Content

What is the Current Europe Biodegradable Plastics Market Size and Share?

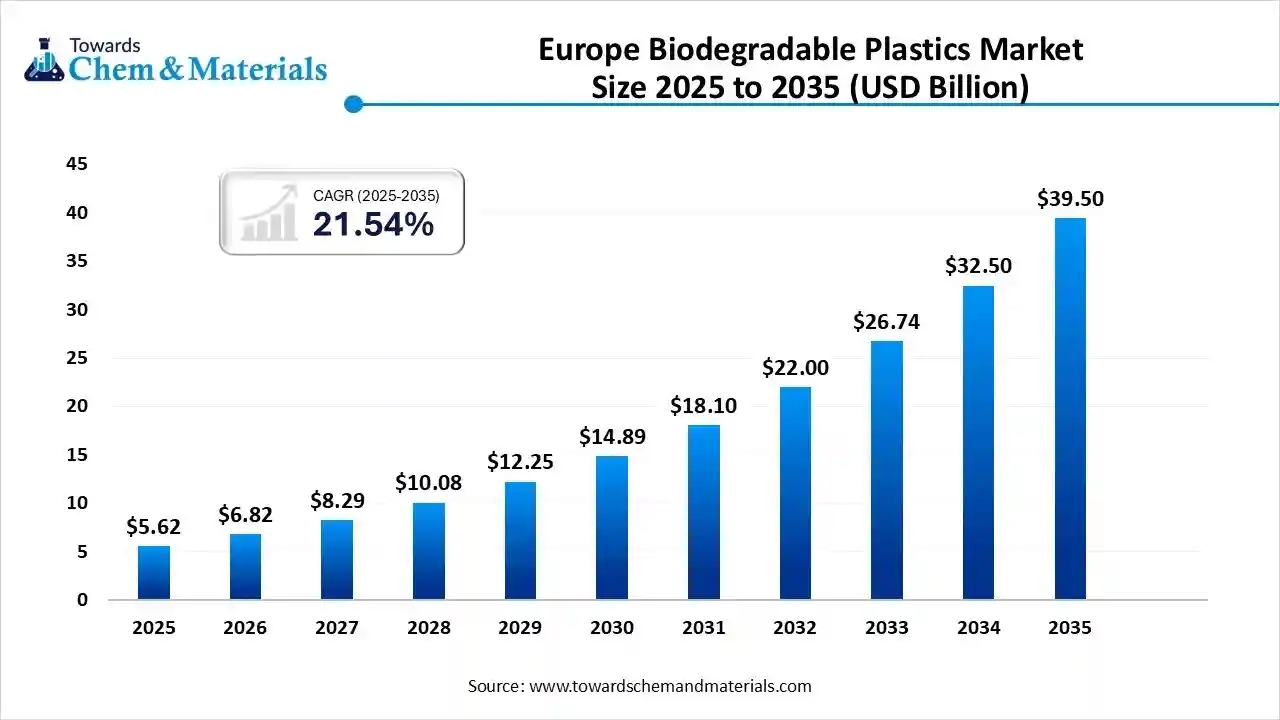

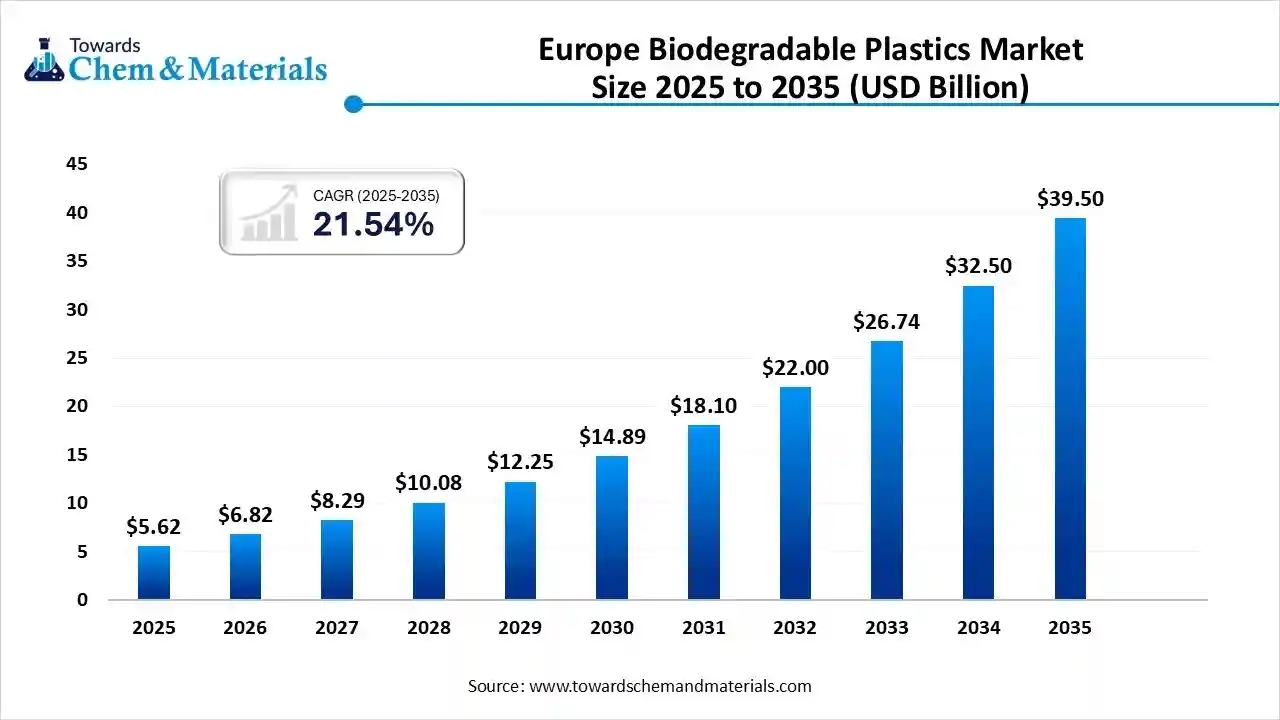

The Europe biodegradable plastics market size is calculated at USD 5.62 billion in 2025 and is predicted to increase from USD 6.82 billion in 2026 and is projected to reach around USD 39.50 billion by 2035, The market is expanding at a CAGR of 21.54% between 2026 and 2035. The market is growing rapidly, driven by strict environmental regulations, increasing consumer demand for sustainable products, and technological advancements, which fuel the growth of the market.

Key Takeaways

- By type, the biobased biodegradables segment dominated the market with a share of 50% in 2024.

- By type, the biobased non-biodegradables segment is expected to grow significantly in the market during the forecast period.

- By feedstock, the sugarcane segment dominated the market with a share of 45% in 2024.

- By feedstock, the cellulosic and wood waste segment is expected to grow in the forecast period.

- By processing technology, the extrusion segment dominated the market with a share of 48% in 2024.

- By processing technology, the 3D printing segment is expected to grow in the forecast period.

- By application, the flexible packaging segment dominated the market with a share of 44% in 2024.

- By application, the rigid packaging segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Europe Biodegradable Plastics Market?

The significance of Europe's biodegradable plastics market lies in its role as a key driver for sustainability through strict regulations, high consumer demand, and continuous innovation. It is a leading global market, pushing the transition away from fossil-fuel-based plastics and reducing plastic waste, particularly in sectors like packaging, consumer goods, and agriculture.

Europe Biodegradable Plastics Market Growth Trends:

- Policy and regulatory push: Stricter EU policies and a push for a circular economy are driving the shift from fossil-based polymers to bio-based alternatives.

- Increasing demand: The market is fueled by high consumer environmental awareness and corporate sustainability commitments, leading to strong growth in both the packaging and agricultural sectors.

- Innovation and R&D: Continuous innovation is key, with countries like Germany leading in research and development, and new materials like PLA and PHA gaining significant market share.

- Application growth: The food and beverage sector is the largest end-user industry. Other sectors like foodservice, personal care, and agriculture are also contributing to market expansion.

- Consumer demand: Increasing environmental awareness and concern over plastic pollution are boosting demand for eco-friendly alternatives.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 6.82 Billion |

| Revenue Forecast in 2035 | USD 39.50 Billion |

| Growth Rate | CAGR 21.54% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Type, By Feedstock, By Processing Technology, By Application |

| Key companies profiled | BASF SE, Novamont S.p.A., NatureWorks LLC, TotalEnergies Corbion, BIOTEC GmbH & Co. KG, Total Corbion PLA, Biome Bioplastics, Carbios, Futerro SA , Braskem S.A., Sabic, Teijin Limited, Toray Industries, Inc., Avantiun N.V., Synbra Holding BV, Bio-on S.p.A. |

Key Technological Shifts In The Europe Biodegradable Plastics Market:

Key technological shifts in the Europe biodegradable plastics market include advancements in processing methods like improved extrusion for higher productivity, the rise of 3D printing filaments, and innovations in material science to create stronger, more versatile bioplastics. These shifts are also driven by the development of new applications beyond packaging, such as in automotive, agriculture, and textiles, and the creation of new materials like poly(lactic-co-glycolic acid) (PLGA) for the pharmaceutical industry.

Trade Analysis Of the Europe Biodegradable Plastics Market: Import & Export Statistics

- According to data on Biodegradable exports from the European Union, there are 4 Biodegradable Suppliers in the EU, serving 4 global buyers.

- Global Export data shows that the world exported 1,010 shipments of Biodegradable Plastic, made by 292 exporters to 291 buyers.

- Most exports of Biodegradable Plastic from the world go to the United States, Vietnam, and Colombia.

- Globally, the leading 3 exporters of Biodegradable Plastic are Vietnam, China, and Italy. China leads with 650 shipments, followed by Vietnam with 112, and Italy with 59.

- According to global Biodegradable Plastic export data, 292 suppliers are exporting to 291 buyers worldwide. DONGGUAN RAYTEK BLISTER PACKAGING C, AN TIEN INDUSTRIES JOINT STOCK COMPANY, and NOVAMONT S P A account for 66% of the total exports.

- DONGGUAN RAYTEK BLISTER PACKAGING C is the top supplier, representing 34% with 122 shipments. Next is AN TIEN INDUSTRIES JOINT STOCK COMPANY with 21% and 76 shipments, and NOVAMONT S P A with 11% and 40 shipments.

Europe Biodegradable Plastics Market Value Chain Analysis

- Chemical Synthesis and Processing: Biodegradable plastics in Europe are manufactured from renewable feedstocks through fermentation and polymerisation processes. Major materials include PLA, PHA, starch blends, and biodegradable polyesters. These are processed via extrusion, injection moulding, thermoforming, and film blowing for packaging, agriculture, and consumer goods.

- Key players: BASF SE, Novamont S.p.A., TotalEnergies Corbion, Fkur Kunststoff GmbH, Biome Bioplastics

- Quality Testing and Certification: Biodegradable plastics undergo testing for compostability, biodegradation rate, tensile strength, and environmental compliance under European standards such as EN 13432, EN 14995, and ISO 17088, along with REACH and EU Green Deal requirements.

- Key players: TÜV Austria (OK Compost), SGS, Intertek, DIN CERTCO

- Distribution to Industrial Users: Biodegradable plastics are supplied to food packaging, agriculture, hygiene products, and consumer goods industries through polymer distributors, converters, and direct partnerships with European manufacturers.

- Key players: BASF SE, Novamont S.p.A., TotalEnergies Corbion, Fkur Kunststoff GmbH.

Biodegradable Plastics Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| European Union | European Commission; ECHA; European Committee for Standardisation (CEN) | EU Packaging & Packaging Waste Directive (and upcoming revisions) Waste Framework Directive (WFD) REACH Regulation & CLP Compostability & biodegradability standards (EN 13432, EN 14995, ISO 17088) |

Biodegradability/compostability certification Chemical safety of polymer components |

EN 13432 is the core standard for certifying a plastic “industrially compostable.” REACH restricts hazardous additives even in biodegradable resins, pushing the sectors toward clean bio-polymers. |

| Germany | Federal Environment Agency (UBA); German Institute for Construction Technology (DIBt) | German Packaging Ordinance (VerpackV) National waste & recycling laws aligned with EU WFD |

Biodegradable packaging compliance Recycling rate compliance and recycling-versus-compost choices |

German markets strongly favour certified compostable films and packaging; high consumer and retail demand for biodegradable alternatives. |

| France | Ministry for Ecological Transition; ADEME | National regulations on single-use plastics & ban schedules Transposition of EU directives; national waste management laws |

Phase-out of non-degradable single-use plastics Encouragement of compostable packaging and disposable items |

Recent bans on many single-use conventional plastics have led to a spike in demand for EN-13432 certified biodegradable products. |

| Italy | Ministry of the Environment; UNI Standards Body | Compliance with EU directives National regulations for biodegradable compostable materials in agriculture, packaging, and catering |

Certification and labelling for compostable products Support for compostable film in agriculture and packaging |

Italy is a strong market for biodegradable films and mulch films under agriculture & horticulture applications national incentives support compostable agriculture plastics. |

| Nordic countries (Sweden, Denmark, Finland) | National Environment Ministries; Nordic Ecolabelling bodies | EU directives transposed nationally Nordic Ecolabel / Nordic Swan certification regimes |

Eco-labelling and environmental product certification Promotion of compostable and bio-based polymers |

Consumers in Nordic countries show a high preference for certified eco-products; demand for biodegradable plastics is coupled with broader sustainability policies, including circular economy goals. |

Segmental Insights

Type Insights

Which Type Segment Dominated The Europe Biodegradable Plastics Market In 2024?

The biobased biodegradables plastics segment dominated the market with a share of 50% in 2024. Biobased biodegradable plastics form the core of Europe’s sustainable materials shift, driven by strong policy mandates and increasing brand-level commitments to reduce plastic waste. Their compatibility with Europe’s industrial composting systems makes them particularly attractive for large-scale use in regulated sectors.

The biobased non-biodegradables segment expects significant growth in the market during the forecast period. Biobased non-biodegradable plastics, including bio-PE and bio-PET, are gaining traction due to their reduced carbon footprint and compatibility with existing recycling streams. These materials are popular among manufacturers seeking to meet sustainability targets without disrupting established packaging lines. Their durability and performance parity with fossil-based plastics, support growing demand across Europe.

Feedstock Insights

How Did the Feedstock Segment Dominated The Europe Biodegradable Plastics Market In 2024?

The sugarcane segment dominated the Europe biodegradable plastics market with a share of 45% in 2024. Sugarcane-based feedstock plays a significant role in Europe’s bioplastics sector due to its high ethanol yield and efficient conversion into biopolymer building blocks. Though primarily imported, sugarcane-based bioplastics are favoured by FMCG brands for their renewable profile and suitability for high-volume packaging applications. Growing demand for low-carbon materials continues to boost market relevance.

The cellulosic and wood waste segment expects significant growth in the market during the forecast period. Cellulosic and wood waste feedstocks are becoming increasingly important as Europe seeks locally sourced, sustainable biomass streams. Their abundance within Europe’s forestry and pulp industries accelerates adoption, especially for speciality films and rigid applications.

The corn segment has seen notable growth in the market. Corn-based feedstock remains one of the most widely used sources for producing PLA and other biodegradable materials in Europe. Its strong fermentation efficiency, predictable supply chains, and compatibility with established processing technologies make it a preferred input for large manufacturers. Demand is driven by rigid and flexible packaging, food service products, and disposable items.

Processing Technology Insights

Which Processing Technology Segment Dominated The Europe Biodegradable Plastics Market In 2025?

The extrusion segment dominated the market with a share of 48% in 2024. Extrusion is a dominant processing technology for biodegradable plastics due to its efficiency in producing films, sheets, and flexible packaging materials. Europe’s large packaging industry relies heavily on extrusion lines that have been adapted to run PLA, starch blends, and compostable polymers. Continuous improvements in processing performance support broader market adoption.

The 3D printing segment expects significant growth in the Europe biodegradable plastics market during the forecast period. Biodegradable polymers, especially PLA, are widely used in Europe’s fast-growing 3D printing sector due to their ease of processing, low emissions, and suitability for prototyping and consumer applications. The rise of additive manufacturing across automotive, medical, and design industries is boosting demand for high-quality biobased filaments, strengthening this segment’s growth outlook.

The injection moulding segment has seen notable growth in the market. Injection moulding is essential for producing durable biodegradable components used in rigid packaging, consumer goods, and automotive parts. European manufacturers increasingly adapt moulding systems to biodegradable polymers, driven by sustainability requirements and product innovations. The process supports complex geometries, making it key for high-performance and reusable bioplastic applications.

Application Insights

How Did the Application Segment Dominated The Europe Biodegradable Plastics Market In 2025?

The flexible packaging segment dominated the market with a share of 44% in 2024. Flexible packaging represents one of the largest application segments, driven by EU directives aimed at reducing single-use plastics and increasing compostable alternatives. The sector benefits from strong regulatory support and rapid technology improvements in barrier properties.

The rigid packaging segment expects significant growth in the Europe biodegradable plastics market during the forecast period. Rigid packaging applications are expanding as bioplastics improve in mechanical strength, thermal resistance, and cost competitiveness. European FMCG and cosmetics companies increasingly adopt biodegradable rigid packaging to meet sustainability commitments. Growing investment in compostable biopolymer grades enhances the performance and availability of rigid packaging solutions.

The automotive and assembly operations segment has seen notable growth in the market. The automotive sector in Europe is gradually integrating biodegradable plastics for interior components, trims, and low-load structural parts. OEMs and suppliers are pursuing lightweight, sustainable materials to meet emission reduction goals and circular economy targets. Biobased polymers offer reduced environmental impact and are increasingly used in next-generation vehicle designs and assembly processes.

Country Insights

Germany: Europe Biodegradable Plastics Market Growth Trends

Germany represents one of the most mature and technologically advanced markets for biodegradable plastics in Europe. Strong industrial capabilities, high recycling standards, and stringent waste management laws support the rapid adoption of compostable plastics across packaging, automotive components, and agricultural films. Government-backed sustainability programs and consumer preference for eco-friendly packaging further reinforce market growth. Collaboration between material producers and FMCG companies strengthens long-term demand.

United Kingdom: Europe Biodegradable Plastics Market Growth Trends

The UK market for biodegradable plastics is expanding rapidly, influenced by the Plastic Packaging Tax, extended producer responsibility (EPR) reforms, and rising public concern about plastic pollution. The country is witnessing increased adoption across retail packaging, food service disposables, and e-commerce applications. Although the country relies on imports for some biopolymer grades, domestic innovation in bio-based materials is increasing, supported by government-funded circular economy programs and university research initiatives.

Ireland: Europe Biodegradable Plastics Market Growth Trends

Ireland shows strong potential for biodegradable plastics due to its proactive environmental policies and rapid growth in food & beverage exports that depend heavily on sustainable packaging. Irish retailers and food processors are increasingly adopting compostable bags, films, and serviceware to align with EU sustainability directives. Despite its smaller industrial base, Ireland’s high consumer awareness and corporate ESG commitments accelerate steady demand growth.

Italy: Europe Biodegradable Plastics Market Growth Trends

Italy holds a prominent position in Europe’s biodegradable plastics market, largely due to its strong biopolymer manufacturing ecosystem and early adoption of compostable material regulations. Italy has one of the most advanced industrial composting networks in Europe, enabling widespread use of biodegradable bags, food packaging, and agricultural films. Government-enforced bans on non-biodegradable shopping bags significantly boosted market penetration.

France: Europe Biodegradable Plastics Market Growth Trends

France’s biodegradable plastics market is growing steadily due to ambitious national policies promoting bio-based materials, bans on single-use plastics, and rising investment in compostable packaging. The country encourages the transition to sustainable alternatives across retail, hospitality, and agriculture sectors, supported by EU directives. Consumer preference for environmentally friendly products and a strong government push toward circular economy practices boost long-term demand for biodegradable solutions.

Recent Developments

- In November 2025, the EU Bioeconomy Strategy fast-tracks binding targets for bio-based plastics to boost industrial competitiveness. It aims to integrate them into the PPWR by 2027 to scale up the market and reduce dependency on fossil fuels.(Source: www.plasticsnews.com)

- In October 2025, BioNatur Plastics launched European production of a biodegradable and 100% recyclable stretch wrap at a competitive price point, matching the cost of traditional, non-biodegradable films.(Source: www.stattimes.com)

Top players in the Europe Biodegradable Plastics Market & Their Offerings:

- BASF SE: BASF SE remains one of the leading suppliers of biodegradable polymers in Europe, offering advanced materials such as ecovio® and ecoflex® for packaging, agriculture, and consumer goods. The company focuses on high-performance compostable solutions aligned with EU sustainability goals, supported by strong R&D and strategic collaborations.

- Novamont S.p.A.: Novamont, through its flagship Mater-Bi product line, is a dominant European player recognised for its strong integration of renewable feedstocks and circular bioeconomy initiatives. The company actively supports policy-driven transitions to compostable plastics in packaging and food-service applications.

- NatureWorks LLC: NatureWorks continues to expand its footprint in Europe through Ingeo™ PLA biopolymers, widely used in rigid packaging, disposable products, and textiles. The company emphasises carbon-reduction, advanced biopolymer performance, and long-term investments in the region’s bio-based supply chains.

- TotalEnergies Corbion: TotalEnergies Corbion plays a key role in Europe’s biodegradable and bio-based plastics sector with its Luminy® PLA. The company focuses on high-heat-resistant PLA grades, catering to packaging, consumer products, and 3D printing applications while supporting end-of-life compostability solutions.

- BIOTEC GmbH & Co. KG: BIOTEC specialises in starch-based biodegradable compounds for packaging films, bags, and agricultural products. Known for innovation and compliance with EN 13432 standards, the company is a strong partner for European converters shifting toward compostable materials.

Top Companies in the Europe Biodegradable Plastics Market

- BASF SE

- NatureWorks LLC

- Novamont S.p.A.

- TotalEnergies Corbion

- Total Corbion PLA

- BIOTEC GmbH & Co. KG

- Biome Bioplastics

- Carbios

- Futerro SA

- Braskem S.A.

- Sabic

- Teijin Limited

- Toray Industries, Inc.

- Avantiun N.V.

- Synbra Holding BV

- Bio-on S.p.A.

Segments Covered:

By Type

- Bio-based Biodegradables

- Starch-based

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Polyesters (PBS, PBAT, PCL)

- Other Bio-based Biodegradables

- Bio-based Non-biodegradables

- Bio Polyethylene Terephthalate (PET)

- Bio Polyethylene

- Bio Polyamides

- Bio Polytrimethylene Terephthalate

- Other Bio-based Non-biodegradables

By Feedstock

- Sugarcane / Sugar Beet

- Corn

- Cassava and Potato

- Cellulosic and Wood Waste

- Others (Algae and Microbial Oil)

By Processing Technology

- Extrusion

- Injection Molding

- Blow Molding

- 3D Printing

- Others (Thermoforming, etc.)

By Application

- Flexible Packaging

- Rigid Packaging

- Automotive and Assembly Operations

- Agriculture and Horticulture

- Construction

- Textiles

- Electrical and Electronics

- Other Applications