterials are extensively used in hip and knee replacements, spinal implants, fracture fixation, and bone graft substitutes. The growing aging population, advancements in surgical techniques, and increasing sports-related injuries are fueling demand. Innovations in bioresorbable materials, 3D-printed implants, and surface-modified metals are enhancing compatibility and long-term performance. With hospitals and orthopaedic clinics increasingly adopting advanced implants and fixation devices, this segment continues to lead in both revenue and technological development across the global market.

The tissue engineering segment expects significant growth in the market during the forecast period. Tissue engineering is an emerging and rapidly growing application segment in the market, focused on regenerating or replacing damaged tissues and organs using scaffolds, cells, and biologically active molecules. Biomaterials play a critical role in creating supportive structures for cell growth and tissue regeneration, especially in skin, bone, cartilage, and vascular engineering. This segment is driven by advancements in stem cell research, 3D bioprinting, and bioactive material development. Increasing demand for organ replacement, wound healing solutions, and customized grafts is accelerating adoption. Despite being in its early stages commercially, tissue engineering holds immense potential for transforming future regenerative medicine.

Regional Insights

How Did North America Dominate The Biomaterials Market In 2024?

The North America biomaterials market volume was estimated at 331.87 Kilo Tons in 2024 and is anticipated to reach 680.19 Kilo Tons by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

North America dominated the biomaterials market in 2024. The growth of the market is driven by the presence of strong research and advanced technology in the region and robust infrastructure development, which propels the demand for the market. The growing aging population, which leads to a rising prevalence of chronic diseases which increases the demand for the market. The advancement in medical technology, like novel biomaterials with improved biocompatibility and performance, with the help of government initiatives and funding in healthcare infrastructure development and for research in the region, further fuels the growth and expansion of the market.

U.S. Significant Growth In The Biodegradable Materials Fuels The Growth Of The Market.

The U.S. has seen significant growth driven by the growing focus on biodegradable materials for tissue engineering and regenerative medicine influences the growth of the market. The adoption of advanced biomaterials is increasing in the country, such as 3D printed implants and personalized medical devices, which is surging the growth of the market. Companies in the country are focusing on mergers and acquisitions, which expand their presence and product, along with ensuring product safety and efficiency, boosting the growth of the market.

The Growing Government Initiatives Boost The Growth Of The Market In The Asia Pacific.

Asia Pacific is expected to have significant growth in the biomaterials market in the forecasted period. The supportive government initiatives and policies in the region foster investment and market growth, which further increases the demand. Other key drivers are technological advancements, the growing medical tourism, and the growing demand for biomaterials due to their applications and for building implants for medical, which further increases the growth of the market, aligning with the rapid growth of natural biomaterials, boosting the growth and expansion of the market.

India Has Seen Significant Growth In The Market, Driven By Technological Advancements.

The growth of the market is driven by technological advancements like innovation in biomaterials and the development of new polymers, ceramics, and natural biomaterials further fuels the growth of the market. The technological advancements are also supported by the government funding and support for research and development of biomaterials, which drives the growth in the country. The key players like Medtronic PLC, Evonik Industries AG, Carpenter Technology Corporation, BASF SE, Corbion, CoorsTeck Inc., and Stryker play a major role in the growth of the market, supporting the expansion of the market in the country.

- The United States shipped out 3000 Dental Materials shipments. These exports were handled by 375 United States exporters to 445 buyers.(Source : www.volza.com)

- Globally, India, Germany, and Japan are the top three exporters of Dental Materials. India is the global leader in Dental Materials exports with 26,150 shipments, followed closely by Germany with 23,635 shipments, and Japan in third place with 17,241 shipments.(Source: www.volza.com)

Biomaterials Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| North America | 41.21% | 331.87 | 34.21% | 680.19 | 7.44% |

| Europe | 30.21% | 243.29 | 27.01% | 499.80 | 8.33% |

| Asia Pacific | 20.43% | 164.53 | 31.19% | 577.15 | 14.96% |

| Latin America | 5.03% | 40.51 | 4.54% | 84.01 | 8.44% |

| Middle East & Africa | 3.12% | 25.13 | 3.05% | 56.44 | 9.41% |

| Total | 100% | 805.32 | 100% | 1850.43 | 8.68% |

Recent Developments

- In April 2025, Northern Illinois University launched a new line of biomaterials and tissue engineering laboratory to improve and for an efficient biomedical engineering programme, which helps students experiment with innovative technology and creates opportunities with advanced analysis tools.(Source: cleanroomtechnology.com)

- In April 2025, Covation Biomaterials announced the launch of its innovation, CovationBio bioPTMEG, an advanced polytetramethylene ether glycol (PTMEG) that helps in reducing environmental impact amid growing environmental concerns, which offers high performance.(Source: worldbiomarketinsights.com )

Top Companies List

- Evonik Industries AG

- BASF SE

- Covestro AG

- Corbion N.V.

- DSM Biomedical

- Berkley Advanced Biomaterials

- Zimmer Biomet Holdings, Inc.

- Medtronic plc

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Royal DSM

- Celanese Corporation

- Invibio Ltd (Victrex plc)

- NUSIL (Avantor)

- Bioretec Ltd

- CoorsTek Medical

- Aran Biomedical

- REVA Medical, LLC

- Astra Tech (Dentsply Sirona)

- Acumed LLC

Segments Covered

By Material Type

- Natural Biomaterials

- Collagen

- Gelatin

- Fibrin

- Cellulose

- Alginate

- Silk

- Chitosan

- Hyaluronic Acid

- Starch-based Biomaterials

- Synthetic Biomaterials

- Polymers

- Polylactic Acid (PLA)

- Polyglycolic Acid (PGA)

- Polycaprolactone (PCL)

- Polyethylene Glycol (PEG)

- Polyurethane (PU)

- Polyetheretherketone (PEEK)

- Ceramics

- Alumina

- Zirconia

- Calcium Phosphates (e.g., Hydroxyapatite)

- Bioactive Glass

- Metals

- Stainless Steel

- Titanium & Titanium Alloys

- Cobalt-Chromium Alloys

- Magnesium Alloys

- Composites

- Polymer-Ceramic Composites

- Metal-Polymer Composites

- Carbon Fiber-Reinforced Composites

By Application

- Orthopaedic

- Joint Replacements

- Bone Grafts & Substitutes

- Spine Implants

- Cardiovascular

- Stents

- Heart Valves

- Vascular Grafts

- Dental

- Dental Implants

- Tissue Regeneration

- Wound Healing

- Dressings

- Skin Substitutes

- Plastic Surgery

- Soft Tissue Fillers

- Breast Implants

- Neurology

- Neural Implants

- Nerve Regeneration Scaffolds

- Ophthalmology

- Contact Lenses

- Intraocular Lenses

- Drug Delivery

- Injectable Biomaterials

- Microspheres & Nanoparticles

- Tissue Engineering

- Scaffolds

- Hydrogels

- Others

- Urological Applications

- Gastrointestinal Stents

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait