Content

What is the U.S. Recycled Polyester Market Size?

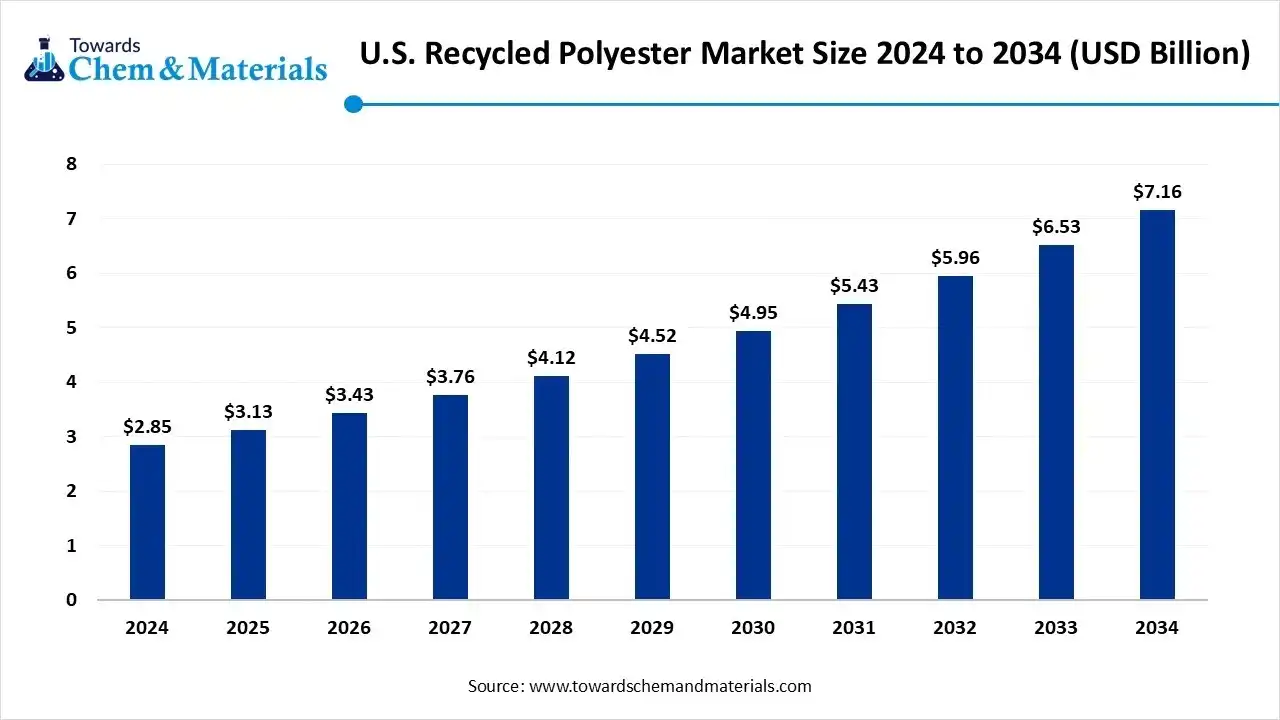

The U.S. recycled polyester market size is calculated at USD 2.85 billion in 2024, grew to USD 3.13 billion in 2025, and is projected to reach around USD 7.16 billion by 2034. The market is expanding at a CAGR of 9.65% between 2025 and 2034. The global shift towards sustainability is set to create competitive advantages in the production spaces.

Key Takeaways

- By product type, the fiber grade segment dominated the market with approximately 54% industry share in 2024.

- By product type, the strapping grade segment is expected to grow at the fastest rate in the market during the forecast period.

- By recycling process type, the mechanical segment dominated the market with approximately 71% industry share in 2024.

- By recycling process type, the chemical segment is expected to grow at the fastest rate in the market during the forecast period.

- By application type, the textiles and apparel segment dominated the market with approximately 47% industry share in 2024.

- By application type, the industrial segment is expected to grow at the fastest rate in the market during the forecast period.

- By form type, the flakes segment dominated the market with approximately 52% industry share in 2024.

- By form type, the pellets segment is expected to grow at the fastest rate in the market during the forecast period.

Turning Waste into Values: The Rise of Recycled Polyester in the United States

The U.S. recycled polyester market focuses on the production and utilization of polyester fibers, filaments, and resins made from post-consumer and post-industrial PET waste, primarily plastic bottles. Recycled polyester (rPET) offers equivalent strength, durability, and versatility to virgin polyester but with a lower carbon footprint and reduced energy consumption.

The market is expanding due to sustainability mandates, circular economy adoption, growing apparel brand commitments to recycled textiles, and advancements in chemical recycling technologies. Key application areas include textiles, packaging, automotive, construction, and consumer goods, positioning rPET as a central material in the U.S. sustainability landscape.

U.S. Recycled Polyester Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the emergence of greener clothing has resulted in enhanced brand positioning and product offerings in recent years. Moreover, the local manufacturers of the United States are actively involved under the establishment of the local production unit for the lower transport cost and traceable recycled products.

- Sustainability Trends: the major manufacturers are accepting the waste that has verified tags and lower carbon scores in the United States. Moreover, by choosing the concentrated supply chain that reuses water and heat between processes, the US brands have gained attention in the global sustainability industry in recent years.

- Global Expansion: The United States has seen heavy export of higher-grade recycled pellets with the same amount of cheaper feedstock imports in recent years. Moreover, several foreign investors are actively bringing new chemical recycling technology to the United States while boosting production facilities in the region.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 3.43 Billion |

| Expected Size by 2034 | USD 7.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By the Recycling Process, By Application, By Form |

| Key Companies Profiled | Indorama Ventures Public Company Ltd. (U.S. operations), Far Eastern New Century (FENC America), DAK Americas LLC (Alpek Polyester), Biffa Polymers (U.S. division) , Nan Ya Plastics Corporation America , Phoenix Technologies International, LLC , Placon Corporation , CarbonLite Industries (now merged into DAK Americas) , Loop Industries , Evergreen Plastics, Inc. , Mohawk Industries, Inc. , Avangard Innovative , PolyQuest, Inc. , Custom Polymers PET, LLC , Clean Tech Incorporated (Plastipak Packaging) , Perpetual Recycling Solutions, LLC , Peninsula Plastics Recycling, Inc. , Nextek, Inc. , Repreve Renewables LLC |

Intelligent Recycling: AI and Sensors Propel United States Polyester Evolution

The major manufacturer of recycled polyester in the United States has shifted towards the simple mechanical flake to fiber to mixed solutions in recent years, as per the observation. Furthermore, the increasing investment for the development of advanced tools like artificial intelligence sorting, sensors, and low-energy drying cuts contamination and energy use is anticipated to enable access to untapped or underserved markets during the forecast period.

Trade Analysis of the U.S. Recycled Polyester Market:

Import, Export, Consumption, and Production Statistics

- The United States exported a huge amount of recovered plastic around the globe in 2024, and it was worth 903 million pounds as per the published report.(Source: resource-recycling.com)

- The United States records a heavy amount of recycled polyester imports in 2024, with 10,036 shipments as per the record.(Source: www.volza.com)

Value Chain Analysis of the U.S. Recycled Polyester Market:

- Distribution to Industrial Users : Distribution of recycled polyester to industrial users in the United States primarily follows a business-to-business (B2B) model.

- Chemical Synthesis and Processing : In the United States recycled polyester (rPET) market, chemical synthesis and processing involve both widely established mechanical recycling methods and emerging advanced chemical technologies

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring in the U.S. recycled polyester (rPET) market are managed by a combination of federal, state, and third-party standards.

U.S. Recycled Polyester Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Federal Trade Commission (FTC) | Green Guides for the Use of Environmental Marketing Claims (16 CFR Part 260) | Preventing greenwashing | The agency governs the safety of recycled polyester. |

Segmental Insights

Product Type Insights

How did the Fiber Grade Segment Dominate the U.S. Recycled Polyester Market in 2024?

The fiber grade segment dominated the market with approximately 54% of industry share in 2024 due to it being considered essential to produce footwear, home textiles, and clothing in the region. Furthermore, several major clothing brands are heavily promoting sustainability while using this recycled polyester as a major material.

The strapping grade segment is expected to grow at a significant rate owing to the sudden shift towards eco-friendly packaging in recent years. Also, with the surge of E-commerce and logistics, the eco-friendly strap is likely to gain major industry share in the coming years, as per the recent industry survey.

The bottle grade segment is also notably growing, akin to it offers high clarity, strength, and food-safe quality. Many beverage and food brands are switching to recycled materials to meet sustainability goals. Recycled bottle-grade polystyrene can be molded again into containers, trays, and packaging with the same look and durability as virgin plastic.

Recycling Process Insights

Why does the Mechanical Segment Dominate the U.S. Recycled Polyester Market?

The mechanical segment dominated the market with approximately 71% industry share in 2024, owing to the this process is known as the proven, simple, and cost-effective method. Furthermore, by turning collected PET bottles into fibers or flakes without any chemical use, the mechanical segment has gained major industry attention in recent years.

The chemical segment is expected to grow at a rapid rate owing to its offerings, like it can turn poor quality or mixed plastic into high-quality or pure recycled polyester. Moreover, the major recycling industries in the United States have seen under the heavy investment towards chemical depolymerization technologies which is likely to create lucrative opportunities in the coming years.

Application Insights

How did the Textiles & Apparel Segment Dominate the U.S. Recycled Polyester Market in 2024?

The textiles & apparel segment dominated the market with 47% of industry share in 2024 because recycled polyester is the most popular sustainable fabric choice for clothing brands. U.S. consumers love activewear, athleisure, and fast-fashion styles made from soft, durable recycled fibers. Fashion companies use recycled polyester to show environmental responsibility while keeping comfort and style.

The industrial segment is expected to grow at the fastest rate because recycled polyester is proving valuable beyond clothing, specifically in automotive interiors, construction materials, filtration, fabrics, and insulation. Industries are moving toward eco-friendly raw materials to meet corporate sustainability targets. Recycled polyester fibers offer strength, heat resistance, and durability, making them perfect for heavy-duty uses.

The packaging segment is notably growing owing to brands and consumers want eco-friendly, safe, and durable packaging options. Recycled polyester (rPET) is strong, lightweight, and transparent, making it ideal for bottles, food containers, and flexible films. Also, major beverage and food companies are pledging to use more recycled materials to meet sustainability goals and reduce plastic waste.

Form Insights

Why does the Flakes Segment Dominate the U.S. Recycled Polyester Market?

The flakes segment dominated the market with approximately 52% industry share in 2024 because they are the starting point for nearly every recycling process. PET bottles are crushed and cleaned into flakes, which can then be used to make fibers, sheets, or straps. The process is simple, fast, and widely available.

The pellets segment is expected to grow at a rapid rate because they are more refined, higher-value, and easier to process for advanced applications. Pellets are made from melted and filtered flakes, offering better purity and consistency. They are ideal for producing strapping. films, and industrial-grade fibers. As chemical recycling grows, it will directly produce high-quality pellets ready for any use.

The fibers and filaments segment is notably growing, akin to polystyrene can be easily spun into strong, lightweight threads used in textiles, filters, and 3D printing. These fibers offer flexibility, strength, and resistance to wear, making them ideal for carpet backing, upholstery, and industrial fabrics.

Recent Developments

In September 2025, Selenis is likely to expand its production facility in the United States in the upcoming years. Also, the company introduced a sustainable textile brand called Texnascis, as per the published report.(Source: www.selenis.com)

Top U.S. Recycled Polyester Market Companies

Unifi, Inc.

Corporate Information

- Name: Unifi, Inc.

- Headquarters: Greensboro, North Carolina, USA.

- Business: Manufactures synthetic and recycled performance fibers and yarns; portfolio includes its flagship brand REPREVE®, a branded recycled performance fiber/resin solution.

History and Background

- Founded in 1971 by George Allen Mebane IV (among others) as a textile company focused on polyester/nylon yarns.

- Over time the company expanded manufacturing capabilities and embraced advanced textile technologies, especially in the 1980s and 1990s.

- In 2007 the REPREVE® platform was launched: a major strategic pivot toward recycling of post consumer bottles and industrial waste into performance fibers.

Key Developments and Strategic Initiatives

- REPREVE scaling: The company has transformed tens of billions of plastic bottles into recycled fiber. For example, in 2020 Unifi announced passing the milestone of 20 billion bottles.

- Profitability Improvement Plan: In January 2024 the company announced a cost reset initiative expected to reduce annual operating expenses by US$10–15 million, plus sales transformation targets.

- Manufacturing footprint adjustment: In May 2025 Unifi announced the sale of a manufacturing facility in Madison, North Carolina, for US$45 million, using the proceeds to reduce debt and expecting annualized savings in operations of ~US$20 million.

Mergers & Acquisitions

- While publicly available major acquisitions by Unifi are less evident in the sources I found, the sale of the facility (above) is a significant asset transaction.

- It should be noted that the textile & fiber industry often sees smaller strategic acquisitions, joint ventures or licensing deals further detailed M&A may require deeper due diligence or filings.

Partnerships & Collaborations

- Unifi collaborates extensively with global brands, textile mills and other partners. For example, the REPREVE Champions of Sustainability awards programme recognizes brand, textile and retail partners that use REPREVE fibers.

- The company’s sustainability platform emphasizes traceable, verified supply chains; fiber technologies; and partnerships across apparel, footwear, home goods, automotive and other industries.

Product Launches / Innovations

- The REPREVE brand offers fibers and resins made from post consumer plastic bottles, ocean bound plastic, and textile waste; product formats include filament yarn, spun yarn, staple fiber and resin.

- REPREVE includes traceability technologies such as FiberPrint® (a tracer embedded in fibers) and U TRUST® certification to provide transparency in recycled content.

- Innovations around performance finishes: Unifi mentions proprietary “PROFIBER™” technology offering added comfort, performance (moisture management, thermal regulation, UV protection, antimicrobial, water resistance).

Key Technology Focus Areas

- Recycled feedstock sourcing: Collecting and processing post consumer bottles, ocean bound plastic, post industrial/consumer textile waste.

- Fiber manufacturing & performance yarns: Engineered yarns that offer both sustainability and performance characteristics for apparel, footwear, home furnishings, automotive, etc.

- Circulary systems / traceability: Embedding tracers in fibers (FiberPrint®), certification (U TRUST®), closed loop recycling of manufacturing waste (yarn/tex waste).

R&D Organisation & Investment

- While specific R&D spend is not detailed in the sources I found, Unifi emphasizes that its history is “marked by investments in technology” and “innovation in performance technologies” (see their history section).

- The company’s innovation focus (performance yarns + circular feedstocks) implies ongoing R&D efforts in fiber engineering, recycling processes, traceability systems and manufacturing optimization.

SWOT Analysis

Strengths

- Strong brand in recycled performance fiber: REPREVE is widely recognized across apparel, footwear, and home goods brands.

- Vertical manufacturing and global footprint: operations in U.S., Latin America, global sales distribution gives scale and flexibility.

- Sustainability credentials and traceability technologies: align well with growing ESG demand from brands/consumers.

- Innovation in recycled feedstocks and performance yarns offers value beyond “just recycled content” (performance features).

- Strategic cost and operational restructuring underway: facility sales and cost reduction programmes may improve margins.

Weaknesses

- Business sensitive to raw material costs, feedstock availability, pricing pressures (virgin vs recycled differential).

- Recent financial performance shows pressure: e.g., Q4 2025 revenue decline, gross margin erosion.

- Dependence on a few large brand customers may create concentration risk. (Though this is typical in the industry).

- The sustainability premium may be challenged if recycled content becomes commoditized; need to maintain differentiation.

Opportunities

- Growth in circular textile solutions: scaling textile to textile recycling opens a large new feedstock/market.

- Increasing brand and regulatory pressures for recycled content and traceability: tailwinds for Unifi’s business model.

- New markets & end uses beyond apparel (industrial, automotive, home furnishings) for recycled performance fibers.

- Geographic expansion: increased presence in Asia, Europe, Latin America offers growth avenues.

Threats

- Macroeconomic/commodity headwinds: soft demand in apparel/textiles, foreign‐exchange risks (international operations).

- Competition: other fiber/resin producers, chemical companies, recycled feedstock solutions may erode margins.

- Technology risks: recycling technologies, feedstock sourcing, traceability standards evolve quickly company must keep pace.

- Operational risks: manufacturing disruptions, supply‐chain bottlenecks, raw material feedstock quality issues.

- Sustainability claims risk: If traceability/verification systems fail, may incur reputational damage.

Recent News & Strategic Updates

- Profitability improvement plan (Jan 2024): As noted earlier, cost reset, headcount reductions, leadership promotions, streamlining operations.

- Sale of manufacturing facility (May 2025): Disposal of facility for $45 million, using net proceeds to reduce debt (~$43.3 million principal reduction) and expecting ~$20 million in annualised operational savings.

Top Vendors in the U.S. Recycled Polyester Market & Their Offerings:

- Indorama Ventures Public Company Ltd. (U.S. operations): As part of a worldwide chemical company, its U.S. operations are involved in the manufacture of polyethylene terephthalate (PET) resins and the recycling of PET bottles.

- Far Eastern New Century (FENC America): This diversified Taiwanese conglomerate, including FENC America, produces polyester materials, textiles, and PET bottles, and specializes in polyester recycling.

- DAK Americas LLC (Alpek Polyester): As a subsidiary of Alpek, DAK Americas is a leading producer of PET resins, polyester staple fibers, and terephthalic acid (TPA) in the Americas, with a focus on recycled materials.

- Biffa Polymers (U.S. division)

- Nan Ya Plastics Corporation America

- Phoenix Technologies International, LLC

- Placon Corporation

- CarbonLite Industries (now merged into DAK Americas)

- Loop Industries

- Evergreen Plastics, Inc.

- Mohawk Industries, Inc.

- Avangard Innovative

- PolyQuest, Inc.

- Custom Polymers PET, LLC

- Clean Tech Incorporated (Plastipak Packaging)

- Perpetual Recycling Solutions, LLC

- Peninsula Plastics Recycling, Inc.

- Nextek, Inc.

- Repreve Renewables LLC

Segments Covered in the Report

By Product Type

- Fiber Grade rPET

- Bottle Grade rPET

- Sheet & Film Grade rPET

- Strapping Grade rPET

By the Recycling Process

- Mechanical Recycling

- Chemical Recycling (Depolymerization, Glycolysis, Methanolysis)

By Application

- Textiles & Apparel (Clothing, Footwear, Upholstery)

- Packaging (Bottles, Containers, Films)

- Automotive (Interiors, Carpets, Insulation)

- Construction (Insulation, Panels, Roofing Membranes)

- Industrial (Straps, Hoses, Geotextiles)

- Others (Consumer Goods, Home Furnishings)

By Form

- Flakes

- Pellets (rPET Resin)

- Fibers & Filaments