Content

Lactic Acid Market Market Size, Share, Analysis and Forecast 2034

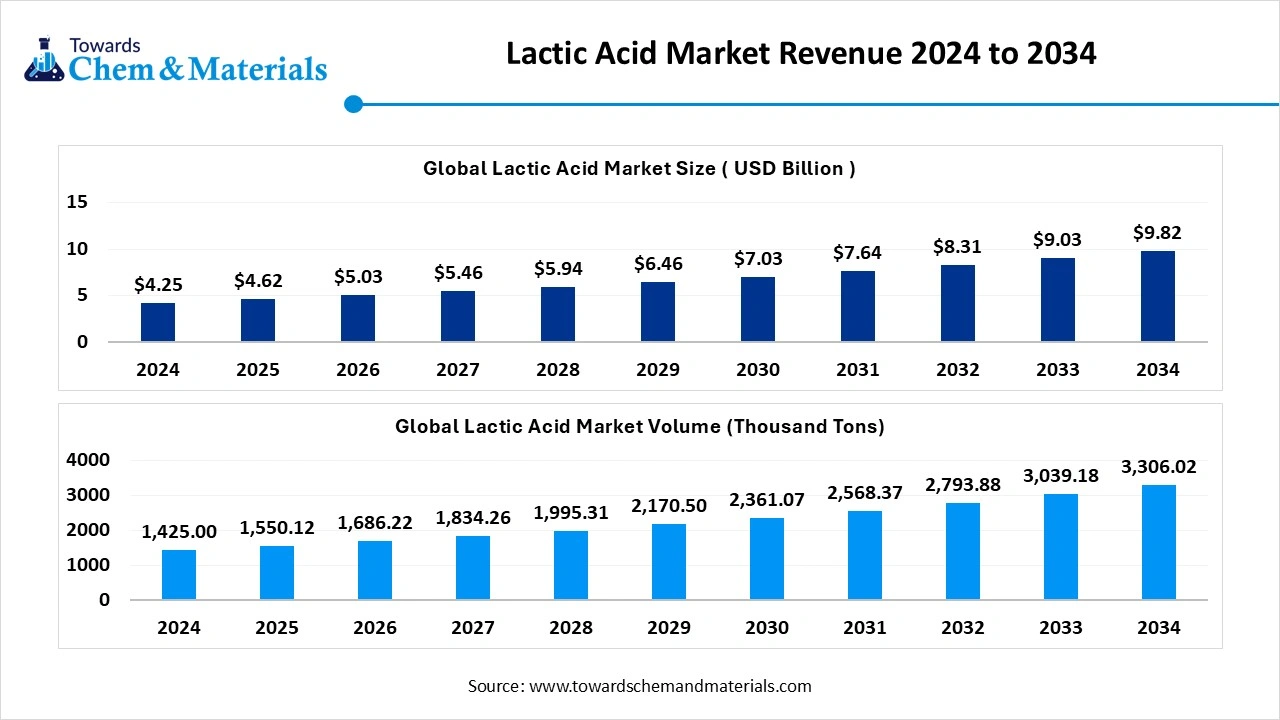

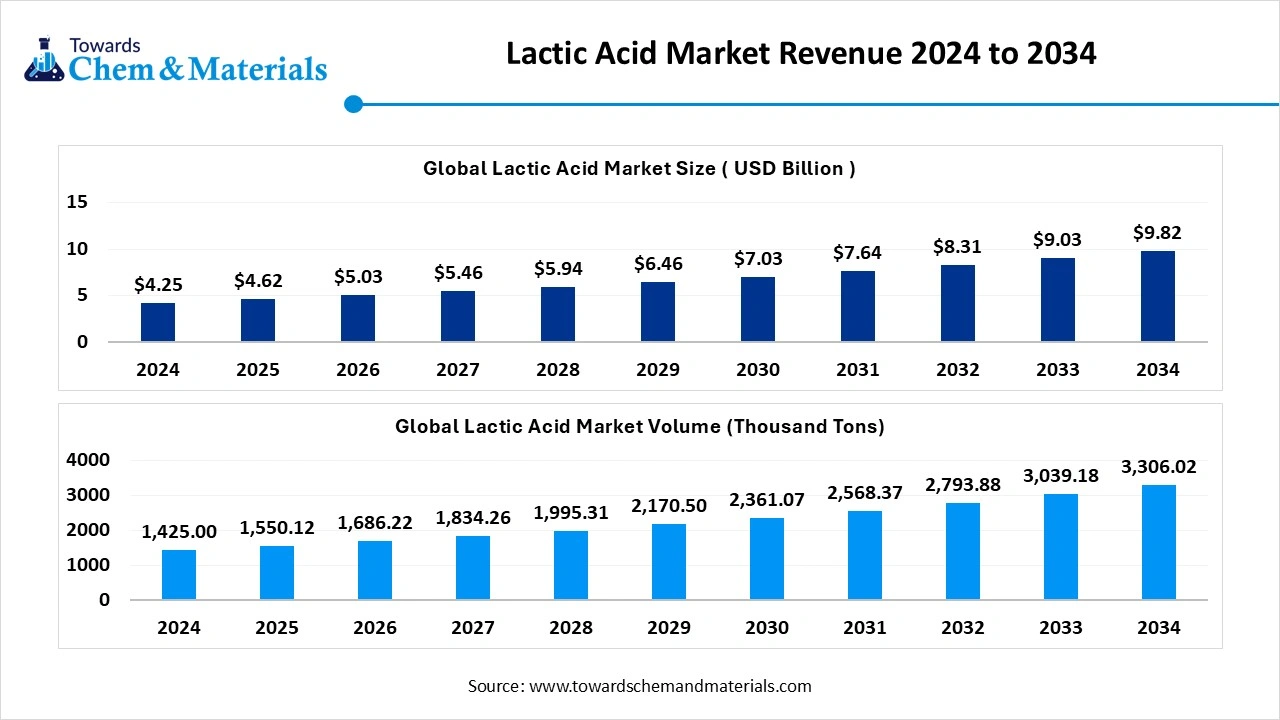

The global lactic acid market size was approximately USD 4.25 billion in 2024 and is projected to reach around USD 9.82 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 8.74% between 2025 and 2034. The enlarged expansion of the food and pharmaceutical sector is strengthening the foundation for future lactic acid industry growth.

The global lactic acid market is expected to reach a volume of approximately 1,550.12 Thousand tons in 2025, with a forecasted increase to 3,306.02 Thousand tons by 2034, growing at a CAGR of 8.78% from 2025 to 2034.

Key Takeaways

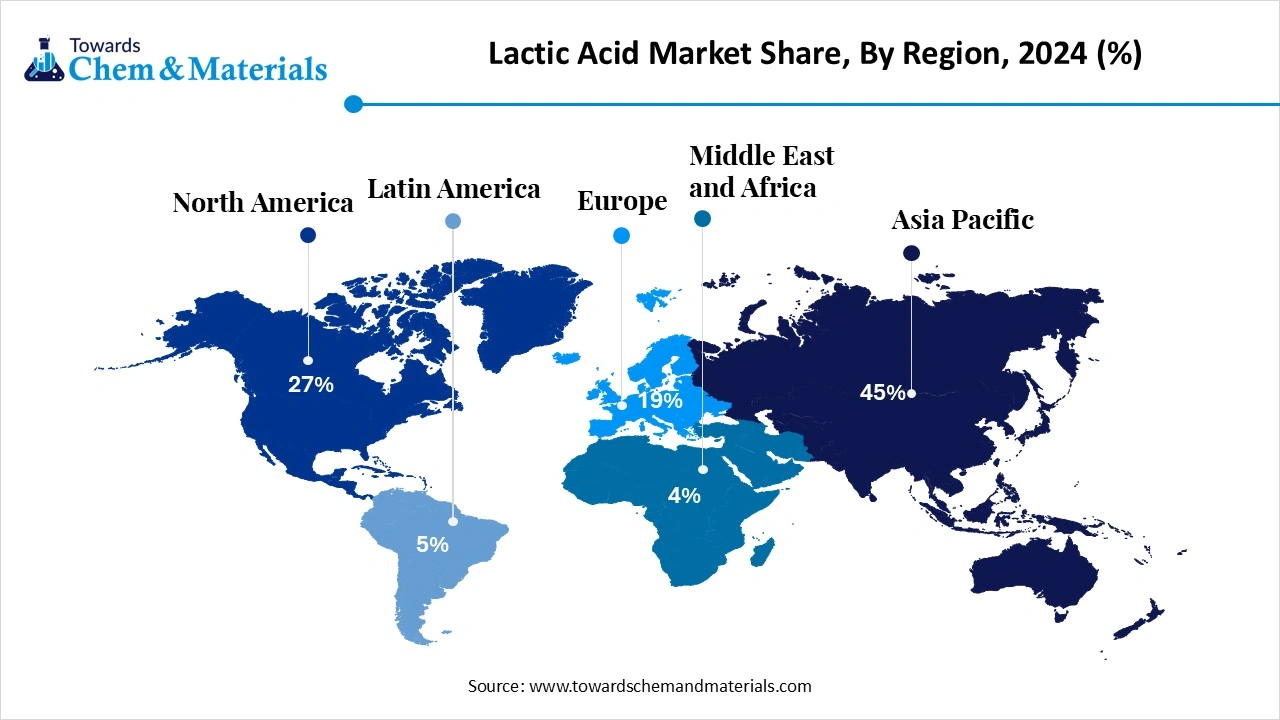

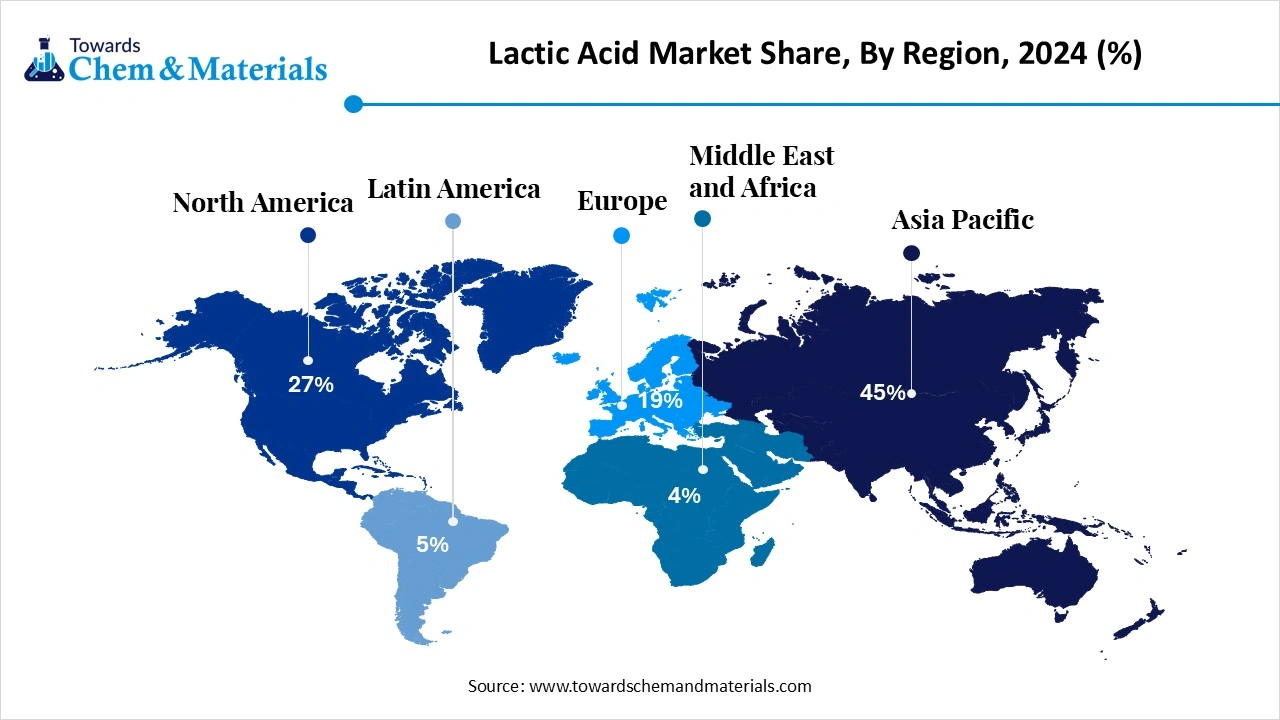

- The Asia Pacific Lactic Acid market held the largest share of 45% of the global market in 2024.

- By type, the L-(lactic acid) segment held the highest market share of 55% in 2024.

- By production process, the fermentation route segment held the highest market share of 80% in 2024.

- By application type, the food and beverages segment held the largest revenue share of 30% in 2024.

- By Raw Material, the Sugarcane segment held the largest market share of 39% in 2024.

What is Lactic Acid, and What's the Current Industry Status?

Lactic acid is known as an organic acid where it is produced by the human body or in chemical labs nowadays. The global commercial market for lactic acid and its derivatives, produced via fermentation or chemical routes, is supplied in various grades and forms, and used across food, pharma, personal care, industrial, and polymer applications.

Lactic Acid Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, factors like a sudden surge in biodegradable plastics, food acids, and green solvents are positively impacting revenue potential and industry scalability. Moreover, factors like affordability and higher purity have contributed to favourable market economics for the industry.

- Sustainability Trends: The global shift towards eco-friendliness is likely to elevate earnings potential for producers in the current period. Also, the manufacturers have seen in combining biobased lactic acid with chemically recycled monomers in recent years.

- Global Expansion: The global region has adopted different standards for lactic acid, such as Europe has observed a heavy demand for certified and high-value PLA and pharma lactic acid, while Asia is boosting product capacity of PLA by using local starch feedstocks.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.62 Billion |

| Expected Size by 2034 | USD 9.82 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.74% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Production Process, By Application, By Region |

| Key Companies Profiled | NatureWorks LLC , Henan Jindan Lactic Acid Technology Co., Ltd. , COFCO Biochemical Co., Ltd. , Musashino Chemical Laboratory, Ltd. , Archer Daniels Midland Company (ADM) , Henan Xinghan Biotechnology Co., Ltd. , Foodchem International Corporation , Qingdao Abel Technology Co., Ltd. , Anhui BBCA Biochemical Co., Ltd. , Wuhan Sanjiang Space Gude Biotech Co., Ltd. , Zhejiang Hisun Biomaterials Co., Ltd. , BASF SE , Futerro SA , Godavari Biorefineries Ltd. , Shandong Fullsail Biochemical Co., Ltd. , Teijin Limited |

Key Technological Shifts in the Lactic Acid Market:

The industry is seen under the wide adoption of modern technology, while the manufacturers are trying to integrate CO2 and waste into lactic acid production in the past few years. Also, the technology has enabled the high cell density formation with immobilized microbes, which provides improved capital and yield.

Trade Analysis of the Lactic Acid Market: Import & Export Statistics

- China has exported 86,547,100 kg of lactic acid, its salts, and esters to wide regions of the world in 2023, as per the published report.(Source: wits.worldbank.org)

- Germany exported lactic with 189 shipments between 2023 to 2024, as per the published report. (Source: www.volza.com)

- The United States has exported a heavy amount of lactic acid, which is $36Million to Mexico, China, Israel, and others.(Source: oec.world)

- Japan also exports a small amount of lactic acid, with 19 shipments in the 2023 to 2024 period.(Source: www.volza.com)

Value Chain Analysis of the Lactic Acid Market:

- Distribution to Industrial Users: The distributors are actively focusing on the various grades of lactic acid while distributing.

- Key Players: BBCA Biochemical, Henan Jimdan, and Cargill

- Chemical Synthesis and Processing: The lactic acid chemical synthesis and process depend upon the biological fermentation, including lactonitrile routes.

- Regulatory Compliance and Safety Monitoring: The safety and regulatory process of lactic acid across the globe is mainly handled by government-established firms like the European Food Safety Authority (EFSA) and the US FDA.

Lactic Acid Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Food and Drug Administration (FDA) and Environmental Protection Agency (EPA) | FDA, 21 CFR 184.1395 | Food Safety and GRAS Status and Pharmaceutical Quality | These agencies are ensuring food safety and sustainability. |

| European Union | European Food Safety Authority (EFSA) | Regulation (EC) No 1333/2008 on food additives | Food Additive Safety (E 270) | The major focus of the agency is on the food and beverage sector nowadays |

| China | National Health Commission (NHC) | GB 2760-2014 | Food Contact Material Safety | These agencies are closely watching food-related contamination. |

| India | Food Safety and Standards Authority of India (FSSAI) | IS 5371:1987 (Reaffirmed 2021) | Food Additive Standards | promotes |

Segmental Insights

Type Insights

How did the L-(Lactic acid) Segment Dominate the Lactic Acid Market in 2024?

The L-(lactic acid) segment held approximately 55% share of the market in 2024, due to it is considered the biologically preferred form and seen widely used in sectors like food, beverages, and pharmaceuticals. Also, having higher optical purity factors, the segment has gained major industry attention while minimizing extra separation costs in recent years.

The D- (lactic acid) segment is expected to grow at a notable rate during the predicted timeframe, owing to its structural importance in high-performance bioplastics. Also, having higher thermal stability with mechanical strength, the segment is anticipated to drive the industry potential in the upcoming years. Furthermore, the need for heat-resistant, recyclable plastic increases, and d-lactic acid can gain major industry attention in the coming years.

Production Process Insights

Why does the Fermentation Route Segment Dominate the Lactic Acid Market by Process?

The fermentation route segment held approximately 80% of the market in 2024 because it uses renewable, low-cost sugars and starches, creating a sustainable and economical process. Fermentation also provides high optical purity, especially for L-lactic acid, which is essential for food and pharma applications.

The chemical synthesis route segment is expected to grow at a notable rate during the forecast period, because of its potential for feedstock flexibility and continuous production efficiency. Unlike fermentation, it can utilize non-food raw materials such as syngas, glycerol, and even captured CO, reducing dependency on agricultural crops.

Application Insights

How did the Food and Beverage Segment Dominate the Lactic Acid Market in 2024?

The food and beverage segment dominated the market with approximately 30% share in 2024, because lactic acid is a natural preservative, acidity regulator, and flavor enhancer, making it essential in processed foods, dairy, meat products, and beverages. Rising demand for clean-label ingredients has boosted lactic acid's popularity as a safe, naturally derived alternative to synthetic additives.

The polymer and bioplastic segment is expected to grow at a significant rate during the forecast period, because lactic acid is the key building block for polylactic acid (PLA), a fast-growing bioplastic. Global bans on single-use plastics and corporate commitments to sustainable packaging are fueling this shift PLA derived from lactic acid, is compostable, lightweight, and can replace petroleum plastics in packaging, textiles, and consumer goods.

Regional Insights

Asia Pacific Lactic Acid Market Trends

Asia Pacific dominated the market in 2024, owing to the presence of enlarged agricultural feedstock and lower product cost advantages. Furthermore, the regional countries such as India, China, and Thailand have a massive food and packaging industry, which is driving the industry potential in recent years. Also, the government's push towards biodegradable plastic is likely to maintain regional dominance.

What Drives China’s Supremacy in Lactic Acid?

China maintained its dominance in the market, owing to the enhanced production infrastructure and the shift towards biodegradable plastics in recent years. Moreover, the Chinese government has actively supported the sustainable manufacturing practices of PLA, while the major brands in the sector, packaging, and other sectors are heavily investing in the R&D activities for eco-friendly lactic acid formations.

Europe Lactic Acid Market Trends

Europe is expected to capture a major share of the market during the forecast period, akin to the regional greater deals of green chemistry in recent years. As the European Union has implemented several green regulations, including the PLA manufacturing, in the current period. Also, the originating demand for the pure and specialty grade lactic acid is likely to create lucrative opportunities in the region, as per the future industry expectations.

Country-level Investments & Funding Trends for the Lactic Acid Industry:

- India: The company called Balrampur Chini invests in the sustainable production of poly lactic acid with raw materials like sugarcane.(Source: www.thehindu.com)

- China: China has imported a heavy amount of lactic acid between 2023 to 2024 with 464 shipments.(Source: www.volza.com)

Recent Development

- In March 2025, Futerro unveiled its latest front-end engineering design, and the company is known for leading lactic acid manufacturers. Also newly launched design called the “Avant-Projet Détaillé” as per the published report.(Source: www.bioplasticsmagazine.com)

Top Vendors in the Lactic Acid Market & Their Offerings:

- Corbion N.V.: the company is a leading biochemicals manufacturer and specializes in bio ingredients like algae-based solutions and lactic acid

- Jungbunzlauer Suisse AG: the company produces natural ingredients and distributes them to food, beverage, and pharmaceutical companies.

- Galactic S.A.: one of the major manufacturers of lactic acid and its derivatives and provides green chemistry solutions in the current period.

- Cargill, Inc.: the company primarily provides precision agriculture solutions and is considered the leading food and agriculture corporation.

Other Key Players

- NatureWorks LLC

- Henan Jindan Lactic Acid Technology Co., Ltd.

- COFCO Biochemical Co., Ltd.

- Musashino Chemical Laboratory, Ltd.

- Archer Daniels Midland Company (ADM)

- Henan Xinghan Biotechnology Co., Ltd.

- Foodchem International Corporation

- Qingdao Abel Technology Co., Ltd.

- Anhui BBCA Biochemical Co., Ltd.

- Wuhan Sanjiang Space Gude Biotech Co., Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

- BASF SE

- Futerro SA

- Godavari Biorefineries Ltd.

- Shandong Fullsail Biochemical Co., Ltd.

- Teijin Limited

Segments Covered in the Report

By Type

- L-(Lactic acid)

- D-(Lactic acid)

- DL-(Racemic lactic acid)

By Production Process

- Fermentation route

- Chemical synthesis route

By Application

- Food & Beverages

- Feed & Animal Nutrition

- Pharmaceuticals

- Personal Care & Cosmetics

- Polymers & Bioplastics

- Chemicals & Intermediates

- Cleaning & Detergents

- Textile & Leather

- Construction

- Electronics

- Agriculture

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait