Content

What is the Current 3D Printing Materials Market Size and Share?

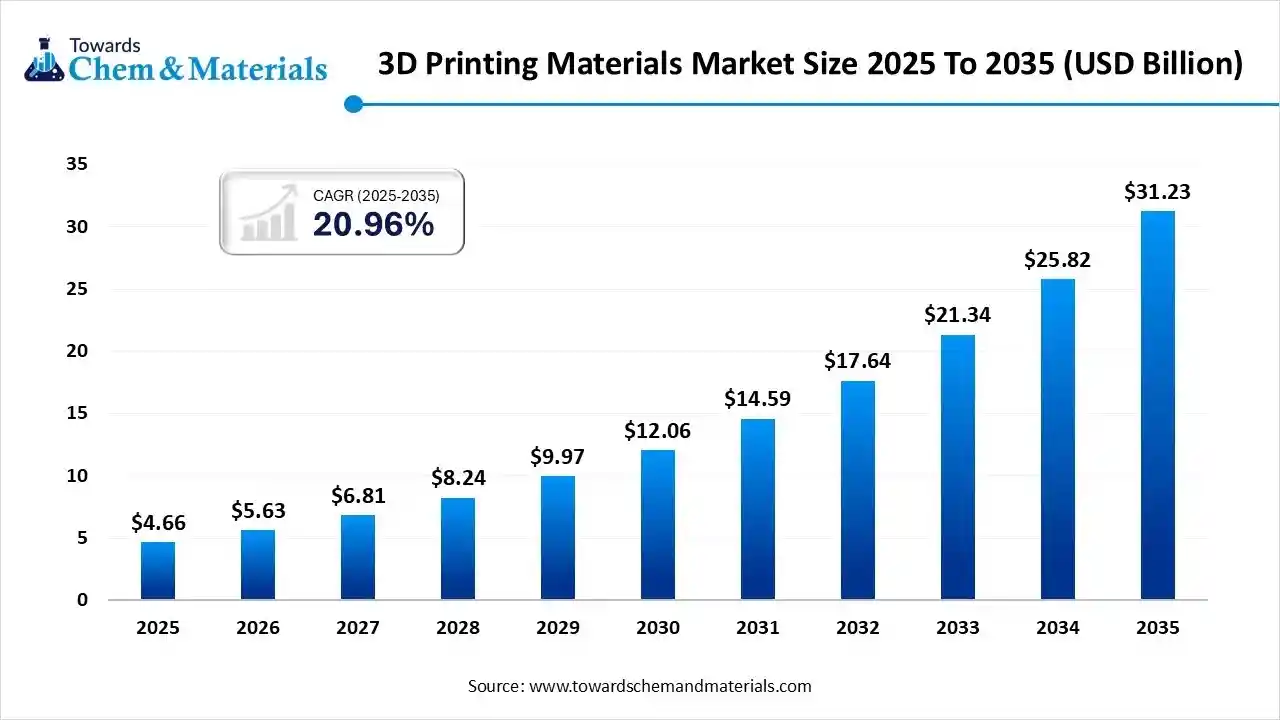

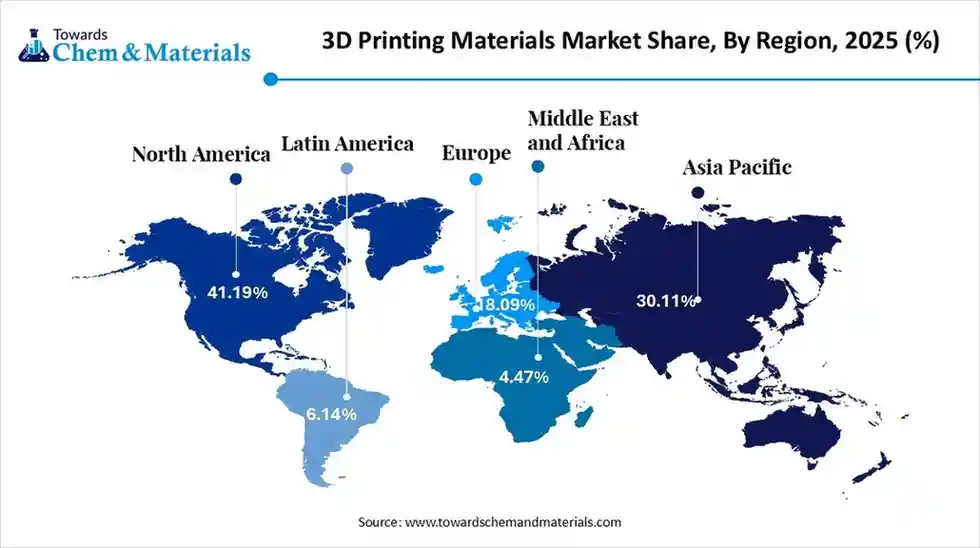

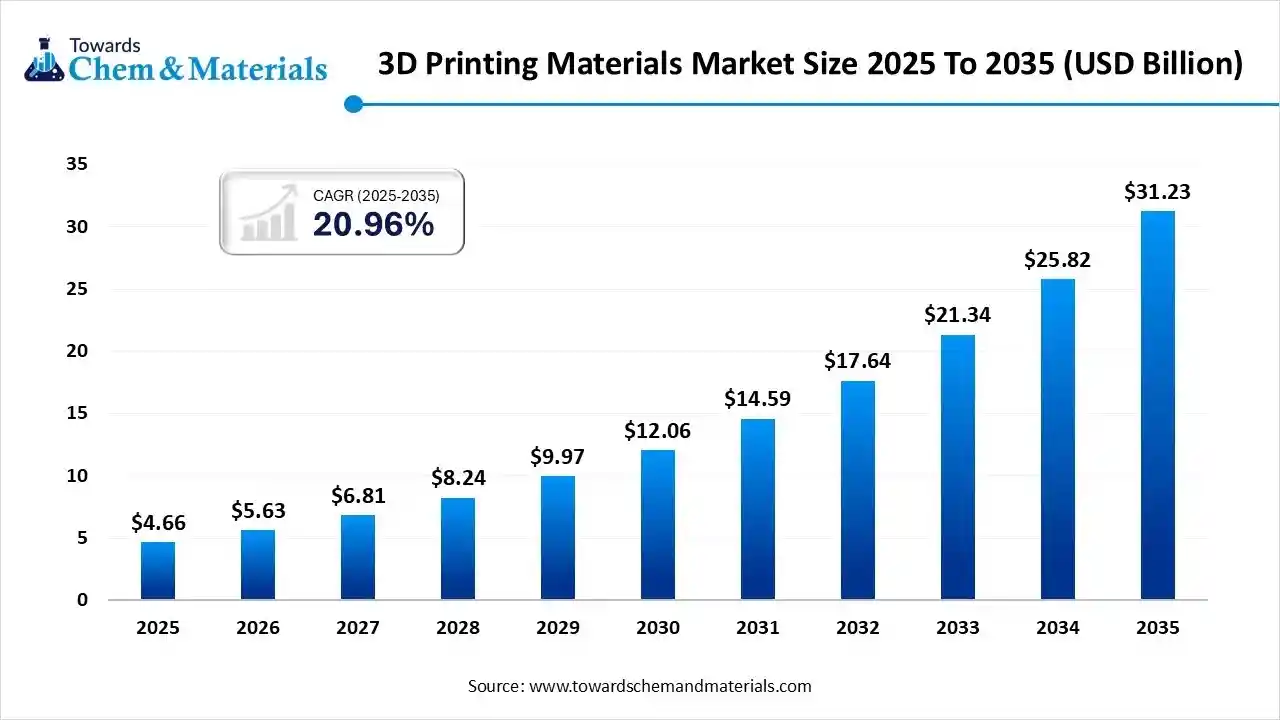

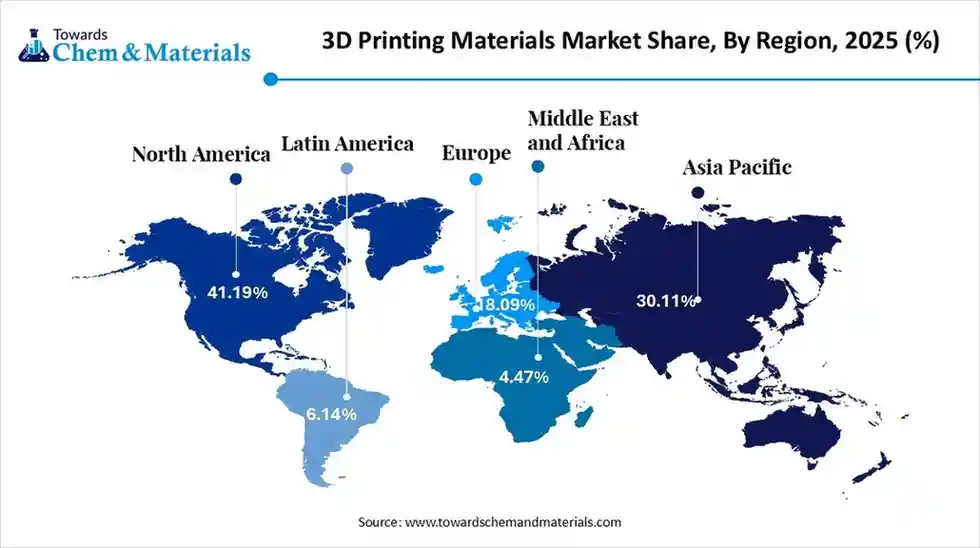

The global 3D printing materials market size is calculated at USD 4.66 billion in 2025 and is predicted to increase from USD 5.63 billion in 2026 and is projected to reach around USD 31.23 billion by 2035, The market is expanding at a CAGR of 20.96% between 2026 and 2035. North America dominated the 3D printing materials market with a market share of 41.19% the global market in 2025. The growth of the market is driven by rising adoption of additive manufacturing across automotive, aerospace, healthcare, and consumer goods industries, driven by demand for rapid prototyping, lightweight components, and customized production.

Key Takeaways

- By region, North America led the 3D Printing Materials market with the largest revenue share of over 41.19% in 2025.

- By product, the photopolymers segment led the market with the largest revenue share of 38.5% in 2025.

- By application, the aerospace and defense sectors segment led the market with the largest revenue share of 25.9% in 2025.

- By application, the automotive segment accounted for the largest revenue share of 31.6% in 2025.

Market Overview

The 3D printing materials market is growing rapidly as businesses use additive manufacturing to produce goods more quickly and economically. The automotive, aerospace, and healthcare industries are seeing an increase in demand for advanced polymers, metals, and composites. The market is still being driven forward by growing industrial applications and growing customization requirements.

Market Trends

- Industry Growth Overview: As manufacturers adopt lightweight components, rapid prototyping, and on-demand production across key sectors, the 3D printing materials market is expanding. The market is expanding more quickly due to growing industrial automation and the need for customized goods.

- Sustainability Trends: Bio-based polymers and recyclable composites are examples of sustainable materials that are gaining popularity as a way to cut waste and energy consumption. Circular economy principles are becoming more and more integrated into the selection and manufacturing of materials.

- Startup Economy: Startups drive innovation in high-performance and eco-friendly 3D printing materials, attracting investments and industry collaborations. Many new entrants are also focusing on niche applications like medical devices and aerospace components.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 5.63 Billion |

| Revenue Forecast in 2035 | USD 31.23 Billion |

| Growth Rate | CAGR 20.96% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Product, By Application, By Region |

| Key companies profiled | ATI, CNPC Powder, Colibrium Additive, GKN Powder Metallurgy, Höganäs AB, Kennametal Inc., Arkema Inc., CRP Technology, Saudi Basic Industries Corporation (SABIC), Polyone Corporation |

Key Technological Shifts

- Advanced Filament Development: Introduction of high-performance filaments, including metal-filled, ceramic-filled, and composite polymers, enabling functional and structural part production beyond prototyping.

- High-Temperature and Heat-Resistant Materials: Development of thermoplastics and composites capable of withstanding higher temperatures, expanding industrial applications in automotive, aerospace, and tooling.

- Multi-Material and Hybrid Printing: Adoption of printers capable of combining different materials, including polymers and metals, for complex, functional components in a single build.

- Biodegradable and Sustainable Materials: Shift toward bio-based polymers and recyclable filaments to reduce environmental impact and support circular manufacturing practices.

Trade Analysis

- According to global import data for 3D Printing Material, the world imported 2311 shipments, handled by 477 exporters to 480 global buyers. This reflects a small but traceable movement of 3D printing material shipments in the global trade records displayed publicly.

- Globally, the top three importers of 3d Printing Material are Vietnam, Costa Rica, and Russia. Vietnam with the imports of 2,946 shipments, followed by Costa Rica with 611 shipments, and Russia with 496.

Value Chain Analysis

- Chemical Synthesis and Processing: Advanced chemical synthesis and processing techniques are used to produce high-performance 3D printing materials, including polymers, composites, and metal powders. These processes ensure consistency, durability, and functionality of filaments and powders.

- Key Players: BASF, Arkema, Evonik, SABIC

- Quality Testing and Certification: Strict quality testing and certification standards ensure materials meet industrial requirements for strength, heat resistance, and reliability in additive manufacturing applications. Certifications also support regulatory compliance and safety.

- Key Players: UL, ASTM International, SGS, Intertek

- Distribution to Industrial Users: Efficient distribution channels deliver 3D printing materials to industrial manufacturers, prototyping labs, and research institutions. This includes direct supply, online platforms, and distributor networks to ensure timely and large-volume deliveries.

- Key Players: 3D Systems, Stratasys, Materialise, Proto Labs

Segmental Insights

Product Insights

What Made The Photopolymers Segment Dominate The 3D Printing Materials Market In 2025?

The photopolymers segment led the market with the largest revenue share of 38.5% in 2025 because of their superior surface quality, great precision, and versatility for functional parts and industrial prototyping. Because of their extensive application in industries like aerospace, automotive, and healthcare, photopolymers are now the most popular material category worldwide.

The thermoplastics are the fastest growing segment in the market as the need for flexible long long-lasting, and heat-resistant materials for industrial uses grows. High-performance thermoplastic filaments and powders are becoming more widely used in end-use part production, tooling, and prototyping.

Metal-based 3D printing materials are notable for producing strong, high-precision components used in aerospace, automotive, and medical devices. Although they represent a smaller market share than polymers, their specialized applications and high-value nature make them increasingly important.

Application Insights

What Made Aerospace And Defense Sectors Dominate The 3D Printing Materials Market In 2025?

The aerospace and defense sectors segment led the market with the largest revenue share of 25.9% in 2025 due to the demand for lightweight, high-strength components and the strict performance requirements. Additive manufacturing is used by industries to create complex geometries and lower production costs without sacrificing dependability.

The automotive segment is fastest growing as producers use additive manufacturing for end-use parts, tooling, and quick prototyping. The market expansion in this industry is being accelerated by the need for components that are lightweight, robust, and customizable.

The medical segment is notable due to 3D printing for surgical instruments, prosthetic implants, and customized healthcare solutions is becoming increasingly common. Despite its smaller market size, this segment is extremely valuable due to the accuracy and customization provided by additive manufacturing.

Regional Analysis

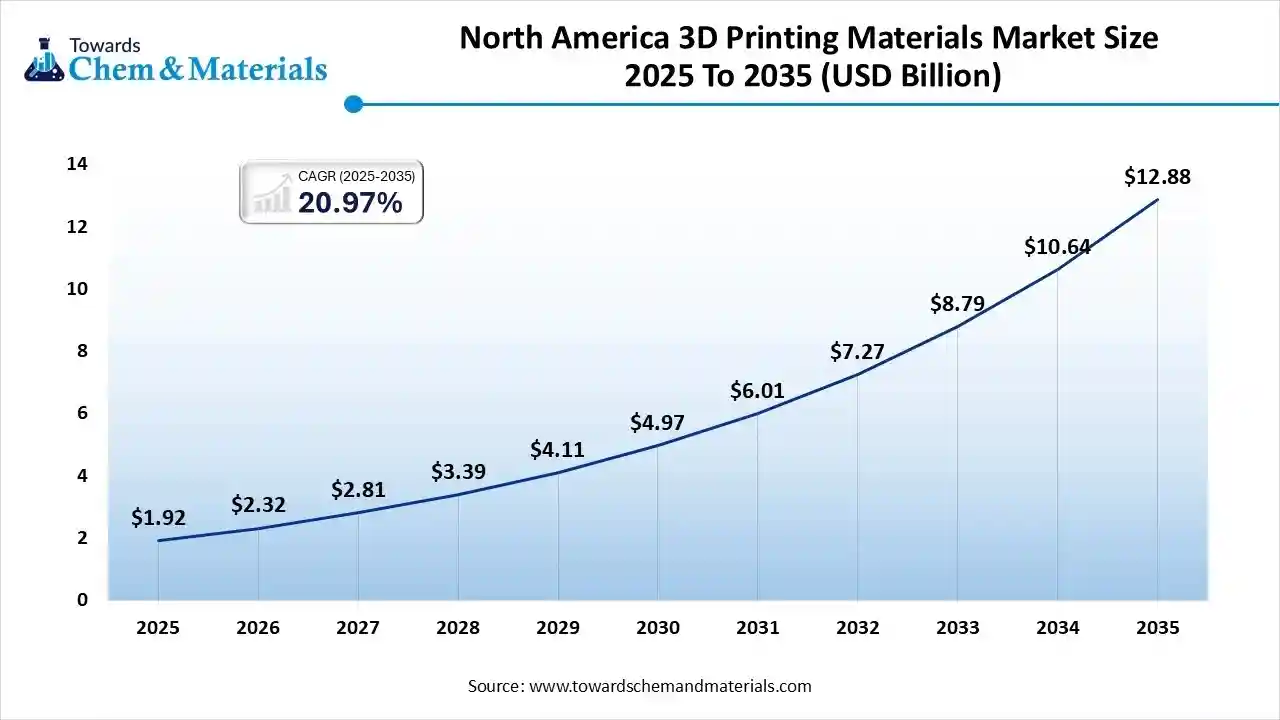

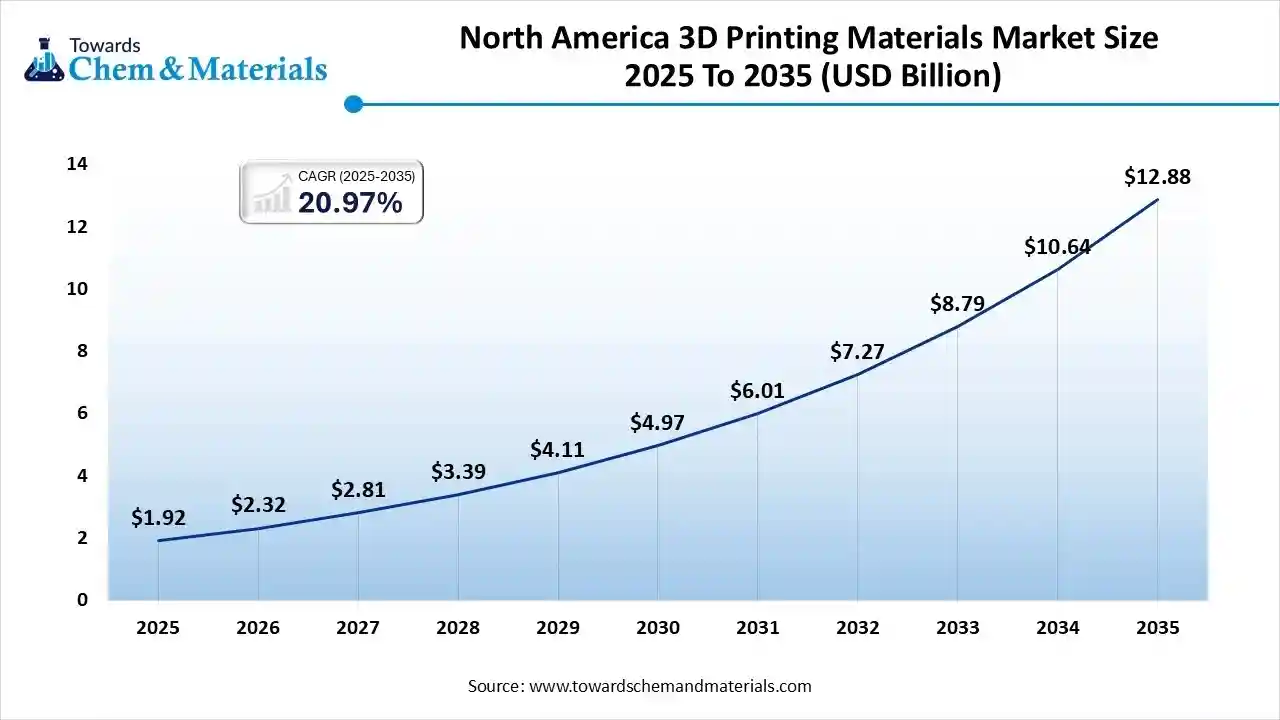

The North America 3D printing materials market size was valued at USD 1.92 billion in 2025 and is expected to reach USD 12.88 billion by 2035, growing at a CAGR of 20.97% from 2026 to 2035. North America led the 3D Printing Materials market with the largest revenue share of over 41.19% in 2025, driven by high industrial adoption, advanced R&D infrastructure, and established additive manufacturing ecosystems. The U.S. in particular accounts for a major share due to widespread use across aerospace, healthcare, and automotive sectors.

U.S. 3D Printing Materials Market Trends

The U.S. dominates the market because of its advanced industrial adoption, robust R&D infrastructure, and well-established ecosystem for additive manufacturing. The automotive, healthcare, and aerospace sectors all rely significantly on 3D printing for production and prototyping, maintaining their market dominance.

Asia Pacific is the fastest-growing region in the market, driven by rapid industrialization, expanding automotive and electronics sectors, and increasing government support for advanced manufacturing technologies. Rising investments in additive manufacturing are accelerating material adoption.

China 3D Printing Materials Market Trends

China is notable for its increasing use of 3D printing materials throughout industrial applications, manufacturing, and prototyping. The nation's strategic importance in the regional market is attributed to its strong domestic production capabilities, expanding startup activity, and emphasis on high-performance materials.

Europe is notable for its adoption of high-quality 3D printing materials, with emphasis on industrial applications, aerospace, automotive, and medical sectors. Strict quality standards and strong R&D investments support the region's growing role in advanced additive manufacturing.

Germany 3D Printing Materials Market Trends

Germany stands out in Europe due to its strong manufacturing foundation of industries 3D printing industry. The need for robust high-performance polymers and metal-based 3D printing materials is driven by the automotive, aerospace, and engineering industries.

The Middle East and Africa 3D printing materials market is experiencing steady growth driven by increasing adoption of additive manufacturing across industries such as healthcare, automotive, construction, and aerospace. Governments are investing in digital manufacturing initiatives, while rising demand for customized and lightweight products supports material innovation. Polymers dominate usage, but metal and composite materials are gaining traction as industrial applications expand.

UAE 3D Printing Materials Market Trends

In the United Arab Emirates (UAE), the 3D printing materials market is growing rapidly as the country embraces additive manufacturing across construction, healthcare, aerospace, and industrial sectors. Key growth is driven by polymer and powder-based materials used in industrial manufacturing, medical devices and prosthetics, as well as construction-scale 3D printing.

In South America, the 3D printing materials market is rapidly expanding. Polymers (plastics) remain the dominant material type, with thermoplastics and other filament/powder plastics widely used because of cost-effectiveness and versatility. Powder-form materials contribute the largest share among all material forms, especially for industrial applications. The fastest growth is seen in industrial manufacturing, automotive, healthcare, aerospace and consumer-goods sectors, driven by rising demand for rapid prototyping, custom components, medical devices, and small-batch manufacturing.

Brazil 3D Printing Materials Market Trends

In Brazil, the 3D printing materials market is growing steadily. Thermoplastics remain the largest and fastest-growing material segment widely used for general-purpose printing. Driving factors include increasing adoption of additive manufacturing in industries such as automotive, healthcare (e.g. implants & prosthetics), aerospace, and consumer goods.

Recent Developments

- In November 2025, Nanoe announced the debut of its ultra-high-temperature ceramic composite and metal filaments, including 304L stainless steel and Monel filaments, at Formnext 2025. These advanced filaments are designed for additive manufacturing applications requiring high durability, corrosion resistance, and thermal stability.(Source: www.metal-am.com)

Top 3D Printing Materials Market Companies

Stratasys Ltd.

Corporate Information

- Name: Stratasys Ltd.

- Type: Public (traded as NASDAQ: SSYS)

- Headquarters: Minnetonka, Minnesota (USA) and Rehovot, Israel.

- Industry: Additive manufacturing / 3D printing (printers, materials, software, on-demand parts)

History and Background

Founded in 1989 by S. Scott Crump and his wife in Eden Prairie, Minnesota.

The idea originated around 1988, when Crump envisioned building objects layer by layer the foundation of what became additive manufacturing.

Mergers & Acquisitions

- More recently, in 2025, the company acquired key assets of Forward AM Technologies GmbH (formerly part of BASF) expanding its materials portfolio.

- Also in 2025, Stratasys acquired certain assets and IP from Nexa3D.

Partnerships & Collaborations

- In 2025, Stratasys announced collaborations with leading aerospace and defense companies including Boeing, Blue Origin, Northrop Grumman, Raytheon Technologies, and others to qualify new high performance 3D printing materials for mission critical applications.

- In April 2024, Stratasys became the exclusive polymer 3D printing partner of Select Additive Technologies (a unit of Morris Group) bringing its full suite of polymer 3D printing solutions (printers, software, materials) to Select Additive’s customer base.

Product Launches / Innovations

- In 2024, the company launched a new IoT enabled platform, GrabCAD IoT Platform enabling fleet management, remote diagnostics, real-time monitoring and data driven maintenance of 3D printing operations.

- In 2025, the firm commercially launched P3 Silicone 25A a flexible, high performance silicone like material for its DLP based printing systems. The material matches performance of traditionally molded silicones (thermal stability, chemical resistance) but eliminates tooling and reduces lead times.

Key Technology Focus Areas

- Material Extrusion (FDM®): Its foundational technology, using thermoplastic filaments layer by layer.

Material Jetting (e.g. PolyJet™): For multi-material, high-detail parts useful in prototyping, modeling, and small-batch production. - Powder Bed Fusion (SAF®): For producing high-volume, end-use parts especially when repeatability and production consistency are necessary.

R&D Organisation & Investment

- The acquisition of Origin (2020) added a software centric, production-focused 3D-printing platform a clear R&D driven strategic investment.

- Post-acquisition, new product launches (e.g. Origin One printer, P3 silicone, IoT/GrabCAD platform) show active R&D output.

- According to industry reports, Stratasys is integrating AI and data analytics (e.g. through acquired firm Riven) to improve print accuracy, predictive maintenance, and operational efficiency signaling a shift toward data driven manufacturing services.

SWOT Analysis

Strengths:

- Pioneer in 3D printing / additive manufacturing, with decades of experience and a mature installed base.

- Broad technology portfolio (FDM, PolyJet, SAF, P3, etc.) can serve prototyping, production, tooling, custom manufacturing, across many industries. (Automotive, aerospace, healthcare, consumer goods, etc.)

- Strong strategic acquisitions (Origin, materials businesses) enhancing capabilities and market reach.

Weaknesses / Challenges:

- The additive manufacturing market is increasingly competitive, including lower cost alternatives and new entrants. Stratasys needs to justify its premium positioning via continuous innovation.

- Legacy reputation mostly in polymer/plastic printing, but materials & use cases sometimes require metal/ceramic this requires consistent R&D and acquisitions to compete.

Opportunities:

- Growing demand for mass-production additive manufacturing (not just prototyping) automotive, aerospace, healthcare, tooling, dental, etc. Stratasys is already targeting this via SAF, P3, etc.

- Partnerships with large industrial players (e.g. aerospace/defense) to qualify high performance materials opens high margin, high barrier markets.

Threats / Risks:

- Competition from other additive manufacturing firms offering cheaper or more specialized solutions (especially for metal printing, or consumer level 3D printers).

- Rapid technological change strain on R&D and risk of disruption if not kept up.

Recent News & Strategic Updates

- In 2025, Stratasys was named by Fast Company among the “World’s Most Innovative Companies” highlighting its growing impact in additive manufacturing beyond prototyping into tooling and full-scale production.

- In 2025, Stratasys launched P3 Silicone 25A a flexible, high-performance additive manufacturing material, expanding its polymer capabilities into areas previously dominated by molded silicone.

Companies Analysis

- ATI: Produces highly engineered specialty metals and components for critical industries like aerospace and defense.

- CNPC Powder: Provides materials as part of the China National Petroleum Corporation; detailed public information on this specific powder unit is limited.

- Colibrium Additive: A GE Aerospace company offering high-powered metal additive manufacturing (3D printing) solutions.

- GKN Powder Metallurgy: A leader in metal powder production and additive manufacturing components for industrial and automotive sectors.

- Höganäs AB: A top global producer of iron and metal powders used across diverse applications, including additive manufacturing.

- Kennametal Inc.: An industrial technology leader providing advanced materials and tooling solutions for demanding environments.

- Arkema Inc.: A global specialty materials and chemical company offering advanced polymers, coatings, and performance additives.

- CRP Technology: An Italian firm specializing in advanced additive manufacturing using high-performance composite (Windform) materials for motorsports and aerospace.

- Saudi Basic Industries Corporation (SABIC): A global petrochemical giant producing polymers, chemicals, and specialized plastic materials.

- Polyone Corporation: Now Avient Corporation, a provider of specialized polymer material solutions, colorants, and additives.

Top Companies in the 3D Printing Materials Market

- ATI

- CNPC Powder

- Colibrium Additive

- GKN Powder Metallurgy

- Höganäs AB

- Kennametal Inc.

- Arkema Inc.

- CRP Technology

- Saudi Basic Industries Corporation (SABIC)

- Polyone CorporationATI

- CNPC Powder

- Colibrium Additive

- GKN Powder Metallurgy

- Höganäs AB

- Kennametal Inc.

- Arkema Inc.

- CRP Technology

- Saudi Basic Industries Corporation (SABIC)

- Polyone Corporation

Segments Covered in the Report

By Product

- Photopolymers

- Thermoplastics

- Metals

- Others

By Application

- Aerospace & Defense

- Medical

- Automotive

- Consumer Products & Industrial

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa