Content

What is the Current Bioplastics In Medical Devices Market Size and Share?

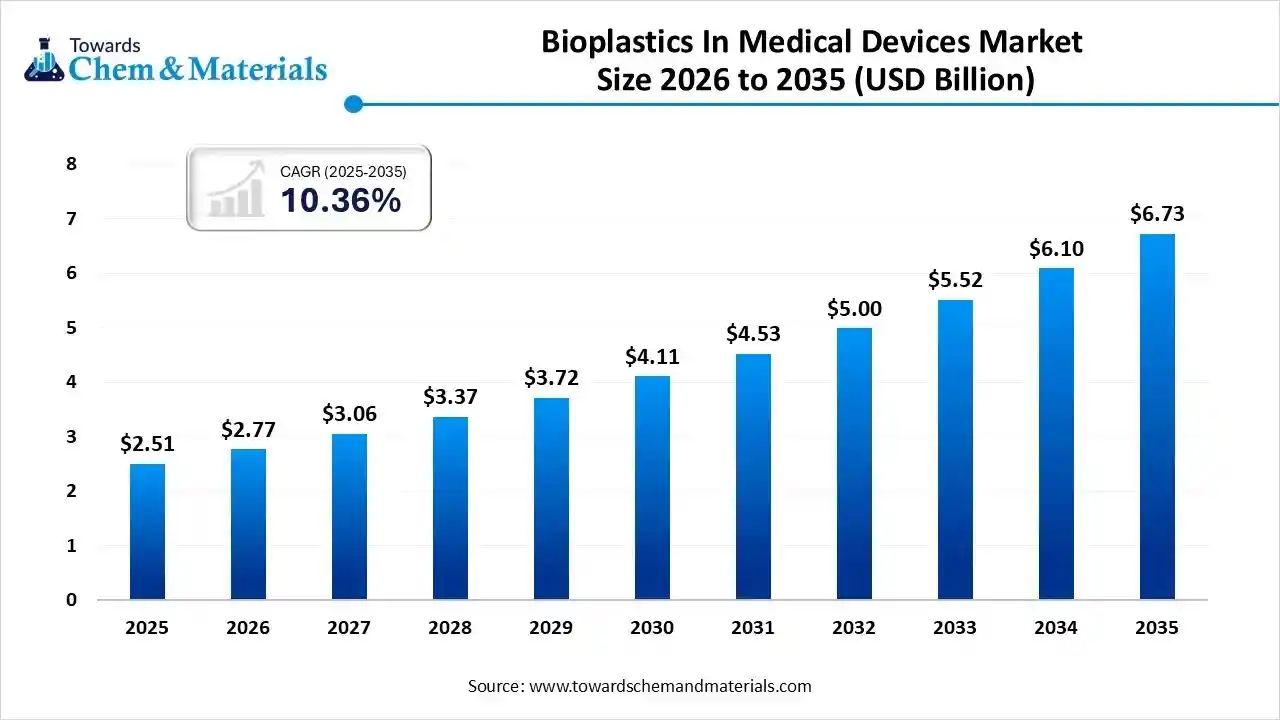

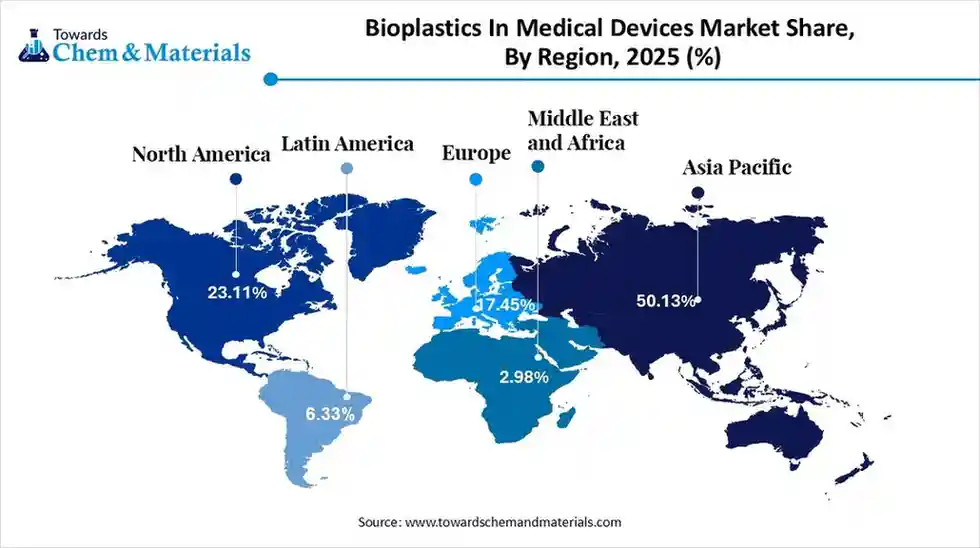

The global bioplastics in medical devices market size was estimated at USD 2.51 billion in 2025 and is predicted to increase from USD 2.77 billion in 2026 and is projected to reach around USD 6.73 billion by 2035, The market is expanding at a CAGR of 10.36% between 2026 and 2035. Asia Pacific dominated the bioplastics in medical devices market with a market share of 50.13% the global market in 2025. The increasing demand for bioabsorbable implants is the key factor driving market growth. Also, technological innovations in polymer science, coupled with the expansion in local manufacturing, can fuel market growth further.

Key Takeaways

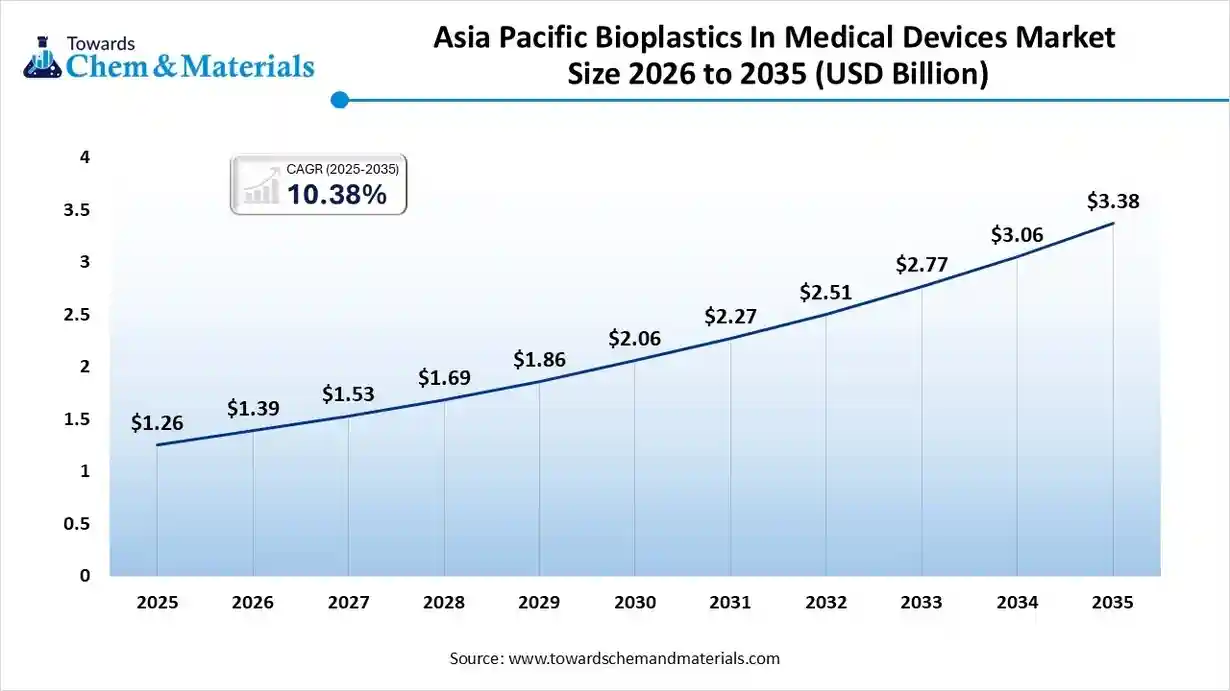

- By region, Asia Pacific dominated the market with the largest share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The dominance and growth of the region can be attributed to the increase in healthcare expenditure.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be driven by robust government support for sustainability and stringent emissions rules.

- By material, the PLA segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to its excellent mechanical strength, biocompatibility, and cost-effectiveness.

- By material, the PHA segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for minimally invasive devices.

- By application, the single-use disposables segment held the largest market share in 2025. The dominance of the segment can be linked to the rising waste management costs for hospitals.

- By application, the diagnostic consumables segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rapid innovations in material science.

What are Bioplastics In Medical Devices Market?

The market refers to the industry that emphasizes polymers from renewable sources or biodegradable materials for healthcare use, replacing conventional plastics in items from diagnostic devices, drug delivery systems, and sutures, fuelled by a lower environmental footprint, sustainability demands, and long-term implantable uses.

Bioplastics In Medical Devices Market Trends

- Increasing environmental awareness globally is the latest trend in the market, propelling the adoption of biodegradable plastics. This surge in ecological awareness has shifted the emphasis to the reduction of the ecological footprint of medical products.

- Technological innovations in biodegradable materials improve their viability and performance, expanding their utilisation in medical applications. These technological innovations raise the properties of degradable plastics as a key substitute material for conventional ones.

- The surge in research investments in research activities provides opportunities for innovation, which leads to more cost-effective and efficient biodegradable medical products. These investments are helping drive initiatives in material science that support rapid growth in the medical sector.

- The growing product demand in the packaging sector is another major trend in the market. The packaging sector is the largest user of bioplastics due to increasing demand for compostable, recyclable, and biodegradable materials. The use of bio-PET and starch-based bioplastics is growing due to demand for sustainable packaging.

- The rising product demand in the textile sector, rapidly using bioplastics as a sustainable solution to conventional petroleum-based materials, is impacting positive market growth. Different projects are being carried out to improve the properties of bioplastic-derived fibers to enhance their thermal resistance and mechanical strength.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 2.77 Billion |

| Revenue Forecast in 2035 | USD 6.73 Billion |

| Growth Rate | CAGR 10.36% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Material, By Application, By Region |

| Key companies profiled | NatureWorks LLC, Danimer Scientific, BASF SE, TotalEnergies Corbion, Novamont S.p.A., Mitsubishi Chemical Corporation, Toray Industries, Inc., Biome Bioplastics Limited, KuR Kunststoff GmbH, RWDC Industries |

How Cutting Edge Technologies are revolutionizing the Bioplastics In Medical Devices Market?

The integration of advanced technologies such as nanotechnology,3D printing, and Artificial Intelligence (AI) is significantly transforming the market, moving beyond simple sustainability to create customization with improved patient outcomes and functionality. Furthermore, AI algorithms can assess extensive data sets from material science experiments to forecast the maximum composition of bioplastic blends.

Trade Analysis of Bioplastics In Medical Devices Market Import & Export Statistics:

- In 2025, the United States imported 159 shipments of Bioplastics during (TTM). These imports were supplied by foreign exporters to 50 United States buyers.

- India's plastics export sector demonstrated robust performance in the first ten months of the 2024-25 fiscal year (FY25), from April 2024 to January 2025, reaching a total value of approximately Rs. 89,296 crore (US$10.34 billion).

Bioplastics In Medical Devices Market Value Chain Analysis

- Feedstock Procurement :It is the crucial process of sourcing, obtaining, and controlling the supply of renewable biological raw materials utilized to create biopolymers. It is derived from sources such as sugarcane, castor beans, and corn.

- Major Players: TotalEnergies, Corbion, BASF SE.

- Chemical Synthesis and Processing : It involves converting renewable raw materials into more highly purified, specialized polymers and forming them into a product using cutting-edge manufacturing techniques.

- Major Players: Evonik Industries AG, Mitsubishi Chemical Group Corporation.

- Packaging and Labelling: It involves various approaches to product presentation and protection, especially broken down into specific levels of packaging with specific needs.

- Major Players: Novamont S.p.A., Danimer Scientific.

- Regulatory Compliance and Safety Monitoring: It includes a crucial, safe, effective, and systematic framework ensuring product quality throughout its entire lifecycle.

- Major Players: Veeva Systems, Qualio.

Bioplastics In Medical Devices Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (U.S.) | The regulatory body in the U.S. is the Food and Drug Administration (FDA). The FDA focuses intensely on the safety and effectiveness of the final device, regardless of the material's origin (fossil-based or bio-based). |

| European Union (EU) | The EU regulatory framework is extensive and is primarily governed by the Medical Device Regulation (MDR 2017/745), a stringent system designed to ensure patient safety and quality. |

| Japan | Japan has generally modeled its regulations after the FDA and EMA (European Medicines Agency) requirements, but with its own specific pathways for safety reviews and approvals. |

Segmental Insights

Material Insights

How Much Share Did the PLA Segment Held in 2025?

The PLA segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to its excellent mechanical strength, biocompatibility, cost-effectiveness, and versatility for temporary implants and packaging. In addition, the PLA has a good track record, which leads to increased investment in its manufacturing technology, fuelling its adoption.

The PHA segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for minimally invasive devices, with a surge in R&D in manufacturing. Moreover, PHA's flexible, lightweight nature promotes new designs for less invasive procedures and components.

Application Insights

Which Application Type Segment Dominated Bioplastics In Medical Devices Market in 2025?

The single-use disposables segment held the largest market share in 2025. The dominance of the segment can be linked to the rising waste management costs for hospitals and increasing sustainability initiatives. Additionally, Bioplastics are first adopted in high-volume, low-risk volumes, where regulatory hurdles are much less and cost sensitivity is high.

The diagnostic consumables segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rapid innovations in material science (like PLA) and a surge in healthcare awareness across the globe. Furthermore, Bioplastics offer flexible, lightweight, and patient-friendly solutions for diagnostic tools utilized in minimally invasive techniques.

Regional Insights

The Asia Pacific bioplastics in medical devices market size was valued at USD 1.26 billion in 2025 and is expected to reach USD 3.38 billion by 2035, growing at a CAGR of 10.38% from 2026 to 2035. Asia Pacific dominated the market with the largest share 50.13% in 2025 and is expected to grow at the fastest CAGR over the forecast period. The dominance and growth of the region can be attributed to the increase in healthcare expenditure, stringent environmental rules, and growing consumer awareness. In addition, Large-scale manufacturing centres in countries such as China, India, and South Korea are increasingly adopting bio-based materials to lower carbon emissions.

China Bioplastics In Medical Devices Market Trends

In the Asia Pacific, China dominated the market owing to strong government support for local manufacturing, along with the surge in domestic medical/healthcare demands. Also, China's extensive consumer goods and packaging sectors offer a large base for bioplastics, leading to market growth soon.

North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be driven by robust government support for sustainability and stringent emissions rules. The region's strong health system and high R&D investment optimise the rapid adoption of innovative bioplastic materials, contributing to regional growth shortly.

U.S. Bioplastics In Medical Devices Market Trends

In North America, the U.S. led the market due to advancements in green material development, which creates residue-free, biodegradable bioplastics with improved performance. The U.S. government supports the use of bio-based products with the reduction of single-use plastics through various strategies.

Europe held a significant market share in 2025. The growth of the region can be credited to the robust EU regulations, including the circular economy push, the Green Deal, and the growing patient demand for biodegradable and sustainable materials. Europe is a leader in bioplastics, pushing beyond packaging into high-grade medical applications such as diagnostic test components.

Germany Bioplastics In Medical Devices Market Trends

The growth of the market in Germany can be driven by an increase in hospital and consumer demand for sustainable solutions and ongoing technological innovations in bio-based materials. Germany boasts an extensive network of research institutions and major market players, fuelling positive market growth soon.

South America held a major market share in 2025. The growth of the region can be fuelled by growing emphasis on sustainable healthcare and adoption of diagnostic & disposable devices such as rapid tests. Bioplastics offer a greener, viable alternative as conventional plastic restrictions increase globally.

Brazil Bioplastics In Medical Devices Market Trends

The growth of the market in the country can be propelled by the growing demand for disposable medical products, coupled with the supportive government policies. The country benefits from having major market players such as Braskem, a leading manufacturer of bio-polyethylene (bio-PE) derived from sugarcane ethanol.

The growth of the market in the Middle East & Africa can be boosted by a surge in healthcare demands and rising environmental awareness. Also, increasing awareness regarding plastic pollution fuels demand for biodegradable & compostable materials in medical settings, leading to market expansion further in the region.

Saudi Arabia Bioplastics In Medical Devices Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be driven by increasing awareness regarding plastic waste and climate change, which encourages the shift from traditional plastics. Cities such as Riyadh, Jeddah, and Dammam are major innovation centres for bioplastics.

Recent Developments

- In November 2025, Emirates Biotech will introduce its Embio product range, a range of polylactic acid (PLA) biopolymers produced in the UAE. The materials represent a major step towards offering the Middle East eco-friendly alternatives to traditional plastics.(Source: www.plasticsnews.com)

Bioplastics In Medical Devices Market Companies

- NatureWorks LLC: NatureWorks LLC is a prominent global producer of Ingeo biopolymers (polylactic acid or PLA), which are renewably sourced materials that have a significant, albeit growing, role in the medical devices market.

- Danimer Scientific: Danimer Scientific is a notable player in the bioplastics market, specializing in the development and manufacturing of biodegradable polymers, particularly PHA, which are suitable for a wide range of applications, including those within the medical devices market.

Other Companies in the Medical Devices Market

- Danimer Scientific

- NatureWorks LLC

- BASF SE

- TotalEnergies Corbion

- Novamont S.p.A.

- Mitsubishi Chemical Corporation

- Toray Industries, Inc.

- Biome Bioplastics Limited

- FKuR Kunststoff GmbH

- RWDC Industries

Segments Covered in the Report

By Material

- PLA

- PHA

- PBS / PBAT

- Other Materials

By Application

- Single-use Disposables

- Sterile Packaging & Trays

- Diagnostic Consumables

- Implantable

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa