Content

Catalyst Market Size and Growth 2025 to 2034

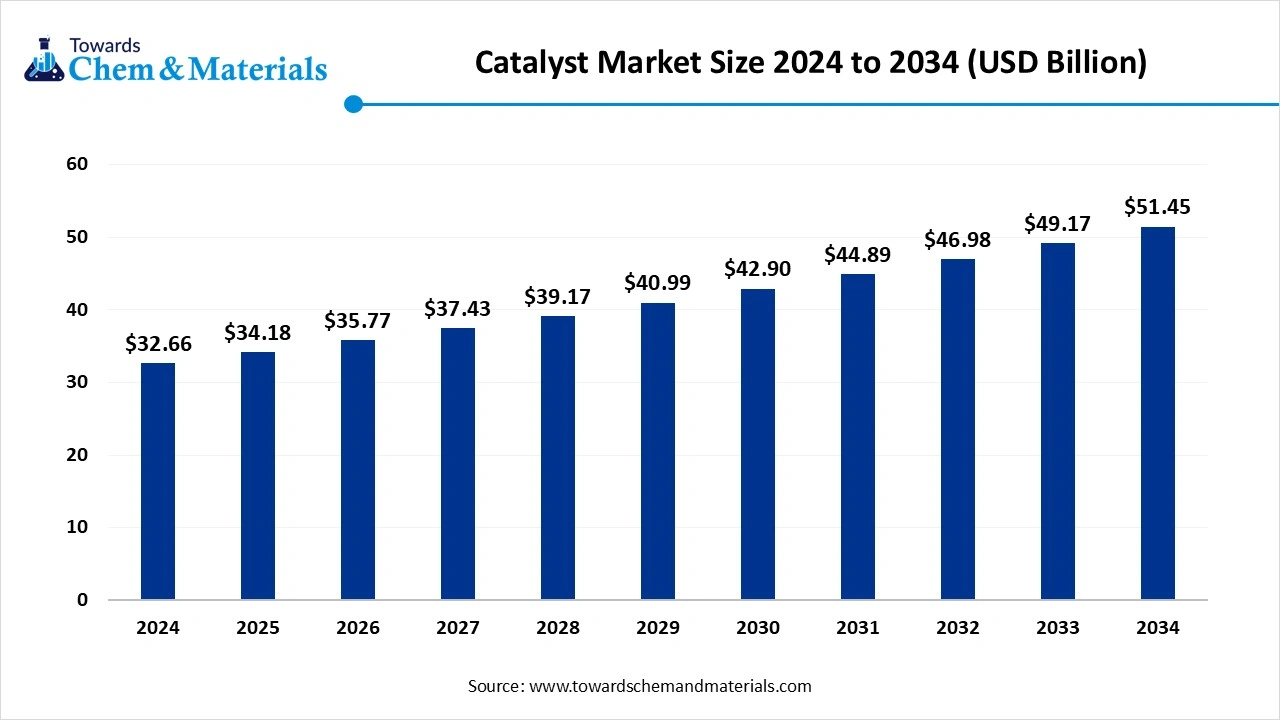

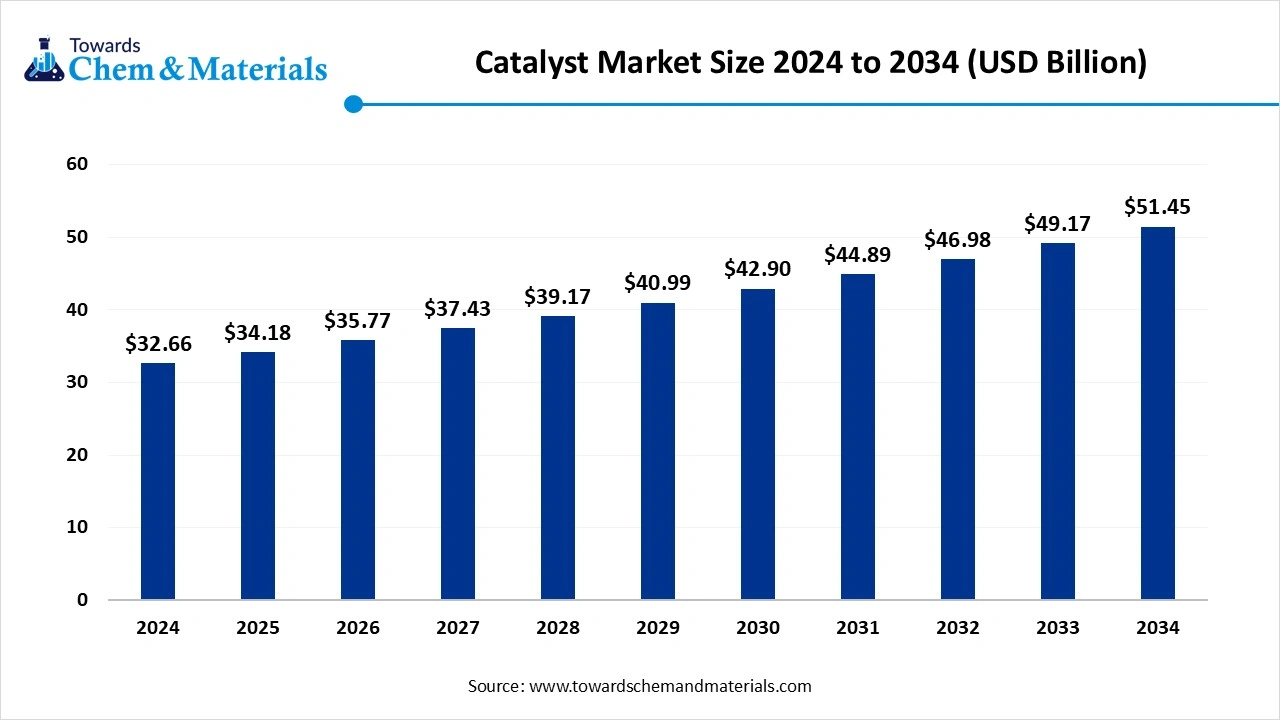

The global catalyst market size accounted for USD 34.18 billion in 2025 and is forecasted to hit around USD 51.45 billion by 2034, representing a CAGR of 4.65% from 2025 to 2034. The growth of the market is driven due to the rapid industrial growth and growth in manufacturing units for optimization, along with the enhanced applications in industries such as chemicals, pharmaceuticals, and petroleum, where there is a need for reaction catalysts, fueling the growth of the market.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024. The growing adoption of sustainable solutions drives the growth of the market.

- By region, North America is expected to have significant growth in the market in the forecast period. The steady growth of the market due to growing demand fuels the growth.

- By type of catalyst, the heterogeneous catalysts segment dominated the market in 2024. Heterogeneous catalysts exist in a different phase than the reactants, typically solid catalysts with liquid or gas reactants.

- By type of catalyst, the biocatalysts segment is expected to grow significantly in the market during the forecast period. Biocatalysts are natural catalysts, such as enzymes or whole cells, that speed up biochemical reactions

- By application, the petroleum refining segment dominated the market in 2024. Petroleum refining catalysts are essential for converting crude oil into valuable fuels and chemicals like gasoline, diesel, and jet fuel.

- By application, the environmental catalysis segment is expected to grow in the forecast period. Environmental catalysts are used to control and reduce pollutants from industrial emissions and vehicle exhaust

- By function, the cracking catalysts segment dominated the market in 2024. Cracking catalysts are primarily used in the fluid catalytic cracking (FCC) process to break down heavy hydrocarbon molecules into lighter ones.

- By function, the selective catalytic reduction (SCR) catalysts segment is expected to grow in the forecast period. SCR catalysts are used to reduce nitrogen oxides (NOx) emissions from diesel engines and industrial exhausts.

- By end use, the oil & gas segment dominated the market in 2024. Catalysts in the oil and gas industry play a crucial role in refining crude oil and processing natural gas into cleaner, high-value products.

- By end use, the energy & power segment is expected to grow in the forecast period. Catalysts in the energy and power sector are used to enhance efficiency and sustainability in energy generation, particularly in clean energy technologies

Market Overview

Rising Demand for Durable Materials: Catalyst Market to Expand

A catalyst is the type of material that enhance the speed s of chemical reaction without being consumed in the process. Catalysts are essential in industrial processes to improve efficiency, yield, and sustainability. Catalyst is a substance with increases the rate of reaction without itself undergoing any change. It lowers the activation energy, making the reaction faster and more efficient. They play a vital role in many industries, from manufacturing to environmental protection, which increases their use.

What Are the Key Growth Drivers Responsible for The Growth of The Catalyst Market?

The growth of the market is driven by the rapid industrialization and increased industrial activities, especially in emerging economies like the Asia Pacific, which increases the demand for the catalyst. The stringent environmental regulations and the rising adoption of sustainable practices and efficient technology solutions by industries across the regions are reducing environmental impact, which is less harmful and efficient, driving the growth of the market. The growing chemical and petrochemical industries are due to the rising demand for chemicals and plastics from the market fuels the demand for catalysts and further boosts the growth of the market and drives the market expansion.

Market Trends

- The growth of various sectors like automotive, pharmaceutical, petrochemicals, chemic, and refinery drives the demand for catalysts, which fuels the growth.

The growing shift towards sustainability and environmental regulations to improve fuel efficiency, reduce emissions, and manage waste is a growing trend that drives the growth. - Technological advancements, like ongoing research and development for more efficient and innovative catalysts for improving the reaction, fuel the growth of the market.

Industrialization and strong demand from the developing nations due to rapid industrial growth fuel the growth of the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 34.18 Billion |

| Market Size by 2034 | USD 51.45 Billion |

| Growth rate from 2024 to 2025 | CAGR 4.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type of Catalyst , By Application, By Function, By End-use Industry, By Region |

| Key Profiled Companies | BASF SE, Johnson Matthey Plc , Clariant AG , W. R. Grace & Co. , Evonik Industries AG , Honeywell UOP , Albemarle Corporation, Topsoe (formerly Haldor Topsoe A/S) , Axens Group , INEOS Group , Umicore , Sasol Ltd. , Zeolyst International , yondellBasell Industries, Other Players |

Market Opportunity

What Are the Key Growth Opportunities Responsible for The Growth of The Catalyst Market?

The growth opportunity responsible for the growth of the market is the increasing demand for petrochemicals due to the increasing demand for more efficient and sustainable industrial processes, which fuels the growth of the market. The other key opportunities are the development of catalysts or alternative energy sources like biofuels, hydrogen, and fuel cells, development of multifunctional and tailored catalysts, refinery catalysts, catalyst for petrochemicals, automotive catalytic converters, supportive government policies and research and development investments for development of more efficient and selective catalyst boosts the growth of the market.

Market Challenge

Fluctuating Raw Materials Cost

The key challenge responsible for limiting the growth of the catalyst market is the fluctuating raw material costs and high production costs, which hinder the growth of the market. The fluctuating raw material price, particularly the crude oil prices, affects the refinery operations, which leads to delays and reduction in catalyst investments, also affecting the profitability and manufacturing of the specialty catalyst, limiting the growth of the market, and hindering the growth. These high raw material prices ultimately affect the production cost, which limits the growth and expansion of the market.

Regional Insights

Asia Pacific dominated the market in 2024. The region is experiencing robust growth in the market, driven by the increasing refinery and automotive sector, driven by rapid industrialization and strict environmental regulations in the region drives the growth of the market. The growth of the market is driven by the increasing demand for the clean and green fuels due to rising shift towards sustainability and eco-friendly alternative fuels the growth of the market, driving the expansion of the market. Major players in the Asia Pacific catalyst market, including Albemarle Corporation, BASF SE, Johnson Matthey, and Clariant AG, play a significant role in the growth and adoption of the market.

India Has Seen a Significant Growth in The Market Driven by Technological Advancements.

India has seen significant growth in the market, driven by the increasing industrial activity growth of the market is driven by the stringent emission norms in the automotive sector to reduce harmful emissions, increased industrial activity, technological advancements, along with government initiatives and policies, and rising investments in sustainability contribute to and support the growth and expansion of the market in the country.

- India shipped out 6,419 Catalyst shipments from November 2023 to October 2024 (TTM). These exports were handled by 590 Indian exporters to 1,540 buyers, showing a growth rate of 5% over the previous 12 months.(Source: www.volza.com)

- Globally China, the United States, and Vietnam are the top three exporters of Materials Composite. China is the global leader in Catalyst exports with 185,962 shipments, followed closely by the United States with 107,035 shipments, and Vietnam in third place with 90,281 shipments.(Source:www. volza.com)

North America Has Seen a Significant Growth in The Catalyst Market Driven by Sustainability.

North America is expected to experience significant growth in the market in the forecast period. The growing industrial sector and demand for catalysts due to rising demand for sustainable and efficient catalysis technology, which drives the growth of the market. The expanding use of catalysts in key areas such as fuel cells, fertilizer production, and polypropylene manufacturing in the region increases the demand for the catalyst, which fuels the growth of the market. The key players like ASF SE, Albemarle Corporation, Haldor Topsoe A/S, Chevron Corporation, and W. R. Grace & Co.-Conn. North America plays a crucial role in the growth and expansion of the market.

The U.S. Seen Significant Growth in Emerging Industries.

The U.S. has seen significant growth, and the growth of the market is driven by industrial expansion and the growing adoption of sustainable alternatives due to the increasing shift towards environmental safety. Key players like Albemarle BASF SE, Corporation, Arkema S.A., Clariant AG, Dow Inc., Chevron Phillips Chemical Company LLC, Evonik Industries AG, Johnson Matthey, Honeywell International Inc., Shell plc, W. R. Grace and Co. play a crucial role in the growth and expansion of the market in the country.

- The United States shipped out 18,813 Catalyst shipments from October 2023 to September 2024 (TTM). These exports were handled by 2,357 Indian exporters to 2,130 buyers.(Source: www.volza.com)

Segmental Insights

Type of Catalyst Insights

How Did Heterogeneous Catalysts Segment Dominate the Catalyst Market In 2024?

The heterogeneous catalysts segment dominated the market in 2024. Heterogeneous catalysts exist in a different phase than the reactants, typically solid catalysts with liquid or gas reactants. They’re widely used in industrial processes such as petroleum refining, chemical synthesis, and environmental applications like catalytic converters. Their benefits include ease of separation, reusability, and high thermal stability. This segment dominates the market due to its efficiency in large-scale, continuous operations and low operational complexity.

The biocatalysts segment expects significant growth in the catalyst market during the forecast period. Biocatalysts are natural catalysts, such as enzymes or whole cells, that speed up biochemical reactions. They are used in industries like pharmaceuticals, food processing, and biofuels. These catalysts offer high specificity, operate under mild conditions (low temperature and pressure), and reduce the need for harmful chemicals. Biocatalysts are gaining popularity due to their eco-friendly nature and alignment with green chemistry principles, though they can be sensitive to pH and temperature changes.

Application Insights

Which Application Segment Dominated the Catalyst Market In 2024?

The petroleum refining segment dominated the catalyst market in 2024. Petroleum refining catalysts are essential for converting crude oil into valuable fuels and chemicals like gasoline, diesel, and jet fuel. These catalysts are used in processes such as catalytic cracking, hydrocracking, and reforming. They improve product yield, enhance fuel quality, and reduce harmful emissions. This segment dominates the market due to the global reliance on refined fuels, though it's gradually evolving with the shift toward cleaner and renewable energy sources.

The environmental catalyst segment expects significant growth in the market during the forecast period. Environmental catalysts are used to control and reduce pollutants from industrial emissions and vehicle exhaust. Common applications include catalytic converters in automobiles, which convert toxic gases like CO, NOx, and hydrocarbons into less harmful substances, and DeNOx and DeSOx catalysts in power plants. These catalysts help industries meet stringent environmental regulations. The segment is growing rapidly due to global efforts to combat air pollution and climate change through cleaner technologies.

Function Insights

How Did the Cracking Catalyst Segment Dominate the Catalyst Market In 2024?

The cracking catalysts segment dominated the market in 2024. Cracking catalysts are primarily used in the fluid catalytic cracking (FCC) process to break down heavy hydrocarbon molecules into lighter, more valuable products like gasoline, olefins, and diesel. These catalysts, typically zeolite-based, operate at high temperatures in petroleum refineries. They enhance fuel quality, increase yield, and support process efficiency. Cracking catalysts are vital in meeting global fuel demand and adapting to varying crude oil qualities in modern refining operations.

The selective catalytic reduction (SCR) catalysts segment expects significant growth in the catalyst market during the forecast period. SCR catalysts are used to reduce nitrogen oxides (NOx) emissions from diesel engines and industrial exhausts. In this process, ammonia or urea is injected into the exhaust stream, and the SCR catalyst facilitates a reaction that converts NOx into harmless nitrogen and water. Common catalyst materials include vanadium, titanium, and zeolites. Widely used in power plants, vehicles, and marine engines, SCR catalysts are key to meeting stringent emission standards worldwide.

End Use Insights

Which End-Use Segment Dominated the Catalyst Market In 2024?

The oil and gas segment dominated the catalyst market in 2024. Catalysts in the oil and gas industry play a crucial role in refining crude oil and processing natural gas into cleaner, high-value products. They are used in catalytic cracking, hydrocracking, hydrotreating, and reforming to improve fuel quality, increase yield, and remove impurities like sulfur and nitrogen. As the industry shifts toward cleaner energy, these catalysts are also being adapted for low-emission processes and integration with renewable feedstocks like bio-oils.

The energy and power segment expects significant growth in the catalyst market during the forecast period. Catalysts in the energy and power sector are used to enhance efficiency and sustainability in energy generation, particularly in clean energy technologies. They enable critical reactions in fuel cells, hydrogen production, and carbon capture systems. For example, catalysts help split water to produce hydrogen or convert CO₂ into usable fuels. As the world transitions to low-carbon energy, this segment is growing rapidly due to rising demand for sustainable power and emission reduction solutions.

Recent Developments

- In June 2025, Battery Ventures, a global technology-focused investment firm, launched The Battery Catalyst Network, a select group of experienced go-to-market leaders and executives who will act as trusted advisors to its portfolio companies. This initiative is designed to provide early-to-growth-stage founders with strategic guidance in sales and marketing to support and accelerate business scaling.(Source: finance.yahoo.com)

Top Companies List

- BASF SE

- Johnson Matthey Plc

- Clariant AG

- W. R. Grace & Co.

- Evonik Industries AG

- Honeywell UOP

- Albemarle Corporation

- Topsoe (formerly Haldor Topsoe A/S)

- Axens Group

- INEOS Group

- Umicore

- Sasol Ltd.

- Zeolyst International

- LyondellBasell Industries

- Other Players

Segments Covered

By Type of Catalyst

- Heterogeneous Catalysts

- Zeolites

- Metal Oxides

- Supported Metal Catalysts

- Mixed Metal Oxides

- Solid Acids/Bases

- Homogeneous Catalysts

- Organometallic Compounds

- Coordination Complexes

- Acid-Base Catalysts

- Transition Metal Complexes

- Biocatalysts

- Enzymes

- Proteases

- Amylases

- Lipases

- Cellulases

- Microbial Catalysts

- Nanocatalysts

- Carbon Nanotube-based Catalysts

- Metal Nanoparticles

- Quantum Dots

- Nano-Structured Oxides

By Application

- Petroleum Refining

- Fluid Catalytic Cracking (FCC)

- Hydroprocessing (hydrotreating & hydrocracking)

- Reforming & Isomerization

- Alkylation & Dehydrogenation

- Chemical Synthesis

- Polymerization Catalysts (Ziegler-Natta, Metallocene)

- Oxidation & Hydrogenation Reactions

- Ammonia & Methanol Production

- Sulfuric & Nitric Acid Production

- Environmental Catalysis

- Automotive Catalysts (TWC, SCR, DPF)

- Industrial Emission Control (NOx, SOx removal)

- VOC Abatement

- Water Treatment (AOPs using catalysts)

- Renewable Energy & Green Chemistry

- Hydrogen Production (water electrolysis, SMR)

- Fuel Cells (PEMFC, SOFC)

- CO₂ Reduction/Conversion

- Biomass Catalysis

- Others (Pharmaceutical & Fine Chemicals, etc.)

By Function

- Oxidation Catalysts

- Hydrogenation Catalysts

- Cracking Catalysts

- Polymerization Catalysts

- Reforming Catalysts

- Selective Catalytic Reduction (SCR) Catalysts

- Dehydrogenation Catalysts

- Acid/Base Catalyst

- Enzymatic Catalysts (biocatalysis)

By End-Use Industry

- Oil & Gas

- Chemical Manufacturing

- Automotive

- Pharmaceutical

- Food & Beverage

- Textile

- Energy & Power

- Pulp & Paper

- Others (Mining & Metallurgy, etc.)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait