Content

Asia Pacific Green Chemicals Market Size | Top Companies

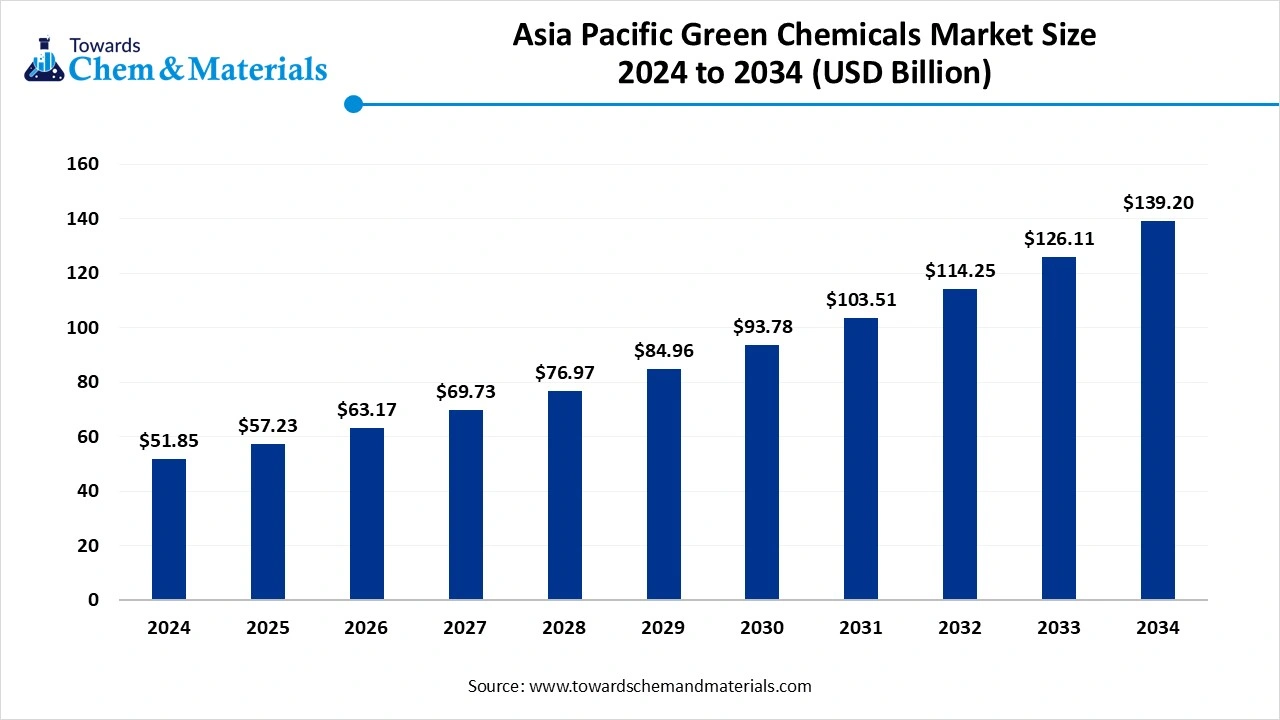

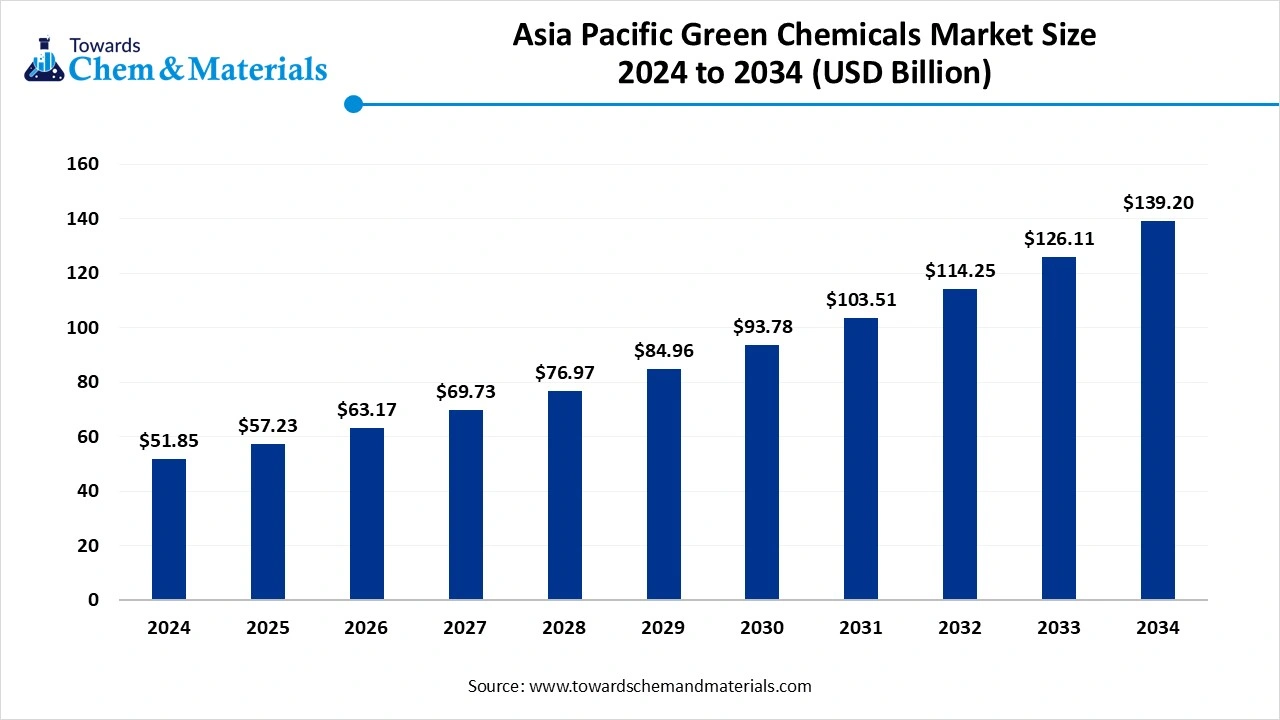

The Asia Pacific green chemicals market size was valued at USD 51.85 billion in 2024 and is expected to hit around USD 139.20 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.38% over the forecast period from 2025 to 2034. The growing industrial activities and rising awareness about environmental issues drive the market growth.

Key Takeaways

- By product type, the bio-alcohols segment held a 38% share in the market in 2024.

- By product type, the biopolymers segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the construction segment held a 28% share in the market in 2024.

- By application, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By source type, the biomass segment held a 70% share in the Asia Pacific green chemicals market in 2024.

- By source type, the agricultural waste & residue segment is expected to grow at the fastest CAGR in the market during the forecast period.

What are Green Chemicals?

Asia Pacific green chemicals market growth is driven by supportive government policies, growing industrial activities, focus on sustainability, rising environmental concerns, and the growing agriculture & automotive industries.

Green chemicals are bio-based chemicals manufactured using environmentally friendly methods to reduce the generation of toxic substances and enhance environmental protection. They offer characteristics like renewable sourcing, safer handling, lower hazards, and minimizing waste. Green chemicals offer benefits like sustainable innovation, environmental protection, and enhanced safety.

Asia Pacific Green Chemicals Market Outlook:

- Industry Growth Overview : Between 2025 and 2034, the industry is expanding across high-margin niches such as textiles, packaging, and personal care. The rapid growth is being reinforced by supportive government policies and increasing demand for sustainable products, particularly in countries like India, South Korea, Japan, & China.

- Sustainability Trends : Sustainability is reshaping the market, with rising demand for biopolymers, bio-alcohols, bio-surfactants, and bio-organic acids. The growing demand for biodegradable packaging and strong government support for biofuels help to achieve sustainability goals.

- Startup Ecosystem: The Asia Pacific green chemicals startup ecosystem is rapidly expanding, especially in the production of green hydrogen, bio-based chemicals, bio-adhesives, bio-based fuels, and bio-plastics. For instance, Greenjoules (India) manufactures biofuel using non-feed and non-food waste.

Key Technological Shifts in the Asia Pacific Green Chemicals Market:

Technological advancements are transforming the market with the integration of artificial intelligence (AI). The significant integration optimizes chemical processes, minimizes waste, and lowers environmental issues. AI enables faster material discovery, sustainable solvent selection, and the discovery of catalysts. AI helps in process optimization, supply chain optimization, and predictive maintenance during the manufacturing process.

- For instance, TATA Chemicals, an India-based company, uses AI-driven laboratory systems to optimize chemical reactions and speed up the research & development process.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 57.23 Billion |

| Expected Size by 2034 | USD 139.20 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.38% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application, By Source Type, |

| Key Companies Profiled | ADM (Archer Daniels Midland Company), Evonik Industries AG, Merck KGaA, Solugen, NatureWorks LLC, TotalEnergies Corbion, Toray Industries Inc., Teijin Limited, Kaneka Corporation, Indorama Ventures, Reliance Industries Ltd, Lotte Chemical, FKuR Kunststoff GmbH, Braskem, Syensqo |

Trade Analysis of Asia Pacific Green Chemicals Market: Import & Export Statistics

- India exported 28 shipments of biopolymer.(Source: www.volza.com)

- China imported 1,446 shipments of biopolymer.(Source: www.volza.com)

- China exported 618 shipments of biodegradable plastic.(Source: www.volza.com)

- China exported 128 shipments of biofertilizers.(Source: www.volza.com)

- India exported 18 shipments of biopesticides.(Source: www.volza.com )

Asia Pacific Green Chemicals Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement is the sourcing of renewable feedstocks like biomass, agricultural waste, and agricultural residue.

- Key Players: Cargill Inc., Japfa Group, Neste, Mitsui & Co., and Alltech Inc.

- Quality Testing and Certifications : The quality testing involves testing of properties like chromatography, elemental analysis, boiling point, spectroscopy, & melting point, and certifications like Eco Mark, Singapore Green Label Scheme, and GreenPro.

- Chemical Synthesis & Processing : The chemical synthesis and processing involve processes like solvent-free reactions, physical synthesis methods, green nanotechnology, and electrochemical synthesis.

- Key Players: LG Chem, Sinopec, Mitsui Chemicals Inc., and Reliance Industries

Asia Pacific Green Chemicals Market Regulations

| Country / Region | Regulatory Body | Key Regulations | Key Regulations |

| India |

|

|

|

| China |

|

|

|

| Japan |

|

|

|

| South Korea |

|

|

|

Market Opportunity

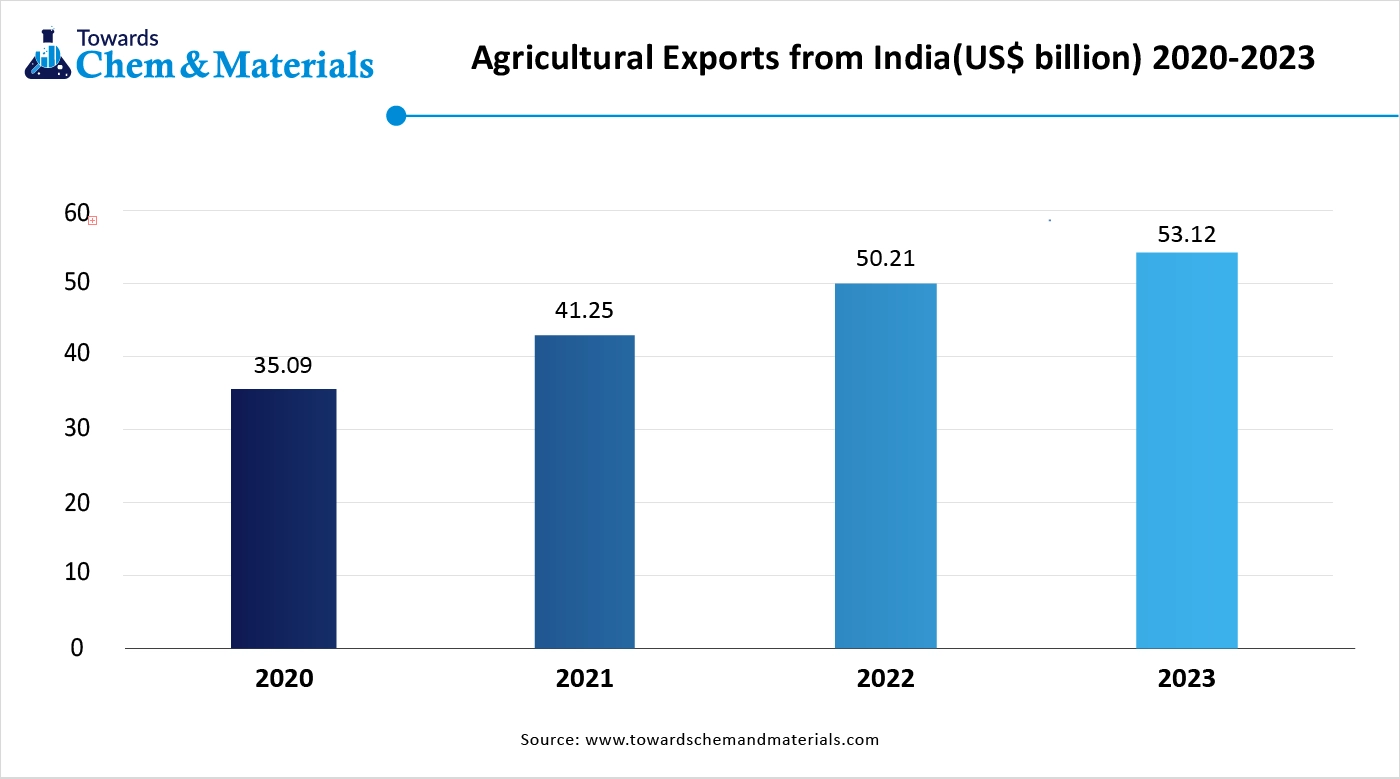

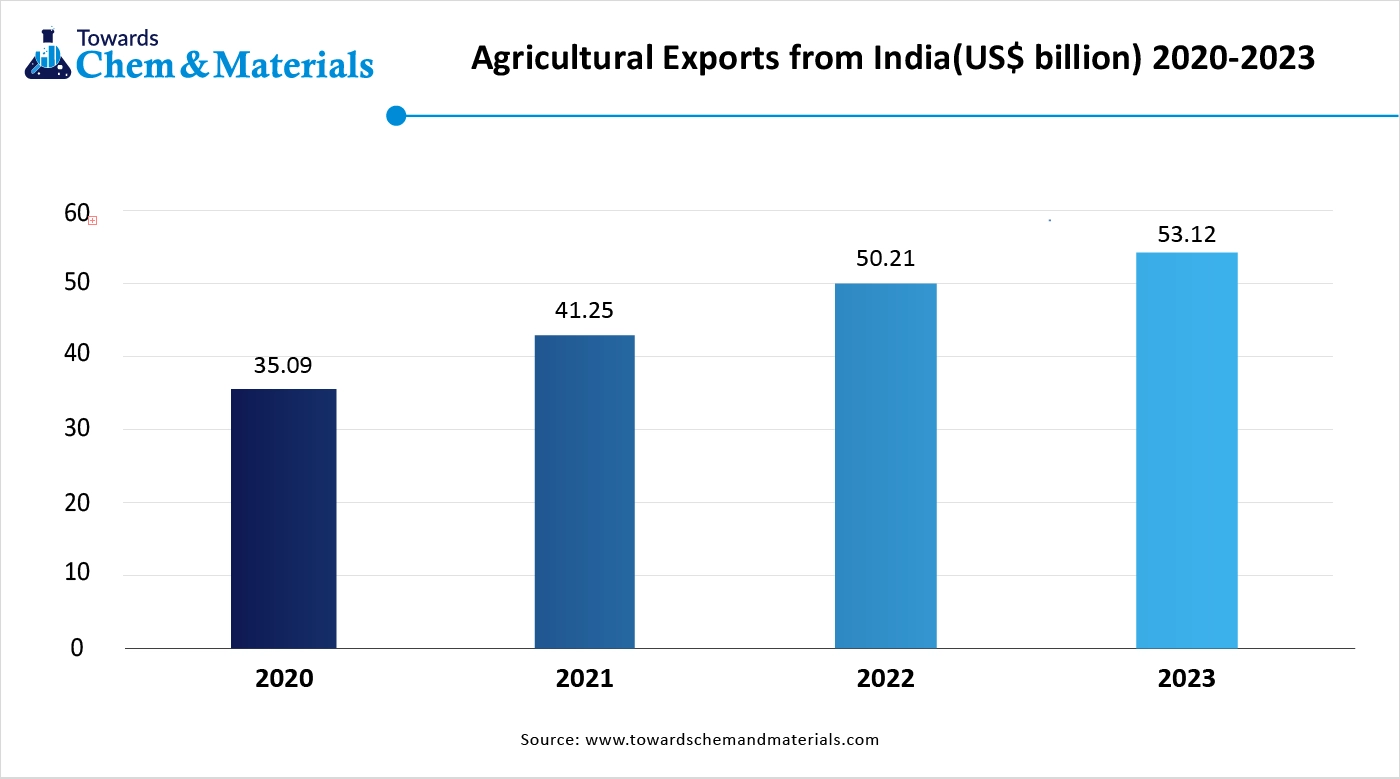

Growing Agriculture Sector Drives Market Expansion

The rise in population and a strong focus on food security increase demand for green chemicals. The increasing adoption of precision agriculture techniques and the rise in organic farming increase the adoption of green chemicals. The intensive farming techniques and rising demand for food require green chemicals. The sustainable farming practices and government support for eco-friendly agrochemicals require green chemicals.

The growing expansion of the farming sector and the high need for crop protection require green chemicals. The strong government support for sustainable agricultural practices and increasing demand for organic products increase the adoption of green chemicals. The development of bio fertilizers and biopesticides requires green chemicals. The growing agriculture sector creates an opportunity for the growth of the Asia Pacific green chemicals market.

Market Challenge

High Production Cost Shuts Down Market Growth

Despite several benefits of the Green Chemicals in the Asia Pacific, the high production cost restricts the market growth. Factors like large-scale manufacturing facilities, regulatory hurdles, fluctuations in feedstock prices, the need for specialized equipment, and manufacturing complexity are responsible for the high production cost.

The fluctuating prices of feedstocks like agricultural residue, biomass, & food processing waste, and the development of large-scale infrastructure, increase the cost. The high investment in research & development of green chemicals and a skilled workforce requires a high cost. The stricter regulations and traditional manufacturing processes increase the cost. The high production cost hampers the growth of the Asia Pacific green chemicals market.

Segmental Insights

Product Type Insights

Why the Bio-Alcohols Segment is Dominating the Asia Pacific Green Chemicals Market?

The bio-alcohols segment dominated the market with a 38% share in 2024. The growing demand for industrial solvents across industries like cosmetics & pharmaceuticals increases demand for bio-alcohols. The strong focus on lowering carbon footprints and stricter environmental regulations increases the adoption of bio-alcohols. The presence of abundant feedstock and a strong focus on sustainable production increases the manufacturing of bio-alcohols like biobutanol & bioethanol, driving the overall growth of the market.

The biopolymers segment is the fastest-growing in the market during the forecast period. The growing concerns about plastic waste and increasing adoption of eco-friendly products increase demand for biopolymers. The increasing development of sustainable packaging solutions and the rising demand for consumer goods increase the adoption of biopolymers. The growing agriculture sector and expansion of the food & beverage industry require biopolymers, supporting the overall market growth.

Application Insights

Which Application Held the Largest Share in the Asia Pacific Green Chemicals Market?

The construction segment held the largest revenue share of 28% in the market in 2024. The growing development of infrastructure projects like metro systems, roads, and bridges increases the adoption of green chemicals. The strong government support for smart cities and the rise in the construction of residential projects require green chemicals. The adoption of green buildings and the high development of commercial spaces require green chemicals, driving the overall growth of the market.

The automotive segment is experiencing the fastest growth in the market during the forecast period. The shift towards electric vehicles and a strong focus on minimizing vehicle weight increases the adoption of green chemicals for the development of lightweight materials. The development of interior components of vehicles like interior trims, seat foams, dashboards, and door panels requires green chemicals like biopolymers. The increasing automotive manufacturing and development of fuel-efficient vehicles drive the market growth.

Source Type Insights

How the Biomass Segment Dominated the Asia Pacific Green Chemicals Market?

The biomass segment dominated the market with a 70% share in 2024. The low cost of raw materials and focus on waste reduction increase demand for biomass. The increasing production of bio-organic acids, bio-alcohols, and bio-polymers increases demand for biomass. The growing expansion of the packaging industry and increasing adoption of sustainable products require biomass, driving the overall market growth.

The agricultural waste & residue segment is the fastest-growing in the market during the forecast period. The abundance of agricultural waste and the rising demand for sustainable raw materials help the market growth. The high volume of agricultural residues like leaves, stalks, & husks increases the production of green chemicals. The increasing manufacturing of bio-organic acids, biofuels, and bio-polymers requires agricultural waste & residue, supporting the overall market growth.

Country Insights

Sustainability Expands Green Chemicals Production in China

China is a major contributor to the market. The strong government support for green industrial policy and high investment in green chemical technologies help the market growth. The increasing industrial activities and rising consumer awareness about environmental issues increase demand for green chemicals. The increasing construction activities and rising adoption of vehicles require green chemicals. The development of large projects like biomass-based chemical production drives the market growth.

- China exported 2,348 shipments of biochemicals.(Source:www.volza.com )

- China exported 19 shipments of biopesticides.(Source: www.volza.com)

India: Heart of Asia Pacific’s Green Chemicals Market Expansion

India is growing in the Asia Pacific green chemicals market. The growing production of sustainable products and strong government support for domestic chemical manufacturing increase demand for green chemicals. The increasing adoption of green chemistry principles and high investment in the development of green chemical solutions help market growth. The national green hydrogen mission and a strong focus on sustainable chemical production support the overall market growth.

- For instance, PM Modi inaugurated India’s first bamboo-based ethanol plant in Assam. The facility aims to minimize dependence on fossil fuels and support clean energy. A total of 5 lakh tonnes of bamboo is 9sourced annually to produce 11000 MTA of acetic acid, food-grade liquid CO2 31000 MTA, 48900 MTA of ethanol, and 19000MTA of furfural.

- India exported 292 shipments of biofertilizers.(Source: www.volza.com )

Recent Developments

- In October 2024, Pertamina launched a sorghum pilot project to produce bioethanol in West Nusa Tenggara. The company focuses on meeting decarbonization goals and diversifying bioenergy sources.(Source: www.reccessary.com)

- In February 2025, LG Chem launched the production of bio-acrylic acid. The bio-acrylic acid uses a microbial fermentation production process and is made up of 3HP. The acid is widely used in electronics, coatings, cosmetics, automotive, and the paint industry.(Source: chemanager-online.com)

- In October 2024, Praj Industries launched India’s first biopolymer facility in Jejuri. The facility is present across 3 acres and has a production capacity of 55 TPA of PLA, 100 TPA of lactic acid, & 60 TPA of lactide. The facility promotes biotechnology and focuses on environmental sustainability. (Source: www.thebridgechronicle.com)

Top Companies List

- BASF SE: The largest chemical production company offers products like plastics, crop protection, coatings, chemicals, performance products, & catalysts, and manufactures ecovio biopolymers.

- Dow Inc.: The material science company focuses on sustainability and consists of an extensive product range, including performance materials, silicones, plastics, industrial intermediates, and coatings.

- Mitsubishi Chemical Group Corporation: The Japanese company produces high-performance chemicals, including petrochemicals, MMA, advanced polymers, and carbon materials.

- Cargill Incorporated: The private company offers products like oilseeds, meat, animal feed, grains, sugar, natural ingredients, and edible oils for the personal care industry.

- Corbion: The food ingredient and biochemical company has an extensive product range, including algae ingredients, functional blends, lactic acid & derivatives, and preservation & fermentation solutions.

Other Companies List

- ADM (Archer Daniels Midland Company)

- Evonik Industries AG

- Merck KGaA

- Solugen

- NatureWorks LLC

- TotalEnergies Corbion

- Toray Industries Inc.

- Teijin Limited

- Kaneka Corporation

- Indorama Ventures

- Reliance Industries Ltd

- Lotte Chemical

- FKuR Kunststoff GmbH

- Braskem

- Syensqo

Segments Covered

By Product Type

- Bio-Alcohols

- Bio-Ethanol

- Bio-Butanol

- Bio-Organic Acids

- Bio-Lactic Acid

- Bio-Citric Acid

- Bio-Succinic Acid

- Biopolymers

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

- Bio-Surfactants & Bio-Solvents

- Bio-Surfactants

- Bio-Solvents

By Application

- Construction

- Green Paints & Coatings

- Adhesives & Sealants

- Packaging

- Biodegradable Films

- Compostable Packaging

- Automotive

- Bio-Based Plastics

- Bio-Based Lubricants

- Agriculture

- Bio-Pesticides

- Bio-Fertilizers

- Consumer Goods

- Personal Care Products

- Cleaning Agents

By Source Type

- Biomass

- Agricultural Waste & Residue

- Crop Residues

- Food Processing Waste