Content

U.S. Green Hydrogen Market Size, Share, Trends and Forecasts 2034

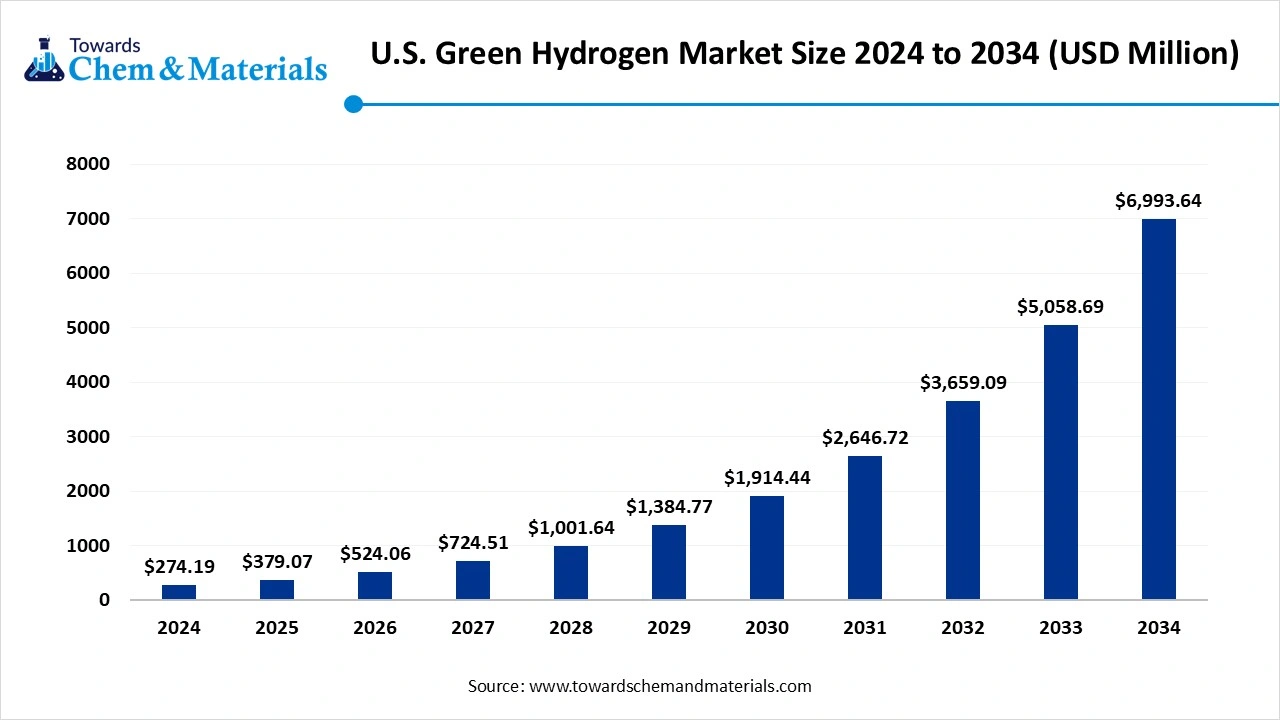

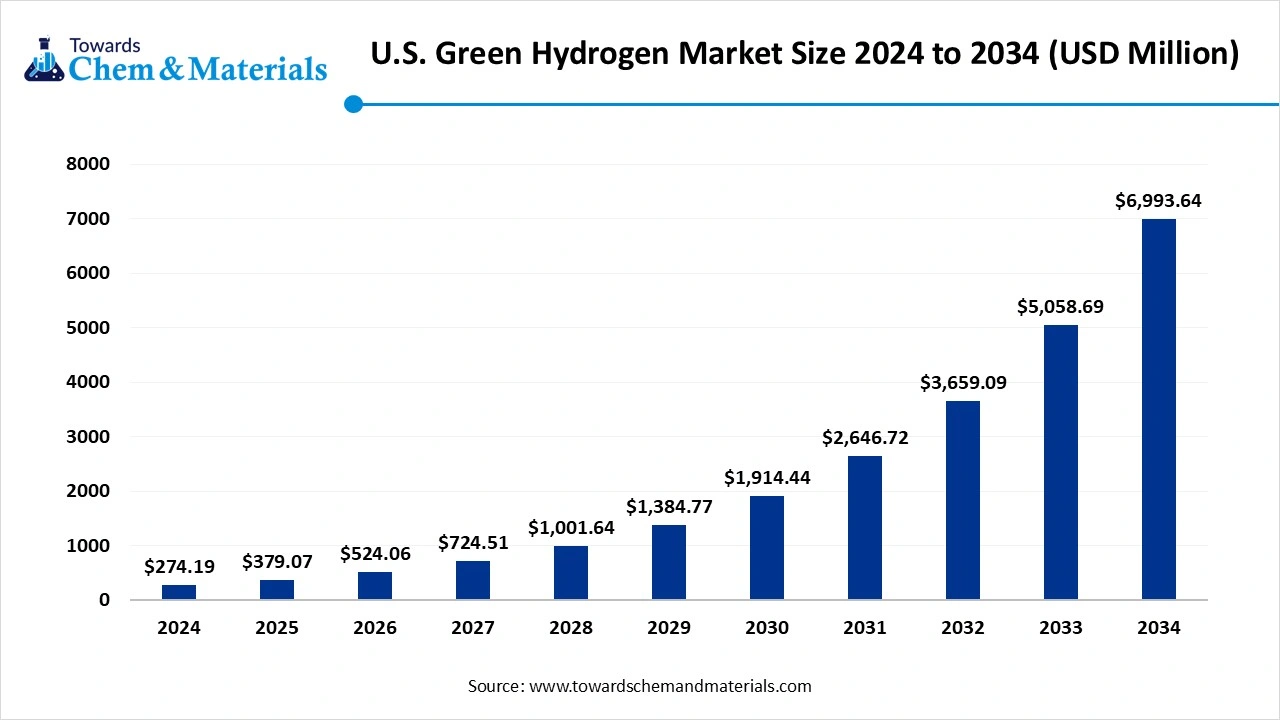

The U.S. green hydrogen market size is calculated at USD 274.19 million in 2024, grew to USD 379.07 million in 2025, and is projected to reach around USD 6,993.64 million by 2034. The market is expanding at a CAGR of 38.25% between 2025 and 2034.The strong focus on energy dependence, the growing clean energy transition, and the lower production cost of green hydrogen drive the market growth.

Key Takeaways

Key Takeaways

- By production technology, the alkaline electrolysis segment held approximately a 45% share in the market in 2024.

- By production technology, the PEM electrolysis segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By feedstock source, the wind-powered electrolysis segment held approximately a 40% share in the market in 2024.

- By feedstock source, the solar-powered electrolysis segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By storage, the compressed hydrogen storage segment held approximately a 60% share in the U.S. green hydrogen market in 2024.

- By storage, the liquid hydrogen/pipelines segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-user, the industrial hydrogen consumers segment held approximately a 50% share in the market in 2024.

- By end-user, the utilities & power generation segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Green Hydrogen?

The U.S. green hydrogen market growth is driven by a strong focus on energy security, increasing adoption of fuel cell electric vehicles, growing power generation, and government investment in green hydrogen projects. Green hydrogen is hydrogen produced using renewable energy sources like hydropower, solar, and wind.

Green hydrogen helps reliable energy supply, energy security, and minimizes greenhouse gas emissions. Green hydrogen is widely used in applications like industrial processes, electricity generation, transportation, and energy storage.

U.S. Green Hydrogen Market Outlook:

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth in high-margin niches such as energy storage, industrial decarbonization, and heavy transportation. Growth is being reinforced by renewable energy integration and government focus on decarbonization goals, particularly in the Gulf Coast and California.

- Sustainability Trends: Sustainability is reshaping the green hydrogen landscape, with technological innovations like advancements in electrolysis and integration with renewable energy helping to achieve decarbonization goals.

- Major Investors: Private investors are actively entering the space to enhance energy security and minimize reliance on fossil fuels. Companies like Linde Plc, Plug Power, Air Products & Chemicals, Cummins Inc., and Bloom Energy are heavily investing in green hydrogen technology.

Key Technological Shifts in the U.S. Green Hydrogen Market:

The green hydrogen market is undergoing key technological shifts driven by the demand for hydrogen production, enhancing predictability, and process optimization. One of the most significant transformations is the adoption of Artificial Intelligence (AI), which helps in streamlining distribution and optimizing green hydrogen production. AI supports in fine-tuning of electrolyzer parameters and the design of advanced catalysts. AI enhances electrolyzer efficiency and prevents electrolyzer degradation by analyzing water quality.

Companies like Honeywell are utilizing an artificial intelligence suite, Protonium, to optimize the green hydrogen manufacturing process. AI portfolio range includes the hydrogen Unified Control & Optimiser, Concept Design Optimiser, and Hydrogen Electrolyser Control System.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 379.07 Million |

| Expected Size by 2034 | USD 6,993.64 Million |

| Growth Rate from 2025 to 2034 | CAGR 38.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Production Technology, By Feedstock / Energy Source, By Storage / Distribution, By End-User / Buyer |

| Key Companies Profiled | Linde plc (U.S. operations), Nikola Corporation, Shell New Energies (U.S. hydrogen projects), Chevron New Energies (green hydrogen pilot projects), ITM Power (partnerships in the U.S.), Nel ASA (U.S. electrolyzer partnerships), FuelCell Energy, Inc., McPhy Energy (U.S. collaborations), Air Liquide (U.S. hydrogen & electrolyzer projects), Siemens Energy (electrolyzer technology & hydrogen solutions) |

U.S. Green Hydrogen Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for U.S. green hydrogen involves a sustainable supply of renewable electricity and water.

- Chemical Synthesis & Processing: The chemical synthesis & processing involves a process of electrolysis, like solid oxide electrolysis cells, AWE electrolysis, and PEM electrolysis.

- Quality Testing & Certifications: The quality testing involves testing of qualities like material, performance, component, purity, & application, and certifications like DOE CHPS, GH2 Standard, & TUV Rheinland.

Which Electrolyzer Technologies are Used in Green Hydrogen Production?

| Electrolyzer Technologies | Features |

| Alkaline Electrolyzer |

|

| Proton Exchange Membrane (PEM) Electrolyzer |

|

| Solid Oxide Electrolyzer |

|

| Anion Exchange Membrane (AEM) Electrolyzer |

|

Market Opportunity

Growing Transportation Sector Accelerating Market Growth

The strong focus on decarbonization and the growing transportation sector in the United States increases demand for green hydrogen. The increasing heavy-duty transport, like buses and trucks, and the growing manufacturing of fuel-cell electric vehicles, increase the adoption of green hydrogen.

The increasing long-distance transport and growing need for long & medium-range flights require green hydrogen. The growing manufacturing of hydrogen-powered trains and the rise in maritime shipping increase the adoption of green hydrogen. The growing air travel and increasing need for public transport require green hydrogen. The growing transportation sector creates an opportunity for the growth of the U.S. green hydrogen market.

Market Challenge

High Production Cost Slowing U.S. Green Hydrogen Market Growth

Despite several benefits of green hydrogen across various applications in the United States, the high production cost restricts the market growth. Factors like the need for expensive materials, expensive renewable electricity, an inefficient conversion process, and expensive electrolyzers are responsible for high production costs. The high cost of installing electrolyzer plants and the need for renewable electricity sources increase the cost. The development of distribution, storage, and transportation infrastructure requires a high cost. The expense of conversion, compression, and liquefaction directly affects the market. The high production cost hampers the growth of the U.S. green hydrogen market.

Country Insights

West Coast U.S. Green Hydrogen Market Trends

The West Coast dominated the market with approximately 35–40% share in 2024. The stringent policies, such as low-carbon fuel standards and zero-emission vehicle programs, increase the adoption of green hydrogen. The well-established offshore & onshore wind resources and growing adoption of solar energy increase the demand for green hydrogen.

The increasing utilization of hydroelectric power and the strong presence of hydrogen fueling stations increase demand for green hydrogen. The presence of key players like Air Products, Plug Power, and Bloom Energy drives the overall growth of the market.

Gulf & South U.S. Green Hydrogen Market Trends

The Gulf & South is experiencing the fastest growth in the market during the forecast period. The strong presence of wind and solar power increases the production of green hydrogen. The well-established oil & gas infrastructure and growth in industrial activities increase the demand for green hydrogen. The growing activities like fertilizer production, refining, and petrochemicals increase the demand for green hydrogen. The presence of the largest hydrogen pipelines and existing fossil fuel infrastructure increases production of green hydrogen, supporting the overall growth of the market.

Segmental Insights

Production Technology Insights

Why the Alkaline Electrolysis Segment Dominates the U.S. Green Hydrogen Market?

The alkaline electrolysis segment dominated the market with approximately 45% share in 2024. The growing chlor-alkali industry and lower expenditure cost increase demand for alkaline electrolysis. The growing large-scale production of green hydrogen and a strong focus on commercial use increase the adoption of green hydrogen. The compatibility with fluctuating inputs and extended operational lifespans increases the adoption of green hydrogen, driving the overall growth of the market.

The PEM electrolysis segment is the fastest-growing in the market during the forecast period. The growing production of high-purity hydrogen gas and integration with renewable energy increases the demand for PEM electrolysis. The high-power density and technological advancements in PEM technology help the market growth. The growing adoption of hydrogen-powered vehicles and the increasing focus on storing energy increase the adoption of PEM electrolysis, supporting the overall growth of the market.

Feedstock / Energy Source Insights

How the Wind-Powered Electrolysis Segment Held the Largest Share in the U.S. Green Hydrogen Market?

The wind-powered electrolysis segment held the largest revenue share of approximately 40% in the market in 2024. The increasing production of offshore and onshore wind energy increases the adoption of wind-powered electrolysis. The growing production of economical hydrogen and strong government support through initiatives like the hydrogen shot initiative increase the adoption of wind-powered electrolysis. The ongoing innovation in wind turbine technology and focus on zero-emission production drive the overall market growth.

The solar-powered electrolysis segment is experiencing the fastest growth in the market during the forecast period. The strong focus on lowering carbon emissions and climate goals increases demand for solar-powered electrolysis. The lower production cost of solar energy and strong government support for green hydrogen increase demand for solar-powered electrolysis. The focus on storing wind & solar energy and modernization in the electrolyzer technologies increases demand for solar-powered electrolysis, supporting the overall market growth.

Storage / Distribution Insights

Why the Compressed Hydrogen Storage Segment is Dominating the U.S. Green Hydrogen Market?

The compressed hydrogen storage segment dominated the market with approximately 60% share in 2024. The simple implementation design and lower expense increase the adoption of compressed hydrogen storage. The growth in fuel cell vehicles and increasing chemical manufacturing activities increases demand for compressed hydrogen storage. The increase in on-site power generation and scalability in large & small volume storage increases the adoption of compressed hydrogen storage, driving the overall market growth.

The liquid hydrogen storage or pipelines segment is the fastest-growing in the market during the forecast period. The growing power generation applications and growth in industrial activities increase the demand for liquid hydrogen storage. The growing focus on minimizing greenhouse gas emissions and strong government support for green hydrogen increase the adoption of liquid hydrogen storage. The increasing investment in the development of long-distance pipelines and the growing transportation of hydrogen support the overall growth of the market.

End-User / Buyer Insights

Which End-User Segment Held the Largest Share in the U.S. Green Hydrogen Market?

The industrial hydrogen consumers segment held the largest revenue share of approximately 50% in the market in 2024. The well-established chemical manufacturing and refining sector increases the demand for green hydrogen. The increasing production of fertilizers and high-temperature industrial processes increases the adoption of green hydrogen. The increasing development of eco-industrial parks and growing metal treatment activities increases demand for green hydrogen, driving the overall market growth.

The utilities & power generation segment is experiencing the fastest growth in the market during the forecast period. The growing generation of solar and wind power increases demand for green hydrogen. The strong focus on energy security and the increasing need for grid stabilization require green hydrogen. The rising government investment in power generation and focus on improving air quality increase demand for green hydrogen, supporting the overall market growth.

Recent Developments

- In April 2024, Akna Energy Collaborated with U.S. Splitwaters for the development of a 20 MW green hydrogen plant. The production capacity of the facility is 3 million kilograms, and Splitwaters is responsible for procurement, commissioning, engineering, & construction of the green hydrogen plant.(Source: www.alchempro.com)

- In May 2024, Fortescue launched its first green hydrogen production facility in Arizona, U.S. The facility is present across 158 acres, and the annual production capacity of liquid green hydrogen is 11000 tons.(Source: www.fortescue.com)

- In March 2024, ABB collaborated with Green Hydrogen International to support a major Power-to-X green hydrogen project in Texas. The facility uses onshore wind energy and solar energy to produce green hydrogen. The annual production capacity of the facility is 280000 tons and uses salt cavern storage.(Source: new.abb.com)

Top Companies List

- Air Products and Chemicals, Inc.: The leading solution in hydrogen production, and consists of a large-scale green hydrogen production facility.

- Plug Power Inc.: The company has a complete green hydrogen ecosystem, and its product portfolio includes GenKey & GenFuel, ProGen & GenDrive, and Electrolyzers.

- Bloom Energy Corporation: The leading manufacturer of solid oxide electrolyzer cells for the production of green hydrogen to support applications like transportation, injection, power generation, and industrial processes.

- Ballard Power Systems Inc: The company is the leading developer of Proton Exchange Membrane and supports applications like material handling, marine, heavy-duty motive, & stationary power.

- Cummins Inc. (Hydrogen & Fuel Cell Division): The Company’s Accelera segment develops green hydrogen, and its product portfolio includes solid oxide, PEM, and alkaline electrolyzers.

Other Top Companies

- Linde plc (U.S. operations)

- Nikola Corporation

- Shell New Energies (U.S. hydrogen projects)

- Chevron New Energies (green hydrogen pilot projects)

- ITM Power (partnerships in the U.S.)

- Nel ASA (U.S. electrolyzer partnerships)

- FuelCell Energy, Inc.,

- McPhy Energy (U.S. collaborations)

- Air Liquide (U.S. hydrogen & electrolyzer projects)

- Siemens Energy (electrolyzer technology & hydrogen solutions)

Segments Covered

By Production Technology

- Alkaline Electrolysis

- Proton Exchange Membrane (PEM) Electrolysis

- Solid Oxide Electrolysis (SOE)

- Other Emerging Electrolysis Technologies

By Feedstock / Energy Source

- Solar-Powered Electrolysis

- Wind-Powered Electrolysis

- Hydro-Powered Electrolysis

- Hybrid / Other Renewable Sources

By Storage / Distribution

- Compressed Hydrogen Storage

- Liquid Hydrogen Storage

- Pipeline Transport

- On-site Generation / Distributed Systems

By End-User / Buyer

- Industrial Hydrogen Consumers (steel, ammonia, refineries)

- Utilities & Power Generation Companies

- Transportation OEMs (fuel cell vehicle integration)

- Government & Defense Fleets

- Commercial & Residential Energy Providers