Content

U.S. Biodegradable Plastics Market Size and Forecast 2025 to 2034

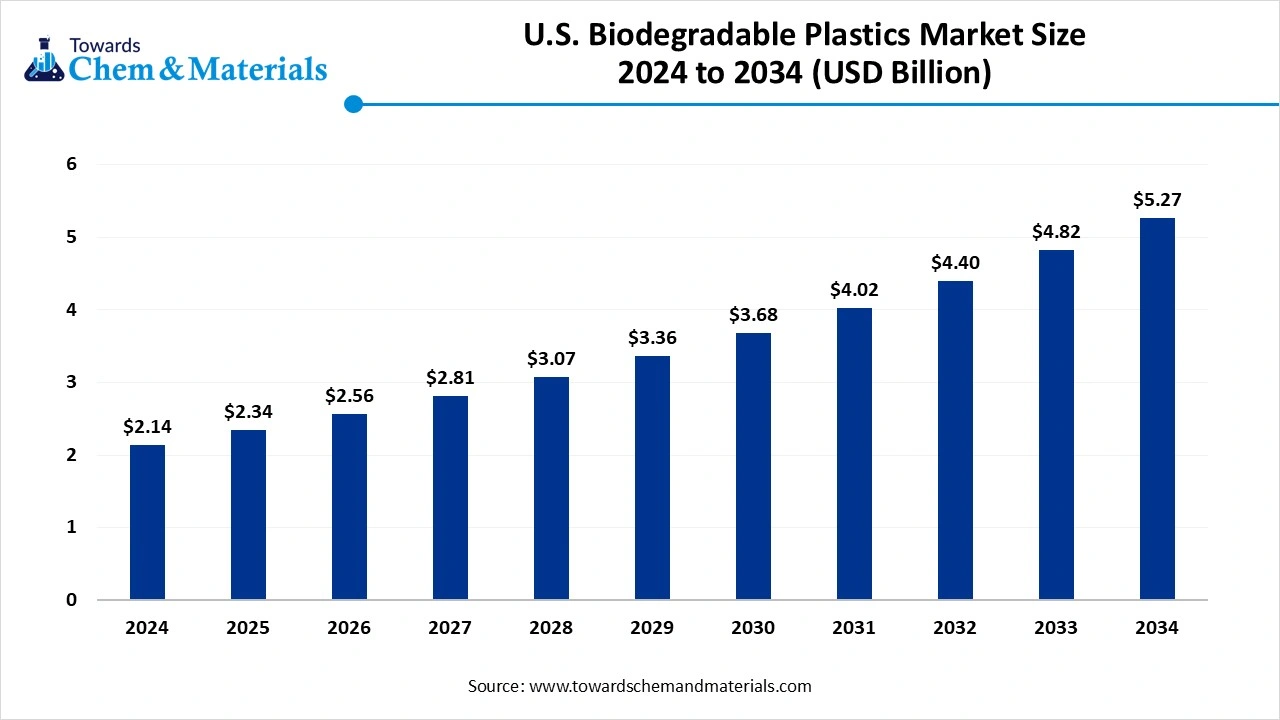

The U.S. biodegradable plastics market size is calculated at USD 2.14 billion in 2024, grew to USD 2.34 billion in 2025, and is projected to reach around USD 5.27 billion by 2034. The market is expanding at a CAGR of 9.44% between 2025 and 2034. The shift towards sustainable manufacturing practices has sparked notable advancements in the industry.

Key Takeaways

- By material type, the starch-based blends segment led the U.S. biodegradable plastics market with approximately 42% industry share in 2024, due to its easy processing and cost-effective properties.

- By material type, the PHA segment is expected to grow at the fastest rate in the market during the forecast period, owing to its versatility and any environmental adaptability.

- By product form, the films segment emerged as the top-performing segment in the market with approximately 55% industry share in 2024, as it is considered the direct replacement of single-use plastics in the current period

- By product form, the fibres and nonwovens segment is expected to lead the market in the coming years, as biodegradable plastics enter textiles, hygiene products, and medical applications.

- By end-use industry, the packaging segment led the market with approximately 60% share in 2024, because it is the largest source of plastic waste and the first target for bans and sustainability pledges.

- By end-use industry, the medical and healthcare segment is expected to capture the biggest portion of the market in the coming years, as biodegradable plastics become integral to safe and sustainable medical products.

- By compostability, the industrial compostable segment led the market with approximately 58% industry share in 2024, because most biodegradable plastics today require controlled, high-heat environments to break down effectively

- By compostability, the marine biodegradable segment is expected to capture the biggest portion of the market in the coming years, as plastic pollution in oceans becomes a central environmental crisis.

- By processing technology, the extrusion segment led the market with approximately 50% share in 2024, because it is the most widely used processing method for films, sheets, and packaging products.

- By processing technology, the 3D printing filament production segment is expected to capture the biggest portion of the market in the coming years, as additive manufacturing continues to grow across industries

- By feedstock origin, the corn/maize segment led the U.S. biodegradable plastics market with approximately 44% industry share in 2024, because it is abundant, affordable, and deeply integrated into the agricultural economy

- By feedstock origin, the waste-derived feedstock segment is expected to capture the biggest portion of the market in the coming years, because of the dual benefit of reducing waste and producing sustainable materials.

Market Overview

Can Biodegradable Plastics Replace Traditional Polymers in America’s Industrial Sectors?

The U.S. biodegradable plastics market has experienced rapid growth in recent years. Also, the United States has seen under a heavy plastic usage due to its advanced industrial sectors and export statistics. As the polymeric materials (bio-based and/or fossil-derived) engineered to undergo breakdown by biological activity into water, CO₂ (or CH₄), and biomass under specified environmental conditions (industrial composting, home composting, soil or marine), are used as drop-in or specialty resins across packaging, agriculture, consumer goods, medical, textiles, and other end-uses.

- In January 2025, the plastic production of the United States had decreased by 1.7% by 2023.(Source: www.plasticsindustry.org)

Compostable Packaging Gains Ground Across U.S Industries

The governmental push towards environmentally friendly manufacturing and waste reduction has heavily improved the performance and scalability of the sector in recent years. Moreover, the manufacturers in the United States are actively promoting compostable packaging where it can be industrial areas or food chains. Furthermore, the major brands in the country have been putting in an enlarged investment into the biodegradable plastic R&D activities in the past few years. Also, factors like consumer awareness and single-use plastic bans are likely to maintain industry potential in the United States for the forecasted period.

- In July 2025, Colorado, USA, has implemented a ban on plastic carryout bags in retail food chains and several stores.(Source: www.earthday.org)

Market Trends

- The food producers are demanding compostable packaging in the current period, where the manufacturers are observed in establishing collaboration with them.

- The increasing investment in the innovation of high-performance biopolymers has actively set benchmarks for industry growth in the past years, as per a recent survey.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.34 Billion |

| Expected Size by 2034 | USD 5.27 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.44% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material Type, By Product Form, By End-use Industry, By Compostability / Biodegradation Environment, By Processing Technology, By Feedstock Origin |

| Key Companies Profiled | NatureWorks LLC, TotalEnergies Corbion, BASF SE, Novamont S.p.A., Braskem S.A., Danimer Scientific, Inc., Mitsubishi Chemical Corporation, PTT MCC Biochem Co., Ltd., FKuR Kunststoff GmbH, Biome Bioplastics Ltd., Plantic Technologies Ltd., Trinseo S.A., Kaneka Corporation, Arkema S.A., CJ CheilJedang / CJ Biomaterials, Biomer (Biomer GmbH), Toray Industries, Inc., Perstorp Holding AB, Solvay S.A., NaturePlast (Groupe Barbier) |

Market Opportunity

Agriculture and Food Waste Fuel the Next Bioplastic Boom

The initiatives, like waste-to-bioplastic production, are expected to become a cornerstone for future industry gains. Moreover, several companies are focused on reducing dependence on the regular food crops like corn and others for the development of plastic instead of using agricultural waste and municipal food waste in recent years. Also, the manufacturers can gain major industry advantages by establishing a collaboration with regional waste management companies during the projected period.

- In November 2023, the new startup called AgroRenew LLC was established in Knox County in the United States. Also, this newly launched plastic is likely to use food waste in the production of bioplastics.(Source : www.insideindianabusiness.com)

Market Challenge

Economic Constraints Slow Bioplastic Industry Growth

The higher cost of the bioplastic as compared to the regular plastic is likely to produce industry barriers in the coming years. Also, the bioplastic production methods, like long fermentation and other specialized processing, seem to be increasing the production cost of bioplastics. Also, the cost can limit market entry for new market entrants where the limited budget is the priority.

Segmental Insights

Material Type Insights

How did the Starch-Based Blends Segment Dominate the U.S. Biodegradable Plastics Market in 2024?

The starch-based blends segment held the largest share of the market in 2024, due to its easy processing and cost-effective properties. Moreover, the United States has seen under a huge corn starch availability, which primarily supports the segment growth in the country nowadays. Also, the United States manufacturers are increasingly using starch-based blends in films, bags, and food packaging in recent years.

The PHA segment is expected to grow at a notable rate during the predicted timeframe, owing to its versatility and any environmental adaptability. Furthermore, PHA has gained attention in sectors like textiles, packaging, and healthcare, akin to its thermal stability and biocompatibility. Also, these sectors are seen to expand, which is likely to create greater opportunities for the PHA segment during the forecast period, as per the industry expectations.

Product Form Insights

Why Does The Films Segment Dominate The U.S. Biodegradable Plastics Market By Product Form?

The films segment held the largest share of the U.S. biodegradable plastics market in 2024, as it is considered the direct replacement of single-use plastics in the current period. Moreover, several industrial sectors are actively seeking starch-based biodegradable films due to increased bans on polyethylene and polypropylene films in the United States nowadays. Also, having benefits like easy manufacturing and wide availability due to being integrated with the existing distribution channel, the film segment has gained industry attention in recent years.

The fibers and nonwovens segment is expected to grow at a notable rate in the market during the forecast period, as biodegradable plastics enter textiles, hygiene products, and medical applications. Non-wovens made from PLA or PHA are increasingly used in diapers, wipes, and feminine hygiene products, which are under scrutiny for generating long-lasting waste.

End Use Industry Insights

How Packaging Segment Dominate the U.S. Biodegradable Plastics Market in 2024?

The packaging segment dominated the market with the largest share in 2024 because it is the largest source of plastic waste and the first target for bans and sustainability pledges. Brands like Coca-Cola, Pepsi, and Unilever are investing heavily in biodegradable packaging for bottles, wrappers, and food containers to reduce environmental impact. Retailers and e-commerce giants are also transitioning to compostable mailers and films.

The medical & healthcare is expected to grow at a significant rate in the market during the forecast period, as biodegradable plastics become integral to safe and sustainable medical products. Materials like PLA and PHA are biocompatible, making them ideal for sutures, implants, tissue scaffolds, and drug delivery systems. Single-use medical items like gloves, syringes, and gowns are also being reimagined with biodegradable alternatives to reduce biomedical waste.

Compostability Insights

How did the Industrial Compostable Segment Dominate the U.S. Biodegradable Plastics Market in 2024?

The industrial compostable segment dominated the market with the largest share in 2024 because most biodegradable plastics today require controlled, high-heat environments to break down effectively. Industrial composting facilities provide the right temperature and conditions for PLA and starch-based plastics to degrade within months. Many state policies, such as California's, specifically mandate the use of industrially compostable packaging.

The marine biodegradable is expected to grow at a significant rate in the market during the forecast period, as plastic pollution in oceans becomes a central environmental crisis. U.S. policymakers, NGOs, and global treaties are increasingly targeting ocean plastics, pushing demand for materials that can break down safely in seawater. PHAs and new biopolymer innovations can degrade in marine environments without leaving harmful microplastics, making them ideal for fishing gear, packaging, and coastal industries.

Processing Technology Insights

Why Does The Extrusion Segment Dominate The U.S. Biodegradable Plastics Market By Processing Technology?

The extrusion segment dominated the market with the largest share in 2024 because it is the most widely used processing method for films, sheets, and packaging products. Biodegradable plastics like PLA and starch blends can be processed using standard extrusion equipment with minimal modification, making it cost-efficient for manufacturers.

The 3D printing filament production is expected to grow at a significant rate in the market during the forecast period, as additive manufacturing continues to grow across industries. PLA is already the most widely used filament in desktop 3D printing because of its ease of use, safety, and biodegradability. Future demand will expand into industrial 3D printing, where sustainable materials are increasingly valued for prototyping and small-batch production.

Feedstock Origin Insights

How can Corn/Maize Reform the U.S. Biodegradable Plastic Industry?

The corn/maize segment dominated the market with the largest share in 2024 because it is abundant, affordable, and deeply integrated into the agricultural economy. The U.S. has one of the world's largest corn supplies, making it a reliable feedstock for starch-based blends and PLA production. Using corn for bioplastics also leverages existing supply chains and processing facilities, reducing costs.

The waste-derived feedstock is expected to grow at a significant rate in the market during the forecast period, because of the dual benefit of reducing waste and producing sustainable materials. Instead of competing with food crops, waste-based sources such as agricultural residues, municipal food waste, or even algae offer a more circular and ethical production pathway. In the U.S., policies are pushing for reduced landfill waste and innovative recycling of organics, making waste-to-bioplastics a perfect fit.

U.S. Biodegradable Plastics Market Value Chain Analysis

- Distribution to Industrial Users: The distributors are linked to major sectors like packaging and agriculture in the United States.

- Chemical Synthesis and Processing: Majorly, bioplastics are synthesized microbiologically and even chemically, where processes like fermentation and others play a significant role.

- Regulatory Compliance and Safety Monitoring: The United States has a specialized regulatory standard for the testing of biodegradable plastic, such as the ASTM International standard, and others.

Recent Developments

- In September 2024, EcoPlastic Inc. introduced its latest product line of biodegradable plastic in the United States. Also, this newly launched biodegradable plastic is produced from natural resources, as per the company's claim.(Source: www.plastics-technology.com)

U.S. Biodegradable Plastics Market Top Companies

- NatureWorks LLC

- TotalEnergies Corbion

- BASF SE

- Novamont S.p.A.

- Braskem S.A.

- Danimer Scientific, Inc.

- Mitsubishi Chemical Corporation

- PTT MCC Biochem Co., Ltd.

- FKuR Kunststoff GmbH

- Biome Bioplastics Ltd.

- Plantic Technologies Ltd.

- Trinseo S.A.

- Kaneka Corporation

- Arkema S.A.

- CJ CheilJedang / CJ Biomaterials

- Biomer (Biomer GmbH)

- Toray Industries, Inc.

- Perstorp Holding AB

- Solvay S.A.

- NaturePlast (Groupe Barbier)

Segment Covered

By Material Type

- Starch-based blends

- Polylactic Acid (PLA)

- Polybutylene Adipate-co-Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Polyhydroxyalkanoates (PHA)

- Polycaprolactone (PCL)

- Cellulose-based biodegradable polymers

- Other specialty biodegradable polymers

By Product Form

- Films

- Rigid articles (containers, trays, cups, lids)

- Fibers & nonwovens

- Foams

- Coatings & laminates

- Pellets/resin

By End-use Industry

- Packaging

- Foodservice disposables

- Agriculture

- Consumer goods

- Textiles & nonwovens

- Medical & healthcare

- Automotive & transportation

- Electronics & electrical

- Industrial & construction

By Compostability / Biodegradation Environment

- Industrial compostable

- Home compostable

- Soil biodegradable

- Marine biodegradable

- Anaerobic digestible

By Processing Technology

- Extrusion (film, sheet)

- Injection molding

- Blow molding

- Thermoforming

- Fiber spinning

- 3D printing filament production

By Feedstock Origin

- Corn/maize

- Sugarcane

- Cellulosic feedstock

- Vegetable oils/lipids

- Fossil-based biodegradable feedstock (e.g., PBAT)

- Waste-derived feedstock

List of Figures

- Figure 1. U.S. Biodegradable Plastics Market Size (USD 2.14 Billion), 2024–2034

- Figure 2. U.S. Biodegradable Plastics Market CAGR (9.44%), 2025–2034

- Figure 3. U.S. Biodegradable Plastics Market Share by Material Type, 2024 (Starch-based blends 42%, PLA 24%, PBAT 10%, PBS 8%, PHA 7%, PCL 4%, Cellulose-based 3%, Other specialty polymers 2%)

- Figure 4. U.S. Biodegradable Plastics Market Share by Product Form, 2024 (Films 55%, Rigid articles 20%, Fibers & nonwovens 10%, Foams 6%, Coatings & laminates 5%, Pellets/resin 4%)

- Figure 5. U.S. Biodegradable Plastics Market Share by End-use Industry, 2024 (Packaging 60%, Foodservice disposables 12%, Agriculture 9%, Consumer goods 7%, Textiles & nonwovens 5%, Medical & healthcare 4%, Automotive & transportation 2%, Electronics & electrical 1%, Industrial & construction <1%)

- Figure 6. U.S. Biodegradable Plastics Market Share by Compostability, 2024 (Industrial compostable 58%, Home compostable 18%, Soil biodegradable 14%, Marine biodegradable 10%)

- Figure 7. U.S. Biodegradable Plastics Market Share by Processing Technology, 2024 (Extrusion 50%, Injection molding 18%, Blow molding 12%, Thermoforming 8%, Fiber spinning 7%, 3D printing filament 5%)

- Figure 8. U.S. Biodegradable Plastics Market Share by Feedstock Origin, 2024 (Corn/maize 44%, Sugarcane 20%, Cellulosic 12%, Vegetable oils/lipids 8%, Fossil-based feedstock 8%, Waste-derived feedstock 8%)

- Figure 9. Competitive Landscape: Market Presence of Leading Companies, 2024

- Figure 10. Value Chain Analysis of the U.S. Biodegradable Plastics Market

List of Tables

- Table 1. U.S. Biodegradable Plastics Market Size (USD 2.14 Billion), 2024–2034

- Table 2. CAGR (9.44%) Comparison of Biodegradable Plastics vs Traditional Plastics, 2025–2034

- Table 3. U.S. Biodegradable Plastics Market Share by Material Type, 2024 (Starch-based blends 42%, PLA 24%, PBAT 10%, PBS 8%, PHA 7%, PCL 4%, Cellulose-based 3%, Other specialty polymers 2%)

- Table 4. U.S. Biodegradable Plastics Market Share by Product Form, 2024 (Films 55%, Rigid articles 20%, Fibers & nonwovens 10%, Foams 6%, Coatings & laminates 5%, Pellets/resin 4%)

- Table 5. U.S. Biodegradable Plastics Market Share by End-use Industry, 2024 (Packaging 60%, Foodservice disposables 12%, Agriculture 9%, Consumer goods 7%, Textiles & nonwovens 5%, Medical & healthcare 4%, Automotive & transportation 2%, Electronics & electrical 1%, Industrial & construction <1%)

- Table 6. U.S. Biodegradable Plastics Market Share by Compostability, 2024 (Industrial compostable 58%, Home compostable 18%, Soil biodegradable 14%, Marine biodegradable 10%)

- Table 7. U.S. Biodegradable Plastics Market Share by Processing Technology, 2024 (Extrusion 50%, Injection molding 18%, Blow molding 12%, Thermoforming 8%, Fiber spinning 7%, 3D printing filament 5%)

- Table 8. U.S. Biodegradable Plastics Market Share by Feedstock Origin, 2024 (Corn/maize 44%, Sugarcane 20%, Cellulosic 12%, Vegetable oils/lipids 8%, Fossil-based feedstock 8%, Waste-derived feedstock 8%)

- Table 9. Key Developments in the U.S. Biodegradable Plastics Market, 2023–2025

- Table 10. Company Profiles of Major Market Participants